What is the Diagnostic Enzymes Market Size?

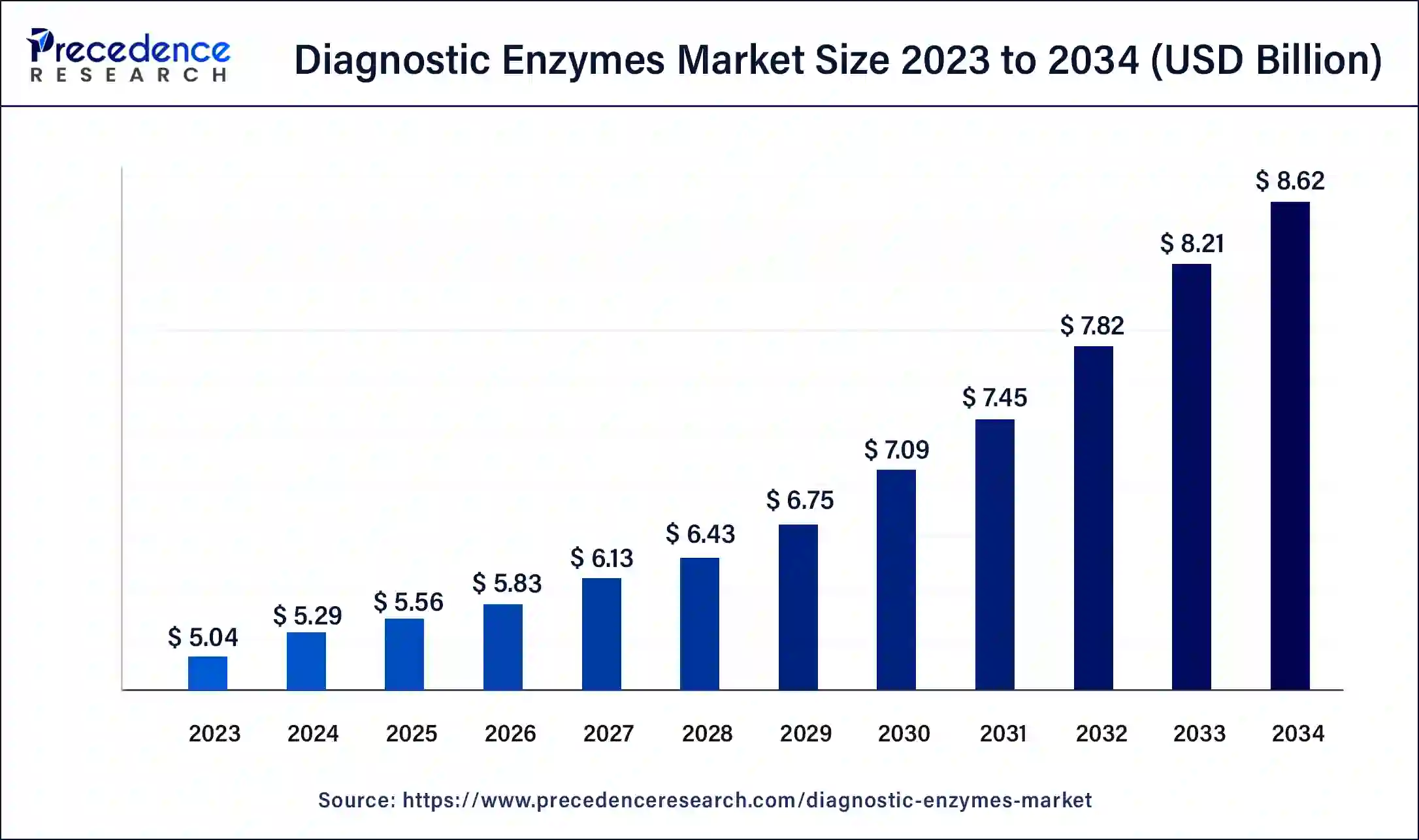

The global diagnostic enzymes market size is calculated at USD 5.56 billion in 2025 and is predicted to increase from USD 5.83 billion in 2026 to approximately USD 9.02 billion by 2035, expanding at a CAGR of 4.96% from 2026 to 2035.

Diagnostic Enzymes Market Key Takeaways

- North America led the global market with the highest market share of 42% in 2025.

- By type, the glucose oxidase/glucose dehydrogenase segment had a major revenue share of 10.7% in 2025.

- By application, the infectious diseases segment had the biggest market share in 2025.

- By product type, the clinical segment captured a significant revenue share of more than 62% in 2025.

What are Diagnostic Enzymes?

Due to factors such as the rising frequency of infectious diseases, the high demand for enzymes, the growing inclination for novel treatments, and the growing patient awareness, the market for diagnostic enzymes is expanding.

The detection and measurement of diverse compounds frequently employ diagnostic enzymes. Various aberrant metabolic processes, infections, infectious and non-infectious disorders, and inflammatory states can all be detected by changes in biomolecule concentration. Rapid & severe accurate disease diagnosis and appropriate treatment support ideal clinical outcomes and general public health.

Enzymes are frequently used to diagnose numerous diseases due to their excellent bio-catalytic properties. The metabolic activity of all living things, including plants, microbes, animals, and people, depends on enzymes, and multiple metabolic problems can result from aberrant enzyme activity. As a result, parts of the enzyme metabolism systems have been used as unique markers to diagnose diseases.

The prompt control of the transmission of infectious illness and the reduction of the dangers to public health depends on adopting proper diagnostic techniques. Significant efforts and breakthroughs have been made to achieve the WHO ASSURED criteria for assays in developing viral diagnostic technologies.

However, due to worries about healthcare spending and an increase in the usage of diagnostic enzyme testing, the financial pressure on these tests has increased during the past ten years. For product approvals, the diagnostic industry is likewise subject to strict rules. At first, the only prerequisite for the registration of diagnostic tests in the EU was CE mark approval. Regulating bodies, however, also need evidence of significant test benefits and affordable costs due to financial constraints.

How is AI Contributing to the Diagnostic Enzymes Market?

AI not only streamlines enzymology diagnostics but also helps in discovering new biomarkers, designers of enzymes, and interpreting results for a variety of biochemical tests. It also increases laboratory automation, speeds up the process, and gives more reliable analysis.

Predictive models based on AI connect enzyme activity with patient data to predict the risks of disease and its progression. Furthermore, it pushes the non-invasive diagnostic field further by integrating sensors better, which gives the doctors a full view and helps in decision-making in different diagnostic settings.

Market Outlook

- Industry Growth Overview: Demand increases through health needs, diagnostic applications, and preventive biochemical testing significantly.

- Sustainability Trends: The green chemistry trend is on the rise due to the renewable enzyme provider that has less impact on the environment and is more efficient regarding resources.

- Global Expansion: The adoption of technology and investments in healthcare are increasing are the main reasons behind the strong regional development in the international diagnostic enzyme markets.

- Major Investors: Roche, Thermo Fisher Scientific, Merck KGaA, Promega, and Advanced Enzymes Technologies are the major investors that tirelessly support the development via strategic innovation backing.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.96 Billion |

| Market Size in 2026 | USD 5.83 Billion |

| Market Size by 2035 | USD 9.02 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.96% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Application, and By Product Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

- Growing Demand in Pharmaceuticals and Diagnostics for Non-Harmful Biological Catalysts

- Growing Clinical in the Industry of Vitro Diagnostics

- Increasing Use of Pharmaceutical Drug Formulations Based on Enzymes to Treat Chronic Disease - The increase in the elderly population, which expands the patient pool for the diagnosis of chronic diseases, has led to the expansion of the market for diagnostic enzymes. Globally, the percentage of adults over 65 rose, along with the prevalence of age-related chronic illnesses. For instance, it is anticipated that in Japan, the rate of seniors will increase from 28% in 2019 to 38% in 2050. The number of people with several chronic conditions, including rheumatoid arthritis, hypertension, diabetes, and cancer, has increased as the population ages. For instance, according to the World Population Ageing research, there were 727 million people over the age of 65, or 9.3% of the world's population, as of 2020; by 2050, the percentage is expected to increase to nearly 16.0%. Around 10 million people died from cancer in 2020, according to a World Health Organization report from 2021. The rise in patients seeking the diagnosis of chronic diseases brought on by the aging population drives the market for diagnostic enzymes.

Market Restraints

- Inconsistency in the Regulatory Framework

- High Adoption Costs for Small and Medium-Sized Businesses

Market Opportunities

- The market for enzymes features numerous industries and technological advancements

- Considerable Investments in Biotechnology and Growing Momentum in Molecular Diagnostics

Market Challenges

- Concern over the quality of enzymes used in diagnostics and pharmaceuticals

Segment Insights

Type Insights

The sector for glucose oxidase/glucose dehydrogenase had the highest revenue share of 10.7% in 2023. Glucose oxidase is a common endogenous oxidoreductase in all living things (GOx). The biomedical sector has recently shown interest in it because of its inherent biocompatibility, lack of toxicity, and distinct catalysis against -d-glucose.

To efficiently speed up glucose oxidation into hydrogen peroxide (H2O2) and gluconic acid, which can be used to detect cancer biomarkers, a variety of biosensors can use GOx. Demand for glucose oxidase is expected to increase due to the enzyme's critical involvement in the diagnosis of diabetes.

Throughout the forecast period, the lactate oxidase sector is anticipated to increase faster as more people are using molecular devices to manage their diabetes. In the cells of various living systems, lactate dehydrogenase (LDH) is widely distributed and catalyzes the interconversion of pyruvate and lactate using the NAD+/NADH coenzyme system.

Human and animal blood plasma and serum include LDH enzymes directly derived from tissues and cells with a unique profile. This profile depends on the quantity of all tissue's intracellular isoenzymes, which create a pool of LDH in serum and plasma due to typical cell deterioration. Certain forms of cancer can be diagnosed using LDH. Additionally, it can be used for the diagnosis and follow-up of illnesses that result in cell destruction, to gauge the seriousness of some cancers, and keep tabs on patients. At the same time, they get therapy and examine aberrant fluid collections in the body.

Application Insights

In 2025, the segment dealing with infectious diseases had the largest market share. The widespread use of PCR technology has made it possible to identify and treat infectious diseases early. Now, it is possible to identify organisms with greater accuracy and sensitivity that were previously difficult to find. When diagnosing infectious disorders, PCR can identify common pneumonia, streptococcal pharyngitis, TB, ulcerative urogenital infections, and several chronic conditions. The polymerase DNA gene expression in Thermusthermophilus Escherichia coli permits effective activity, reverse transcriptase, for one-step identification of cellular mRNA expression.

The oncology category will likely increase fastest during the forecast period. The use of diagnostic enzymes in this market is driven by the widespread adoption of ISH techniques and the development of high-throughput technologies for diagnosing human tumors, such as comparative genomic hybridization and next-generation DNA sequencing.

The US government launched the COVID-19 pandemic-related Cancer Moonshot in February 2022 to increase cancer screening rates and locate instances that had gone undiagnosed. The government intends to cut cancer-related fatalities by 50% over the next 25 years through early detection and treatment, which will propel the demand for cancer diagnostic enzyme testing.

Product Type Insights

Due to the growing usage of enzymes in clinical chemistry, which is connected to examining body fluids for diagnostic and therapeutic purposes, the clinical segment accounted for the most significant revenue share of over 62% in 2023. Slight variations in the concentrations of body fluids like blood, plasma, or serum may signal the beginning of an illness that could be fatal. As a result, the analytical methods used in clinical chemistry should be quick, focused, and extremely sensitive.

The selectivity and speed of the enzymes make them an essential component of clinical chemistry diagnostic processes. The substrate in an assay can be evaluated using enzyme specificity, or interferences can be eliminated from another function. Enzymes are additionally used to measure inhibitors, co-factors, and activators. Enzymes are also ideal for use as labels in immunoassay processes because of their catalytic activity.

The molecular market will likely grow at a profitable rate. Different enzymes are mostly used in molecular diagnostics through PCR tests, NGS assays, and others. One of the most used molecular biology methods is PCR. The technology is widely used in various industries, such as cloning, sequencing, forensic investigation, and diagnostic testing.

Transcription-Mediated Amplification (TMA) and Isothermal Nucleic Acid Amplification Technology (INAAT) are other molecular biology tests that use enzymes (TMA). A target nucleic acid sequence can be found more quickly and exponentially with INAAT. This gets around the problems with thermal cycling.

Regional Insights

What is the U.S. Diagnostic Enzymes Market Size?

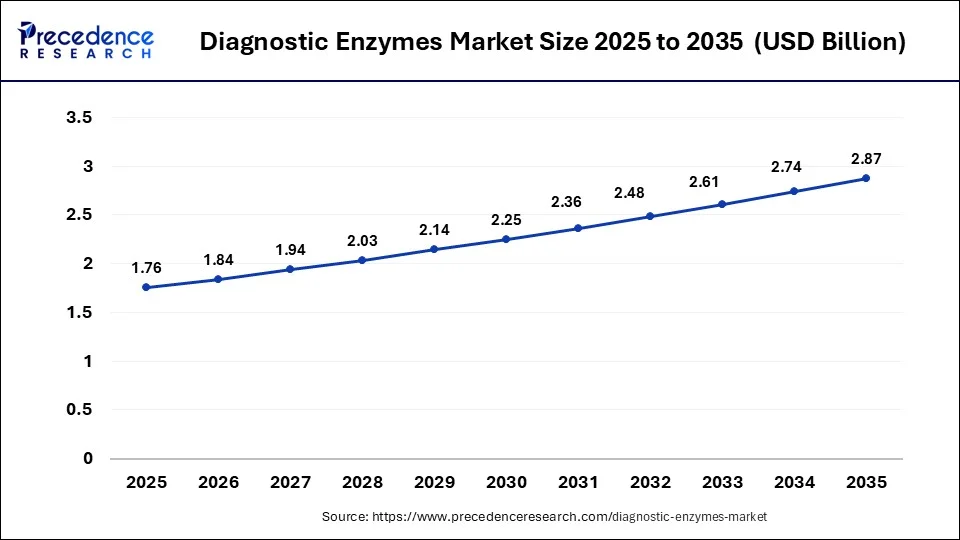

The U.S. diagnostic enzymes market size was estimated at USD 1.76 billion in 2025 and is predicted to be worth around USD 2.87 billion by 2035, at a CAGR of 5.01% from 2026 to 2035.

How is North America leading in the Diagnostic Enzymes Market?

North America is the main beneficiary of its well-established health care capabilities, vigorous research activity, and the steadily increasing use of enzyme-based diagnostics. More avenues for growth have been created with the modernization of analytical technology, an ever-increasing focus on preventive care, and persistent financing for development and acceptance of innovations.

North America will likely experience significant growth in the market under study and hold a substantial share in the market for diagnostics enzymes during the forecast period due to significant funding for R&D from the government and private players, as well as the presence of key market players there.

U.S. Diagnostic Enzymes Market Trends:

The U.S. is making progress by relying heavily on enzyme-based diagnostic tools backed up by strong regulatory support and increasing precision medicine projects. The coming times will see an increase in the number of opportunities due to the developments in the areas of specialized testing, wider clinical applications, and the active deployment of new enzyme platforms that can advance diagnostic accuracy and ensuing clinical decision-making.

Due to its technological superiority over the rest of the globe and significant R&D expenditure, the United States is predicted to have the most significant growth in North America. In 2018, the United States spent around USD 606.1 billion on R&D, according to the National Center for Science and Engineering Statistics. Additionally, it was predicted that the overall capital investment in R&D will be close to USD 656 billion in 2019, based on performance statistics. The existence of prominent market participants who are developing and introducing new products, top-notch research facilities led by some of the most renowned scientists (including Nobel laureates), technologically cutting-edge biotechnology firms, and public awareness are the other factors contributing to the United States' significant market share. For instance, San Diego-based Mesa Biotech Inc., a provider of molecular diagnostics, was acquired by Thermo Fisher Scientific in January 2021.

Canada and Mexico may hold the second and third-largest shares of the North American market for diagnostic enzymes after the United States. In addition to enhancing its health infrastructure and public awareness, Canada is following the United States' lead and investing extensively in R&D in the biotechnology and pharmaceutical sectors.

What are the driving factors of the Diagnostic Enzymes Market in Europe?

Europe is boosting its position with solid healthcare systems, supportive screening initiatives, and sustained biotechnology investments, which are gradually becoming all-encompassing enzyme-based diagnostics. The market opportunities are getting stronger through the establishment of high-quality regulatory standards, the intensity of research collaborations, and the preference for rapid and precise diagnostic solutions that will ultimately improve clinical workflows in diverse healthcare environments.

Germany Diagnostic Enzymes Market Trends:

Germany shows a great deal of interest in advanced diagnostic enzyme solutions, which are backed by the existing healthcare infrastructure and the current situation that emphasizes testing. Opportunities come upon us through the adoption of fast biochemical tools, increased research activities, and the presence of established regulatory frameworks that promote trust, standardization, and the growth of enzymatic diagnostic applications.

How is Asia-Pacific performing in the Diagnostic Enzymes Market?

The Asia-Pacific region is moving forward while enlarging its market in a steady manner of healthcare access improvement, raising awareness, and the adoption of advanced diagnostic technologies. The region will see more opportunities with increased focus on biochemical testing, stronger investments in biotechnology, and rapidly expanding availability of innovative enzyme-based tools across the region's rapidly developing healthcare systems.

China Diagnostic Enzymes Market Trends:

China elevates its position in the diagnostic enzyme market, which is supported by an increasing number of biotechnology initiatives, and growing government investments and grants, as well as a rising local market for cheap and high-quality enzyme-based diagnostics and pharmaceuticals.

Diagnostic Enzymes Market-Value Chain Analysis

- R&D: Involves research and development of new diagnostic enzymes and production processes with biochemical testing performance that is improved, supported by, and developed.

Key Players: Bio-Rad, Thermo Fisher Scientific, Roche - Clinical Trials and Regulatory Approvals: Concentrates on enzyme testing through the triaging method: safety, efficacy, and regulatory approval from the relevant authority.

Key Players: IQVIA, Charles River Laboratories, Covance - Formulation and Final Dosage Preparation: The process of encapsulating active enzyme ingredients in a stable, ready-to-use format, thus taking care of quality, consistency, and application suitability.

Key Players: Catalent, Lonza, Piramal Pharma Solutions - Packaging and Serialization: Products are securely packed and labeled with traceable identifiers that allow compliant handling, shipping, and overall supply chain transparency.

Key Players: West Pharmaceutical Services, Gerresheimer, SCHOTT - Distribution to Hospitals, Pharmacies: Logistics handling of the finished enzyme products, safe and efficient delivery to the end healthcare locations.

Key Players: McKesson Corporation, Cardinal Health, AmerisourceBergen

Diagnostic Enzymes Market Companies

- Sanofi Genzyme: The company supplies specific enzyme solutions aimed at the treatment of patients, and at the same time, it collaborates with its parent company to use its broader capabilities to create an impact in the healthcare sector.

- Codexis Inc.: They are making new highly efficient enzymes that are needed for diagnostics, sequencing, and different life science areas via the use of advanced development platforms that are reliable and highly productive.

- Aldevron: This company caters to the needs of high-quality enzymes required for diagnostics, research, and commercial purposes, thus playing a vital role in the creation of reliable biochemical solutions in the very diverse application areas.

Other Major Key Players

- F Hoffmann-La Roche Ltd

- Biocatalysts Ltd

- Amano Enzymes

- Kaneka Eurogentec

- Others

Recent Development

- In June 2025, FAO initiated specialized training workshops in Tajikistan to improve brucellosis diagnosis via serological methods, celebrating its 80th anniversary. These workshops gathered laboratory experts from the national food security system across Sughd, Khatlon, and Gorno-Badakhshan to upgrade their skills. (Source: https://www.fao.org )

- In September 2025, Quest Diagnostics launched a pharmacogenomic lab test to assist providers in understanding patients' genetic responses to specific drug therapies. This service aims to guide medication selection and dosing across various medical fields, including psychiatry, cardiology, neurology, oncology, and more. (Source: https://www.prnewswire.com )

- In June 2020, a collaboration agreement was struck by Codexis Inc. and Alphazyme LLC for the manufacturing and joint marketing of the enzymes utilized in the diagnostics and life sciences industries.

- In May 2020, a nuclease-based testing kit called Logix Smart developed by Co-Diagnostics was successfully used to find COVID-19 in cancer cells in people.

Segmentation of the Report

By Type

- MMLV RT

- Taq Polymerase

- Hot Start Taq Polymerase

- HIV RT

- RNase Inhibitors

- UNG

- PCR Master Mix

- Bst Polymerase

- T7 RNA Polymerase

- Lyophilized Polymerase

- Acid Phosphatase

- Cas9 Enzyme

- Amylase

- Alanine Aminotransferase

- Aspartate Aminotransferase

- Angiotensin Converting Enzyme

- Creatinine Kinase

- Cholinesterase

- Lactate Dehydrogenase

- Gamma GlutamylTransferase

- Glucose Oxidase/Glucose Dehydrogenase

- Renin

- Lactate Oxidase

- Urease

- Glutamate Oxidase

- Horseradish Peroxide

- Others

By Application

- Oncology

- Diabetes

- Infectious Diseases

- Cardiology

- Autoimmune Diseases

- Nephrology

- Others

By Product Type

- Clinical Enzymes

- Molecular Enzymes

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting