What is the Fiber Cement Market Size?

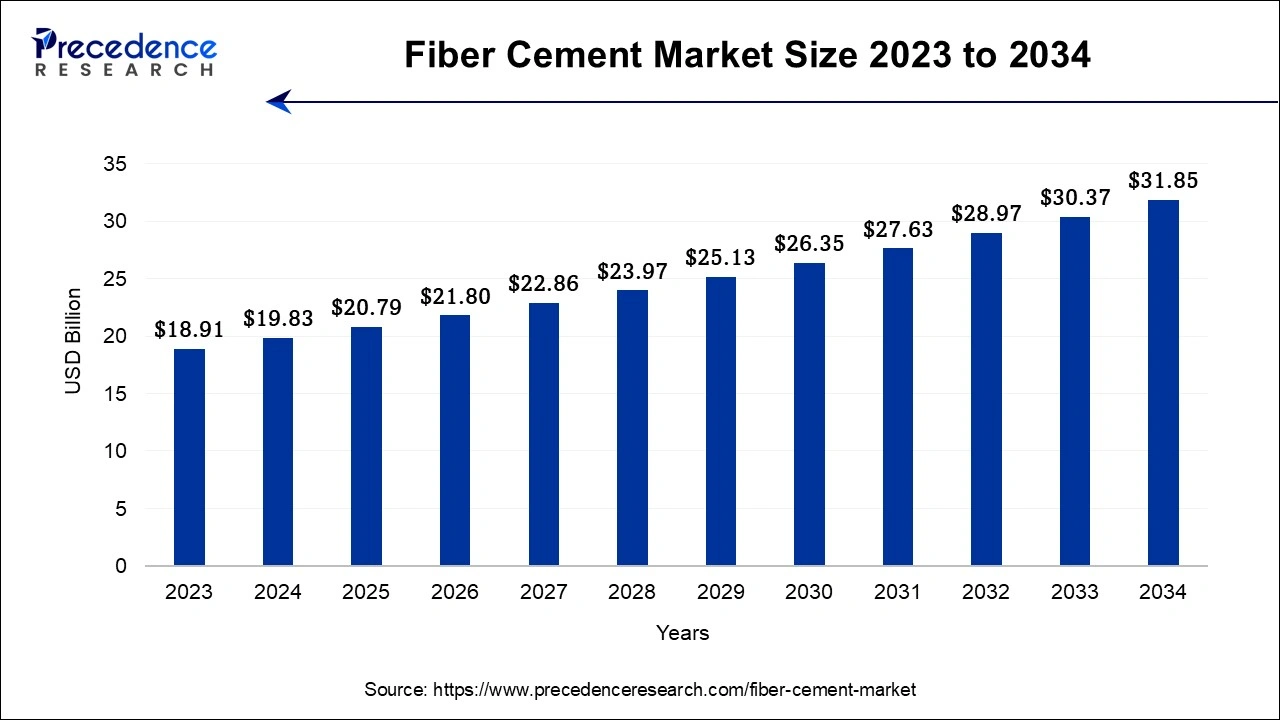

The global fiber cement market size is calculated at USD 20.79 billion in 2025 and is predicted to increase from USD 21.80 billion in 2026 to approximately USD 33.28 billion by 2035, expanding at a CAGR of 4.82% from 2026 to 2035.

Market Highlights

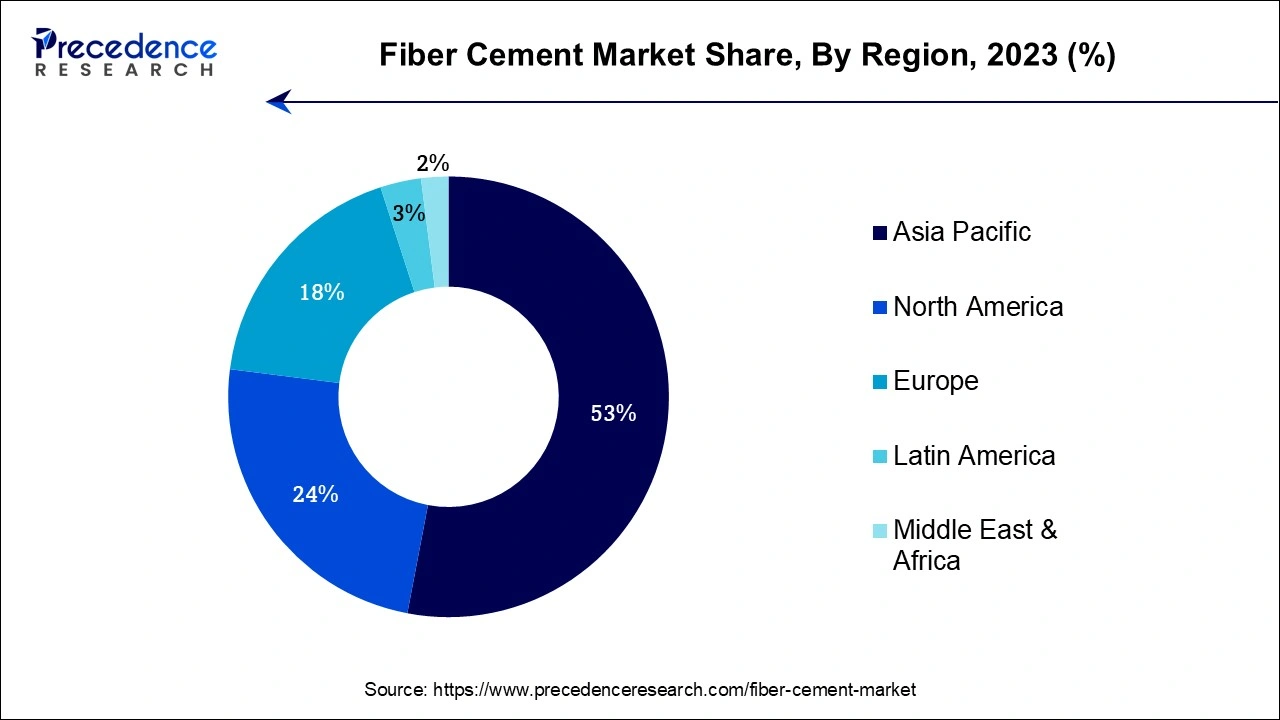

- Asia Pacific led the market with the highest market share of 53% in 2025.

- By raw materials, the Portland cement segment dominated the market with the largest market share in 2025. On the other hand, the silica segment is expected to witness a significant growth rate during the forecast period.

- By construction type, the siding segment dominated the market with the highest market revenue in 2025, the segment is expected to sustain its position during the forecast period.

- By end-user, the residential segment is expected to grow at robust pace during the forecast period.

Market Overview

Fiber cement is another advanced version of cement material, which is augmented by fiber material to make cement more effective and stronger. Fiber cement can be used in the development of strong and long-lasting construction materials. In recent times fiber cement is specialized and prominently used as cladding and roofing material. The commercial value, performance, and functional properties of fiber cement are observed to sustain its importance in the construction industry for the upcoming years.

Fiber cement requires low maintenance and is durable, the long-lasting property of fiber cement also acts as a significant factor for the application of fiber cement. There are some of the other significant properties of fiber cement such as it is not combustible in nature, it is water resistant and resistant to water damage. Moreover, the material is UV resistant and also resistive to wrapping and rotting. Such factors or properties contributed to the growth of the fiber cement market by highlighting its application for various end-users.

Fiber Cement Market Growth Factors

Fiber cement is being used in the various parts of the construction type, like the tiling backer board, or floor tiling base. Fiber cement tile backer board products are specially used in wet places such as bathrooms and kitchens due to its water resistance properties. The installation of the fiber cement backer board is very easy and can be directly installed on the stud wall. Rising construction activities across the globe along with rising requirement for sustainable material for construction activities across the globe acts as a growth factor for the market.

Fiber cement is also used as a cladding material and becomes the major alternative to wooden cladding, and PVC or vinyl. It is very durable and has lower maintenance as compared to the other cladding material. Fiber cement cladding is water-resistant and resistant to termites, woodpeckers, and other pests. The rising construction industry globally will enhance the growth of the fiber cement market in the upcoming period. The rising population and the economic development of the countries will tend to the rising commercialization in the world will result in the rise in the construction industry.

The increasing construction industry will result in a higher demand for durable and long-lasting materials for the stronger construction of the building. Various functional properties of fiber cement contributed to the growth of the fiber cement market. The adaptation of fiber cement in residential, non-residential, infrastructural, hospitality, etc. the growth of the residential segment highly contributed to the growth of the fiber cement market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 20.79 Billion |

| Market Size in 2026 | USD 21.80 Billion |

| Market Size by 2035 | USD 33.28 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.82% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Raw Materials, Raw Materials, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Aesthetic looks for construction

Homebuilders are focused on installing these adaptable panels in a variety of forms using fiber cement, which is utilized in homes all over the world. Fiber cement in combination with other products and materials can be successfully used to give texture and aesthetic interest to façade. Using various finishes and veneers provides home design with a dynamic appearance, whereas combining textures is considered to be an ideal way to add contrast to façade. As the demand for aesthetic appearance for construction increases, the market is observed to be accelerated.

Restraint

Environmental concerns in production

The production of fiber cement generates waste such as fly ash, cement kiln dust and other by-products that require proper disposal. Improper waste management can lead to soil and water contamination. Cement production and curing process requires significant water usage, which can strain local water resources and contribute to water scarcity issues. Thus, potential environmental issues caused during the production of cement acts as a restraint for the market.

Opportunity

Utilization of fiber cement sheets

A roof is an important part of a house that is intended to remain for decades, if not forever. Aside from being a functional home covering, a roof is also the first thing people notice from a distance. As a result, they must be visually appealing. Keeping this in mind, a fiber cement sheet emerges as a possible roofing solution. Fiber cement sheets are becoming increasingly popular among architects for a variety of reasons, including their ability to withstand weather changes even as they age. The components used to make fiber cement sheets are resistant to moisture, making it an appropriate roofing material for wet areas, one significant advantage of fiber cement over concrete tiles is that it is substantially lighter in weight. Moreover, the aesthetic look offered by fiber cement sheet is another factor for using such sheets in construction. Thus, the rising utilization of fiber cement sheets is observed to act as an opportunity for the market.

Segment Insights

Raw Material Insights

The Portland cement segment dominated the market with the highest share in 2025, the segment is expected to continue the trend in the upcoming period. Portland cement is widely being used in the manufacturing of buildings, bridges, dams, and pavements, etc. It is also used as plastering material, filler material, and floor surface smooth material. It is used for the smoothening of the surface of the floor. Portland cement minimizes pollution to the environment, so it will be beneficial for the manufacturers as well as consumers seeking a sustainable choice. It is cost-effective, so the construction cost of the building can be minimized due to the lower cost of cement. Portland cement carries crack-resisting property, it reduces the risk of cracking in buildings. All these factors highly contribute to the growth of the segment.

Construction Type Insights

The siding segment dominated the market with a higher market share in 2025. The growth of the segment is attributed to the increasing use of siding fiber cement for the increasing exterior look of the building. Fiber cement siding is the lower maintenance exterior of residential and non-residential buildings. Siding protects and helps to maintain the building from the exterior elements. Siding is a major application or type of fiber cement in both the residential and non-residential sectors.

Fiber cement siding is cost-effective and is generally made of wood pulp or fiber, fly ash, sand, clay, and Portland cement. The siding is durable, has fire resistance, and has pest protection. These properties contribute to the growth of the segment in the fiber cement market.

End-User Insights

The residential segment dominated the market with the highest market share in 2025. The growth of the segment is attributed to the rising use of fiber cement in the retrofitting of houses. The rising construction activities, especially in developing countries, promote the segment's growth. The requirement for durable and low-maintenance material for residential construction plays a significant role for the segment's growth.

On the other hand, the non-residential segment is observed to witness a significant growth during the forecast period. Fiber cement is generally used in commercial buildings like mills, factories, warehouses, etc. Nonresidential includes industrial, commercial, and agricultural buildings. The supporting regulations by the government bodies of the countries such as The United States, Canada, United Kingdom, etc. Is expected to boost the construction program in non-residential projects. Rising economic growth tends to the rise in the development in the construction industry which results in the growth of the segment.

Regional Insights

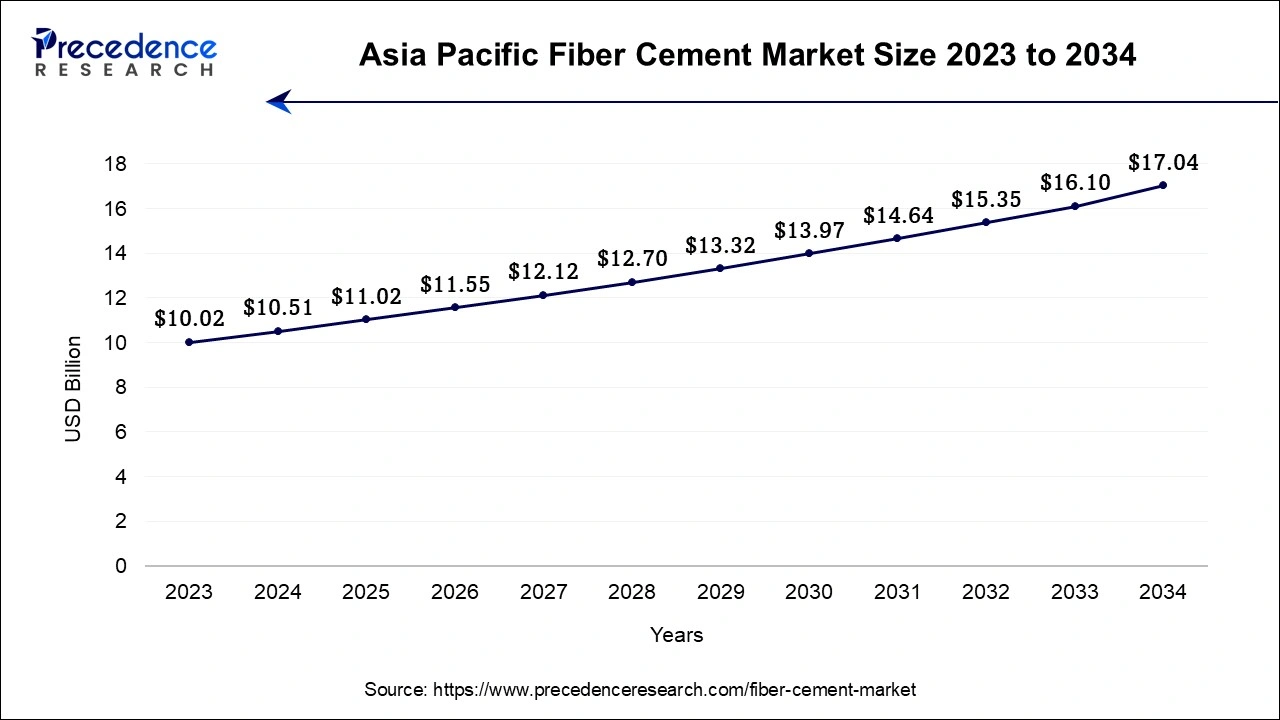

Asia Pacific Fiber Cement Market Size and Growth 2026 to 2035

The Asia Pacific fiber cement market size is estimated at USD 11.02 billion in 2025 and is predicted to be worth around USD 17.98 billion by 2035, at a CAGR of 5.02% from 2026 and 2035.

What Makes Asia Pacific the Dominant Region in the Fiber Cement Market?

Asia Pacific dominated the market with the largest market size in 2025, the region is expected to maintain its position throughout the forecast period. The growth of the market in this region is attributed to the rising population and the disposable income which tends to a significant growth in the real estate industry. The growing construction industry in commercial and non-commercial buildings results in the growth of the market in this region. The growing economies of the countries in the regions result in higher growth in industrialization and these contributed to the growth of the market across the region. In addition, the availability of raw materials, low-labor costs and potential players in the region drive the growth of the market.

How is the Opportunistic Rise of North America in the Fiber Cement Market?

North America is expected to witness significant growth in the market during the forecast period. Increasing industrialization and commercialization in the region will result in the growth of the market across the region. Moreover, substantial government support for the development of the construction industry in the region is observed to support the growth of the market.

What Potentiates the Market in Europe?

The fiber cement market in Europe is potentiated by stringent fire and energy regulations, which drive demand for safe, durable, and low-maintenance construction materials. Growing infrastructure development and renovation projects are increasing the use of fiber cement for facades, cladding, and roofing applications. Additionally, innovations that allow fiber cement to mimic natural materials like wood, stone, or brick provide architects and builders with design versatility while reducing maintenance costs, further boosting market adoption.

What Drives the Market in Latin America?

The fiber cement market in Latin America is driven by growing demand for cost-effective, durable, and quick-to-install housing solutions, suitable for both affordable and high-end construction projects. Major investments, such as Votorantim Cimento's USD 5 billion modernization and capacity expansion plan in Brazil through 2028, are enhancing production capabilities and supporting market growth. Additionally, increasing focus on sustainable and low-carbon building materials is further boosting the adoption of fiber cement across the region.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) presents immense opportunities in the fiber cement market due to rapid urbanization, large-scale infrastructure projects, and rising demand for durable, fire- and weather-resistant building materials suitable for hot and arid climates. The adoption of fiber cement for residential, commercial, and industrial construction is being driven by its low maintenance, long lifespan, and aesthetic versatility, including products that mimic wood, stone, or brick. Additionally, government initiatives promoting sustainable and energy-efficient construction are encouraging builders to use fiber cement, creating strong growth potential across the region.

Fiber Cement Market - Value Chain Analysis

- Feedstock Procurement : This primarily encompasses sourcing of Portland cement, finely ground silica sand, cellulose fibers, and water, as well as minor chemical additives.

Key Players: UltraTech Cement, Zillion Sawa Minerals Pvt. Ltd., James Hardie Technology Ltd., etc. - Quality Testing and Certification: This stage ensures performance standards through mandatory national schemes, such as India's BIS, i.e., ISI Mark for IS 14862, IS 14871, and voluntary systems, including France's NF/QB for asbestos-free products.

Key Players: TCR Engineering, Anacon Laboratories, RKCT Laboratory Pvt Ltd, etc. - Regulatory Compliance and Safety Monitoring

This mainly follows strict regulatory compliance, which emphasizes product standards and safety monitoring of workplace hazards, especially respirable crystalline silica and historical asbestos risks.

Key Players: Aleph INDIA, Omega QMS Pvt. Ltd., Aerem, etc.

Fiber Cement Market Companies

- PPG Industries Incorporated

- Akzo Nobel NV

- Canfor Corporation

- Ecolab Incorporated

- Central Fiber LLC

- Mercer International Incorporated

- US Silica Holdings Incorporated

- Dow Chemical Company

- Hardie (James) Industries Plc.

- Imerys SA

- Elementia SA de CV

- Building Materials Corporation of America

Recent Developments

- In November 2025, BirlaNu, a building-materials and home-solutions company, introduced to set up a greenfield fibre cement board plant in the Nellore district of Andhra Pradesh. (Source- https://economictimes.indiatimes.com)

- In January 2025, Cemvision, the Swedish green cement manufacturer, introduced the UK's first known commercial deployments of high-performing low-carbon cement at a Sunbury development of STOREX Self Storage.

(Source- https://www.worldcement.com)

Segments Covered in the Report

By Raw Materials

- Portland cement

- Silica

- Cellulosic Fiber

By Construction Type

- Siding

- Roofing

- Molding & Trim

By End User

- Non-Residential

- Residential

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Afric

Get a Sample

Get a Sample

Table Of Content

Table Of Content