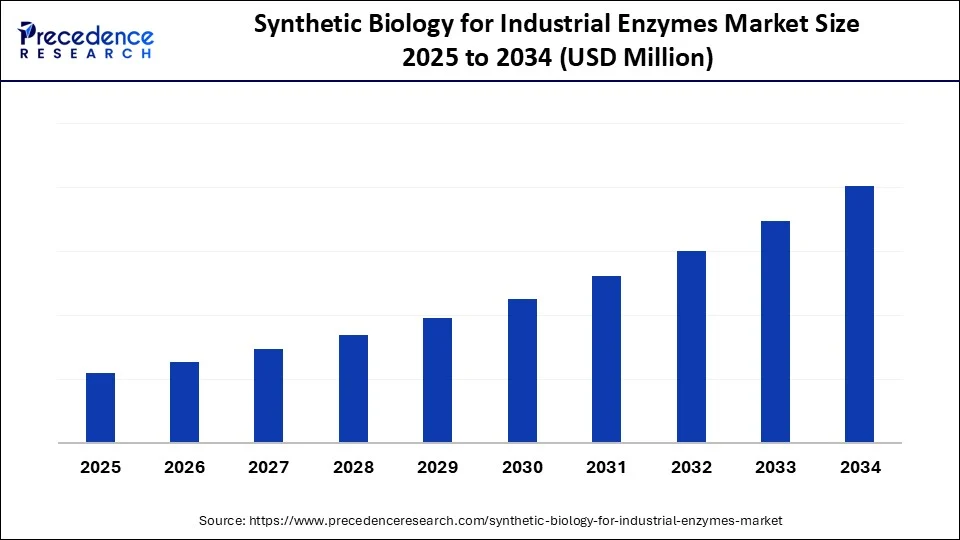

Synthetic Biology for Industrial Enzymes Market Size and Forecast 2025 to 2034

The synthetic biology for industrial enzymes market is witnessing growth as industries seek eco-friendly alternatives. Customized enzymes enable cleaner manufacturing, energy savings, and reduced environmental impact. The market is growing due to rising demand for sustainable, efficient, and cost-effective enzyme production across industries such as food, biofuels, and pharmaceuticals.

Synthetic Biology for Industrial Enzymes MarketKey Takeaways

- North America dominated the synthetic biology for industrial enzymes market in 2024.

- Asia Pacific is expected to grow at a notable CAGR during the forecast period.

- By product type, the enzymes segment held the largest share in 2024.

- By product type, the synthetic DNA segment is expected to grow at the fastest rate during the forecast period.

- By technology, the DNA synthesis segment captured the biggest market share in 2024.

- By technology, site-directed mutagenesis is expected to grow at the fastest CAGR during the forecast period.

- By application, the carbohydrase segment contributed the highest market share in 2024.

- By application, the biofuels segment is emerging as the fastest-growing during the forecast period.

- By end user, the pharmaceutical & biotech segment generated the major market share in 2024.

- By end user, the academic research segment is expected to grow at the fastest CAGR during the forecast period.

Impact of AI on Synthetic Biology for Industrial Enzymes Market

Artificial Intelligence is significantly transforming the synthetic biology for industrial enzymes market by accelerating the discovery, design of algorithms, combined with machine learning models, which can analyze vast datasets of genetic sequences, protein structures, and biochemical pathways to predict enzyme functionality with higher accuracy. As a result, the research and development cycle is shortened from years to months, which lowers expenses and speeds up commercialization.

By finding advantageous mutations enhancing enzyme stability in harsh industrial settings and customizing activity for uses in food processing, biofuels, and pharmaceuticals, AI further advances protein engineering.

- Additionally high high-throughput screening and data-driven decision making are made possible by AI-powered automation platforms, increasing the success rates of enzyme development. AI is becoming increasingly important as a bridge between synthetic biology research and large-scale industrial applications as industries look for efficient and sustainable bio-based solutions.

Market Overview

What Is Driving the Synthetic Biology for Industrial Enzymes Market Today?

Synthetic biology for the industrial enzymes market is being driven by the rising demand for sustainable, efficient, and cost-effective biocatalysts that can outperform traditional chemical processes. The use of enzymes created using synthetic biology is growing in industries like food and beverage, biofuels, detergents, textiles, and pharmaceuticals in an effort to increase yields, reduce energy use, and lessen environmental impact. High-throughput DNA synthesis. AI-assisted enzyme design and protein engineering are all making it possible to quickly tailor enzymes to industrial requirements, increasing their adaptability and commercial viability. Furthermore, increasing government backing for circular bioeconomy and green technology projects is speeding up adoption and investment, establishing synthetic biology as a major force behind industrial transformation.

Synthetic Biology for Industrial Enzymes Market Growth Factors

- Rising demand for sustainable solutions:Industries are shifting toward eco-friendly enzyme production to reduce reliance on chemical synthesis and minimize environmental impact.

- Advancements in gene editing and DNA synthesis:Tools like CRISPR and next-generation sequencing are accelerating the design of highly efficient, customized enzymes.

- Expansion of bio-based industries:Growing applications of enzymes in biofuels, bioplastics, and green chemicals are driving the adoption of synthetic biology.

- Cost reduction in enzyme manufacturing: Synthetic biology enables large-scale, low-cost production of enzymes compared to conventional fermentation methods.

- Strong investment and R&D funding:Increasing government initiatives and private investments in synthetic biology are boosting innovation in enzyme development.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Technology, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Industrial Application

Many industries, including food and beverage, textiles, detergents, agriculture, and pharmaceuticals, are embracing products in the synthetic biology for industrial enzymes market. These enzymes improve the specificity of reactions, shorten processing times, and use less energy, which increases the economics of industrial processes. They are also very well suited for extensive industrial use due to their resilience to adverse environments. Additionally, they promote new product development, such as low-sugar and lactose-free dairy products with increased consumer appeal. As industries expand internationally, enzyme adaptability is emerging as a crucial differentiator.

- In April 2025, eXoZymes announced the launch of BioClick, an enzyme engineering game changer.(Source: https://www.globenewswire.com)

Rising Demand in Healthcare & Biofuels

Synthetic biology enzymes are being utilized by the energy sector for the efficient production of biofuels and by healthcare companies for the production of biopharmaceutical diagnostics and precision medicine. Huge growth prospects are being created by the growing demand for biobased medications and renewable energy sources. The synthetic biology for industrial enzymes market will grow steadily over the next several years, thanks to this dual demand across important sectors. Additionally, enzymes are making it possible for advances in gene therapy and vaccine production, which will increase the uptake of healthcare. Engineered enzymes are enhancing nonfood biomass yields for biofuels, promoting global energy security.

- In 2024, Twist Bioscience and bitBiome announced a strategic collaboration offering one-of-a-kind enzymes for biocatalysis.

(Source: https://investors.twistbioscience.com)

Restraints

High Development Costs

Infrastructure, specialized talent, and a substantial investment in research and development are necessary for the development of products in the synthetic biology for industrial enzymes market. Advanced technologies like DNA synthesis, CRISPR, and high-throughput screening are still expensive, which makes it hard for smaller businesses to compete. Commercialization timelines are slowed down by these high entry barriers, and many startups depend significantly on outside funding to stay afloat.

- In March 2025, Epoch Biodesign secured $18.3 million in Series A funding to scale production of AI-accelerated plastic-degrading enzymes.

(Source: https://techcrunch.com)

Regulatory Challenge

Stringent and fragmented regulatory frameworks across regions delay enzyme commercialization, especially in sensitive sectors like food, agriculture, and healthcare. Companies must navigate differing biosafety standards, labeling rules, and approval pathways, adding time and cost to product development cycles.

- In March 2025, Merck filed a petition challenging a patent held by Halozyme Therapeutics regarding the Mdase enzyme used in a new injectable form of Keytruda, citing patent overbreadth. (Source: https://www.wsj.com)

Opportunities

Expansion in Biofuels and Bioplastics

Strong prospects are being created for the synthetic biology for industrial enzymes market by the global transition to sustainable materials and renewable energy. Engineered enzymes can increase biofuel production yields and make it possible to convert biomass into sophisticated bioplastics at a reasonable cost. Additionally, they are more efficient than conventional catalysts, which guarantees increased output and lower expenses. The global pledge to achieve carbon neutrality has made synthetic enzymes essential for upcoming material and energy transitions.

- In May 2024, Fermbox Bio launched EN3ZYME, a cellulosic enzyme cocktail to convert agricultural waste into 2G ethanol.

(Source:https://ethanolproducer.com)

Strategic Collaboration & Investments

Growing collaborations between biotech firms, academia, and industrial players are creating new opportunities for scaling innovation in the synthetic biology for industrial enzymes market. Partnerships accelerate research and development while unlocking new industrial applications. Increased venture capital interest and cross-industry alliances are fostering an innovation ecosystem that speeds up commercialization. These collaborations also reduce risk by sharing resources, infrastructure, and intellectual expertise among multiple stakeholders.

- In March 2025, Epoch Biodesign secured $18.3 million in Series A funding to scale AI-accelerated plastic-degrading enzymes.

(Source: https://techcrunch.com)

Product Type Insights

Why Did Enzyme Segments Lead the Market in 2024?

The enzyme segments led the product type in the synthetic biology for industrial enzymes market because they are widely used in detergents, food and drink, pharmaceuticals, and bio-based chemicals. For industrial use, they are essential due to their capacity to effectively and sustainably catalyze particular biochemical reactions. Businesses are using enzyme-based solutions more frequently in place of conventional chemical processes because they provide higher yields, lower costs, and environmentally friendly production techniques.

The synthetic DNA segment is witnessing the fastest growth, driving the development of customized enzymes with increased stability and activity, thanks to developments in specialty chemicals, pharmaceuticals, and biofuels. Because DNA synthesis is becoming less expensive and is used in CRISPR and other editing tools, synthetic DNA is a crucial component of the development of next-generation industrial enzymes.

- In 2024, Integrated DNA Technologies announced the opening of a new synthetic biology manufacturing facility in Coralville, Iowa, and launched a rapid gene synthesis offering. (Source: https://www.idtdna.com)

Technology Insights

Why Did the DNA Synthesis Technology Segment Dominate the Market in 2024?

DNA synthesis technology dominates the market since it serves as the foundation for enzyme engineering, enabling scientists to produce unique DNA sequences that code for unique enzymes. Businesses can quickly design and test several variants to find the most effective enzymes thanks to developments in automation and high-throughput synthesis. Its crucial function in permitting scalability and enhancing the performance of industrial enzymes serves to further solidify this dominance.

Site-directed mutagenesis is the fastest-growing technology, driven by its capacity to precisely alter enzyme structures to improve specificity, stability, and activity. It is being used more often in industrial enzyme optimization for uses in biofuels, agriculture, and pharmaceuticals. As the need for focused and economical enzyme development grows, this technology is becoming increasingly popular as a means of accelerating innovation.

Application Insights

Why Did the Carbohydrase Segment Make Up a Significant Portion of the Synthetic Biology for Industrial Enzymes Market in 2024?

The carbohydrases segment made up a significant portion of the application segment because they are widely used in textiles, animal feed, detergents, and the food and beverage industries. The brewing, baking, and starch processing industries greatly value them because of their capacity to convert complex carbohydrates into simpler sugars. Carbohydrases remain at the forefront of industrial enzyme applications due to the increasing demand for processed foods and effective production methods.

Biofuels represent the fastest-growing application segment as the global shift toward renewable energy accelerates. Enzymes that effectively convert biomass into bioethanol and biodiesel are being engineered thanks to synthetic biology, offering sustainable and affordable substitutes for fossil fuels. Investment in the development of biofuel enzymes is also being boosted by governments' push for cleaner energy and growing environmental concerns.

End User Insights

Why Did Pharmaceuticals & Biotech Lead the End-User Segment in the Synthetic Biology for Industrial Enzymes Market?

The pharmaceutical & biotech companies led the market because they make extensive use of synthetic biology tools for biomanufacturing, drug discovery, and enzyme production. Continuous innovation in enzyme engineering is driven by the need for precision medicine biologics and new therapeutics. Despite significant investments in R&D and partnerships with startups in synthetic biology, this industry continues to be the biggest consumer of industrial enzymes.

Academic research institutions are the fastest-growing end-user segment, driven by a rise in public and private investment in synthetic biology initiatives. Universities and research facilities are essential to the development of genome editing, protein engineering, and enzyme design technologies. Their contributions give the industry new enzyme prototypes and creative applications in addition to broadening the body of knowledge.

- In October 2024, the University of California, Irvine announced it had engineered a new enzyme capable of synthesizing synthetic genetic material.

(Source: https://news.uci.edu)

Regional Insights

Why Did North America Dominate the Synthetic Biology for Industrial Enzymes Market in 2024?

North America dominates the synthetic biology for industrial enzymes market owing to its substantial investments in synthetic biology startups, the presence of topenzyme manufacturers, and robust biotechnology infrastructure. The U.S. specifically is a center for innovation with government backing and industry-academia partnerships promoting extensive enzyme production for food, medicine, and biofuels. North America's dominance so further cemented by robust regulatory support and sophisticated R&D capabilities.

- In 2024, Integrated DNA Technologies announced a new U.S.-based synthetic biology manufacturing expansion to strengthen its North American operations.

(Source: https://www.idtdna.com)

Asia Pacific is the fastest-growing region, driven by the growth of the food processing and pharmaceutical industries, quick industrialization, and growing use of bio-based solutions. The need for sustainable industrial practices and the region's rising energy demand are also driving advancements in enzyme-based technologies. Additionally, government-backed initiatives and funding programs are fostering rapid advancements in synthetic biology research and commercialization across the region. Local startups and collaborations with global biotech players are further strengthening the Asia Pacific position as a key growth hub for industrial enzymes.

Synthetic Biology for Industrial Enzymes Market Companies

- Novozymes

- DSM-Firmenich

- IFF (International Flavors & Fragrances)

- Codexis

- Ginkgo Bioworks

- Amyris

- Twist Bioscience

- Zymergen

- Arzeda

- DNA Script

- Genomatica

- Creative Biogene

- Synthetic Genomics

- Creative Enzymes

- Eurofins Scientific

- Thermo Fisher Scientific

- Merck KGaA

- Illumina

- New England Biolabs

- Synthego

Recent Developments

- In April 2025, EnginZyme raised €6.4 million in Series A funding to scale its cell-free synbio technology

(Source: https://www.labiotech.eu) - In 2025, the University of Illinois Urbana-Champaign improved two industrial enzymes via an AI-guided auto biology lab, announcing that an AI-driven automated synthetic biology platform enhanced the activity of one enzyme by 16X activity and 90X greater substrate specificity.

(Source: https://news.illinois.edu)

Segments Covered in the Report

By Product Type

- Enzymes

- Carbohydrases

- Proteases

- Lipases

- Polymerases & Nucleases

- Other Enzymes

- Synthetic DNA

- Cloning Technologies & Kits

- Chassis Organisms

- Xeno-Nucleic Acids

- Others

By Technology

- DNA Synthesis

- Site-Directed Mutagenesis

- Cloning

- Bioinformatics

- Nucleotide Sequencing

- Microfluidics

- Other Technologies

By Application

- Food & Beverages

- Detergents

- Animal Feed

- Biofuels

- Textiles

- Pulp & Paper

- Other Applications

By End-User

- Pharmaceutical & Biotechnology Companies

- Clinical & Diagnostic Laboratories

- Academic Research Institutions

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle, East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting