What is the Biodefense Market Size?

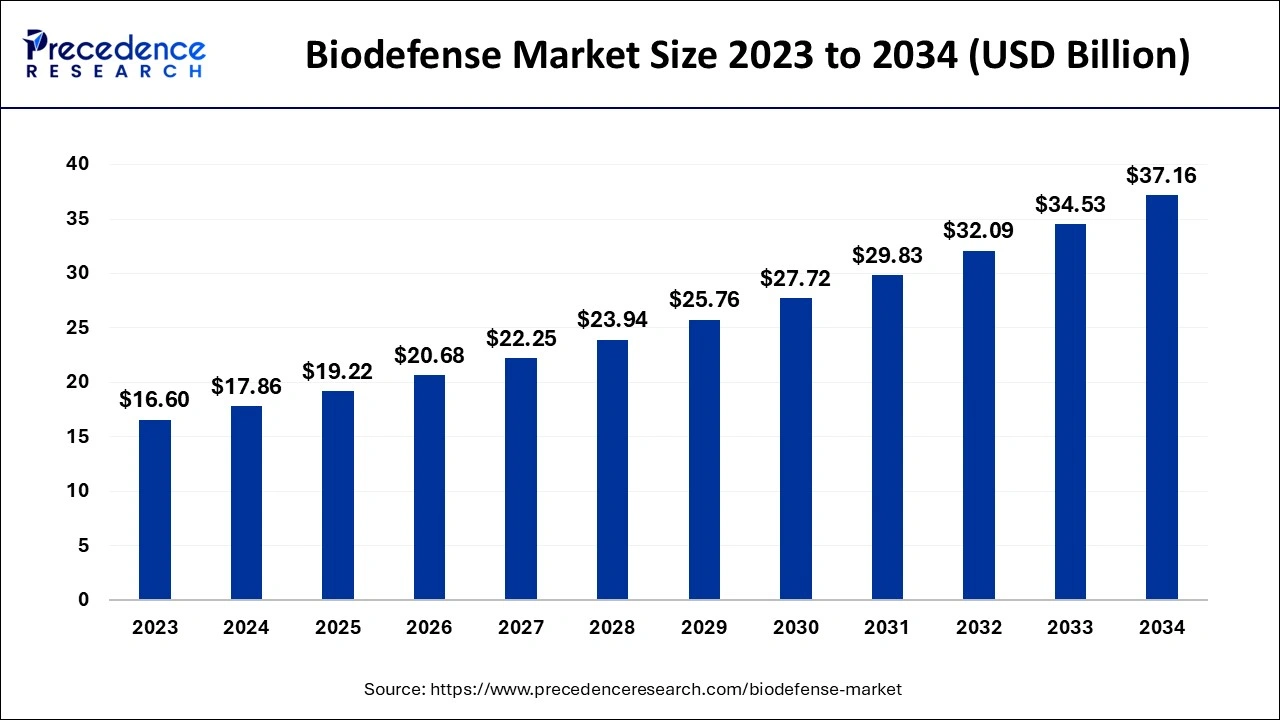

The global biodefense market size is estimated at USD 19.22 billion in 2025 and is anticipated to reach around USD 37.16 billion by 2034, expanding at a CAGR of 7.60% from 2025 to 2034.

Market Highlights

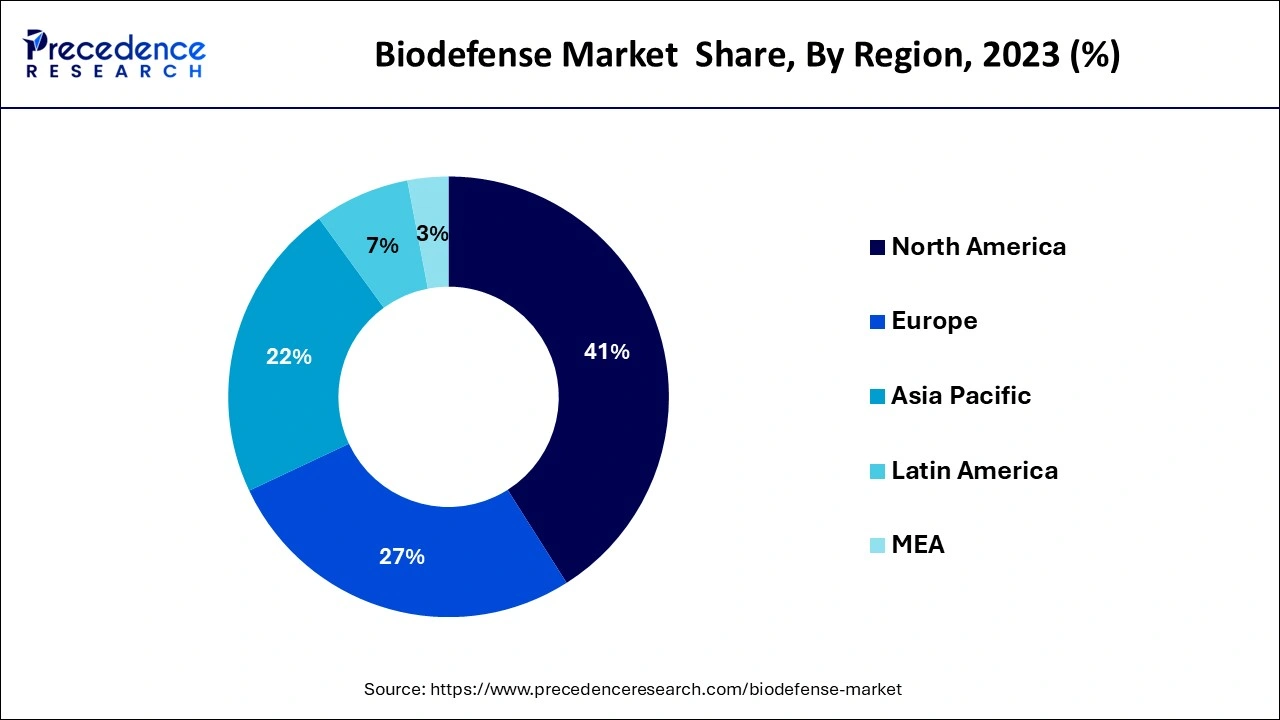

- North America dominated biodefense market in 2024.

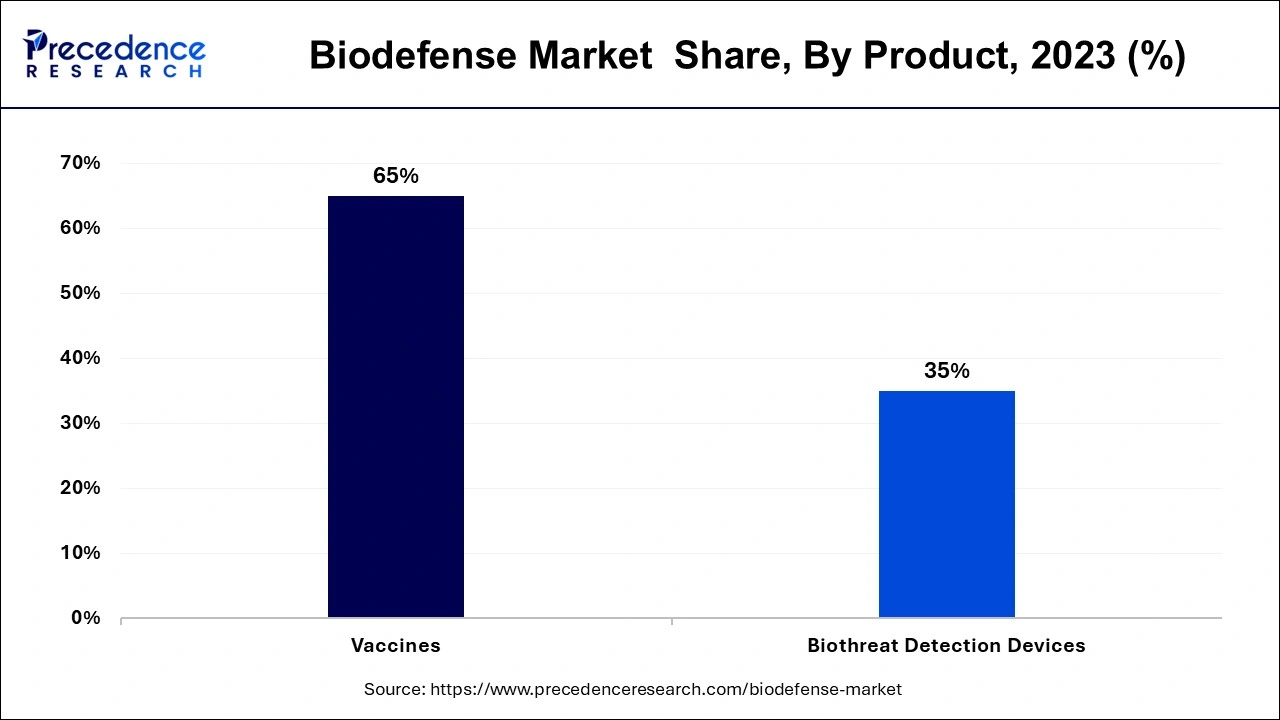

- By product, the vaccines segment dominated the market in 2024.

Market Size and Forecast

- Market Size in 2025: USD 19.22 Billion

- Market Size in 2026: USD 20.68 Billion

- Forecasted Market Size by 2034: USD 37.16 Billion

- CAGR (2025-2034): 7.60%

- Largest Market in 2024: North America

Market Overview

The deadly and naturally occurring viruses can now be easily modified to cause even more harm thanks to recent scientific advancements in the fields of genetic engineering and biotechnology. Furthermore, it is simple to access these organisms, making biodefense an essential component for nations all over the world. Anthrax, botulism, as well as chemical and radioactive agents, have all been employed as biological weapons in the past by bioterrorists to create major economic havoc. These occurrences compelled the creation of biodefense laws, agreements, and regulations by the government in order to defend against biological threats, lower risks, and prepare for, respond to, and recover from bio-incidents.

The National Institute of Infectious Disease has played a crucial role in developing medical products and strategies to counter bioterrorism and emerging and re-emerging infectious diseases by conducting ongoing research to diagnose, treat, and prevent them, whether they are intentional or naturally occurring since the anthrax bioterrorism act that was carried out in 2001 through the mail.

AI in the Market

Artificial Intelligence is transforming the biodefense market by improving detection, prediction, and response strategies against biological threats. AI-based algorithms analyze untapped huge datasets in search of new pathogens, and in the process, they shorten the time taken for designing vaccines and therapeutics, thereby also aiding in the research process. An AI determines the spread of an epidemic as well as the containment strategies in response to a crisis. Audits conducted by AI ensure the observance of biosafety and aim to harmonize regulatory standards across regions when it comes to governance. In this way, the applications end up building a more resilient, more efficient, and more globally coordinated biodefense ecosystem, thereby enhancing the national security and readiness of public health.

Biodefense Market Growth Factors

The factors that will drive the growth of the biodefense market include the rise in the number of naturally occurring outbreaks, the existence of supportive government initiatives, the increasing importance of disease surveillance missions to combat bioterrorism, the growing focus of public health services on the development of tests and procedures for the identification of biothreat agents, the growing threat of biological weapons and nuclear-armed ICBMs, and the growing threat of terrorism. Innovative technologies are being adopted widely in the sectors of nanotechnology, forensics, and biodefense-related drug development for the detection of infections, such as gene chips.

- Growing Incidence of Several Agents, Like the Flu, Zika Virus, And Others

- Increasing Investment from Private Players

- Increasing frequency of natural epidemics and the emergence of new infectious agents are driving the biodefense market in demand.

- Supportive government initiatives and strategic funding programs aim to enhance preparedness measures.

- A rise in priority being given to disease surveillance missions is causing the uptake of advanced diagnostic technologies.

- The greater bioterrorism threat and the potential misuse of biological weapons are pressuring countermeasure development investment.

- The deployment of emerging technologies related to nanotechnology, forensics, and drug development enhances biodefense capabilities.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 19.22 Billion |

| Market Size in 2026 | USD 20.68 Billion |

| Market Size by 2034 | USD 37.16 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.60% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered |

Product,Application,End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

Presence of favorable government initiatives in the U.S.

- Governments in industrialized nations, therefore, make a variety of efforts and adopt preventative steps to be able to survive these attacks. The government regularly keeps stocks of vaccines and bio-threat-detecting tools to protect the populace. High federal financing, technical breakthroughs, and rising public awareness are all credited with this. Major players being present in this area also bodes well for the market. According to Federal Research and Development (R&D) Funding, the Department of Defense (39.3%) and the Department of Health and Human Services (27.3%) got 96.3% of the total funding obtained by eight federal agencies during the 2017 fiscal year. It is projected to raise this amount to 48.4% of total funding for the DoD in 2019. The National Biodefense Strategy is in line with the U.S. 2018 National Security Strategy. The plan is to better the emergency response in the event of biological epidemics, encourage and promote biomedical innovation, and identify and contain biothreats at their source. These governmental measures are fueling the regional biodefense market.

The growing significance of biodefense

The market for biodefense is also being driven by the expanding importance of biodefense and the growing danger posed by hazardous biological agents that cause emergencies. For instance, Asia-Pacific is one of the most developed regions for biodefense due to the presence of well-established facilities for the development of vaccines there. Additionally, the country's market position is aided by the excellent healthcare infrastructure present there. To prepare for future biological dangers, nations like China and India are aggressively enhancing their R&D capacities. After the United States, China spends the second-highest proportion of its GDP on research and development. These are the elements that are anticipated to increase demand for biodefense.

Competition between market participants

The biodefense industry is characterized by intense competition. The quick uptake of cutting-edge technology for the creation of vaccines and medications is one of the main causes of boosting competition among market participants. Key firms are swiftly choosing strategic partnerships with governments in order to get large orders and boost sales volume in developing and economically advantageous locations. For speedier product introduction in the biodefense sector, many businesses are collaborating to create medications. For instance, a privately held medicationscompany named Ichor Medical Systems, Inc. stated in March 2019 that it had signed into a research license and partnership agreement with AstraZeneca for the development and clinical evaluation of plasmid DNA constructions (recombinant monoclonal antibody). Ichor will be given upfront and yearly compensation as well as developmental milestones under the terms of the agreement.

Key Market Challenges

- Low funding - Poor government funding for R&D activities in developing and underdeveloped nations as well as strict regulatory regulations are the factors that would restrain market expansion and present new challenges for the biodefense market over the aforementioned projection period.

Key Market Opportunities

- Growing focus on R&D - The protection of human health and the creation of a sophisticated biodefense system both heavily rely on the development of new technology. One of the key factors driving the expansion in the biodefense market is the continued rise in the number of clinical trials and rising R&D spending. For instance, Emergent BioSolutions and the US government inked a partnership deal in April 2020. This agreement was meant to facilitate the development of a plasma-derived therapy for COVID-19 patients. To support its COVID-HIG program, one of two hyperimmune development programs that Emergent announced, Biomedical Advanced Research and Development Authority (BARDA), a division of the Office of the Assistant Secretary for Preparedness and Response (ASPR) at the U.S. Department of Health & Human Services (HHS), awarded Emergent USD 14.5 million.

Segments Insights

Product Insights

The biodefense market is divided into two segments based on product: vaccinations and biothreat detection tools. The different types of vaccines include those for anthrax, smallpox, and botulism. As opposed to the further classification of biothreat detection tools into detectors/triggering devices, samplers, assays, reagents, and identifiers. Due to increased vaccine production worldwide to stop the spread of numerous diseases, the vaccine category among these held around 65% of the market in 2024. The development of the biodefense market will also be boosted by researchers' ongoing investigations into novel vaccination technologies, such as vector technology, that induce quick protection against pathogen attacks. A single oral dose of recently designed vaccines can trigger a long-lasting immune response and can treat a wide spectrum of bioterrorism agents.

Over the course of the forecast period, the biodefense market's other product segment is anticipated to grow at the greatest CAGR. Viral hemorrhagic fever, cholera, brucellosis, plague, food poisoning, tularemia, influenza, Zika, and Ebola are just a few of the viruses that are included in the "others" category. Since 2003, the Vaccine Research Centre (VRC), a division of the National Institute of Allergy and Infectious Diseases (NIAID), has focused on developing VHF vaccines, particularly those that protect against the Ebola and Marburg viruses. The U.S. Department of Defense (DoD) has given the University of Texas at San Antonio (UTSA) a contract to create a tularemia vaccine. Due to its highly contagious and occasionally lethal characteristics, tularemia has been developed as a bioweapon.

Many businesses are competing to create vaccines as a result of the recent spike in Zika and Ebola virus infections in numerous nations. The vaccine MVA-BN Filo, produced by Bavarian Nordic, protects against the Marburg and Ebola viruses, which are the two most common causes of viral hemorrhagic fever. The firm and the American NIAID have worked together on the vaccine's phase 3 clinical studies.

Regional Insights

U.S. Biodefense Market Size and Growth 2025 to 2034

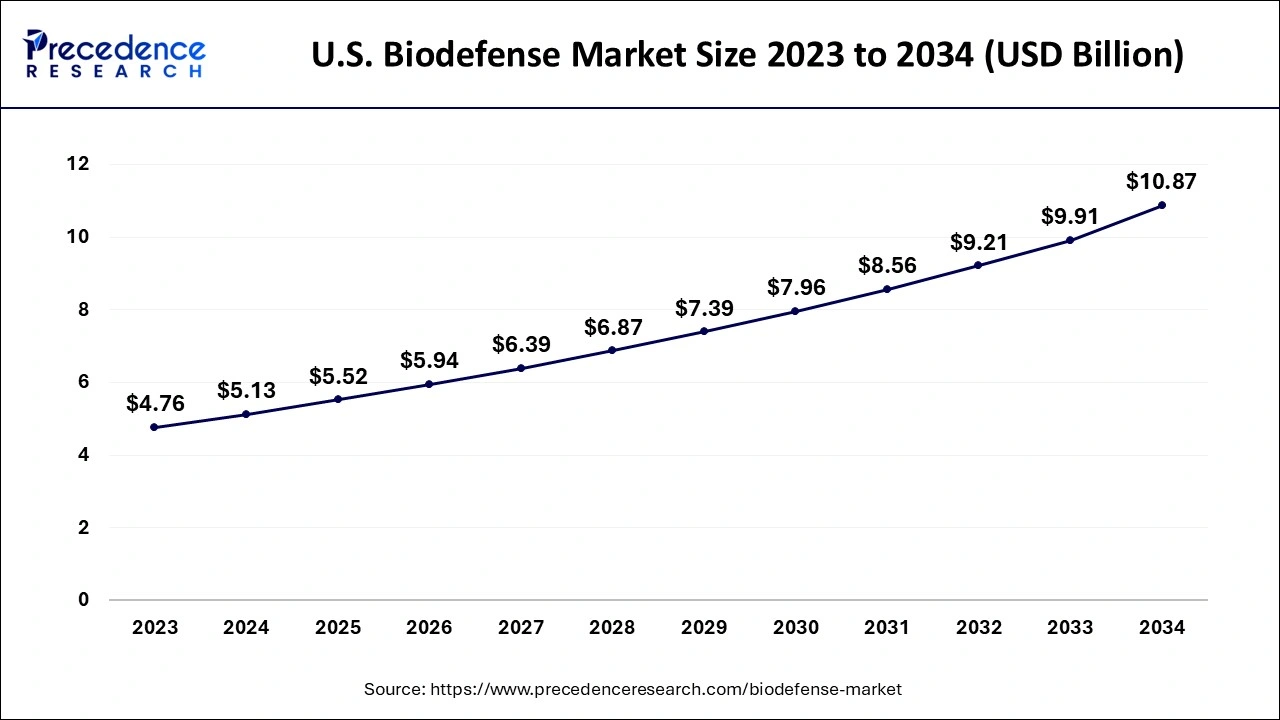

The U.S. biodefense market size is evaluated at USD 5.52 billion in 2025 and is predicted to be worth around USD 10.87 billion by 2034, rising at a CAGR of 7.80% from 2025 to 2034.

Due to the growing significance of biodefense and the growing danger posed by dangerous biological elements, the North American biodefense market, which accounted for over 41% of global revenue in 2024, is expected to expand significantly over the next years. Furthermore, with established vaccine production facilities, the United States has one of the most sophisticated biodefense markets in the region. The U.S. government also carries out a number of activities that aid in enhancing security against bioterrorism threats. The government plans a number of biodefense initiatives, including a program to combat infectious diseases including the pandemic flu. The regional market predictions will be boosted by other variables including expanding consumer awareness of biodefense and growing acceptance of technologically sophisticated products.

To help response efforts and improve readiness, many governments have been working with a number of international partners. For instance, the World Health Organization and DRC MoH have approved the experimental single-dose Ebola vaccine [rVSV-ZEBOV-GP] for safe usage. As of November 17, 2019, roughly 250,000 people who are at risk for contracting Ebola have received the vaccine. Many companies, including Bavarian Nordic and Ology Bioservices, are conducting research on the Ebola and Zika viruses in nations with weak medical infrastructure and little research capacity. Developed economies are contributing aid to these nations. In order to increase funding for acquiring, creating, and utilising medical countermeasures against biological, chemical, radiological, and nuclear (CBRN) warfare weapons, the Project BioShield Act was introduced. The market for biodefense is anticipated to expand as a result of the aforementioned factors as well as the increased risk of the prevalence of infectious diseases.

Value Cain Analysis

- R&D

This biodefense R&D-induced biological aims to understand agents, such as viruses and bacteria, to develop medical countermeasures-vaccines, diagnostics, and therapies-for naturally occurring infectious diseases and potential bioterrorist threats.

Key Players: Emergent BioSolutions, SIGA Technologies

- Clinical Trials and Regulatory Approvals

Clinical trials for biodefense are research studies that test and evaluate new medical countermeasures (MCMs), including vaccines, therapeutics, and diagnostics, that are aimed at protecting against chemical, biological, radiological, and nuclear (CBRN) threats.

Key Players: FDA, EMA, Emergent BioSolutions

- Formulation and Final Dosage-Administration

In biodefense, formulation and final dosage administration means stabilizing, manufacturing, and delivery of medical countermeasures (MCMs) against biological weapons.

Key Players: Biomedical Advanced Research and Development Authority (BARDA), U.S. Department of Defense

- Hospitals and Pharmacy Distribution

Distribution to hospitals and pharmacies for biodefense can refer to the rapid delivery and coordinated distribution of medical countermeasures (MCMs), including drugs and vaccines, to the public in response to a biological attack.

Key Players: STERIS, ASP International (Fortive), Ushio Inc

- Patient Support and Services

Patient support and services of biodefense refer to the comprehensive public health and medical infrastructure needed to diagnose, treat, and care for people affected by biological threats.

Key Players: National Institute of Allergy and Infectious Diseases, Centers for Disease Control and Prevention

Biodefense Market Companies

- Alexeter Technologies, LLC.

- Dynport Vaccine Company.

- ClevelandBiolabs.

- XOMA corporation

- Altimmune Inc.

- Emergent Biosolutions Inc.

- Dynavax Technologies Corporation.

- SIGA Technologies.

- Elusys Therapeutics Inc.

- Ichor Medical Systems.

- Bavarian Nordic.

- Ology Bioservices.

- Alnylam Pharmaceuticals Inc.

- Biosearch Technologies

- Bruker Detection

Recent Developments

- In September 2025, the Coalition for Epidemic Preparedness Innovations introduced a new Biosecurity Strategy to enhance global health security and combat emerging epidemic and pandemic threats. (Source: https://cepi.net)

- In July 2025, the UK reaffirmed its commitment to strengthening biosecurity, highlighting major milestones and strategic plans for the next 12 months, focusing on scientific innovation and international cooperation. (Source: https://globalbiodefense.com)

Segments Covered in the Report

By Product

- Vaccines

- Anthrax

- Smallpox

- Botulism

- Others

- Biothreat Detection Devices

- Samplers

- Detectors/Triggering Devices

- Identifiers

- Assays and Reagents

By Application

- Military

- Civilian

By End-User

- Hospitals & Clinics

- Ambulatory Care Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content