What is the Flow Batteries Market Size?

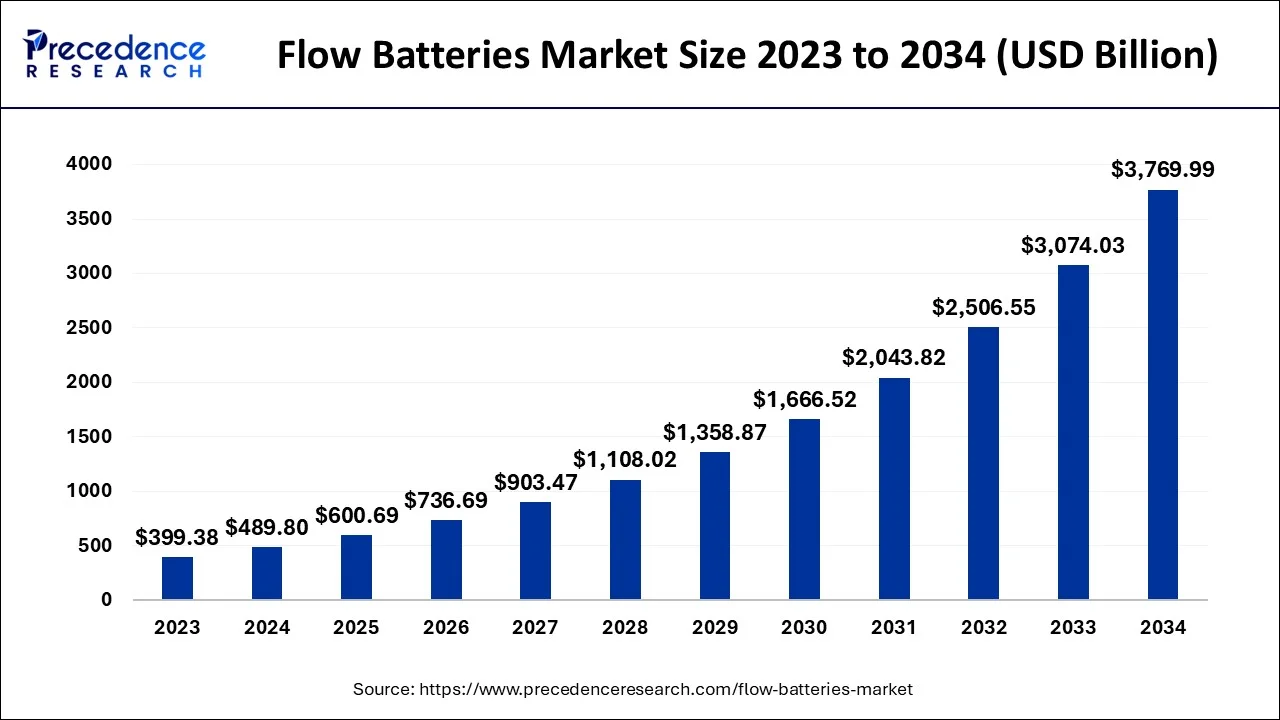

The global flow batteries market size is accounted at USD 600.69 billion in 2025 and predicted to increase from USD 736.69 billion in 2026 to approximately USD 4,465.95 billion by 2035, representing a CAGR of 22.22% from 2026 to 2035. A flow battery is a completely rechargeable electrical energy storage system in which fluids containing the active ingredients are pushed through a cell to promote reduction/oxidation on both sides of an ion-exchange membrane, producing an electrical potential.

Flow Batteries Market Key Takeways

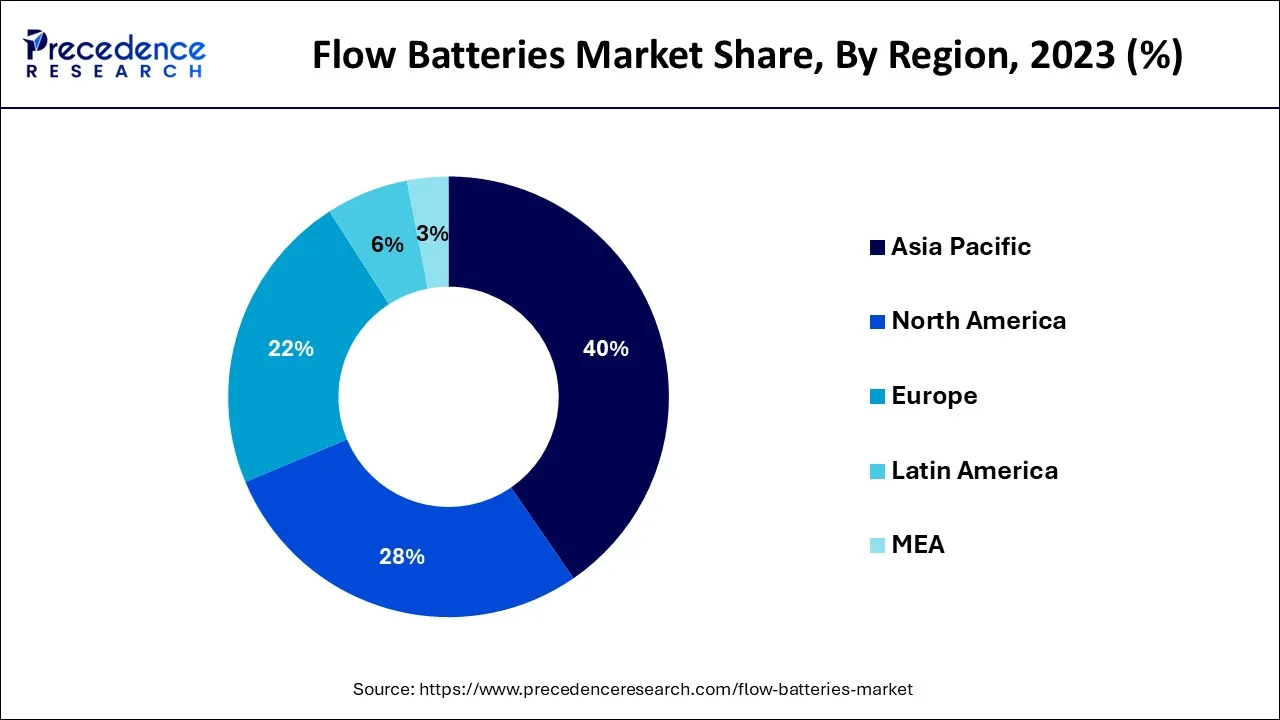

- Asia Pacific dominated flow batteries market in 2025.

- By Material, all vanadium segment dominated the market in 2025.

Flow Batteries MarketGrowth Factor

There is a greater requirement for energy backup due to the rising need for a consistent supply in all major nations. In the event of power outages or high demands, flow batteries serve as a backup power source. The flow is viewed as a replacement for lithium-ion batteries and fuel cells. One distinctive feature that sets flow batteries apart from other alternatives is their ability to be scaled up and recharged simply by adding the necessary amount of electrolyte. The functioning of flow batteries is more adaptable because of the capability of recycling wasted electrolytes in storage tanks. Other benefits provided by flow batteries are their long operational life and low maintenance requirements. The demand for these batteries has grown along with the introduction of renewable energy sources like solar and wind, which has a negative impact on the market for flow batteries. With green energy targets set by several developed and developing nations, this trend is expected to continue globally. Utility companies use flow batteries primarily for energy storage. A further benefit for utility-scale grid operations is the scalability of the flow batteries, which can increase their capacity by using a higher amount of electrolyte. This, along with another benefit of longer operation duration and longer life, acts as a market driver for the global flow battery market. Flow battery installations have risen globally as a result of the expanding use of solar and wind energy.

- The increase in investments in renewable energy sources and consumer acceptance of these sources.

- The market value will be further impacted by the inherent benefits of flow batteries and high storage needs in data centers.

- Rising demand from the utility sector

- The rise in telecoms tower deployments

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 600.69 billion |

| Market Size by 2035 | USD 4,465.95 billion |

| Growth Rate from 2026 to 2035 | CAGR of 22.64% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

|

| Regions Covered |

|

Market Dynamics

Key Market Drivers

High demand for the flow batteries in the utilities

- As they deal with the grid penetration of renewable energy, utilities are one of the early application areas for flow batteries. Flow batteries are perfect for prolonged discharge times in MW scale power increments in utilities. Besides. They transmit energy during the interruption of grid services while avoiding interrupted power supplies. The majority of flow battery installation projects globally to date serve utility needs. Government and business organizations have been enhancing the electric grid infrastructure recently to meet the increased demand for electrification in rural and urban regions. Given the increased need for power, the governments of numerous countries are likewise investing heavily in grid construction.

Key Market Challenges

High initial expenditure needed to manufacture flow batteries

- The flow battery has developed throughout time as a potential replacement for traditional batteries such as lithium-ion, lead acid, and sodium-based batteries. However, the high price of the flow batteries may serve as a significant barrier to the market's expansion. Components, materials, installation, repair, and maintenance costs are included in the flow battery's overall cost. These expenses are significant investments for small and medium-sized businesses. In addition, most flow batteries have rather expensive chemicals and parts compared to other traditional batteries.

Key Market Opportunities

The use of flow batteries in residential applications is expanding

- Due to its ability to lower greenhouse gas emissions and power costs, solar PV systems have seen a significant increase in popularity in residential applications over the past several years. Solar PV systems aren't ideal for grid integration because of the unforeseen variations that are produced in the energy they capture as a result of the sun's intermittent irradiance. In place of a solar PV system, a battery energy storage system is used. Homes and small companies may secure the most energy possible, save energy costs, and prevent blackouts thanks to flowing batteries. The flow batteries are particularly well suited for residential and commercial applications due to inherent characteristics including a high life cycle count, adaptability, and huge storage capacity.

Application Insights

Flow batteries are thought to be appropriate for utilities as well as commercial and industrial clients looking for long-term and lengthy hours of energy storage due to their big and hefty properties. Flow batteries are mostly used in utility applications as a buffer between the supply of energy from the electric grid and the demand for electricity. Since flow batteries can reliably store and discharge power, utility owners may reduce the amount of excess electricity produced. Additionally, utilities need batteries that can handle a significant penetration of renewable energy throughout the grid and are durable, robust, and long-lasting. The focus on improving the electric grid systems has increased due to the rising demand for power in rural and urban regions, which is likely what will lead to the adoption of flow batteries in utility applications.

Blackouts interrupted power supplies, and machine downtime all have an influence on commercial and industrial applications, which can severely hinder corporate operations since they can harm production lines, delay deliveries, and cause product damage. Unexpected power outages in certain places might persist for a minute, an hour, a day, or even a week. Here, flow batteries are essential because they save energy costs for commercial and industrial businesses while also enhancing power quality and dependability. Additionally, they lessen the chance that output may be lost during blackouts or power supply shortages. Battery storage systems make it easier to deploy renewable energy systems that provide affordable, environmentally friendly power and generate income by selling any extra energy or grid-stabilizing services.

Material Insights

The market is divided into All-Vanadium, Iron, Zinc-Bromine, Hydrogen-Bromine, Polysulfide Bromine, Organic, and Others based on the kind of material used. Vanadium is anticipated to expand at a 22.4% CAGR and reach US$819.7 Million. Vanadium electrolyte, which is present in the majority of flow batteries, may deliver dependable charging and discharge for numerous cycles without degradation. Vanadium's electrochemical characteristics, which make it simple to take electrons out of the element and then put them back in, make this possible. Vanadium redox couples (V2+/V3+ in the negative and V4+/V5+ in the positive half-cells) are used in the vanadium redox flow battery (VRFB), a suitable redox flow battery (RFB), to store energy. These batteries' power and energy ratings are independent of one another, and each may be tailored specifically for a certain application. Numerous nations have continually concentrated on expanding energy demand without any fluctuation, leading to the installation of numerous energy storage devices in independent and renewable energy systems. The country with the greatest commercial success in renewable energy is China, which in 2020 deployed 1.6 GW of energy storage. Other nations also have a number of new technology energy storage projects planned. At its electrolyte manufacturing plant in Arkansas, United States, U.S. Vanadium started the capacity expansion project in September 2021 to produce Ultra-High-Purity Vanadium Redox Flow Battery Electrolyte. A USD 2.1 million investment was made in the project. The program is anticipated to have an impact on the entire region's sales of vanadium redox batteries.

The commercial effects of the pandemic and the economic crisis it caused have been carefully examined, and the growth of the ZINC-BROMINE segment has been readjusted to a revised 24.1% CAGR over the following seven years. Currently, this sector holds a 23.1% market share for flow batteries worldwide. The market for vanadium-based flow batteries is predicted to expand rapidly as a result of the battery's unique benefits, particularly for large stationary applications. The leading energy storage technology is vanadium redox flow batteries, which are in great demand in the mini-grid, utility, and off-grid sectors. Since most manufacturers choose zinc-bromine over vanadium due to the latter's high price and restricted availability, zinc-bromine is predicted to see rapid development. Additionally, grid, residential, industrial, commercial, and microgrid applications have all seen an increase in the utilization of zinc-bromine flow batteries in the past.

Regional Insights

Asia Pacific Flow Batteries Market Size and Growth 2026 to 2035

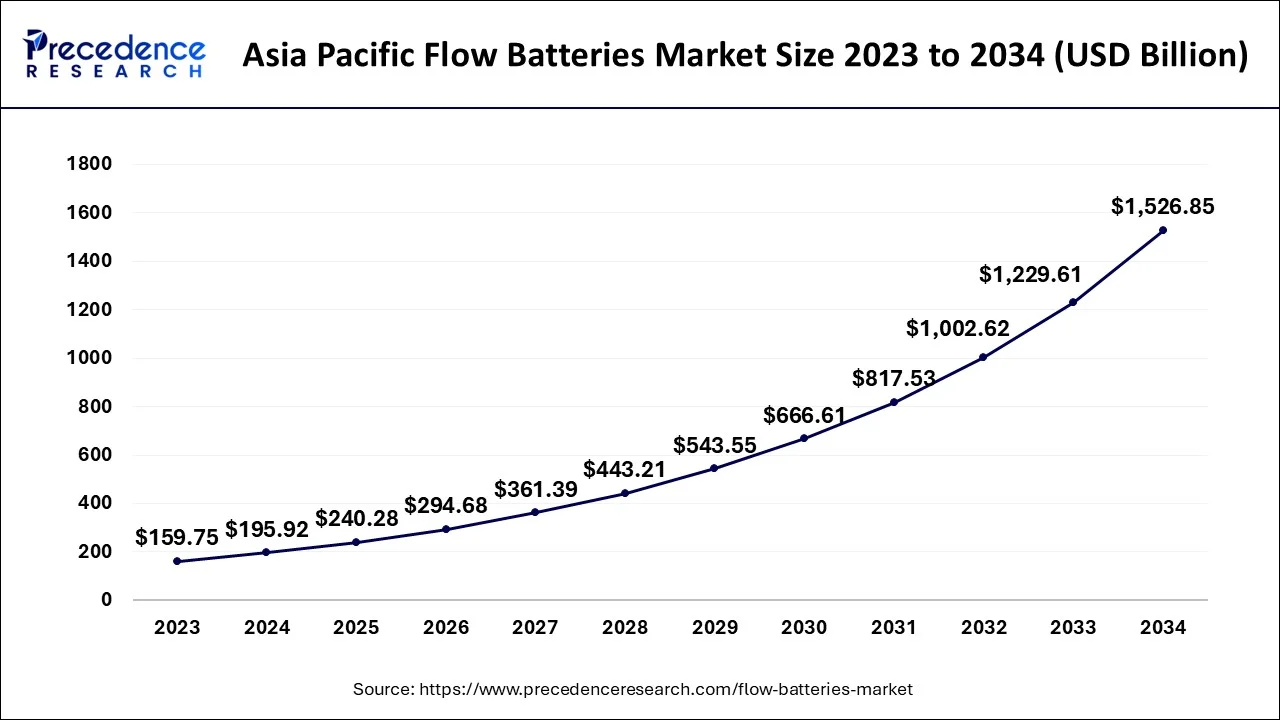

The Asia Pacific flow batteries market size is estimated at USD 240.28 billion in 2025 and is expected to be worth around USD 1,824.09 billion by 2035, rising at a CAGR of 22.47% from 2026 to 2035.

The flow battery market in the US was projected to grow to US$ 63 million in 2025. The country now controls 20.6% of the global market. Over the course of the study period, it is expected that China, the second-largest economy in the world, would expand at a considerable CAGR reaching an estimated market size of US$162 million in 2033.

Two other important regional markets are Japan and Canada, with growth rates of 19.6% and 21.3% expected for each throughout the length of the inquiry. Germany is projected to grow within Europe at a pace of around 21.4% CAGR, and by the end of the research period, the market in the rest of Europe will be worth US$213.8 Million. Numerous flow battery-based systems with higher power ratings may be found in the Asia-Pacific area. Australia has the most flow battery-based projects in operation for its residential, utility, commercial, and industrial uses, while China has installed the most flow batteries to date with the highest capacity. One of the main factors propelling the market for flow batteries in the area is the necessity to store renewable energy.

What Made Asia Pacific the Dominant Region in the Market?

Asia Pacific dominated the flow batteries market with the largest share in 2024. This is mainly due to large-scale renewable energy integration, grid modernization initiatives, and rising investments in long-duration energy storage. Countries across the region are focusing on adding solar and wind capacity, creating strong demand for flow batteries for utility-scale storage, microgrids, and industrial energy management. Government-backed energy transition programs and cost-sensitive grid applications further support regional market growth.

China

China holds a dominant position in the Asia Pacific flow batteries market because of its aggressive renewable energy goals and strong domestic manufacturing capabilities. The country leads in vanadium redox flow battery installations, supported by government funding, pilot projects, and involvement of state-owned utilities. China's focus on grid stability, peak shaving, and energy storage localization continues to speed up commercial-scale adoption.

What Potentiates the Growth of the Flow Batteries Market within North America?

The market in North America is driven by grid resilience needs, renewable integration, and policies for long-duration energy storage. Utilities and independent power producers are increasingly using flow batteries for load balancing, renewable firming, and backup power. The region also benefits from strong R&D efforts, supportive regulatory systems, and growing interest in non-lithium battery options for stationary storage.

U.S.

The U.S. is a significant player in the North American flow batteries market, driven by pilot projects, utility-scale demonstrations, and federal backing for advanced energy storage. Flow batteries are increasingly used in grid-scale renewable integration, data centers, and microgrids. Supportive policies, funding from energy agencies, and concerns over lithium supply chains are enhancing the commercial prospects for flow battery systems.

Europe: A Notably Growing Area

Europe is expected to grow at a notable rate during the forecast period, driven by strict decarbonization goals, high renewable energy adoption, and the need for grid flexibility. The region focuses on long-duration storage to stabilize variable energy sources, especially wind and solar. Flow batteries are increasingly used in renewable energy centers, smart grids, and industrial energy storage projects, supported by EU funding and sustainability-focused energy strategies.

Germany

Germany leads the market within Europe, thanks to its advanced renewable energy infrastructure and energy transition goals. The country emphasizes grid-scale storage, community energy systems, and industrial energy efficiency. Strong research institutions, supportive policies, and pilot projects involving vanadium and zinc-based flow batteries are speeding up market growth.

Flow Batteries Market - Value Chain Analysis

- Battery Manufacturing & Processing

Flow batteries are developed through processes such as electrolyte formulation (vanadium, zinc-bromine, iron-based), membrane fabrication, stack assembly, pump and tank integration, power management system development, and large-scale energy storage system engineering.

Key Players: Sumitomo Electric Industries, Invinity Energy Systems, Redflow Limited, ESS Inc. - Quality Testing & Certification

Flow batteries require certifications for electrical safety, system reliability, electrolyte stability, grid compatibility, and long-duration energy storage performance. Key certifications include IEC energy storage standards, UL 1973, UL 9540 for ESS safety, ISO quality systems, and UN transportation safety compliance.

Key Players: UL Solutions, IEC (International Electrotechnical Commission), ISO (International Organization for Standardization), TÜV Rheinland. - Distribution to End-Use Industries

Flow battery systems are distributed to utility-scale energy storage projects, renewable energy integration facilities, microgrids, industrial backup power systems, and commercial energy storage installations.

Key Players: Invinity Energy Systems, ESS Inc., Sumitomo Electric Industries.

Flow Batteries Market Companies

- ESS Inc. (US)

- GILDEMEISTER energy solutions (Austria)

- Primus Power (US)

- RedFlow (Australia)

- redT Energy (UK)

- SCHMID (Germany)

- Sumitomo Electric. (Japan)

- UniEnergy Technologies (US)

- ViZn Energy (US)

- EnSync Energy Systems (US)

Recent Developments

- The first American wholesale power market to connect a ground-breaking form of flow technology battery to the grid was the California Independent System Operator in May 2019. A large-scale storage capability might be developed as a result of the use of flow batteries. Over a four-year period, the new storage technology would be assessed.

- According to studies from many societies published in the American Chemical Society's journal in May 2019, they have solved the problem of the organic anthraquinone molecules that powered their ground-breaking battery degrading. The approach addressed not only how molecules decompose but also how to slow down, stop, or even reverse it so that molecules resume their original state of existence.

- In order to accelerate the commercial adoption of flow battery technology, the American chemical business Chemours Company and the Washington-based manufacturer UniEnergy Technology merged in April 2019.'

Segment Covered in the Report

By Type

- Redox

- Hybrid

- Membrane less

By Application

- Utilities

- Commercial

- Industrial

- Military

- EV Charging Station

- Off Grid & Micro grid Power

- Others

By Material

- All Vanadium

- All Iron

- Zinc–Bromine

- Hydrogen-Bromine

- Polysulfide Bromine

- Organic

- Others

By Storage

- Compact

- Large Scale

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting