What is the Biosensors Market Size?

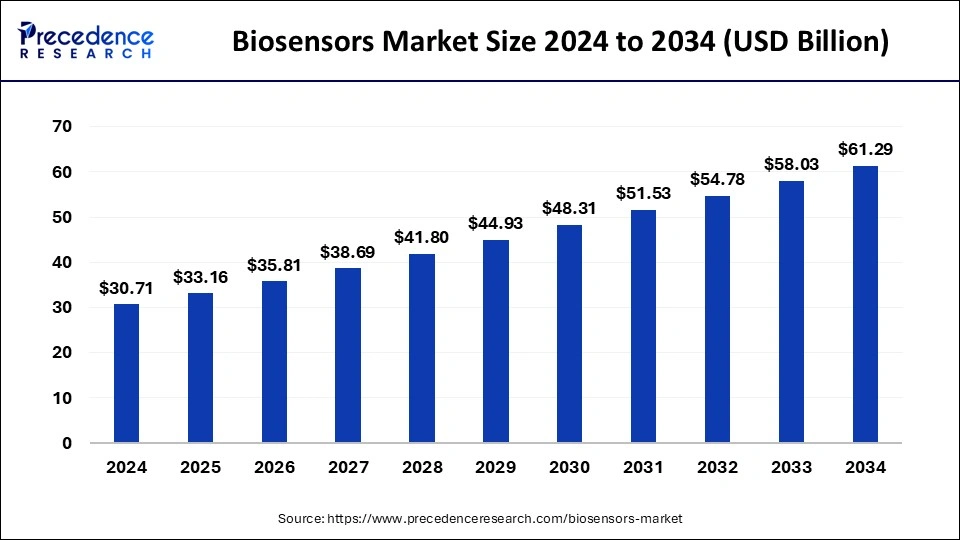

The global biosensors market size is valued at USD 33.16 billion in 2025 and is predicted to increase from USD 35.81 billion in 2026 to approximately USD 64.54 billion by 2035, expanding at a CAGR of 6.89% from 2026 to 2035.

Biosensors Market Key Takeaways

- In terms of revenue, the market is valued at $33.16 billion in 2025.

- It is projected to reach $64.54 billion by 2035.

- The market is expected to grow at a CAGR of 6.89% from 2026 to 2035.

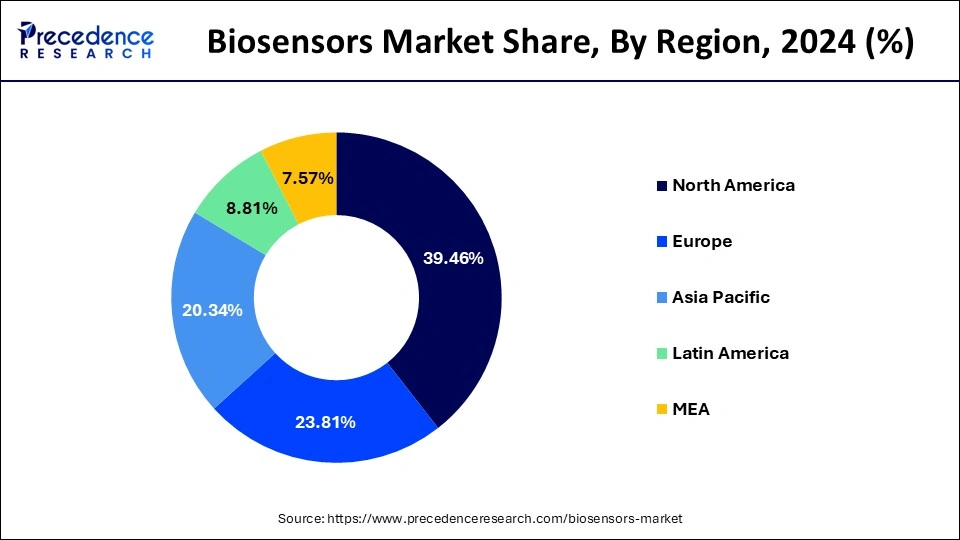

- North America has dominated the biosensors market in 2025 with revenue share of 39.33%.

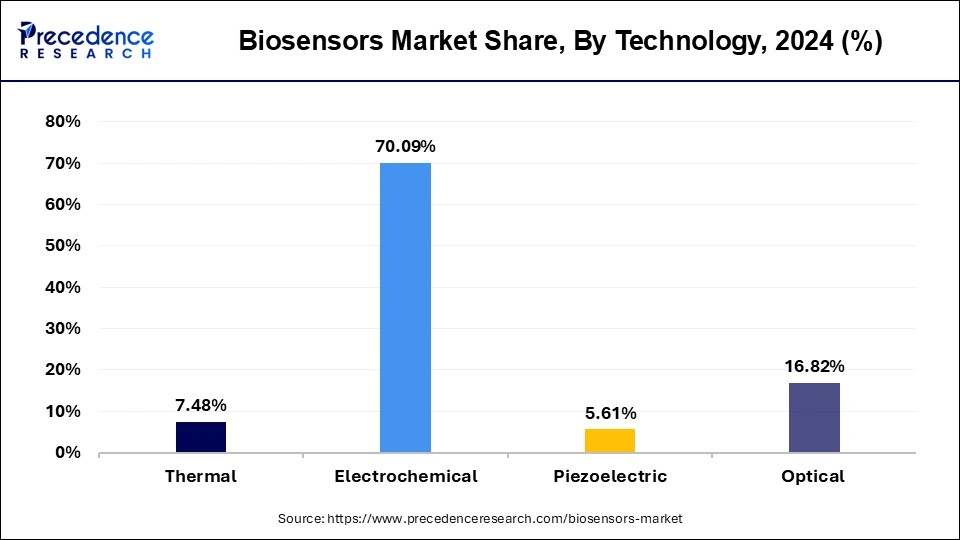

- By technology, the optical biosensors segment is projected to experience the highest growth rate in the market between 2026 and 2035.

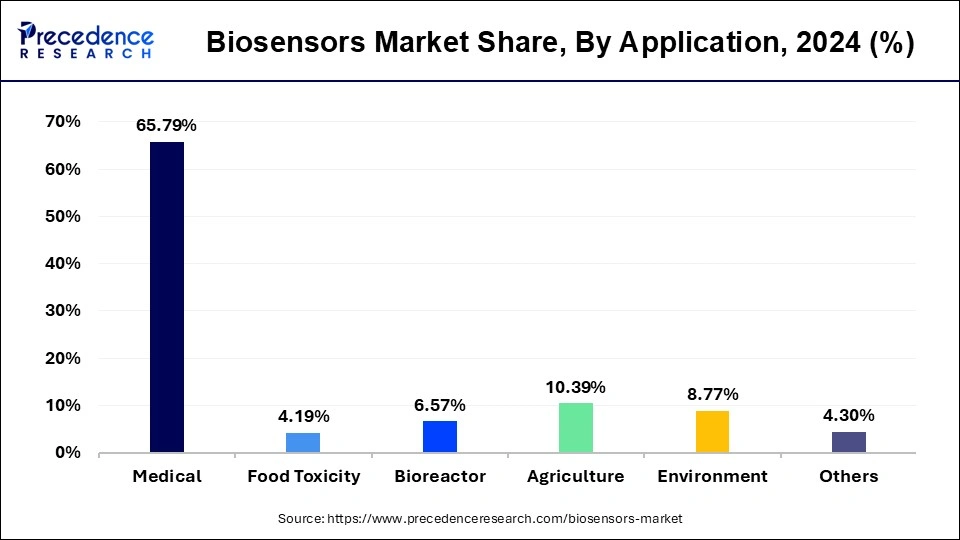

- By application, the agriculture segment is set to experience the fastest rate of market growth from 2026 to 2035.

- By End User, the food industry segment is anticipated to grow with the highest CAGR in the market during the studied years.

Market overview

Worldwide product highlights

| Country | Company | Product | Technological |

| U.S. | Medi sense | Glucose monitoring systems | Enzyme-based electrochemical |

| Switzerland | Roche diagnostics | Accu-Check biosensor platform | Nano-enhanced electrodes, wireless data |

| U.S. | Abbott Laboratories | Freestyle libre | Continuous glucose monitoring with a wearable |

| Sweden | Biacore | SPR biosensor | Surface plasmon resonance for label-free detection |

| Japan | Sysmex corporation | Immunoassay biosensor analyzer | Compact design, integrated AI for diagnosis |

Technological Advancements in the Market

- Nano-enabled biosensors: Enhanced sensitivity using nanomaterials like graphene and gold nanoparticles.

- Wearable biosensors: For continuous health monitoring through smartwatches and skin patches.

- Point-of-care (POC) devices: Portable biosensors allowing immediate diagnostics at clinics or in the field.

- Label-free detection technologies: Reducing testing time and costs by eliminating reagent steps.

- Multiplexing capabilities: Detecting multiple analytes simultaneously in a single assay.

The Role of AI in the Biosensors Market:

Artificial intelligence (AI) is increasingly playing a transformative role in the biosensors market, enabling enhanced functionality, greater diagnostic precision, and more effective data interpretation. Traditionally, biosensors functioned as passive detectors of biological or chemical reactions, but with the integration of AI, they are becoming intelligent systems capable of learning, adapting, and predicting physiological changes in real time. One of the most significant contributions of AI is in data analytics. Biosensors generate large volumes of complex biological data, especially in applications like glucose monitoring, cardiovascular assessment, and wearable fitness tracking. AI algorithms, particularly machine learning (ML) and deep learning (DL), are used to analyse this data to identify patterns, detect anomalies, and even predict disease onset. For example, AI-integrated biosensors in wearable devices can monitor heart rate variability and use predictive analytics to alert users of potential arrhythmias or cardiac events before symptoms occur.

In healthcare settings, AI is revolutionizing point-of-care diagnostics by enhancing the speed and accuracy of biosensor-based testing. AI-enabled biosensors are being explored for early detection of chronic conditions like diabetes, cancer, and neurodegenerative diseases. They also support remote monitoring, allowing healthcare providers to track patient health in real time and intervene proactively. Moreover, AI is contributing to the development of more personalized bio-sensing solutions. Through continuous learning, AI models can adapt to individual users' baseline health metrics, making biosensors more accurate and tailored to specific needs. AI is also helping to improve the design and manufacturing of biosensors, from optimizing sensor architecture to quality control in production, AI-driven automation ensures higher precision and reduced development cycles.

Biosensors Market Growth Factors

The biosensors are used as medical devices to detect biological substances. The growth of global biosensors market is being driven by the rising prevalence of chronic disorders. According to World Health Organization (WHO), the incidence of chronic diseases is growing at a rapid pace. In addition, the adoption of innovative technologies such as artificial intelligence and internet of things are paving way for the growth opportunities for the global biosensors market.

The biosensors are widely used in healthcare sector for sensing, detecting, and monitoring various kind of disorders among the people. One of the key factors boosting the growth of global biosensors market is rising prevalence of diabetes all around the globe. The biosensors are used to detect blood glucose levels which are directly utilized for the detection of diabetes on a large scale. Thus, this factor is supporting the growth and development of global biosensors market.

The growth of the global biosensors market is being restricted by the stringent government regulations and reimbursement policies. In addition, the adoption of new and latest technologies is quite slow in low- and middle-income nations. This factor is hampering the growth of the biosensors market.

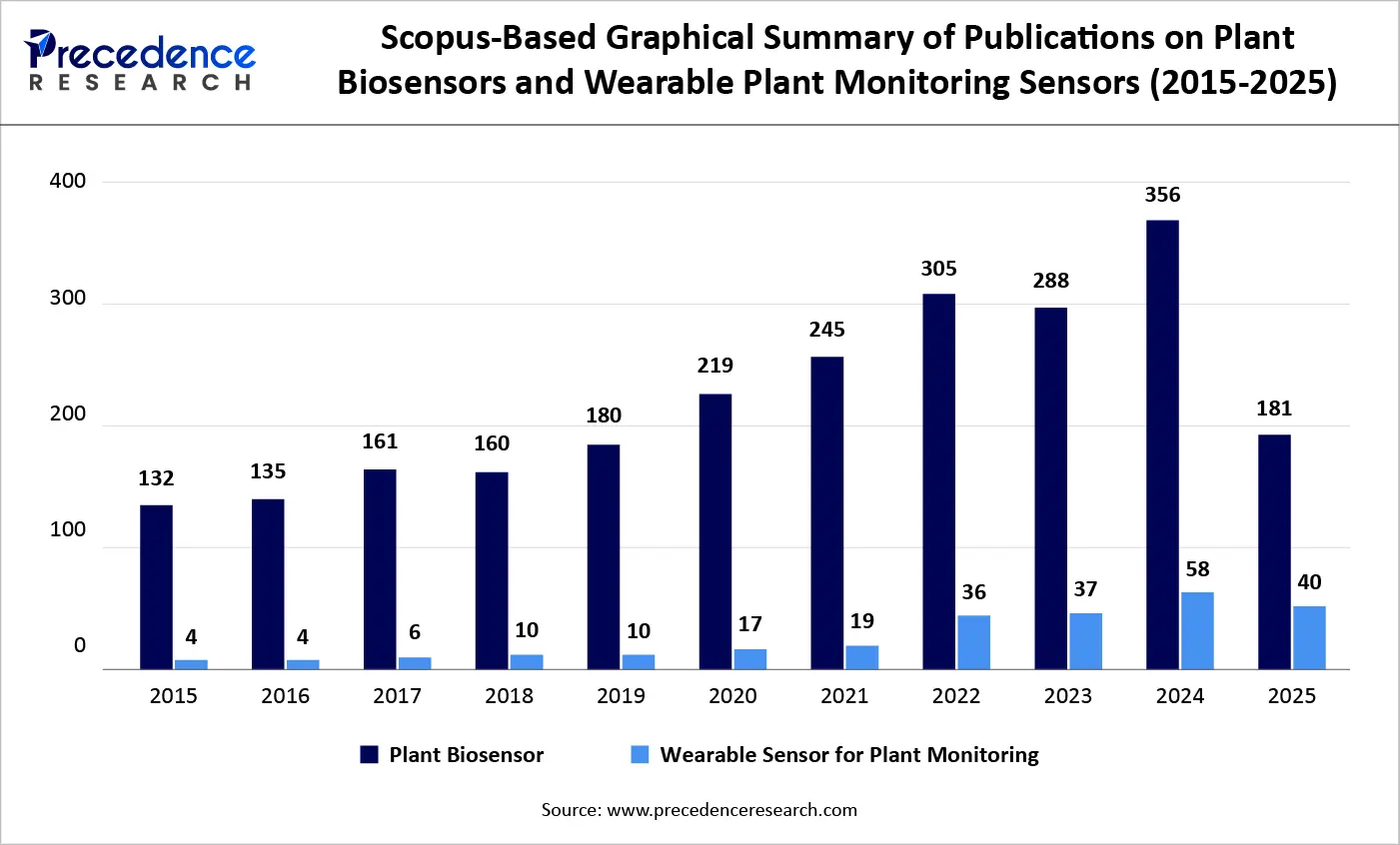

The Scopus-based publication trend highlights a sustained expansion of research activity in plant sensing technologies, with a clear divergence between conventional plant biosensors and wearable plant monitoring sensors. From 2015 to 2025, publications on plant biosensors increased steadily, rising from just over 132 papers in 2015 to a peak of around 356 publications in 2024, reflecting the maturation of biochemical and electrochemical sensing approaches for plant diagnostics. In contrast, wearable sensors for plant monitoring remain a smaller but rapidly emerging subfield, growing from fewer than 5 publications annually before 2018 to nearly 60 papers in 2024.

This gap aligns closely with the review by Singh et al. (2026), which identifies wearable interfaces such as plant tattoos, flexible wraps, and microneedle arrays as a critical next frontier. The rising interest in AI- and ML-enabled nanobiosensors underscores a shift from laboratory-bound diagnostics toward real-time, in-field monitoring, positioning wearable plant sensors as a key enabler of precision and sustainable agriculture despite their current underrepresentation in the literature.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 33.16 Billion |

| Market Size in 2024 | USD 35.81 Billion |

| Market Size by 2035 | USD 64.54 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.89% |

| Dominated Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Type, Application, End Use, Technology, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Technology Insights

Optical biosensors are emerging as the fastest growing technology in the biosensors market due to their advanced capabilities in real-time, label-free detection. These sensors use light-based mechanisms to measure biological interactions, which provides high sensitivity and specificity in detecting target analytics.

They are increasing being adopted in medical diagnostics, environmental monitoring, and food safety testing owing to their non-invasive nature and miniaturization potential. Furthermore, the integration of optical biosensors with smartphones and wearable health devices is enabling remote diagnostics and personal health monitoring, making them a preferred choice in both clinical and non-clinical settings. Their ability to deliver immediate and accurate results is also enhancing their applicability in resource-limited environments and point-of-care testing.

Global Biosensors Market Revenue, by Technology (USD Million)

| Technology | 2023 | 2024 | 2025 |

| Thermal | 2,123.40 | 2,296.84 | 2,485.05 |

| Electrochemical | 19,977.59 | 21,523.09 | 23,193.77 |

| Piezoelectric | 1,601.13 | 1,721.54 | 1,851.45 |

| Optical | 4,742.07 | 5,164.63 | 5,625.63 |

Application Insights

In terms of application, the agricultural sector is expected to witness the most rapid growth in biosensor adoption. The rising emphasis on sustainable farming practices and precision agricultural has increased the demand for tools that offer real-time monitoring of soil health, crop conditions, and pathogen presence. Biosensors provide farmers with timely data that allows for targeted pesticide use, optimal irrigation scheduling, and nutrient management, ultimately improving crop yields and reducing environmental impact.

These sensors are also gaining popularity for detecting contaminants and toxins in agricultural produce, assuring food safety from farm to table. The growth of smart farming technologies and IoT integration further supports the use of biosensors in this evolving application area.

Global Biosensors Market Revenue, by Application ( USD Million)

| Application | 2023 | 2024 | 2025 |

| Medical | 18,677.15 | 20,202.69 | 21,858.13 |

| Food Toxicity | 1,193.59 | 1,285.93 | 1,385.75 |

| Bioreactor | 1,875.45 | 2,016.49 | 2,168.66 |

| Agriculture | 2,936.61 | 3,189.15 | 3,464.25 |

| Environment | 2,483.76 | 2,692.00 | 2,918.40 |

| Others | 1,277.64 | 1,319.84 | 1,360.71 |

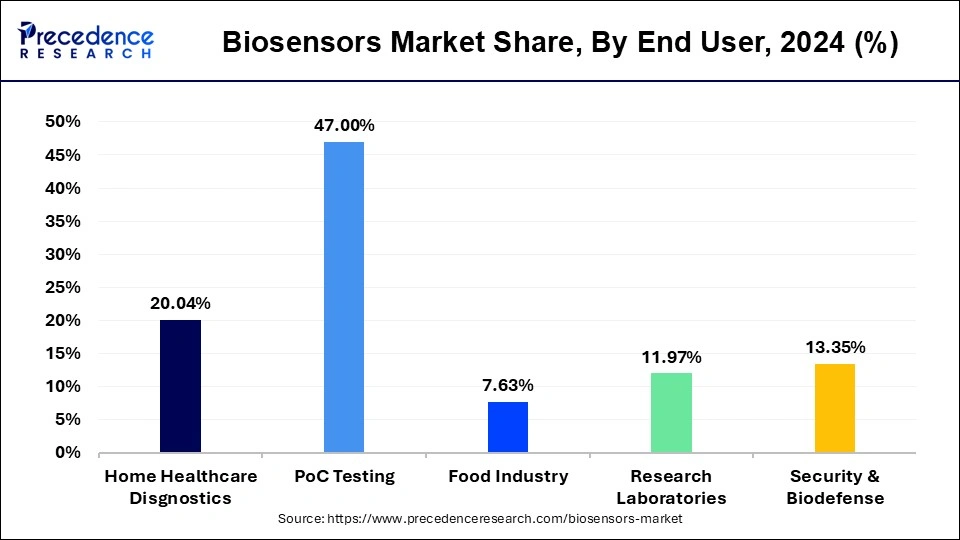

End User Insights

Among end users, the food industry is rapidly adopting biosensors for applications across safety testing, quality assurance, and supply chain monitoring. With growing consumer awareness and stringent regulatory standards, manufacturers are prioritizing the detection of pathogens, allergens, and chemical contaminants in food products. Biosensors offer quick, on-site testing capabilities, reducing the time and resources typically required for laboratory analysis. Their portability, ease of use, and real-time feedback are particularly beneficial for small to medium-scale food processing units. Additionally, biosensors are being integrated into packaging solutions to monitor freshness and spoilage, enabling smarter inventory control and reducing food waste. The food industry's shift toward automation and digitalization continues to drive the demand for bio-sensing technologies.

Their portability, ease of use, and real-time feedback are particularly beneficial for small to medium-scale food processing units. Additionally, biosensors are being integrated into packaging solutions to monitor freshness and spoilage, enabling smarter inventory control and reducing food waste. The food industry's shift toward automation and digitalization continues to drive the demand for bio-sensing technologies.

Global Biosensors Market Revenue, by End Use (USD Million)

| End Use | 2023 | 2024 | 2025 |

| Home Healthcare Disgnostics | 5,700.62 | 6,160.09 | 6,658.20 |

| PoC Testing | 13,369.92 | 14,476.40 | 15,678.25 |

| Food Industry | 2,170.88 | 2,355.23 | 2,555.85 |

| Research Laboratories | 3,405.23 | 3,661.32 | 3,937.61 |

| Security & Biodefense | 3,797.56 | 4,053.07 | 4,325.99 |

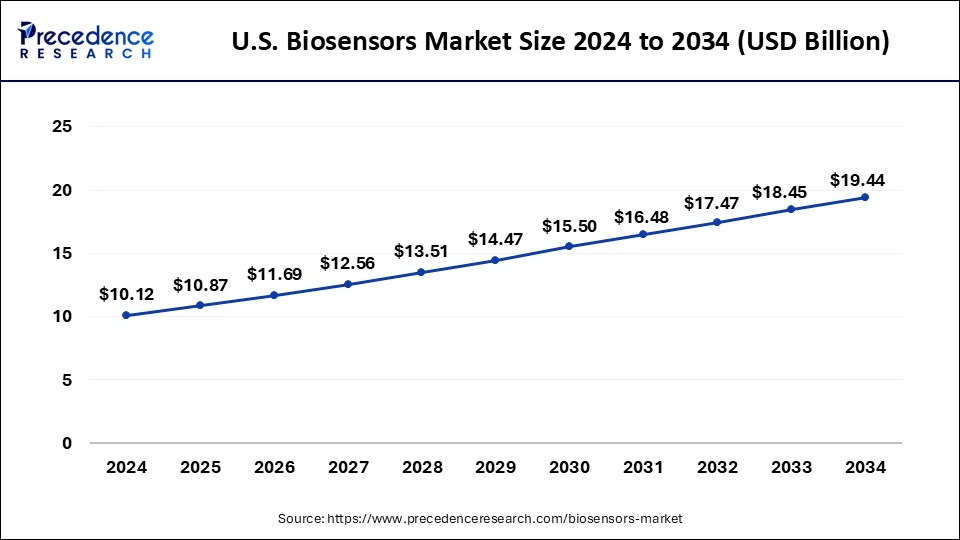

U.S. Biosensors Market Size and Growth 2026 to 2035

The U.S. biosensors market size was exhibited at USD 33.16 billion in 2025 and is projected to be worth around USD 64.54 billion by 2035, growing at a CAGR of 6.89% from 2026 to 2035.

North America dominated the biosensors market in 2025 with 39.33% revenue share. The factors such as rising prevalence of chronic disorders, growing health awareness among the consumers, expansion of healthcare sector, and technological advancements are driving the growth of biosensors market in the region. In addition, the biosensors market in North America region is being driven by growing healthcare expenditures. Moreover, market players are adopting various strategies for increasing their market share in biosensors market. For example, Nova Biomedical got Food and Drug Administration (FDA) approval for its Stat Profile Prime Plus device in point of care use in 2020.

North America Top countries

Pioneering Precision Sensing with Innovation

The U.S. is the central hub of biosensor innovation, housing major players and advanced regulatory support. Emerging market with growing adoption in agricultural and environmental biosensing. Manufacturing base for biotech and biosensor assembly due to tax incentives. It holds a leading position in the biosensor market, driven by strong R&D infrastructure, a robust healthcare system, and favorable reimbursement policies.

Canada has strong academic research backing and an increasing focus on portable diagnostics, driven by research-led advancements, particularly in biopharma and healthcare diagnostics. Canada benefits significantly from the presence of globally renowned biosensor manufacturers and frequent technological breakthroughs in diagnostics and point-of-care testing.

Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. The UK dominates the biosensors market in Europe region. In 2018, the International Diabetes Federation estimated that 32.7 million persons in Europe had diabetes. Thus, the growing prevalence of life related diseases are driving the demand for biosensors in Europe region. In addition, growing geriatric population is also driving the growth of biosensors market in this region.

- North America biosensors market size was valued at USD 12.12 billion in 2024 and it is expected to surpass around USD 23.64 billion by 2034.

- Europe biosensors market size was accounted for USD 7.31 billion in 2024 and is expanding at a CAGR of 6.9%.

- Asia Pacific biosensors market size was exhibited at USD 6.24 billion in 2024 and is projected to hit USD 12.74 billion by 2034.

Europe is the second fastest growing region due to living in a base that has strong regulatory frameworks, good quality healthcare systems, and early adopters of innovative diagnostic methods. Contributing heavily to this market growth is Germany, due to its advanced R&D capabilities and presence of biosensor manufacturers. With a concentrated effort on personalized medicine and supplying health from home, biosensors' integration into healthcare workflows has substantially increased.

Europe Major contributing factors

Empowering Sensing with Sustainability and Safety

- Growing need for non-invasive diagnostics in public health.

- Regulatory encouragement for green and sustainable technologies.

- Expansion of point-of-care devices for rural and ageing populations.

- Increased funding for biotech start-ups and research institutions.

- Rising adoption of wearable biosensors for chronic disease monitoring.

- Rapid technological expansion and adoption of biosensors, especially in environmental monitoring, food safety, and chronic disease management.

- Stringent regulatory standards and environmental policies are pushing industries to adopt biosensing solutions for real-time analysis.

Asia Pacific is the fastest moving region in the biosensors market due to rapid improvements in health care infrastructure, increased prevalence of chronic diseases, and rising point-of-care diagnostics demand. Countries like China and India are making large investments in biotechnology and digital health initiatives to accelerate the adoption of biosensors in clinical applications and with wearables. The rise in the number of government programs likely to bolster the region's momentum, combined with the rapid increase in medical device manufacturing.

Latin America:

In Latin America, the biosensors market is steadily progressing as healthcare modernization and digital diagnostics solutions take centre stage. Electrochemical biosensors remain the dominant technology, prized for their affordability, reliability, and adaptability across diverse medical and food safety applications. Wearable and non-wearable biosensor devices are gaining traction, with particular emphasis in point-of-care settings where portability and ease of use are crucial. Brazil and Mexico are leading regional activity, driven by their robust demand for efficient biosensing technologies. Across the region, demand is rising for diagnostics related to chronic diseases, environmental monitoring, and food safety. At the same time, innovation in wearable solutions and the integration of biosensors into remote healthcare tools are opening fresh pathways for growth and customer engagement.

Middle East and Africa (MEA)

In the Middle East and Africa, the biosensors landscape is evolving with heightened demand for electrochemical-based technologies, which hold a leading position due to their versatility in monitoring factors like metabolic indicators and environmental pollutants. Elevated prevalence of non-communicable diseases, such as cardiovascular conditions, combined with expanding infrastructure, is fuelling the adoption of biosensor-enabled diagnostics in hospitals and clinics. Governments are actively supporting advancements in healthcare through technology integration, positioning biosensors as a vital component of digital health strategies. In countries like South Africa, Saudi Arabia, the UAE, and Egypt, expectations are growing for biosensor-based solutions to become embedded in standard clinical workflows, enhancing diagnostics speed and reliability.

Biosensors Market Companies

- Bio-Rad Laboratories Inc.

- Abbott Laboratories

- Biosensors International Group Ltd.

- DuPont Biosensor Materials

- Pinnacle Technologies Inc.

- Johnson & Johnson

- Molecular Devices Corporation

- QTL Biodetection LLC

- TDK Corporation

- Zimmer & Peacock AS

Recent Developments

- October 2024- Bruker Corporation enhanced its biosensor capabilities by acquiring Dynamic Biosensors GmbH, a company renowned for pioneering single-cell interaction technologies. This acquisition bolsters Bruker's biophysical toolkit, combining Dynamic Biosensor's advanced single-cell interaction cytometry systems with its own high-throughput Surface Plasmon Resonance products. The expanded biosensors portfolio now supports more comprehensive molecular and cellular interaction analysis, position Buker as an enhanced technology leader for pharmaceutical and biotech drug discovery workflows.

- April 2025- Researchers have developed a cutting-edge optical biosensor utilizing a nano-pillar photonic crystal structure enhanced with gold nanoparticle amplification. This innovation enables the sensitive.

Segments Covered in the Report

By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

By Application

- Medical

- Cholesterol

- Blood glucose

- Blood gas analyzer

- Pregnancy testing

- Drug discovery

- Infectious disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

By End User

- Home Healthcare Diagnostics

- PoC Testing

- Food Industry

- Research Laboratories

- Security and Bio-defense

By Type

- Cholesterol

- Blood Glucose

- Blood Gas Analyzer

- Pregnancy Testing

- Drug Discovery

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting