Point-of-care Ultrasound Market Size and Forecast 2025 to 2034

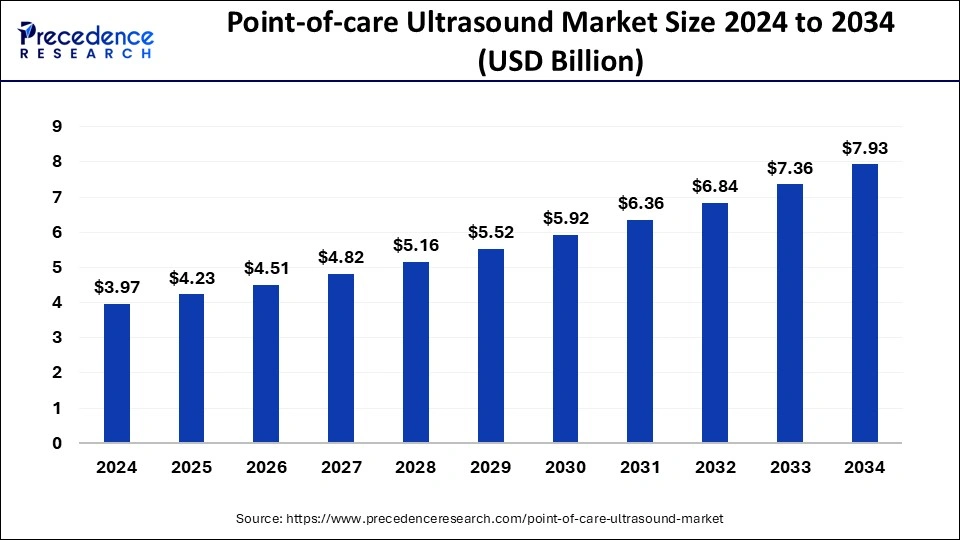

The global point-of-care ultrasound market size accounted for USD 3.97 billion in 2024 and is predicted to increase from USD 4.23 billion in 2025 to approximately USD 7.93 billion by 2034, expanding at a CAGR of 7.20% from 2025 to 2034.

Point-of-care Ultrasound MarketKey Takeaways

- In terms of revenue, the global point-of-care ultrasound market was valued at USD 3.97 billion in 2024.

- It is projected to reach USD 7.93 billion by 2034.

- The market is expected to grow at a CAGR of 7.20% from 2025 to 2034.

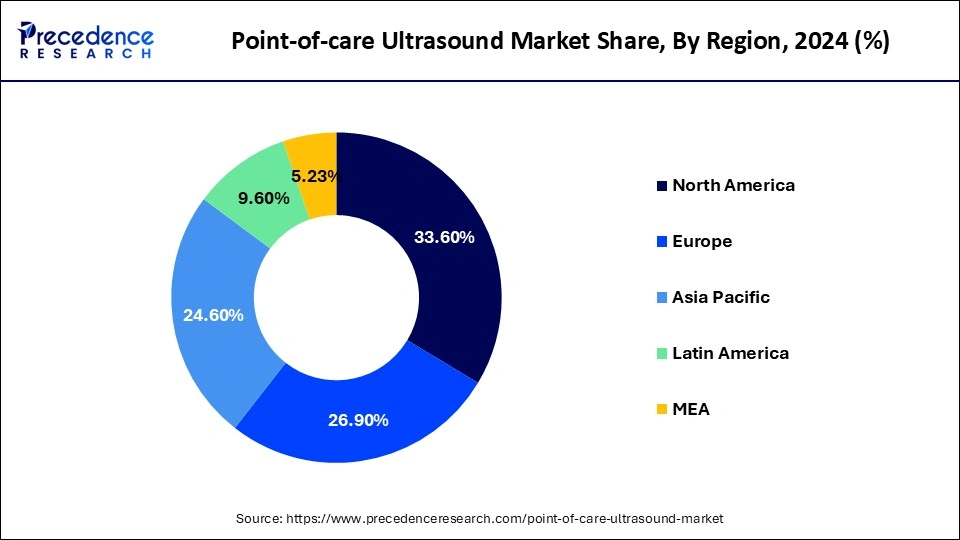

- North America held the largest share of 33.6% of the market in 2024. The region is observed to sustain the position during the forecast period.

- Europe is expected to witness the fastest rate of growth while being the second largest marketplace in the upcoming years.

- By type, the diagnostic segment led the point-of-care ultrasound market with the largest share in 2024.

- By type, the therapeutic segment is observed to witness a notable rate of growth during the forecast period.

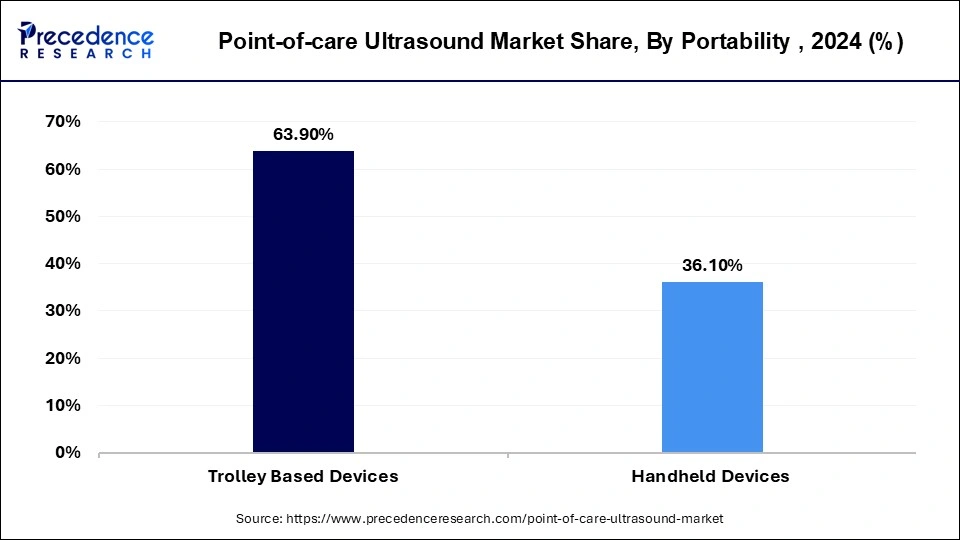

- By portability, the trolley-based devices segment held the largest share of the market in 2024. The segment is observed to continue to grow at an impressive rate during the forecast period.

- By portability, the handheld devices segment is observed to grow at the rapid pace during the forecast period.

- By application, the emergency medicine segment held the largest share of the market in 2024.

- By end users, the hospitals segment accounted for the largest market share in 2024.

- By end users, the clinics segment is expected to grow at a rapid CAGR during the forecast period.

U.S.Point-of-care Ultrasound Market Size and Growth 2025 to 2034

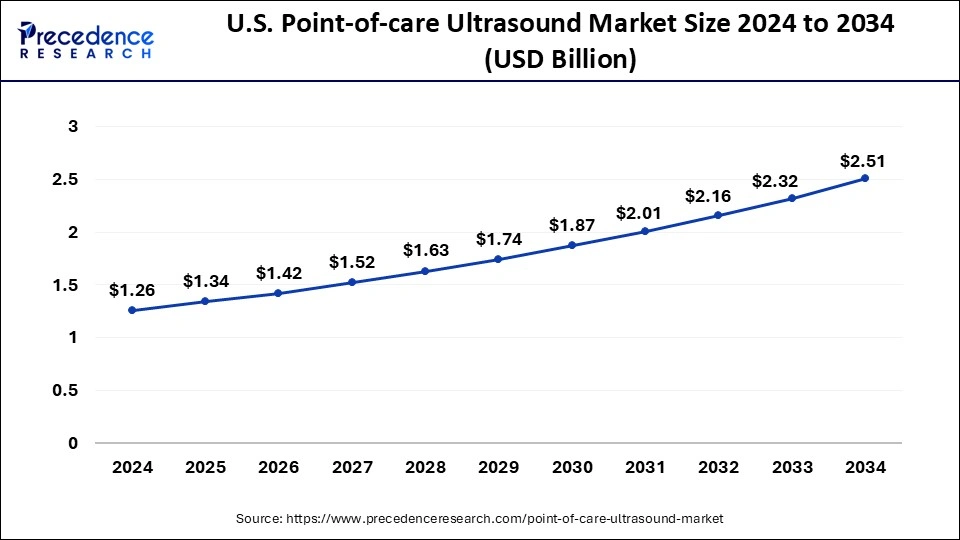

The U.S. point-of-care ultrasound market size was exhibited at USD 1.26 billion in 2024 and is projected to be worth around USD 2.51 billion by 2034, growing at a CAGR of 7.23% from 2025 to 2034.

North America held the largest market share of 33.6% in 2024. The growth of the region is attributed to the presence of sophisticated healthcare infrastructure, rapid advancement of technology, rising healthcare spending, rising adoption of point of care ultrasound (POCUS) by healthcare professionals, presence of efficient reimbursement policies, increasing investment for research and development of ultrasound systems, and rising need for medical imaging due to the increasing incidence of chronic illnesses.

The United States is the major contributor to the point-of-care ultrasound market in North America. The growth of the market in the United States is driven by the presence of prominent market players, rising product approvals by various regulatory organizations, significant healthcare spending, the rising introduction of innovative and compact ultrasound devices, the increasing number of patients undergoing diagnostic screening, and the increasing prevalence of chronic diseases. Cardiovascular disorder or heart disease is one of the top causes of death among Americans.

- According to data published by the CDC in 2023, 1 person dies every 33 seconds in the United States from cardiovascular disease. Nearly 695,000 people in the U.S. died from heart disease in 2021, that's 1 in every 5 deaths. Every year, nearly 805,000 people in the United States have a heart attack. Out of these, 605,000 are a first heart attack, 200,000 happen to people who have already had a heart attack, and about 1 in 5 heart attacks are silent in which the damage is done, but the person is unaware of it.

- In February 2024, Butterfly Network, Inc., announced the launch of Butterfly iQ3, its third-generation handheld point-of-care ultrasound (POCUS) system in the United States.

- In September 2023, Exo, a medical imaging software and device company, introduced a new age of ultrasound with Exo Iris. A first-of-its-kind handheld ultrasound that delivers precise, on-the-go answers from anywhere, creating new care pathways across healthcare. Exo Iris delivers versatile imaging performance for point-of-care ultrasound (POCUS) at a fraction of the size and cost of cart-based systems.

The European point-of-care ultrasound market is expected to grow at a significant CAGR in the coming years while being the second largest marketplace due to several factors such as increasing spending for research and development in ultrasound systems, rapid adoption of technologies and presence of skilled healthcare professionals in the healthcare sector. Moreover, the rising prevalence of disorders that require continuous ultrasound imaging services propel the growth of the market in the region. Growing need for portable equipment used for diagnostic and therapeutic applications and rising strategic initiatives, along with product innovations supplement the growth of the market. the well-established healthcare sector of the region is observed to act as a major contributor to the market's expansion.

- In September 2022, Fujifilm Sonosite, Inc., a pioneer in point-of-care ultrasound (POCUS) solutions announced the European launch of Sonosite LX POCUS. Sonosite LX system features the company's largest clinical image. The clinical display features touchscreen controls to enable an optimized heads-up workflow, allowing clinicians to keep their eyes on the image while making adjustments.

Market Overview

The point-of-care ultrasound market revolves around the production, innovation and distribution of ultrasound devices that are also widely fragmented as portable ultrasound devices or handheld ultrasound devices. They are compact and relatively easy-to-use ultrasound machines. Point-of-care ultrasound (POCUS) is the practice of skilled medical professionals using ultrasound to diagnose problems. In recent years, the advancement in point-of-care ultrasound (POCUS) has gained immense popularity as it is a versatile tool for assessment, diagnosis, and follow-up in numerous fields. As a result, the developments in POCUS assist in expanding its applications and improving patient care. Portable ultrasound machines provide crisp and detailed images to facilitate real-time guidance during a procedure or provide rapid deep insights that assist clinicians in making informed decisions.

Point-of-care Ultrasound MarketGrowth Factors

- The increasing prevalence of chronic diseases is estimated to accelerate the growth of the point -of-care ultrasound market. POCUS devices are highly preferred in specific medical fields including gynecology, obstetrics, cardiology, musculoskeletal applications, and others to serve diverse clinical needs.

- The advancements in POCUS devices including the development of handheld and portable devices which are more compact and user-friendly POCUS devices and is estimated to accelerate the market's revenue during the forecast period.

- The growing need for POCUS in emergency medicine, intensive, and critical care settings is anticipated to spur the demand for POCUS devices during the forecast period.

- The growing awareness about POCUS systems in emerging markets and the expansion of cost-effective POCUS technology are projected to offer significant opportunities for the market's expansion.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.20% |

| Market Size in 2025 | USD 4.23 Billion |

| Market Size by 2034 | USD 7.93 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Portability, Application, and End users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising prevalence of chronic diseases

The rising prevalence of chronic diseases across the globe has increased the demand for point-of-care ultrasound systems to diagnose the disease. POCUS devices are being used for therapeutic and diagnostic purposes across various fields such as cardiology, musculoskeletal, vascular surgery, urology, and obstetrics & gynecology. The rising prevalence of chronic diseases led to an increasing number of patients undergoing diagnostic screening due to various health conditions including severe abdominal pain, urology problems, and acute chest pain which in turn spur the demand for POCUS devices during the forecast period.

- According to the CDC, 6 in 10 Americans suffer from at least one chronic disease. In addition, the immense popularity of ultrasound devices in point-of-care settings for numerous applications is due to their several benefits over traditional ultrasound and provide safety as compared to other imaging alternatives.

The integration of innovative technologies to offer detailed and clear images increases its adoption in various healthcare facilities. Thus, increasing incidences of chronic diseases are anticipated to fuel the growth of the point -of-care ultrasound market during the forecast period.

Restraint

Lack of trained experts

The lack of skilled professionals is anticipated to projected to hamper the market's growth. The market has observed a lack of skilled professionals in underdeveloped areas. The effective use of POCUS devices requires specialized knowledge as well as training. Lack of effective training among doctors and health professionals about the safe management of POCUS devices as well as less product accessibility in middle and lower-income countries. In addition, stringent reimbursement scenarios in the healthcare sector may restrict the expansion of the point-of-care ultrasound market.

Opportunity

Technological advancements

Advancements in technology have led to the development of smaller, portable ultrasound devices, enabling healthcare providers to perform scans at the patient's bedside, in remote locations, or in emergency situations. This expands the potential applications of POCUS and increases its accessibility. User-friendly interfaces and automated features make modern POCUS devices easier to operate, reducing the need for extensive training. This allows a wider range of healthcare professionals, including nurses and primary care physicians, to incorporate ultrasound into their practice, thereby increasing the demand for POCUS devices. Thereby, technological advancements are observed to open lucrative opportunities for the point-of-care ultrasound market.

Type Insights

The diagnostics segment accounted for the largest share in 2024 and the segment is observed to sustain the position throughout the forecast period in point-of-care ultrasound market. POCUS devices play a critical role in point-of-care diagnostics by offering real-time visualization and assisting in the diagnosis of several health conditions such as cardiac abnormalities, abdominal pathologies, trauma, and others. The wide utilization of POCUS devices in maternity homes to offer diagnostic services during pregnancy creates a significant supplementary factor for the segment's growth.

The therapeutics segment is observed to grow at a rapid pace during the forecast period. Therapeutic point-of-care ultrasound enables healthcare professionals to treat patients accurately, rapidly, and non-invasively. They are extensively used in ambulatory surgical centers, homecare settings, clinics, and hospitals. The rising demand for therapeutic devices for bedside patient health assessments to gather clinical data.

Portability Insights

The trolley-based devices segment held the largest share of the point-of-care ultrasound market in 2024, the segment is expected to sustain the position throughout the forecast period owing to its increasing adoption of devices by hospitals and clinics in emergency medicine, vascular access and to perform other sophisticated medical tasks. The market has experienced the increasing use of trolley-based devices in emergency care rooms due to their portability from one room to the other without disrupting patient care. Such factors propel the growth of the segment.

The handheld devices segment is expected to grow significantly in the coming years owing to new product launches and rising demand for hand-held devices in various healthcare settings. Handheld devices assist healthcare professionals in optimizing healthcare operations, services, and experience. The rising popularity of mobile healthcare devices creates a significant driver for the segment to grow.

- In September 2023, Mindray announced the launch of its 2-in-1 handheld ultrasound device with multi-device connectivity, a new imaging solution that improves ultrasound accessibility. This compact, wireless technology enables healthcare professionals to carry comprehensive scanning capabilities in their pockets, adapting to a wide array of clinical scenarios.

Application Insights

The emergency medicine segment held the largest share of the point-of-care ultrasound market in 2024 due to the increasing adoption of emergency diagnostic tools in emergency care to provide critical clinical information quickly. The ultrasound scan can be performed at the time of physical examination in a few minutes. Moreover, the rising focus on offering quality healthcare services for patients in emergency rooms create a significant growth factor for the segment.

The cardiology segment is observed to grow at a significant rate during the forecast period owing to the prevalence of cardiovascular disorders. For instance, according to the WHO, Cardiovascular diseases are the leading cause of death around the world, it is estimated that it takes 17.9 million lives each year. More than 4 out of 5 CVD deaths are due to heart attacks and strokes, and one-third of these deaths occur prematurely in people under 70 years of age. Cardiac P.O.C. ultrasound facilitates rapid real-time cardiac analysis and accurate hemodynamic profiling and properly guides patient care for better healthcare outcomes.

End-users Insights

The hospital segment accounted for the largest share in the point-of-care ultrasound market. The growth of the segment is driven by the rising number of emergency patient visits to hospitals with mild to severe health conditions such as cardiac arrest, abdominal pain, stroke, and others. The increasing use of Point-of-care (POC) ultrasound in the hospital to offer real-time imaging-guided treatments during surgery. The hospital segment has witnessed strong demand for ultrasound imaging in emergency care and intensive care units (ICUs). In hospitals, healthcare professionals such as doctors, nurses, and radiologists are highly skilled in using this advanced device effectively for better outcomes as well as assisting them in quick decision-making processes and patient management. Such supportive factors are fueling the segment's dominance in the market.

The clinics segment is expected to grow at a rapid CAGR due to the rising number of ultrasound tests conducted for OPD. The integration of cost-effective and technologically advanced ultrasound devices in small-scale clinics also promotes the growth of the segment.

Recent Developments

- In October 2023, Butterfly Network announced a 5-Year co-development agreement with Forest Neurotech for next-generation brain-computer interfaces using ultrasound-on-chip technology. The agreement includes USD 20MM to be paid to Butterfly for annual licensing, chip purchases, services, and milestone payments, of which USD 3.5MM was received on signing.

- In October 2023, GE HealthCare announced that it signed a USD 44 million contract with the Biomedical Advanced Research and Development Authority (BARDA) part of the Administration for Strategic Preparedness and Response (ASPR) within the U.S. Department of Health and Human Services (HHS) to develop and obtain regulatory clearance for next-generation advanced point-of-care ultrasound technology with new artificial intelligence (AI) applications.

- In July 2023, Konica Minolta Healthcare Americas Inc. announced the launch of PocketPro H2, a new wireless handheld ultrasound device for general imaging in point-of-care applications.

- In February 2022, Philips announced it has expanded its ultrasound portfolio with advanced hemodynamic assessment and measurement capabilities on its handheld point-of-care ultrasound, Lumify. Lumify assists clinicians in quantifying blood flow in a wide range of point-of-care diagnostic applications including cardiology, vascular, abdominal, urology, obstetrics, and gynecology as well as helps in the early assessment of gestational age and the identification of high-risk pregnancies.

Point-of-care Ultrasound Market Companies

- Koninklijke Philips N.V.

- GE Healthcare

- FUJIFILM Sonosite, Inc.

- Hitachi Ltd.

- ALPINION MEDICAL SYSTEMS Co., Ltd

- Terason Corporation

- Shenzhen Mindray Bio-Medical Electronics Co. Ltd.

- EDAN Instruments

- Esaote S.p.A

- Butterfly Network Inc.

- Teknova Medical System

- DRE medical

- Landwind Medical

- Terason Corporation

- CHISON Medical Technologies

- Siemens

- Mindray Bio-Medical Electronics

- B. Braun

- Canon Medical Systems

- Analogic Corporation

Segments Covered in the Report

By Type

- Diagnostic

- Therapeutic

By Portability

- Trolley-Based Devices

- Handheld Devices

By Application

- Emergency Medicine

- Cardiology

- Obstetrics & Gynecology

- Urology

- Vascular Surgery

- Musculoskeletal

By End users

- Hospitals

- Clinics

- Maternity Centers

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content