What is the Decentralized Finance Technology Market Size?

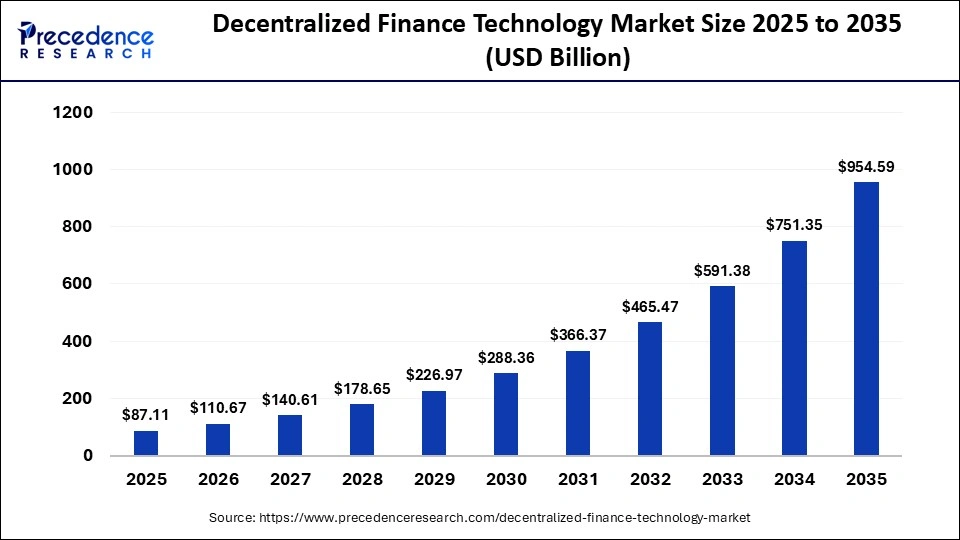

The global decentralized finance technology market size accounted for USD 87.11 billion in 2025 and is predicted to increase from USD 110.67 billion in 2026 to approximately USD 954.59 billion by 2035, expanding at a CAGR of 27.02% from 2026 to 2035. The market is driven by the increasing demand for financial inclusion, secure blockchain-based transactions, and the rise of yield farming, peer-to-peer lending, and decentralized exchanges.

Market Highlights

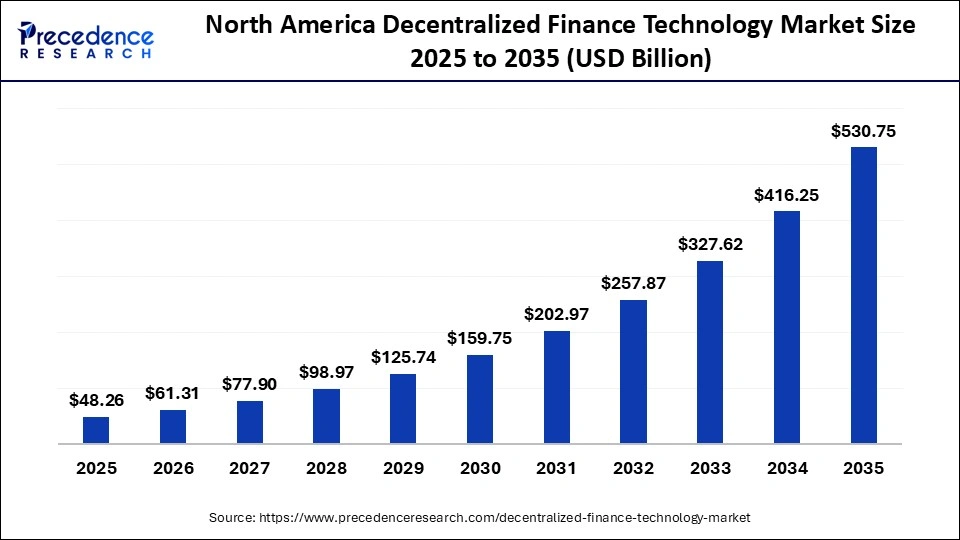

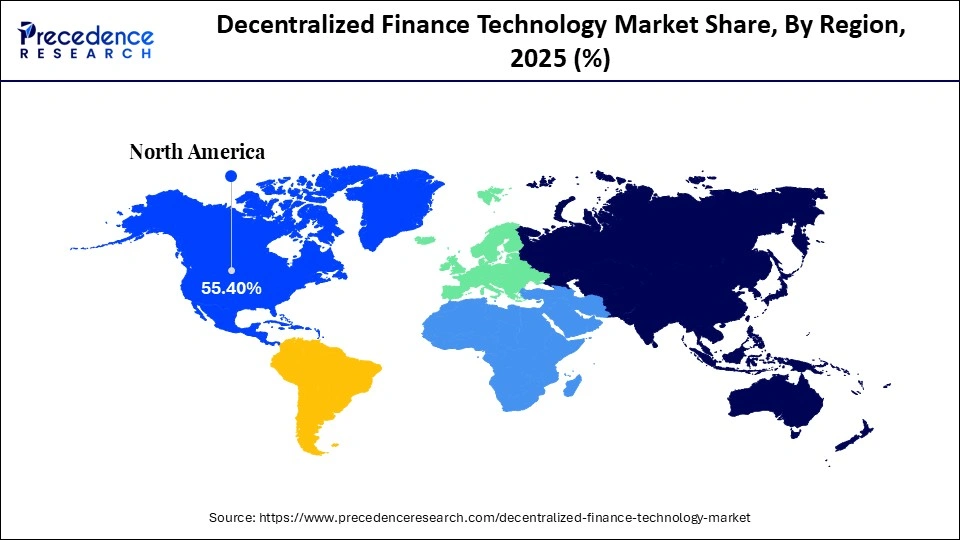

- North America accounted for the largest market share of 55.40% in 2025.

- Asia Pacific is expected to witness the fastest growth between 2026 and 2035.

- By component, the decentralized applications (dApps) segment held a major market share in 2025.

- By component, the smart contracts segment is expected to grow at a significant CAGR from 2026 to 2035.

- By application, the asset management segment led the market with the largest share in 2025.

- By application, the gaming segment is growing at a significant CAGR between 2026 and 2035.

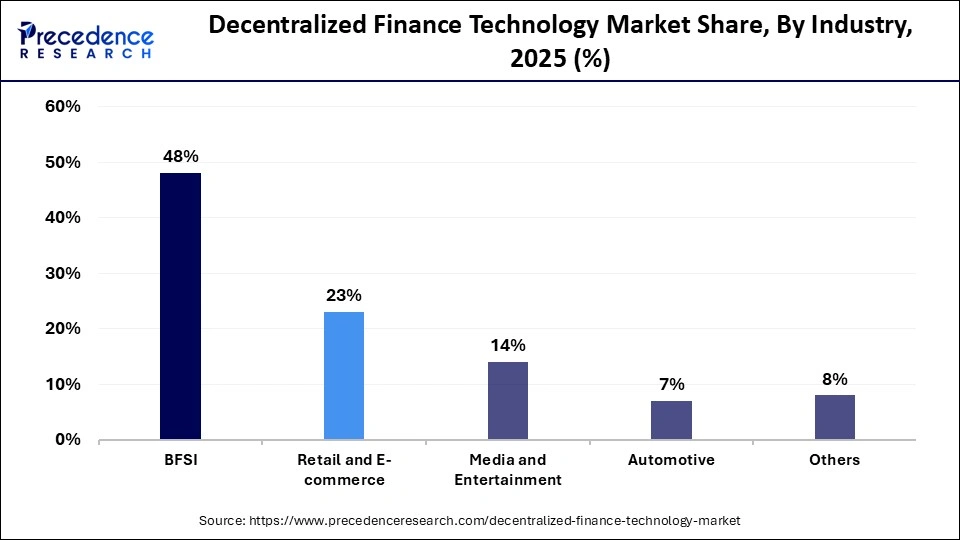

- By industry, the BFSI segment led the market with a largest market share of 48% in 2025.

- By industry, the automotive segment is expected to grow at the fastest CAGR between 2026 and 2035.

What is Decentralized Finance Technology?

Decentralized finance technology involves the use of blockchain, cryptocurrencies, and smart contracts to create open, peer-to-peer financial services without traditional banks. It aims for transparency and accessibility and is projected for strong growth driven by digital asset adoption for lower costs, faster speeds, and user control. The market is expanding driven by increased investment in digital assets, rising enterprise interest in new ecosystems like tokenized assets and DAOs, and a strong focus on Layer-2 solutions and interoperability to achieve mainstream success.

How is AI Influencing the Decentralized Finance Technology Market?

Artificial intelligence (AI) is impacting the global market mainly through data analysis, risk management, security improvements, and automation. AI-powered bots carry out complex algorithmic trading strategies and automatically rebalance user portfolios based on real-time market data and individual risk tolerance. AI models examine large amounts of on-chain data to spot suspicious transaction patterns, identify potential security threats, and flag fraudulent activities in real time. AI-driven chatbots and virtual assistants offer real-time support and customized financial advice or investment recommendations.

Decentralized Finance Technology Market Outlook

- Industry Growth Overview: The market is expected to grow rapidly from 2026 to 2035. This is because it provides open, permissionless, and borderless financial services that eliminate the need for traditional intermediaries like banks. The global adoption of cryptocurrencies continues to increase, alongside user demand for transparency and self-custody of assets, focusing on stability, regulation, and user experience.

- Tokenization of Real-World Assets: This major trend involves converting physical or traditional financial assets into digital tokens on a blockchain. This unlocks liquidity for illiquid assets, offers fractional ownership, and attracts significant institutional attention, creating new investment opportunities and liquidity.

- Global Expansion: The market is expanding worldwide, driven by a growing tech-savvy population and high cryptocurrency adoption rates. Asia-Pacific region is the fastest-growing market, characterized by supportive regulatory sandboxes. Emerging markets in Europe, Latin America, and MEA are also showing significant user growth.

- Major Investors: Major investors in the market include venture capital firms, blockchain-focused investment funds, and financial institutions such as Andreessen Horowitz, Pantera Capital, and Coinbase Ventures. These investors contribute by funding innovative DeFi startups, supporting the development of new blockchain protocols, decentralized applications (dApps), and infrastructure, and driving mainstream adoption through strategic partnerships and ecosystem expansion.

- Startup Ecosystem: The startup ecosystem in the market is rapidly growing, with new companies emerging to develop innovative solutions in areas like decentralized exchanges, yield farming, and tokenized assets. These startups contribute by driving innovation in blockchain protocols, enhancing user experience through decentralized applications (dApps), and pushing the boundaries of security, scalability, and interoperability, accelerating the adoption of DeFi services in mainstream finance.

Makret Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 87.11 Billion |

| Market Size in 2026 | USD 110.67 Billion |

| Market Size by 2035 | USD 954.59 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 27.02% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Application, Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

What Made Decentralized Applications (dApps) the Dominant Segment in the Decentralized Finance Technology Market?

The decentralized applications (dApps) segment dominated the market in 2025, primarily because they directly offer user-facing financial services and drive most user interactions and investments within the ecosystem. dApps provide the main interfaces through which users engage with underlying protocols to monitor performance, manage assets, and participate in financial activities like lending, borrowing, and trading with ease. Additionally, dApps empower users by giving them control over their finances and enabling participation without relying on traditional, centralized financial authorities.

The smart contracts segment is expected to grow at the fastest rate during the forecast period due to their ability to facilitate automated, trustless transactions that reduce intermediaries, costs, and risks while eliminating paperwork and slow processes. They operate on blockchains, offering immutable and transparent records that prevent fraud and tampering, a key benefit for financial services. They power essential applications such as DeFi wallets, DEXs, lending platforms, and NFTs, and also accelerate growth through Layer-2 solutions and mobile DApps, driving mass adoption.

Application Insights

How Does the Asset Management Segment Lead the Decentralized Finance Technology Market?

The asset management segment led the market in 2025, driven mainly by direct wallet-based trading, tokenization of assets like real-world assets (RWA), fractional ownership, and increased liquidity, with user-friendly mobile and web apps making access easy. Mobile apps and web platforms serve both retail and institutional investors. Enterprises use decentralized finance for diversification, risk management, and compliance, fueling demand for robust, integrated solutions. By leveraging smart contracts, decentralized protocols, and blockchain technology, this segment ensures transparency, security, and greater control for investors, driving the adoption of DeFi solutions in wealth management and investment strategies.

The gaming segment is expected to grow at the fastest rate in the near future, mainly driven by the rise of GameFi, which combines finance and entertainment through Play-to-Earn models. Blockchain enables true ownership of unique in-game assets as Non-Fungible Tokens (NFTs), offering real economic value. Decentralized platforms create vibrant digital worlds where players trade, stake, and interact with user-owned assets, boosting engagement and supporting new digital economies.

Industry Insights

Why did the BFSI Segment Dominate the Decentralized Finance Technology Market in 2025?

The BFSI segment dominated the market in 2025 due to its early and extensive adoption of blockchain technology for core operations, which offers significant cost savings and efficiency gains. Using blockchain, BFSI institutions streamline inefficient, costly processes, with a transparent, immutable transaction record that simplifies regulatory reporting and compliance management. The secure, cryptographically protected nature of decentralized ledgers enhances security against fraud and cyber threats.

The automotive segment is expected to grow at the fastest CAGR during the forecast period. This growth is driven by the shift toward autonomous vehicles, which require secure data, peer-to-peer mobility, automated financing through smart contracts, and tokenization of vehicle assets, all of which promise improved security, transparency, and new revenue streams beyond traditional models. Digital tokens representing vehicle usage rights can unlock new liquidity and fractional ownership options, enhancing the user experience.

Regional Insights

How Big is the North America Decentralized Finance Technology Market Size?

The North America decentralized finance technology market size is estimated at USD 48.26 billion in 2025 and is projected to reach approximately USD 530.75 billion by 2035, with a 27.10% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Decentralized Finance Technology Market?

North America dominated the decentralized finance technology market while holding the largest share in 2025. The region's leadership is supported by its advanced technological infrastructure, significant investment and innovation, and a regulatory environment gradually becoming more supportive. Many prominent decentralized finance platforms and companies, such as Uniswap, Compound Labs, and MakerDAO, are based there. Countries like the U.S. and Canada are at the forefront of blockchain and Web3 adoption, establishing a strong foundation for growth. Key tech hubs like San Francisco and New York, with skilled blockchain engineers, developers, and entrepreneurs, foster vibrant innovation ecosystems.

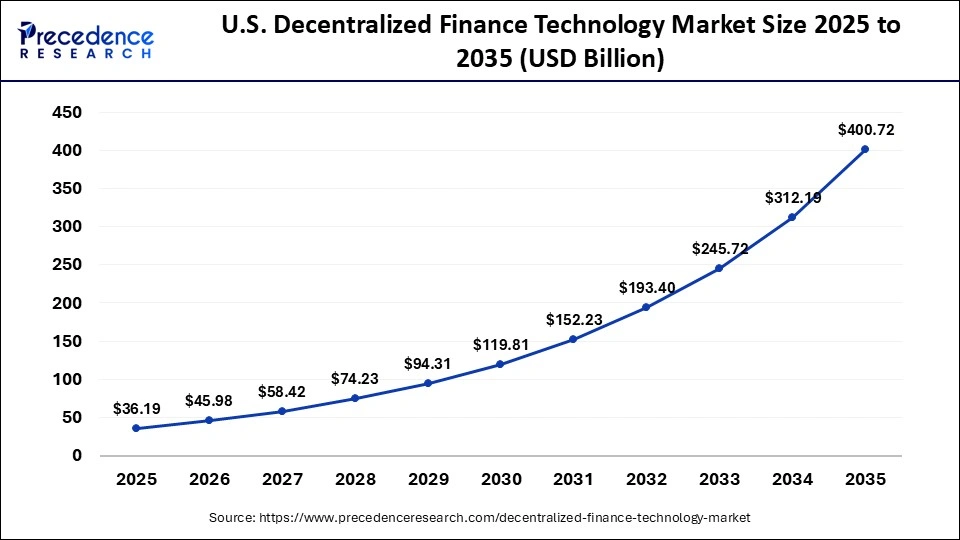

What is the Size of the U.S. Decentralized Finance Technology Market?

The U.S. decentralized finance technology market size is calculated at USD 36.19 billion in 2025 and is expected to reach nearly USD 400.72 billion in 2035, accelerating at a strong CAGR of 27.18% between 2026 and 2035.

U.S. Decentralized Finance Technology Market Trends

The U.S. remains a key contributor to the market in North America, distinguished by a mature, innovative ecosystem backed by significant venture capital funding and the presence of major tech giants such as IBM, Microsoft, Amazon, and Cisco. Its primary role is to lead R&D in decentralized identity and secure authentication systems, fostering an environment where new financial products and smart contracts continue to develop and scale.

Why is Asia Pacific Considered the Fastest-Growing Region in the Decentralized Finance Technology Market?

Asia Pacific is expected to see the fastest growth during the forecast period. This growth is mainly driven by high mobile and internet penetration, a large unbanked population, especially in rural areas, seeking financial access, strong government support for blockchain innovation, and rising institutional investment. The region has a sizable youth population comfortable with mobile-first technology and digital financial services, which speeds up the adoption of dApps and cryptocurrencies. Many governments in this region consider blockchain a strategic technology. Initiatives like China's digital yuan and India's IndiaChain show strong government backing and investment in the technology behind decentralized finance.

India Decentralized Finance Technology Market Trends

India is an emerging market focused on financial inclusion and digital change. The government's efforts and partnerships in advanced technologies, including IoT security and blockchain, promote growth. India's role involves using the combination of IoT and blockchain for practical uses like secure, transparent supply chain management, asset tracking, and providing financial services to unbanked people through accessible mobile-based DeFi platforms.

What Makes Europe a Notably Growing Region in the Decentralized Finance Technology Market?

Europe is expected to grow at a notable rate in the foreseeable future, driven by its strong regulatory environment, high demand for financial transparency, a robust existing fintech infrastructure, and high levels of digital literacy. Countries such as the UK, Germany, and Switzerland have well-established financial centers and dynamic fintech ecosystems that include numerous startups, accelerators, and innovation labs. Furthermore, Europe benefits from enhanced scalability, interoperability, and security of its underlying blockchain protocols, supporting the expansion of decentralized finance platforms and use cases.

Germany Decentralized Finance Technology Market Trends

In Germany, the market is growing due to a strong focus on establishing a clear regulatory framework and developing a robust token economy within Europe. The country hosts major development centers for global blockchain projects and is exploring practical applications for euro-denominated smart contracts and digital securities. Its efforts emphasize ensuring stability and fostering innovation within a compliant environment alongside established financial institutions.

What Potentiates the Decentralized Finance Technology Market within South America?

The market in South America is expanding due to strong demand for accessible finance, supportive regulations such as Brazil's Pix and Mexico's CoDi, growing digital infrastructure, and high crypto adoption driven by economic instability. Flourishing startup ecosystems in Brazil, Argentina, and Colombia make the region a leader in fintech innovation and Web3 solutions. A large unbanked and underbanked population is seeking alternatives to traditional banking, making decentralized finance particularly appealing.

Brazil Decentralized Finance Technology Market Trends

Brazil stands out as an emerging player in the market due to proactive government initiatives and a tech-savvy population. Projects such as the instant payment system, PIX, and the development of a digital currency lay the foundation for future DeFi applications. Brazil is also a significant testbed for combining IoT with blockchain to meet specific sector needs, addressing the country's vast geographical challenges and financial inclusion gaps.

What Opportunities Exist in the Middle East & Africa for the Decentralized Finance Technology Market?

The Middle East & Africa (MEA) presents significant opportunities for the market, mainly due to its large unbanked populations, high demand for efficient cross-border payments, and government initiatives supporting digital transformation. The region also has a young demographic with high mobile and internet penetration rates, which fosters the quick adoption of innovative digital financial solutions. Middle Eastern countries are actively pursuing economic diversification strategies, such as Saudi Arabia's Vision 2030 and various blockchain projects in the UAE, to lessen dependence on oil.

UAE Decentralized Finance Technology Market Trends

The UAE is a significant player in the Middle East & Africa, demonstrating a strong commitment to smart city solutions and government-led digital transformation. Its role often involves rapidly adopting advanced technologies, leveraging its position as a global business hub to attract investment and implement large-scale, high-tech projects that integrate IoT and blockchain to enhance public and financial services.

Decentralized Finance Technology Market Value Chain

Top Companies in the Decentralized Finance Technology Market

- Aave: It is a leading decentralized lending and borrowing protocol that offers unique features like flash loans and variable/fixed interest rates across multiple blockchains.

- Uniswap: The prominent decentralized exchange (DEX) in the market, utilizing an Automated Market Maker (AMM) model to enable direct peer-to-peer trading of crypto tokens without a central intermediary.

- MakerDAO: The creator of DAI, a decentralized stablecoin soft-pegged to the U.S. dollar. Users can generate DAI by locking up other crypto assets as collateral in smart contracts, providing a stable medium of exchange.

- Lido Finance: A liquid staking platform that allows users to earn staking rewards on assets like Ethereum (ETH) and Solana (SOL) without locking up the assets or managing complex infrastructure.

- Chainlink Labs: A crucial infrastructure provider, offering decentralized oracle networks that securely connect smart contracts to real-world data and off-chain systems.

Other Key Players

- Yearn Finance

- GMX

- Fireblocks

- Compound Finance

- Curve Finance

Recent Developments

- In March 2024, zkLink launched zkLink Nova, the first aggregated Layer 3 zkEVM rollup network based on zkSync's ZK Stack. This platform unifies liquidity and assets from Ethereum and Layer 2 rollups, offering an EVM-compatible dApp deployment environment. Founder Vince Yang highlighted that zkLink Nova addresses key challenges in Ethereum's fragmented ecosystem, enhancing interoperability and fostering innovation.(Source: https://www.prnewswire.com)

- In June 2025, JP Morgan's Kinexys announced plans to issue JPMD, a deposit token on Coinbase's Base blockchain. The permissioned token aims to provide a secure, stable coin alternative for institutional clients, enabling 24/7 transactions at a low cost. The bank emphasized its role in enhancing the global digital payments ecosystem through trusted financial infrastructure.(Source: https://www.ledgerinsights.com)

Segments Covered in the Report

By Component

- Decentralized Applications

- Smart Contracts

By Application

- Asset Management

- Compliance and KYT

- Data Analytics

- Payments

- Gaming

By Industry

- BFSI

- Retail & E-commerce

- Media & Entertainment

- Automotive

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting