What is the Managed Network Services Market Size?

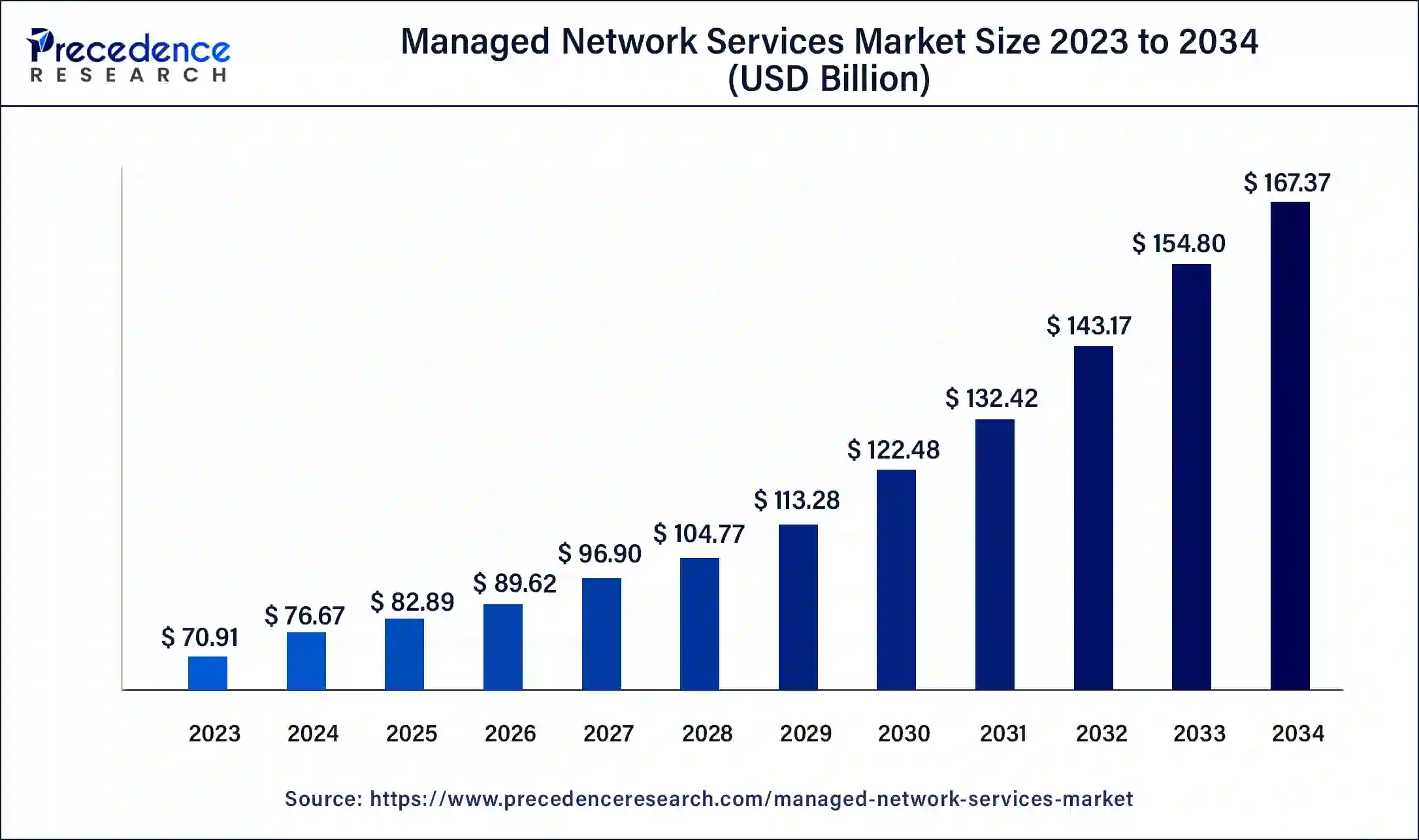

The global managed network services market size is calculated at USD 82.89 billion in 2025 and is predicted to increase from USD 89.62 billion in 2026 to approximately USD 179.31 billion by 2035, expanding at a CAGR of 7.99% from 2026 to 2035.The increasing need to cut capital and operating expenses is expected to drive the growth of the managed network services market.

Managed Network Services Market Key Takeaways

- The global managed network services market was valued at USD 82.89billion in 2025.

- It is projected to reach USD 179.31billion by 2035.

- The managed network services market is expected to grow at a CAGR of 7.99% from 2026 to 2035.

- North America contributed more than 34% of market share in 2025.

- Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By type, the managed WAN segment accounted for the dominating share of the market in 2025.

