Synthetic Small Molecule API Market Size and Forecast 2025 to 2034

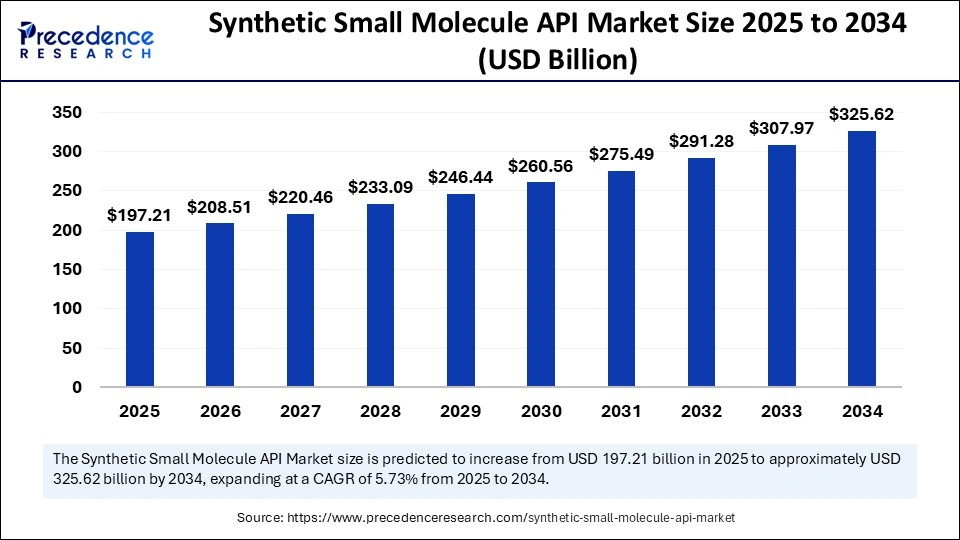

The global synthetic small molecule API market size accounted for USD 186.52 billion in 2024 and is predicted to increase from USD 197.21 billion in 2025 to approximately USD 325.62 billion by 2034, expanding at a CAGR of 5.73% from 2025 to 2034.The increased chronic disease prevalence and demand for personalized medicines are fostering the growth of the synthetic small molecule API market. Additionally, the rising need for cost-effective generic drugs is driving the market growth.

Synthetic Small Molecule API Market Key Takeaways

- In terms of revenue, the synthetic small molecule API market is valued at $ 197.21 billion in 2025.

- It is projected to reach $ 325.62 billion by 2034.

- The market is expected to grow at a CAGR of 5.73% from 2025 to 2034.

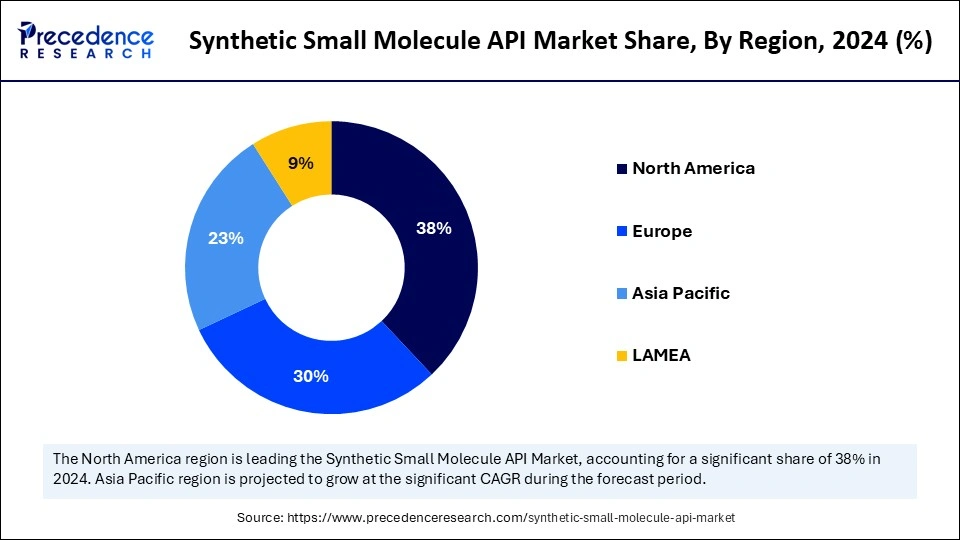

- North America held the largest revenue share of 38% in 2024.

- Asia Pacific is expected to grow at a CAGR of 6.72% between 2025 and 2034.

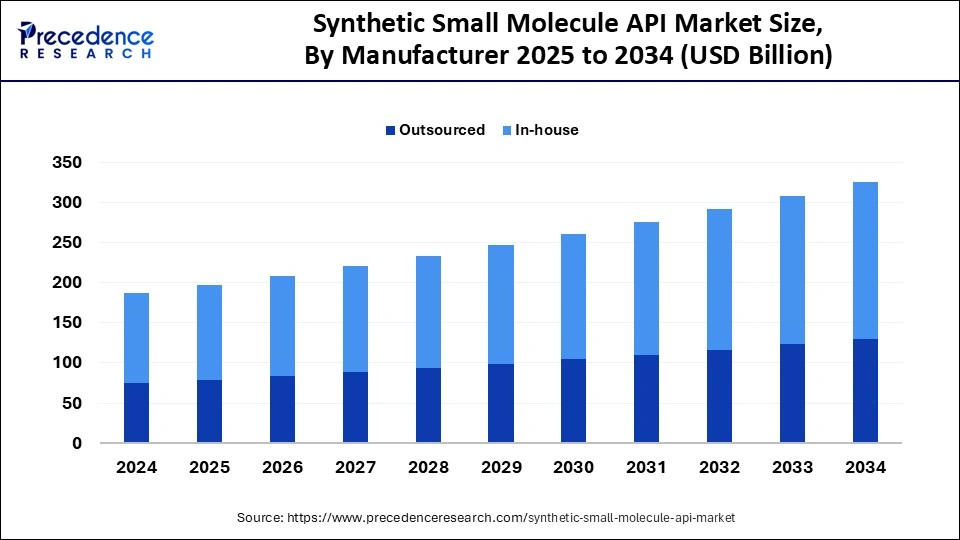

- By manufacturers, the in-house segment accounted for the largest revenue share of 60% in 2024.

- By manufacturer, the outsourced segment is growing at a CAGR of 5.84% from 2025 to 2034.

- By application, the cardiovascular diseases segment accounted for the largest revenue share of 22% in 2024.

- By application, the oncology segment is expected to expand at the highest CAGR of 7.51% during the forecast period.

How is AI Impacting the Development and Production of Synthetic Small Molecule APIs?

Artificial Intelligence plays a vital role in accelerating drug discovery, development, and production capabilities. In the production of synthetic small molecule API, AI plays a vital role in the identification of potential drug candidates, helping to reduce discovery costs and downtime. AI-driven predictive modeling and process optimization solutions enhance ADMET (Absorption, Distribution, Metabolism, and Excretion) and toxicity predictions, enabling more efficient, reliable, and safer drug candidates. AI also helps in the quality control process, enhancing purity and maintaining consistency in small molecule APIs. Pharmaceutical companies are increasingly investing in AI solutions to enhance process quality and efficiency and drive innovations.

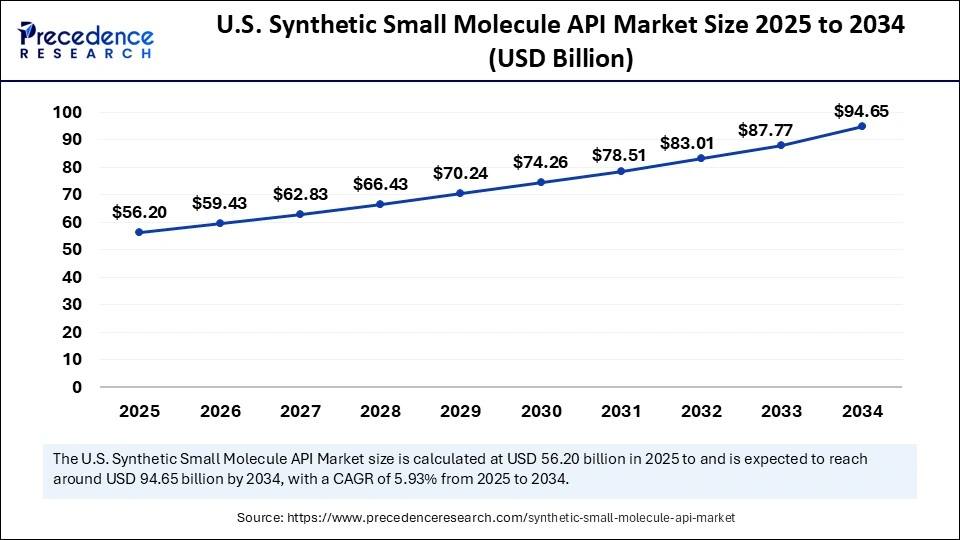

U.S. Synthetic Small Molecule API Market Size and Growth 2025 to 2034

The U.S. synthetic small molecule API market size was exhibited at USD 53.16 billion in 2024 and is projected to be worth around USD 94.65 billion by 2034, growing at a CAGR of 5.93% from 2025 to 2034.

How Does North America Dominate the Synthetic Small Molecule API Market in 2024?

North America registered dominance in the market by capturing the largest revenue share of 38% in 2024. The region's dominance is mainly attributed to the high prevalence of chronic disease, early adoption of advanced technologies, well-established pharmaceutical infrastructure, government support, regulatory approvals for innovative drugs, and significant investments in research & development. The region's efforts in bringing API production back to the U.S. bolstered the market growth. The region has a well-established pharmaceutical industry, facilitating rapid production of small molecule APIs.

The U.S. is a major player in the market. This is mainly due to the rising demand for generic drugs and affordable oncology medicines. A favorable regulatory environment and rising approvals for novel and innovative drugs further support regional market growth. Market players in the U.S. are focusing on enhancing their production capacity and supporting market growth. Moreover, there is a high demand for personalized therapies due to the rising burden of chronic diseases, which contribute to market expansion.

Recently, Bold Goals for U.S. Biotechnology and Biomanufacturing R&D has laid the foundation strategies by the Office of Science and Technology Policy (OSTP), to deploy cutting-edge synthetic biology and biomanufacturing in the U.S. within 5 years. The plan is expected to produce 25% of all APIs for small-molecule drugs in the country.

In May 2025, a U.S.-based Contract Development and Manufacturing Organization (CDMO) and Active Pharmaceutical Ingredient (API) supplier, Benuvia Operations, LLC, executed a multi-year supply agreement with a prominent U.S. pharmaceutical company to support Dronabinol API. The agreement is projected to enhance the development of a cannabinoid-based drug product to enhance patient access to advanced treatment solutions.

(Source:https://www.morningstar.com)

Asia Pacific Synthetic Small Molecule API Market Trends

Asia Pacific is projected to grow at the fastest CAGR of 6.72% in the upcoming period, driven by improvements in healthcare infrastructure, the rapid expansion of the pharmaceutical industry, and the rising prevalence of chronic disease. The demand for personalized medicine is rising in the region as a result of the increased burden of chronic diseases. This, in turn, creates the need for synthetic small-molecule APIs. Additionally, the presence of some well-known contract development and manufacturing organizations (CDMOs) and rising outsourcing of production to accelerate drug development contribute to market expansion.

China and India are emerging as major forces due to their high production of synthetic small molecule APIs and significant investments in pharmaceutical research. Chinese companies are focusing on ensuring that APIs meet stricter quality standards. Rising government investments in novel drug discovery and development further contribute to market growth.

European Synthetic Small Molecule API Market Trends

Europe is considered to be a significantly growing area. European pharmaceutical companies are leveraging cutting-edge technologies like computational modeling and high-throughput screening for the development of novel and innovative synthetic small-molecule APIs. The region's strong regulatory framework supports approvals for novel and innovative drugs, including small-molecule APIs. Well-established research institutions, strong pharmaceutical infrastructure, and increasing collaborations between pharmaceutical companies and research institutions are fostering innovation and the development of novel synthetic small-molecule APIs in the region. Ongoing focus on technological advancements in API synthesis, including enhancing efficiency and reducing cost burden, contribute to regional market growth.

Germany is a major player in the market, driven by its robust pharmaceutical industry, extensive research & development investments, and the presence of well-established CDMOs and pharmaceutical companies like Boehringer Ingelheim and Merck. France and the UK are also significant players in the market due to their strong focus on increasing local production, investments in API innovations, growing manufacturing capabilities, and collaboration between academic and clinical research institutions.

Market Overview

The synthetic small molecule API market is expanding rapidly due to factors like the increased prevalence of chronic disease, the growing aging population, and the need for effective treatments for age-related diseases. Increased generic drug consumption, driven by expiring branded drug patents and worldwide demand for cost-effective medications, also supports market expansion. Rising government investments in pharmaceutical research and advancements in oncology and targeted therapies are fostering the growth of the market. With rising healthcare spending and demand for novel therapies, the development of innovative synthetic small molecule API formulations is rising.

The surge in sustainable manufacturing practices and cost-effective innovations is changing the production aspects of pharmaceuticals. Additionally, ongoing investments in research & development, including synthetic small-molecule APIs, are opening growth avenues. Market key players like Cipla, Merck, Aurobindo Pharma, and Teva Pharmaceutical Industries continue to lead in the areas of innovation and strategic partnerships in the market, supporting market growth.

In April 2025, Ginkgo Bioworks signed a new contract with the Advanced Research Projects Agency for Health (ARPA-H), alongside partners Tritica Biosciences, US Pharmacopeia (USP), On Demand Pharmaceuticals, and Isolere Bio by Donaldson for a two-year program, Wheat-based High-efficiency Enzyme and API Technology (WHEAT). The program aims to establish a new manufacturing process for the distributed production of biological and small molecule active pharmaceutical ingredients (APIs) using wheat germ cell-free expression systems.

(Source:https://www.prnewswire.com)

What are the Trends in the Synthetic Small Molecule API Market?

- Chronic Disease Prevalence: The rising prevalence of chronic diseases, like cardiovascular disease, neurological disorders, and cancers, is driving the demand for effective therapeutics, contributing to the adoption of synthetic small-molecule APIs.

- Investments in Pharmaceutical Research & Development: Rising investments in pharmaceutical R&D aimed at developing novel synthetic small molecules further drive the market growth.

- Technological Advancements: Ongoing advancements in drug discovery technologies like high-throughput screening and computational chemistry for the identification and optimization of small-molecule APIs contribute to market growth.

- Aging Population: The growing aging population is creating the need for effective treatments for age-associated diseases, leading to the adoption of synthetic small-molecule APIs.

- Focus on Sustainable Manufacturing: Growing focus on sustainable and environmentally friendly manufacturing practices creates opportunities in the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 325.62 Billion |

| Market Size in 2025 | USD 197.21 Billion |

| Market Size in 2024 | USD 186.52 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.73% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Manufacturer, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Generic Drug Consumption

The consumption of generic drugs is increasing worldwide, driven by the increased prevalence of chronic disease and rising healthcare costs. The expiry of branded drug patents is encouraging key players to focus on producing APIs. The growing focus on healthcare affordability and accessibility is promoting the consumption of generic drugs, creating the need for synthetic small-molecule APIs. In addition, the rising geriatric population supports market expansion. Geriatric people are more prone to age-related chronic diseases, which leads to the demand for effective therapeutics. This, in turn, creates the need for synthetic small-molecule APIs for novel drug production.

Restraint

High Manufacturing Costs

The high manufacturing costs of synthetic small molecule APIs are a major restraint for the global market. The complex and lengthy process of API synthesis, purification, and isolation contributes to higher production costs. Stringent regulatory requirements, along with compliance with good manufacturing practices, lead to high manufacturing costs. Fluctuation in raw material costs also impacts the manufacturing cost. In addition, various pharmaceutical and biopharmaceutical companies are expanding their manufacturing facilities to meet the growing demand for biosimilar drugs, shifting focus away from small molecule APIs.

Opportunity

Rising Global Demand for Pharmaceuticals and Increasing R&D

With the increasing number of cases of chronic diseases, the demand for pharmaceutical products is rising, which creates immense opportunities in the synthetic small molecule API market. Synthetic small-molecule APIs are essential for the formulation of various pharmaceutical products, like medicines and injectables. Companies are focusing on improving manufacturing efficiency and reducing costs to provide innovative and affordable product developments. Moreover, rising investments in research and development, especially in oncology and rare diseases, open up new growth avenues for the market.

Manufacturer Insights

Why did the In-House Segment Dominate the Synthetic Small Molecule API Market in 2024?

The in-house segment dominated the market with the largest revenue share of 60% in 2024. This is mainly due to the increased manufacturers' focus on reducing outsourcing costs and maintaining strict regulatory standards. The in-house segment allows manufacturers to maintain greater control over quality. There is a heightened need for specialized expertise and affordable manufacturing solutions, encouraging pharmaceutical companies to invest in in-house production. Additionally, the rapid regulatory changes and requirements are making in-house manufacturing essential for pharmaceutical manufacturers.

The outsourced segment is expected to grow at a solid CAGR of 5.84% in the upcoming period. The growth of the segment is driven by the increasing demand for outsourced services. Pharmaceutical companies are outsourcing their small molecule API production to CDMOs. These organizations offer specialized expertise, accelerating the production of drugs and time-to-market. CDMOs boast expertise in every area, ensuring compliance with stringent regulatory standards. Moreover, outsourcing production enables pharmaceutical companies to focus more on core competencies.

Application Insights

What Made Cardiovascular Diseases the Dominant Segment in the Market?

The cardiovascular diseases segment dominated the synthetic small molecule API market by holding more than 22% of revenue share in 2024. This is mainly due to the increased prevalence of cardiovascular disease and the demand for effective therapeutic interventions. Synthetic small-molecule APIs are widely used in cardiovascular disease treatments, including heart failure, arrhythmias, and hypertension. Pharmaceutical companies are developing synthetic small-molecule APIs for personalized medicines, like targeted therapies, making them ideal for cardiovascular disease treatments. Ongoing investments in R&D for cardiovascular disease treatments lead to the development of new synthetic small-molecule APIs.

The oncology segment is poised to grow at a CAGR of 7.51% during the forecast period. The growth of the segment is attributed to the rising demand for target therapies for cancer treatments. The prevalence of cancer disease is boosting the demand for low-toxicity and high-potency drugs, driving the use of synthetic small-molecule APIs. Advancements in oncology research have led to the innovation and development of innovative APIs. Additionally, growing demand for specialized capabilities and outsourcing production to accelerate the development of novel cancer treatments support segmental growth.

Synthetic Small Molecule API MarketCompanies

- AbbVie, Inc

- Merck & Co., Inc.

- Bristol-Myers Squibb Company

- Cipla, Inc.

- Albemarle Corporation

- Boehringer Ingelheim International GmbH

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy's Laboratories Ltd.

- Aurobindo Pharma

- Teva Pharmaceutical Industries Ltd

Recent Developments

- In May 2025, Lonza, a contract development and manufacturing organisation (CDMO), launched its novel Design2Optimize platform to improve the development process and manufacturing of small-molecule APIs. (Source: https://pharmaceuticalmanufacturer.media)

- In May 2025, Eli Lilly and Company announced that it has doubled its investment in its Lebanon, Indiana, manufacturing site with a new USD 5.3 billion commitment, increasing the company's total investment in this site from USD 3.7 billion to USD 9 billion. This expansion will enhance Lilly's capacity to manufacture active pharmaceutical ingredients (API) for Zepbound (tirzepatide) injection and Mounjaro (tirzepatide) injection (Source: https://investor.lilly.com)

Segment Covered in the Report

By Manufacturer

- In-house

- Outsourced

By Application

- Cardiovascular Diseases

- Oncology

- CNS and Neurology

- Orthopedic

- Endocrinology

- Pulmonology

- Gastroenterology

- Nephrology

- Ophthalmology

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content