What is Gas Insulated Switchgear Market Size?

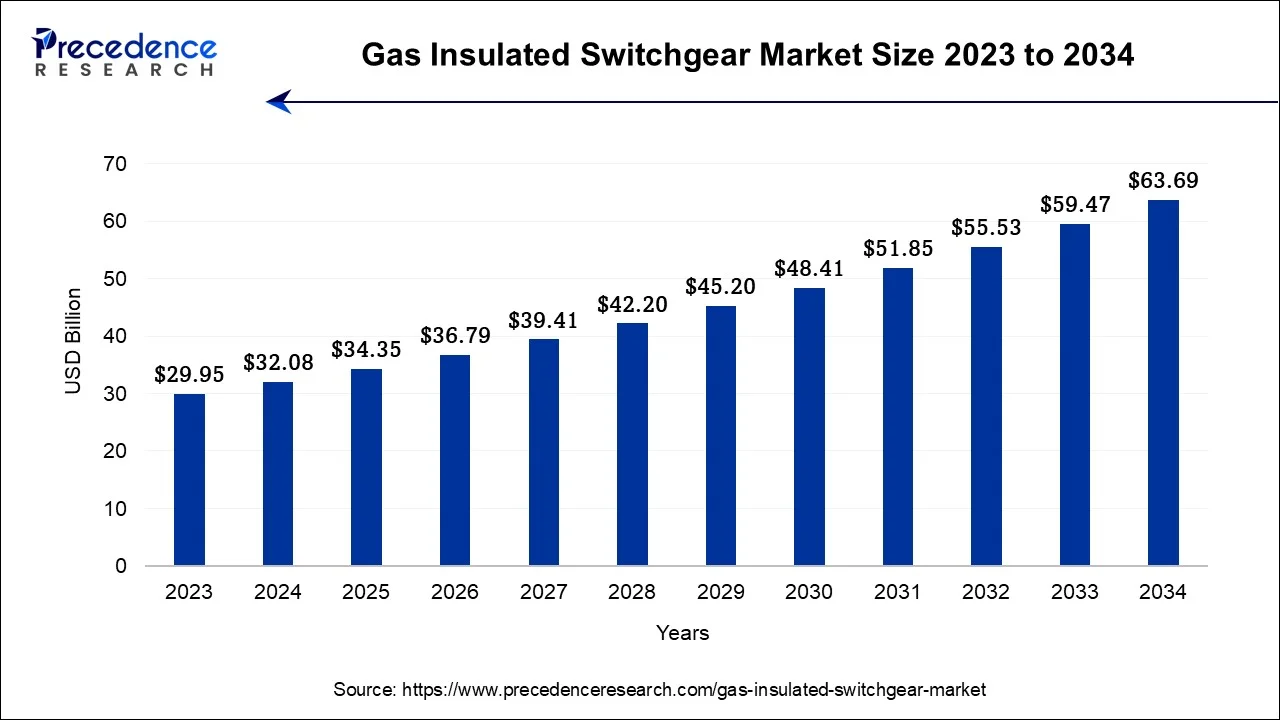

The global gas insulated switchgear market size is calculated at USD 34.35 billion in 2025 and is predicted to increase from USD 36.79 billion in 2026 to approximately USD 67.72 billion by 2035, expanding at a CAGR of 7.02% from 2026 to 2035.

Market Highlights

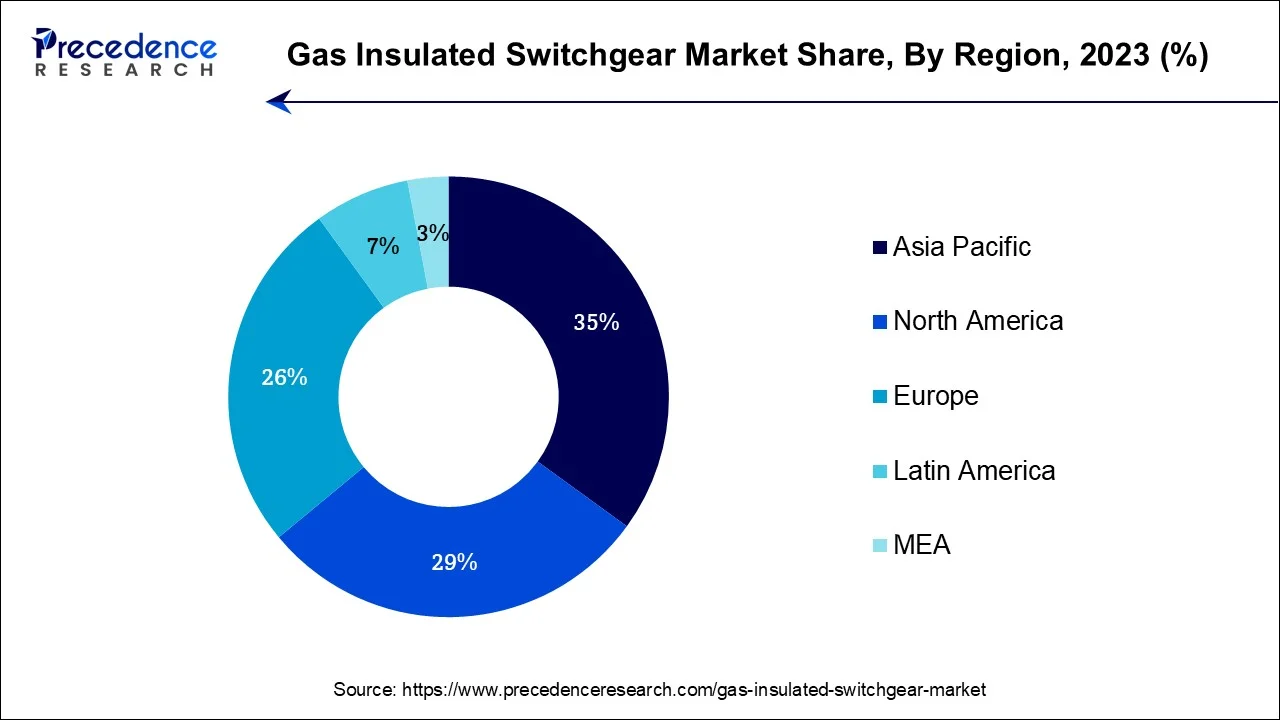

- Asia-Pacific led the global market with the largest revenue share of 35% in 2025.

- North America is expected to expand at the fastest CAGR during the forecast period.

- By voltage rating, the high voltage segment (72.6-220 kV) led the market share of 38.70% in 2025.

- By voltage rating, the extra-high voltage segment is expected to grow at a significant CAGR of 9.30% over the projected period.

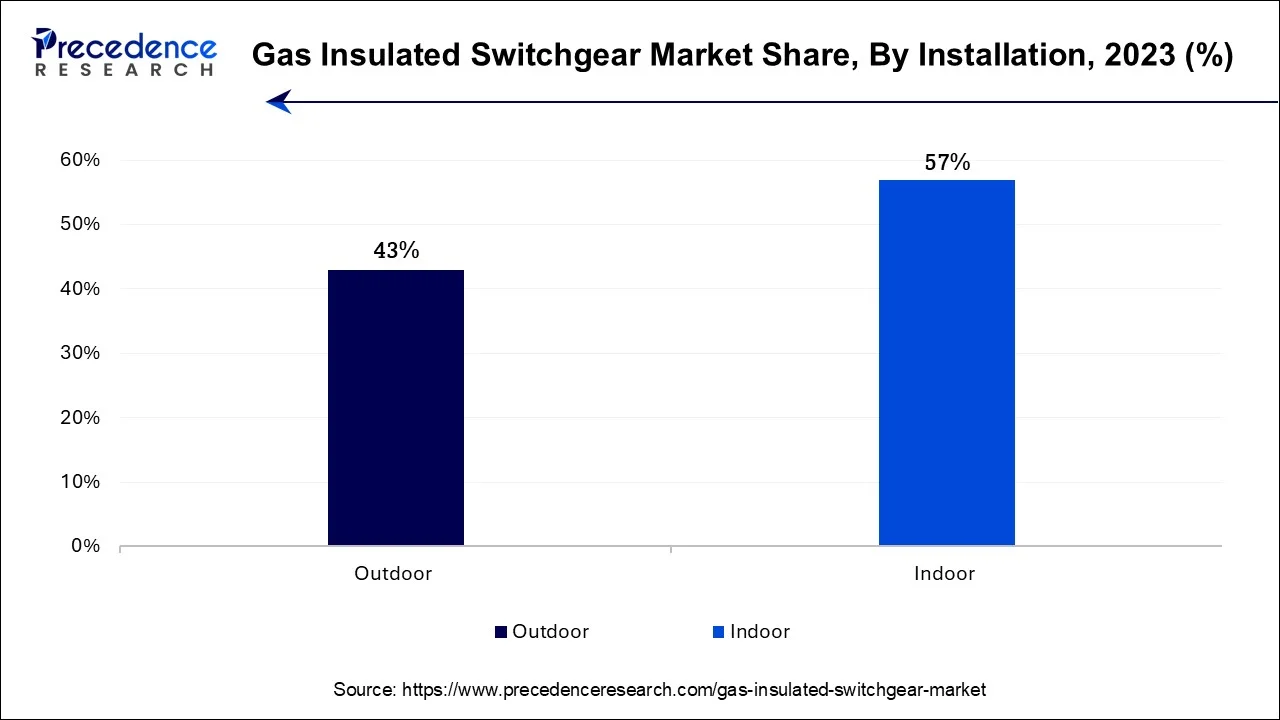

- By installation type, the outdoor GIS segment held the biggest market share of 59.10% in 2025.

- By installation type, the indoor GIS segment is expanding at a significant CAGR of 8.20% from 2026 to 2035.

- By configuration, the integrated three-phase GIS segment dominated the market with the largest share of 42.80% in 2025.

- By configuration, the hybrid GIS segment is expected to grow at a significant CAGR of 8.70% from 2026 to 2035.

- By technology, the conventional GIS segment led the market with a major market share of 83.40% in 2025.

- By technology, the eco-efficient GIS (SF6-free) segment is expected to grow at a significant CAGR of 12.20% over the projected period.

- By application, the transmission substations segment dominated the market with the largest share of 35.60% in 2025.

- By application, the railway electrification segment is expected to grow at a significant CAGR of 10.60% over the projected period.

- By end-user, the power utilities segment led the market with a major market share of 54.20% in 2025.

- By end-user, the renewable energy sector segment is expanding at a significant CAGR of 11.80% from 2026 to 2035.

Market Overview

The gas insulatedswitchgear marketencompasses a sector within the electrical power industry, specializing in the production, distribution, and maintenance of high-voltage switchgear systems that utilize sulfur hexafluoride (SF6) gas as an insulating agent. GIS systems present compact and highly efficient solutions for electrical substations and power distribution networks, resulting in reduced space requirements and a diminished environmental footprint. This market has experienced expansion driven by factors such as growing urbanization, heightened demand for dependable electricity supply, and a heightened focus on curbing greenhouse gas emissions. Key industry players comprise ABB, Siemens, Schneider Electric, Hitachi, and others.

Artificial Intelligence: The Next Growth Catalyst in Gas Insulated Switchgear

AI is profoundly impacting the gas-insulated switchgear industry by enabling sophisticated predictive maintenance, enhancing operational efficiency, and facilitating smart grid integration. AI-powered systems analyze vast amounts of real-time data from IoT sensors to predict equipment failures before they occur, which significantly reduces unplanned downtime and maintenance costs.

Machine learning algorithms also optimize switching operations for improved grid stability and integrate seamlessly with digital monitoring systems for enhanced asset management, including lifespan estimation and optimal replacement schedules.

Gas Insulated Switchgear Market Growth Factors

The gas insulated switchgear market is a pivotal segment within the electrical power industry, responsible for the development, distribution, and maintenance of high-voltage switchgear systems that employ sulfur hexafluoride (SF6) gas as an insulating medium. These GIS systems offer compact, efficient solutions for electrical substations and power distribution networks, addressing space constraints while reducing environmental impact.

The GIS market has witnessed robust growth attributed to several key industry trends and growth drivers. Firstly, the surge in urbanization across the globe has led to a rising demand for reliable electricity supply in densely populated areas, necessitating advanced GIS solutions. Secondly, the industry's focus on reducing greenhouse gas emissions aligns perfectly with SF6 gas's lower environmental footprint, driving its adoption.

Additionally, the increasing integration of renewable energy sources into power grids has spurred the demand for GIS systems to manage fluctuating power inputs effectively. Furthermore, the need for grid modernization to enhance resilience and minimize downtime during adverse weather conditions has accelerated GIS system deployments.

Several factors contribute to the ongoing expansion of the GIS market. The compact nature of GIS systems makes them particularly appealing, as they require less physical space compared to traditional air-insulated switchgear. Moreover, their high reliability and low maintenance requirements make them an attractive option for utilities seeking cost-effective solutions. The growing emphasis on energy efficiency and the ability of GIS to minimize transmission losses further enhance their market prospects. Additionally, governments' investments in infrastructure development and the expansion of power grids in emerging economies are stimulating market growth.

Despite its growth potential, the GIS industry faces certain challenges. One significant challenge is the high initial investment required for the installation of GIS systems. Moreover, the environmental concerns associated with SF6 gas, which has a potent greenhouse effect, have prompted regulatory scrutiny and the exploration of alternative insulation gases. Businesses operating in this sector must navigate these regulatory challenges and invest in research and development to stay competitive.

However, amid these challenges, numerous business opportunities abound. The development of eco-friendly, SF6-free GIS systems represents a promising avenue for innovation and market expansion. Additionally, the increasing adoption of digital technologies and smart grid solutions within the GIS sector opens doors for value-added services and enhanced system monitoring and control. As the global demand for electricity continues to witness growth, the GIS market is expected to witness steady expansion, driven by its efficiency, reliability, and adaptability to evolving energy landscapes.

In summary, the Gas Insulated Switchgear market is experiencing robust growth driven by urbanization, environmental considerations, renewable energy integration, and grid modernization efforts. While challenges like high upfront costs and environmental concerns exist, innovative solutions and regulatory compliance offer promising business opportunities for those in the GIS industry.

Gas Insulated Switchgear Market Outlook

- Industry Growth Overview: The gas insulated switchgear market is set for robust growth from 2025 to 2034, driven by increasing global electricity demand and the need to modernize electrical infrastructure. GIS offers compact, reliable solutions essential for high-density urban areas and locations with limited installation space.

- Advanced GIS Solutions: A major trend is the development of hybrid, compact GIS solutions that offer flexibility and a reduced footprint. The integration of smart grid technologies and digitalization enables remote monitoring and predictive maintenance. The shift toward higher voltage levels and renewable energy integration is also a significant driver.

- Global Expansion:The market is expanding worldwide, with significant opportunities in emerging regions. Increasing investments in local power infrastructure and supportive government policies are driving global demand for modern, efficient power transmission solutions.

- Major Investors:Large energy and technology corporations such as Siemens AG, ABB Ltd., Schneider Electric SE, and General Electric (GE) are the primary investors. Investment is also significantly driven by government-backed initiatives and private investments in infrastructure projects.

- Startup Ecosystem: A startup ecosystem is emerging, focusing on niche innovations like specialized sensor development and AI-enabled control software for GIS optimization. Innovators are also creating sustainable alternatives to traditional SF6 gas to address environmental concerns.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 34.35 Billion |

| Market Size in 2026 | USD 36.79 Billion |

| Market Size by 2035 | USD 67.72Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.02% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Installation, Voltage, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Urbanization and infrastructure development

The expansion of urbanization and the simultaneous development of infrastructure are acting as primary catalysts propelling the growth of the gas insulated switchgear (GIS) market. With an increasing global population gravitating toward urban centers, there emerges an escalating requirement for robust and dependable electrical distribution systems to cater to the burgeoning needs of these expanding cities. Urban landscapes come with inherent spatial limitations, demanding electrical infrastructure solutions that are not only efficient but also space-saving.

GIS systems emerge as the favored choice due to their streamlined design, effectively utilizing the limited urban real estate. Their compactness becomes pivotal in fulfilling the electricity demands of densely populated urban zones. Moreover, infrastructure development initiatives, encompassing the establishment of new commercial and residential structures, industrial complexes, and transportation networks, necessitate the installation of state-of-the-art electrical grids.

GIS systems shine in this regard, as they are adept at managing high-voltage power distribution in these new developmental projects, guaranteeing a stable and uninterrupted power supply. In summation, urbanization and infrastructure development are acting as potent drivers of the GIS market by creating a substantial demand for electrical distribution solutions that are not only efficient and dependable but also tailored to fit the spatial constraints inherent to rapidly growing urban environments and contemporary infrastructure endeavors.

Restraints

Environmental concerns

Environmental apprehensions are acting as a substantial impediment to the expansion of the gas insulated switchgear market. The central issue revolves around the utilization of sulfur hexafluoride (SF6) gas as the insulation medium in GIS systems. SF6 is notorious for its exceptionally high global warming potential, making it thousands of times more potent than carbon dioxide. As the global community intensifies its efforts to combat climate change and curtail greenhouse gas emissions, there is a heightened focus on controlling SF6 emissions originating from GIS operations.

Rigorous environmental regulations and emissions reduction targets are exerting pressure on GIS manufacturers and users to curtail SF6 leakage and explore more ecologically responsible alternatives. This transition towards environmentally conscious practices often entails substantial retrofitting costs and technological upgrades, which can affect the economic viability of GIS solutions.

Furthermore, environmental concerns can impact the image and reputation of companies associated with SF6-based GIS systems, potentially resulting in public relations challenges and influencing decision-makers to explore greener insulation alternatives. As a result, these environmental considerations are prompting the GIS industry to innovate and pivot toward insulation technologies that are more sustainable and environmentally friendly.

Opportunity

SF6 alternatives development

The development of alternatives to sulfur hexafluoride (SF6) insulation gas is catalyzing substantial opportunities within the gas insulated switchgear market. Growing environmental concerns and stringent regulations regarding SF6's high global warming potential have prompted intensive research and innovation in pursuit of more eco-friendly insulation solutions. Companies investing in and successfully commercializing SF6-free alternatives, such as dry air, fluoronitrile-based gases, or solid-state technologies, are poised to capture a significant market share by offering environmentally responsible GIS systems.

These alternatives not only address environmental apprehensions but also position manufacturers to align with evolving sustainability goals and compliance requirements. As the demand for greener and more sustainable energy solutions escalates, GIS manufacturers embracing SF6 alternatives are well-positioned to meet market needs, gain a competitive edge, and contribute to the transition towards cleaner and more environmentally responsible power infrastructure.

Segment Insights

Application Insights

The transmission substations segment maintained its dominance in the market in 2025. This is primarily due to its ability to handle high voltages, its compact size, and its reliability in harsh environmental conditions, making it ideal for long-distance power transmission and the integration of renewable energy sources. GIS is particularly effective at managing the high voltage levels required for long-distance transmission, which is crucial for connecting power generation facilities to distribution networks. Worldwide investments by governments and utilities in grid modernization include upgrading transmission infrastructure with GIS to improve efficiency, reduce losses, and enhance grid stability. Additionally, GIS requires less maintenance compared to other switchgear types, contributing to lower operational costs.

The railway electrification segment is experiencing rapid growth within the market. This is mainly due to global efforts to modernize and expand rail networks, coupled with the need for compact, reliable, and safe power distribution systems in space-constrained urban environments. GIS is well-suited for integration with smart grid technologies, enabling real-time monitoring, control, and optimization of energy distribution. Furthermore, it offers a compact footprint compared to traditional air-insulated switchgear, making it ideal for urban areas, underground substations, and other locations with limited space, while protecting against environmental contaminants and reducing the risk of electrical faults.

End-user Insights

The power utilities segment led the market in 2025, largely due to its essential role in modernizing and expanding power transmission and distribution networks. Power utilities are primarily responsible for the transmission and distribution of electricity, and GIS technology is critical for these functions, especially at higher voltage levels (220 kV and above). The growing deployment of smart grids, which require reliable and efficient power distribution, further drives the demand for GIS. Utilities depend on GIS for its reliability, compact design, and ability to manage high voltages, making it ideal for urban settings and the integration of renewable energy sources, thereby enhancing grid stability and efficiency.

The renewable energy sector is also experiencing rapid growth in 2024. This increase is primarily a result of the global transition to cleaner energy sources and the necessity for efficient, space-saving solutions in densely populated areas where renewable energy projects are often located. In urban environments, where many renewable projects are situated, space can be limited. GIS provides a compact solution for power distribution and transmission, making it particularly suitable for these areas. The growth in this sector is further supported by the expansion of renewable energy infrastructure, the integration of renewable energy into existing power grids, and the demand for reliable and compact switchgear in urban environments.

Installation Insights

The outdoor GIS segment captured the largest market share in 2025. This is largely attributed to its ability to withstand harsh environmental conditions and its space-saving design compared to traditional air-insulated switchgear. Outdoor GIS systems are designed to operate reliably in various weather conditions, including extreme temperatures, humidity, and pollution, while air-insulated switchgear tends to be more vulnerable to environmental factors. This characteristic makes outdoor GIS systems ideal for high-voltage transmission lines and large power plants, where long-distance power transfer is essential, particularly in areas with space constraints or challenging environmental conditions.

The indoor GIS segment is experiencing the fastest growth in the market. This growth is driven by increasing urbanization, the demand for space-efficient solutions, and the integration of renewable energy sources. Indoor GIS can be easily integrated with monitoring systems for real-time diagnostics and predictive maintenance, making it suitable for smart grid applications. It provides a reliable and efficient power distribution system, which is crucial for critical infrastructure and industrial facilities where an uninterrupted power supply is essential. Moreover, rapid urbanization and the modernization of aging power infrastructure are driving demand for compact and reliable power distribution systems, making indoor GIS a preferred choice.

Voltage Insights

The high voltage segment (72.6-220 kV) dominated the gas-insulated switchgear (GIS) market in 2025. This dominance is primarily due to its essential role in high-voltage power transmission, particularly in the integration of renewable energy sources and support for urban development. This voltage range is vital for transmitting large amounts of power over long distances, making it crucial for connecting power plants, including renewable sources like wind and solar, to the electrical grid. Additionally, the demand for reliable, space-saving, and efficient power distribution solutions in both urban and rural areas, along with the growing electricity demand and the modernization of aging infrastructure, further enhances its prevalence.

The extra high voltage segment (greater than 220 kV) is experiencing the fastest growth in the market. This growth is mainly driven by its critical function in high-voltage transmission networks, particularly for long-distance power transfer and the integration of renewable energy sources, such as solar and wind farms, to population centers. This segment is also a key component in upgrading existing power grids to manage increased electricity demand and enhance efficiency, especially in rapidly urbanizing and industrializing regions. These systems are favored for their compact design, reliability, and ability to operate in harsh environments, making them essential for meeting rising electricity demands.

End User Insights

The utility segment held the largest revenue share of 30% in 2025. The utility segment holds a major share in the gas insulated switchgear (GIS) market due to its critical role in electrical power distribution. Utilities are responsible for supplying reliable electricity to homes, industries, and commercial establishments. GIS systems offer compact, high-performance solutions that meet the stringent reliability and efficiency demands of utility companies. They are vital for enhancing grid stability, reducing transmission losses, and accommodating renewable energy integration, all of which are essential in the evolving energy landscape. As utilities continually invest in infrastructure upgrades and grid modernization, the GIS market continues to thrive in response to their specific needs.

The retail and consumer goods sector is anticipated to grow at a significantly faster rate, registering a CAGR of 15.9% over the predicted period. The industrial segment holds a substantial growth in the gas insulated switchgear (GIS) market due to its critical need for efficient and reliable electrical distribution solutions. Industries require uninterrupted power supply to maintain production processes, and GIS systems offer compact, dependable, and space-saving solutions. They are well-suited for industrial applications where space constraints are prevalent. Additionally, the increasing integration of renewable energy sources and the need for grid modernization in industrial areas further boost the demand for GIS systems, making the industrial segment a major contributor to the market's growth.

Configuration Insights

The integrated three-phase GIS segment dominated the market in 2025. This is primarily due to its space-saving design, high reliability, and suitability for high-voltage applications. This configuration offers a compact solution for power transmission and distribution, especially in urban areas where space is limited. Additionally, the increasing adoption of smart grids and the need for advanced monitoring and control systems are driving the demand for GIS, as it can be seamlessly integrated with these technologies. While SF6 gas has excellent insulating properties, its high global warming potential has led to the development of eco-friendly alternatives and improved gas management systems, which further boost GIS adoption in response to growing electricity demands.

The hybrid GIS segment is also experiencing rapid growth in the market. This growth is mainly attributed to its compactness, flexibility, and adaptability, making it ideal for space-constrained environments and evolving power systems. Hybrid GIS offers high reliability and operational efficiency, even in harsh conditions, and requires minimal maintenance. It can effectively handle fluctuating power inputs from renewable sources like wind and solar, making it crucial for the energy transition. Government initiatives and the need for resilient power grids are driving the adoption of hybrid GIS to upgrade transmission networks and integrate renewable energy sources.

Technology Insights

The conventional GIS segment using SF6 gas was the market leader in 2025. This is primarily due to SF6's excellent insulating and current interrupting properties, which allow for compact designs that are ideal for environments with limited space, such as urban areas and substations. However, increasing environmental concerns regarding SF6's high global warming potential (GWP) are driving a shift toward SF6-free alternatives. GIS utilizing SF6 provides reliable performance and requires less maintenance compared to other types of switchgear, facilitating the integration of renewable energy sources and supporting the development of smart grids due to its compact and dependable nature, making it suitable for high-voltage applications.

The eco-efficient GIS (SF6-Free) segment is the fastest-growing segment in the market. This growth is attributed to tightening environmental regulations and rising concerns about the high global warming potential of sulfur hexafluoride (SF6). These factors have spurred the development and adoption of alternative technologies, such as vacuum and dry air insulation. Stringent regulations aimed at reducing greenhouse gas emissions, especially in Europe, are accelerating the adoption of SF6-free GIS. Although SF6-free switchgear may incur higher initial costs, the potential for long-term operational and maintenance savings can make it a more appealing option. The growth of renewable energy sources necessitates robust and reliable grid infrastructure, often utilizing SF6-free GIS.

Regional Insights

What is the Asia-Pacific Gas Insulated Switchgear Market Size?

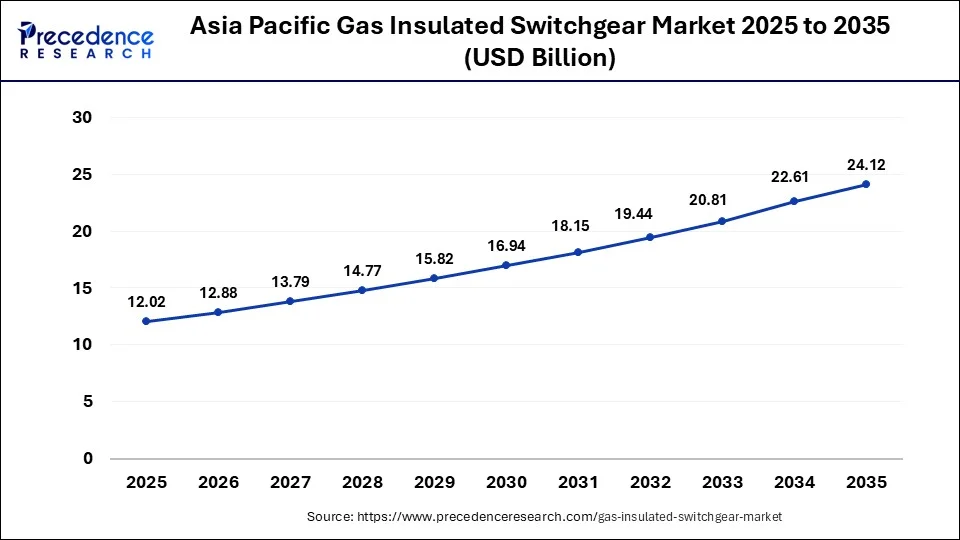

The Asia-Pacific gas insulated switchgear market size is valued at USD 12.02 billion in 2025 and is estimated to reach around USD 24.12 by 2035, growing at a CAGR of 7.21% from 2026 to 2035.

Asia-Pacific has held the largest revenue share 35% in 2025. The Asia-Pacific region commands a significant share in the gas-insulated switchgear (GIS) market due to several key factors. Rapid urbanization, industrialization, and infrastructure development in countries like China and India are driving substantial demand for reliable electrical distribution systems, where GIS technology excels. Moreover, government initiatives to enhance electricity access and grid reliability contribute to GIS market growth. The Asia-Pacific region's large population and expanding economies underscore the necessity for robust power infrastructure, making it a major contributor to the GIS market's share.

China

The Chinese gas insulated switchgear market is going through significant growth, led by increasing power demands for industry and rapidly growing urbanization. China is one of the biggest manufacturing hubs, having a considerable energy requirement. While following these, the Chinese market is looking for an active transition toward renewable energy solutions to curb greenhouse gas emissions.

The government is showing strong support for the smart grid systems and the ultra-high voltage (UHV) transmission lines, which is further driving the market growth, as there is a very high requirement for the modernization of power grids, as they provide the capability of better monitoring and control.

India

India is experiencing a strong demand in this market due to growing requirement for reliable and efficient switchgear systems due to their compact design the gas insulated switchgear market systems are perfectly suitable for urban areas where many space constraints are there particularly in cities like Delhi, Mumbai, and Bangalore due to high population density in these cities considering this requirements government is pushing the infrastructure development of smart grids and renewable energy integration into the power projects as they are becoming increasingly necessary to ensure efficient Power transmission and distribution operations.

What Makes North America the Fastest-Growing Region in the Market?

North America is estimated to observe the fastest expansion. North America holds a significant growth in the gas insulated switchgear (GIS) market due to several factors. The region has a mature and technologically advanced electrical infrastructure that necessitates regular upgrades and modernization. Additionally, stringent environmental regulations have accelerated the adoption of eco-friendly SF6 alternatives, driving demand for GIS systems. The region's focus on renewable energy integration and grid reliability further supports GIS market growth. Furthermore, the presence of major GIS manufacturers and ongoing investments in smart grid technologies contribute to North America's dominance growth in the market.

U.S.

The continuous expansion of renewable energy projects, for example, wind and solar farms, is driving the demand for gas-insulated switchgear systems for integrating these facilities into the main power grid. The growth of the gas insulated switchgear market in the U.S. is also attributed to the high safety and reliability offered by gas insulated switchgear systems because of their sealed design, which provides strong protection against dust, moisture, and various pollutants. In the U.S., indoor GIS systems are holding a significant market share because of its growing requirement in urban areas as they offer space efficiency in high-density areas.

UK

Strong demand in the renewable energy sector and integration of wind and solar power in primary power grid considering the requirement of high voltage transmission and distribution gas insulated switchgear systems, the market has shown considerable growth in the UK in recent times. It is because of the performance reliability it offers compared to other technologies as GIS systems have offered less downtime and better grid stability. The smart grid installations are continuously rising in this market because of the real-time monitoring, diagnostics, and predictive maintenance, leading to better functioning of the entire power system.

How is Latin America Emerging in the Gas Insulated Switchgear Market?

Latin America plays a distinctive role in the global market, driven by increasing urbanization, growing investments in expanding power transmission networks, and a strong need for reliable electricity supply to remote areas. The region's vast geography requires the development of compact and durable substations capable of operating in various climates. The market is supported by collaborations between local utilities and international technology providers to meet the rising electricity demand.

Why is Europe Considered a Notably Growing Region in the Gas Insulated Switchgear Market?

urope is growing at a notable rate in the market due to aging electricity infrastructure that requires modernization and strong government mandates focused on grid reliability and efficiency. Growth is further fueled by extensive R&D in compact GIS designs suited for urban substations and the integration of high-voltage systems into the expanding offshore wind energy sector. Additionally, major players such as Siemens Energy and Hitachi Energy continue to invest in digital monitoring technologies and eco-friendly insulating gases to strengthen their competitive position.

Brazil Gas Insulated Switchgear Market Trends

Brazil is leading the market in Latin America, driven by significant investments in renewable energy projects, which require efficient long-distance power transmission. The demand for high-speed connectivity and reliable power in the country is increasing the adoption of GIS technology in new substations and grid upgrades, supported by local initiatives focused on technological development and modernizing the national grid infrastructure.

What Potentiates the Middle East & Africa Gas Insulated Switchgear Market?

The market in the Middle East & Africa is driven by rapid infrastructure development, large-scale smart city projects, and a strong focus on economic diversification into technology and industrial sectors. The demand remains high for compact, reliable, and visually appealing GIS solutions that can manage high power demands and seamlessly integrate into urban environments, further boosting the market in the region.

UAE Gas Insulated Switchgear Market Trends

The UAE plays a key role in the gas insulated switchgear market due to its ambitious technological visions and smart city initiatives. The country is investing significantly in fiber optic networks and ultra-high-speed power infrastructure to ensure reliable and efficient energy distribution. As a regional hub for technology and innovation, the UAE attracts investment in data centers and high-efficiency power systems, accelerating the adoption of cutting-edge GIS solutions.

Value Chain Analysis

- R&D, Raw Materials, and Core Technology

Focuses on innovating GIS technologies and procuring specialized raw materials.

Key Players: Siemens, Hitachi Energy, Schneider Electric, Eaton, and Toshiba. - Component Manufacturing and Production

Involves the precise engineering and mass production of GIS components like circuit breakers, busbars, and metal-encapsulated enclosures.

Key Players: ABB, Siemens AG, GE Grid Solutions, Schneider Electric, and Mitsubishi Electric Corporation. - Assembly and System Integration

This assembles components into GIS units and integrates monitoring systems.

Key Players: ABB, General Electric, Mitsubishi Electric, Hyundai Electric, China XD Group, and BHEL. - Installation and Commissioning

Involves the physical installation of GIS units in substations and other facilities, performed by manufacturers' field teams or certified contractors.

Key Players: ChargePoint, EVgo, and ElectReon.

Top Companies in the Gas Insulated Switchgear Market and Their Offerings

- ABB contribution is centered on pioneering high-voltage GIS technologies, including eco-efficient alternatives utilizing innovative gas mixtures like free solutions, for utility and industrial applications globally.

- Fuji Electric contributes by providing a wide range of highly reliable, compact, and environmentally conscious GIS solutions for applications ranging from power plants to substations, focusing on high-voltage equipment efficiency.

- Hyundai Electric & Energy Systems focuses on engineering complete GIS solutions for substations, ranging from 72.5kV up to 800kV, emphasizing robust performance and safety for heavy industries and infrastructure projects.

- Eaton primarily addresses the medium-voltage segment of the market with products that offer compact footprints and enhanced safety features for commercial buildings, data centers, and industrial facilities, often integrating these systems into broader power management solutions.

- Nissin Electric contributes specialized expertise in high-voltage AC and DC equipment, delivering customized, reliable, and space-saving GIS substations primarily for Japanese and other Asian markets.

- Toshiba International Corporation contributes with integrated high-voltage power solutions, supplying durable and compact GIS technology optimized for both utility modernization and reliable industrial power distribution needs.

- Meidensha Corporation supplies custom-engineered GIS products, including mobile substations and specialized high-voltage switchgear, emphasizing tailored solutions for specific infrastructure challenges and superior long-term reliability.

- Siemens: Offers Blue GIS (SF₆-free) and traditional systems for all voltage levels, focusing on sustainability.Hitachi Energy: Provides ultra-high voltage GIS (up to 1200 kV) and the sustainable EconiQ portfolio.

- Mitsubishi Electric: Known for highly reliable, compact, and modular designs for harsh and space-constrained environments.

- General Electric (GE): Offers a range of solutions with a focus on advanced monitoring, digital integration, and sustainable gas blends.

- Schneider Electric: Specializes in medium-voltage GIS with options like SF₆-free SafeRing Air, focusing on digital intelligence and commercial applications.

Other Key Players

- Larsen & Toubro

- CHEM Group

- Bharat Heavy Electricals Limited

Leaders' Announcements

- In February 2024, ABB announced its agreement to acquire SEAM Group, a key provider of energized asset management and advisory services for industrial and commercial clients. This acquisition will enhance ABB's Electrification Service offerings by adding expertise in predictive, preventive, and corrective maintenance, electrical safety, renewables, and asset management. SEAM Group serves over 800 clients and manages more than 1 million energized assets across various sectors, including healthcare and EV charging infrastructure.

- In June 2024, Lauritz Knudsen, a subsidiary of Schneider Electric Group, announced plans to invest approximately Rs 850 crore over three years to strengthen its position in the electrical sector. Previously known as L&T Switchgear, which was acquired by Schneider Electric in 2020, Lauritz Knudsen aims to enhance its low and medium voltage business while expanding into renewable energy and e-mobility solutions. With a manufacturing footprint of 2.1 million sq. ft. and over 33 offices nationwide, Lauritz Knudsen has trained over 400,000 professionals through its six training centers across India.a.

Recent Developments

- In May 2025, Hitachi Energy announced the world's first 550 kV SF6-free GIS for China's State Grid, a milestone for ultra-high-voltage decarbonization. It reduces environmental impact and ensures greater grid reliability. (Source: https://www.hitachienergy.com )

- In July 2025, JST Power Equipment launched the J20N™ Dry-Air Gas-Insulated Switchgear, rated at 38kV. This solution is recognized for its quick lead times, reliability, and advanced engineering. Alex Ivanov, an Applications Engineer, highlighted that the J20N™ offers robust switching and fault-interruption capabilities while being ultra-compact, making it ideal for installations in space-limited urban environments and offshore platforms. David Lasher, the Product Line Manager, noted its durability and minimal maintenance needs, which are designed for long-term performance.

- In August 2024, Hitachi Energy introduced new switchgear technology to address concerns regarding sulfur hexafluoride (SF6) emissions. SF6 is a significant environmental concern, being 24,300 times more harmful than CO2. The company launched the EconiQ 550 kV circuit breaker, the highest voltage SF6-free switchgear, along with the EconiQ 420 kV Live Tank Breaker, aiming to mitigate the power sector's environmental impact.

- In 2022, ABB forged a strategic partnership with Samsung Electronics to jointly develop cutting-edge technologies aimed at achieving energy efficiency, effective energy management, and seamless integration into the Internet of Things (IoT) for both residential and commercial buildings.

- In 2021, ABB entered into a four-year framework agreement with Italy's Transmission System Operator (TSO), Terna. Terna, responsible for managing and dispatching energy throughout Italy, engaged ABB for its Gas-Insulated Switchgear (GIS) technology, renowned for its ability to substantially reduce equipment footprint compared to traditional air-insulated switchgear substations.

- In 2021, Siemens secured a contract to supply ten bays of SF6-free gas-insulated switchgear to Fingrid, Finland's transmission system operator. This deal marked Siemens' largest order for SF6-free GIS in Europe, representing a significant milestone in sustainable energy technology adoption.

- In 2021,Toshiba Energy Systems and Solutions joined forces with Meidensha Corporation to collaboratively develop gas-insulated switchgear utilizing sulfur hexafluoride (SF6)-free natural gas. This strategic partnership aims to meet the rising market demand for eco-friendly products, underscoring their commitment to environmentally conscious technology solutions.

- In 2020witnessed Schneider Electric's successful completion of a significant transaction, merging its Low Voltage and Industrial Automation business in India with Larsen & Toubro's Electrical & Automation business, fostering collaboration and growth in the Indian market.

- In 2020, Hyundai Electric clinched two contracts valued at USD 28.6 million in Saudi Arabia. These contracts encompassed the provision of power transformers and gas-insulated switchgear to Saudi Electricity Company (SEC) and Saudi Aramco, highlighting the growing demand for advanced electrical infrastructure in the region.

Segments Covered in the Report

By Voltage Rating

- Low Voltage (<= 1kV)

- Medium Voltage (1 – 72.5 kV)

- High Voltage (72.6 – 220 kV)

- Extra High Voltage (> 220 kV)

By Installation Type

- Indoor GIS

- Outdoor GIS

By Configuration

- Hybrid GIS

- Integrated 3-Phase GIS

- Single-Phase GIS

By Technology

- Conventional GIS (SF6)

- Eco-efficient GIS (SF6-Free)

By Application

- Transmission Substations

- Distribution Substations

- Power Generation Units

- Railway Electrification

- Others (Offshore Platforms, etc.)

By End-user

- Power Utilities

- Industrial

- Oil & Gas

- Mining

- Chemical & Petrochemical

- Steel & Metal

- Others (Cement, etc.)

- Commercial Infrastructure

- Airports & Metros

- Data Centers

- Hospitals & Commercial Complexes

- Renewable Energy Sector

- Solar PV Substations

- Wind Farms

- Onshore

- Offshore

- Battery Energy Storage Systems (BESS)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting