What is the Glaucoma Surgery Devices Market Size?

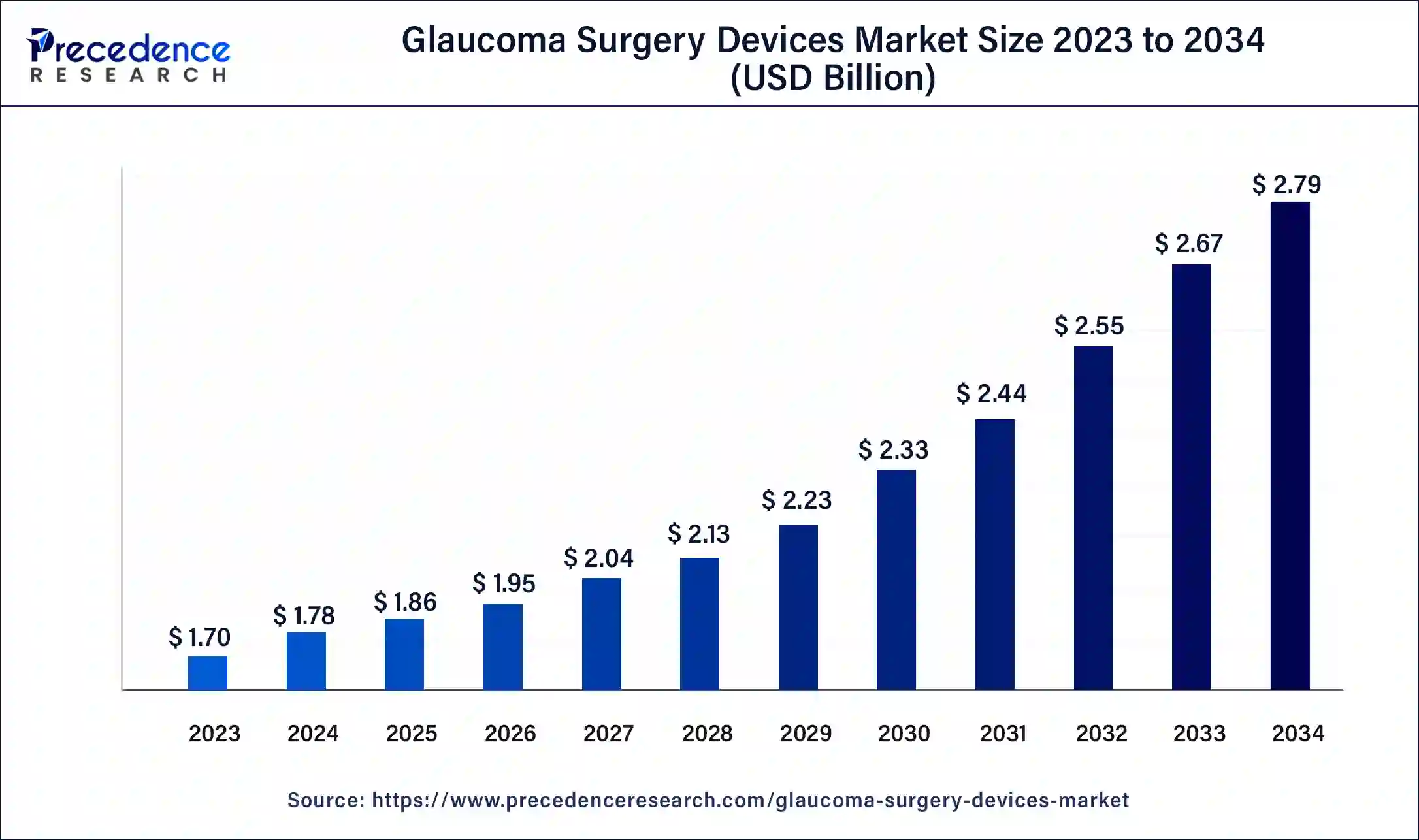

The global glaucoma surgery devices market size is estimated at USD 1.86 billion in 2025 and is predicted to increase from USD 1.95 billion in 2026 to approximately USD 2.79 billion by 2034, expanding at a CAGR of 4.60% from 2025 to 2034. The glaucoma surgery devices market is experiencing growth due to factors like increasing prevalence, rising geriatric populations, advancements in technology, and rising awareness about glaucoma

Glaucoma Surgery Devices Market Key Takeaways

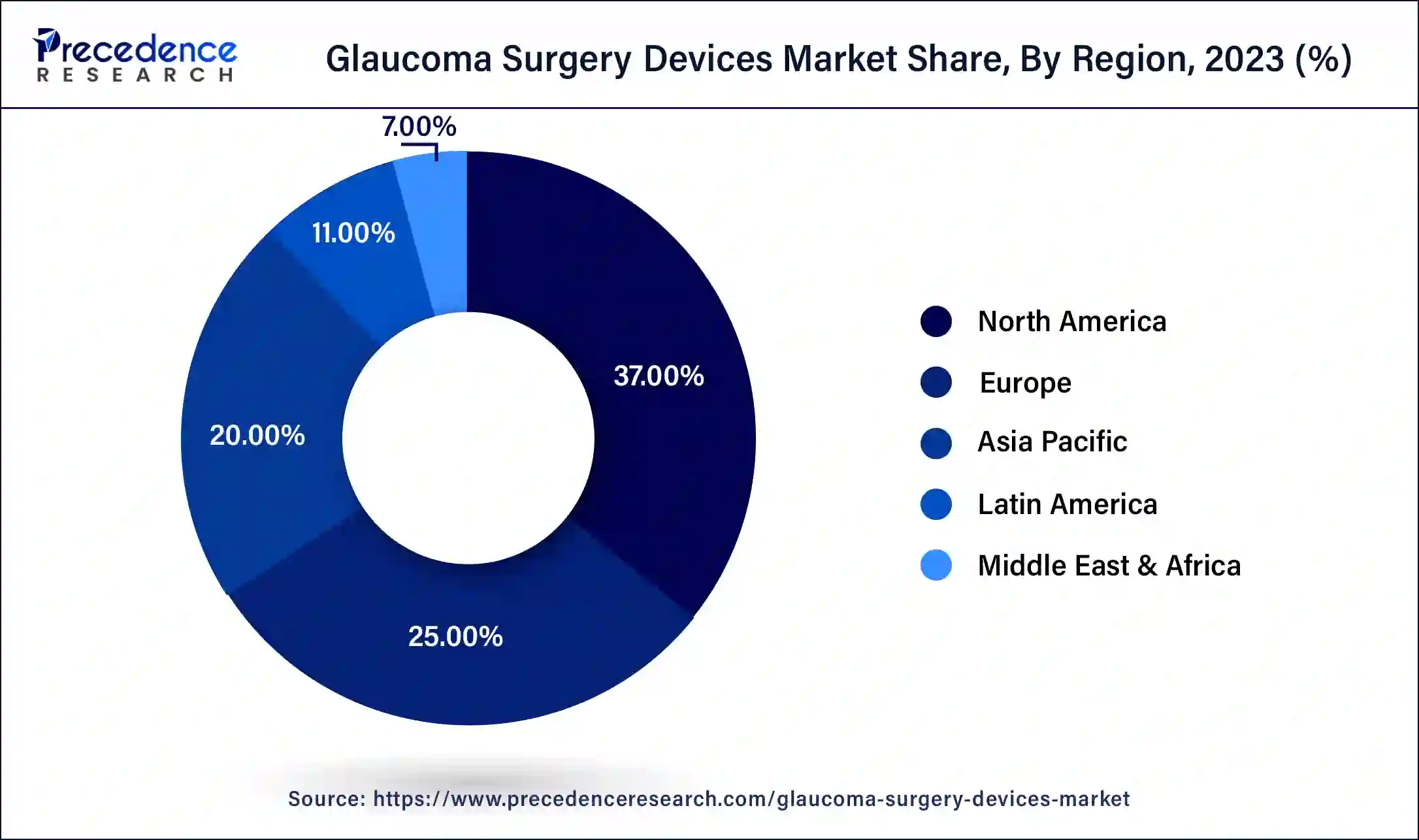

- North America dominated the glaucoma surgery devices market with the largest market share of 37% in 2024.

- Asia Pacific is anticipated to grow at the fastest CAGR of 5.26% during the forecast period.

- By product, the traditional surgery devices segment held the largest share of the market in 2024.

- By product, the diamond knives segment is expected to grow at a CAGR of 5.44% during the forecast period.

- By surgery method, the traditional glaucoma surgery segment contributed more than 37% in 2024.

- By surgery method, the minimally invasive glaucoma surgery segment is projected to grow at a significant CAGR of 5.45% during the forecast period.

- By end-use, the hospital segment generated the largest market share of 38% in 2024.

- By end-use, the ophthalmic clinics segment is expected to expand at a notable CAGR of 4.83% during the projected period.

Market Overview

Glaucoma is a chronic, progressive ocular condition that affects the optic nerve and can lead to irreversible vision loss. It is often referred to as the ‘silent thief of sight' because it slowly damages the optic nerve before causing noticeable central vision loss. The device is used to treat mild to moderate glaucoma and is approved for implantation during phacoemulsification. These devices include those designed to enhance outflow as well as sustained-release drug delivery systems and extraocular devices that aim to reduce glaucomatous progression through the novel method. The glaucoma surgery devices market is expanding due to several key factors.

Impact of AI on the Glaucoma Devices Market

The integration of artificial intelligence in the glaucoma surgery devices market is rapidly transforming the fields. AI technology enhances the capabilities of glaucoma devices by improving diagnostic accuracy and reducing the need for manual intervention. Artificial intelligence can significantly reduce the need for manual labor and improve the efficiency of classified treatment systems, enabling earlier diagnosis and treatment of more patients. Notable success in both diagnostic and prognostic aspects. An ideal AI system for glaucoma should comprehensively assess all relevant parameters, including intraocular pressure, disc morphology, gonioscopy, visual fields, and OCT.

- In October 2023, a hospital in Chennai launched a project to use AI for screening both glaucoma and diabetic retinopathy.

- In March 2023, artificial intelligence technology was introduced to improve efficiency and enhance chronic disease management in Shanghai grassroots-level glaucoma screening, as reported by local health authorities during World Glaucoma Week.

Glaucoma Surgery Devices Market Growth Factors

- Advances in technology and the introduction of innovative diagnostic and treatment options are also fueling market expansion.

- Multiple countries are witnessing effective government policies for diabetes associated cases, such initiative along with improving healthcare infrastructure is observed to promote the market's expansion.

- The growing prevalence of age-related eye disorders, including glaucoma, underscores the need for improved healthcare solutions and drives market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.79 Billion |

| Market Size in 2026 | USD 1.95 Billion |

| Market Size in 2025 | USD 1.86 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.62% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Surgery Method, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing prevalence of glaucoma

The rising prevalence of eye disorders, particularly glaucoma, is a growing concern in the glaucoma surgery devices market. Glaucoma refers to a group of progressive optic neuropathies that involve the degeneration of retinal ganglion cells and the retinal nerve fiber layer, leading to changes in the optic nerve head. It is a leading cause of irreversible vision loss globally. Although advances in imaging and visual field testing have improved early diagnosis and treatment, many patients remain undiagnosed until the disease has significantly progressed. This delay can result in irreversible vision loss and diminished quality of life.

- According to the World Glaucoma Association, glaucoma was the most common cause of irreversible blindness, with an estimated 79.6 million individuals affected in 2020. This number was projected to rise to 111.8 million by 2040.

Increasing geriatric population

The increasing prevalence of glaucoma, particularly among the geriatric population, is a major factor driving the glaucoma surgery devices market, as this age group is at a significantly higher risk for the disease. Adults over 60 are six times more likely to develop glaucoma, especially if a parent or sibling has the condition. Additionally, certain groups, such as African Americans and Hispanic Americans, are disproportionately affected and face increased risk as they age. Age significantly influences the impact of intraocular pressure on glaucomatous damage to the retinal nerve fiber layer, with older patients often experiencing more rapid progression.

The Global Burden of Diseases, Injuries, and Risk Factors Study reported that the age-standardized prevalence of glaucoma was approximately 3-5% in the population aged 40 years and older worldwide. This figure was expected to rise to 112 million people by 2040 due to the rapid increase in global population aging.

- In March 2022, The Glaucoma Research Foundation article estimated that in 2010, 8.4 million individuals worldwide were blind from primary open glaucoma. By 2040, it was projected that this number would increase to 22 million people globally who would be blind from glaucoma.

Restraint

The economic burden associated with glaucoma

The significant economic burden associated with glaucoma, particularly as the disease progresses, presents a restraint for the glaucoma surgery devices market. With an estimated 3% of the global population over 40 years affected by glaucoma, many of them remain undiagnosed, and the overall costs associated with advanced stages of the disease can be substantial. As glaucoma progresses, direct medical costs increase, impacting healthcare budgets and patient finances. This economic strain can limit access to advanced glaucoma devices, especially for patients in lower income brackets or regions with less robust healthcare systems. Furthermore, the need for early diagnosis and ongoing treatment adds to the financial burden, potentially constraining market growth for new and innovative glaucoma surgical solutions.

Opportunity

Rising awareness

Rising awareness about glaucoma presents a significant opportunity for the glaucoma surgery devices market. Increased public understanding of the importance of regular eye check-ups, knowledge of family medical history, and adopting healthy lifestyles can lead to earlier detection and intervention. As more individuals become aware of glaucoma's risks and the necessity for timely treatment, there is a growing demand for advanced glaucoma devices. Early detection and proactive management can drive the market. Enhanced awareness also supports greater adoption of new technologies and processes, ultimately improving patient outcomes and expanding market potential.

- World Glaucoma Week (10-16 March 2024), organized by the World Glaucoma Association (WGA), aims to raise global awareness about glaucoma. It encourages patients, eye-care providers, health officials, and the public to participate in activities that promote regular eye and optic nerve checks for early detection of glaucoma and sight preservation.

Segmental Insights

Product Insights

The traditional surgery devices segment held the largest share of the glaucoma surgery devices market in 2024. The traditional surgery devices market is dominated by traditional surgery methods, which have widespread applications. The increase in success rate for glaucoma surgery and the lower treatment costs of traditional glaucoma surgery contribute to its dominance. In underdeveloped economies, conventional glaucoma surgery is preferred as the first-line treatment due to its affordability compared to other segments.

The diamond knives segment is expected to grow significantly in the glaucoma surgery devices market during the forecast period. Diamond knives offer significant advantages over traditional blades in surgical techniques. Scanning electron microscopy has demonstrated that incisions made with diamond knives cause minimal corneal epithelium and stroma disruption, promoting better healing and less postoperative discomfort. Many surgeons prefer diamond knives because they often result in improved surgical outcomes and fast patient recovery times.

- In June 2024, MicroSurgical Technology introduced a diamond knife subscription to reduce waste and lower the carbon footprint associated with cataract surgery.

Surgery Method Insights

The traditional glaucoma surgery segment is expected to dominate the glaucoma surgery devices market in 2024. Its long-standing efficacy and widespread use have driven the market growth. Trabeculectomy, a key procedure in this segment, has been the gold standard for managing advanced glaucoma or cases unresponsive to medical or laser treatment. Despite the emergence of newer techniques, such as the Ex-PRESS glaucoma shunt, which offers a less invasive option and often achieves rapid pressure stabilization, traditional surgery continues to dominate the market due to its extensive history of successful outcomes.

The minimally invasive glaucoma surgery segment is observed to grow at a significant rate in the glaucoma surgery devices market during the forecast period. MIGS techniques, such as Hydrus stent, iStent, and XEN implant, offer rapid visual recovery, high safety, and minimal tissue trauma, making them appealing to both patients and surgeons. MIGS represents a promising, less invasive alternative in glaucoma management with evolving long-term results.

- In January 2023, Palmetto GBA collaborated with CGS Administrators, National Government Services, Noridian Healthcare Solutions, and WPS Government Health Administrators to host a Multi-Jurisdictional Contractor Advisory Committee meeting. Discussions focused on Micro-Invasive Glaucoma Surgery (MIGS).

End-use Insights

The hospital segment led the global glaucoma surgery devices market in 2024. This leadership is largely attributed to the comprehensive care provided in hospital settings, where complex procedures such as glaucoma drainage implant surgeries are performed. The specialized resources, advanced technology, and multidisciplinary teams available in hospitals contribute to their prominence in the glaucoma surgery market.

The ophthalmic clinics segment is expected to witness the fastest growth in the glaucoma surgery devices market during the projected period. This growth is driven by the increasing demand for specialized, accessible, and cost-effective glaucoma treatment. Ophthalmic clinics offer focused expertise in managing glaucoma, including advanced minimally invasive procedures and regular follow-up care.

Regional Insights

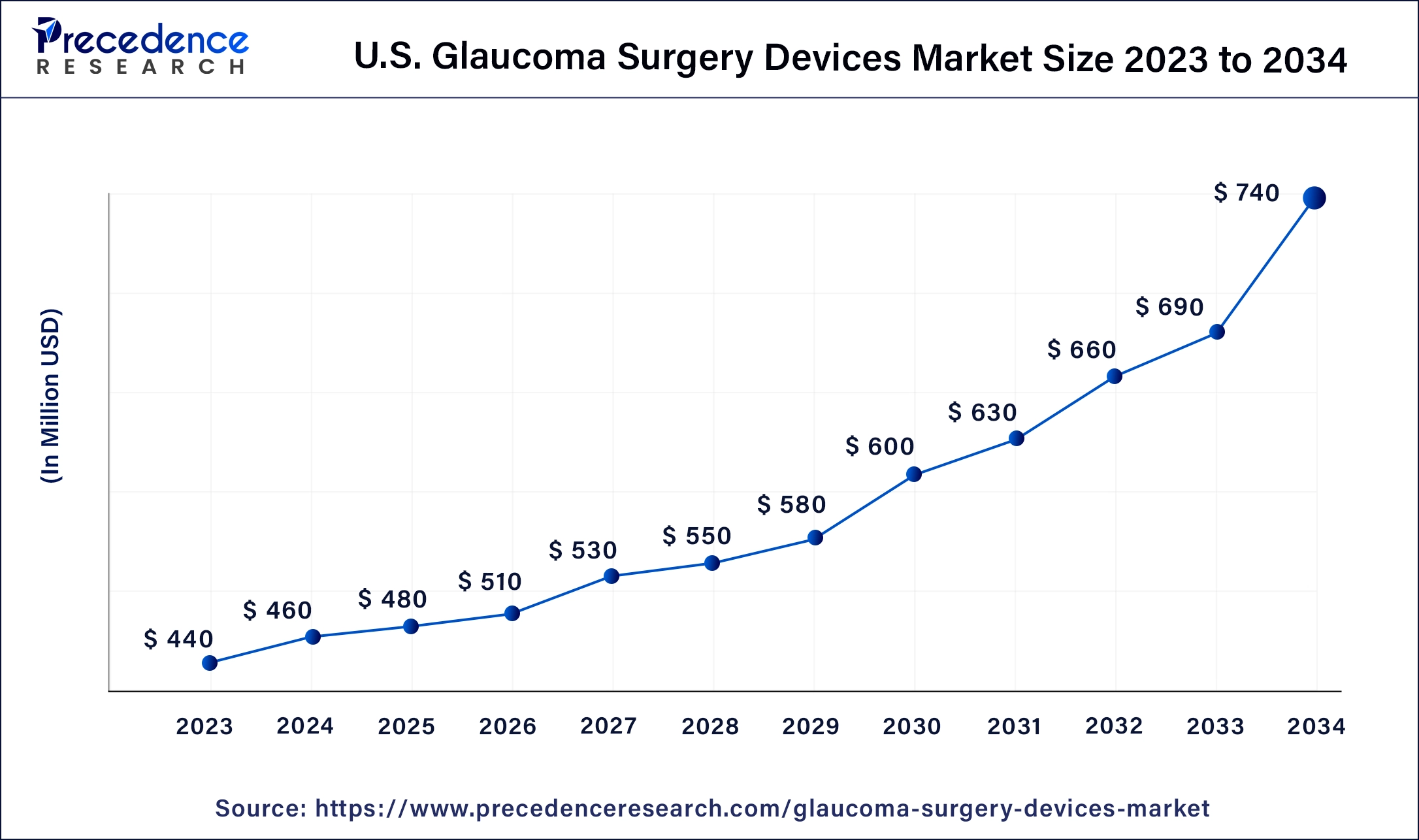

U.S. Glaucoma Surgery Devices Market Size and Growth 2025 to 2034

The U.S. glaucoma surgery devices market size is valued at USD480 million in 2025 and is expected to be worth around USD 740 million by 2034, rising a CAGR of 4.87% from 2025 to 2034.

What Made North America the Dominant Region?

North America held the largest share of the glaucoma surgery devices market in 2024 and is expected to sustain its position throughout the forecast period. North America has been the leading region in the market, driven by high awareness of the disease, advanced healthcare infrastructure, and substantial investments in research and development. The American Glaucoma Society (AGS) is a leading organization focused on enhancing the lives of individuals with glaucoma and those at risk by advancing education, research, healthcare access, and advocacy.

- January was National Glaucoma Awareness Month. Glaucoma, a leading cause of vision loss and blindness in the U.S., involves elevated eye pressure damaging the optic nerve. Open-angle glaucoma was the most common type in the country. The CDC reported that 50% of people with glaucoma were unaware of their condition due to a lack of early symptoms.

- The European Glaucoma Society (EGS) has committed substantial efforts to enhance education, training, and testing knowledge in glaucoma.

U.S. Glaucoma Surgery Devices Market Trends

In the U.S., the market is increasingly driven by the rapid adoption of minimally invasive glaucoma surgery (MIGS) techniques, particularly micro stents and drainage implants, which are preferred over traditional surgeries due to their safety profile and quicker recovery. In addition, rising initiatives to support glaucoma treatments bolster market growth. In February 2025, Alcon announced the U.S. launch of Voyager DSL, the first treatment offered by Alcon for glaucoma and ocular hypertension. In August 2025, Iantrek raised $42 million to boost the launch of its glaucoma treatment in the U.S.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is anticipated to witness the fastest growth in the glaucoma surgery devices market during the forecast period. The increasing prevalence of glaucoma, driven by aging populations and lifestyle changes, is increasing the demand for advanced diagnostic and treatment technologies. The expanding healthcare infrastructure and growing investments in ophthalmic research and development contribute to the market expansion. Countries like India, China, and Japan are particularly significant in this growth trend.

- Asia Pacific Congress 2024 will unite clinicians, scientists, students, and other health practitioners in ophthalmology to collaborate and share the latest research and innovation in glaucoma care.

- The Asia Pacific Glaucoma Society (APGS) organized an event aimed at enhancing communication among glaucoma specialists, fostering collaborative research, and updating professionals on advancements in diagnosis and management.

- The National Programme for Control of Blindness & Visual Impairment in the Ministry of Health & Family Welfare reported that glaucoma was one of the leading causes of blindness, accounting for 5.8% of the approximately 12 million cases of blindness in India.

India Glaucoma Surgery Devices Market Trends

The growing burden of glaucoma, fuels by an aging population and high prevalence of risk factors like diabetes, is boosting demand for such advanced surgical interventions. Meanwhile, rising investments in India's ophthalmic infrastructure and the entry of local and international device-makers are helping expand access and adoption of these newer surgical technologies. In April 2025, the Ministry of Defense took a pioneering initiative by launching an advanced 3D microscope, the first of its kind in an army hospital, for minimally invasive glaucoma surgery. Akums, the leading company, recently launched a new combination of eye drops for treating glaucoma in India.

Why is Europe Considered a Significant Region in the Glaucoma Surgery Devices Market?

Europe is considered a significant region in the market due to its high prevalence of glaucoma, particularly among the aging population, which drives consistent demand for advanced surgical interventions. Regulatory certifications and new product launches by medical device companies bolster the regional market. The current government-led reimbursement policies for medical devices greatly influence the market's growth in the region. Additionally, Europe hosts key medical device manufacturers and ongoing clinical research, fostering continuous technological innovation and early introduction of next-generation glaucoma surgery devices.

France Glaucoma Surgery Devices Market Trends

Elios Vision, an innovative technology for glaucoma treatment, is now registered for use in France, reflecting the country's adoption of cutting-edge medical solutions. The market for glaucoma surgery devices is rapidly growing, driven by technological innovations such as minimally invasive glaucoma surgery (MIGS). Further advancements, including next-generation subconjunctival shunts and canal surgery devices, continue to fuel market expansion and improve patient outcomes.

What Factors Drive Latin America's Lead in the Glaucoma Surgery Devices Market?

Latin America is expected to experience steady growth during the forecast period. The launch of novel medical devices and companies' investments drives market growth. The market is expanding due to numerous government initiatives aimed at preventing blindness and increasing healthcare access. Moreover, a rising rate of glaucoma, especially in aging and high-risk populations, boosts demand for surgical interventions.

Brazil Glaucoma Surgery Devices Market Trends

Brazil leads the Latin American market due to several government initiatives. In August 2025, the Brazilian government invested $480 million in health equipment to strengthen the medical device sector. These investments target ophthalmic surgical devices, including lasers and microscopes, supporting the country's growing eye care infrastructure. Strategic alliances and new product launches by leading companies such as Johnson & Johnson, Medtronic, and GE Healthcare further drive the expansion of the glaucoma surgery devices market in Brazil.

What Potentiates the Glaucoma Surgery Devices Market Within the Middle East & Africa?

The market in the Middle East & Africa (MEA) is driven by government initiatives to improve access to healthcare solutions and rising rates of glaucoma and other ocular diseases. Increasing investment in healthcare infrastructure, especially in Gulf countries such as the UAE and Saudi Arabia, is supporting the broader adoption of minimally invasive glaucoma surgery (MIGS) and other advanced surgical devices. Saudi Arabia is a major contributor to the market.

The government's Vision 2030 healthcare modernization plan aims to enhance infrastructure and expand the private healthcare sector across Saudi Arabia. The development of medical tourism hubs in cities like Riyadh and Jeddah, along with increased hospital capacity, is further strengthening ophthalmic care. These initiatives collectively support the growth and adoption of advanced glaucoma surgery devices in the region.

Glaucoma Surgery Devices Market Companies

- Alcon, Inc.

- Glaukos Corporation

- Johnson & Johnson Vision

- AbbVie Inc. (Allergan Plc.)

- ASICO, LLC

- Carl Zeiss Meditec AG

- Katalyst Surgical

- Lumenis Lt.

- Ziemer Ophthalmic Systems AG

- Iridex Corporation.

- Altomed

Recent Developments

- In July 2024, Alcon acquired Belkin Vision, gaining access to new laser treatment for glaucoma. Alcon planned to introduce this technology to the U.S. market.

- In February 2024, Glaukos launched the iDose TR (travoprost intracameral implant) to reduce intraocular pressure in patients with ocular hypertension or open-angle glaucoma.

- In August 2023, Nova Eye Medical reported strong sales following the U.S. launch of its iTrack Advance glaucoma surgical device. The iTrack Advance, a consumable device with an illuminated fiber optic tip, aimed to improve the efficacy of canaloplasty surgery in treating glaucoma.

- In December 2023, the U.S. Food and Drug Administration (FDA) granted 510(k) clearance for the Eagle device, a glaucoma laser.

- In April 2023, Bausch + Lomb Announced the U.S. Launch of the StableVisc Cohesive Ophthalmic Viscosurgical Device and TotalVisc Viscoelastic System. These products provided eye surgeons with new options for dual-action protection during cataract surgery.

- In April 2023, the FDA cleared Nova Eye Medical iTrack Advance for the U.S. launch. These canaloplasty devices were designed for canal-based glaucoma surgery

- In July 2022, Bausch + Lomb and Sanoculis entered into strategic agreements aimed at addressing unmet needs in glaucoma.

Segments Covered in the Report

By Product

- Glaucoma drainage device

- Valves

- Glaucoma drainage implant

- Glaucoma tube shunts

- Stents

- Traditional Surgery Devices

- Scalpel

- Forceps

- Ophthalmic scissors

- Punch

- Sutures

- Surgical drapes

- Microcatheter

- Others

- Diamond knives

- Laser systems

- Others

By Surgery Method

- Traditional Glaucoma Surgery

- Trabeculectomy

- Tube Shunt Surgery

- Minimal Invasive Glaucoma Surgery

- Trabecular Meshwork Bypass

- Suprachoroidal Space Implants

- Subconjunctival Space Implants

- Schlemm's Canal Implants

- Gonioscopy-assisted Transluminal Trabeculectomy

- Endocyclophotocoagulation

- Laser Surgery

- Trabeculoplasty

- Iridotomy

- Cyclophotocoagulation

By End-user

- Hospitals

- Ophthalmic clinics

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting