Synthetic Biosensors Market Size and Forecast 2025 to 2034

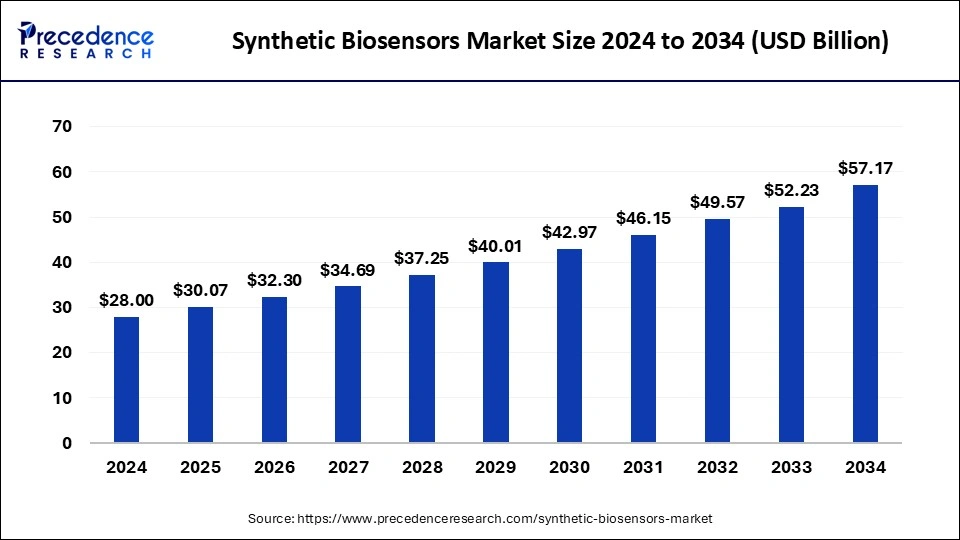

The global synthetic biosensors market size was calculated at USD 28.00 billion in 2024 and is predicted to increase from USD 30.07 billion in 2025 to approximately USD 57.17 billion by 2034, expanding at a CAGR of 7.30% from 2025 to 2034.

Synthetic Biosensors Market Key Takeaways

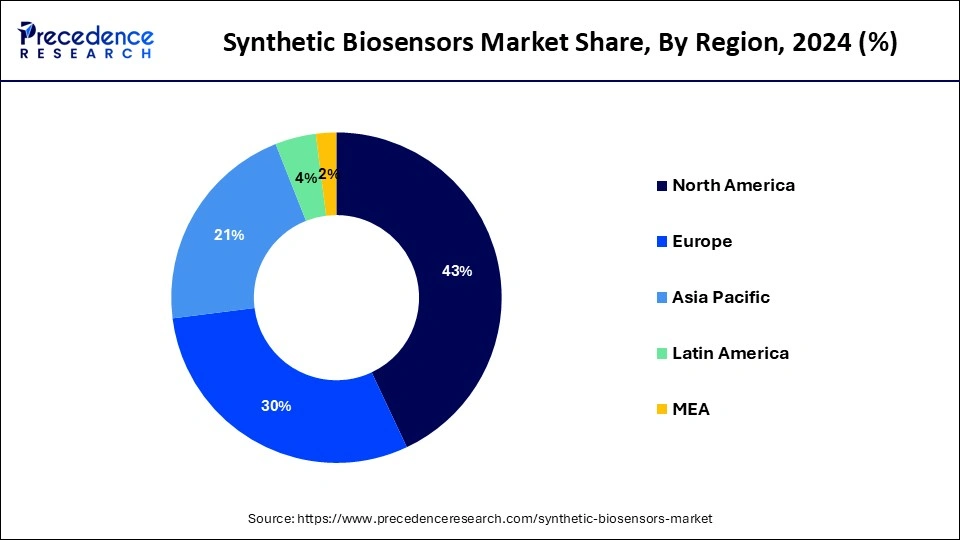

- North America led the global market with the highest market share of 43% in 2024.

- Asia-Pacific is expected to be the largest synthetic biosensor market from 2025 to 2034.

- By type, the embedded device segment is a major revenue-generating segment in the synthetic biosensors market from 2025 to 2034.

- The wearable synthetic biosensors segment is predicted to show the highest growth rate from 2025 to 2034.

- The home diagnostics segment is projected to show the highest growth rate during the forecast period.

- By technology, the electrochemical synthetic biosensors contributed the largest market share in the year 2024.

U.S. Synthetic Biosensors Market Size and Growth 2025 to 2034

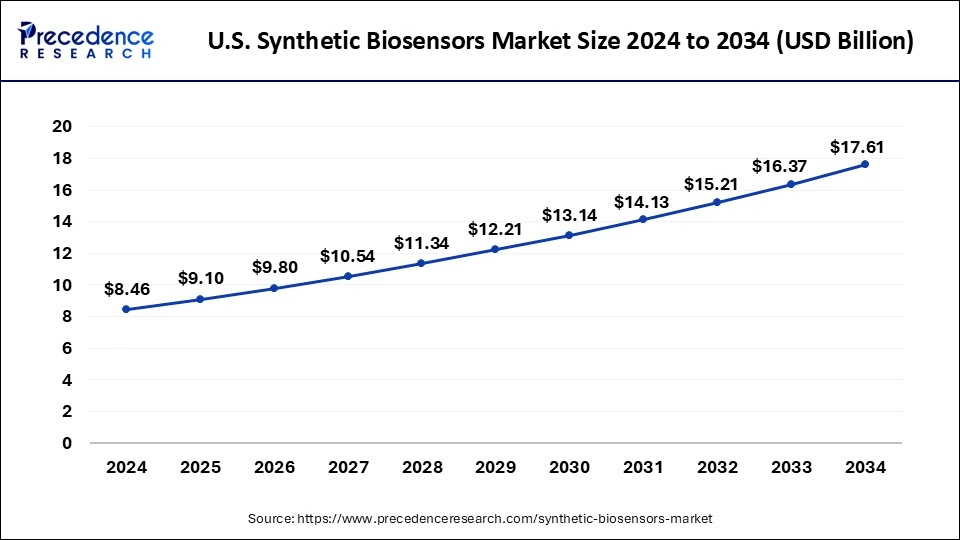

The U.S. synthetic biosensors market size was exhibited at USD 8.46 billion in 2024 and is projected to be worth around USD 17.61 billion by 2034, growing at a CAGR of 7.60% from 2025 to 2034.

North America is the dominating region in the synthetic biosensors market in the year 2024 owing to the growing prevalence of life-threatening diseases. The development and advancement of technology in the medical diagnostic industry a key factors driving the biosensor market in North America. The presence of medical institutes and pharmaceutical research and development organizations in North America is driving market growth in the region. The growing awareness of health problems, environmental hazards, and food toxicity in North America has driven demand for synthetic biosensors in the region. Technological developments and advancements in diagnostic devices in North America are driving the synthetic biosensors market.

Asia-Pacific is expected to be the largest synthetic biosensors market during the forecast period. The presence of a large population base and the increasing prevalence of lifestyle-related diseases are the key factors driving the market growth in the Asia-Pacific region. In 2019, new materials for vaccine production and medical facilities were added to the 2019 national incentive list. Asian countries like China are now encouraging investment in the health sector and creating infrastructure, opportunities for foreign investors to access preferential policies and tax rates. These policies are expected to attract several opportunities for the synthetic biosensor market in this region.

Synthetic Biosensors Market Growth Factors

The global synthetic biosensors market is anticipated to witness potential growth opportunities due to an increase in applications in various industries such as pharmaceutical, healthcare, food, agriculture, environment, and others. The increase in government investment in the health and pharmaceutical industries, the incidence of cardiovascular diseases, diabetes, and the increasing trend of self-monitoring are the key factors driving the global synthetic biosensors market during the forecast period. The major market players operating in the global biosensor market are focused on the production of cost-effective biosensor devices for accurate measurements. Additionally, the market players have huge growth opportunities due to the increasing applications of synthetic biosensors amid the global pandemic. Technological advancements in synthetic biosensors and developments in the field of nanotechnology are driving the expansion of the global synthetic biosensors market during the forecast period.

The main driving factors for the synthetic biosensor market include significant technological advancements in recent years, the emergence of nanotechnology-based synthetic biosensors, the rising usage of synthetic biosensors, the increase in the use of synthetic biosensors to monitor blood sugar levels in diabetic consumers, growing demand for home care devices during the COVID19 Pandemic, and increasing government initiatives towards diagnostics.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 30.07 Billion |

| Market Size in 2024 | USD 28.00 Billion |

| Market Size by 2034 | USD 57.17 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.30% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, Technology, Application, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Type Insights

By type, the embedded device segment is a major revenue-generating segment in the synthetic biosensors market and is expected to dominate during the forecast period. These devices are widely used in a wide range of applications such as point of care, home diagnostics, food and beverage, research laboratories, environmental monitoring, and bioremediation. With the rise of the Internet of Things (IoT) devices, there has been a massive shift in connected healthcare applications. IoT enables real-time alerting, tracking, and monitoring, enabling convenient treatment, greater accuracy, appropriate physician intervention, and better holistic patient care. Many medical facilities have started to adopt integrated solutions for IoT-enabled medical devices to solve the shortage of doctors in remote areas.

Product Insights

Depending on the product, the market is divided into wearable and non-wearable. The wearable synthetic biosensors segment is predicted to show the highest growth rate during the forecast period. Wearable synthetic biosensors have attracted considerable attention due to their potential to change conventional medical diagnoses and concepts of continuous health monitoring. Wearable biosensor applications aim to transform centralized hospital care systems into personalized home medicine and reduce healthcare costs and diagnostic times. Today, wearable synthetic biosensors are bringing a wave of innovation to society. The availability of this real-time data enables better clinical decisions and translates into better health outcomes and more efficient use of the health system. Wearable synthetic biosensors can help detect health events early and avoid hospitalization. Such events are expected to accelerate the growth of the wearable biosensor market.

Application Insights

Depending on the application, the market is divided into food & beverages, POC, research lab, home diagnostics, environmental monitoring, and biodefense. The home diagnostics segment is predicted to show the highest growth rate during the forecast period. The growth of the market is attributed to the growing development of the healthcare industry, the high adoption rate of new diagnostic methods, and the convenience of using medical devices at home. As a result, manufacturers in the domestic diagnostic market are expanding their production capacity. In addition, with the growing demand in the wearables segment and as lifestyle-related diseases increase in prevalence, there is huge potential for the biosensor market in the home diagnostics segment.

Technology Insights

Depending on the technology, the electrochemical synthetic biosensors accounted for the largest market share in the year 2021. Electrochemical synthetic biosensors are increasingly being used in non-medical applications, such as environmental monitoring; and also used in food and beverage quality inspection. Indirect monitoring via electrochemical synthetic biosensors can be performed for the analysis of organic pesticides or inorganic substances that interfere with the biocatalytic properties of the sensor.

Synthetic Biosensors Market Companies

- Abbott

- Roche

- Medtronic

- Bio-Rad Laboratories, Inc.

- DuPont

- Biosensors International Group, Ltd.

- Cytiva

- Dexcom, Inc.

- Lifescan IP Holdings, LLC

- Masimo

- Nova Biomedical

- Universal biosensors

Recent Developments

- In January 2021, Roche signed a Global Business Partner (GBP) agreement with Sysmex to provide hematology testing solutions. The new agreement aims to use IT systems to improve clinical decision-making and customer experience. This long and successful partnership continues to grow and bring hematology innovations to laboratories around the world.

- In December 2020, Abbott announced its next-generation sensor-based blood glucose monitoring technology, FreeStyle Libre 2, which has received Health Canada approval for adults and children (4 years). age or older) have diabetes.

- In December 2020, BioRad Laboratories announced the extension of a joint marketing agreement with Siemens Healthineers, in which BioRad will provide quality control products and the Unity Quality Control data management solution for the Solution Platform.

- In November 2020, Medtronic launched an integrated InPen with Guardian Connect CGM real-time data. The InPen is the first and only FDA-approved smart insulin pen on the market for consumers who receive multiple daily injections (MDI).

- In October 2020, BioRad Laboratories announced the global launch of the CFX Opus 96 and CFX Opus 384 real-time PCR systems, as well as BR.io, a data connectivity, management, and analysis platform.

- In September 2020, Medtronic received Food and Drug Administration (FDA) approval for its MiniMed 770G mixed closed-loop system. This all-new insulin pump system offers the company's most advanced SmartGuard technology, as featured in the MiniMed 670G system, with the added benefits of smartphone connectivity and an extended age indicator.

- In June 2020, Abbott and Tandem Diabetes Care completed an agreement to develop and commercialize integrated diabetes solutions that incorporate our world-leading Continuous Blood Glucose Monitoring (CGM) technology.

Segments Covered in the Report

By Type

- Sensor Patch

- Embedded Device

By Product

- Wearable Synthetic biosensors

- Non-wearable Synthetic biosensors

By Technology

- Electrochemical Synthetic biosensors

- Optical Synthetic biosensors

- Piezoelectric Synthetic biosensors

- Thermal Synthetic biosensors

- Nanomechanical Synthetic biosensors

By Application

- POC

- Home Diagnostics

- Research Labs

- Environmental Monitoring

- Food & Beverages

- Biodefense

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content