- By type, the managed LAN segment is expected to witness significant growth in the market during the forecast period.

- By deployment mode, the cloud segment held a dominant presence in the market in 2025.

- By deployment mode, the on-premise segment is expected to register considerable growth in the global market over the forecast period.

- By enterprise size, the large enterprises segment registered its dominance over the market in 2025.

- By enterprise size, the small & medium enterprises segment is projected to expand rapidly in the market in the coming years.

- By end user, the BFSI segment accounted for the highest share of the market in 2025 and is anticipated to grow at a robust CAGR over the forecast period.

- By end user, the healthcare segment is expected to grow at the fastest rate in the market during the forecast period of 2026 to 2035.

Market Overview

In a world of digitally interconnected, managed network services are integral to ensuring smooth, reliable, and efficient business operations. The managed network services market enables business organizations to outsource web applications, functions, and services that are remotely administered, operated, monitored, and maintained by a managed service provider (MSP).

Managed network services include a wide range of offerings, from managing local area networks (LAN) and wide area networks (WAN) to the latest software-defined WAN (SD-WAN) connections and network security solutions. The adoption of the managed network services market has increased substantially as it offers businesses a strategic advantage in a competitive and digitally driven landscape.

- According to the Ericsson Mobility Report in June 2024, 5G is expected to overtake 4G to become the dominant subscription type in 2028. Global 5G subscriptions are forecast to reach close to 5.6 billion in 2029, making up 60% of all mobile subscriptions at that time. During the first quarter of 2024, 160 million 5G subscriptions were added to exceed a total of 1.7 billion. Around 300 service providers have now launched commercial 5G services, and around 50 have deployed or launched 5G standalone.

- It is projected that North America will still have the highest 5G penetration in 2029 at 90%, followed closely by the Gulf Cooperation Council (GCC) at 89% and Western Europe at 86%.

- At the end of 2023, North America had the highest 5G subscription penetration globally at 59%. In North East Asia, penetration reached 41%, followed by the GCC countries at 34% and Western Europe at 26%. 5G subscriptions increased by 160 million during the first quarter of 2024 to a total of 1.7 billion.

How is Artificial Intelligence (AI) Improving the Managed Network Services Market?

Artificial intelligence has transformed the managed network services market. As these services involve outsourcing network management tasks to specialized providers and with the help of AI integration, managed network services can become more efficient. Managed network services can offer quick incident response, real-time monitoring, and continuous optimization, which ensures that networks run securely and seamlessly.

The AI-managed network services market involves leveraging AI to efficiently manage several IT functions within an organization. These services include various tasks such as predictive maintenance, system monitoring, data management, security enhancement, and others. Therefore, the use of AI-managed AI services can optimize and streamline IT operations, enhancing operational efficiency and cost-effectiveness and overall improving IT performance.

Managed Network Services Market Growth Factors

- The increasing need for secure connectivity and data protection is anticipated to boost the growth of M cybersecurity threats incidents, spurring the demand for robust managed network security solutions.

- A growing participation of key players in the managed network services market is observed in the form of improved services, new launches, mergers, and acquisitions.

- Organizations around the world are increasingly adopting cloud-based managed network services to enhance security, improve access, boost productivity, and reduce operational costs.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 179.31 Billion |

| Market Size in 2025 | USD 82.89 Billion |

| Market Size in 2026 | USD 89.62 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.99% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vehicle Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Cost-effectiveness

The rising need to reduce capital and operating expenditure is expected to boost the expansion of the managed network services market during the forecast period. Organizations hire skilled experts to handle their networks rather than employing internal IT workers, which often results in large infrastructure expenditures. This outsourcing approach is gaining immense popularity as an affordable option for various sizes of businesses.

The managed network services market helps business to trim down their expenses as they are not required to make expensive technology investments. A cloud-based allows remote employees to access their applications, files, and data from anywhere. Companies only pay for the services they avail; providers provide scalable services that can be modified according to the needs of the company.

Restraint

Lack of data privacy and growing security concern

The lack of data privacy and growing security concerns are anticipated to hamper the growth of the managed network services market. Companies often face several security concerns and data privacy issues that discourage them from adopting these services. In addition, the lack of IT infrastructure and technical expertise in lower and middle-income countries is likely to result in a slow adoption rate and limit the expansion of the market during the forecast period.

Opportunity

Rising demand from small-scale enterprises

The increasing demand from small-scale enterprises is projected to offer lucrative opportunities to the managed network services market during the forecast period. Managed network services assist small-scale enterprises to concentrate on their core strengths and offer them opportunities to grow and accomplish their defined goals.

The IT spending among SMEs has steadily increased, witnessing that these businesses are under constant pressure to grow by installing advanced and extended IT services. The need for managed service providers (MSPs) is expected to increase as SMEs are widely adopting automated services, cloud computing, and other innovative digital technologies. Thus, SMEs can increase their efficiency and productivity through this strategic outsourcing, which boosts overall performance.

Segment Insights

Type Insights

The managed WAN segment accounted for the dominating share of the managed network services market in 2025. Managed wide area network (WAN) is a crucial component for IT and business operations. Companies are adopting these services to improve security, enhance performance, and streamline network management. Companies are heavily investing in WAN infrastructure as WAN networks support remote workforces. Companies are increasingly relying on WAN networks to connect their branch sites and ensure uninterrupted connectivity to remote locations. The rise in remote work, coupled with increasing demand for bandwidth-intensive applications, has significantly increased the demand for WAN services. Therefore, the adoption of managed WAN services has increased to improve the network for reliable and secure information delivery with speed and ease.

The managed LAN segment is expected to witness significant growth in the managed network services market during the forecast period. Managed LAN services to support operations, maintain network reliability, and control costs. The segment's growth is majorly driven by the increasing implementation of LAN in businesses for effective and centralized network management. Managed LAN Services is a service provided by a third-party service provider to manage a company's local area network (LAN). Managed LAN service providers offer several benefits, such as security, network monitoring, improved network performance, cost savings, reliability, and 24-hour availability. This type of service allows companies to improve business productivity and save expenses by reducing the cost of maintaining network infrastructure. It also provides an effective way to access the network remotely.

Deployment Mode Insights

The cloud segment held a dominant presence in the managed network services market in 2025. The growth of the segment is majorly driven by the rising need to manage complex network infrastructure and ensure seamless network communications security. Many enterprises lack the in-house capabilities to manage highly complex networks, which increases the importance of specialized MNS. Cloud-based tools assist in streamlining workflows, eliminating the burden of software updates, automating routine tasks, and more.

Cloud providers emphasize data security and employ robust cybersecurity measures to protect sensitive information. Cloud computing plays an integral role in remote work and offers several benefits, such as improved security, centralized data management, enhanced flexibility, cost optimization, and others. Such factors drive the growth of the segment.

- In February 2024, the 2024 Data Attack Surface report predicts the total amount of data that the world will need to protect over the next two yearsCybersecurity Ventures predicts that the total amount of data stored in the cloud will reach 100 zettabytes by 2025. Total global data storage is projected to exceed 200 zettabytes by 2025. This includes data stored on private and public IT infrastructures, on utility infrastructures, on private and public cloud data centers, on personal computing devices — PCs, laptops, tablets, and smartphones — and on IoT (Internet-of-Things) devices.

- According to Cybersecurity Ventures, there were 6 billion internet users in 2022. It is predicted that this will increase to 7.5 billion internet users by 2030.

The on-premise segment is expected to register considerable growth in the global managed network services market over the forecast period. Several enterprises prefer on-premises deployment to maintain physical ownership of their network assets. On-premises deployment allows complete control over network infrastructure and data, which makes it particularly suitable for industries with stringent compliance and security requirements.

Enterprise Size Insights

The large enterprises segment registered its dominance over the managed network services market in 2025 owing to the presence of extensive network infrastructures and the large volume of data they handle. Large enterprises opt for these services to ensure smooth and uninterrupted business operations. Large enterprises generally have considerably high IT budgets, and they are more inclined to outsource network management to specialized service providers. In addition, the increasing cases of security threats have compelled the business to leverage expertise for cybersecurity measures.

- In March 2023, IBM and Cohesity announced a collaboration to address the critical need organizations have for increased data security and resiliency in hybrid cloud environments. Combining data protection, cyber resilience, and data management capabilities from both companies, IBM will launch its new IBM Storage Defender solution, which will include Cohesity's data protection as an integral part of the offering. IBM Storage Defender is being designed to leverage AI and event monitoring across multiple storage platforms through a single pane of glass to help protect organizations' data layers from risks like ransomware, human error, and sabotage.

The small & medium enterprises segment is projected to expand rapidly in the managed network services market in the coming years. The cost-effectiveness of outsourcing network management attracts small & medium enterprises (SMEs) to adopt these services. Small & medium enterprises often have limited resources and expertise to manage their network infrastructure. Managed network services allow SMEs to focus on core competencies while leveraging expert network management capabilities at an affordable cost. Therefore, SMEs can increase their productivity and efficiency through outsourcing, fueling the segment's growth in the coming years.

End-user Insights

The BFSI segment accounted for the highest share of the managed network services market in 2025 and is anticipated to grow at a robust CAGR over the forecast period. In today's digital-paced world, financial institutions cannot afford to compromise with their security. The banking, financial services, and insurance (BFSI) sector deals with data generation and processing, which includes various critical information, including account numbers, passwords, details of credit/debit cards, and many other important details that need the utmost security.

Managed security services assist them in maintaining efficient operations and protecting the privacy of their client's data. Therefore, managed network services play a crucial role in ensuring data privacy, safeguarding against cyber threats, and facilitating uninterrupted network connectivity for all important financial transactions.

- According to the Data Breach Investigations Report 2023, the DBIR team analyzed 16,312 security incidents, of which 5,199 were confirmed data breaches.

The healthcare segment is expected to grow at the fastest rate in the managed network services market during the forecast period of 2024 to 2034. In the healthcare industry, managed network services are important for smooth connectivity between different healthcare facilities, secure data transmission, and others. Managed network services empower healthcare providers to efficiently manage HIPAA-compliant networks and securely deploy and maintain mobile health applications. This outsourcing approach enables healthcare institutions to navigate complex IT challenges while focusing on their core competencies of delivering better quality patient care. Moreover, there is a rising adoption of digital health solutions and telemedicine around the world.

Regional Insights

North America held the largest share of the managed network services market in 2025. It is a hub for world-leading MNS market players such as IBM, Lumen, Cisco, Verizon, CommScope, AT&T, and Masergy. The region's growth is attributed to the presence of a robust technological infrastructure, increasing investments in digital transformation, a rising need for cost-effective solutions through outsourcing, a supportive Government framework, and a rising number of technology start-ups. The United States is the major contributor to the market owing to the increasing number of major IT companies coupled with the widespread adoption of managed network services among businesses.

Additionally, the North American market has witnessed the rising adoption of advanced technologies in the BFSI, manufacturing, retail, and pharmaceutical industries, resulting in the growing demand for managed network services in the region. Furthermore, the rapid development of cloud computing has led to an increasing need for reliable and secure network solutions, which in turn is expected to boost the growth of the managed network services market in the coming years. Thus, cybercrime remains one of the primary risks that companies in the United States face. Cyberattacks, if successful, might have serious consequences, the main one being financial damage.

- In July 2023, the federal government allocated nearly USD 42.5 billion to expand broadband connectivity across the United States. 5G is gaining attention. The funds have been allocated to all 50 states, the District of Columbia, and five U.S. territories. The Broadband Equity, Access, and Deployment (BEAD) funds are targeted at expanding broadband networks to unserved and underserved areas and providing ongoing financial support to increase access.

- In September 2024, US Signal Company, LLC, a leading digital infrastructure provider and portfolio company of Igneo Infrastructure Partners, completed its acquisition of OneNeck IT Solutions LLC and OneNeck Data Center Holdings LLC (OneNeck) from Telephone and Data Systems, Inc., a provider of wireless, broadband, video, voice, hosted and managed services to U.S. businesses.

- In January 2022, the U.S. Department of Agriculture (USDA) awarded Lumen Technologies a task order worth more than USD 1.2 billion to deliver a fully integrated wide area data transport service with secure remote access, contact center, and cloud connectivity solutions to more than 9,500 USDA locations across the country and abroad. These solutions will enable nearly 100,000 USDA employees.

- In 2023, 3 in 4 companies in the US were at risk of a material cyberattack, according to chief information security officers (CISO). Their concerns are based on the fact that the number of cyberattacks has been increasing in recent years, amounting to 480 thousand in 2022.

- According to the forecast, in 2024, cybercrime will cost the U.S. more than USD 452 billion. However, financial losses are not what company leaders are mostly concerned about but rather reputational damage.

Asia Pacific is anticipated to grow at the fastest rate in the managed network services market during the forecast period. The robust growth of the region is attributed to the rising advancements in technology infrastructure, particularly in emerging economies such as China, Japan, and India. The region has a large and expanding base of small and medium-sized enterprises (SMEs) that adopt managed network services due to their cost effectiveness and streamlining of their operations.

The growing emphasis on digital transformation has increased the need for high-speed and seamless connectivity coupled with complying with regulatory standards, which is anticipated to fuel the growth of the managed network services market in the region. In addition, other factors such as increasing 5G internet penetration, rapid economic growth, increasing need for effective security solutions, and the growing adoption of cloud-based solutions are expected to spur the demand for managed network services in Asia Pacific.

- According to the Government Services and Data Management Bureau of Nanshan District, to support city-level administration and services, Nanshan, a developed administrative region in the first-tier city, adheres to a thorough top-level design plan powered by cutting-edge 5G + technology. The program addresses the majority's most urgent requirements by considering governance, public services, and industry development.

- According to Erqicsson Mobility Report, in June 2024, in India, 5G subscriptions reached around 119 million by the end of 2023. 5G subscriptions are expected to reach around 840 million by the end of 2029

- India continues to lead in data consumption per smartphone, which is expected to grow at a compound annual growth rate (CAGR) of 15% from 2023 to 2029. Monthly data consumption per smartphone in India is anticipated to rise from 29 GB in 2023 to an unprecedented 68 GB by 2029, maintaining its position as the highest globally.

Managed Network Security Services Industry in Europe

Europe shows a significant growth during the forecast period. It is driven by intense regulatory pressure, a dramatic rise in sophisticated AI-driven cyberattacks, and the demand to secure complex hybrid cloud environments. 74% of European companies lack internal cyber-awareness programs, thus making them reliant on third-party experts to handle complex cloud, network, and even security infrastructure.

France Managed Network Services Market Trends

The French managed network services market is driven by fast digital transformation, high cybersecurity risks, and the demand for operational efficiency. Enterprises are moving away from legacy infrastructure to agile, thus, cloud-native architectures to fund hybrid work, optimize costs, and enhance performance.

Regulatory Compliance and Data Protection Driving Network Outsourcing in Latin America

Latin America shows a notable growth during the forecast period. As local laws now closely work with global standards such as GDPR and Brazil's LGPD. Firms outsource to leverage specialized providers who ensure compliance, decreasing risks of data breaches and even legal penalties, while benefiting from time zone alignment and cost savings.

5G Deployment and Edge Computing Supporting Market Growth in MEA

MEA shows a rapid growth during the forecast period. By offering ultra-low latency, high bandwidth, and localized data processing. This combination is vital for supporting rapid industrial IoT expansion over 30 million connections, government-backed smart city initiatives, and thus, real-time data needs in sectors such as oil & gas, healthcare, and logistics.

Managed Network Services Market Companies

- Ericsson: Ericsson's managed services offer end-to-end, AI-driven, and automated network operations for communication service providers, aiming at 5G, multi-vendor, and even multi-technology environments.

- Hewlett Packard Enterprise Development LP: Hewlett Packard Enterprise provides comprehensive, AI-driven managed network services, mainly through HPE GreenLake for Networking as well as Aruba Networking services.

- Accenture Plc: Accenture PLC provides comprehensive managed network services aiming at AI-driven automation, security, and cloud-driven, software-defined infrastructure (SD-WAN) to improve operational efficiency, reduce expenses by up to 30%, and enhance network reliability.

- Verizon: Verizon provides a comprehensive suite of managed network services targeted at improving agility, security, and performance for enterprises. These solutions use AI and machine learning for automation, with alternatives ranging from monitoring to full outsourcing, thus backed by 24/7 expert support.

- Fujitsu: Fujitsu supports modern infrastructure, which includes SDN, SD-WAN, and NFV, providing flexible consumption-driven models to improve security, reduce costs, and accelerate digital transformation for global clients.

Other Major Key Players

- Alcatel-Lucent Enterprise

- LG Networks

- Huawei Technologies

- Verizon Communications Inc.

- Telstra Global

- AT&T Inc.

- NTT Communications

- HCL Technologies

- Wipro Limited

- IBM Corporation

- Cisco Systems Inc.

- Sift Technologies Ltd.

Recent Developments

- In August 2023, HCLTech announced a strategic global partnership with Verizon Business to become its primary managed network services (MNS) collaborator in all networking deployments for global enterprise customers. HCLTech signs a USD 2.1 billion managed network services deal with Verizon.

- In February 2023, At MWC Barcelona 2023, Steven Zhao, Vice President of Huawei's data communication product line, launched a digital managed network solution and products for carriers' B2B services. It will help carriers seize digital transformation opportunities and boost new growth. This solution provides digitally managed network capabilities and rich product portfolios, helping carriers transform from ISPs to MSPs.

- In May 2023, NTT Ltd., a leading IT infrastructure and services company, announced SPEKTRA (sentient platform for network transformation) as the next generation of its global services platform for NTT Managed Networks solutions. The platform provides customers with a direct pathway towards network transformation, underpinned by NTT's managed services experience, expertise, and expansive technical resources.

Segments Covered in the Report

By Type

- Managed VPN

- Managed WAN

- Managed LAN

- Managed Network Security

- Managed WiFi

- Others

By Deployment Mode

- On-premise

- Cloud

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By End-user

- Bfsi

- Retail & E-commerce

- Media & Entertainment

- Healthcare

- Government

- Telecom & IT

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting