What is the Preterm Birth and PROM Testing Market Size?

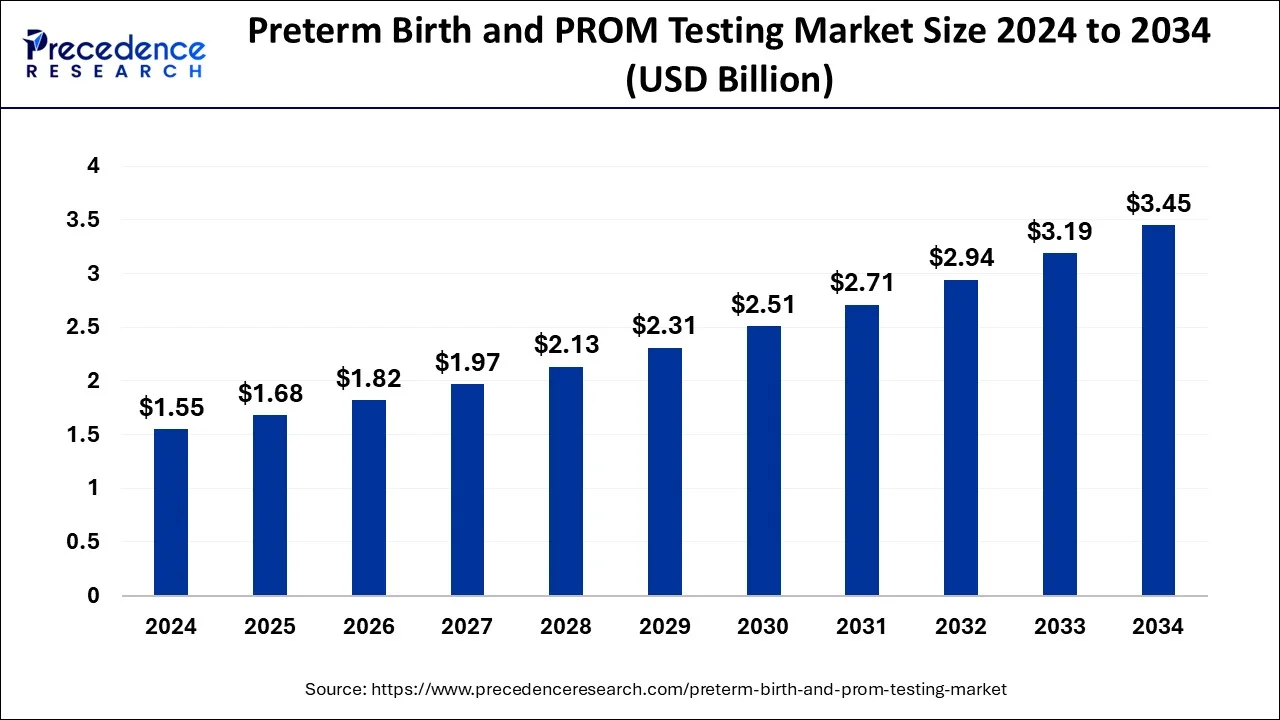

The global preterm birth and PROM testing market size is estimated at USD 1.68 billion in 2025 and is anticipated to reach around USD 3.45 billion by 2034, expanding at a CAGR of 8.34% from 2025 to 2034.

Market Highlights

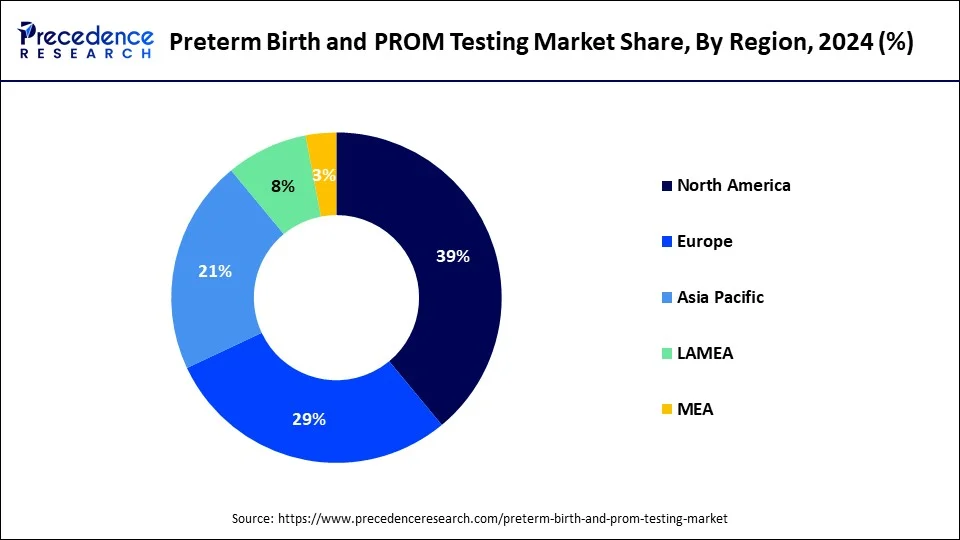

- North America dominated the market with largest revenue share of 39% in 2024.

- Asia-Pacific is expected to be the most opportunistic market throughout the forecast period.

- By test type, the ultrasound segment held a dominant presence in the market in 2024.

- By test type, the biomarker test segment is estimated to be the fastest growing during the forecast period.

- By end-user, the diagnostic laboratories segment led the global market in 2024.

- By end-user, the others segment is estimated to grow at a promising rate over the coming years.

Market Size and Forecast

- Market Size in 2025: USD 1.68 Billion

- Market Size in 2026: USD 1.82 Billion

- Forecasted Market Size by 2034: USD 3.45 Billion

- CAGR (2025-2034): 8.34%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

How Many Diagnostic Methods are Promoting the Market?

Preterm birth includes when a baby is born alive before 37 weeks of pregnancy are completed. Premature rupture of membranes (PROM) is a rupture of the amniotic sac before labor begins. When the PROM occurs before 37 weeks of gestation, the term preterm premature rupture of membranes (PPROM) is used. PROM occurs in about 8-10% of all pregnancies. At the same time, PPROM causes in around one-fourth to one-third of all preterm births. PROM can be diagnosed in many ways, including physical examination, microscopic analysis, vaginal fluid pH testing, diagnostic tests for amniotic fluid proteins, and dye test. Additional diagnostic tests may include obstetric ultrasound, urinalysis, and blood tests.

How Can AI Impact the Preterm Birth and PROM Testing?

Artificial intelligence (AI) can significantly impact the market by revolutionizing diagnostic testing. AI can be used to screen a large number of spontaneous preterm births based on clinical and ultrasonographic variables. AI and machine learning (ML) techniques including artificial neural networks and convolutional neural networks can aid in the early diagnosis of spontaneous preterm labor and birth. AI and ML result in improved efficiency and enhanced accuracy, sensitivity, and specificity. AI can also predict the outcomes of preterm birth and histologic chorioamnionitis in PROM. Additionally, AI and ML can aid in the effective diagnosis of imaging tests during pregnancy, enabling healthcare professionals to make timely decisions and reduce manual errors. However, the integration of AI and ML is still in its infancy requiring more research and generation of data.

Preterm Birth and PROM Testing Market Growth Factors

- Growing Cases of Preterm Birth: The growing cases of preterm birth occurring spontaneously or due to medical complications require PROM testing.

- Increasing Number of Diagnostic Labs: The rising incidences of PROM and other complications necessitate the development of diagnostic labs.

- Latest Innovations in Diagnostic Techniques: The growing research and development activities facilitate the latest innovations in diagnostic techniques.

- Technological Advancements: The advent of advanced technologies, such as AI and ML, aid in effective testing of PROM.

- Favorable Government Policies: Several government organizations release guidelines and initiatives to increase awareness about preterm birth and PROM testing.

Preterm Birth and PROM Testing Market Outlook:

- Global Expansion: Eventual growth is impacted by a rise in the ageing pregnant population, socio-demographic shifts, and expanded awareness of risks linked with conditions like COVID-19.

- Major Investor: In July 2024, Novocuff secured $26 million in Series A funding to generate a device focusing on the prevention of preterm births caused by PPROM and cervical shortening.

- Startup Ecosystem: Baymatob, an Australian startup, created an AI-based health risk analysis tool for healthcare professionals that supports the health monitoring of pregnant women.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 1.68 Billion |

| Market Size in 2026 | USD 1.82 Billion |

| Market Size by 2034 | USD 3.45 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 8.34% |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Test Type, End User |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Market Dynamics

Drivers

Favorable Government Policies

The increasing incidences of preterm births and PROM globally facilitate several government organizations to impose strict guidelines for early detection and screening of preterm births and PROM. The World Health Organization also makes efforts to increase the effectiveness of screening programs globally. The UK government has recently launched initiatives to ensure that all women have access to information and advice on pregnancy planning and preconception health. Government organizations provide funding for developing novel and innovative diagnostics for PROM. Additionally, they are on the verge of increasing awareness about PROM testing. Government-led insurance companies also offer favorable reimbursement policies to support patient's healthcare expenses.

Restraint

High Cost and Lack of Skilled Professionals

The major challenge of the preterm birth and PROM testing market is the high cost of PROM testing. The high cost of advanced PROM testing limits the affordability of several patients in low- and middle-income countries. Another major challenge is the lack of skilled professionals. The lack of skilled professionals, especially in developing and underdeveloped countries, restricts the market.

Opportunity

Point-of-Care Diagnostics

The growing demand for point-of-care (POC) diagnostics presents future preterm birth and PROM testing market growth opportunities. POC diagnostics are methods to test a medical condition at or near the patient. Several researchers are developing POC diagnostics for testing PROM. The ActimPROM test is the first FDA-approved reliable bedside test developed by Abbott Laboratories for quickly and easily detecting premature rupture of fetal membranes (PROM) in all patients. The demand for POC diagnostics increases due to improved patient outcomes and cost-effectiveness. They also save time for patients and help clinicians in effective decision-making. Thus, POC diagnostics have the potential to transform the healthcare sector by providing a path to increased access, cost, and treatment quality.

Segments Insights

Test Type Insights

The ultrasound dominated the market with largest share in terms of revenue of the total market.Ultrasound is the most common type of test conducted by the doctors to observe developing fetus. Ultrasound is a simple test where sound waves are used to produce images of the fetus inside the womb. It is considered to be the safest and painless test as no needles or injections and ionizing radiations are used. Therefore, the ultrasound is projected to retain its dominance throughout the forecast period.

On the other hand, the biomarker test is estimated to be the fastest growing during the forecast period. This is attributed to the accuracy of the biomarker test. A biomarker test is more accurate and reliable than the ultrasound testing. Moreover, biomarker tests can identify the patients that need urgent care. Further it is inexpensive, reliable, and usable at the POC (Point of Care). All these factors make the biomarker the most opportunistic segment during the forecast period.

End User Insights

The diagnostic laboratories dominated the market with around 45% share in terms of revenue of the total market.The growing penetration of diagnostic labs all over the globe is positively contributing towards the growth of the preterm birth and PROM testing market. The rising awareness regarding PROM test coupled with rising disposable income and technological advancements in the medical test equipment has fostered the segment growth in the past few years. Moreover, cost-effectiveness has been achieved in the field of PROM testing that drives the growth of this segment.

The others segment includes healthcare units, and others point of care units. This segment is gaining rapid traction due to its increasing penetration across the globe. This segment is estimated to grow at a promising rate during the forecast period.

Regional Insights

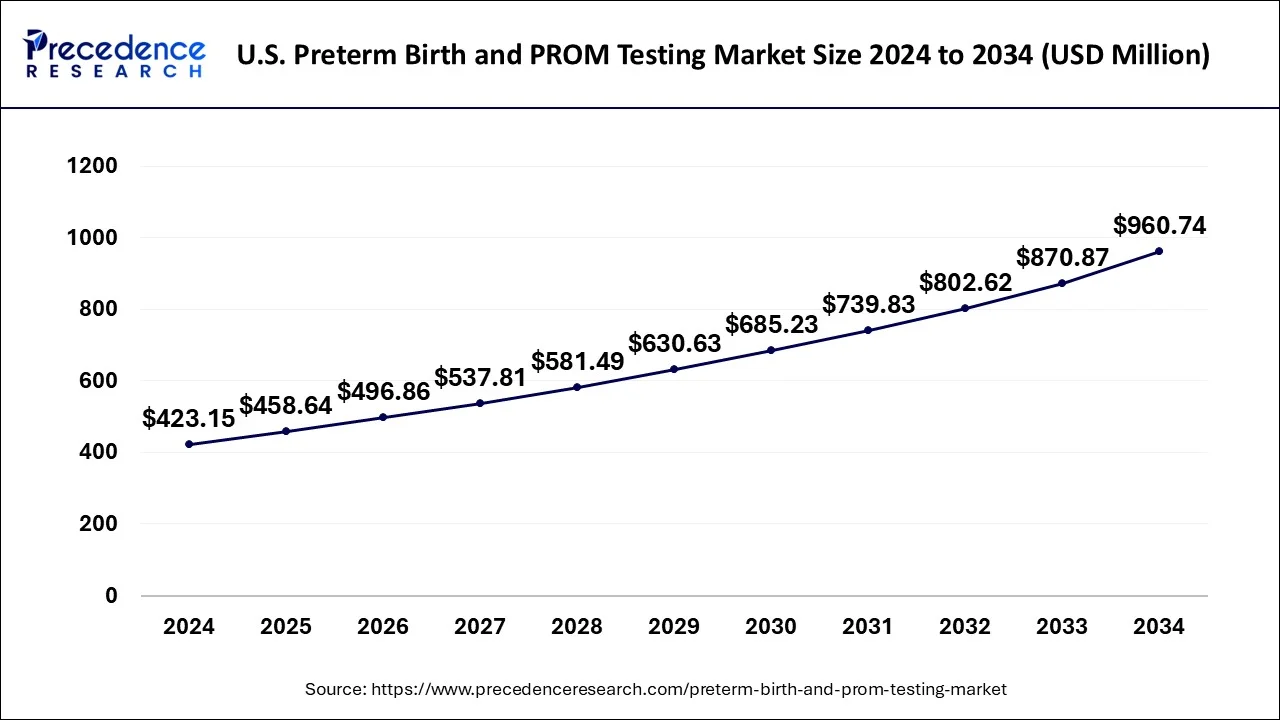

U.S. Preterm Birth and PROM Testing Market Size and Growth 2025 to 2034

The U.S. preterm birth and PROM testing market size is evaluated at USD 458.64 million in 2025 and is predicted to be worth around USD 960.74 million by 2034, rising at a CAGR of 8.62% from 2025 to 2034.

North America dominated the preterm birth and PROM market and accounted for the largest revenue share of 39% in 2024. This is attributed to the growing cases of preterm birth rate in U.S. It is reported that more than 370,000 babies were born prematurely in the U.S. in 2023. According to the Centers for Disease Control and Prevention, the early preterm rate was 2.76% and the late preterm rate was 7.65% in 2023 Around 17% of the preterm babies die due to low birth weight. The higher adoption of advanced technologies in the preterm birth and PROM testing has fueled the growth of the market in this region.The favorable reimbursement policies by the Centers for Medicare & Medicaid Services also propels market growth.

On the other hand, Asia Pacific is expected to be the most opportunistic market throughout the forecast period. According to the WHO, over 60% of the preterm birth cases occur in Africa and South Asia. The poor families in this developing region suffer the most. However, the growing awareness regarding the availability of PROM tests is positively impacting the market growth in the Asia Pacific region.

Ongoing Government Initiatives & POC Diagnostics are Propelling Europe

Europe is experiencing a notable expansion in the preterm birth and PROM testing market, due to the persistent government encouragement in healthcare programs. These programs are mainly focused on the reduction of preterm birth rates and accelerating awareness between patients and healthcare providers. Alongside, Europe is escalating demand for more efficient and convenient POC testing solutions.

Well-Developed and Validated Study: UK Market Analysis

Recent development in the UK's market encompasses the QUID study, which has evolved and validated a prognostic model, coupled with quantitative fetal fibronectin and clinical risk factors for the prediction of spontaneous preterm birth within seven days in women with symptoms.

Wider Exposure to Biochemical Tests & Molecular Tools is Impacting Latin America

In this era, the Latin American population is highly reliant on biochemical tests, like PAMG-1 Immunoassay, as it has greater sensitivity and negative predictive value. Besides this, the market I bolstering integrated molecular tools, specifically next-generation sequencing, and breakthroughs in 3D ultrasound with raised accuracy and safety in risk detection.

Emphasis on Social Determinants: Brazilian Market Analysis

Ongoing research activities in Brazil are continuously addressing the robust linkage among PTB and socioeconomic vulnerability, race/ethnicity, and inadequate prenatal care quality. This is further accelerating risk stratification solutions that are seamless within the existing public health system (SUS).

Broader Emergence of AI and Remote Monitoring is Supporting MEA

Many areas in the MEA preterm birth and PROM testing market have been stepping into the development of the integration of AI and machine learning into diagnostic solutions. For this, researchers at the University of Jeddah in Saudi Arabia have introduced an AI-assisted device utilising ultrasonic sensors for persistent, remote monitoring of amniotic fluid levels and uterine activity.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved and efficient preterm birth and PROM testing solutions. Moreover, they are also focusing on maintaining competitive pricing.

Value Chain Analysis

- Research and development involves initial conceptualization, laboratory testing for safety and efficacy, conducting rigorous clinical trials across different phases to validate results, and finally seeking necessary regulatory approvals from bodies like the FDA or EMA before production begins.

Pfizer, Johnson & Johnson, Moderna, Novartis, Merck, Roche, AstraZeneca, Gilead, Amgen, and Biogen are prominent companies in the market. - Distribution to hospitals and clinics requires scaling up manufacturing processes, establishing a secure, temperature-controlled supply chain for transport and storage, managing wholesale logistics, and coordinating efficient delivery to ensure consistent availability at healthcare facilities.

Pfizer, Johnson & Johnson, Moderna, Novartis, Merck, Roche, AstraZeneca, Gilead, Amgen, and Biogen are prominent companies in the market. - Patient support and services encompass educating healthcare providers on usage, providing comprehensive resources and assistance for patients, establishing robust adverse event reporting systems, and offering ongoing support for product adherence and long-term follow-up care.

Pfizer, Johnson & Johnson, Moderna, Novartis, Merck, Roche, AstraZeneca, Gilead, Amgen, and Biogen are prominent companies in the market.

Key Players Offering:

- Abbott- In January 2025, it unveiled an AI-assisted ultrasound system that analyzes cervical images to facilitate a risk score for preterm birth.

- Qiagen N.V.- It received the FDA approval for PartoSure is a test kit for pregnant women experiencing symptoms of preterm labor.

- Biosynex- A player has introduced Premaquick, a combined diagnostic test for preterm birth that reports three biomarkers.

- Hologic- It launched Actim PROM rapid test, a point-of-care diagnostic device in early 2024 for the fastest and accurate detection of premature rupture of fetal membranes (PROM).

Preterm Birth and PROM Testing Market Companies

- Cooper Surgical

- Sera Prognostics

- Medixbiochemica

- IQ Products

- NX Prenatal, Inc.

- Clinical Innovations, Inc.

Latest Announcement by Industry Leaders

- Brian Brohman, CEO of NX Prenatal, commented that there is an inability to access relevant information in the maternal-fetal microenvironment leading to limited advances in personalized prenatal care. He added that any biomarker assessment for adverse pregnancy conditions is incomplete without evaluating biomarkers derived from extracellular vesicles (EVs). He emphasized that EVs could be essential in the development of future tests for premature birth and beyond.

Recent Developments

- In July 2024, scientists from the National Institute for Research in Reproductive and Child Health and the Indian Council of Medical Research developed an AI-based software and kit to identify microbes that increase preterm birth risks.

- In April 2023, researchers from the Korea Institute of Science and Technology and Seoul National University College of Medicine identified 17 differentially expressed proteins (DEPs) as potential plasma biomarkers associated with microbial invasion of the amniotic cavity and/or intraamniotic inflammation in women with PPROM.

Segments Covered in the Report

By Test Type

- Ultrasound

- Biochemical Markers

- Pelvic Exam

- Nitazine Test

- Uterine Monitoring

- Pooling

- Ferning Test

- Others

By End User

- Diagnostic Laboratories

- Hospitals

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting