Ultrasound Market Size and Forecast 2025 to 2034

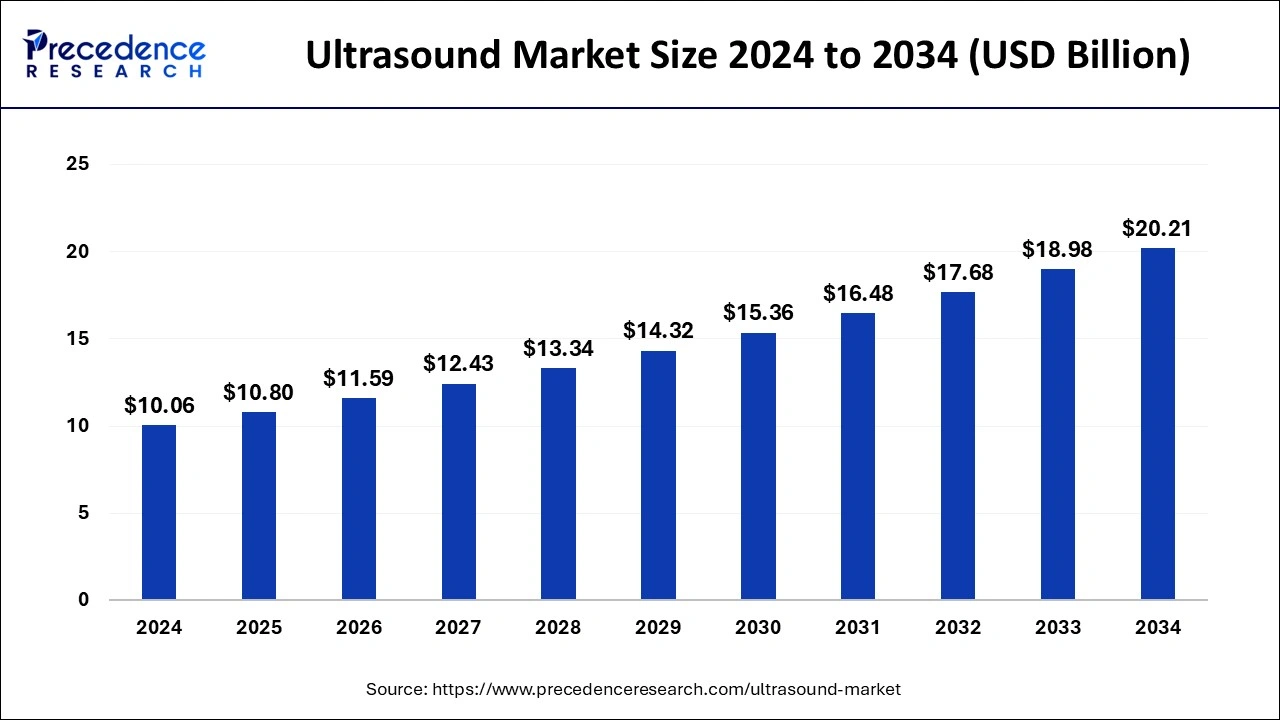

The global ultrasound market size was calculated at USD 10.06 billion in 2024 and is predicted to increase from USD 10.80 billion in 2025 to approximately USD 20.21 billion by 2034, expanding at a CAGR of 7.23% from 2025 to 2034. The rise in the number of diagnostic centres and hospitals is driving the growth of the ultrasound market.

Ultrasound Market Key Takeaways

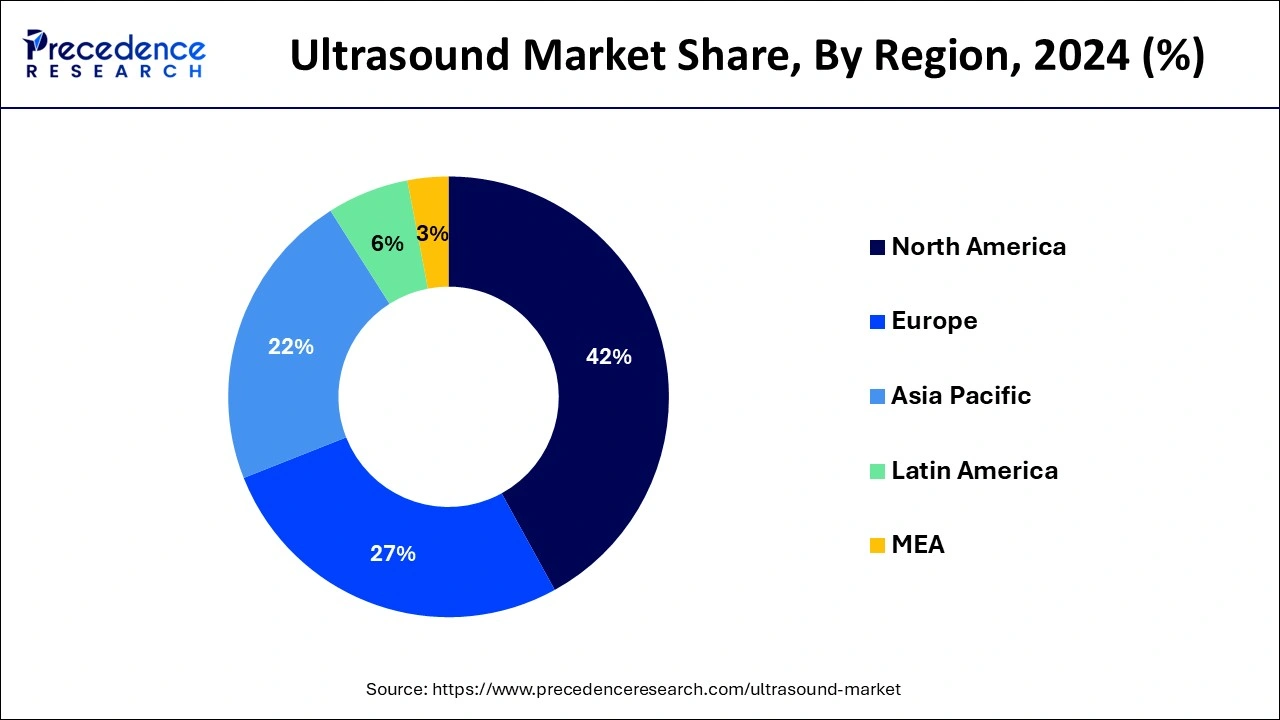

- The North America ultrasound market size accounted for USD 3.85 billion in 2024 and is expected to attain around USD 7.88 billion by 2034 with a CAGR of 7.42% from 2025 to 2034.

- North America led the ultrasound market with the largest share in 2024.

- Asia Pacific is observed to experience a notable rate of growth during the forecast period.

- By product, the diagnostic segment held the largest share of the market in 2024.

- By portability, the cart-trolley segment dominated the market in 2024.

- By application, the radiology segment dominated the market in 2024.

- By end-use, the hospitals segment held the dominating share in 2024.

How has AI benefited the Market?

Ultrasound with artificial intelligence provides a new meaning of accessibility, reliability, and efficiency. The AI processor allows real-time feedback for the less experienced or first-time users, and the entire solution is delivered on portable devices so as to perform ultrasounds in remote sites. Using AI to improve image quality, detect abnormalities autonomously, and prevent human errors will instil confidence in the diagnosis. Having AI measure and report will fast-track exams, greatly improving the utilization of resources. This will, in a way, address disparities in healthcare delivery by allowing frontline health workers to perform scans and also reduce prices for scans. It gives personalized care by doing an intensive analysis of huge quantities of ultrasound data.

U.S.Ultrasound Market Size and Growth 2025 to 2034

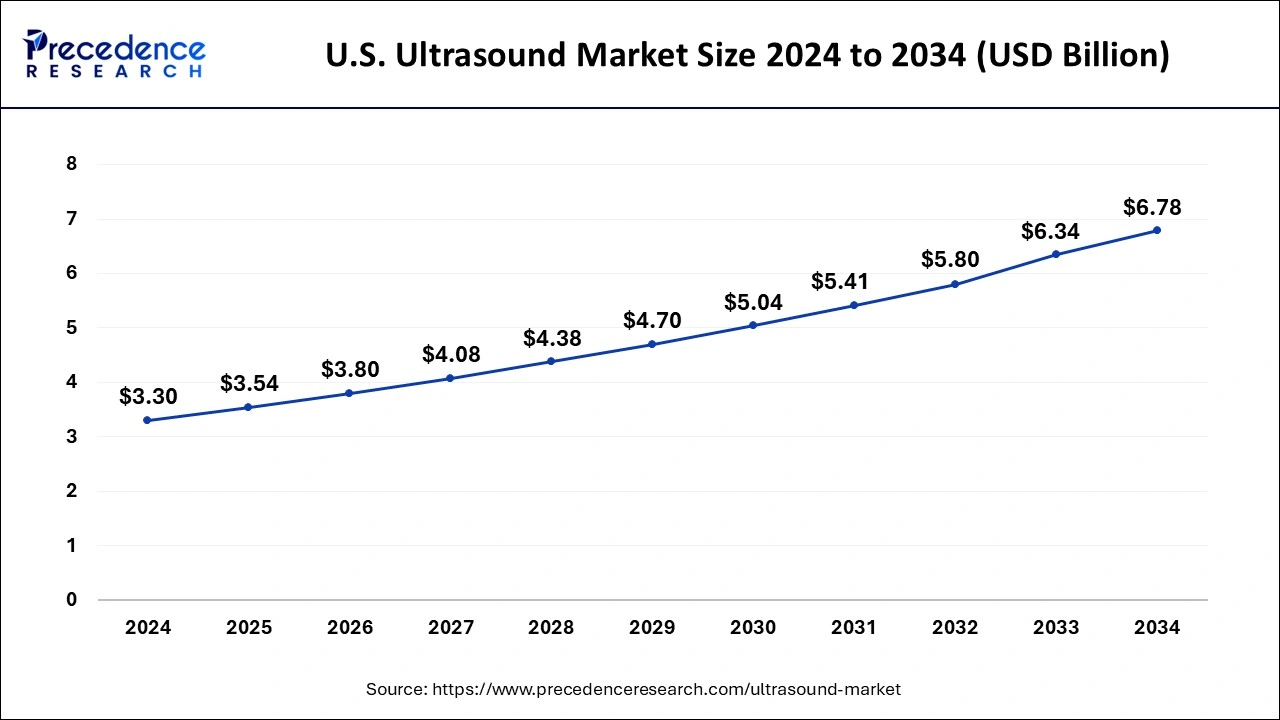

The U.S. ultrasound market size was exhibited at USD 3.30 billion in 2024 and is projected to be worth around USD 6.78 billion by 2034, growing at a CAGR of 7.47% from 2025 to 2034.

North America dominated the ultrasound market in 2024. The market growth is generally driven by the rising prevalence of target diseases, the growing trend of cosmetic surgeries, and increased healthcare spending by the private and public sectors. Moreover, new research developments and innovations in the medical field, along with new approvals from the United States Food and Drug Administration and the launch of new products by key market players such as Mindray, Butterfly, GE, Medtronic, Siemens, and others.

- For instance, in April 2024, Butterfly announced that the FDA had approved a next-generation handheld point-of-care ultrasound (POCUS) system named iQ3. This new device features a new ergonomic design and delivers high data processing speed for optimized image resolution and accuracy for the detection of various body parts.

In North America, the U.S. led the market owing to the growing adoption of point-of-care ultrasound along with ongoing technological innovations. Also, heavy private investments in healthcare infrastructure and government funding are also major factors contributing to the country's growth. Major market players in the U.S. are Siemens Healthineers AG, GE Healthcare, Koninklijke Philips N.V., and Canon Medical Systems.

Asia-Pacific is expected to be the fastest-growing region during the forecast period. The market in this region is generally driven by the rising prevalence of chronic diseases such as cancer, cardiovascular diseases, and other gastrointestinal disorders. According to the World Health Organisation (WHO), more than 2.2 million new cancer cases and approximately 1.4 million cancer-related deaths in the Southeast Asia Region in 2020. According to a study by Asia Pacific Cohort Studies Collaboration (APCSC), there is an estimated increase of 60% in CVD patients in Asian countries. Also, it is estimated that the total number of hypertension patients in India and China is likely to increase to more than 500 million by the year 2025. Thus, rising cases of cancers and cardiovascular diseases are likely to be diagnosed early for detection and treatment, which increases the demand for ultrasound devices, which is likely to boost the ultrasound market in this region.

In addition, the rise in the geriatric population suffering from chronic diseases in countries such as Japan, India, and China has increased rapidly over time. According to a Journal of Medical Internet Research, 80% of adults above 75 years or over suffered from multiple chronic diseases, and 90% of them suffered from at least one chronic disease. Thus, the rise in the number of geriatric populations suffering from such diseases requires regular checkups to get cured, which drives the demand for ultrasound systems. Also, the rising development in medical sciences and rising demand for portable ultrasound machines, along with the growing adoption of 2D ultrasound imaging, further drive the growth of the ultrasound market.

In Asia Pacific, India dominated the market by holding the largest market share, due to technological advancements, growing incidence of chronic diseases, and increasing awareness regarding the advantages of ultrasound imaging. Moreover, States such as Uttar Pradesh, Haryana, and Punjab have a much higher population density which are substantial consumers of ultrasound systems.

Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be attributed to the ongoing innovations in imaging technology, the surge in the prevalence of chronic disease, and the increasing focus on early diagnosis. Furthermore, Europe's robust healthcare sector and emphasis on cutting-edge diagnostic technologies, especially in countries such as Germany, France, and the UK are boosting market expansion in the region soon.

Market Overview

An ultrasound is a risk-free imaging test of body parts that uses the principle of sound waves. The frequencies of ultrasound sound waves are always greater than 20 kilohertz. It is also known as sonography and is done for detecting the internal body parts of humans. It is mainly done for viewing various reproductive parts, such as the uterus and ovaries, during pregnancy, along with monitoring the infant inside the womb. Sonography is also done to detect gallbladder and appendix-related issues inside the human body. Some ultrasounds are also performed to check the blood flow and tumour treatment.

Nowadays, ultrasounds are also performed in veterinary fields to examine various soft tissues present in the musculoskeletal system of animals. The ultrasound industry has experienced several changes in engineering methods and technological advancement over the past decade. This industry is fragmented, with the presence of several small and big players. The market players are effectively engaged in improving product offerings by exploring acquisitions and government approvals, developing new products, and collaborating to increase their brand demand and attain a greater ultrasound market share.

- For instance, in February 2023, Boston Imaging launched a new AI-enabled ultrasound device. This device was named Hera W10 Elite and will be used for obstetrics and gynecology. It will also provide radiologists with better imaging capabilities and accurate results to enhance the diagnostic experience.

Ultrasound Market Growth Factors

- Advancements in technologies related to medical equipment have also boosted market growth.

- The growing number of musculoskeletal disorders has impacted the ultrasound market positively.

- Increased preference for minimally invasive surgeries also propels the market growth of the ultrasound industry.

- The rising number of government initiatives and investments to strengthen the healthcare sector drives the growth of the ultrasound market.

- Higher investment from private sector entities for the development of medical equipment fosters the growth of the ultrasound market.

- Growing adoption of table-top equipment in medical sectors positively impacts the growth of the ultrasound market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.23% |

| Market Size in 2025 | USD 10.80 Billion |

| Market Size in 2024 | USD 10.06 Billion |

| Market Size by 2034 | USD 20.21 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Portability, Application, and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising number of chronic diseases

The rise in the prevalence of chronic diseases such as arthritis, cancer, Chronic Obstructive Pulmonary Disease (COPD), and others. The prevalence of cancer has increased globally in recent times. The main types of cancer include carcinoma, melanoma, lymphoma, sarcoma, and leukemia. According to WHO, the number of new cancer patients reached 20 million, along with 9.7 million cancer-related deaths in the year 2022. Also, there is a high growth rate in patients suffering from heart disease globally. According to a report published by the World Heart Federation, more than half a billion people across the world were affected by cardiovascular diseases, which accounted for 20.5 million deaths in 2021. Thus, the increasing number of cancer patients and heart patients require early detection for proper treatment, which increases the demand for ultrasound devices, thereby boosting the growth of the ultrasound market.

Restraint

Stringent government regulations and high cost

The governments of several countries, such as China, Japan, Canada, and others, may not approve some medical equipment due to various reasons such as high risk, negative effects, and other problems. Thus, non-approval of medical equipment, including ultrasound machines, is likely to restrain the growth of the ultrasound market. Also, the initial cost of setting up an ultrasound system is very high, and maintenance charges are rising day by day. Thus, the high cost associated with ultrasound systems is expected to restrain the ultrasound market growth during the forecast period.

Opportunity

Integration of AI in medical equipment

The healthcare sector has experienced several transitions from time to time. There have been several technological developments in this field that can positively impact the healthcare sector. Nowadays, traditional surgeries are being replaced by robotic surgeries so as to get maximum precision and accuracy. The integration of AI in medical instruments such as MRI machines, ultrasound systems, BP machines, and others can result in superior results.

- For instance, In December 2023, Siemens Healthineers launched a new AI-enabled ultrasound system named ‘Acuson Maple.' This system uses the same software and hardware platform to automate workflow and analysis to examine body parts efficiently. Thus, medical equipment suppliers and healthcare professionals are investing significantly in research and development related to AI in health sectors. This, in turn, is expected to create growth opportunities in the future.

Product Insights

The diagnostic segment held the largest market share in 2024. The segment is observed to sustain the position during the forecast period. This segment is mainly driven by technological advancements such as 2D and 4D imaging and rising adoption of point-of-care ultrasound system (POCUS). Moreover, the growth of this segment can be attributed to the rise in the number of minimally invasive surgeries and growing number of clinal laboratories and hospitals across the globe. According to an article published by the Annals of Medicine and Surgery in October 2021, MIS has replaced the conventional methods of surgical interventions due to rising interest of people towards rapid recoveries, improved survival and fewer complications.

The therapeutic ultrasound devices are expected to witness the fastest growth owing to better treatment methods demanded for oncology and other medical fields. These units render non-invasive treatment options that produce better patient outcomes, mostly in the treatment of cancer with high-intensity focused ultrasound. The therapeutic use and resulting technological advances ensure that the system is being rapidly deployed on the market. On the other hand, imaging ultrasound devices presently occupy the biggest market share since they are most commonly utilized for routine imaging, prenatal care, and general medical diagnostics. These opposing forces of the respective segments keepthe market evolving into one balancing diagnostic precision and cutting-edge treatment options.

Portability Insights

The cart/trolley segment dominated the ultrasound market in 2024. The growth of this segment is mainly driven due to cost-effectiveness and rising demand for ultrasound systems with features such as enhanced picture quality, high grade battery capacity and user-friendly interfaces. Also, several medical device companies such as Medtronic, Hologic, Canon Medical Systems and others are engaged in research and development of Cart/Trolley ultrasound systems that are likely to boost the growth of the global ultrasound market. For instance, recently, Hologic, launched SuperSonic MACH 40 ultrasound system. This is a cart-based ultrasound system that integrates AI and B-mode imaging technology to provide clearer images of cells and other body parts.

The handheld ultrasound devices segment is anticipated to register the fastest growth during the forecast period. Handheld devices are in high demand due to the growing trend of home healthcare and remote patient monitoring. During the pandemic, handheld ultrasound devices have proven efficient in monitoring critically ill patients. Thus, since the pandemic, the demand for handheld ultrasound devices has only been accelerating. Technological advancements are further expected to boost market growth. For instance, a novel cordless handheld ultrasonic device called the PocketPro H2 was introduced by Konica Minolta Healthcare Americas, Inc. for application in point-of-care settings for general screening. With the PocketPro H2, offering an entirely novel form of versatility and cost in ultrasound imaging, Konica Minolta Healthcare teamed up with Healcerion to offer it across the U.S. for use in human and animal purposes.

Application Insights

The radiology segment dominated the ultrasound market in 2024. This segment is mainly driven by integration of AI in ultrasound systems along with growing cases of cardiac disorders that require proper diagnosis and treatment to get cured. Ultrasound technology is widely used in radiology for diagnostic imaging across various medical specialties, including obstetrics and gynecology, cardiology, oncology, and musculoskeletal imaging. Its versatility makes it an essential tool for radiologists in assessing a wide range of medical conditions. Ultrasound imaging is non-invasive and does not involve ionizing radiation, unlike other imaging modalities such as X-rays and CT scans. This makes it safer for patients, particularly for pregnant women and pediatric patients, and reduces the risk of radiation exposure.

Since ultrasound has been one of the principal tools used in fetal monitoring and diagnosing gynecological problems, the obstetrics and gynecology segment shall yield the fastest revenues during the forecast period. Increased awareness and early diagnosis of maternal and fetal health problems are some of the driving forces nurturing the growth of this segment. The ultrasound industry continues to evolve toward higher accessibility and better image quality and in consideration of ergonomics tailored for OB/GYN applications. In contrast, general diagnostic applications outnumber others and are widely used in almost all realms of medical specialization, thus requiring ultrasound technologists to work in a diverse set of clinical environments.

End-use Insights

The hospitals segment dominated the ultrasound market in 2024 and the segment is observed to sustain the position during the forecast period. The growth of this segment is mainly driven by growing use of ultrasound devices in hospital settings along with rising number of patients in hospitals suffering from different diseases. Moreover, introduction of portable ultrasound systems in hospitals is expected to fuel the demand for ultrasound devices in OPD and in-patient departments. Furthermore, the increasing investment from public and private entities related to development in healthcare sectors is also expected to foster the growth of the market. Additionally, growing awareness regarding regular healthcare checkups and rising number of accident cases globally has increased the demand for ultrasound devices in hospitals, thereby driving the market growth.

Recent Developments

- In June 2025, Philips launched a new point-of-care (POC) ultrasound system designed to broaden the accessibility of ultrasound for diagnostic and therapeutic interventions. The Flash 5100 POC system is applicable for use cases in anesthesia, critical care, emergency medicine, and musculoskeletal imaging.

(Source: https://www.medicaldevice-network.com) - In March 2025, Evident Vascular, Inc, announced the successful closing of its Series B financing with new investors Shangbay Capital and two undisclosed multinational strategics joining founding investor Ventana Capital. The funding will accelerate the development of the Company's advanced IVUS technology designed to enhance vascular imaging.

- In February 2024, Fujifilm launched a new endoscopic ultrasound machine in India, the ‘ALOKA ARIETTA 850'. This machine offers superior features such as enhanced image quality, HD-THI for deeper penetration, and combi-elastography.

- In November 2023, Samsung launched a new ultrasound system named ‘V6'. This ultrasound system enhances image clarity and accuracy. It is also adaptable to various medical settings through its simplified workflows, wide screen, remote access, and powerful design with a battery option.

- In November 2023, Koninklijke Philips N.V. announced the launch of its flagship ultrasound system, the Compact Ultrasound 5000 Series. This system features Contrast-enhanced ultrasound, an ultra-high-frequency transducer, 3D-like vascular flow advanced imaging, quality advanced image acquisition, and expanded tele-ultrasound capability.

- In May 2024, Esaote SPA launched a portable ultrasound system named ‘MyLab Omega eXP VET.' This system will help veterinarians examine animals with a high level of flexibility and accuracy in diagnostic imaging. It also covers animals of all species and ensures high performance, ranging from general imaging and echocardiography to interventional procedures.

- In April 2024, GE HealthCare (GEHC) launched two ultrasound systems, ‘Voluson Signature 20' and ‘Voluson Signature 18'. These systems are equipped with AI features and advanced tools to increase the efficiency of diagnostic centers and improve women's health.

- In September 2023, Mindray Medical International Limited launched the TE Air wireless handheld ultrasound device. This device offers multi-device connectivity and flexible charging options. It also produces high-quality images and ensures accessibility in critical clinical scenarios.

Ultrasound Market Companies

- Zimmer MedizinSysteme GmbH

- General Electric Healthcare

- Fujifilm Corporation

- Hitachi, Ltd.

- Mindray Medical International Limited.

- Samsung Healthcare

- Siemens Healthineers AG

- Koninklijke Philips N.V.

- Canon Inc.

- ESAOTE SPA

Segments Covered in the Report

By Product

- Diagnostic Ultrasound Devices

- 2D

- 3D/4D

- Doppler

- Therapeutic Ultrasound Devices

- High-intensity Focused Ultrasound

- Extracorporeal Shockwave Lithotripsy

By Portability

- Handheld

- Compact

- Cart/Trolley

- Point-of-Care Cart/Trolley Based Ultrasound

- Higher-end Cart/Trolley Based Ultrasound

By Application

- Cardiology

- Obstetrics/Gynaecology

- Radiology

- Orthopaedic

- Anaesthesia

- Emergency Medicine

- Primary Care

- Critical Care

By End-use

- Hospitals

- Imaging Centres

- Research Centres

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting