What is the Managed Services Market Size?

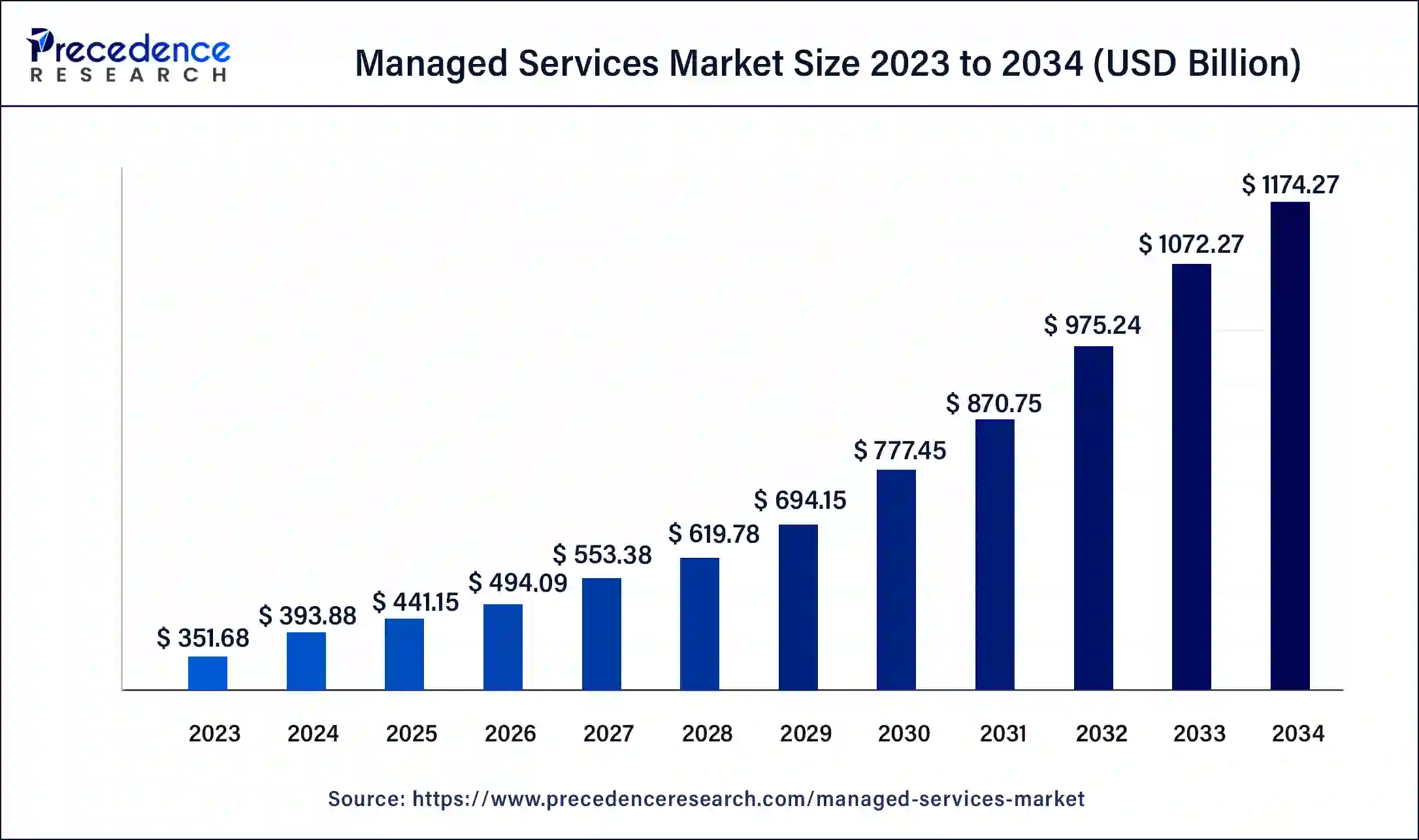

The global managed services market size is calculated at USD 441.15 billion in 2025 and is predicted to increase from USD 493.09 billion in 2026 to approximately USD 1272.95 billion by 2035, expanding at a CAGR of 11.18% from 2026 to 2035.

Managed Services Market Key Takeaways

- In terms of revenue, the market is valued at $441.15 billion in 2025.

- It is projected to reach $1272.95 billion by 2035.

- The market is expected to grow at a CAGR of 11.18% from 2026 to 2035.

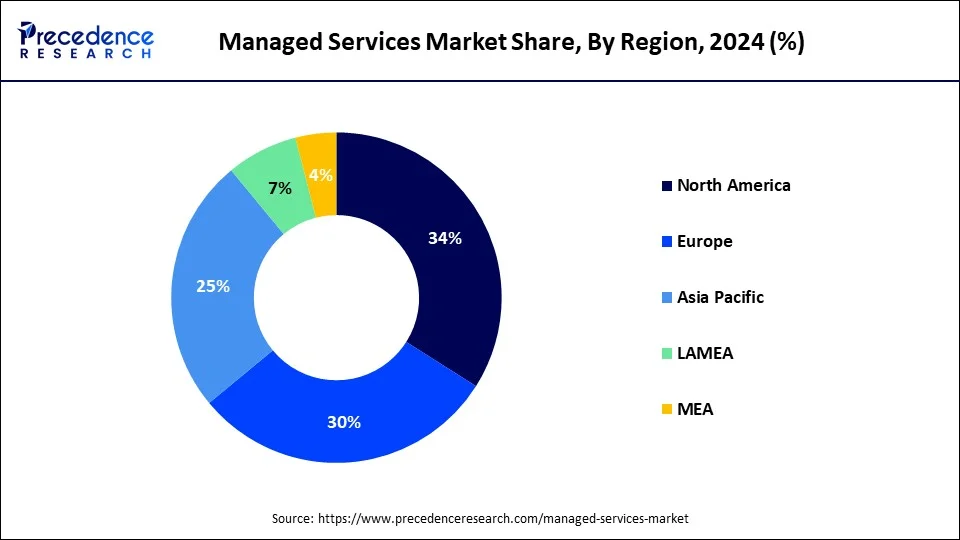

- North America dominated the high-speed camera market with the largest market share of 34% in 2025.

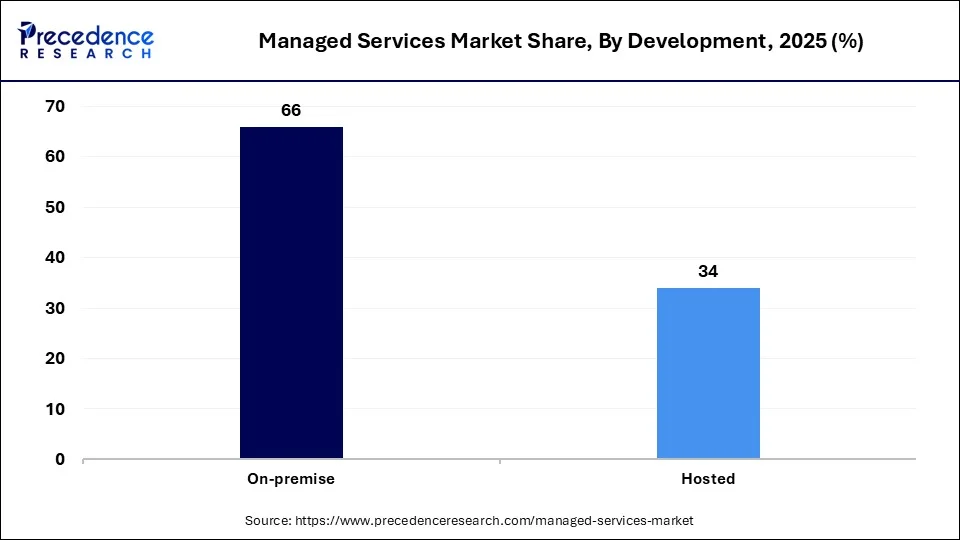

- By deployment, the on premise segment has held revenue share of 67% in 2025.

- By deployment, hosted deployment segment is projected to grow rapidly in the market in the coming years.

- By end User, the financial services segment has held revenue share of 21.5% in 2025.

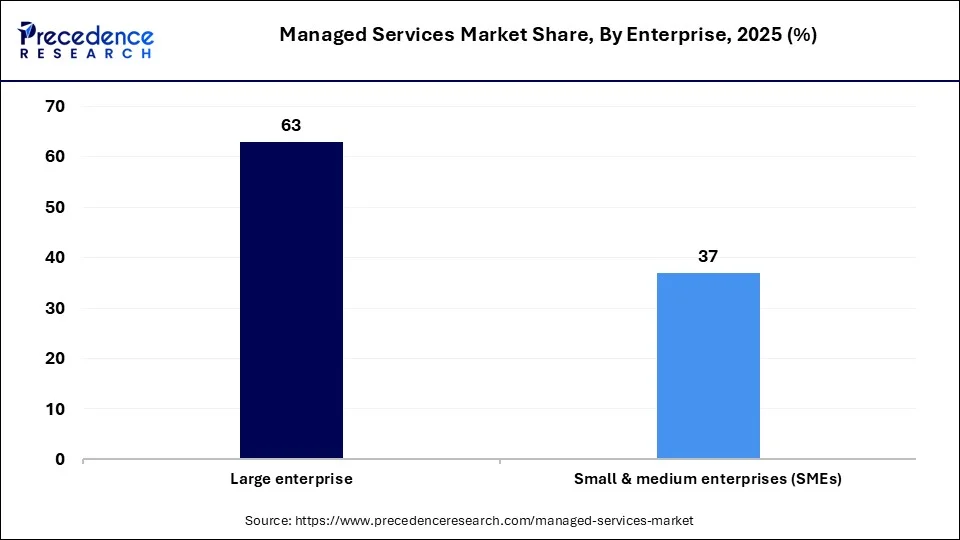

- By enterprise Size , the communication segment has generated revenue share of 63% in 2025.

Market Overview

Due to pandemic, many companies are resorting for business automation as the business aggressively resorts to remote working. About 55% of companies have approached the managed service providers in order to opt for their value added services and reduce security risks for the employees and the business partners. Managed services help in outsourcing the management functions to a third party in order to escalate the business operations.

In order to improve the operational efficiencies and the operating expenses many businesses are approaching managed service providers. The outbreak of the pandemic has largely prompted the businesses to put a strong foot forward on remote working. Many organizations are adopting the latest technologies like that of augmented reality. The use of cloud management will help in optimizing the business.

Managed Services Market Growth Factors

Managed services provide optimum resource distribution utilization and they help in augmenting the overall profit for the businesses to operate. It's always helps in cutting down the company's operating expenses by improving the operational efficiency. There's an increase in outsourcing the management functions to manage service providers and to cloud service providers. Due to the spread of COVID lockdowns were imposed and they could be imposed by government and the adoption of cloud service will ensure business continuity even during those times.

The use of artificial technology and cloud management are solving the various functional business requirements, managed services, helping effective functioning of the organization with minimal cost and it does not compromise on the quality of the work done. The major market players are investing in the development of the new products and expansion of the products portfolio. They are also engaging in research and development activities in order to offer reliable services and cost-effective services.

Managed Services Market Trends

- As businesses expand globally, seamless cross-border communication and efficient IT infrastructure management become a vital factor, thus driving the need for advanced managed services.

- The increasing shift towards remote work further highlights the importance of dependable cloud computing, cybersecurity, and network management systems to support distributed workforces in an effective manner.

- We can see that several businesses are partnering up with specialist service providers to manage and maintain their cloud platforms, applications, and infrastructure so that they can focus on their core competencies. This approach leverages the expertise of managed service providers to optimize the cost, scalability, and performance of their cloud systems.

- As companies continue to modernize their IT infrastructure and embrace digital transformation initiatives, the demand for cloud-managed services is expected to surge even more in the upcoming years.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 1272.95 Billion |

| Market Size in 2025 | USD 441.15 Billion |

| Market Size in 2026 | USD 494.09 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.18% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Solution, Enterprise Size, End-use, Managed Information Service, Deployment, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Solution Insights

The managed data center segment accounted revenue share 16.5% in 2024. The managed data center segment is expected to grow during the forecast as it provides cutting edge technology to the existing as well as the new corporates. Managed datacenters help in boosting business automation and strengthening the management of the business in an IT architecture. Due to a rise in cyberattacks the use of the managed security services is expected to grow during the forecast.

Business operations use managed security services to protect their confidential data. Due to increased complexities in the growing networks there are drawbacks in the effective data security management. There is a need for adoption of managed security services. The security services help in detecting and mitigating the risks with the help of security assessments. Therefore, the demand for the managed security services has increased. Apart from the managed security services, the endpoint management solutions are also available. In order to safeguard the business and secure the individual identities in the IT sector, organisations are proactively adopting these security technologies.

Deployment Insights

The on premise segment hit largest share 67% in 2024 and many organisations are adopting the on premise mode of deployment which does not require any Internet connection. The on premise segment helps in easy customization of the software in order to meet the requirements of the clients. As the on premise segment provides a Control Center within an organization, there is an increased efficiency in operations. There is efficient coordination and control in various management duties and activities. The constant technological developments that provide the benefits of minimal operational costs and the software setup cost.

The hosted deployment segment is also expected to grow fast during the forecast. The need for upgrading the software is ruled out in the hosted deployment segment. The upgrade to the software systems can be done as and when needed in order to relieve the organizations from various licensing expenses. The hosted managed services deployment approach is expected to gain more demand as it helps in saving time and as there are no upgrades required.

End User Insights

The financial services segment accounted largest revenue share 21.5% in 2024 and these financial institutes are turning to managed services in order to help them with their issues, including keeping up with the advancements in technology, regulatory changes in the market and the looming storage of employees with cutting edge technologies. The use of managed services helps in increasing the operational efficiency and the product quality. Amongst all the businesses, the managed services are becoming increasingly popular as they provide a strategic approach in order to protect the operations of an organization. Long term use of managed services helps in providing significant strategic benefits and also cost savings.

In order to automate the business operations, retailers can also use managed services and focus more on their core activities. The examples of this are retail assets management, remote monitoring and management and retail managed services. The retailers happen to overlook the infrastructure which is required in case there is an expansion since the retail sectors are also rapidly growing, the retail managed services will allow the company to have more flexible software during the time of growth.

Enterprise Size Insights

The large enterprise segment had the largest market share of around 63% in 2024. Large enterprises deal with a lot of data which must be maintained and it should be accessible locally and remotely. Large organisations are using managed security services in order to monitor and manage their corporate data security. As there are less developed infrastructure in order to detect breaches and increasing cyber-attacks, Managed security services are in great demand across many businesses in the world. If there is a cyberattack or data breach in any organization which is located in the Asia Pacific region, there will be an enormous loss. The managed services have applications in manufacturing, telecom and IT, healthcare, retail and consumer goods. In order to encourage and promote SME's and various digital SME's, Governments are carrying out campaigns worldwide by providing loans, tax reliefs, social support, financial support.

Due to an increasing adoption of modern information technology, infrastructure and business operations and automation, the market is expected to grow during the forecast period. In order to provide the managed services effectively, cloud computing automation and virtualization are providing the delivery platform, which is very cost effective and efficient. Small businesses are also expected to increase their spending on it as they are benefiting from the managed service providers.

Regional Insights

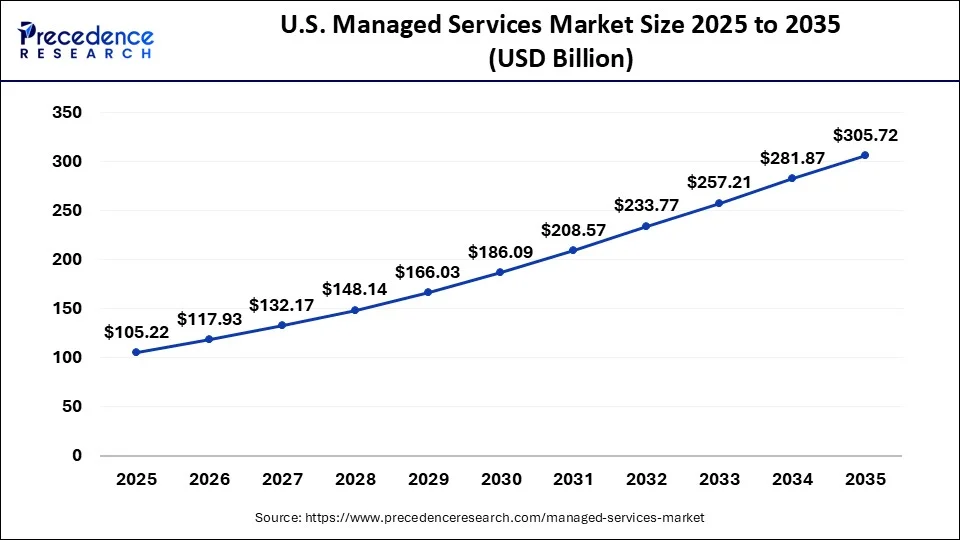

U.S Managed Services Market Size and Growth 2026 To 2035

The U.S. managed services market size was reached at USD 105.22 billion in 2025 and is expected to be worth around USD 305.71 billion by 2035 with a CAGR of 9.99% from 2026 to 2035.

The North American market had the largest revenue share 34% in 2025 due to an emphasis on digitalization. In US, the IT firms are trying to lower their operational expenses. Various companies are adopting a varied range of managed services to improve the operational efficiency. In case of IT support services, the businesses in the US are dependent on the managed service providers. It helps them in staying competitive.

In North America, the US dominated the market due to the growing need for specialized expertise and technological innovation in the sector.MSPs offer the necessary expertise and infrastructure to help businesses manage and implement these advanced technologies, providing them with a competitive landscape in their respective industry.

As there is digitalization across many industries the Asia Pacific market is also expected to have a significant growth due to the use of cloud based solutions and boosting data security investments.

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be attributed to the increasing regional spending on cloud-based solutions along with the increasing government focus on digitalization. Moreover, the aggressive investments of top IT companies like International Business Machines Corporation, Google, and Microsoft Corporation in emerging countries such as China and India are fuelling market growth soon.

China Managed Services Market Trends

In Asia Pacific, China led the market owing to the increasing adoption of cloud computing, IoT, and other emerging technologies, which is also propelling the rollout of cloud computing infrastructure in the country. Also, the rising popularity of the SaaS delivery model is impacting positive market growth in the country.

Europe Managed Services Market Trends

Europe is expected to witness a significant rate of growth throughout the forecast period. This growth is due to the rising need for enhanced cybersecurity all across the region, especially due to the growing volume and complexity of cyberattacks. The European Union's General Data Protection Regulation (GDPR) has also heightened the importance of data protection and privacy, further pushing businesses and enterprises to adopt advanced cybersecurity measures.

The rise in ransomware attacks, phishing scams, and data breaches across sectors like healthcare, banking, and government compels companies to seek the necessary expertise in cybersecurity services. The expanding demand for multi-cloud and hybrid cloud environments is also contributing to the market growth in the region. We can see that several businesses are increasingly shifting from a single cloud provider to multi-cloud or hybrid cloud strategies to avoid vendor lock-in, further optimizing performance and improving data redundancy.

Latin America Managed Services Market Trends

Latin America is expected to witness a substantial growth rate in the upcoming years. This growth and development are due to the continued growth of the IT industry in the region and the increasing need to maintain a uniform flow of information and develop a secure cyber environment. All these factors are opening up new areas of opportunity for the adoption of advanced managed services.

Government Initiatives are gaining traction, encouraging the adoption of emerging technologies even more. Moreover, the aggressive adoption of cloud-based technologies by both governments and corporates in the region is expected to drive market growth even more.

Middle East and Africa Managed Services Market Trends

The Middle East and Africa are witnessing significant growth in the market and are expected to maintain this steady growth trajectory in the upcoming years as well. This growth is fueled by the increasing investments that are being made in IT infrastructure as well as the rising demand for cloud services.

Governments in the region are seen prioritizing various digital transformation initiatives, thus creating a supportive and fertile environment for managed service providers to grow. Countries like South Africa, the UAE, and Saudi Arabia are leading players in the region. The region's competitive landscape includes both local and international players.

Managed Services Market Companies

- Accenture PLC

- Alcatel-Lucent Enterprise

- AT&T Inc.

- Avaya Inc.

- Ericsson

- Fujitsu Limited

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Lenovo Group Limited

- BMC Software, Inc.

- CA Technologies

- Cisco Systems, Inc.

- DXC Technology Company

Recent Developments

- In June 2025, HCL Technologies (HCLTech) announced the launch of a managed Secure Service Edge (SSE) solution developed with Cisco to enhance enterprise security and improve cyber incident response times. Secure Service Edge (SSE) is a cloud-based security framework that combines networking and security functions to provide safe and efficient access to applications and data. }

(Source: business-standard.com) - In March 2025, Cognizant announced the launch of an AI-powered dispute management solution in partnership with ServiceNow. This Business Process as a Service (BPaaS) offering is specifically designed for mid-market banks in North America with the goal of streamlining the dispute resolution process and enhancing customer satisfaction. (Source: news.cognizant.com)

- In May 2025, Capgemini introduced a new perpetual Know-Your-Customer (pKYC) sandbox to help financial institutions move away from static compliance processes toward continuous, event-driven customer risk assessment. The offering provides a secure testing ground for organizations to pilot advanced KYC capabilities. (Source: channele2e.com)

- In June 2021, IBM announced the IBM Center for Government Cyber security which is a collaborative environment which focuses on helping federal agencies to address current and future cybersecurity threats.

- Accenture launched a new business group with VMware in 2021 to help organizations move to the cloud faster. The new business group helps professionals with deep expertise in hybrid cloud and cloud migrations, cloud-native and application modernizaton, and security across various industries.

Segments Covered in the Report

By Solution

- Managed Data Center

- Managed Network

- Managed Mobility

- Managed Infrastructure

- Managed Backup and Recovery

- Managed Communication

- Managed Information

- Managed Security

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By End-use

- Financial Services

- Government

- Healthcare

- IT & Telecom

- Manufacturing

- Media & Entertainment

- Retail

- Others

By Managed Information Service

- Business Process Outsourcing (BPO)

- Business Support Systems

- Project & Portfolio Management

- Others

By Deployment

- On-premise

- Hosted

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting