What is the Managed SD-WAN Services Market Size?

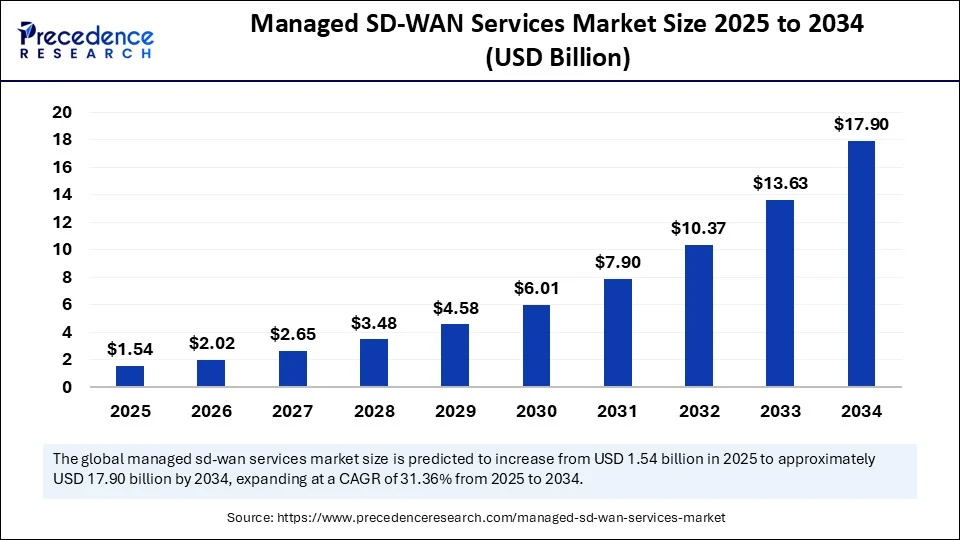

The global managed SD-WAN services market size is valued at USD 1.54 billion in 2025 and is predicted to increase from USD 2.02 billion in 2026 to approximately USD 17.90 billion by 2034, expanding at a CAGR of 31.36% from 2025 to 2034. The market is growing due to rising demand for cost-efficient, secure, and agile network connectivity across distributed enterprise locations.

Managed SD-WAN Services Market Key Takeaways

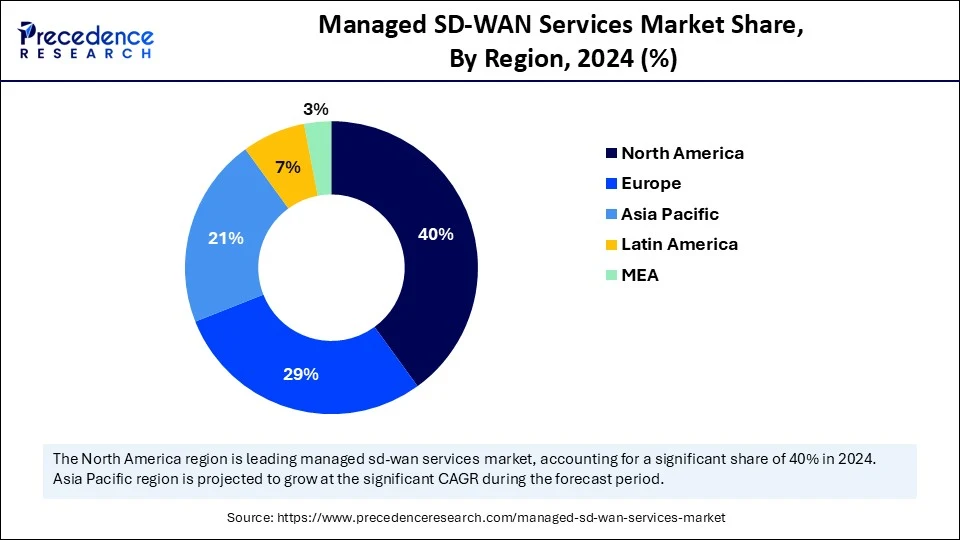

- North America dominated the managed SD-WAN services market and captured the biggest market share of 40% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR between 2025 and 2034.

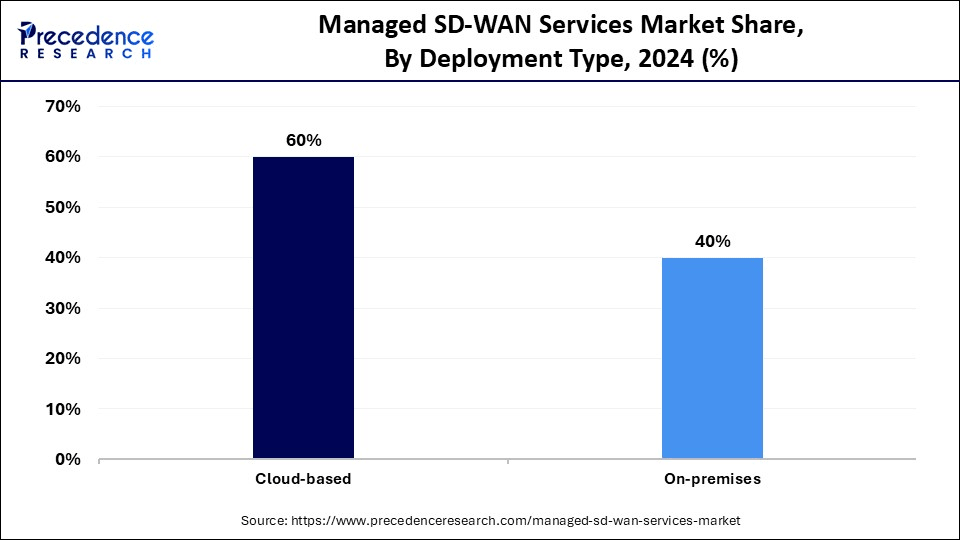

- By deployment type, the cloud-based segment held the highest market share of 60% in 2024.

- By deployment type, the on-premises segment is expected to grow at the fastest CAGR during the forecast period.

- By end-use industry, the IT & telecom segment contributed the major market share of 35% in 2024.

- By end-use industry, the healthcare segment is expected to grow at the fastest CAGR in the upcoming period.

- By service model, the fully managed services segment held the largest market share of 50% in 2024.

- By service model, the co-managed services segment is expected to grow at the fastest CAGR over the projection period.

- By offering, the SD-WAN as a service segment generated a major market share of 70% in 2024.

- By offering, the hardware segment is expected to grow at the fastest CAGR during the forecast period.

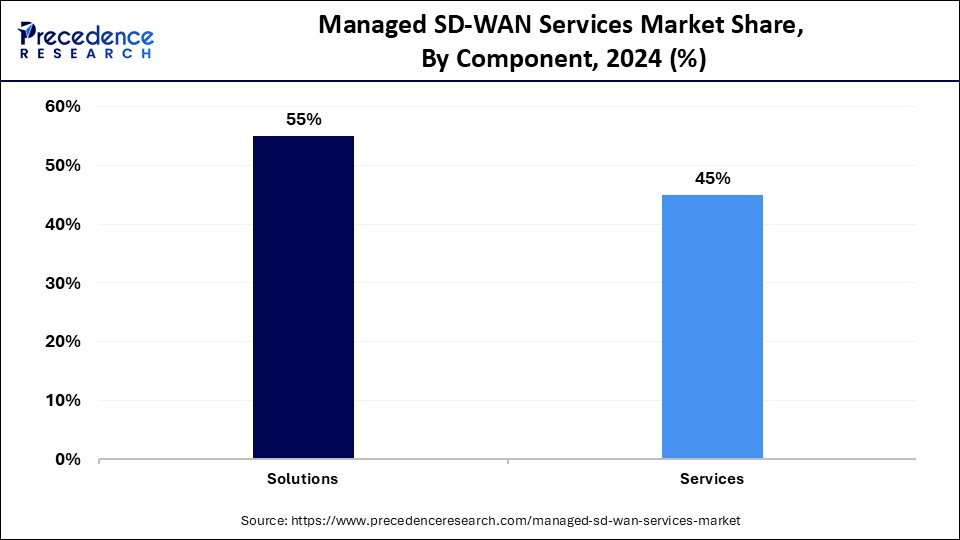

- By component, the solutions segment accounted for significant market share of 55% in 2024.

- By component, the services segment is observed to grow at the fastest CAGR during the forecast period.

- By type of connection, the MPLS held the biggest market share of 45% in 2024.

- By type of connection, the 4G/5G LTE segment is emerging as the fastest growing.

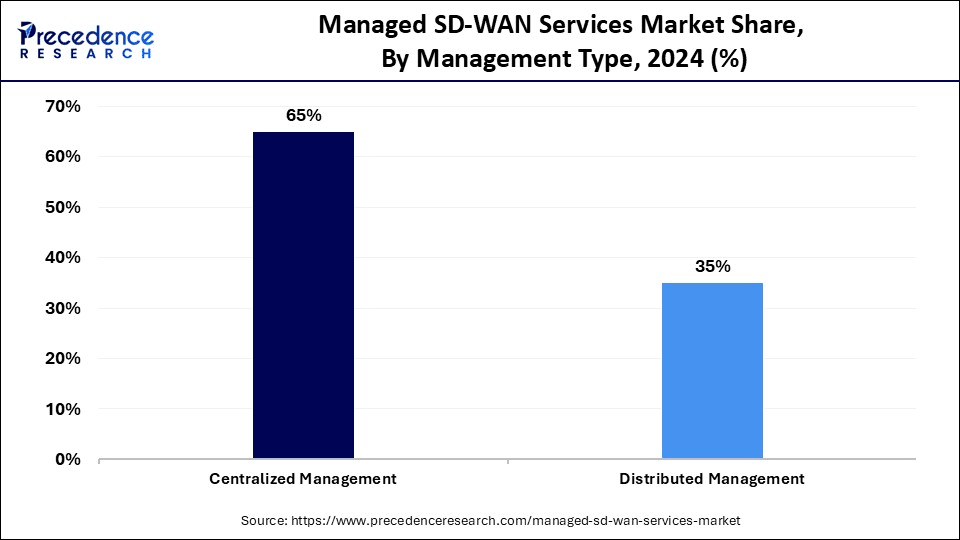

- By management type, the centralized segment captured the major market share of 65% in 2024.

- By management type, the distributed management segment is observed to grow at the fastest CAGR during the forecast period.

Managed SD-WAN: The Network Outsourcing Revolution

Managed SD-WAN (software-defined wide area network) services refer to the outsourcing of SD-WAN technology management and optimization to a third-party service provider. These services allow enterprises to simplify and optimize their network infrastructure by using software to manage WAN connections, ensuring secure, scalable, and high-performance networking solutions. SD-WAN enables companies to efficiently connect branch offices, data centres, and cloud applications with ease, reducing operational complexity and costs. Managed SD-WAN services offer features like traffic prioritization, real-time performance monitoring, and centralized control, which is ideal for organizations with complex, distributed environments.

Why are enterprises increasingly adopting managed SD-WAN services?

To streamline complicated network infrastructures, cut expenses, and improve connectivity across several locations, businesses are heavily investing in managed SD-WAN services. Businesses are moving toward flexible and secure SD-WAN solutions that provide centralized control, improved performance, and seamless scalability because traditional WAN architectures are becoming ineffective due to the increasing reliance on cloud apps and remote workforces.

How is Artificial Intelligence Transforming the Managed SD-WAN Service Delivery?

Artificial intelligence is optimizing the delivery of managed RD-WAN services by enabling real-time network optimization, predictive analytics, and automated decision-making. To guarantee steady performance and little downtime AI. AI-driven systems can identify traffic irregularities, forecast congestion, and dynamically reroute data. This boosts user experience overall and increases application responsiveness, particularly in multi-branch or cloud-heavy environments.

Additionally, AI supports zero-touch provisioning and intelligent policy enforcement, allowing SD-WAN devices to be configured automatically based on real-time needs. More effective troubleshooting, quicker deployments, and less operational complexity are all advantages for managed service providers. Consequently, businesses benefit from a network that is more secure, scalable, and resilient with less manual involvement.

Market Outlook

- Industry Growth Overview

The managed SD-WAN services market is growing, driven by increasing digital transformation, the increase of remote work, the rise of cloud adoption, and the requirement for improved network safety. Adoption of 5G technology, with its high speed and lower latency, allows SD-WAN to deliver advanced performance for mobile and Internet of Things (IoT) applications. - Global Expansion

The managed SD-WAN services market is experiencing global expansion, as the growing acceptance and deployment of third-party managed Software-Defined Wide Area Networking (SD-WAN) services by international corporations in various regions and continents. North America presently holds the largest market share due to its advanced IT ecosystem. - Major investors

Major investors are the established networking and cybersecurity organizations such as Cisco, Fortinet, and Broadcom (VMware), as well as other providers and major financial firms.

Managed SD-WAN Services Market Growth Factors

- Cloud Adoption: Growing use of cloud apps requires reliable, secure connectivity.

- Remote Work: Hybrid workforces demand flexible and secure network access.

- Cost Saving: Replaces costly MPLS with affordable broadband alternatives.

- Simplified Management: Outsourcing reduces IT complexity for enterprises.

- Built-in Security: Integrate firewalls and encryption to enhance data protection.

- Digital Shift: Businesses modernize networks as a part of digital transformation.

- IoT Expansion: More devices need scalable, low-latency connectivity.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 17.90 Billion |

| Market Size in 2026 | USD 2.02 Billion |

| Market Size in 2025 | USD 1.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 31.36% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment Type, End-use Industry, Service Model, Offering, Component, Type of Connection, Management Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Cloud Migration

As businesses rapidly migrate to cloud-based platforms like AWS, Microsoft Azure, and Google Cloud, the demand for SD-WAN significantly rises. SD-WAN provides secure and reliable connectivity to cloud-based applications and services. In facilitating distributed traffic that is cloud native, managed SD-WAN eliminates the need for data center backhauling by enabling direct-to-cloud connectivity. This guarantees increased throughput, decreased latency, and increased user productivity. Better application visibility and prioritization are also made possible, which improves the efficiency and security of cloud usage.

Need for Network Agility

Network deployment must be quick and flexible for digital transformation, particularly for multinational and multi-branch companies. Without relying on hardware, managed SD-WAN enables companies to quickly add or remove sites, adjust bandwidth allocation, and adjust to changing demand. Real-time policy changes are made possible by centralized management tools, which also increase visibility and decrease manual labor. For sectors like manufacturing, retail, and BFSI, where flexibility and uptime are critical, this agility is essential.

Restraints

Complex Integration with Legacy Infrastructure

Firmly established legacy networks with outdated MPLS routers and firewalls that are incompatible with SD-WAN are frequently found in large enterprises. However, integrating SD-WAN in existing infrastructure is challenging. Implementing and managing SD-WAN is complex, requiring specialized expertise and careful planning. This discrepancy results in longer migration schedules, potential data loss, and inefficient operations during transition periods. The alignment of new SD-WAN routing policies with current security protocols presents additional challenges for network teams. For companies without funds for modernization, this integration complexity becomes a significant turnoff.

Limited Awareness

Many small and mid-sized enterprises are unaware of the benefits of SD-WAN or perceive it as a solution only for large corporations. Misconceptions regarding the intricacy and applicability of the technology have been caused by a lack of technical know-how and indagate vendor outreach. Adoption is frequently delayed by these companies' preference for short-term operational requirements over long-term IT investment. The problem is further compounded in regional markets by the restricted availability of technology advisors or IT consultants.

Opportunity

Integration with 5G and Edge Computing

Low-latency high-performance networking will become much more important as 5G is deployed and edge computing expands. SD-WAN is perfect for edge applications and real-time data processing because of its capacity to route traffic across various network types intelligently. Businesses can also optimize traffic flow by dynamically balancing 5G broadband and MPLS with the aid of managed SD-WAN. The rising demand for increased bandwidth in various industries creates immense opportunities in the market.

Deployment Type Insights

Why did the cloud-based segment dominate the managed SD-WAN services market in 2024?

The cloud-based segment dominated the market with the largest share in 2024. The dominance of the segment stems from the adaptability, scalability, and simplicity of SD-WAN in integrating with cloud infrastructure and SaaS platforms. Because of its centralized management, quicker provisioning, and cheaper initial costs cloud cloud-hosted SD-WAN is preferred by the organization. Cloud-based models provide seamless connectivity, real-time updates, and improved traffic optimization across distributed environments, which are important for businesses that continue to support hybrid workforces and implement multi-cloud strategies.

- On 1 July 2025, Arista Networks announced the launch of AI-optimized Cloud WAN solutions via the acquisition of VeloCloud, enabling seamless cloud-based SD-WAN integration.(Source: https://blogs.arista.com)

The on-premises segment is expected to grow at the fastest rate in the upcoming period, as on-premises deployment is becoming more popular among industries with stringent regulations regarding data privacy and safety and compliance requirements. On-premises deployment offers more control over data, reducing the risk of unauthorized access or data breaches. Industries like banking, healthcare, and defense favor on-premises SD-WAN solutions. On-premises solutions are seeing a resurgence in popularity as more businesses seek to balance agility and governance through hybrid deployment strategies.

End-Use Industry Insights

How does the IT & Telecom segment dominate the managed SD-WAN services market in 2024?

The IT & Telecom segment dominated the managed SD-WAN services market in 2024, as IT and telecom businesses heavily rely on reliable, fast connectivity for their dispersed networks. Telecom companies are increasingly incorporating SD-WAN into their service offering to improve customer satisfaction and simplify networks. To ensure uptime and service quality across numerous locations, these businesses profit from SD-WAN automation, real-time analytics, and centralized management.

The healthcare segment is expected to expand at the fastest rate in the coming years. SD-WAN adoption is rising in the healthcare industry due to the growth of digital health records, telehealth, and remote patient monitoring. To comply with stringent regulations such as HIPAA, managed SD-WAN provides healthcare providers with low-latency, secure connectivity for critical applications. Healthcare systems are becoming increasingly digitalized, which is driving up demand for scalable, secure, and dependable networking.

Service Model Insights

What made fully managed services the dominant segment in the managed SD-WAN market in 2024?

The fully managed services segment dominated the market with a major share in 2024, as enterprises increasingly outsource complex network management to focus on core operations. In addition to optimizing cloud security performance and monitoring, these services provide end-to-end support from deployment to maintenance. Fully managed models are favored by businesses across all industries due to the lower IT overhead, quicker time to market, and improved SLA compliance they provide.

The co-managed services segment is expected to grow at the highest CAGR over the forecast period. Co-managed services are gaining popularity as organizations seek greater control over their networks while still leveraging expert support. This approach allows enterprises to collaborate with service providers, enabling more flexibility in policy control and customization. It appeals to large enterprises within house IT teams who want vendor assistance for monitoring, analytics, or optimization without fully relinquishing control.

Offering Insights

Why did the SD-WAN as a service segment dominate the market in 2024?

The SD-WAN as a service segment dominated the managed SD-WAN services market in 2024. This is mainly due to the fact that this service offers a scalable, subscription-based solution with little infrastructure investment. The OPEX model appeals to businesses because it enables them to take advantage of centralized management and on-demand scalability without incurring significant upfront costs. Additionally, this strategy makes it possible for quicker deployment, simpler cloud platform integration, and automated software updates, all of which are essential in the hectic business world of today.

Hardware is the fastest-growing segment. The expansion of hybrid network environments is increasing demand for SD-WAN hardware such as edge routers and appliances, despite the move to software-defined solutions. Hardware is necessary for edge computing, branch connectivity, and secure local internet breakout in many organizations. Moreover, the need for compatible hardware components is rising due to the expansion of 5G and IoT device connectivity.

Component Insights

How does the solutions segment dominate the managed SD-WAN services market in 2024?

The solutions segment dominated the market in 2024, as solutions form the core of SD-WAN architecture, providing essential features like traffic prioritizing, intelligent routing, and security integration. Through central administration of application flows and policies, these software-defined solutions improve performance. Comprehensive SD-WAN software packages that facilitate cloud connectivity, multi-path optimization, and centralized orchestration are becoming increasingly expensive for businesses.

The services segment is expected to grow at the fastest CAGR in the coming years. The growth of the segment is attributed to the rising demand for consulting, deployment, training, and ongoing network monitoring services. As SD-WAN deployments grow in complexity, enterprises seek expert assistance for implementation and continuous support. Managed services offer scalable, on-demand expertise, reducing the pressure on internal IT teams and ensuring optimized network performance.

Type of Connection Insights

What made MPLS the dominant segment in the managed SD-WAN services market in 2024?

The MPLS segment led the market while holding the largest share in 2024. The dominance of the segment stems from its dependability, low latency, and promised quality of service (QoS), particularly in sectors that deal with real-time or vital data. Many businesses still use MPLS for certain applications where reliable performance is essential, even though SD-WAN improves connectivity. MPLS has remained relevant in SD-WAN architecture due to the prevalence of hybrid models that combine broadband and MPLS.

The 4G/5G LTE segment is expected to expand at a rapid pace during the forecast period. The growing availability of 4G and 5G networks is enabling enterprises to adopt wireless links as a primary or backup WAN option. LTE offers quick deployment, especially in remote locations or during temporary setups, while 5G brings high bandwidth and low latency, ideal for edge applications. This wireless flexibility is becoming vital for SD-WAN deployments across industries like retail, logistics, and construction.

Management Type Insights

Why did the centralized management segment dominate the managed SD-WAN services market?

The centralized management segment dominated the market with the largest share in 2024 because it allows IT teams to manage network, monitor performance, and distribute updates across several branches. In dispersed locations, centralized management systems improve security posture and streamline operations. Businesses operating in hybrid and multi-cloud environments, where consistency and real-time control are essential, will particularly benefit from centralized orchestration.

Distributed management is the fastest-growing segment, due to its localized control and flexibility, making it more popular as networks become more decentralized and dynamic. It enabled real-time decision-making at branch offices or edge locations independent of the central hub. Applications needing local data processing or ultra-low latency will find this particularly helpful, which is why industries like manufacturing and logistics are showing interest in distributed SD-WAN configurations.

Regional Insights

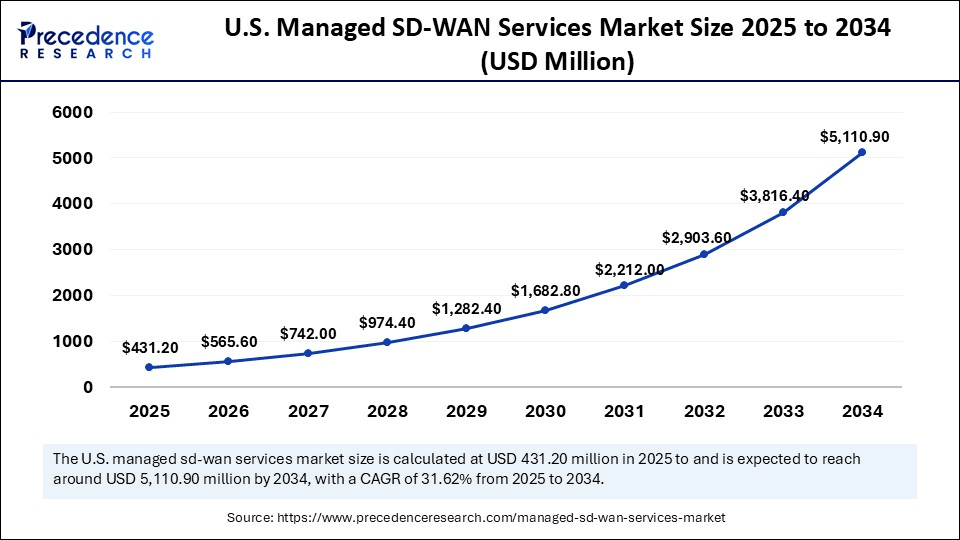

U.S. Managed SD-WAN Services Market Size and Growth 2025 to 2034

The U.S. managed SD-WAN services market size is evaluated at USD 431.20 million in 2025 and is projected to be worth around USD 5,110.90 million by 2034, growing at a CAGR of 31.62% from 2025 to 2034.

What made North America the dominant region in the managed SD-WAN services market?

North America dominated the managed SD-WAN services market while capturing the largest share in 2024. This is mainly due to its advanced IT infrastructure, presence of major service providers, and early adoption of SD-WAN technology. Businesses in the area are spearheading digital transformation initiatives, and there is a strong need for cybersecurity and cloud native networking solutions. Furthermore, significant investments in 5G and edge computing, as well as regulatory support, spur ongoing development and innovation in SD-WAN deployment. The growing need for business agility further supports regional market growth.

U.S.: Early and Rapid Technology Adoption

In the U.S., early adoption of advanced technology, a robust IT infrastructure, a high concentration of massive technology and service providers, and the extensive embrace of cloud-driven services and digital transformation in a large enterprise base. Many United States businesses, specifically SMEs, prefer completely or co-managed SD-WAN models to influence the proficiency of managed service providers (MSPs).

Asia-Pacific's SD-WAN Growth: Connecting Cloud-First Businesses

Asia Pacific is expected to experience the fastest growth in the coming years, driven by a rapid shift of businesses to cloud environments. SD-WAN enables IT teams to manage network policies, keep an eye on performance, and distribute updates to various branches all from a single dashboard. Operations are made simpler, andsecurity posture is improved across dispensed locations thanks to this unified visibility. The growing digital transformation across industries and demand for centralized management to reduce the need for on-site IT staff further support regional market growth.

China: Presence of Major Key Players

Chinese organizations, specifically in sectors like logistics, manufacturing, and e-commerce, are experiencing massive digitalization and adopting multi-cloud environments. Increasing government initiatives, such as New Infrastructure and Made in China 2025, vigorously promote the adoption of next-generation IT and communication techniques. China has large telecom giants, such as presence of China Telecom and Huawei, which drive the growth of the market.

Europe: High Rate of Cloud Adoption

Europe is significantly increasing in the managed SD-WAN services market, as European organizations are quickly shifting workloads to the cloud. In 2023, 45.2% of EU organizations purchased cloud computing solutions, like services used over the internet to access software, computing power, and storage volume. This marks a 4.2 % point rise compared to 2021. Additionally, small and medium enterprises (SMEs) are adopting managed SD-WAN to reduce reliance on costly legacy MPLS networks and gain the advantages of dynamic scalability and affordable wideband use, which contributes to the growth of the market.

UK: Advancement in Fire Protection Systems

The UK has a robust sector of managed service providers (MSPs), contributing major telecommunications organizations such as BT Group Plc, Vodafone Group Plc, and Virgin Media Business. SD-WAN technology is supporting UK SMEs in optimizing their network infrastructure for superior efficiency, flexibility, and expense savings. UK Managed SD-WAN offers a better consumer experience and resource utilization, higher application performance, enhanced outcomes, and lower bandwidth expenses.

Top Vendors in the Managed SD-WAN Services Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Cisco Systems, Inc. |

San Jose, California |

Robust and diverse product portfolio |

In November 2025, Cisco updated its SD-WAN integration with Megaport for on-demand AI data center access. |

|

VMware, Inc. |

California |

Comprehensive hybrid cloud platform |

Managed Hybrid WAN, the next-generation WAN service that is easier to manage and deploy, built on the foundation of a cloud-delivered SD-WAN. |

|

Juniper Networks, Inc. |

United States |

AI-Native Networking |

Juniper's AI-driven SD-WAN streamlines branch operations, accelerates deployments, and secures the network with a unified "Branch-in-a-Box" service. |

|

Huawei Technologies Co., Ltd. |

China |

Strong R&D |

Huawei inventively launched the all-in-one financial gateway that combines routing, switching, security, and SD-WAN capabilities, greatly lowering the networking complexity and the number of NEs in branches. |

|

Riverbed Technology |

United States |

Automated workflows, open and integrated platform |

Riverbed is going back to its WAN optimization roots with a novel strategy focusing on resolving application performance. |

Other Major Companies

- Aryaka Networks, Inc.

- Versa Networks, Inc.

- Nokia Corporation

- Silver Peak (now part of HPE)

- Fortinet, Inc.

- Extreme Networks, Inc.

- Citrix Systems, Inc.

- Palo Alto Networks, Inc.

- SD-WAN Solutions

- Windstream Enterprise

- TPX Communications

- Telstra Corporation Limited

- GTT Communications, Inc.

- Orange Business Services

- CenturyLink (now Lumen Technologies)

Recent Developments

- In June 2025, Cisco unveiled next-generation AI-ready SD-WAN devices and a unified architecture. New platforms incorporate post-quantum encryption and AI-driven diagnostics via AgenticOps for intent-based operations and real-time threat mitigation under the Cisco SD-WAN Manager ecosystem.(Source: https://www.wwt.com)

- On 17 May 2025, Spectrotel's managed SD-WAN solution was recognized as the 2025 Internet Telephony SD-WAN product of the Year. Awarded for the fifth consecutive year, Spectrotel's Secure SD-WAN emphasizes centralized orchestration, built-in security, real-time analytics, and fully managed lifecycle services.

- On 29 April 2025, Verizon announced the launch of its first government cloud-managed software defined wide area network (SD WAN) product.(Source: https://www.globenewswire.com)

Segments Covered in the Report

By Deployment Type

- Cloud-based

- On-premises

By End-use Industry

- IT & Telecom

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- Retail

- Manufacturing

- Government

- Education

- Energy & Utilities

- Media & Entertainment

- Transportation & Logistics

By Service Model

- Fully Managed Services

- Co-Managed Services

- Do-It-Yourself (DIY) Services

By Offering

- SD-WAN as a Service

- Hardware (Edge Devices, Routers, etc.)

- Software (Network Monitoring, Security)

By Component

- Solutions

- Network Control

- WAN Optimization

- Security Features (Firewall, Encryption)

- Application Visibility & Control

- Services

- Consulting Services

- Integration & Implementation

- Support & Maintenance

- Training & Certification

By Type of Connection

- MPLS (Multiprotocol Label Switching)

- Broadband Internet

- 4G/5G LTE

- Satellite

- Private Line (Ethernet)

By Management Type

- Centralized Management

- Distributed Management

By Region

- North America

- Europe

- Asia-Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting