What is the Cloud Managed Services Market Size?

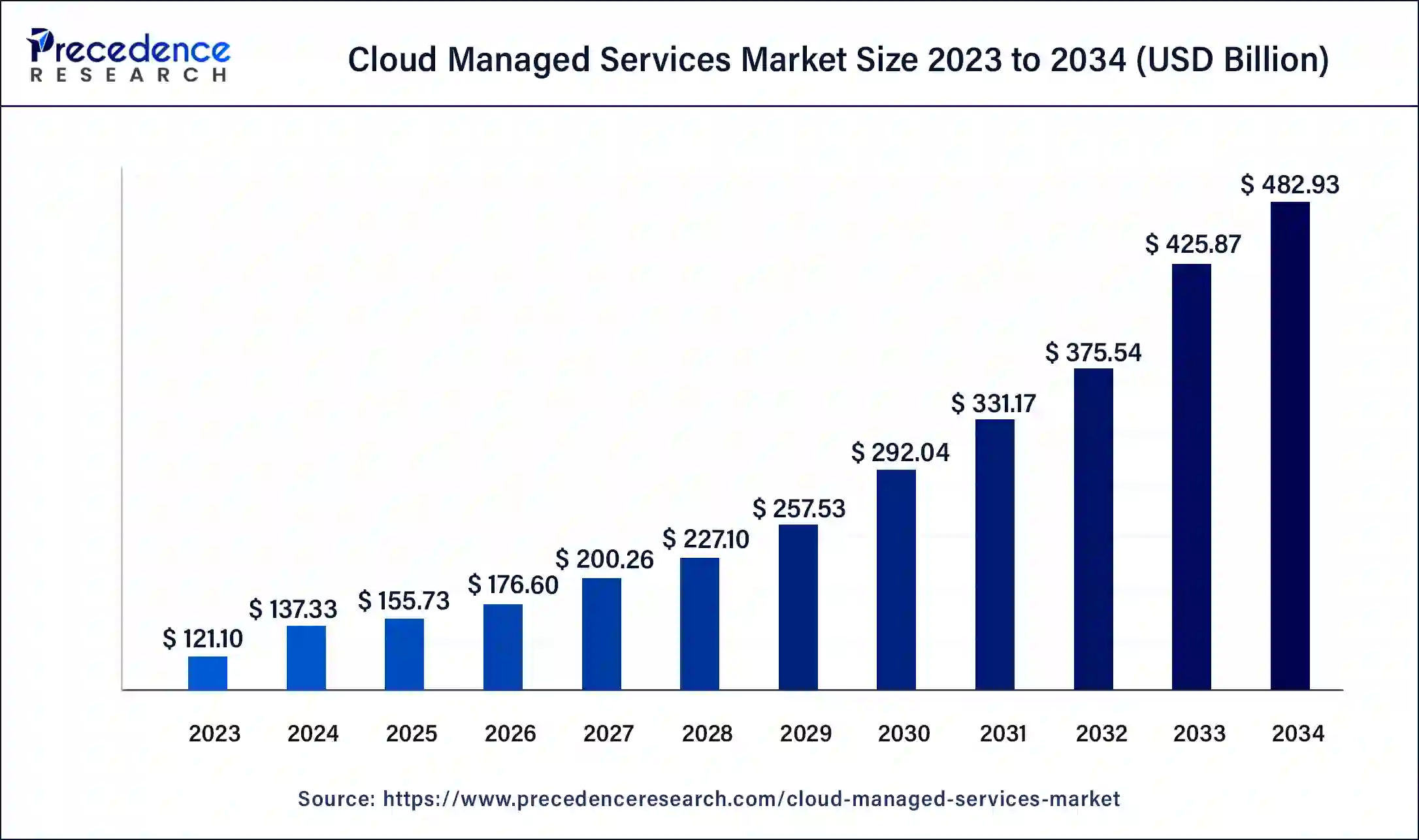

The global cloud managed services market size accounted for USD 155.73 billion in 2025, and is projected to hit around USD 176.60 billion by 2026, and is expected to reach around USD 482.93 billion by 2034, expanding at a CAGR of 13.4% from 2025 to 2034. The North America cloud managed services market size reached USD 39.96 billion in 2023. The growing emphasis on mobility and the requirement to focus on core business functions will drive cloud managed services market growth.

Market Highlights

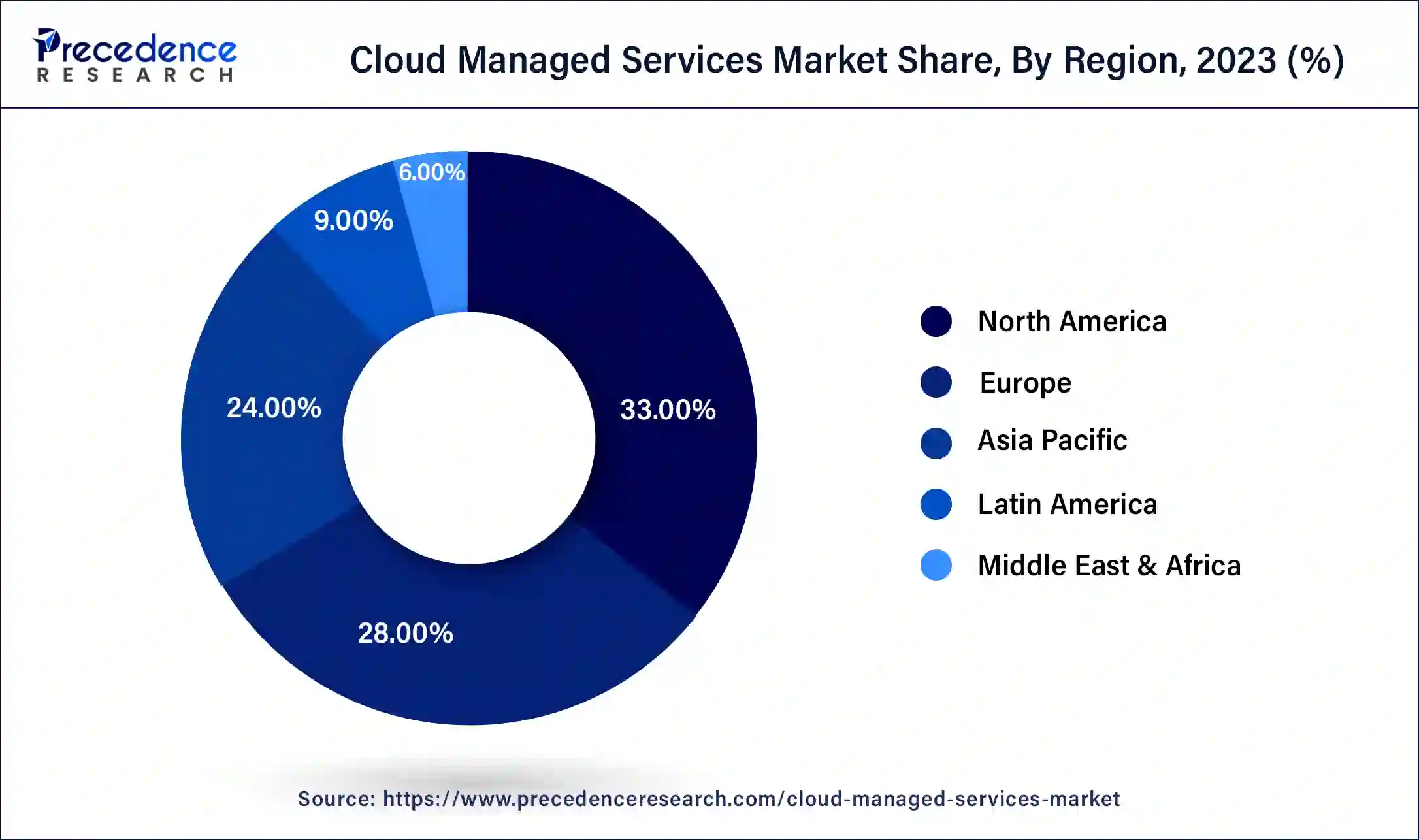

- North America held the largest share of 33% in the global cloud managed services market in 2024.

- Asia Pacific is expected to experience significant growth in the coming years.

- By service, the mobility segment dominated the market in 2024 and accounted revenue share of 38.3%.

- By service, the network services segment is anticipated to grow at the fastest CAGR over the forecast period.

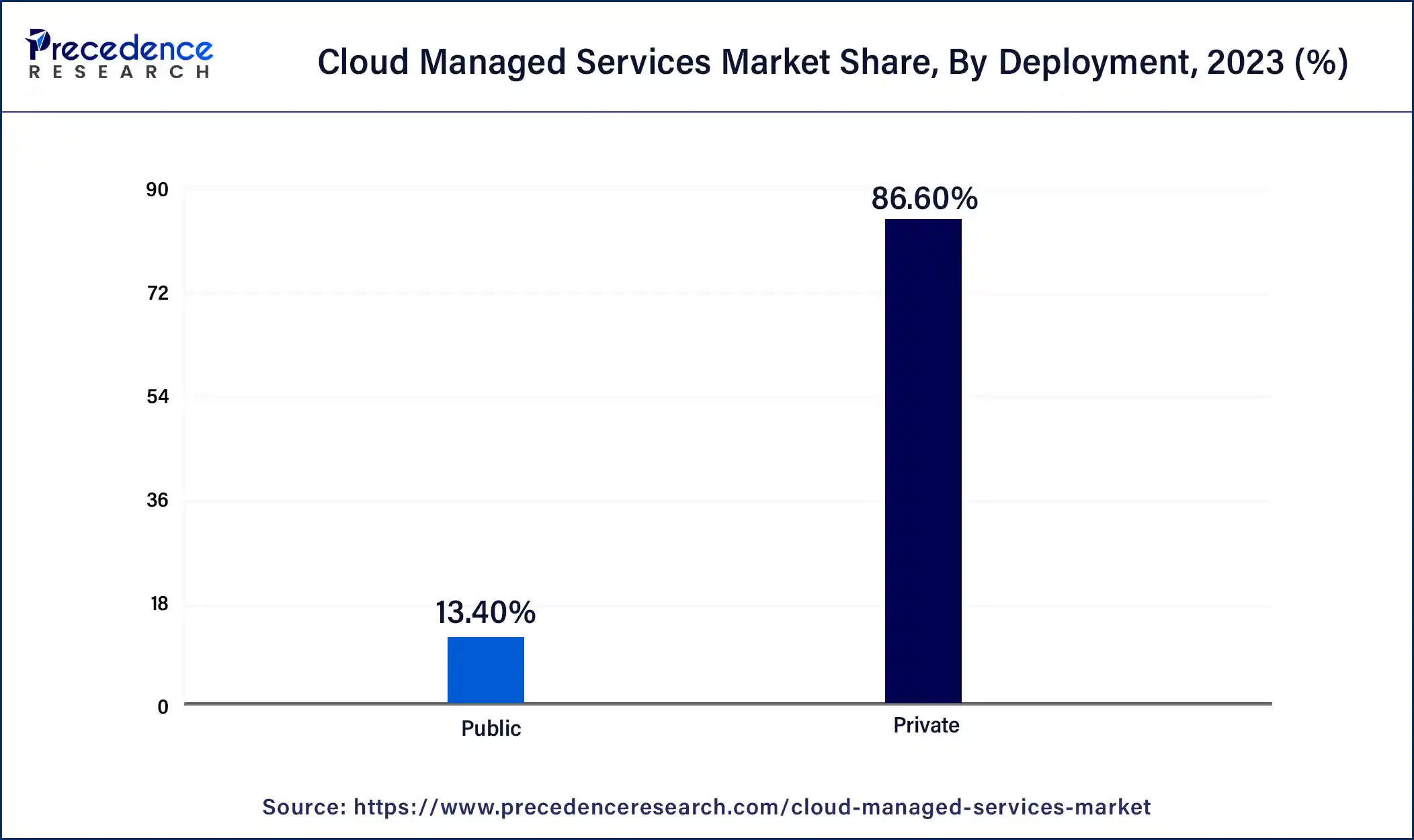

- By deployment, the private segment held the largest market share of around 86.6% in 2024.

- By deployment, over the forecast period, the public segment is estimated to grow at the fastest CAGR.

- By vertical, the telecom & ITes segment dominated the market with revenue share of 20.7% in 2024.

- By vertical, the government segment is anticipated to experience the fastest growth in the upcoming years.

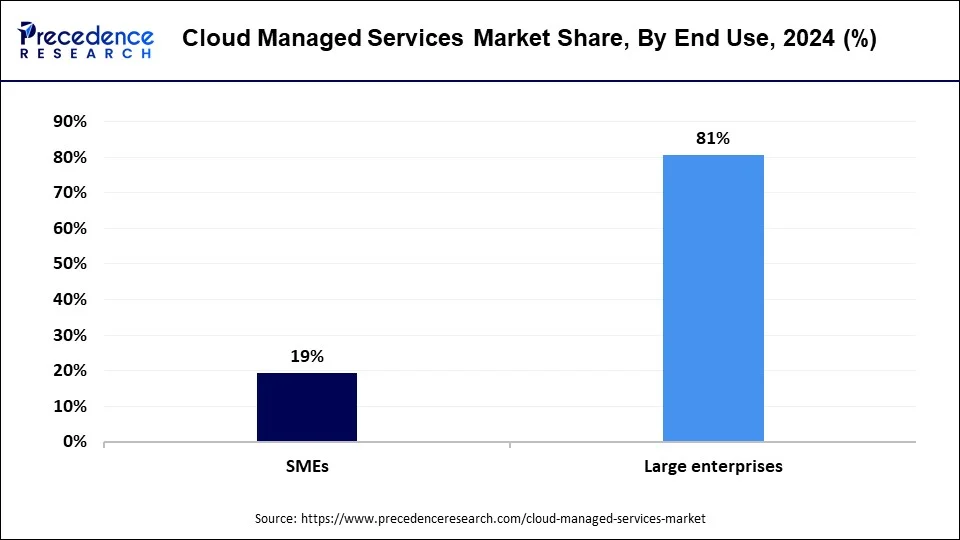

- By end use, the large enterprise segment has contributed market share of 80.7% in 2024.

- By end use, the SME segment is projected to experience the highest growth rate during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 155.73 Billion

- Market Size in 2026: USD 176.60 Billion

- Forecasted Market Size by 2034: USD 482.93 Billion

- CAGR (2025-2034): 13.4%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The cloud managed services market involves outsourcing various IT functions to external service providers, who oversee and manage a client's cloud-based platforms, applications, and infrastructure. These services encompass tasks such as cloud security, optimization, troubleshooting, resource monitoring, and maintenance. By leveraging cloud-managed services, businesses can ensure scalability, cost-effectiveness, and optimal performance while allowing internal IT teams to focus on strategic initiatives and core business objectives.

Additionally, businesses benefit from professional support and guidance in navigating complex cloud environments. Cloud-managed services offer a comprehensive solution for organizations seeking to optimize operations, enhance efficiency, and bolster security in today's digital landscape. This includes services such as data analytics, cybersecurity, infrastructure management, and application support, all delivered through the cloud managed services market.

Cloud Managed Services Market Growth Factors

- The rise in demand for reliability and scalability will increase the demand for the cloud managed services further in the future.

- Enterprises are also concerned with a reduction in IT costs, which will boost cloud managed services market growth during the forecast period.

- The increasing adoption of cloud computing among various businesses can fuel the growth of the cloud managed services market.

- Efforts made by cloud service providers and stakeholders to foster the growth of the market can create market opportunities soon.

- The growing demand for advanced networking and databases can contribute to cloud managed services market expansion.

Market Scope

| Report Coverage | Details |

| Global Market Size in 2025 | USD 155.73 Billion |

| Global Market Size in 2026 | USD 176.60 Billion |

| Global Market Size by 2034 | USD 482.93 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 13.4% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Deployment, End-user, Verticals and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing need to manage critical business applications and IT systems

As companies seek to enhance their security, operations, and organizational capabilities, they are increasingly turning to managed services. Cloud-managed services offer valuable benefits, including the ability to streamline complex system integration and ensure scalability and cost-effectiveness in the cloud.

In the cloud managed services market, many small- and medium-sized enterprises maintain full-time IT professionals to handle cloud services is prohibitively expensive. By outsourcing these services, businesses can reduce network maintenance expenses without compromising productivity or security.

- In January 2022, according to FCW (The Business Federal Technology), more than 44% of companies believed that cloud-managed services could help them get a quick return on investment. Due to such trends, the cloud managed services market is expected to grow rapidly in the coming years.

Restraint

Security and privacy concerns

One of the main drawbacks of relying on multiple third-party providers for cloud-managed services is the concern surrounding security and privacy. This comprises various aspects such as web network security, endpoint protection, application infrastructures, virtualization, database security, and mobility.

For many businesses, the primary obstacle to adopting cloud-managed services is apprehension regarding security and privacy risks. To address this concern, managed service providers (MSPs) have implemented robust privacy and security measures to safeguard data stored and transmitted over the cloud, such as encryption and end-to-end network protection, which offer clients enhanced security options.

Opportunities

Rise in demand for cloud-based solutions via MSP

Managed cloud services will surpass all other technologies as businesses create plans and follow strategies to satisfy their IT and network requirements. Effective IT system management is vital for any organization, and managed service providers can help address IT issues. Most MSPs offer 24/7 monitoring to attract clients. They use security solutions to monitor IT systems and detect potential threats or disturbances.

Many businesses have shifted their IT applications to cloud servers for various functions such as accounting, finance, customer relationship management, and others. The global adoption of cloud solutions is on the rise due to the widespread use of cloud technology for managing corporate operations.

- In June 2023, Hewlett Packard Enterprise Co. announced it is rolling out a cloud computing service designed to power artificial intelligence systems like ChatGPT. HPE's high-performance computing and artificial intelligence unit said the company would use its experience in supercomputers to offer a service specifically for what are called large language models, the technology behind services, including ChatGPT.

Technological Advancement

Technological advancements in the cloud-managed services market feature automation, cloud-based solutions, and container orchestration. AI and automation tools ease IT operations. The trend in cloud services is computing and data storage. MSPs enable the management of cloud services, mainly used for security purposes. The developed service for container orchestration maintains and improves containerized applications. It is adopted by businesses to ease microservices. These technologies contribute largely to the cybersecurity and data safety sector.

The vital impact of the advancements strengthens and encourages the cloud providers to leverage performance. The switch to hybrid and multi-cloud environments is being approached by businesses to improve security. It's a cost-effective and reliable service. The acceptance and quick adoption of the cloud-managed services market is accelerating the growth of the market.

Segments Insights

Service Type Insights

The mobility segment dominated the cloud managed services market in 2024. This is because businesses are using the cloud for data protection because of its inherent advantages like flexibility and cost savings. Moreover, the rising adoption of portable and mobile devices in the industry can drive the segment growth further.

The network services segment is anticipated to grow at the fastest CAGR over the forecast period. This is attributed to the adoption of cloud computing and the expansion of cloud-based applications and services, which are increasing the demand for network services. Furthermore, enterprises seek more secure, highly efficient networks to connect with their own infrastructure with cloud services.

Deployment Insights

The private segment held the largest share of the cloud managed services market in 2024. The private cloud offers enterprises various advantages, including enhanced data security and control over access. Additionally, it brings benefits like cost efficiency and reliability. However, the expenses involved in implementing and maintaining a private cloud can be substantial.

- In February 2024, T-Systems launches a private cloud region in Spain. The Deutsche Telekom company announced the launch of the region from two Tier III-certified data centers in the Sant Boi and Cerdanyola del Vallès areas of Barcelona.

The public segment has captured 13.4% revenue share in 2024 and is estimated to grow at the fastest CAGR. Public clouds assist commercial organizations in reducing their investment requirements for building independent IT infrastructure. This enables businesses to better fulfill customer needs and preferences while enhancing the scalability of their operations.

Verticals Insights

The telecom & ITes segment dominated the cloud managed services market in 2024. This is linked to the rapid digital transformation in the telecommunication and IT industry that is driving the segment's growth. Various organizations in this sector strive to optimize and modernize their infrastructure and service delivery. Cloud solutions also offer flexibility and cost-efficiency.

The government segment is anticipated to experience the fastest growth in the upcoming years. Governments at different levels are progressively embracing cloud technologies to improve operations, enhance service delivery, and propel digital transformation efforts. Cloud technologies enable governments to optimize their IT infrastructure, streamline processes, and cut costs. By utilizing cloud-managed services, government agencies can prioritize their core functions while entrusting the management of cloud infrastructure to skilled service providers.

End-user Insights

The large enterprise segment dominated the cloud managed services market. Large enterprises, known for their extensive operations and complex IT setups, have increasingly turned to cloud-managed services. This move aims to boost operational efficiency, scale up easily, and optimize IT investments. Cloud-managed services have also helped small- and medium-sized organizations by handling their IT infrastructure, allowing them to concentrate on core business activities and improve productivity.

The SME segment has captured a 19.3% revenue share in 2024 and is projected to experience the highest growth rate during the forecast period. Service providers offering customizations give organizations the flexibility they need, which is expected to fuel the adoption of cloud-managed services among SMEs.

- In August 2023, Qarar, a wholly owned subsidiary of SIMAH and the Middle East's prominent data analytics company, and Biz2X, a global fintech technology and financing provider with an established presence in the USA, India, and Australia and over $10 billion USD funded through its Biz2Xdigital lending platform, announced a strategic joint venture that aims to revolutionize the landscape of SME lending in Saudi Arabia.

Regional Insights

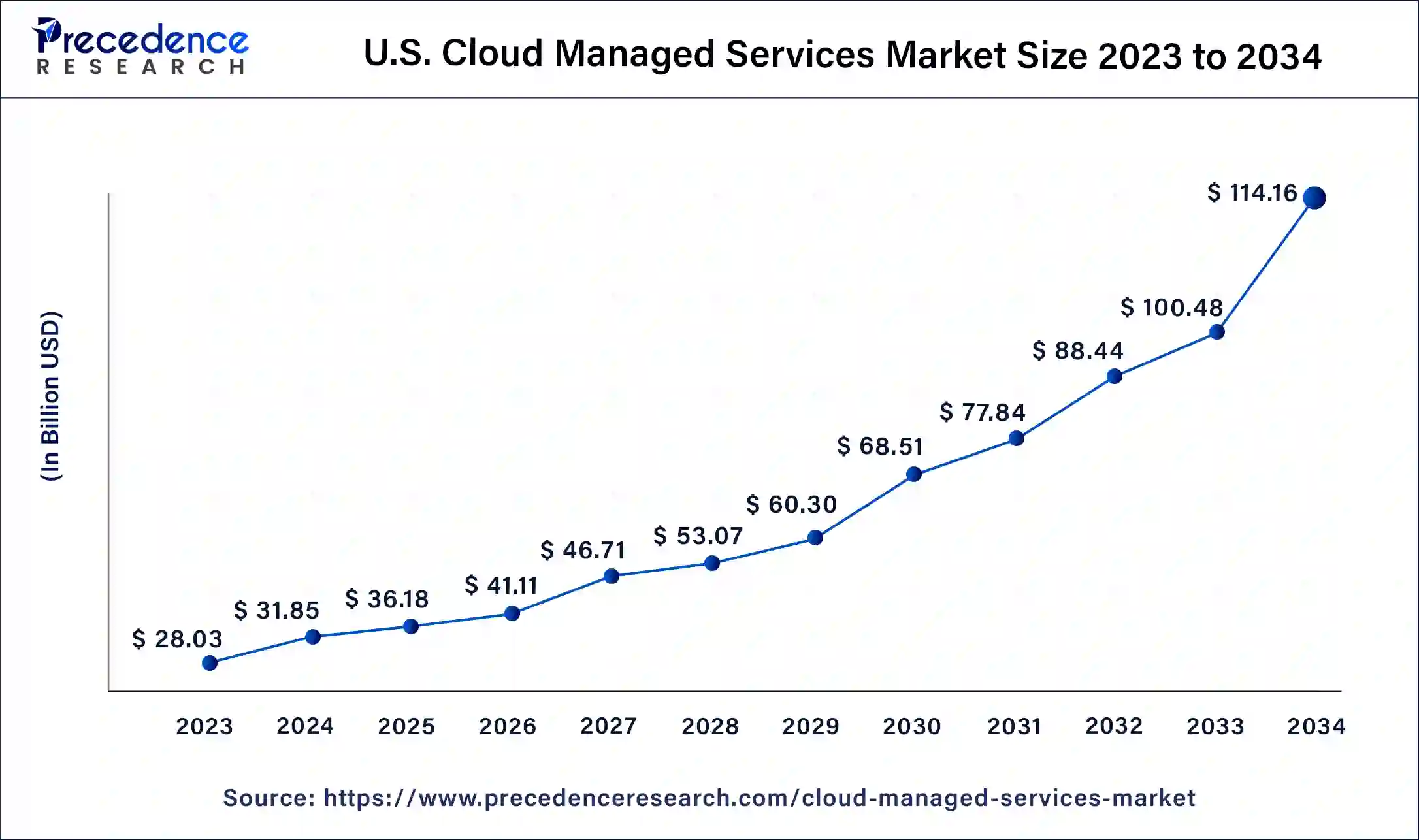

U.S. Cloud Managed Services Market Size and Growth 2025 to 2034

The U.S. cloud managed services market size was estimated at USD 36.18 billion in 2025 and is predicted to be worth around USD 114.16 billion by 2034, at a CAGR of 13.6% from 2025 to 2034.

North America held the largest share of the global cloud-managed service market in 2024and is poised for rapid expansion in the coming years. This growth is driven by the region's widespread adoption of cloud computing technologies and the increasing deployment of data centers. Furthermore, North America benefits from a thriving IT industry, which has led to the development of advanced cloud-managed services. The presence of numerous established suppliers in the region has also contributed to the growth of the cloud-managed services market.

- In November 2023, Google Cloud announced the launch of a new cloud region in Dammam, which could contribute around $109 billion to the country's GDP by 2030. The expansion will extend Google Cloud's high-performance, low-latency services to a wide range of customers in Saudi Arabia and the Middle East.

- In June 2022, AWS Managed Services launched Accelerate. Regardless of where customers are in their cloud journey, AWS Managed Services (AMS) Accelerate is a new cloud operations product that aids clients in achieving operational excellence.

- In May 2023, Serviceaide, Inc., a U.S.-based IT and service management solutions provider, unveiled its AI-powered solutions and the AI-Everywhere Luma Virtual Agent. Luma 3.0, incorporating Generative AI, introduced a significant advancement in productivity, efficiency, cost reduction, and business process innovation. This enhancement aims to improve all service management functions.

Asia Pacific has captured a 26% revenue share in 2024 and is expected to experience significant growth in the coming years. This growth is driven by improvements in the IT industry and government initiatives to promote cloud computing technologies. The expansion of data centers, particularly driven by the high activity of BPOs and data centers, further fuels the demand for cloud-managed services in the region. Countries like China and India play a crucial role as leading suppliers of advanced cloud-managed services to their clients.

- In June 2023, Samsung Electronics and NAVER Cloud collaborated to launch a 5G network for Hoban Construction. This innovative network is the first in the Korean construction sector, empowering companies to integrate diverse 5G applications to enhance efficiency and safety at construction sites.

- In March 2024, CloudMile, a leading artificial intelligence and cloud service provider in Asia, announced the launch of its “Information Security Management Solution,” tailored for corporate clients, dedicated to addressing risks associated with hybrid multi-cloud environments and AI applications.

Cloud Managed Services Market Companies

- IBM Corporation

- Cisco Systems, Inc.

- Telefonaktiebolaget LM Ericsson

- Verizon

- Accenture

- NTT DATA Corporation

- Huawei Technologies Co., Ltd.

- Fujitsu

- CHINA HUA XIN

- CenturyLink

- Trianz

Recent Developments

- In February 2025, Atos Group launched a comprehensive Google Cloud, managed security services portfolio and earned Google Cloud Security Specialization. This platform ensures excellent cybersecurity solutions for organizations. (Source - https://atos.net)

- In November 2024, Deloitte's Cyber Cloud Managed Services (CCMS) enhanced its cyber posture with AWS and Wiz. The required enhancement and transitional shift to the technology will stimulate the workflow more democratically. (Source - https://www.wiz.io)

- In March 2025, ZehnTek acquired BossNine Technologies, strengthening its cybersecurity, cloud, and managed services portfolio. The acquisition has expanded ZehnTek's customer footprint across the Northeast, Midwest. It has also contributed largely to the cloud managed services market. (Source - https://www.businesswire.com)

- In April 2023,Sinch, a computer software company, joined forces with Synoptek, an IT service provider and Microsoft Gold partner. This strategic partnership enables Sinch to provide professional and managed Microsoft Teams Phone System services that are seamlessly integrated with Operator Connect or Direct Routing.

- In April 2023, VMware, Inc., a cloud computing company, launched VMware Cross-Cloud managed services. These comprehensive offerings benefit partners and customers, empowering skilled partners to expand their managed services practices. The launch of VMware Cross-Cloud managed services facilitates growth, profitability, and recurring revenue for providers while also addressing the challenge of talent and skills gaps in multi-cloud environments.

- In February 2022,IBM collaborated with SAP, a multinational software company. Together, the companies aim to deliver consulting and technology experience to make it easy for buyers to hold hybrid cloud access and move mission-critical workloads from SAP solutions to the cloud for organized and non-regulated enterprises.

Segments Covered in the Report

By Service Type

- Business

- Network

- Security

- Datacenter

- Mobility

By Deployment

- Public

- Private

By End-user

- SMEs

- Large Enterprises

By Verticals

- Telecom & ITes

- Government

- BFSI

- Retail & Consumer

- Healthcare

- Manufacturing & Automotive

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting