Earthquake Insurance Market Size and Forecast 2025 to 2034

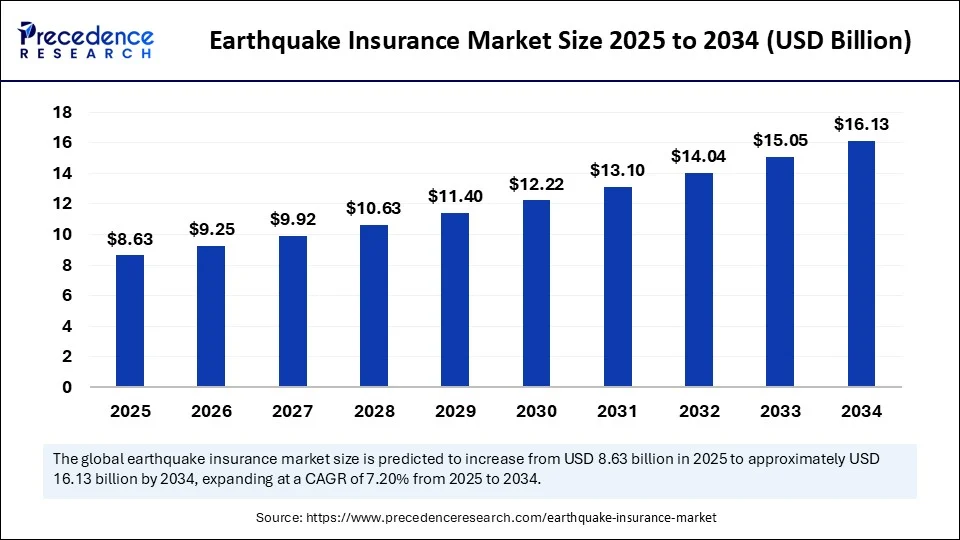

The global earthquake insurance market size accounted for USD 8.05 billion in 2024 and is predicted to increase from USD 8.63 billion in 2025 to approximately USD 16.13 billion by 2034, expanding at a CAGR of 7.20% from 2025 to 2034.The growing frequency and severity of natural disasters are driving the growth of the earthquake insurance market. The rising demand for personalized coverage further contributes to market growth.

Earthquake Insurance MarketKey Takeaways

- In terms of revenue, the earthquake insurance market was valued at USD 8.05 billion in 2024.

- It is projected to reach USD 16.13 billion by 2034.

- The market is expected to grow at a CAGR of 7.20% from 2025 to 2034.

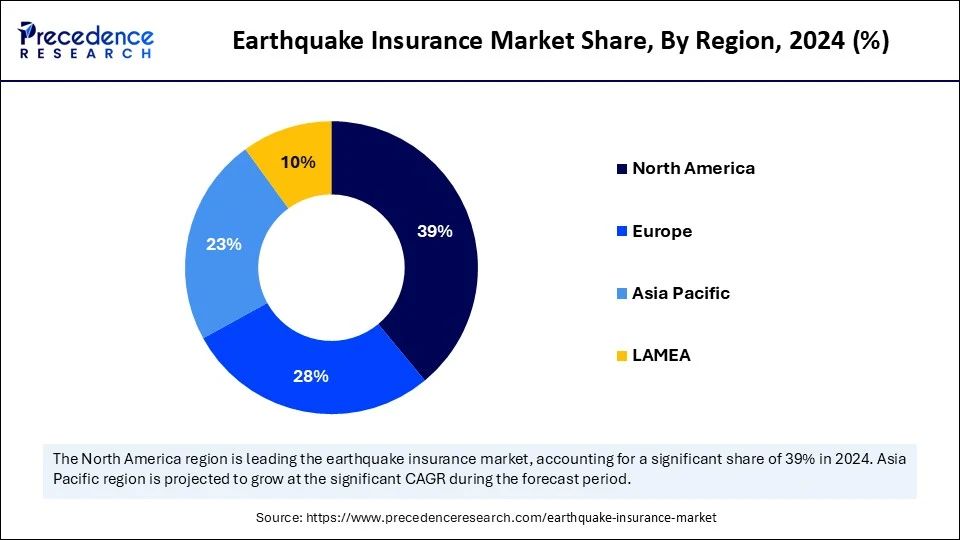

- North America accounted for the largest revenue share of 39% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

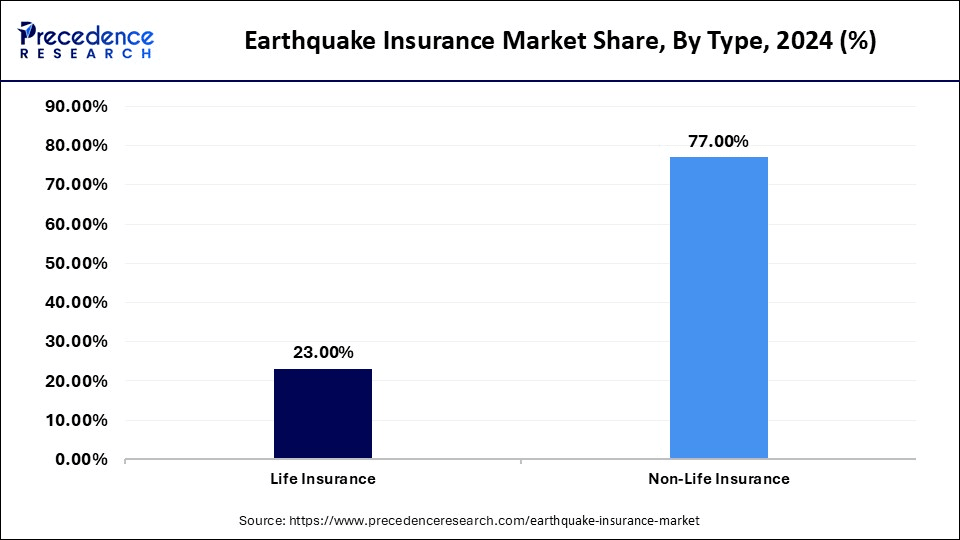

- By type, the non-life insurance segment contributed the major revenue share of 77% in 2024.

- By type, the life insurance segment is expected to grow at a significant CAGR between 2025 and 2034.

- By application, the personal segment held the major market share in 2024.

- By distribution channel, the agents segment held the major market share in 2024.

- By distribution channel, the brokers segment is expected to grow at a considerable CAGR in the coming years.

- By end-user, the individual segment contributed the largest market share in 2024.

- By end-user, the business segment is likely to expand at a significant CAGR in the coming years.

How is AI Impacting the Earthquake Insurance Industry?

Artificial Intelligence plays a crucial role in improving operations by enhancing risk assessments, claim processing, and fraud detection. It analyzes large datasets to identify potential risks and automate claims. Several countries are using AI to predict potential natural disasters to prepare both physically and financially before the event occurs. AI provides about 70% accuracy in predicting earthquakes. Researchers at UT Austin have used machine learning algorithms to forecast activities like seismic events to enhance preparedness in earthquake conditions.

AI is transforming the insurance industry, enhancing the accuracy and efficiency of claim operations by 14 times. AI is not only improving accuracy but also helping to detect fraud cases. In the insurance industry, around 11% of cases have been flagged by AI to detect potential fraud. According to the report by Policybazar, AI utilization has led to a 14x enhancement in early claim factors since FY 2022. AI manages 45% of particular insurance tasks in companies. Moreover, according to Deloitte, property and casualty insurers can save up to $80 billion to $160 billion by FY 2032 by adopting AI.

(Source: https://economictimes.indiatimes.com)

(Source: https://www.roots.ai)

U.S. Earthquake Insurance Market Size and Growth 2025 to 2034

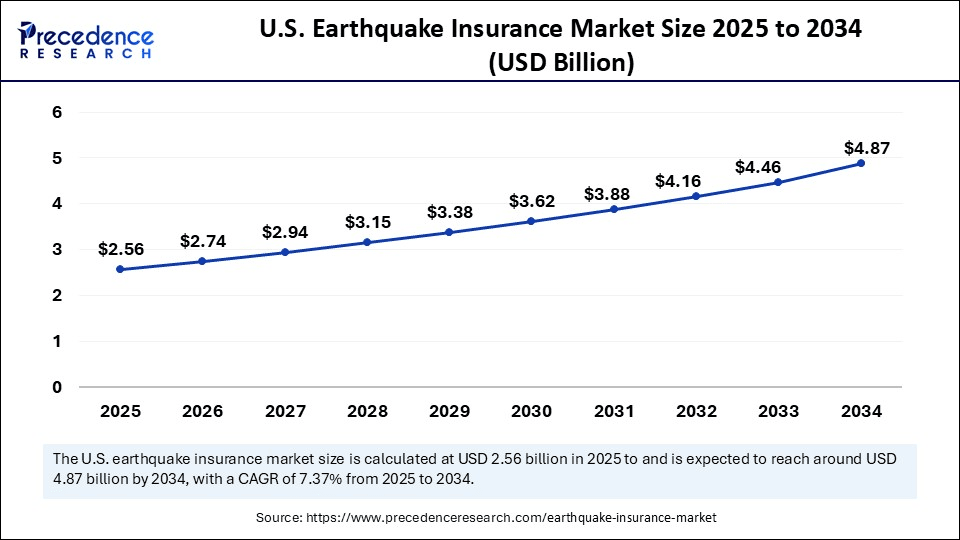

The U.S. earthquake insurance market size was exhibited at USD 2.39 billion in 2024 and is projected to be worth around USD 4.87 billion by 2034, growing at a CAGR of 7.37% from 2025 to 2034.

What Made North America the Dominant Region in the Earthquake Insurance Market?

North America dominated the global earthquake insurance market by capturing the largest revenue share of 39% in 2024. This is mainly due to its strong insurance sector and increased demand for novel and innovative insurance products. The region benefits from strong regulatory support, encouraging the adoption of earthquake insurance. Governments around the world are promoting the use of earthquake insurance by spreading awareness about seismic risk and financial loss, contributing to increased adoption of earthquake insurance in the region. Additionally, increased seismic activities and industrialization contributed to the region's dominance.

The U.S. is a major player in the regional market growth due to the high frequency of seismic events like hurricanes and wildfires. As a result, the demand for earthquake and parametric insurance has increased in the U.S. Additionally, the robust regulatory policies for insurance coverage encourage the adoption of earthquake insurance in the country. The U.S. government is not only enhancing countries' insurance industry but also playing a prominent role in providing support at the geopolitical level.

In June 2025, President Donald J. Trump approved the major disaster declaration for Tennessee. The federal disaster assistance is available for the state of Tennessee for supplemental recovery efforts in affected areas. The federal funding is now available to affected areas in individual countries like Cheatham, Dickson, Dyer, Davidson, Hardeman, Montgomery, McNairy, Obion, and Wilson.

(Source: https://www.fema.gov)

Asia Pacific Earthquake Insurance Market Trends

Asia Pacific is the fastest-growing region. The growth of the market within the region is attributed to the increased risk of seismic events and consumer awareness of benefits insurance coverage. Governments around the region have implemented strict regulations for insurance. The region's focus on advancing parametric insurance plays a crucial role in market growth. Additionally, rapid urbanization and infrastructure developments are fueling the need for earthquake insurance in the region.

China is a major player in the regional market, with growth driven by high adoption of earthquake insurance in the commercial sector. The Chinese government is providing an educational campaign to advance understanding of and risks of natural disasters and the importance of insurance. Ongoing initiatives in the development of advanced technologies for the prediction of natural disasters also play a vital role in the growth of the market.

Additionally, China's "The 14th Five-Year Plan (2021–2025) for National Economic and Social Development and the Long-Range Objectives Through the Year 2035" explicitly states the need to "enhance disaster prevention, mitigation, and relief capabilities and develop catastrophe insurance," further emphasizing the role of catastrophe insurance in risk protection.

(Source:https://www.sciencedirect.com)

Japan is a significant player in the regional market due to the country's high incidence of seismic events and robust efforts in disaster preparedness. Japan experiences more earthquake incidents, creating opportunities for insurance providers in the country to provide proactive efforts on managing disasters and provide sufficient financial coverage to individuals and businesses. Government support in insurance claims and management fosters market growth in the country.

Middle East & Africa Earthquake Insurance Market Trends

The Middle East & Africa is a significantly growing region in the market. The growth of the market within the region is driven by increased awareness about seismic events, regulatory support, and high infrastructure developments in the region. The region experiences major financial diversification and demand for insurance, particularly in high-risk areas. The rapid digitalization, ongoing innovations, and demand for risk transfer solutions are the major factors contributing to the rising demand for earthquake insurance in the region.

Europe Earthquake Insurance Market Trends

Europe is expected to grow at a notable rate in the upcoming period, driven by the high risks of earthquakes in several European countries like Greece and Turkey. The region's focus on advancing risk modeling and technology contributes to market expansion. Additionally, the regional government is emphasizing disaster preparedness. Stringent building codes and regulations in some areas further contribute to regional market growth.

Market Overview

The global earthquake insurance market has witnessed transformative growth, driven by increased earthquake incidence all over the world. The increased frequency and severity of natural disasters and government initiatives for implementing suitable insurance policies & regulations and promoting awareness of the importance of financial coverages contribute to market growth. Growing urbanization and developments of infrastructure are fueling the risk of earthquakes, making insurance the first and ideal solution to manage asset and financial loss.The awareness of seismic risks has shifted consumers toward the adoption of proactive measures, including financial help like insurance. Personal and commercial are the major adopters of earthquake insurance. Businesses are prioritizing preventive efforts to reduce the risk of losing their assets and business. The demand for comprehensive and catastrophic coverage is high in the market. Insurers are offering parametric insurance according to the seismic event parameters.

Hurricanes and Earthquakes Lead to Global Insured Losses

- The wildfires started in Los Angeles in April 2025, causing an estimated $40 billion of insured losses from secondary peril. Primary perils like hurricanes or strong earthquakes remain the biggest threat, hitting a densely populated urban area, leading to increased losses in the year, which is more than double the long-term loss trend.

- According to the model analysis and considering the industry-exposure database, the Swiss Re Institute estimates that hurricanes and earthquakes could drive global insured losses to USD 300 billion or more in a peak year.

(Source: https://www.swissre.com)

What are the Key Factors Boosting the Growth of the Earthquake Insurance Market?

- Growing Natural Disaster Incidence: The frequency of earthquakes and natural disasters has increased demand for comprehensive insurance coverage.

- Urbanization and Infrastructure Developments: The growing urbanization and infrastructure development efforts are increasing the potential risk of earthquake damage, encouraging property owners to invest in insurance coverage.

- Government Initiatives: The government initiatives and regulations are implementing policies for the adoption of earthquake insurance, contributing to the market growth.

- Demand for Personalized Coverage: The insurance providers are offering personalized policies, making them more suitable for businesses and individuals within their budgets.

- Technological Advancements: Insurance companies are integrating advanced technologies to enhance risk assessments, process of claim process, and customer engagements, driving the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 16.13 Billion |

| Market Size in 2025 | USD 8.63 Billion |

| Market Size in 2024 | USD 8.05 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.20% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Distribution Channel, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Awareness of Seismic Risks

The awareness of seismic risk, particularly in high-risk areas, has increased, driving demand for earthquake insurance. The awareness about the importance of insurance and the rising frequency of disasters is increasing the need for comprehensive financial coverage. The awareness enables people for proactive in risk mitigation and preparedness. Businesses in high-risk areas are prioritizing insurance for the protection of their property and business economy, driven by rising awareness of seismic risks. Additionally, the growing urbanization in those areas is fostering the adoption of comprehensive coverage, contributing to market growth.

Restraint

Complex Policies and Coverage Restrictions

The complexity of earthquake insurance policies is a major factor restraining the growth of the market. These policies require specialized knowledge, experience, and understanding. The complex nature of policies requires training programs for advanced risk assessments and underwriting techniques. The need for specialized claim handling and adjusting experience makes insurance policies more complex. Regulatory compliance for specific earthquake insurance further mandates a professional understanding of relevant laws and regulations. The lack of professionals and experts can lead to a risk of cyber threats and fraud. Moreover, the limited availability of these insurance policies in high-risk zones hamper the growth of the market.

- In April 2025, after a new earthquake disaster in Myanmar, several insurance companies temporarily stopped the sales of new disaster insurance policies to reduce the risk of potential fraud claims. (Source: https://www.nationthailand.com)

Opportunity

Novel Products and Distribution Channel

Insurers are offering newly developed insurance products like customized policies, comprehensive coverage, and parametric insurance. New insurance policies and their combination with other insurance coverages are driving convenience and accessibility to consumers. The ongoing focus of insurers on developing tailored solutions for specific industries and needs is changing the emphasis on earthquake insurance demands. Additionally, the emergence of new distribution channels like online platforms, partnerships with brokers and agents, and direct sales relationships with consumers holds the potential to boost insurance consumption in natural disaster areas.

Type Insights

What Made Non-Life Insurance the Dominant Segment in the Market in 2024?

The non-life insurance segment dominated the earthquake insurance market with the largest share of 77% in 2024. This is mainly due to the offering of broad coverage for asset damage, including property, vehicles, and businesses by non-life insurance providers. Non-life insurance policies provide financial coverage for properties like infrastructure, buildings, and others. Businesses and established infrastructure get significantly impacted due to seismic events, creating a heightened need for insurance coverage. Grooving seismic events, advancements in risk assessment technologies, and government policies for property damage further ensure the long-term growth of the segment.

In January 2025, the California Department of Insurance and CEA's Governing Board approved two changes and one clarification for new and renewal policies, including all policies to include a CEA rate increase of 6.8% and new policies to include property coverage of a $500 sub-limit for specific breakable items of individual property at no additional cost.

(Source: https://portal.earthquakeauthority.com)

The life insurance segment is expected to grow at a significant CAGR in the upcoming period, driven by rising seismic events and natural disasters. Life insurance provides financial coverage for accidental death or disability riders. These policies include comprehensive coverage for beneficiaries in the event of death or disability caused by earthquakes. Moreover, technological advances in disaster management for disaster prediction and quick response in areas are narrowing the death toll or lump incidence of earthquakes.

Application Insights

How Does the Personal Segment Dominate the Earthquake Insurance Market in 2024?

The personal segment dominated the market with a major revenue share in 2024 due to increased seismic events and awareness among renters and homeowners. The rental homeownership in earthquake areas is increasing, driving the need for personal insurance coverage. The personal property asset values are highlighted in urban areas. Government initiatives like education campaigns and policies are expanding to empower individuals and businesses to secure coverage. Additionally, insurance companies are focusing on developing specialized insurance products to make it easier for individuals to find specialized and sustainable solutions according to their budgets, driving segmental growth.

Meanwhile, the commercial segment is expected to grow at a significant rate during the projection period. This is mainly due to the increased focus of businesses on disaster preparedness. Commercial insurance covers a variety of risks, ranging from property damage and liability to company disruption and employee injuries. This insurance helps businesses to continue operations in disaster risks by providing coverage for financial losses.

Distribution Channel Insights

Which Distribution Channel Dominate the Earthquake Insurance Market in 2024?

The agents segment dominated the market with the biggest share in 2024, driven by the longstanding trust and relationships built by agents with clients. Agents help consumers to educate about earthquake insurance and support by providing insurance coverage according to specific needs and risk profiles. Agents provide services, including advice and helping businesses and individuals understand policies and coverage limits. Agents play a vital role in offering personalized policy solutions and enhancing customer experiences.

The brokers segment is expected to grow at a considerable CAGR during the forecast period due to their crucial role in connecting clients with insurers. Brokers help clients receive tailored insurance policies according to their needs. Brokers help clients understand specific policy and coverage limitations and assist clients in navigating the claims process. The complexity of insurance makes brokers to understand policy nuances and mitigate risk.

End-User Insights

Why Did the Individual Segment Dominate the Market in 2024?

The individual segment dominated the earthquake insurance market with a major share in 2024, primarily due to increased awareness among homeowners in high-risk areas. The increased frequency of seismic events and awareness about financial risk are fostering the adoption of earthquake insurance by individuals. Insurers are offering specialized insurance policies to meet coverage levels and deductibles, enabling suitable solutions according to the budgets of individuals. Additionally, governmental and educational campaigns and regulations to secure adequate coverage are contributing to the segment's growth.

The business segment is likely to expand at a significant CAGR in the coming years. The growth of the segment is attributed to the rising demand for specialized and personalized insurance coverage among businesses like buildings, industrial facilities, and retailers in high-risk areas. Insurers provide specialized insurance coverage for businesses to protect their property and assets against seismic risk. Companies are prioritizing earthquake insurance for continued business operations and maintaining stakeholders' confidence.

Earthquake Insurance Market Companies

- USAA

- Nationwide Mutual Insurance Company

- Allstate Insurance Company

- MAPFRE

- State Farm Mutual Automobile Insurance Company

- Farmers

- Mercury Insurance Services LLC

- Liberty Mutual Insurance

- Country Financial

- GeoVera Insurance Group

Recent Developments

- In June 2025, KBZMS General Insurance paid more than K3.5 billion to accelerate the recovery for individuals who are affected by the Mandalay earthquake. Also, since March 2025, individuals from affected areas have been granted a one-month extension for their insurance term.

(Source:https://www.gnlm.com.mm)

- In January 2025, the Pacific Catastrophe Risk Insurance Company (PCRIC) gave the first payout of $1.2 million to the government of Vanuatu, following the earthquake that affected Port Vila, which happened in December 2024.

(Source: https://www.reinsurancene.ws)

- In June 2024, Emerald Bay Risk Solutions partnered with Arrowhead to launch a new commercial earthquake insurance facility called Arrowhead EQ DIC. This new initiative aims to provide difference in conditions (DIC) insurance policies specifically designed for medium to large businesses in earthquake-prone regions like California and the Pacific Northwest.

(Source:https://www.insurancebusinessmag.com)

Segment Covered in the Report

By Type

- Life Insurance

- Non-Life Insurance

By Application

- Personal

- Commercial

By Distribution Channel

- Banks

- Agents

- Brokers

- Retailers

- Others

By End-User

- Individuals

- Business

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting