HDPE Pipes Market Size and Growth 2025 to 2034

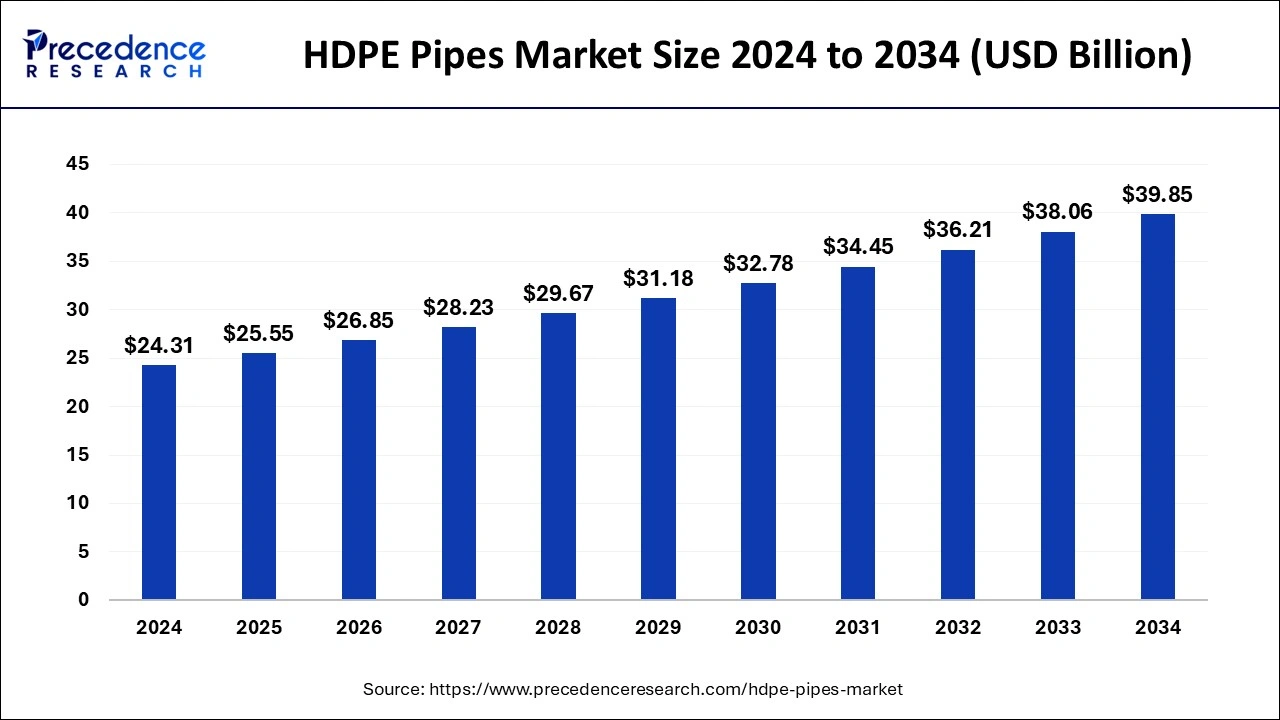

The global HDPE pipes market size was estimated at USD 24.31 billion in 2024 and is predicted to increase from USD 25.55 billion in 2025 to approximately USD 39.85 billion by 2034, expanding at a CAGR of 5.07% from 2025 to 2034. The HDPE pipes market is driven by the increasing global demand for effective water and waste management systems.

HDPE Pipes Market Key Takeaways

- In terms of revenue, the global HDPE pipes market was valued at USD 24.31 billion in 2024.

- It is projected to reach USD 39.85 billion by 2034.

- The market is expected to grow at a CAGR of 5.07% from 2025 to 2034.

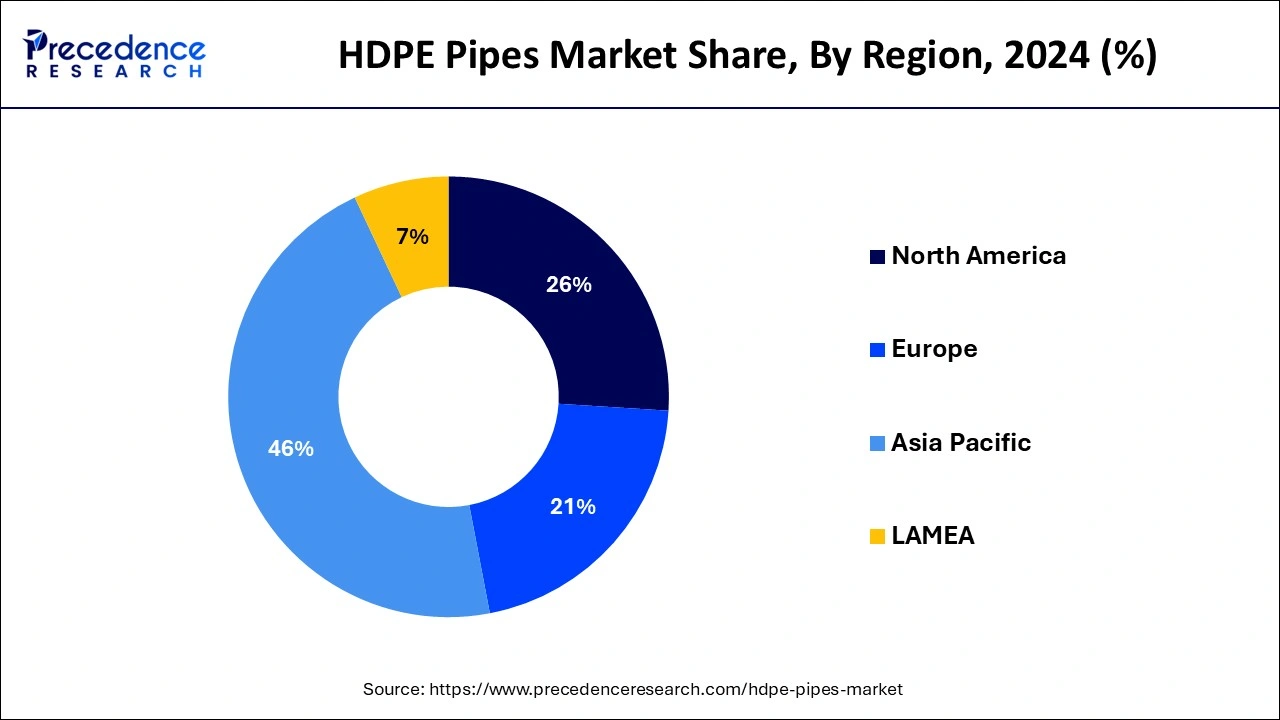

- Asia-Pacific dominated the global market with the largest market share of 46% in 2024.

- Europe shows a significant growth in the market during the forecast period.

- By type, the HDPE 100 segment dominated the HDPE pipes market in 2024.

- By type, the HDPE 80 segment is observed to be the fastest growing market during the forecast period.

- By application, the sewage system pipe segment dominated the HDPE pipes market in 2024.

- By application, the oil and gas pipe segment are observed to be the fastest growing market during the forecast period.

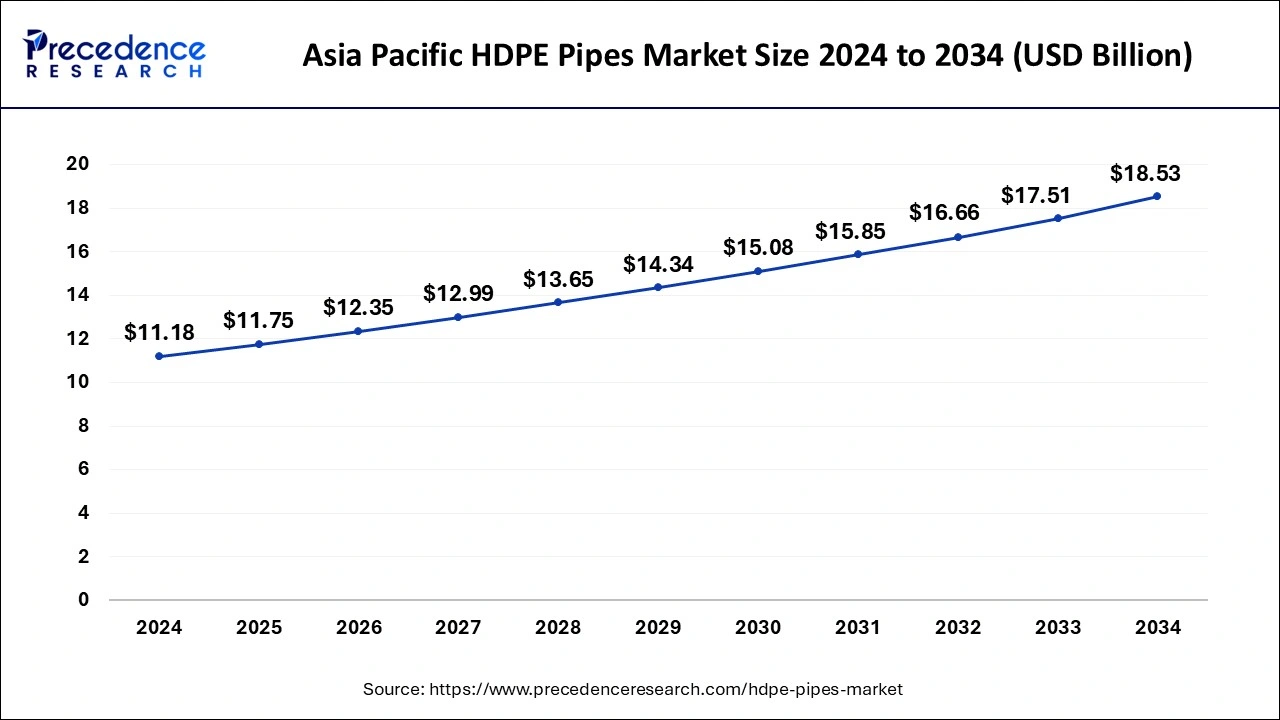

Asia Pacific HDPE Pipes Market Size and Growth 2025 to 2034

The Asia Pacific HDPE pipes market size was estimated at USD 11.18 billion in 2024 and is predicted to be worth around USD 18.53 billion by 2034 with a CAGR of 5.18% from 2025 to 2034.

Asia-Pacific had the largest market share in 2024 in the HDPE pipes market. There is a significant and expanding industrial sector in the area. HDPE pipes are recommended for industries such as petrochemicals, manufacturing, and pharmaceuticals that need dependable piping solutions for moving chemicals, water, and waste. A significant industry in many Asia-Pacific nations is still agriculture. HDPE pipes are widely employed in irrigation systems because of their extended service life, resistance to chemicals and fertilizers, and capacity to tolerate high pressure. The Asia-Pacific market has attracted foreign investments due to its excellent growth prospects, which have improved local capabilities and facilitated technology transfer, supporting market expansion.

Saudi Plastic Products Company (Sappco) has said that it has won a significant contract to provide HDPE pipes for a $426 million seawater cooling project in the Jazan area of the Kingdom. Sappco, a significant plastic pipe manufacturer in Saudi Arabia, supplies its cutting-edge large-diameter technology HDPE pipes to an ambitious saltwater cooling project site as part of an earlier agreement with China Harbour Engineering Company (CHEC).

Europe shows a significant growth in the HDPE pipes market during the forecast period. To lower carbon footprints and advance sustainable development, European countries are putting strict restrictions into place. HDPE pipes comply with environmental friendliness and recycling requirements, increasing demand for them. The use of HDPE pipes is strongly encouraged by several national and EU-funded initiatives targeted at enhancing water management and lowering leakage losses. HDPE pipes are renowned for their exceptional flexibility, resistance to corrosion and chemicals, and high strength-to-density ratio. These characteristics make them appropriate for various uses, including industrial pipe systems, agricultural irrigation, and potable water.

- In January 2024, by building the first sustainable gas pipeline in history, INEOS pioneered a revolutionary advancement in sustainable infrastructure. This innovative project's use of bio-based, INEOS-produced high-density polyethylene (HDPE) represents a significant turning point in the shift towards environmentally conscious infrastructure.

Market Overview

The industry segment that produces, distributes, and sells pipes composed of high-density polyethylene material is known as the HDPE pipes market. The exceptional strength-to-density ratio, chemical resistance, flexibility, and longevity of HDPE pipes make them ideal for various uses, such as industrial operations, irrigation, gas distribution, sewage systems, and water supply.

Applications of HDPE pipes

| Sr.No. | Applications | HDPE Pipes Used |

| 1. | Water Supply Systems | Their superior resistance to UV rays, chemicals, and high pressure makes them perfect for supplying pure and secure drinking water. |

| 2. | Wastewater & Sewage Systems | Their smooth inner surface keeps obstructions and clogs at bay, guaranteeing wastewater flows continuously. HDPE pipes can handle caustic substances found in sewage and industrial wastewater because of their high resistance to abrasion and chemicals. Furthermore, their non-leaking joints shield groundwater from pollution, supporting environmental sustainability. |

| 3. | Gas Distribution Networks | Areas that experience seismic activity and soil movement by making installation more accessible, lowering the requirement for extra fittings, and reducing the possibility of leaking spots. |

| 4. | Industrial Fluid Transportations | Carrying corrosive materials such as acids, chemicals, alkalis, and other materials. HDPE's chemical resistance and smooth inner surface facilitate effective industrial operations, reducing frictional losses and improving flow characteristics. |

| 5. | Geothermal Heating Systems | Heat transfer fluid is circulated underground, utilizing renewable energy sources for heating and cooling. HDPE's insulating qualities and tolerance to high temperatures maximize energy efficiency in geothermal systems. |

HDPE Pipes Market Growth Factors

- HDPE pipes are the favored choice for water and gas distribution systems due to their strength, flexibility, and resistance to corrosion. The increasing need for dependable gas and water infrastructure drives the HDPE pipe market.

- Certain governments are promoting HDPE pipes owing to their advantages over conventional materials. This may encourage broader adoption and market expansion.

- Rapid industrialization and urbanization in areas like the Asia Pacific, especially China and India, fuel the demand for additional infrastructure. HDPE pipes are an affordable and long-lasting option for these kinds of applications.

- Manufacturers are developing new HDPE pipe solutions to solve issues such as stress cracking and weathering resistance. Improvements in performance and efficiency have the potential to grow the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 25.55 Billion |

| Market Size by 2034 | USD 39.85 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.07% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for water supply and irrigation system

Growing agricultural output is required to feed the world's population, which raises the requirement for effective irrigation systems. Because they are dependable and long-lasting, HDPE pipes are widely used in agriculture to deliver water over large distances without leaking, there is an exponential growth in the HDPE pipes market. When compared to more conventional materials like metal or concrete, HDPE pipes have a longer lifespan. They are appropriate for potable water supplies due to their resistance to corrosion and chemical reactions, guaranteeing the delivery of clean and safe water in urban areas.

Innovative installation techniques

Considering its dependability and simplicity of use, electrofusion welding has become the industry standard for gas and water distribution systems, fostering market expansion by guaranteeing durable infrastructure solutions. Fusion welding has become more and more common because of its efficiency and durability, especially in applications where joint integrity is critical, including water and wastewater management. These techniques are propelling the growth of the HDPE pipes market.

Restraint

Limited awareness and acceptance of HDPE pipes

Professionals with the necessary training and experience to install and maintain HDPE pipes are hard to come by. Preference for known materials results from the different knowledge needed for fusion welding and handling HDPE materials compared to more conventional materials like PVC, steel, or concrete. HDPE pipe marketing campaigns may not be as extensive or aggressive as those for conventional materials. Insufficient marketing initiatives may cause prospective customers to be unaware of the benefits of HDPE pipes. In some places, there might not be any uniform laws or policies governing the use of HDPE pipes. This may result in variations in performance and quality, discouraging acceptance even more, which ultimately hinders market growth.

Opportunity

Increasing awareness about water scarcity

Governments and organizations around the world are investing in sustainable infrastructure to overcome water scarcity. HDPE pipes are essential to these kinds of projects because of their efficiency and environmental advantages. Hydroelectric power and solar water heating systems are two examples of renewable energy projects that use HDPE pipes because of their dependability and efficiency. Sustainable materials such as HDPE are recognized by many green building standards and certifications, like LEED, and their use is encouraged in new construction and retrofits.

Type Insights

The HDPE 100 segment dominated in the HDPE pipes market in 2024. The high-density molecular structure of HDPE 100 is well known for giving the pipes remarkable strength and toughness. Because of its improved material quality, HDPE 100 pipes can endure severe environments, high-pressure applications, and temperature changes without losing functionality. Although they are premium grade, over their lifetime, they are incredibly cost-effective.

As compared to more conventional piping materials such as concrete, steel, or PVC, HDPE pipes' long-term performance, low maintenance needs, and quicker installation all result in cheaper total costs. Their lightweight design also makes handling and shipment simpler, which lowers installation costs even more.

The HDPE 80 segment is observed to be the fastest growing in the HDPE pipes market during the forecast period.

Regarding qualities, HDPE 80 pipes are better than other HDPE pipe kinds. A particular type of high-density polyethylene, which provides remarkable strength, durability, and flexibility, is used to manufacture these pipes. The material is perfect for various applications, such as industrial pipelines, gas distribution, sewage systems, and water supply. Its high tensile strength, corrosion resistance, and capacity to tolerate high temperatures further contribute to its appeal. A growing consciousness of sustainability in the environment is impacting the selection of pipe materials.

Recyclable and eco-friendly, HDPE 80 pipes help lower carbon emissions compared to other materials. The need for environmentally friendly piping solutions, such as HDPE 80 pipes, is predicted to rise as sustainability becomes a top priority for businesses and governments around the globe.

Application Insights

The sewage system pipe segment dominated the HDPE pipes market in 2024. Since HDPE pipes are flexible and lightweight, they are simple to transport and install, especially in cities with intricate subterranean systems. Because of their flexibility, they can tolerate settling and ground movement, which lowers the possibility of long-term pipe damage or failure. HDPE pipes are also more suitable for sewage systems because of the jointing methods used to create leak-proof connections, such as heat fusion or mechanical fittings. HDPE pipes greatly benefit as environmental sustainability becomes a top priority for governments and municipalities.

They guarantee that the nearby soil and water sources are not contaminated because they are non-toxic, chemically inert, and resistant to biological growth. Moreover, HDPE pipes are recyclable, which lessens the environmental effect of sewage infrastructure projects and promotes a circular economy.

The oil and gas pipe segment is observed to be the fastest growing in the HDPE pipes market during the forecast period. Exploration and production of oil and gas are becoming more necessary as the world's energy consumption rises. Because HDPE pipes are flexible, long-lasting, and corrosion-resistant, they are the favored choice for long-distance oil and gas transportation in this industry. Pipes made of plastic are gradually replacing more conventional materials like steel in several industries, including the oil and gas sector. Particularly, HDPE pipes are becoming increasingly popular because of their excellent qualities, including flexibility, durability, and resistance to abrasion and corrosion.

HDPE Pipes Market Companies

- Lane Enterprises, Inc

- POLY PLASTIC Group

- RADIUS System

- SCG Chemicals Public Company Limited

- JM EAGLE, INC.

- United Poly Systems

- Vectus

- Prinsco, Inc.

- WL Plastics

- Blue Diamond Industries

Recent Developments

- In April 2024, based in Sequin, Texas, AmeriTex Pipe & items LLC is constructing a new Conroe, Texas factory to extrude corrugated pipe from virgin high-density polyethylene and polypropylene, meeting the state's demand for infrastructure items.

- In December 2023, announcing the acquisition of Infinity Plastics, a manufacturer of manufactured high-density polyethylene (HDPE) piping products, was ISCO Industries.

- In November 2023, a definitive agreement was reached to acquire nearly all of the assets of Lee Supply Company Inc. (Lee Supply), the ability to rent HDPE fusion equipment and perform custom fabrication. Core & Main Inc. is a leader in advancing dependable infrastructure with local service across the country.

Segments Covered in the Report

By Type

- HDPE 63

- HDPE 80

- HDPE 100

By Application

- Oil and Gas Pipe

- Agricultural Irrigation Pipe

- Water Supply Pipe

- Sewage System Pipe

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting