What is the Cosmetic Antioxidants Market Size?

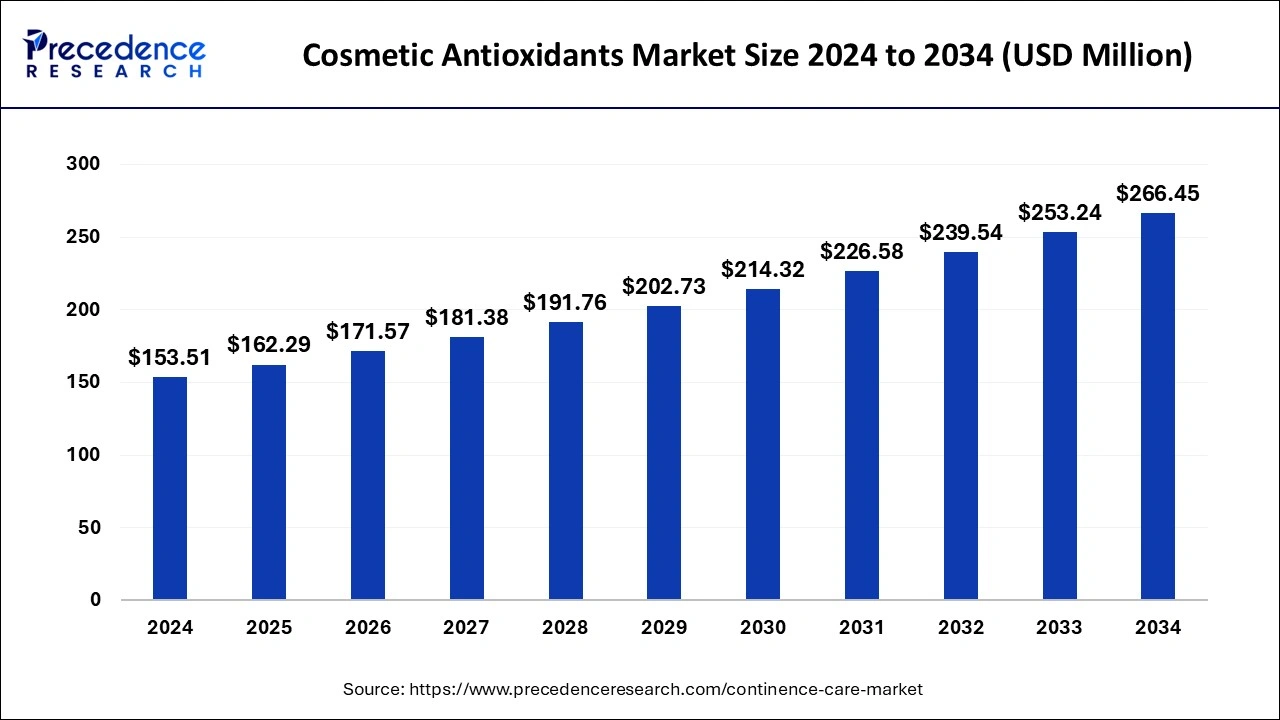

The global cosmetic antioxidants market size was estimated at USD 162.29 million in 2025 and is predicted to increase from USD 171.57 million in 2026 to approximately USD 266.45 million by 2034, expanding at a CAGR of 5.67% from 2025 to 2034.

Cosmetic Antioxidants Market Key Takeaways

- The global cosmetic antioxidants market was valued at USD 153.51 billion in 2024.

- It is projected to reach USD 266.45 billion by 2034.

- The market is expected to grow at a CAGR of 5.67% from 2025 to 2034.

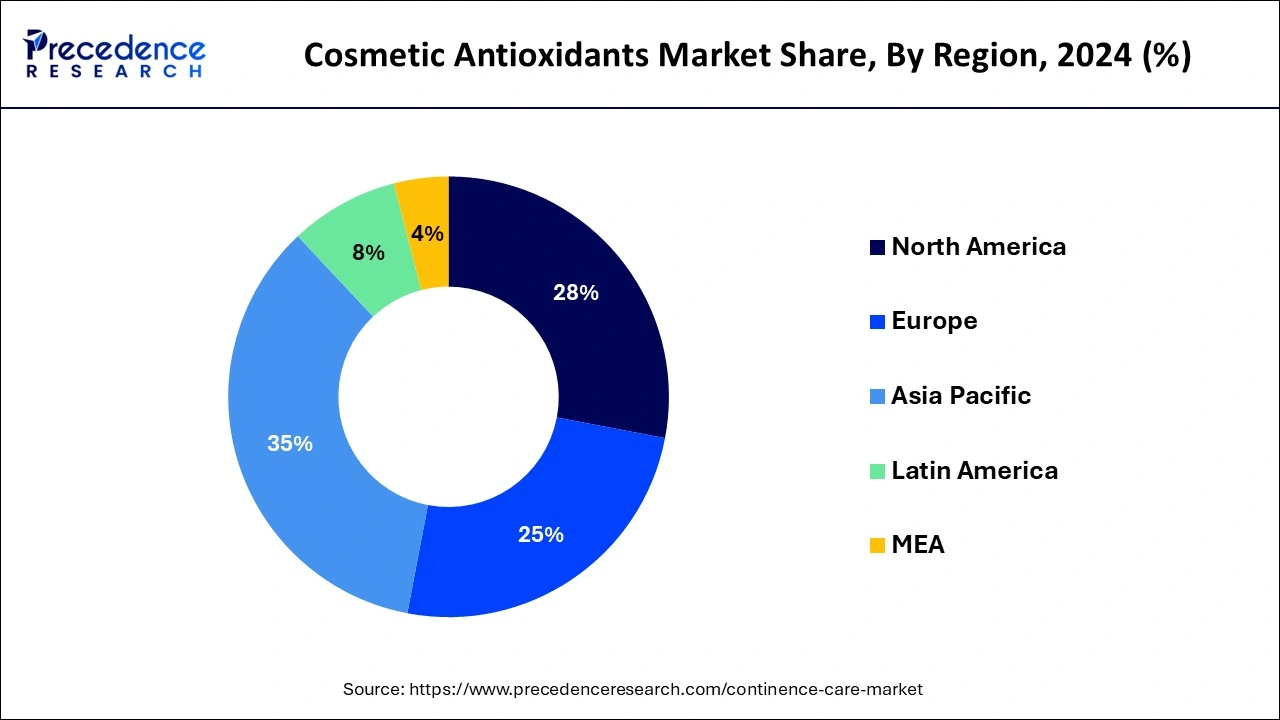

- Asia Pacific led the market with the largest market share of 35% in 2024.

- North America is expected to witness significant growth in the market during the forecast period.

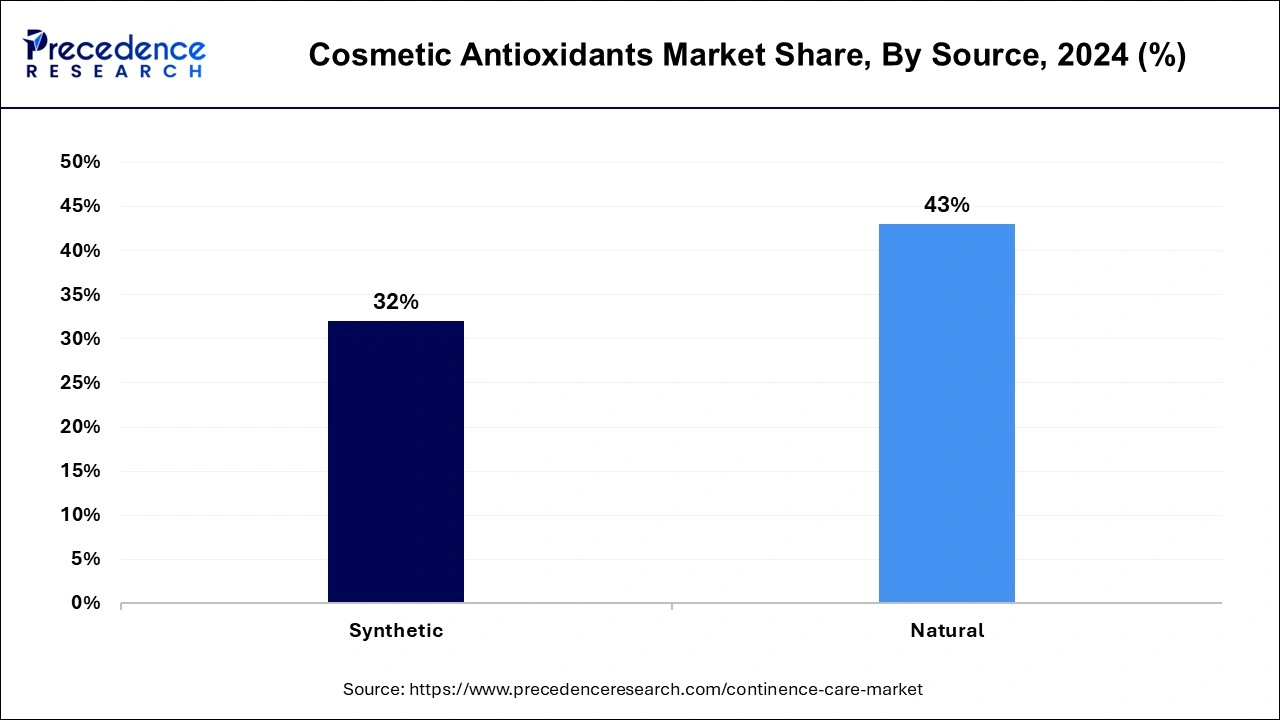

- By source, the natural segment accounted for the dominating share of the market in 2024.

- By source, the synthetic segment is projected to grow considerably in the global market over the forecast period.

- By type, the vitamins segment held the largest share of 54% in 2024.

- By type, the carotenoids segment is expected to grow significantly in the market during the forecast period.

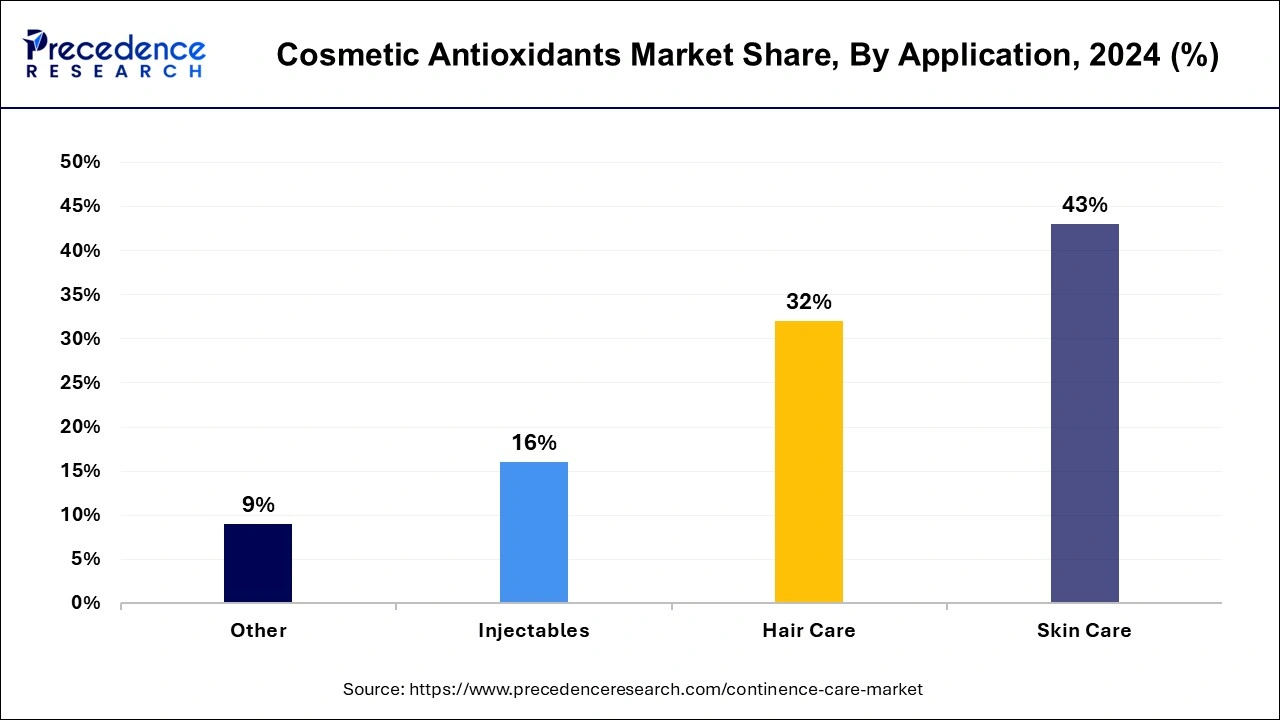

- By application, the skin care segment has contributed more than 43% of market share in 2024.

- By application, the hair care segment is expected to grow at a notable rate in the upcoming years.

Asia Pacific Cosmetic Antioxidants Market Trends

- In January 2023, Mac Cosmetics announced its planned to launch a new skincare line in India. The North American beauty brand has diversified its product selection to tap into the fast-growing skincare market. Mac Cosmetics has previously launched products that fall under the skincare category, such as its ‘Strobe Cream' and its ‘Prep + Prime Fix+' setting spray.

- In May 2024, Beauty & wellness brand VLCC announced its plans to launch over 100 beauty and wellness clinics in India to expand its retail presence. All the new clinics will be featuring VLCC services, encompassing skincare, haircare, and wellness treatments.

- According to the data published by secondary sources, United States consumers spend nearly 89.7 billion on beauty products annually.

- In June 2023, L'Oréal announced its investment in US biotech company Debut to create active ingredients. The minority investment builds on existing joint development programs between L'Oréal and Debut that leverage the start-up's extensive IP portfolio, from which more than 7,000 ingredients can be created to bring high-value, more sustainable ingredients to market faster.

How do Cosmetic Antioxidants Spur Skin Care Products?

The growing interest in cosmetics increases the popularity of antioxidants. Antioxidants are a popular ingredient in a variety of cosmetic products to enhance healthy and youthful skin. Antioxidants protect the skin's surface from oxidative damage, which is often caused by the harmful effects of free radicals. Cosmetic antioxidants are the active ingredients that are used in various formulations to manufacture skincare and cosmetics products. They are most commonly found in skin care product formulas due to excellent benefits including anti-aging, anti-inflammatory, UV protection, anti-wrinkle, and moisturizing functions.

Antioxidants come in several different forms, such as Vitamin E, Vitamin A, Vitamin C, flavonoids, polyphenols, beta-carotene, and others. Each of the antioxidants is associated with a unique molecular structure and health benefits. For instance, vitamin C is water-soluble, which offers protection against UV damage, whereas vitamin E is fat-soluble, which helps retain skin moisture. Several dermatological and cosmetic formulations contain fats, fragrances, and oils, which are subjected to auto-oxidation by exposure to air, causing odor and chemical degradation. The use of antioxidants can preserve the formulations and enhance the shelf life of a product.

Cosmetic Antioxidants Market Growth Factors

- The increasing significance of cosmetic antioxidants and the surge in preventive skincare trends in emerging countries is estimated to accelerate the cosmetic antioxidants market growth rate during the forecast period.

- Therapeutic antioxidants in cosmetics products prevent skin damage caused by free radicals, pollution, and other environmental effects.

- The increasing use of skin care products to maintain skin health and the rapid adoption of beauty-enhancing products to protect and nourish the skin is expected to be credited for driving the cosmetic antioxidants market's growth.

- Rising online merchants coupled with a strong desire for skincare benefits in makeup products among the young population are expected to propel the need for cosmetic antioxidants.

- Rising customer expenditure on cosmetic products is likely to spur the demand for cosmetic antioxidants and boost the market's revenue during the forecast period.

- The increasing usage of cosmetics and rising disposable are anticipated to propel the market's growth in the coming years. Cosmetics products are widely used to enhance beauty and maintain healthy skin.

Cosmetic Antioxidants Market Outlook:

- Global Expansion: A prominent growth is impacted by a rise in natural, anti-ageing, and multi-functional skincare products. In September 2024, Syensqo unveiled "Riza," a new brand featuring rosemary-derived, plant-based antioxidants.

- Major Investor:In March 2025, BASF invested in a new manufacturing site in Puebla, Mexico, to boost the capacity of aminic antioxidants, indicating wider efforts in the antioxidant supply chain.

- Startup Ecosystem: VerTan Technologies was founded in 2024, is establishing advanced anti-ageing solutions using multi-noble metal nanoparticles.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.67% |

| Market Size in 2025 | USD 162.29 Million |

| Market Size in 2026 | USD 171.57 Million |

| Market Size by 2034 | USD 266.45 Million |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Source, By Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing adoption of cosmetics products

The rising adoption of cosmetics products around the world is expected to drive the growth of the cosmetic antioxidants market during the forecast period. Cosmetic antioxidants are composed of minerals and vitamins. Gradually, consumers are becoming more conscious regarding the ingredients used in cosmetic formulations and seeking high-quality products. Cosmetics antioxidants assist in protecting skin against environmental stressors such as UV radiation, blue light, and pollution. These stressors often cause oxidative damage to cells, which results in premature aging, hyperpigmentation, and various other skin issues.

Antioxidants play a vital role in neutralizing free radicals by donating electrons, which prevent oxidative damage and promote healthy skin. Additionally, the increasing number of adverse effects related to the use of cosmetics products has fueled the market's expansion during the forecast period. Thus, the rising use of cosmetics products is expected to supplement the market growth during the forecast period.

- According to point-of-sale data from Circana (formerly IRI and The NPD Group), U.S. prestige beauty sales grew 16 percent year over year in Q1 2023, totaling USD 6.6 billion. The mass beauty market generated USD 7 billion in the same period, representing a 10 percent growth compared to the previous year, 2022.

Restraint

High cost

The high cost associated with cosmetic antioxidants are anticipated to hamper the market's growth. The market has also observed a lack of awareness regarding the significance of antioxidants in cosmetics in underdeveloped countries. In addition, strict government regulations and high packaging costs may restrict the expansion of the global cosmetic antioxidants market.

Opportunity

Robust growth of the e-commerce platform

The robust growth of the e-commerce platform is projected to offer lucrative opportunities to the cosmetic antioxidants market during the forecast period. The market has witnessed increasing online purchases of skincare and cosmetics products to grab attractive discounts and value-added services offered by them. Changes in lifestyles increase the purchase of cosmetic products to preserve the attractive appearance and texture and maintain healthy skin. E-commerce offers the availability of a wide range of cosmetics products at an affordable range, which contributes to the market growth of the cosmetic antioxidants market.

Source Insights

The Natural segment dominated the cosmetic antioxidants market with largest share of 43% in 2024 owing to the rising consumption of a wide variety of cosmetic products, which includes butylated hydroxytoluene (BHT), propyl gallate (PG), Tert-butylhydroquinone (TBHQ), and butylated hydroxyanisole (BHA). Synthetic antioxidants enhance the shelf life of a product and provide better color, fragrance, and texture to cosmetic products.

The Synthetic segment is expected to grow at a notable rate in the market during the forecast period. The growth of the segment is driven by the increasing usage of natural antioxidants in cosmetics products, including carotenoids, polyphenols, enzymes, and vitamins due to their anti-aging properties. Premature aging has become a major concern among women, increasing the demand for anti-wrinkle creams and moisturizers.

- In April 2024, Nuxe announced the launch of six new anti-aging products in global travel retail. Laboratoire Nuxe has introduced Nuxuriance Ultra Alfa (3R), a collection of six new products with a new green technology designed to tackle the signs of aging skin. Nuxuriance Ultra Alfa (3R) has a formula that is said to contain an ultra-powerful, natural-origin technology exclusive to Nuxe.

Type Insights

The vitamins segment had the largest share of the cosmetic antioxidants market in 2024 and is expected to maintain its position throughout the forecast period. The segment's growth is fueled by the increasing use of natural antioxidants as a better alternative to chemically derived synthetic antioxidants. Vitamins can be extracted from plants, fruits, vegetables, and other sources without the need for additional chemicals in their formulation, and they offer several benefits. Vitamin C is a vital nutrient for skin health as it stimulates reactions that lead to collagen production. Additionally, avocados are a rich source of antioxidants and have long been used in facial treatments to nourish dry skin.

The cosmetic antioxidants market is predicted to witness significant growth in the carotenoids segment during the forecast period. This is mainly due to the rising number of skin diseases. Carotenoids act as antioxidants and can help reduce acne, soften the epidermis, and slow down the aging process. Furthermore, they can minimize the effects of photoaging. Beta-carotene and lycopene are two powerful antioxidants that can help alleviate the negative effects of sun damage on the skin, such as DNA damage caused by exposure to UV radiation.

Application Insights

The skin care segment held the dominating share of the cosmetic antioxidants market in 2024. Factors such as growing demand for sunscreens, fairness creams, body lotions, and others. A wide variety of face creams and moisturizers are becoming popular and gaining attention among people who are more conscious about their physical appearance and prevent skin-related diseases. Antioxidants in skincare products help prevent skin damage caused by free radicals, pollution, and other adverse environmental effects. It safeguards the skin surface against oxidative damage, including dryness, itching, infection, and others. Thereby, the consumer's inclination toward antioxidant-based skin care products is expected to influence the segment's growth positively.

The hair care segment is expected to grow at a notable rate in the upcoming years owing to increasing consumer expenditure on hair care products coupled with growing consciousness concerning aesthetic look. The effects of free radicals may result in frizzy, dry, and brittle hair. Antioxidants help prevent these hair issues. They are protective and useful ingredients in hair care products, as free radicals can damage cellular structures such as lipids, DNA, and proteins.'

- In April 2024, Debenhams announced the expansion of its beauty offering with the SALON64 hair care launch. The UK department store chain-turned-ecommerce retailer Debenhams has teamed up with London-based SALON64 to launch a range of hair products based on the success of the celebrity-favourite salon.

- In a 2021 study conducted by the Society of Cosmetic Scientists, results showed that when antioxidants were added to shampoo and conditioner, a group of subjects with thinning hair saw less shedding and more fullness, concluding that antioxidants were successful in helping hair growth and retention.

Regional Insights

Asia PacificCosmetic Antioxidants Market Size and Growth 2025 to 2034

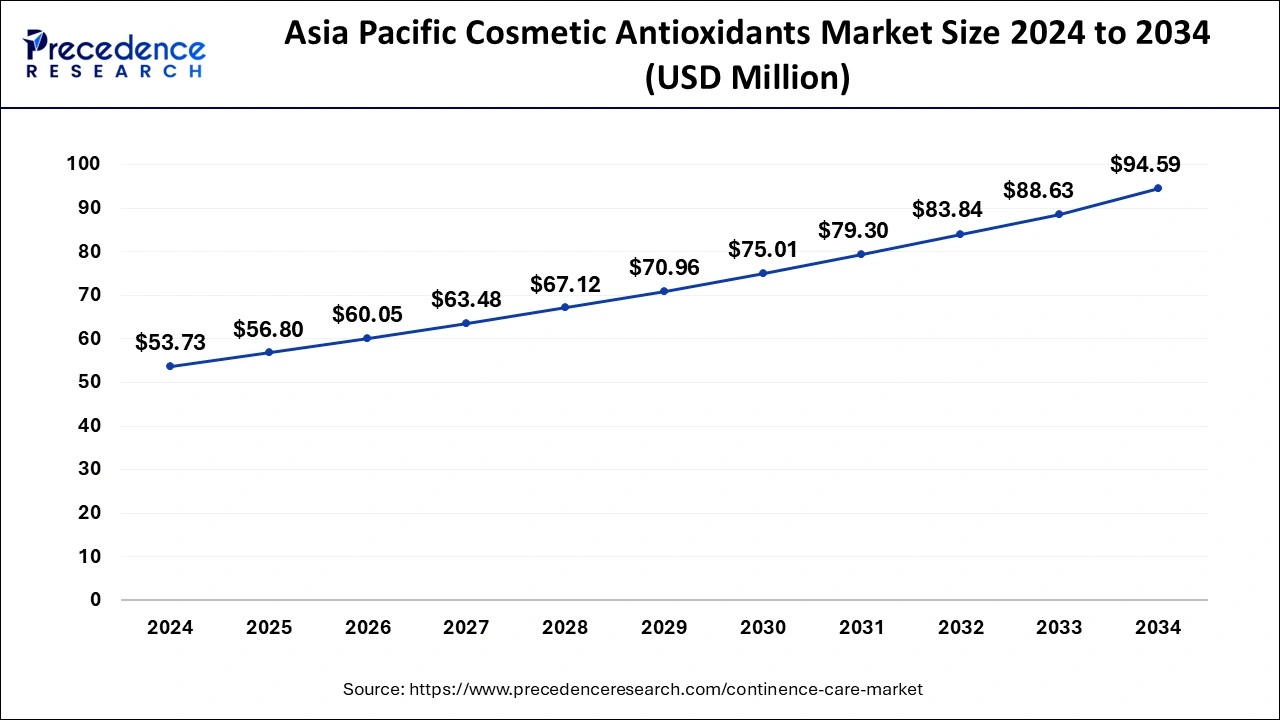

The Asia Pacific cosmetic antioxidants market size is estimated at USD 56.80 million in 2025 and is predicted to be worth around USD 94.59 million by 2034, at a CAGR of 17.37% from 2025 to 2034.

How do Cosmetic Antioxidants Spur Skin Care Products?

Asia Pacific dominated the cosmeticantioxidants market in 2024. The region's growth is driven by the presence of prominent market players, a rising population, growing awareness regarding the safety of skincare products, and rising consumer interest concerning appearance, beauty, and appeal. The rising use of cosmetic products to protect skin and hair from the effects of environmental factors like UV and pollution is likely to spur the demand for cosmetic antioxidants.

Countries such as China, India, South Korea, and Japan are the leading countries contributing to the growth of the cosmetic antioxidants market in the region. Due to the rising population's concern for improving the standard of living, rising consumer spending on cosmetic products, and rising engagement in e-commerce activities to purchase cosmetics products, stringent government regulation regarding undesirable or adverse effects of skin care products and increasing government concern about the safety of ingredients used in cosmetic products to safeguard from the harmful effects of free radicals.

Several Indian companies such as Mama Earth, Cipla Limited, Khadi Essential, Biotique, Coloressence, Sugar Cosmetics, and others promote their cosmetics and personal care products to meet the increasing demand in the nation. Furthermore, cosmetics companies use marketing strategies such as new product launches and acquisitions, collaborating with beauty bloggers and influencers, and increasing investment in TV and social media advertising to boost product sales.

Promotion of Integrated Solutions: Leverages the South Korean Market

A major growth of the cosmetic antioxidants market in South Korea has been influenced by the expanding fusion of the time-tested ingredients from traditional Korean herbal medicine (hanbang), such as ginseng, mugwort, and liquorice root, with scientifically proven actives (peptides, ceramides, etc.), for accelerated effectiveness with reduced irritation.

Emergence of Advanced Technologies & Products is Fueling North America

In the prospective period, North America is predicted to witness a notable growth in the cosmetic antioxidants market. This will be propelled by the ongoing inventions in formulation technologies, including encapsulation technology and nanotechnology, for bolstering the stability and delivery of antioxidants. Alongside, they are shifting towards multifunctional products, like a combination of antioxidants with SPF or anti-pollution shields.

Emphasis on Regulatory Compliance: Impacts the U.S. Market

The U.S. will have a significant expansion in the market with a robust contribution from the Modernization of Cosmetics Regulation Act of 2022. This is amended with a need for mandatory facility registration, product listing, and the reporting of serious adverse events. At the same time, diverse brands must facilitate adequate scientific safety substantiation for their products, rising scrutiny on all ingredients, such as antioxidants.

Exploration of the Skin Microbiome is Driving Europe

The European market is emphasizing formulations that are created to be "microbiome-friendly," employing antioxidants to assist skin harmony while highlighting issues, such as acne or ageing, reflecting a more holistic approach to skin health. Furthermore, many significant companies are putting efforts into the development of niosomes, liposomes, and nanostructured lipid carriers.

Cosmetic Antioxidants Market: Value Chain Analysis

- R&D

This mainly covers research and idea generation, then formulation and prototyping, and finally testing and evaluation.

Key Players: Ashland, Symrise, Eastman Chemical Company, Wacker Chemie AG, etc. - Formulation and Final Dosage Preparation

This leverages the selection of appropriate active ingredients and stabilizers, while final dosage preparation includes careful mixing into diverse bases (creams, serums, masks) and packaging in protective containers to maintain potency.

Key Players: HCP Wellness, Aura Herbal, BioAtoms, etc. - Patient Support & Services

The market is assisted by general dermatological guidance, product usage information, and consumer education resources provided by skincare brands, healthcare professionals, and health organizations.

Key Players: L'Oréal, BASF SE, Shiseido Co., Ltd., etc.

Key Players and Their Offerings and Contributions in the Market

| Company | Offerings | Contribution | Focus |

| BASF SE | Provides tocopherols, vitamin antioxidants, and stabilizers | Enhances formulation stability and extends product shelf life | Broad R&D-driven skincare innovation |

| Wacker Chemie AG | Offers hydroxytyrosol, silicones, and cyclodextrins | Improves antioxidant delivery and protection in formulations | Emphasizes efficiency and reliability |

| Evonik Industries AG | Supplies botanical extracts and toco-based antioxidants | Supports natural preservation and skin defense performance | Prioritizes sustainable, high-quality solutions |

| Jan Dekker International | Provides natural oils, tocopherols, and rosemary extracts | Delivers plant-based antioxidant functionality | Focuses on purity, traceability, and global sourcing |

| Nexira | Offers polyphenol-rich botanical extracts | Enhances antioxidant efficacy across cosmetic formulations | Specializes in standardized, clean-label ingredients |

Cosmetic Antioxidants Market Companies

- BASF SE

- Wacker Chemie AG

- Evonik Industries AG

- Jan Dekker International

- Nexira

- Archer Daniels Midland Company

- Croda International PLC

- Provital Group

- Yasho Industries

- Kemin Industries, Inc.

- Barentz International BV

- Eastman Chemical Company

- Ashland Global Holdings

- BTSA Biotecnologias Aplicadas S.L.

- Koninklijke DSM N.V.

- SEPPIC

Recent Developments

- In August 2023, Natura developed the Chronos Intensive Antioxidant Serum, formulated with Amazonian antioxidant extracts and components to boost antioxidant mechanisms and minimize the appearance of early signs of aging.

- In September 2022, Amour's Secrets Skincare debuted in the United States beauty industry, emphasizing natural, clean, non-toxic, plant-based ingredients that refresh, rejuvenate, and enhance the skin.

- In June 2023, Sofia Vergara unveiled the suncare-focused beauty range. Vergara announced its plans to launch its beauty venture with a range of SPF 50+ essentials, including sun care, skin care, supplements, and makeup. Toty provides results-driven products to preserve beauty and skin health, with a focus on fighting photoaging.

- In June 2023, DKSH signed a distribution agreement with Bitop, the manufacturer of cosmetics ingredients, in Malaysia, Australia, New Zealand, and Singapore.

- In February 2022, Huda Beauty's founders announced their investment in a new wellness brand. Iraqi-US entrepreneur Huda Kattan is introducing a new wellness brand by Huda Beauty Angels, which falls under HB Investments, Kattan's venture capital firm.

Segments Covered in the Report

By Source

- Natural

- Synthetic

By Type

- Vitamins

- Polyphenols

- Enzymes

- Carotenoids

- Other Types

By Application

- Skin Care

- Hair Care

- Injectables

- Other

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting