What is the Contact Center as a Service Market Size?

The global contact center as a service market size is calculated at USD 7.27 billion in 2025 and is predicted to increase from USD 8.77 billion in 2026 to approximately USD 39.25 billion by 2034, expanding at a CAGR of 20.60% from 2025 to 2034. The growth of the market is driven by the increased need to enhance customer experience.

Contact Center as a Service Market Key Takeaways

- In terms of revenue, the contact center as a service market is valued at $ 7.27 billion in 2025.

- It is projected to reach $ 39.25 billion by 2034.

- The market is expected to grow at a CAGR of 20.6% from 2025 to 2034.

- North America dominated the global market with the largest share of 35% in 2024.

- Asia Pacific is expected to grow at a notable CAGR of 23.5% throughout the forecast period.

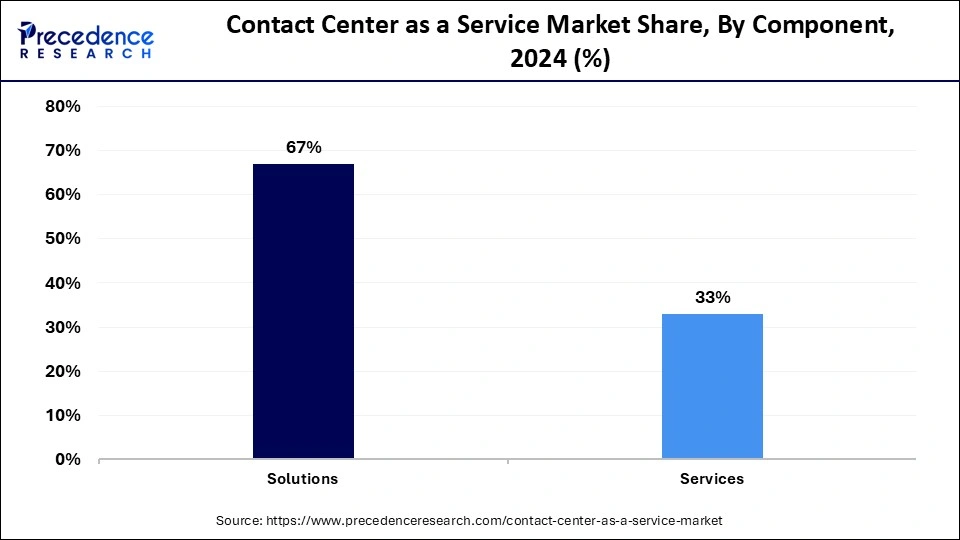

- By component, the solutions segment held the major market share of 67% in 2024.

- By component, the services segment is projected to grow at a double-digit CAGR of 22% in the coming years.

- By enterprise size, the large enterprises segment accounted for the highest market share in 2024.

- By enterprise size, the small and medium enterprises segment is expected to grow at a significant CAGR of 22.6% between 2025 and 2034.

- By end use, the BFSI segment led the market in 2024.

- By end use, the consumer and retail segment is growing at a highest CAGR of 26% during the upcoming period.

Impact of AI on the Contact Center as a Service Market

Artificial intelligence (AI) is opening up new avenues for the growth of the contact center as a service market. AI automates routine tasks, personalizing consumer interaction and providing data-driven insights. AI-driven contact center as a service (CCaaS) solutions enhance various aspects of customer interaction and contact center operations by offering deeper insights into customer behavior. AI-driven CCaaS solutions help handle customer queries, manage interactions, and enhance overall efficiency and productivity. Most contact centers use AI technology to create a more personalized communication solution. These solutions also bring unbelievable insights to help managers understand service performance and improve its quality. AI-driven solutions allow customers to solve their queries by self, lowering the burden on contact centers.

Market Overview

The contact center as a service market is growing rapidly, driven by the increasing need to improve agents' productivity while enhancing customer experience. CCaaS solutions allow organizations to communicate with their customers through various channels, such as chat, SMS, voice, e-mail, and social media. They capture critical data from customers' and employees' interactions to improve customer experience. These solutions keep organizations at the lead of the novelty curve, providing better agility and growth opportunities.

CCaaS solutions also eliminate the requirement for organizations to deploy IT infrastructure to manage software and hardware. They are an affordable and flexible cloud-based alternative to outdated contact centers, permitting businesses to deliver modern service through a central platform. CCaaS is a cloud-hosted, on-demand service that offers all the functionalities and features of a traditional contact center without the requirement of physical hardware. CCaaS software permits companies to create a scalable technique to handle inbound and outbound communications on each channel while lowering telephony, hardware, and IT expenses.

Contact Center as a Service Market Growth Factors

- The growing focus on enhancing customer satisfaction is boosting the growth of the market. Modern CCaaS platforms provide consumer-friendly interfaces and helpful training materials. The spontaneous interface and AI-powered features confirm rapid onboarding and equip agents to deliver excellent customer solutions.

- The rising demand for personalized solutions supports market growth. Incorporating CCaaS with applications like CRM, e-commerce systems, and marketing technologies allows businesses to create a streamlined and connected consumer journey by extracting data from several sources to offer efficient and personalized solutions.

- Technological advances further drive the growth of the market. Rapid adoption of automation technologies, like robotic process automation (RPA), helps automate repetitive and manual tasks in contact centers.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 39.25 Billion |

| Market Size in 2025 | USD 7.27 Billion |

| Market Size in 2026 | USD 8.77 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 20.60% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Enterprise Size, End-Use, Regions |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Focus on Omnichannel Strategy

The rising focus on omnichannel strategy is a key factor driving the growth of the contact center as a service market. An effective omnichannel contact strategy empowers businesses to offer customers multiple communication touchpoints, such as voice, e-mail, chat, social media, and messaging apps, each with its particular characteristics and requirements. To deliver a seamless and frictionless consumer journey, businesses must unify all these channels into a single integrated platform. This strategy is beneficial in collecting feedback from customers and agents to refine and optimize engagement. As new channels and technologies emerge, specifically digital technologies, the market is set to grow rapidly.

Restraint

Compatibility Issues

Integrating CCaaS solutions with existing IT infrastructure creates complexities. Representatives in most contact centers use various tools and traditional applications on separate screens to carry out their daily operations. This complicates simple tasks and consumes a lot of time, negatively affecting consumer experience. It increases the screen toggling time for agents and the waiting time for consumers, as they rely on multiple applications to deliver a single solution. This declines agents' productivity, ultimately impacting the overall goals of the organization.

Opportunity

Integration with Emerging Technologies

The integration of CCaaS solutions with Internet of Things devices, blockchain applications, and AI technologies presents significant opportunities in the contact center as a service market. This transformation empowers organizations to maximize data utilization and deliver hyper-personalized experiences at scale, aligning with the expectations of digital consumers. By adopting a digital-first consumer engagement model, businesses not only evolve to meet consumer demands but also establish a distinct competitive edge in the marketplace. This evolution allows proactive service delivery and intelligent routing, which were previously unattainable.

Component Insights

The solutions segment dominated the contact center as a service market with the largest share in 2024. This is mainly due to an increased need for outbound calls to reach out to customers. The demand for solutions like call recording, reporting & analytics, and workforce optimization has increased due to a strong focus of contact centers to improve customer experience. These solutions streamline operations in data centers while improving customer engagement.

The services segment is projected to grow at the fastest rate in the coming years. The growth of the segment is attributed to the rising integration of CCaaS solutions, as industries embrace CCaaS solutions, the need for integration & deployment, support & maintenance, and managed services increases. These services help industries seamlessly integrate CCaaS solutions in their existing systems. Moreover, these services address complexities that occur during the implementation of these solutions.

Enterprise Size Insights

The large enterprises segment led the contact center as a service market in 2024. As large enterprises often deal with a large customer base spread worldwide, they require effective solutions to manage customer queries. CCaaS solutions are ideal for large enterprises. These solutions improve consumer service and maintenance capabilities of large-scale businesses by streamlining their contact center operations. CCaaS solutions handle a large volume of calls, which is beneficial for large enterprises to improve customer experience. These solutions also offer reporting and analytics capabilities that provide insights into the contact center performance, agent productivity, and customer interactions in large enterprises.

The small & medium enterprises segment is anticipated to expand at a significant growth rate over the forecast period. CCaaS platforms are suitable for all sizes of businesses, including small and medium enterprises. These platforms allow SMEs to access modern features at affordable prices. Since these enterprises often face a shortage of skilled customer service representatives, they need CCaaS solutions to enhance customer service.

End Use Insights

The BFSI segment held the largest share of the contact center as a service market in 2024. BFSI institutes often require effective solutions to build customer trust and enhance the experience. CCaaS solutions provide BFSI institutes with the capability to handle a huge volume of customer inquiries regarding transactions and provide real-time support. These solutions improve consumer interactions and streamline communications.

The consumer & retail segment is expected to expand at the highest CAGR during the upcoming period. CCaaS is a customer service that provides retail stores with the capabilities to enhance consumer interactions. CCaaS solutions allow retailers to manage and solve consumer queries seamlessly through numerous channels. This further helps consumers make informed purchasing decisions. The rising need for personalized customer services further contributes to segmental growth.

Regional Insights

U.S. Contact Center as a Service Market Size and Growth 2025 to 2034

The U.S. contact center as a service market size is exhibited at USD 1.96 billion in 2025 and is projected to be worth around USD 10.80 billion by 2034, growing at a CAGR of 20.81% from 2025 to 2034.

North America dominated the contact center as a service market with the largest share in 2024. This is mainly due to its robust technological infrastructure, enabling seamless deployment of CCaaS solutions. There is a high adoption rate of cloud-based solutions, creating fertile ground for CCaaS solutions. The region is set to sustain its position in the market throughout the forecast period. Businesses in the region are seeking solutions to enhance customer service and experience. Businesses are increasingly adopting Internet of Things (IoT) devices and chatbots to enhance the delivery of customer services, supporting regional market growth.

The U.S. is a major contributor to the North American contact center as a service market. The country is an early adopter of cloud-based solutions. The country is home to some of the major CCaaS vendors, such as Salesforce, Sprinklr, Talkdesk, Twilio, Zoom, RingCentral, and Five9. The availability of a skilled workforce increases the deployment of CCaaS platforms, supporting the market's growth.

Asia Pacific is expected to experience the fastest growth in the upcoming period. The growth of the market in the region can be attributed to the rapid expansion of the BFSI sector, which relies on efficient solutions like CCaaS to improve customer experience. CCaaS platforms provide detailed reporting and analytics tools that support BFSI firms to track employee performance, detection of areas for improvement, and optimize workflow. India can have a stronghold on the contact center as a service market in the Asia Pacific. This is mainly due to the rapid industrialization and the growing need to improve customer experience. Domestic market players are continuously launching new solutions to satisfy the need for effective solutions that can enhance customer experience.

- In October 2023, Bharti Airtel, India's leading telecommunications solution provider, announced the launch of Airtel CCaaS, an industry-first omnichannel cloud platform that provides a unified experience for all contact center solutions essential for an enterprise.

Recent Developments

- In January 2025, HCLTech, a leading global technology company, announced the expansion of its strategic partnership with Microsoft to transform customer service experiences with generative AI and cloud-based contact center solutions.

- In January 2025, TransPerfect, the world's largest provider of language and AI solutions for global business, announced the acquisition of H2A, a French leader in contact center customer experience and business process outsourcing (BPO) solutions.

- In November 2024, NUSO announced the acquisition of T-Metrics, a provider of advanced contact center solutions and communication tools for the enterprise, US Federal, State, and Local government markets. This acquisition solidifies NUSO's commitment to delivering resilient, scalable, and customizable communication solutions that empower business, government, and educational organizations of all sizes to communicate with their customers, engage their employees, and stay competitive.

- In July 2024, SS&C Technologies Holdings, Inc. announced its new Contact Center platform to help asset management, life and pensions, and retirement sectors modernize and elevate the customer experience.

- In February 2024, Accelecom, a leading provider of next-generation fiber and cloud-based communication solutions, announced the launch of its latest offering, Contact Center as a Service (CCaaS). This state-of-the-art solution is designed to empower businesses with advanced tools and capabilities to enhance customer experience and streamline contact center operations.

Contact Center as a Service Market Companies

- Alcatel Lucent Enterprise

- Avaya, Inc.

- Cisco Systems, Inc.

- Enghouse Interactive Inc.

- Five9, Inc.

- Genesys

- Microsoft Corporation

- NICE inContact

- SAP SE

- Unify Inc.

Segments Covered in the Report

By Component

- Solutions

- Automatic Call Distribution

- Call Recording

- Computer Telephony Integration

- Customer Collaboration

- Dialer

- Interactive Voice Response

- Reporting & Analytics

- Workforce Optimization

- Others

- Services

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Travel & Hospitality

- Others

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting