What is the Point-of-care Biosensors Market Size?

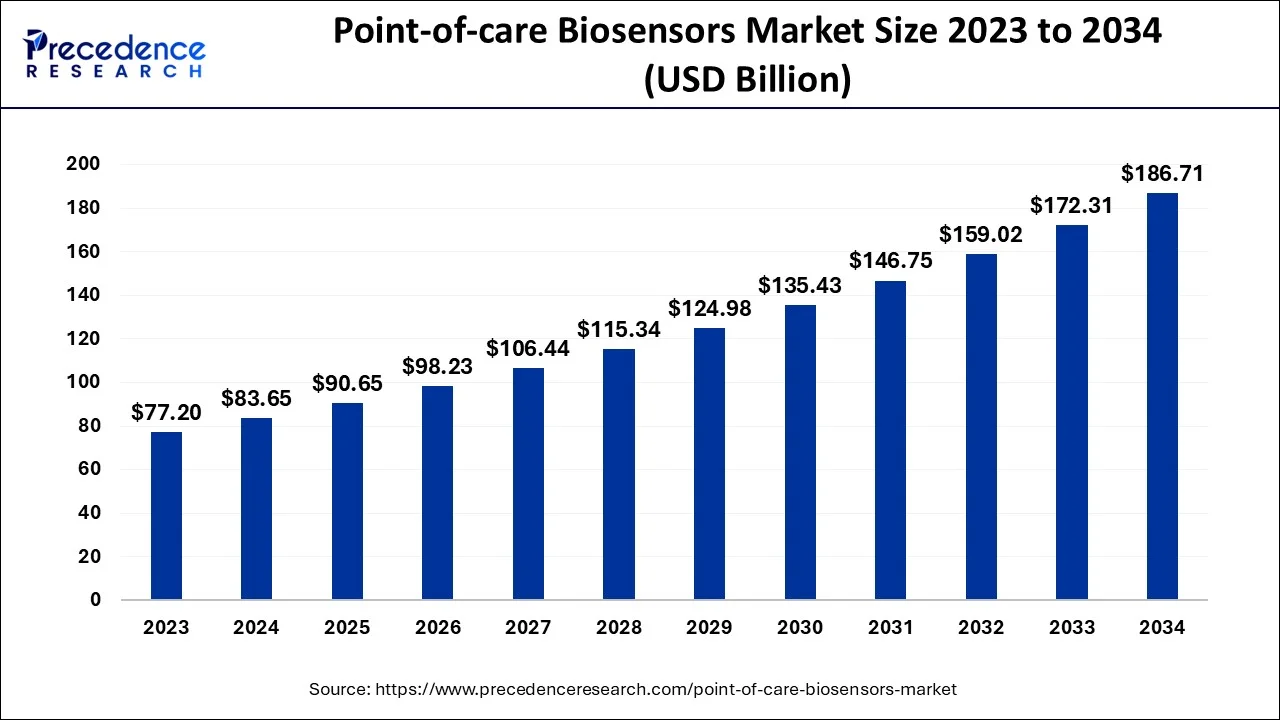

The global point-of-care biosensors market size is calculated at USD 90.65 billion in 2025 and is predicted to increase from USD 98.23 billion in 2026 to approximately USD 200.37 billion by 2035, expanding at a CAGR of 8.25% from 2026 to 2035.

Point-of-care Biosensors Market Key Takeaways

- North America is predicted to dominates the market from 2026 to 2035.

- Asia-Pacific is expected to expand at the fastest CAGR between 2026 to 2035.

- By Product, the glucose monitoring segment is predicted to generate the maximum market share between 2026 to 2035.

- By Platforms, the immunoassays segment is expected to record the largest market share between 2026 to 2035.

- By Purchase, the OTC segment is projected to capture the highest market share between 2026 to 2035.

- By Sample, the blood segment is expected to account the major market share between 2026 to 2035.

- By End-user, the homecare segment is predicted to dominate the global market from 2026 to 2035.

What are Point-Of-Care Biosensors?

The point-of-care biosensors market refers to the industry that develops and produces devices for detecting and measuring biological molecules, such as glucose, cholesterol, and proteins, at the point of care, which can be at the patient's bedside or in a physician's office. These biosensors are portable, easy to use, and provide rapid results. They are used for various applications such as disease diagnosis, monitoring of chronic diseases, and drug testing.

The market for point-of-care biosensors has grown rapidly due to the increasing demand for personalized and convenient healthcare services. These biosensors offer advantages such as real-time monitoring of physiological parameters, non-invasiveness, and cost-effectiveness. They are used in several fields, such as clinical diagnostics, food safety, environmental monitoring, and biodefense. The market is anticipated to grow as new technologies are developed, and the demand for personalized healthcare services increases.

Furthermore, The prevalence of chronic diseases, such as diabetes and cardiovascular diseases, is increasing globally. Point-of-care biosensors offer a convenient and rapid way to monitor and manage these diseases, driving the demand for such devices. In addition, governments and healthcare organizations are investing heavily in healthcare infrastructure and technology to expand the reduce healthcare costs and quality of care. Point-of-care biosensors offer a cost-effective disease management solution, driving their adoption.

However, the high development and production cost, limited accuracy and specificity, and lack of trained healthcare professionals are anticipated to impede the market growth. The development and production of point-of-care biosensors require significant investment in research and development and specialized manufacturing processes. This can result in high production costs, which m the affordability and accessibility of these devices. Also, point-of-care biosensors offer rapid and convenient diagnostic solutions, but their accuracy and specificity may be limited compared to traditional laboratory tests. This can result in false positives or negatives, impacting patient outcomes and limiting the adoption of these devices.

The lockdown measures implemented by various governments in anticipation of the COVID-19 pandemic have created a significant demand for rapid and accurate COVID-19 testing. Point-of-care biosensors have played a critical role in addressing this demand by offering rapid and convenient testing solutions. The COVID-19 pandemic has enhanced the development of new point-of-care biosensors for COVID-19 testing. Many companies have invested in developing new biosensors that can detect the SARS-CoV-2 virus, leading to innovative testing solutions. However, the COVID-19 pandemic has disrupted global supply chains, which has affected the distribution and production of point-of-care biosensors. This disruption has led to delays in the delivery of biosensors and increased production costs.

Market Outlook

- Industry Growth Overview:

The point-of-care biosensors market is experiencing significant growth, driven by rising demand for real-time, convenient diagnostics, specifically for managing long term diseases (diabetes, CVDs) and infectious outbreaks. - Global Expansion:

The market expanded globally due to technological development, growing adoption of home-based healthcare, supportive guidelines, and the requirement for faster, more precise results for the patient. North America is dominant in the market due to the presence of a highly developed medical care system. - Major investors:

Major investors of the market include large medical device/diagnostics companies such as Abbott, Roche, Medtronic, and Thermo Fisher Scientific, alongside specialized firms such as Dexcom and Siemens Health.

Market Scope:

| Report Coverage | Details |

| Market Size in 2025 | USD 90.65 Billion |

| Market Size in 2026 | USD 98.23 Billion |

| Market Size by 2035 | USD 200.37 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.25% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, By Platforms, By Purchase, By Sample, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers

Growing demand for personalized healthcare to brighten the market prospect

Personalized healthcare refers to solutions tailored to an individual's unique needs and characteristics, including genetics, lifestyle, and medical history. Point-of-care biosensors offer a convenient and rapid way to monitor and manage various health conditions, making them well-suited for personalized healthcare. Their ability to provide real-time monitoring of physiological parameters will further boost demand in the point-of-care biosensors market. This allows healthcare providers to identify health issues early and tailor treatment plans to each patient. With the surging prevalence of chronic diseases and the necessity for more efficient and effective healthcare solutions, the demand for personalized healthcare is expected to grow significantly in the coming years.

Furthermore, technological advances have made point-of-care biosensors more accurate, sensitive, and specific, making them an increasingly attractive option for personalized healthcare. The development of innovative biosensors that can detect multiple biomarkers simultaneously and provide more detailed information about a patient's health status will further drive demand for the market. Thus, the growing demand for personalized healthcare is anticipated to be a key driver of the point-of-care biosensors market. These devices offer a convenient and effective real-time monitoring and disease management solution.

Increasing healthcare expenditure:

Healthcare expenditure includes all the costs associated with healthcare, including hospital care, medication, and medical devices. As healthcare expenditure continues to surge globally, there is a growing demand for cost-effective solutions that can help reduce healthcare costs while improving patient outcomes. Point-of-care biosensors offer a convenient and affordable solution for real-time monitoring and disease management, making them an attractive option for healthcare providers looking to reduce costs and improve patient outcomes. With the surging prevalence of chronic diseases and the need for more efficient and effective healthcare solutions, the demand for point-of-care biosensors is expected to grow significantly in the coming years.

Moreover, governments worldwide are increasingly investing in healthcare infrastructure to improve access to healthcare services, further driving demand for point-of-care biosensors. Additionally, the increasing adoption of point-of-care biosensors in emerging economies due to rising healthcare expenditure and growing awareness of the benefits of these devices will also contribute to the market's growth. Thus, the increasing healthcare expenditure is expected to be a key driver of the point-of-care biosensors market. These devices offer a cost-effective and efficient solution for real-time monitoring and disease management, making them an attractive option for healthcare providers looking to reduce costs and improve patient outcomes.

Key Market Challenges

The high cost of point-of-care biosensors is causing hindrances to the market

The development and production of point-of-care biosensors require significant investments in research and development and manufacturing processes. This results in high production costs, which can limit the adoption of these devices, particularly in low- and middle-income countries. Furthermore, the regulatory requirements for point-of-care biosensors are complex and stringent, which adds to the cost of development and production. Meeting regulatory requirements can be a time-consuming and costly process, limiting the development of new point-of-care biosensors and hindering the market's growth. Also, producing these devices requires advanced manufacturing technologies and highly skilled personnel, which can further increase production costs.

Moreover, the high cost of point-of-care biosensors can also limit their adoption by healthcare providers and patients. In many cases, these devices may not be covered by insurance, making them unaffordable for some patients. Additionally, healthcare providers may be reluctant to invest in expensive point-of-care biosensors, particularly if other, more affordable alternatives are available. Thus, the high cost of development and production is a significant restraint for the point-of-care biosensors market, as it limits the adoption of these devices and can hinder the market's growth.

Key Market Opportunities

Technological advancements

The growing technological advancements in the point-of-care biosensors market are presenting significant opportunity insights. One of the most significant advancements is the miniaturization of biosensors, which has led to the development of portable, handheld devices that can be used by healthcare professionals for point-of-care testing. These biosensors are becoming increasingly sophisticated, incorporating technologies such as nanotechnology, microfluidics, and wireless communication.

Increasing government support

Governments around the world are recognizing the importance of point-of-care biosensors in improving healthcare outcomes, particularly in underserved areas and developing countries. One of the key ways in which governments are supporting the adoption of point-of-care biosensors is through funding initiatives. Governments are investing in research and development to support the development of new biosensors and technologies, and they are also providing funding to healthcare providers to purchase and implement these technologies.

For example, in the United States, the National Institutes of Health (NIH) and the National Science Foundation (NSF) provide funding for research in the development and use of biosensors in healthcare. In addition, governments are also implementing policies and regulations that support the adoption of point-of-care biosensors.

Aging population

Aging is associated with an increased risk of chronic diseases, such as diabetes, cardiovascular diseases, and cancer. According to the World Health Organization, by 2050, the number of people aged 60 and above will be more than double that of 2015, reaching 2.1 billion. The growing aging population is expected to increase the demand for point-of-care biosensors, which can help in the early detection and management of chronic diseases.

In addition, the growing aging population has also led to an increase in demand for home-based care and remote monitoring. Point-of-care biosensors enable remote monitoring and telemedicine, allowing healthcare providers to monitor patients from a distance. This technology can help in reducing the burden on healthcare systems and improve patient outcomes. For instance, biosensors integrated into wearable devices can continuously monitor vital signs such as heart rate, blood pressure, and oxygen saturation. This data can be transmitted to healthcare providers, who can then monitor patients remotely and provide timely interventions if necessary.

Segment Insights

Product Insights

On the basis of product, the point-of-care biosensors market is divided into glucose monitoring, HIV, hepatitis C, and pregnancy, with the glucose monitoring segment accounting for most of the market. This is primarily due to the high prevalence of diabetes and the need for continuous glucose monitoring in diabetic patients. Glucose monitoring biosensors measure blood glucose levels in real-time and provide accurate readings to patients and healthcare providers. Diabetic patients commonly use these biosensors to make informed decisions about insulin dosing, diet, and exercise and monitor their blood sugar levels.

Platforms Insights

On the basis of the platforms, the point-of-care biosensors market is divided into microfluidics, dipsticks, and immunoassays, with immunoassays accounting for most of the market. This is because immunoassays are biochemical tests that use antibodies to detect the presence of a target molecule in a sample. These tests are commonly used to rapidly screen and diagnose infectious diseases, such as HIV and hepatitis C, and pregnancy testing.

Immunoassay-based point-of-care biosensors are widely used in the diagnosis of infectious diseases due to their high sensitivity and specificity. These biosensors can detect and quantify biomolecules, such as proteins, hormones, and enzymes, which are markers of various diseases. Additionally, the immunoassay platform is simple, cost-effective, and easy to use, making it suitable for use in resource-limited settings. This has led to the widespread adoption of immunoassay-based point-of-care biosensors in developing countries, where healthcare infrastructure is often lacking.

Purchase Insights:

On the basis of purchase, the point-of-care biosensors market is divided into OTC and prescription, with the OTC segment accounting for most of the market. OTC point-of-care biosensors can be purchased without a prescription and are typically used for home healthcare and self-monitoring of chronic diseases such as diabetes. These biosensors are easy to use and provide quick and accurate results, allowing patients to monitor their health status regularly without visiting a healthcare professional.

In addition, the OTC segment of the point-of-care biosensors market has been gaining traction due to the increasing demand for self-monitoring and home healthcare devices. OTC point-of-care biosensors have emerged as a cost-effective and convenient option for patients to monitor their health conditions and receive quick results without visiting healthcare professionals.

The growing geriatric population and the increasing prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular diseases have been driving the demand for OTC point-of-care biosensors.

Sample Insights

On the basis of the sample, the point-of-care biosensors market is divided into blood, and urine, with blood accounting for most of the market. Blood-based point-of-care biosensors detect and monitor various diseases and conditions, including infectious diseases, cardiac markers, and cancer biomarkers. Blood samples can be obtained through a simple fingerstick or venipuncture and tested in real-time to provide quick and accurate results.

End-User Insights

On the basis of the end user, the point-of-care biosensor market is divided into pharmacies, hospitals, and home care. The homecare segment is expected to dominate the market due to the increasing adoption of self-monitoring devices for chronic diseases. With the rise in the prevalence of chronic diseases such as diabetes and cardiovascular diseases, the demand for point-of-care biosensors for homecare is expected to rise.

In addition, homecare biosensors are typically designed to be user-friendly and easy to operate, allowing patients to monitor their health parameters on a regular basis. These biosensors are often portable and compact, which makes them convenient for patients to carry around and use as needed. The increasing trend of remote patient monitoring (RPM) is expected to further drive the demand for point-of-care biosensors for homecare.

Regional Insights

North America: Increasing Prevalence of Chronic Diseases

On the basis of geography, North America dominates the market, primarily driven by the growing prevalence of prolonged diseases such as cardiovascular disease, diabetes, and cancer, as well as increasing demand for rapid and accuratediagnostic tests in various healthcare settings.

U.S. Point-of-Care Biosensors Market Trends

In the U.S., a strong network of hospitals, clinics, and research centers drives the use and development of PoC devices. Significant spending in biotech and R&D yields cutting-edge, compact biosensor technologies. Seamless incorporation with Electronic Medical Records (EMRs) and digital platforms enhances market penetration and utility.

Europe: Increasing Government Initiative

Europe is a significant market for point-of-care biosensors, with Germany, the United Kingdom, and France being the major contributors to the market's growth. This is due to various factors, such as the growing prevalence of chronic diseases, the aging population, and rising healthcare expenditures. Technological advancements and increasing demand for rapid and accurate diagnostic tests drive the market. Furthermore, government initiatives to improve healthcare access and quality drive the European point-of-care biosensors market. For instance, in the UK, the National Health Service (NHS) has implemented several initiatives to improve access to diagnostic tests, particularly in remote and underserved areas.

The UK Point-of-Care Biosensors Market Trends

In the UK, robust R&D efforts, innovation hubs in London and Manchester, government and NHS support for technology, a high burden of chronic diseases like diabetes, and an emphasis on personalized medicine are fueling demand for rapid diagnostics. Integration of AI and IoT is also enhancing future growth prospects.

The region in Asia-Pacific is anticipated to have the greatest CAGR

The increasing prevalence of chronic diseases drives the market, growing demand for rapid and accurate diagnostic tests, and rising healthcare expenditure, increasing investment in healthcare infrastructure, and technological advancements drive the market. China, Japan, and India are the largest markets for point-of-care biosensors in the APAC region, accounting for most of the market share.

India Point-of-Care Biosensors Market Trends

In India, the ICMR INDIAB-17 study estimates that over 100 million people have diabetes, with an additional 136 million experiencing prediabetes. Coronary heart disease has become epidemic, driving the need for quick cardiac marker biosensors for early treatment. Supportive policies such as Ayushman Bharat now insure over 150 million families, expanding access to diagnostic services.

Value Chain Analysis – Point-of-care Biosensors Market

- Research & Development:

R&D for the point-of-care biosensors market involves developing highly sensitive and precise detection systems, often using immunosensors for protein biomarkers, and advanced technologies such as screen printing.

Key Players: Siemens Healthineers and LifeScan - Clinical Trials:

Point-of-care biosensor clinical trials focus on validating device performance using real patient samples across three phases: Pre-analytical, Analytical, and Post-analytical.

Key Players: Medtronic plc and Dexcom, Inc. - Patient Services:

Point-of-care (POC) biosensors offer different patient services, significantly by allowing rapid, on-site medical monitoring and diagnostics outside of traditional laboratory settings.

Key Players: Abbott Laboratories and F. Hoffmann-La Roche Ltd

Point-of-care Biosensors Market Companies:

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

United States |

Financial performance |

It provides real-time point-of-care (POC) monitoring through molecular feedback is essential for these systems. |

|

|

Bayer AG |

United States |

Strong global presence, robust financial health

|

In August 2025, Abbott recently announced plans to build a new cardiovascular device manufacturing facility in Georgia, which is expected to be completed in 2028. |

|

Accubiotech Co, Ltd. |

China |

Extensive experience and expertise |

AccBio tech company specializes in developing, manufacturing, and distributing pregnancy rapid tests, drug of abuse tests, and infectious disease tests. |

|

ACON Laboratories, Inc |

California |

diverse and affordable product lines |

In October 2025, ACON Laboratories announced breakthrough 4-in-1 Flowflex Plus RSV + Flu A/B + COVID Home Test |

|

Biolytical Laboratories |

Canada |

Innovative rapid diagnostic technology |

In October 2025, HIV testing just became faster, easier, and more accessible. The U.S. Food and Drug Administration (FDA) has approved the INSTI HIV Self-Test from bioLytical Laboratories Inc. (bioLytical), making it the first one-minute HIV self-test available in the U.S. |

Other Major Key Players

- Abbott Laboratories

- Becton, Dickinson and Company

- Danaher Corporation (HemoCue)

- Siemens Healthineers

- Meridian Bioscience, Inc

Recent Developments:

- In August 2020,Abbott Laboratories launched its BinaxNOW COVID-19 Ag Card rapid test, a portable and affordable antigen test that provides results in 15 minutes.

- In September 2020,Quidel Corporation acquired the diagnostic platform of Adeno-Plus Medical AB, a Swedish company that develops diagnostic tests for infectious diseases, to expand its product offerings in the field of respiratory and gastrointestinal infections.

- In February 2021,Abbott Laboratories acquired the medical device company, Walk Vascular, to expand its offerings in peripheral vascular interventions and improve patient outcomes.

- In March 2021, Biomerica Inc. launched its InFoods IBS diagnostic test in Europe, a point-of-care test that helps diagnose Irritable Bowel Syndrome (IBS) quickly and accurately.

- In August 2021,Siemens Healthineers partnered with Beckman Coulter to develop a new range of high-throughput immunoassay systems for diagnostic testing in laboratories.

Segments Covered in the Report:

By Product

- Glucose Monitoring

- HIV

- Hepatitis C

- Pregnancy

By Platforms

- Microfluidics

- Dipsticks

- Immunoassays

By Purchase

- OTC

- Prescription

By Sample

- Blood

- Urine

By End User

- Pharmacy

- Hospital

- Homecare

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting