What is the Esoteric Testing Market Size?

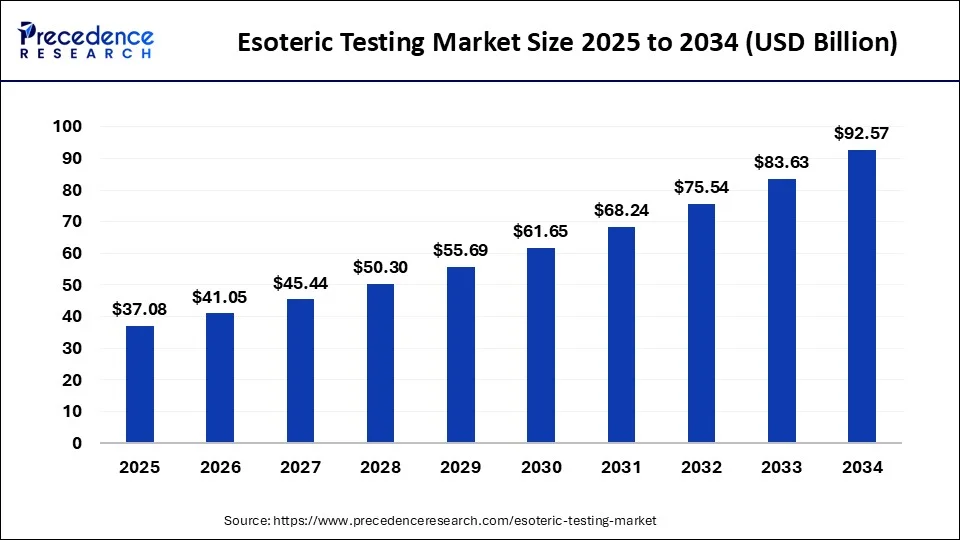

The global esoteric testing market size is estimated at USD 37.08 billion in 2025 and is predicted to increase from USD 41.05 billion in 2026 to approximately USD 92.57 billion by 2034, expanding at a CAGR of 10.70% from 2025 to 2034.

Esoteric Testing Market Key Takeaways

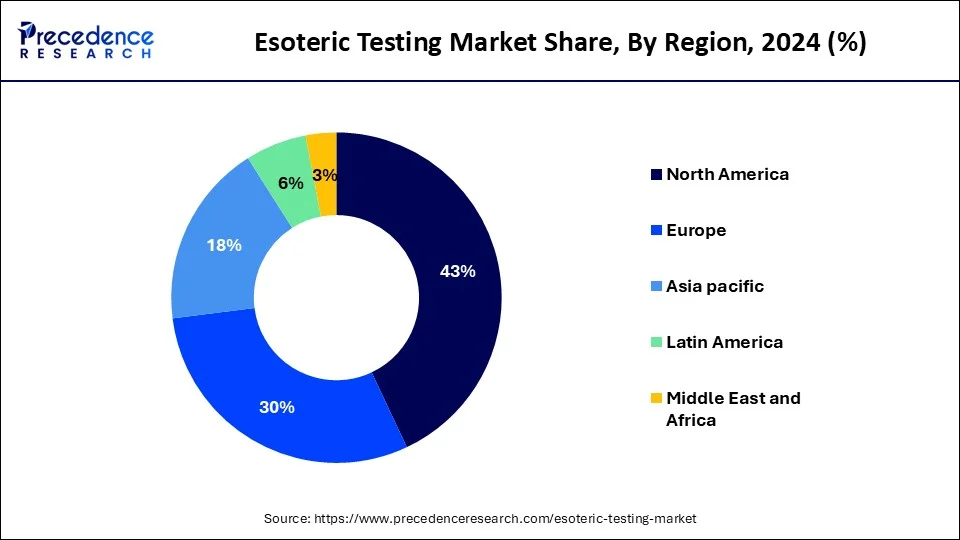

- North America dominated the global market with the largest market share of 44% in 2024.

- By type, the Infectious disease testing segment contributed the highest share of 32% in 2024.

- By technology, the chemiluminescence immunoassay (CLIA) segment accounted highest share in 2024.

- By teste type, endocrinology segment held the biggest market share of 20% in 2024.

- By technology, ELISA segment was valued at USD 6.2 billion in 2024.

- North America esoteric testing market is expected to grow at a CAGR of 10.82% from 2025 to 2034.

Market Overview

Esoteric testing enables the examination of uncommon substances or compounds that are typically not studied in a medical lab. Large commercial laboratories frequently contract out challenging testing to standard and specialist testing centers. Therefore, as diagnostic test technology progresses, tests that are currently thought to be esoteric may end up being commonplace in a short period. Committed research & development professionals usually produce this. These tests are requested by doctors when they require more detailed information than routine lab testing to finish a diagnosis, determine a prognosis, or select and track a treatment plan.

Esoteric testing frequently requires the use of sophisticated tools and equipment, as well as skilled personnel to conduct the test and analyse the results. Generally speaking, these tests are much more significant and performed more regularly than standard tests. Esoteric testing includes, for example, tests in endocrinologists, genetics, immunological, microbiological, molecular techniques, cancer, serological tests, and toxicology. The field of clinical techniques is the one within esoteric clinical studies that is expanding the quickest. Finding medical technologists with the requisite training and paying employees the higher wages that respective skill sets require are two issues faced by labs that perform such procedures. Furthermore, the materials needed for these tests can be costly, especially as they are infrequently purchased in sufficient quantities to be eligible for the economy of scale.

Allergy, platform pathologists for complicated anatomic abnormalities, indicators for bones, genetic analysis, HLA genotyping, autoimmune response functional assays, and environmental toxicological are just a few of the competencies that are accessible in the labs that do these tests. Among the institutions that perform these procedures in the U. S. are Architects Facility, Mayo Healthcare Laboratory, Analysis and information Corporation, and Medical Corporations of America, as well as an increasing number of specialized esoteric testing centers that provide proprietary esoteric assays. Examples of such specialty testing lab businesses are Myriad Genomics, Genetic Healthcare, and Basis Medicine.

What's Causing the Country-Wide Expansion of the Global Esoteric Testing Market?

The esoteric testing market is growing rapidly as healthcare systems increase their demands for advanced diagnostics to better manage the testing for complex and rare diseases that require esoteric testing. Specialized esoteric tests, such as molecular diagnostics and genetic testing, now play a key role in recommending early diagnosis, precision testing, and personalized care.

Major drivers increasing the use of esoteric testing in health care systems are the rising awareness of chronic illnesses, increased successful adoption of laboratory automation, and advancements in the field of genomics, all of which have led to more doctors routinely ordering esoteric tests in hospitals, specialized laboratories, and research environments.

Market Outlook

- Industry Growth Overview: The industry will continue to grow as health care providers increasingly direct attention to early detection, personalized therapies, and high-complexity diagnostics. The integration of molecular technologies, along with advancements in laboratory automation, will fuel adoption at all levels.

- Sustainability Trends: Green laboratory practices, less waste generated through reagents, energy-efficient diagnostic platforms, and green laboratory protocols for sample processing are all gaining importance as companies look to move towards more sustainable testing practices.

- Global Expansion:A global network of diagnostics is growing as labs utilize partnerships with large reference labs across Asia, Latin America, Europe, and the Middle East to improve access to higher-level advanced tests.

- Startup Ecosystem: Startups focused on AI-driven diagnostics, genomics-based testing (e.g., liquid biopsy), and decentralized laboratory operational solutions (e.g., CLIA) are changing the landscape with point-of-care rapid esoteric testing solutions that provide high precision, low-cost greater access to high-complexity testing capability.

Esoteric Testing Market Growth Factors

Globally, the major objective of healthcare practitioners is to add value to patients and provide high-quality medical treatment. Health care organizations are eager to adapt their business models, offer their services for fair prices, and concentrate on enhancing patient health. This has caused a significant focus on outsourcing complicated clinical tests, which has contributed to global growth trends in the obscure diagnostics market. It is more probable also that the industry is expected to grow considerably within the next decade as a result of the numerous specializations seen in the medical field as well as the wide variety of application areas of esoteric testing from across domains of serological testing, pharmacology, bacteriology, diagnostic tools, genetics, cardiology, immunology, and forensic science.

The necessity need personalized genomics technologies in healthcare has extended the reach of forecasting and analyzing medication responses, pharmaceutical expansion, and the increasing prevalence of diseases. Furthermore, the industry's expansion would be constrained in the predicted timeframe by strict laws and a lack of expertise in emerging markets. In turn, this will neutralize the adverse effects of the obstacles to the economic surge during the following few years. These tests are carried out after additional details outside of regular laboratory tests are needed for an accurate diagnosis of a condition, to create a forecast, or to choose and oversee a therapy course of action. Because esoteric analysis uses complicated machines and equipment, competent professionals are needed to test the study hypotheses and analyze the data.

High price, the testing will be carried out by specialized and autonomous medical research facilities. The size of the specialized market studied will be driven by the increase in complex disorder occurrences and awareness campaigns for these diseases' early detection and treatment. In addition, third-party telecommunications companies have placed a focus on improving the efficiency of their global supply chain, assuring that healthcare units have only access to systems. The growth of the specialized testing sector will be hampered by a scarcity of expertise and a dearth of training programs on the subject for recent graduates.

Additionally, the expense of the materials required to conduct these tests results in externalities, further reducing the business's potential. In the coming years, the desire for specialized testing should increase due to the increasing frequency of highly contagious viral diseases including cancer, diabetes, and other similar conditions. Moreover, the development of esoteric research will be accelerated over time by technical developments like antidote mechanization, standardization of cutting-edge instruments, and analytic software. Business expansion will be aided by rising interest in pharmacogenomics as well as increasing funding for the creation of cutting-edge body identification testing methods.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 92.57 Billion |

| Market Size in 2026 | USD 41.05 Billion |

| Market Size in 2025 | USD 37.08 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.70% |

| Dominated Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Technology, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insight

Type Insights

The business of esoteric testing was dominated by the industry that tested for infectious diseases. The entirety of the section's growth can be attributed to the rising incidence of chronic diseases, technological changes in clinical techniques, and improving health facilities in emerging nations. The genetic screening market stays estimated to expand at a rapid speed during the projection. The rapid expansion in the genotyping market can be attributed to developments in sequencing data like NGS as well as heightened understanding.

Because of an escalation in the frequency of infectious diseases, the expansion of healthcare laboratories, and improvements in molecular diagnostic technologies, the communicable diseases testing segment accounted for the largest in 2023 and is anticipated to maintain this tendency in during the projected period.

Furthermore, due to the rise in the frequency of genetic illnesses, the requirements increase for stem cell biology initiatives, and the rise in demand for sequencing frameworks, the genetic screening segment is anticipated to have significant market expansion throughout the forecast timeframe.

Technology Insights

This market for specialized screening was dominated by CLIA. Due to the rising prevalence of the immune disorder, diabetes, heart problems, and melanoma, as well as the progression of Research and innovation for product development and manufacturing events, the chemiluminescence enzyme-linked- linked immunosorbent assay segment held the largest share esoteric diagnostics industry in the next year and is anticipated to maintain this general pattern even during the forecast timeframe. Its benefits over some other testing techniques, which would include peak performance, sensitivity, and selectivity, needs in terms, of signal power strength, and two attributes, could be attributed to this company's sizeable share of the market.

The pervasiveness of communicable diseases like liver damage, AIDS, neurodegenerative problems, hemorrhagic fever, and melanoma is projected to rise even during the projected timeframe, along with the aging populations and the growing preference for affordable diagnostic testing services. Moreover, this same Generation sequencing region is predicted to experience significant growth throughout the estimated timeframe.

End User Insights

Individual and reference institutions make up a significant amount of the specialized market studied. The majority is caused by the increased testing volumes. Additionally, growth is being fuelled by the continuous automation technology of laboratory testing, the rise in the national accreditation board, the extent of payment covering, and the aggressive incentives provided by these suppliers. The sector is expanding as just a result of continuous diagnostic laboratory automation technology, an increase in independent labs, extensive insurance coverage, and aggressive incentives provided by all these suppliers.

Due to increasing examination throughput, development in some programs, and a spike in the digitization of laboratory testing, the autonomous and comparison research facilities sector, which made it popular throughout 2023, stays estimated to uphold the situation tendency even during the projected timeline.

Furthermore, owing to the increase in long-term term illness frequency, advancements in clinical laboratories, and growing demand for preventative medicine, this healthcare research labs sector is estimated to have significant growth over the coming years.

Regional Insights

U.S. Esoteric Testing Market Size and Growth 2025 to 2034

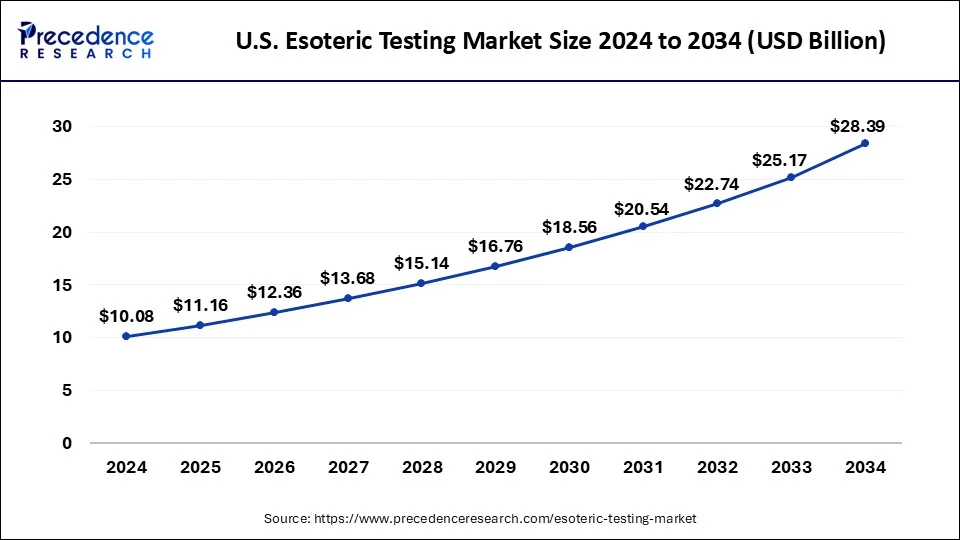

The U.S. esoteric testing market size is evaluated at USD 11.16 billion in 2025 and is predicted to be worth around USD 28.39 billion by 2034, rising at a CAGR of 10.89% from 2025 to 2034.

The biggest portion of the international market was controlled by the United States, which accounts for the largest share. This enormous global unit health spending, the sizable number of elderly and medical conditions such as diabetes clients, and the existence of top corporations in the area all contribute to North America's predominance. Due to an increased incidence of degenerative illnesses, growth in the screening procedures, and technical advancements in obscure screening, North America liberated the global market of exotic diagnostics throughout 2023 and therefore stays estimated to continue doing so during the projected timeline.

Moreover, due because of an increase in the incidence of degenerative illnesses, a start rising in policy measures for clinical testing, a massive rise in the supply ofEnzyme-linked immunosorbent assayas well as RT-PCR tests, and an increased public understanding of the advantages of personality testing, India is predicted to have had the fastest growth from next upcoming year. The world's largest portion of the world market was in the United States, followed by the UK. The significant market percentage in the United States is likened to the nation's well-established obscure factors driving the growth, which is fueled by rising healthcare spending per person, the presence of major market players, growing utilization take effective measures, the nation's increasing prevalence, and indeed the development of personalized medicine.

North America: U.S. Esoteric Testing Market Trends

The U.S. market is expanding rapidly, driven by growing demand for specialized diagnostics in areas like oncology, rare diseases, and genetics. Technological advances, especially next generation sequencing, liquid biopsies, and AI based data interpretation, are making these sophisticated tests more powerful and accessible. Laboratories are increasingly investing in automation and cloud based platforms to scale up capacity and reduce turnaround times.

What Factors Are Making Europe a Global Center for Innovative Esoteric Diagnostics?

Europe remains a leader in esoteric testing due to having strong healthcare ecosystems and oversight regulations to ensure the accuracy and reliability of diagnostic tests. A formalized approach with widespread adoption of molecular diagnostics is combined with increasing investment in developing new R&D initiatives, as well as major early disease screening programs.

Germany, the U.K., France, and the Nordics have strong laboratory networks with more established reference laboratories. We look at how these and other advances in personalized medicine, genomics-driven care, and rare disease diagnostic detection will lead Europe to continue to be a pioneer in the advance of diagnostic technology.

Latin America Esoteric Testing Market

Latin America is becoming a potential region of interest for esoteric testing due to modernization in healthcare systems and investment in more advanced pathology services, for countries including Brazil, Mexico, and Argentina, to enhance laboratory and department construction, which improves the capacity for high-complexity diagnostics related to infectious diseases, cancers, and rare diseases.

Broader cooperation with international reference laboratories and growing private healthcare investments are bringing improvements to test accessibility. Medical tourism and regional emphasis on preventative diagnostic services will increase demand for more specialized and higher precision testing.

In what ways does the Esoteric Testing Value Chain promote Accuracy, Efficiency, and Global Access?

The value chain starts with biotechnology companies which develop complex assay technologies, as labs take on these assays for testing, they integrate automated testing systems to achieve higher precision, and then there are an array of service providers, such as Quest Diagnostics, LabCorp, and Eurofins Scientific, who underpin all of the esoteric testing value chain by enabling innovation, processing large numbers of tests and distributing test across channels and countries.

Pillars of Value Chain:

- Innovation & Assay Development: Many biotechnology companies focus their development efforts on the advancement of genetic, molecular, and proteomic work to improve the sensitivity, reliability, and specificity of test for specific disease processes.

- High-Complexity Laboratory Operations: Leading laboratories utilize automated and robotic testing, enabling workflows and quality assurance systems in order to turn around tests quickly with high precision.

- Logistics & Clinical Usage: Laboratories often utilize logistics and digital platforms to facilitate communication and transport of specimens for testing.

Esoteric Testing Market Companies

- ACM Global Laboratories (US)

- ARUP Laboratories (US).

- Baylor Esoteric and Molecular Laboratory (US)

- BioAgilytix Labs (US)

- BP Diagnostic Centre SDN BHD (Malaysia)

- BUHLMANN Diagnostics Corp (BDC, US)

- Cerba Xpert (Belgium)

- Eurofins Scientific (Luxembourg)

- Flow Health (US)

- Foundation Medicine (US)

- Georgia Esoteric & Molecular Laboratory, LLC (US)

- H.U. Group Holdings, Inc. (Japan)

- Helius Limited (Australia)

- HealthQuest Esoterics (US)

- Kind star Global (Beijing) Technology, Inc. (China)

- Labcorp (US)

- Leo Labs, Inc. (India).

- Mayo Foundation for Medical Education and Research (US)

- National Medical Services Inc. (NMS) (US)

- OPKO Health (US).

- Quest Diagnostics (US

- Sonic Healthcare Limited (US)

- Stanford Clinical Pathology (US)

- Thyrocare Technologies Ltd. (India)

Key Market Developments

- The autoimmunity operations segment of Myriad Genomics would be purchased by Labcorp, in May 2021.

- Quest Laboratories and GRAIL partnered to develop Galleri, a ground-breaking complete blood count for the early diagnosis of several cancers In Feb 2021.

- In the US, OPKO Healthcare Inc. (In addition to its core Laboratory) introduced Scarlett Healthcare in Jan 2021, a seamlessly engaged in-home testing platform.

- H.U., in Mar 2019, Tokyo Chugai Pharma. and sourced from local Enterprises, a division of Group Acquired, collaborated.

- ARUP Laboratory and PacBio confirmed their participation in research to boost the identification of uncommon diseases in Nov 2021, these have given the firm the ability to find cutting-edge paramount in ensuring and presenting corporate development opportunities.

- Fulgent Genomics, Inc. reported in Aug 2021 that it will purchase CSI Laboratory to expand cellular molecular biology techniques and tumor detection. The business scope of the company has benefited from this transaction.

Segments are Covered in the Report

By Type

- Infectious Diseases Testing

- Endocrinology Testing

- Oncology Testing

- Genetics Testing

- Toxicology Testing

- Immunology Testing

- Neurology Testing

- Other Testing

By Technology

- Chemiluminescence Immunoassay

- Enzyme-Linked Immunosorbent Assay

- Mass Spectrometry

- Real-Time PCR

- DNA Sequencing

- Flow Cytometry

- Other Technologies

By End User

- Independent & Reference Laboratories

- Hospital-Based Laboratories

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting