What is the Geosynthetics Market Size?

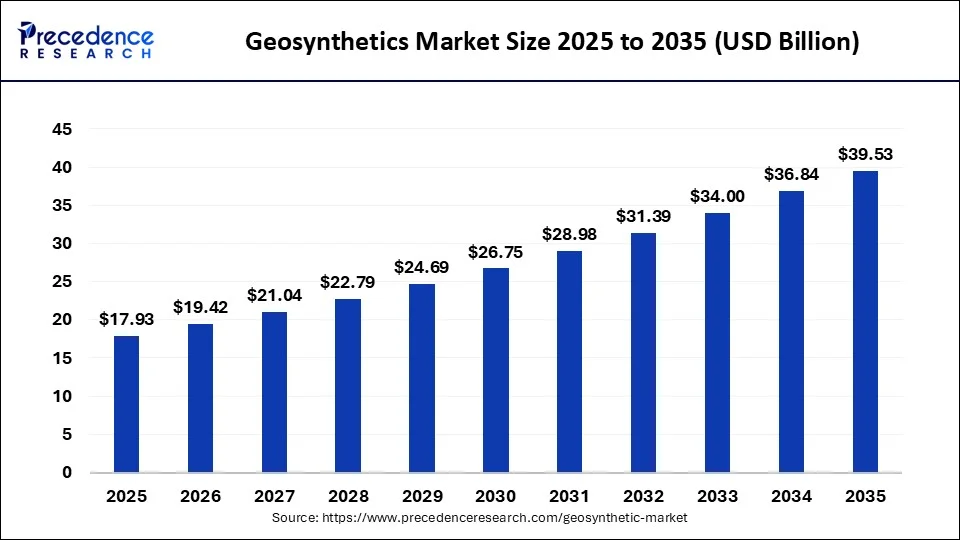

The global geosynthetics market size is calculated at USD 17.93 billion in 2025 and is predicted to increase from USD 19.42 billion in 2026 to approximately USD 39.53 billion by 2035, expanding at a CAGR of 8.23% from 2026 to 2035.

Market Highlights

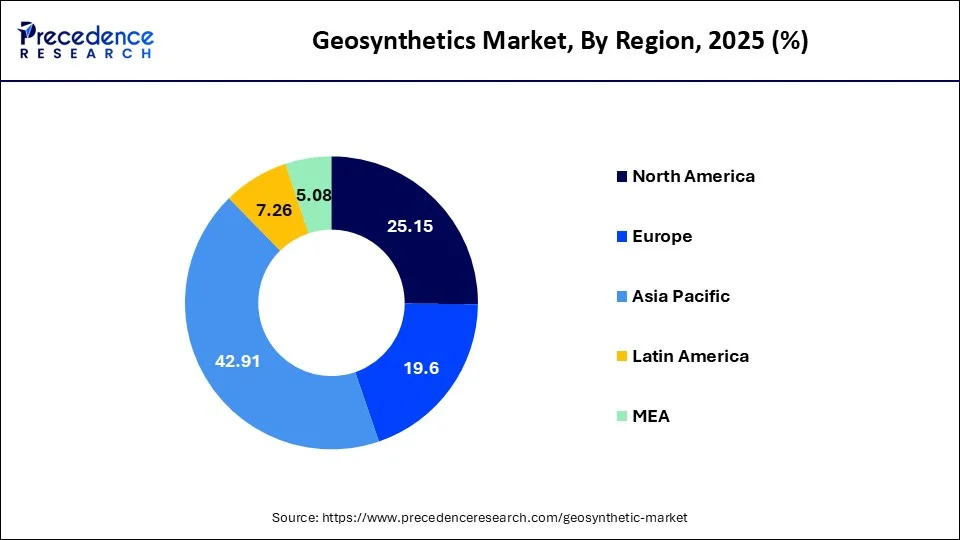

- Asia Pacific dominated the global geosynthetics market with the largest market share of 42.91% in 2025.

- North America is projected to expand at the fastest CAGR during the forecast period.

- By type, the Geotextiles segment contributed the highest market share in 2025.

Market Overview

Over the forecast timeframe, it is expected that emerging markets like India and Brazil will accelerate infrastructure construction. Infrastructure improvements were stopped as a result of the implementation of a shutdown by the ruling authorities to stop the disease from spreading in 2020 resulting in the COVID-19 epidemic. Due to supply network obstacles, market participants noticed a decrease in demand for modern office buildings and other infrastructures. Companies within the industry are encouraged to enhance output by the raw material availability like Polypropylene (PP), which is made possible by the widespread presence of petrochemical compounds owned by corporations like ExxonMobil, Chevron Phillips, Shell, and BP.

Throughout the projection period, the abovementioned elements are predicted to fuel the desire for geosynthetic items in the United States. In the building of ponds, embankments, streets, and tunnels, geotextiles remain working as covering systems. Additionally, because they make it easier to separate layers of soil from the subsurface without obstructing the movement of groundwater, these materials are also utilized in the construction of a rail network. To safeguard the shoreline and encourage vegetative development, connectivity options and geocells are essential. This prevents soil erosion. Additionally, the market is anticipated to be driven by current soil preservation programs in several countries, like Canada, South Africa, Spain, and India.

AI in the Market

Artificial intelligence is transforming the geosynthetic marketplace, thereby allowing better design, performance, and sustainability. With predictive modeling and simulation tools, the engineer predicts and acts upon ground behavior to lessen the chances of failure. During manufacturing, AI-based quality control ensures utmost accuracy, while material optimization provides varied customizations to meet the distinct needs of each project. Robotics is then interfaced with AI and operated by IoT sensors through installation, road profiling, real-time auditing, and work progress control of which help to reduce human error. In maintenance, the prediction of failure based on quantified data allows organizations to avoid heavy costs due to downtime. Simultaneously, the optimization of resources through AI-based insights makes way for much faster project execution at lower costs. It thus has sustainability profit as it fosters low consumption of materials and a well-managed lifecycle. So the bulk of AI is assisting in operating efficiently, the basis of reliability, and is environmentally friendly. This enhancement makes geosynthetics more efficient and ready for the future.

Geosynthetics Market Growth Factors

Geosynthetics have recently become prevalent in several industries. In drainage channels, geosynthetics are employed as filtration components that produce continuous polyethylene threads, improving filtering effectiveness. To assure that the most dangerous particles are retained and not released into the atmosphere in bodies of water & soils, such textiles are used as filtering systems. By adding rigidity and strengthening the asphalt, geosynthetics are also combined with asphalt to boost resistance to cracking during road building. These are used in the dam construction process to lower the risk for coastal erosion when water runs over the geonet, extending the life of a barrier.

In contrast side, geomembranes are polymer sheeting that is used to line landfills, canals, and tunnels trod to keep the upper layer in position and prevent the dumping of debris. As a result, it plays a crucial role in making these places safe for human usage and extending life. Due to their capacity to disperse loads over a broader area, geocells are used in construction projects to limit degradation on steep slopes, as retaining walls, and as a sub-base reinforcement for road bases, railway tracks, etc. The development of the construction and construction industry has stayed enhanced by the upsurge in management disbursement to progress amenities in numerous countries in the effort to raise living standards, along with the rise in urbanization. Additionally, the need for Geosynthetics has been positively influenced by rising environmental precautions that aim to decrease sediment management and soil degradation. The industry for geosynthetic materials is expanding as a result of these causes and their numerous advantages.

- Rising Construction Activities: With the infrastructure projects and urban development being expanded, the demand for geosynthetics is being created in soils used for reinforcement, road bases, and foundation stabilization.

- Environmental Protection Needs: Increasing attention on soil erosion control, sediment management, and fair water treatment is driving the adoption of the product.

- Waste Management Expansion: The increase in landfill projects gives a greater scope due to more stringent regulations in waste containment.

- Cost-Effectiveness and Durability: It ensures long-term savings and structural stability by increasing the life span of infrastructure and reducing maintenance.

- Technological Advancements: Continuous innovation in materials engineering and advanced applications is setting the pace for penetrations in several other industries.

Major Trends in the Geosynthetic Market

- Increased use of polymer-blended geosynthetics offering greater tensile strength at a decreased material thickness, thus allowing projects to be designed with improved lifecycle cost efficiencies associated with larger capital projects.

- Geosynthetics are being used for coastal protection and climate change adaptation, specifically erosion protection, flood barriers, and slope stabilization.

- Increased demand for tailored, application-specific geosynthetic solutions, especially for mine tailings management and high-load rail projects.

- Rapid trends toward the development of recyclable and low-carbon geosynthetics in response to public infrastructure procurement requiring sustainable-based solutions.

- Increased use of prefabricated geosynthetic systems that enable reduced on-site installation times and lower levels of labour dependency in remote and high-hazard environments.

Market Outlook

- Industry Growth Overview: The geosynthetics market is poised for rapid growth from 2025 to 2034. This is mainly due to increasing infrastructure development, urbanization, and demand for sustainable construction solutions. Rising environmental regulations and the need for erosion control, soil stabilization, and drainage systems further fuel market expansion.

- Sustainability Trend: The sustainability trend is driving the market toward eco-friendly materials and solutions that reduce environmental impact, such as recycled polymers and long-lasting erosion control systems. This shift is encouraging adoption in green infrastructure projects, stormwater management, and sustainable road and landfill construction, boosting demand globally.

- Major Investors: Major investors in the geosynthetics market include global construction material companies, polymer manufacturers, and infrastructure-focused investment firms. These investors support expansion of production capacity, R&D, and geographic diversification through their funding. Most strategic investment goes toward sustainable materials and advanced manufacturing technologies.

- Global Expansion: The market is growing worldwide due to rapid urbanization, expanding infrastructure projects, and increased focus on durable, cost-effective construction solutions. Emerging regions offer opportunities in roadways, railways, and water management projects, where governments are investing heavily in modernizing infrastructure and implementing sustainable construction practices.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 17.93 Billion |

| Market Size in 2026 | USD 19.42 Billion |

| Market Size by 2035 | USD 39.53 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.23% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing expenditures in the management of waste in developing nations can be attributed to the enlargement of the geosynthetics market

- Rapid urbanization and the world's rapidly growing population both contribute to rising volumes of liquid and solid waste. Growing awareness of environmental issues is driving up the need for initiatives that properly handle water and waste. By lowering or preventing the post-closure production of trash and related medical costs, geotextiles are utilized as garbage tops to stop liquid movement into landfill. Due to the growing public concern about substantial and pervasive water contamination, geosynthetics are progressively existence employed in various flood mitigation operations. The requirement for geosynthetics is anticipated to increase during the projected time frame as a result of the usage of geosynthetics liners solutions in sewage treatment lagoons at sewage treatment plants to safeguard water supplies, such as rivers, lakes, ponds, reservoirs, and aquifers.

Growing Use of Geotextiles in a Variety of Applications Would Boost Sales

- One of these is the geotextile category, which is anticipated to grow at a remarkable CAGR throughout the forecast period. The growing use of geosynthetics in building applications, such as railways, highways, harbors, and drainage structures, is credited with driving the company's development. Additionally, producers are providing geotextiles in lengths and qualities tailored to certain purposes, which is expanding the industry. With the appropriate separation and reinforcing material, geotextiles have experienced tremendous growth. Geosynthetic use greatly improves soil stabilization, avoids waterlogging, and hence increases the longevity of facilities. The expansion of the geotextiles industry is predicted to be aided by rising infrastructure building expenditures and rising consumer understanding of the advantages of geotextiles throughout the evaluation period.

Polypropylene's Growth Furled by Attractive Features

- According to FMI, polypropylene is still the most popular raw material used to produce geosynthetic goods because of its many desirable qualities, including its high strength, lightweight, corrosion resistance, and longevity. Thus, the industry for geosynthetics would expand more quickly as polypropylene-based geosynthetic materials become more and more common throughout numerous sectors.

Key Market Challenges

Raw material costs change as a result of crude oil price swings

- The main variables influencing finished pricing are the costs and supply of raw materials. The crude oil market price has an impact on the plurality of materials used in the production of geotextiles, including polyethylene, ethylene propylene diene, polypropylene, & PVC polymers.

- The cost of the raw resources needed to create geotechnical parameters is directly affected by changes in the price of petroleum products. Nevertheless, practically every government has restricted both domestic and foreign travel as a result of the present epidemic. As a result, there has been a major drop in the desire for transportation fuel which has had an impact on crude oil prices.

Key Market Opportunities

Increasing oil and gas and mining industry demand

One of the biggest users of geosynthetics is still the resource sector. The mining sector is anticipated to be driven by the Asian need for minerals and metals. Chinese is the world's top producer of metals, rare earth metals, copper, gold, coal, and gypsum, whereas India has seen major investments in the sector. Furthermore, significant international mining companies are increasingly choosing to engage in mining in South America. Huge mining capacity exists in important nations like Peru, Brazil, and Chile, where during the last five years there has been a rise in foreign company investment. The geosynthetics market is anticipated to grow throughout the projected time frame as a result of the expanding use of improved separation techniques in mining operations.

Segment Insights

Type Insights

Geotextiles are constructed fabrics created using fibers that are permeable, long-lasting, and non-biodegradable. In geotechnical engineering uses like major construction, hydrogeology, building, paving, and environmental science, geotextiles are being used. Along with pavement maintenance and repairs, embankments, soil reinforcement & stabilization, asphalt replacements, and other uses, they also were utilized for draining and eroding management.

Due to its superior functionality and practical benefits over other substances, the segment dominated the market. PP, polyamide, and polyethylene polyester are the synthetic fibers used to make geotextiles. Due to growing awareness of such products' use as floater coverings for the reservoirs to regulate evaporating, decrease Volatile Organic Components (VOC) emissions, and reduce the need for draining and maintenance, geomembranes are predicted to grow at a stable CAGR in terms of profits from 2025 to 2034.

Application Insights

The highest sales volume belongs to resource disposal. Waste management uses geosynthetics to serve a variety of purposes, including drainage, filtration, separation, barriers, and reinforcement. industrial, Residential, and commercial garbage must be collected, moved, treated, recycled, and disposed of appropriately. Preventing the leaking of polluted liquids and gases into aquifers, freshwater, rivers, and other aquatic resources requires the use of geotextiles. During the projection period, there will likely be a greater need for waste management initiatives as a result of urbanization, population growth, and industrialization.

Regional Insights

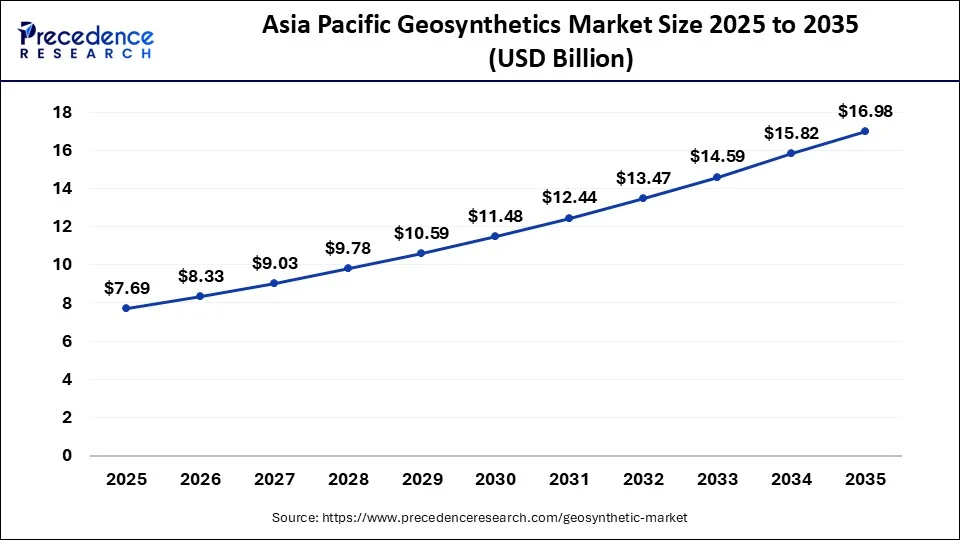

Asia Pacific Geosynthetics Market Size and Growth 2026 to 2035

The Asia Pacific geosynthetics market size is evaluated at USD 7.69 billion in 2025 and is predicted to be worth around USD 16.98 billion by 2035, rising at a CAGR of 8.24% from 2026 to 2035.

What Made Asia Pacific the Dominant Region in the Geosynthetics Market?

Asia Pacific dominated the market by capturing a 42.91% share in 2025. This is mainly due to rapid infrastructure development, urbanization, and large-scale investments in roads, railways, mining, and environmental protection projects across countries like China, India, and Southeast Asia. Large-scale national initiatives and smart city projects across this region expand the market. The government enforces strict regulations on solid and liquid waste management and water conservation. These efforts are driving increased use of geomembranes and other geosynthetics in landfills.

China is the major contributor to the Asia Pacific geosynthetics market due to its massive infrastructure investments in highways, high-speed rail, landfills, and water management projects. The country's large-scale construction activities, strong government funding, and extensive local manufacturing ecosystem significantly increase the demand and availability of geosynthetic products.

India Geosynthetics Market Trends

India's market is growing rapidly, driven by large-scale investments in highways, railways, urban infrastructure, and water management projects that increasingly rely on geosynthetics for soil reinforcement, drainage, and erosion control. Geotextiles remain the dominant product segment due to their widespread use in road construction, railways, and embankment stabilization, while demand for advanced, high-strength, and durable materials is rising.

What Makes North America the Fastest-Growing Region in the Geosynthetics Market?

North America is expected to grow at the fastest CAGR in the market during the forecast period. There is strong integration of geosynthetics into infrastructure and environmental projects. Government mandates, sustainability goals, and funding from large infrastructure bills are driving the North American market. Strict environmental regulations and increasing climate‑resilience requirements, including flood protection, erosion control, and sustainable landfill practices, are boosting the adoption of high-performance geosynthetic materials such as geotextiles, geomembranes, and geocells.

The U.S. is the major contributor to the North American market due to extensive investments in transportation infrastructure, water management projects, and environmental protection initiatives. The country's focus on sustainable construction, erosion control, and modern landfill engineering drives high adoption of geosynthetic materials such as geotextiles, geomembranes, and geocells.

Why is Europe Considered a Notable Region in the Geosynthetics Market?

Europe is expected to grow at a notable rate in the market in the upcoming period. The European Commission approved the use of geosynthetics for the construction of new wastewater treatment plants. The rapid policy shifts led to increased adoption of these materials across wastewater treatment. Government regulations on waste management further support regional market growth. The region's investments in road construction, railways, flood control, and landfill lining projects drive steady demand for geosynthetic materials.

Germany leads globally in precision engineering and advanced material applications, driving high adoption of specialized geosynthetics. France and the UK show strong demand for geosynthetics in transportation infrastructure and landfill management. In Southern Europe, these materials are widely used for coastal protection and slope stabilization. Meanwhile, rising infrastructure investment in Eastern Europe is creating new growth opportunities. Overall, regulatory support and long-term infrastructure planning are key factors fueling the expansion of geosynthetics across various European countries.

What Opportunities Exist in Latin America for the Geosynthetics Market?

Latin America presents significant market opportunities, driven by the government's commitment to improving overall infrastructure, increasing construction activities, and addressing the need for soil reinforcement and erosion control projects. With major investments underway in roads, railways, bridges, ports, and urban housing across countries such as Brazil, Mexico, Argentina, and Colombia, demand for geosynthetics for soil stabilization, subgrade reinforcement, and erosion control in large‑scale infrastructure projects is rising. Rapid population growth and urban sprawl, combined with increasing climate risks, create demand for durable, flexible engineering solutions, thereby supporting the market.

Brazil dominates the market in Latin America, thanks to its extensive transportation networks and large-scale environmental projects. Steady growth is supported by the expansion of the mining sector and the rising construction of roads. There is a strong focus on water management and soil erosion projects, boosting the demand for geosynthetics. Consistent regulatory compliance across states and provinces ensures sustained demand nationwide.

What are the Major Factors Contributing to the Market Within the Middle East & Africa?

The market in the Middle East & Africa (MEA) is driven by Saudi green initiatives, infrastructure development, and waste and water management projects. The rapidly growing infrastructure projects require advanced geosynthetic solutions for drainage, soil reinforcement, and environmental containment. There is significant investment in transportation corridors and road construction across the UAE, African nations, and Egypt. This, in turn, boosts the demand for geosynthetics.

Saudi Arabia is a major contributor to the MEA geosynthetics market, driven by extensive investments in infrastructure, urban development, and large-scale industrial projects. The country's focus on road construction, water management, and land reclamation projects has significantly increased the adoption of geosynthetic materials. Additionally, government regulations and long-term planning for sustainable development further support steady market growth in the region.

Value Chain Analysis of the Geosynthetics Market

- Raw Material and Polymer Processing: focuses on the production of polypropylene, polyethylene, and polyester polymers, because the quality of the resin will directly impact the durability and performance of the final product.

Key Players: ExxonMobil Chemical, BASF SE, Dow Inc. - Manufacturing & Fabrication: The manufacturers that operate in this phase of the value chain use techniques including extrusion, weaving, and calendaring to transform these polymers into geotextiles, geogrids, geomembranes, and geonets. Having the necessary technological capability and certifications is an important competitive differentiator for these companies.

Key players: TenCate Geosynthetics, HUESKER Synthetic, Solmax. - Distribution and Application Integration: logistics providers, engineering firms, and contractors provide services to integrate geosynthetics into their designs for infrastructure projects. The two elements that can provide strong market support for these companies include their strong distributor networks, along with the ability to offer a full complement of technical support services.

Key players: Maccaferri, Tensar International, NAUE GmbH.

Geosynthetics Market Companies

- ABG Ltd (UK)

- Advanced Drainage Systems, Inc.

- AGRU Kunststofftechnik GmbH

- Berry Global.

- Cooley Group

- Fibertex Nonwovens A/S

- Garware-Wall Ropes Ltd.

- Geofabrics Australasia Pty. Ltd.

- Geotrst Environmental Science Technology (China)

- Global Synthetics

- Gorantla Geosynthetics Pvt Ltd. (India)

- GSE Environmental Inc.

- HUESKER Synthetic GmbH

- Koninklijke Ten Cate N.V.

- Low and Bonar PLC (UK) - Bontec

- Maccaferri S.p.A. (Italy) - MacDrain

- MacLine

- MacMat

- NAUE GmbH & Co. KG (Germany)

- Officine Maccaferri S.p.A.

- Polymer Group Inc. (US)

- Propex Operating Company, LLC,

- PRS Geo-Technologies

- Raven Industries, Inc.

- SKAPS Industries (US)

- Solmax International Inc.

- Suntech Geotextile Pvt. Ltd.

- Taian Modern Plastic Co

- Tenax Corporation

- TenCate Geosynthetics

- Tensar International Corporation

- Texel Technical Materials Inc. (US)

- Thrace Group (Greece)

Recent Developments

- In June 2025, Solmax launched its new Performance Materials platform, integrating TenCate Geosynthetics and Propex, now a division of Solmax.

- In October 2024, E Squared Technical Textiles launches a geomembrane-focused website, www.e2geomembranes.com, featuring BABAA Certified geomembrane products for environmental, civil engineering, and water management industries.

- TenCate Geosynthetics, a Dutch supplier of geotextiles and commercial fabrics, was purchased by SOL MAX in June 2021. The company's capacity for development and global influence should expand as a result of the merger. For the business, the acquisition is anticipated to open up new commercial potential in infrastructural and container solutions for the mining, waste management, transportation, power, and civil engineering sectors.

- SOL MAX will extend its business by opening a new geotextiles facility in Nevada, United States, in June 2019. By creating new, more dependable goods to serve a variety of end-use sectors, the development is anticipated to give the business a competitive advantage.

- Under the trademark Secutex Green, NAUE created its first recyclable nonwoven geosynthetics fabric in July 2020. For use in structural engineering, the product is made from natural and sustainable elements.

- Tensar International Company recently created an improved version of its TriAx geogrid, which is used in the transport industry. Road homogeneity and soil stabilization efficiency are significantly enhanced by TriAx geogrid.

- In Gujarat, India, Strata System opened a new manufacturing plant in Feb 2019. The business plans to produce HDPE geocells and StrataGrid geogrid to meet the increasing need for geosynthetic reinforcement. The new plant is anticipated to have enough manufacturing capacity to supply both the domestic geotextiles Indian market and foreign exports.

- Fibertex Nonwovens will spend USD 49 million in March 2021 to boost the capacity of production of its US production plant. To fulfill the increasing demand from the North American market, the new factory is anticipated to contain a spunlace operations line that focuses on sustainable product design.

- At its location in Adorf, Germany, NAUE increased its geogrid manufacturing capacity in May 2019 by adding a new production line.

Segments Covered in the Report

By Type

- Geotextiles

- Geomembranes

- Geogrids

- Geofoam

- Geonets

- Others

By Application

- Waste Management

- Water Management

- Transportation Infrastructure

- Civil Construction

- Energy

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content