CRO Mass Spectroscopy Services Market Size and Forecast 2025 to 2034

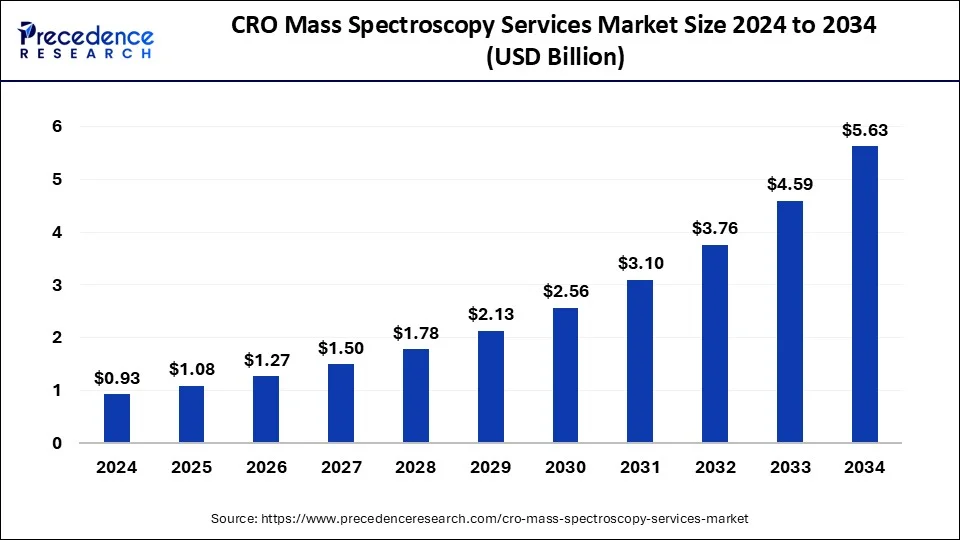

The global CRO mass spectroscopy services market size was calculated at USD 0.93 billion in 2024 and is predicted to increase from USD 1.08 billion in 2025 to approximately USD 5.63 billion by 2034, expanding at a CAGR of 20.10% from 2025 to 2034.

CRO Mass Spectroscopy Services Market Key Takeaways

- The global CRO mass spectroscopy services market was valued at USD 0.93 billion in 2024.

- It is projected to reach USD 5.63 billion by 2034.

- The CRO mass spectroscopy services market is expected to grow at a CAGR of 20.10% from 2025 to 2034.

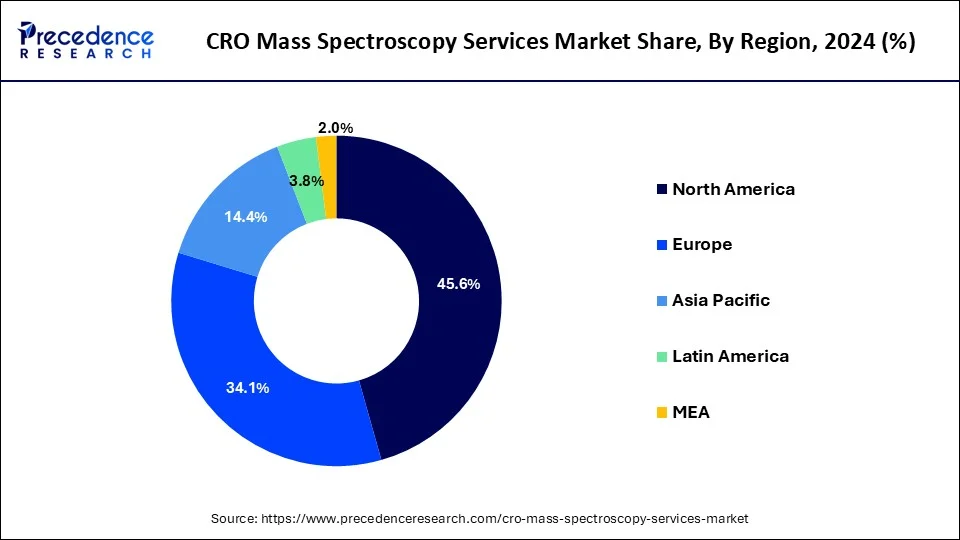

- North America has captured the largest market share of 45.6% in 2024.

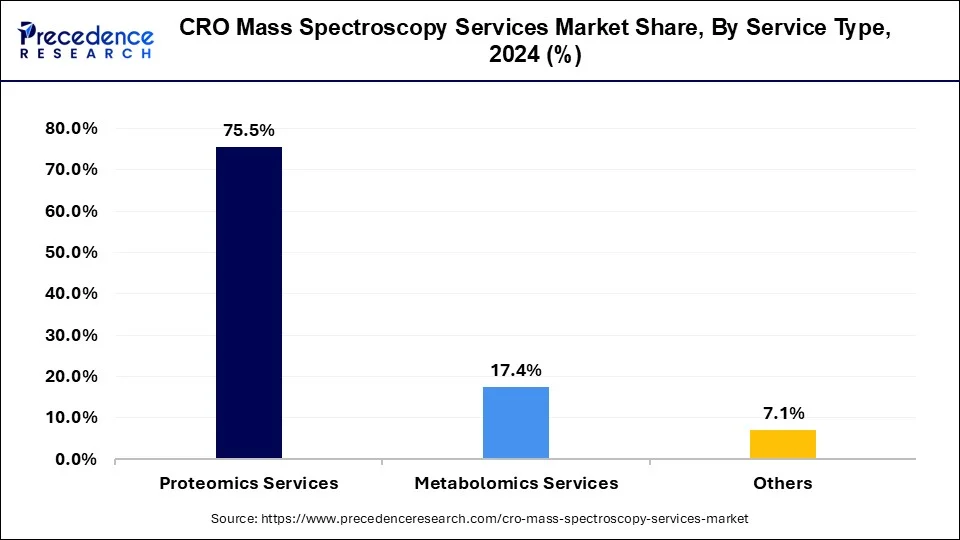

- By service, the proteomics services segment has held the biggest market share of 75.5% in 2024.

- By end use, the pharmaceutical and biopharmaceutical companies segment contributed the largest market share of 73.3% in 2024.

U.S. CRO Mass Spectroscopy Services Market Size and Growth 2024 to 2034

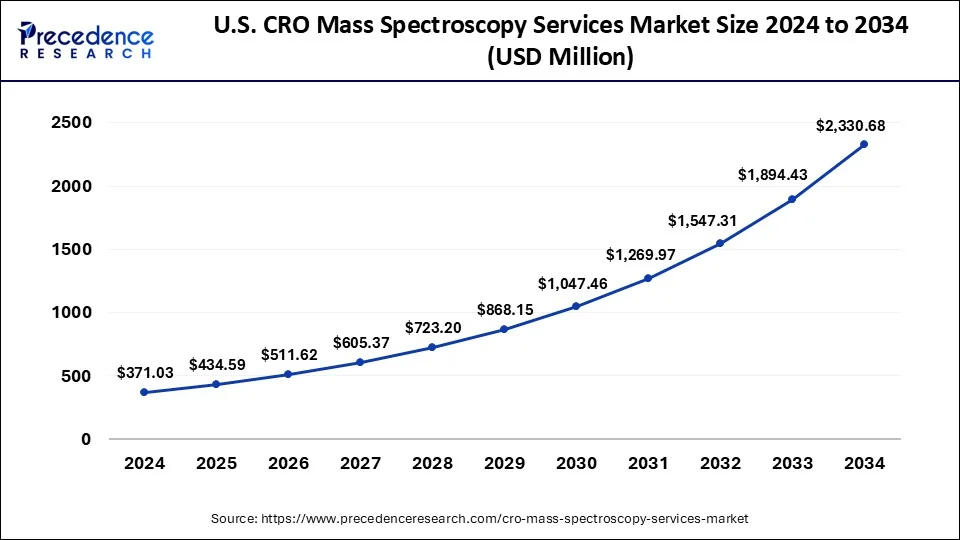

The U.S. CRO mass spectroscopy services market size reached USD 371.03 million in 2024 and is expected to be worth around USD 2,330.68 million by 2034, poised to grow at a CAGR of 20.50% from 2025 to 2034.

North Americaled the market with the biggest market share of 45.6% in 2024., propelled by the widespread adoption of mass spectrometry (MS) technology. MS has revolutionized modern research by offering precise and accurate analysis of various molecules within samples, making it indispensable across industries such as pharmaceuticals, biotechnology, environmental science, and forensics.

In this region, companies and academic institutions are leveraging MS to its full potential, employing the latest technology and techniques to drive innovation in drug development, biomolecular analysis, and scientific research. Notable examples include:

- Seattle, Washington: A hub for small molecule drug development in oncology, combining cell processing with high-sensitivity quantitative proteomics and advanced analytics, including Mass Spectrometry. This innovative approach aids in gene control and fosters advancements in drug development.

- Lincoln, Nebraska: The Spectroscopy and Biophysics Core focuses on providing instrumentation, training, and support for experimental work involving biophysical and spectroscopic measurements. Their services extend to whole-cell assays and tissue analysis, facilitating research in biophysics and related fields.

- La Jolla, California: The Center for Metabolomics and Mass Spectrometry offers routine and specialty services utilizing various MS approaches such as LC/MS, ESI, and MALDI. They analyze compounds ranging from peptides to polymers, catering to diverse research needs in metabolomics and biomolecular analysis.

- Rensselaer, New York: REPR specializes in developing custom assays and providing services for protein identification and characterization of biosimilars or protein complexes. They offer essential laboratory services to researchers in academia, industry, and government agencies, contributing to advancements in proteomics research.

The strong growth of the CRO mass spectroscopy services market in North America is fueled by technological innovations within MS techniques, particularly in LC–MS. These innovations, including triple quadrupole and ion trap technologies, offer high performance and drive demand for MS services, particularly in the life sciences sector. With a concentration of leading research institutions and companies utilizing MS technology effectively, North America remains at the forefront of advancements in mass spectroscopy applications and services.

- In January 2024, Biognosys established a new Proteomics CRO Facility in Massachusetts, marking an expansion of its presence in the United States.

- In January 2023, Biognosys and Bruker joined forces to offer advanced proteomics CRO services tailored for global biopharma and biomarker customers.

Market Overview

The CRO mass spectroscopy services market offers techniques and services utilized across diverse scientific domains, including proteomics, metabolomics, pharmaceuticals, environmental, and forensic sciences. It involves the measurement of the mass-to-charge ratio of analyte ions within a sample, enabling the identification, quantification, and structural elucidation of molecules. CRO mass spectrometry services are offered by specialized companies equipped with cutting-edge technology and skilled professionals. These services cater to researchers, industries, and agencies seeking precise analytical solutions. By leveraging mass spectrometry analysis, customers can address scientific inquiries, overcome analytical challenges, and attain their research or business objectives effectively.

- In November 2023, Greenphire collaborated with Florence Healthcare and Oxford Nanopore to develop data tech, while the University of Texas launches the Oncology Institute.

CRO Mass Spectroscopy Services Market Growth Factors

- Breakthroughs such as discontinuous ion injection-induced Electrospray Ionization (ESI) have revolutionized mass spectrometry. These techniques offer superior control and precision over ionization processes, minimizing side reactions and improving accuracy. Consequently, the adoption of mass spectrometry services has surged, propelling market growth.

- Continuous improvements in hardware and software have transformed mass spectrometry. State-of-the-art instruments and sophisticated software tools streamline data acquisition, processing, and analysis. This enhanced efficiency and functionality attract a broader user base, fostering market expansion.

- High-resolution instruments and advanced data visualization tools have reshaped data interpretation. Researchers can now handle complex datasets more effectively, leading to more accurate and insightful results.

- MS-based Multiple Attribute Monitoring (MAM) technology enables simultaneous monitoring of diverse attributes in complex samples. This innovative approach offers efficiency and versatility, leading to increased adoption in industries and research fields. Consequently, the market for mass spectrometry expands.

- CRO mass spectrometry's versatility in proteomics research creates new opportunities for analysis. Ongoing advancements in mass spectrometry-based proteomics lower barriers to entry and expand the market for proteomics analysis services. This contributes significantly to the overall growth of the CRO mass spectroscopy services market as demand for proteomics research increases.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 20.10% |

| Market Size in 2024 | USD 0.93 Billion |

| Market Size in 2025 | USD 1.08 Billion |

| Market Size by 2034 | USD 5.63 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, By End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Integral role in drug development and research

The CRO mass spectrometry services market is experiencing robust growth, primarily driven by its integral role in drug development and research. These services serve as accelerators at every phase of drug R&D, offering invaluable insights that steer drug innovation in the right direction. From target identification to regulatory approval.

Such services play a critical role in ensuring the safety and efficacy of drugs. By delivering accurate and reliable data on drug properties, metabolism, and pharmacokinetics, these services help minimize risks and maximize therapeutic benefits. This assurance of drug safety and efficacy is driving the demand for mass spectrometry services among pharmaceutical companies, the increasing regulatory compliance needs in the pharmaceutical industry are contributing to the growth of the CRO mass spectrometry services market.

Stringent regulatory requirements necessitate extensive testing and analysis throughout the drug development process. Mass spectrometry services offer precise and comprehensive analytical solutions that meet these regulatory standards, making them indispensable for pharmaceutical companies striving to bring safe and effective drugs to market. As regulatory compliance standards continue to evolve, the demand for CRO Mass spectrometry services is expected to further increase, driving market expansion in the foreseeable future.

- In May 2022, Ampersand-backed Alliance Pharma acquired LGC's Drug Development Solutions Business ("DDS") and welcomes KKR as a joint shareholder.

- In May 2022, Synexa Life Sciences expanded its bioanalysis capabilities through the acquisition of Finnish CRO Syrinx Bioanalytics.

Restraint

Limitations of mass spectrometry imaging (MSI)

The remarkable capability of mass spectrometry imaging (MSI) to localize panels of biomolecules in tissues without prior knowledge of their presence and in a label-free manner has made a significant impact in clinical and pharmacological research. MSI has been instrumental in uncovering biomolecular changes associated with diseases and providing cost-effective imaging of pharmaceuticals. However, this very capability poses a restraint on the growth of the CRO mass spectroscopy services market. While MSI offers unparalleled insights into tissue biomolecular composition and distribution, its label-free approach and complex data interpretation processes can limit its adoption in clinical and pharmaceutical research conducted by Contract Research Organizations (CROs). The lack of standardized protocols and the need for specialized expertise in MSI data analysis present challenges for CROs aiming to integrate MSI into their service offerings.

The requirement for specialized instrumentation and significant computational resources for MSI data analysis may deter CROs from investing in this technology. As a result, the potential of MSI to drive growth in the CRO mass spectroscopy services market may be constrained, despite its immense potential in clinical and pharmacological research. Strategies to overcome these limitations, such as standardization of protocols and the development of user-friendly data analysis software, will be crucial in unlocking the full potential of MSI and facilitating its adoption by CROs.

Opportunity

Advancement in Mass Spectrometry Imaging (MSI) techniques

These advancements in MSI techniques create significant opportunities for the CRO mass spectroscopy services market. CROs specializing in mass spectroscopy services stand to benefit from the growing demand for MSI in drug development and fundamental research. By offering MSI-based services tailored to the needs of pharmaceutical companies and research institutions, CROs can capitalize on this opportunity to expand their service portfolio and attract new clients, the integration of MSI into the drug discovery and development process enhances the efficiency and effectiveness of preclinical studies, ultimately accelerating the drug development timeline.

This increased adoption of MSI in drug research creates a favorable market environment for CROs offering mass spectroscopy services, positioning them for growth and success in the evolving landscape of pharmaceutical research and development.

- In December 2023, QPS expanded its UPLC-HRMS presence into Europe, dedicated to supporting advancements in gene therapy and protein drug development.

Service Type Insights

The proteomics services segment has emerged as the cornerstone of the CRO mass spectroscopy services market share of 75.5% in 2024, revolutionizing protein analysis with mass spectrometry. At the heart of this innovation lies the Protein-Works services, offering comprehensive support across multiple workflows in the biological sciences. These services encompass critical tasks such as protein identification, confirmation of protein sequences, determination of protein molecular weights, and complex sample profiling.

Proteomics services utilize advanced techniques and methodologies to analyze proteins comprehensively. These services can be tailored to analyze a single protein or to conduct large-scale analysis of specific proteomes, including protein abundances, modifications, interactions, and compound associations. Key to this capability are two primary mass spectrometry systems: nano LC-MS/MS and MALDI TOF/TOF. These systems enable peptide mapping, protein identification, and analysis of post-translational modifications, empowering researchers with unparalleled insights into protein function and regulation.

In a rapidly evolving landscape of biological sciences, Proteomics services continue to drive innovation and unlock new possibilities in protein analysis. By leveraging advanced mass spectrometry techniques and expertise, Proteomics services play a pivotal role in advancing research and development efforts across various industries. As the demand for precise and comprehensive protein analysis grows, proteomics services are poised to remain at the forefront of the CRO mass spectroscopy services market, driving continued growth and innovation in the field.

- In May 2022, CellCarta enhanced its proteomics portfolio by acquiring next-generation immuno-MRM assays from Precision Assays.

CRO Mass Spectroscopy Services Market Revenue, By Service Type 2022-2024 (USD Million)

| Service Type | 2022 | 2023 | 2024 |

| Proteomics Services | 529.0 | 605.5 | 699.5 |

| Metabolomics Services | 120.3 | 138.5 | 161.0 |

| Others | 49.9 | 57.0 | 65.6 |

End Use Insights

The pharmaceutical & biopharmaceutical companies segment, in 2024, stood as the largest contributor to the CRO mass spectroscopy services market. Mass spectrometry (MS) has emerged as a pivotal technology across various application domains, with its importance steadily increasing in recent years. In pharmaceutical analysis, MS plays a crucial role due to the stringent regulatory procedures, adherence to good laboratory/manufacturing practices, and the necessity for numerous routine quality control analyses.

Throughout the drug development cycle, the role of MS varies significantly. It takes center stage during the drug discovery and development phase, where its capabilities are paramount in elucidating molecular structures, identifying potential drug candidates, and analyzing complex biomolecules. However, in routine quality control, the role of MS is more subdued, serving indispensable functions for selected applications where precision and accuracy are paramount.

As pharmaceutical and biopharmaceutical companies continue to drive innovation and development in the healthcare industry, the demand for CRO mass spectroscopy services is expected to rise correspondingly. By providing specialized expertise and state-of-the-art instrumentation, CROs play a vital role in supporting the diverse analytical needs of pharmaceutical companies, contributing to advancements in drug discovery, development, and quality assurance. As such, the Pharmaceutical & biopharmaceutical companies segment remains a key driver of growth in the CRO mass spectroscopy services market, underscoring the indispensable role of MS in pharmaceutical analysis and development.

- In September 2023, Biognosys showcases technological innovations and scientific progress aimed at making the proteome actionable for life science research at the HUPO 2023 World Congress.

CRO Mass Spectroscopy Services Market Revenue, By End Use 2022-2024 (USD Million)

| End Use | 2022 | 2023 | 2024 |

| Pharma/Biopharma Companies | 509.9 | 585.7 | 678.9 |

| Medical Device Companies | 122.5 | 140.4 | 162.3 |

| Others | 66.7 | 74.9 | 84.9 |

CRO Mass Spectroscopy Services Market Companies

- Alturas Analytics Inc.

- BGI Group

- Charles River Laboratories International Inc

- Creative Proteomics

- Evotec SE

- Inotiv Inc.

- Bioanalytical Systems Inc.

- Labcorp Drug Development

- MtoZ-Biolabs Inc.

- PPD Inc.

- WuXi AppTec

- Eurofins Scientific

- MS Bioworks

- Novatia LLC

- Alphalyse

- Metabolon Inc.

- Biocrates life sciences AG

- Biognosys

- Proteome Sciences

- Rapid Novor Inc

- iBET

- BioCAT GmbH

- Olink

- AxisPharm

- MtoZ-Biolabs Inc

- Somalogic Inc

- Seer Inc.

Recent Developments

- In June 2023, Bruker unveils the innovative EVOQ DART-TQ+ for Chromatography-Free Mass Spectrometry, targeting applied market segments.

- In August 2023, Scantox enhances its bioanalytical services by acquiring Q&Q, further bolstering its offerings.

- In February 2022, Waters broadens its applications in cell and gene therapy with the acquisition of Charge Detection Mass Spectrometry Technology.

Segments Covered in the Report

Service Type

- Proteomics Services

- Metabolomics Services

- Others

By End Use

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting