Hosted Private Branch Exchange Market Size and Forecast 2025 to 2034

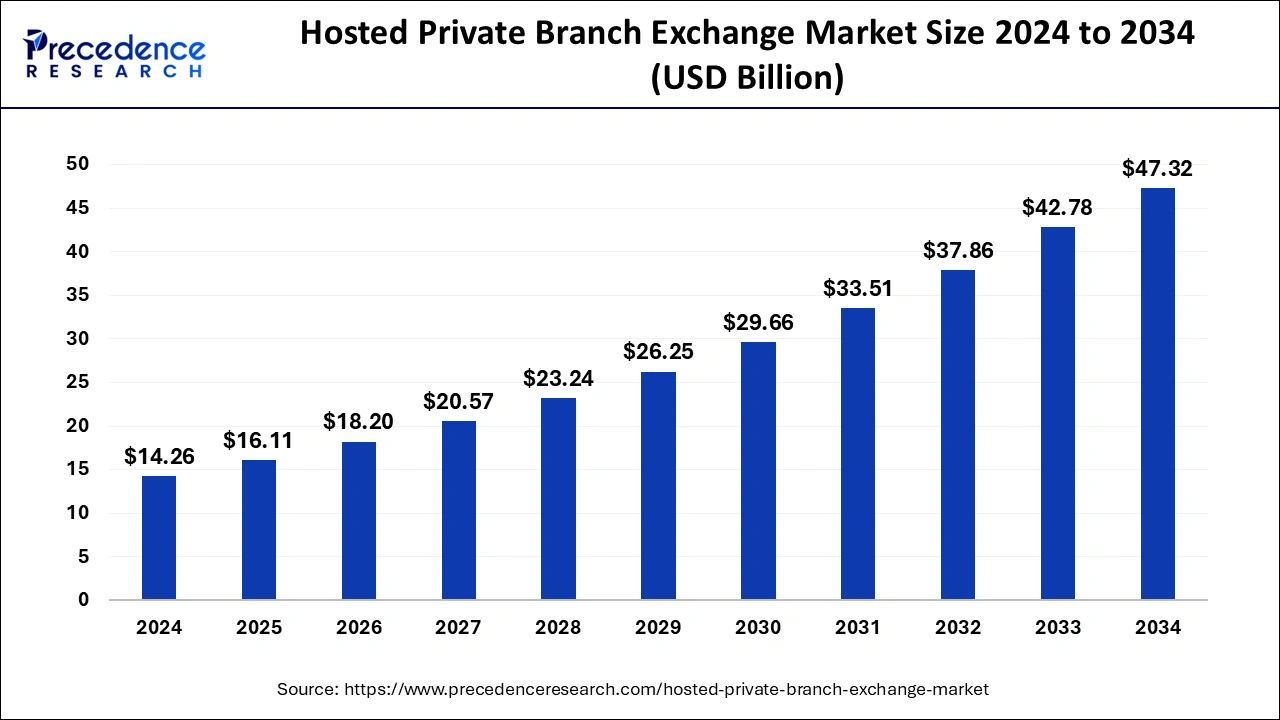

The global hosted private branch exchange market size was estimated at USD 14.26 billion in 2024 and is predicted to increase from USD 16.11 billion in 2025 to approximately USD 47.32 billion by 2034, expanding at a CAGR of 12.74% from 2025 to 2034.

Hosted Private Branch Exchange MarketKey Takeaways

- The global hosted private branch exchange market was valued at USD 14.26 billion in 2024.

- It is projected to reach USD 47.32 billion by 2034.

- The hosted private branch exchange market is expected to grow at a CAGR of 12.74% from 2025 to 2034.

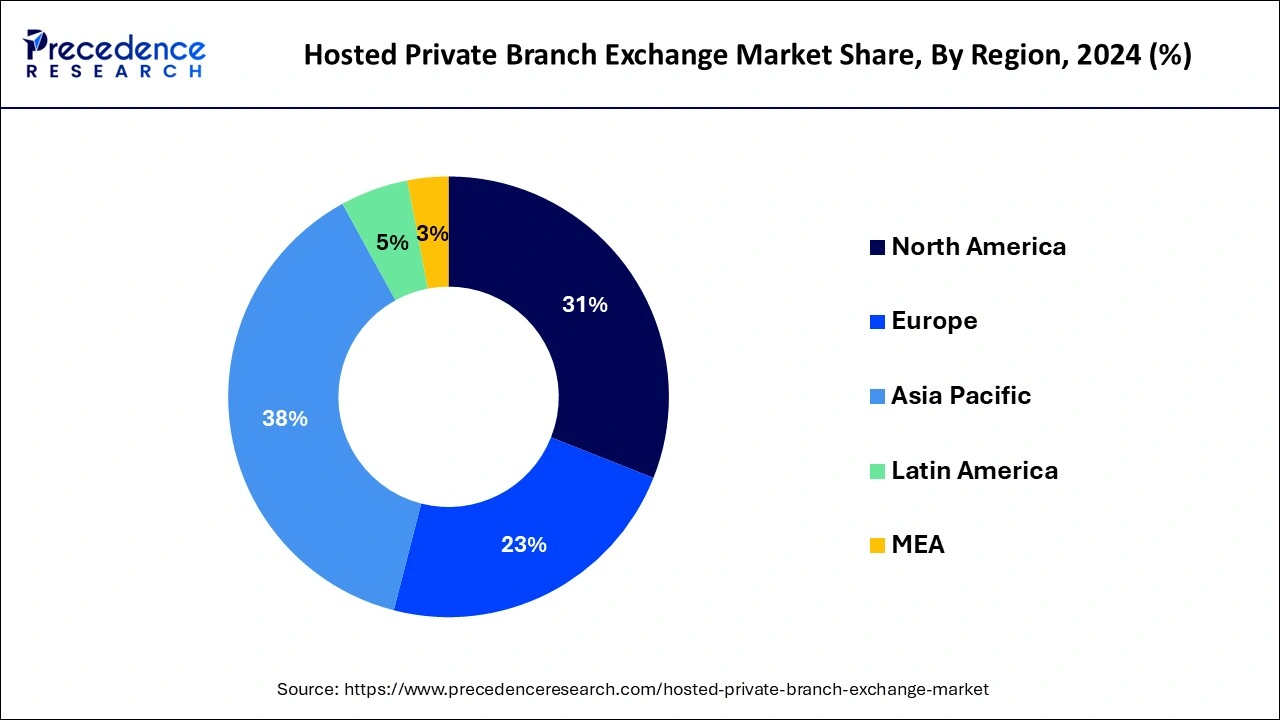

- Asia-Pacific contributed 38% of market share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By component, the solution segment held the largest market share of 65% in 2024.

- By component, the service segment is anticipated to grow at a remarkable CAGR of 13.8% between 2025 and 2034.

- By organization size, the large enterprises segment generated over 62% of market share in 2024.

- By organization size, the SMEs segment is expected to expand at the fastest CAGR over the projected period.

- By industry vertical, the healthcare segment generated over 32% of market share in 2024.

- By industry vertical, the retail segment is expected to expand at the fastest CAGR over the projected period.

Asia PacificHosted Private Branch Exchange Market Size and Growth 2025 to 2034

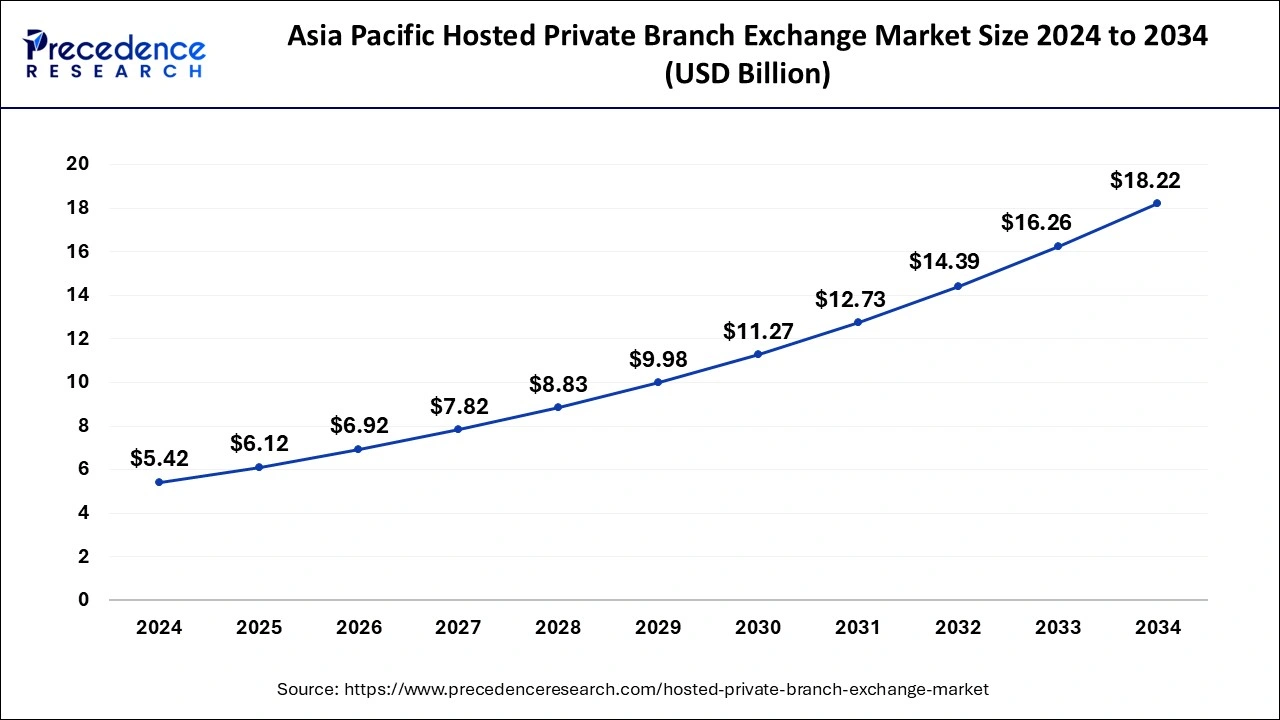

The Asia Pacific hosted private branch exchange market size was estimated at USD 5.42 billion in 2024 and is projected to surpass around USD 18.22 billion by 2034 at a CAGR of 12.89% from 2025 to 2034.

Asia-Pacific region contributed 38% of the market share in 2024in hosted private branch exchange market due to several factors. These include the region's burgeoning economy, increasing adoption of cloud-based technologies, and rising demand for cost-effective communication solutions among businesses of all sizes. Additionally, the proliferation of mobile devices and internet connectivity, coupled with the region's large and diverse population, further drives the uptake of hosted PBX services. Moreover, the growing trend towards remote work and digital transformation initiatives across industries contributes to the expanding market opportunities in the Asia-Pacific region for hosted PBX solutions.

North America is observed to expand at a significant rate in the hosted private branch exchange market due to several factors.Firstly, the region has a robust technological infrastructure and a high adoption rate of cloud-based solutions, driving the demand for hosted PBX services. Additionally, North American businesses prioritize communication efficiency and flexibility, leading to the widespread adoption of advanced communication technologies like hosted PBX. Furthermore, the presence of key market players and a competitive business landscape contribute to North America's dominant position in the global hosted private branch exchange market.

Meanwhile, Europe is experiencing notable growth in the hosted private branch exchange market due to several factors. Firstly, there is a growing trend towards cloud-based communication solutions across industries, driving the adoption of hosted PBX systems. Additionally, the rise in remote work, technological advancements, and the focus on cost reduction and efficiency are contributing to the market's expansion. Moreover, the scalability, flexibility, and enhanced mobility offered by hosted PBX solutions are appealing to businesses of all sizes, further fueling market growth in Europe.

Market Overview

Hosted private branch exchange (PBX) is a cloud-based communication system that allows businesses to manage their phone systems remotely. Unlike traditional PBX systems that require on-site hardware and maintenance, hosted PBX operates over the internet, eliminating the need for physical infrastructure. With hosted PBX, businesses can access advanced phone features like call routing, voicemail, conferencing, and auto-attendants through a subscription-based service. This technology offers scalability, flexibility, and cost-effectiveness, as businesses can easily add or remove phone lines and features based on their evolving needs without significant upfront investments. Hosted PBX also enhances mobility, enabling employees to make and receive calls from anywhere with an internet connection. Overall, hosted PBX empowers businesses of all sizes to streamline communication, improve customer service, and enhance productivity while reducing the complexities and costs associated with traditional phone systems.

Hosted Private Branch Exchange Market Data and Statistics

- In April 2020, ThinkTel, a division of Distributel, unveiled its hosted PBX unified communications offering named MaX UC, developed in collaboration with Metaswitch.

- In September 2020, Atlantech Online announced the completion of fiber connectivity at Anthem Row. Tenants at 700 K Street, NW and 800 K Street can now access high-speed Internet at competitive prices. Atlantech's Hosted PBX Service is available to tenants, enhancing the company's service legacy.

- In October 2020, Vonage collaborated with Hacktoberfest to promote and celebrate contributions to the Open Source community. The company aims to facilitate participation by providing access to its libraries, code snippets, and demonstrations via GitHub.

Hosted Private Branch Exchange MarketGrowth Factors

- The growing trend towards cloud-based technologies across industries is driving the adoption of hosted PBX systems. Businesses are recognizing the benefits of cloud-based communication solutions in terms of scalability, flexibility, and cost-effectiveness.

- The shift towards remote work, accelerated by factors such as globalization and the COVID-19 pandemic, has fueled the demand for hosted PBX solutions. These systems enable seamless communication and collaboration among remote teams, supporting the needs of distributed workforces.

- Hosted PBX systems offer cost savings compared to traditional on-premises PBX solutions. With no need for upfront hardware investments and reduced maintenance costs, businesses can achieve significant cost reductions while enhancing operational efficiency.

- Ongoing advancements in telecommunications technology are driving innovation in hosted PBX systems, leading to the development of advanced features and functionalities. These include AI-powered call routing, real-time analytics, and integration with other business applications.

- Hosted PBX solutions provide businesses with scalability and flexibility, allowing them to easily scale their communication infrastructure up or down based on changing business requirements. This scalability is particularly beneficial for growing businesses or those experiencing fluctuating call volumes.

- Hosted PBX systems offer built-in redundancy and disaster recovery capabilities, ensuring business continuity even in the event of network outages or disasters, this requirement offers a sustained growth factor for the hosted private branch exchange market. This resilience is crucial for businesses, especially in today's interconnected and digitally driven environment.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 12.74% |

| Market Size in 2025 | USD 16.11 Billion |

| Market Size by 2034 | USD 47.32 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Organization Size, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Scalability and flexibility of hosted PBX solutions

The scalability and flexibility of hosted PBX solutions play a pivotal role in surging market demand. Businesses appreciate the ability to easily scale their communication infrastructure up or down according to their evolving needs. Whether a company is expanding its operations or experiencing fluctuations in call volumes, hosted PBX offers the agility to adjust without the need for costly hardware upgrades or installations. This scalability aligns with the dynamic nature of modern businesses, allowing them to adapt quickly to changing market conditions and organizational requirements.

Moreover, the flexibility of hosted PBX solutions enables businesses to customize their communication systems to meet specific preferences and workflows. From adding new features and functionalities to integrating with other business applications, hosted PBX offers a level of customization that empowers organizations to tailor their communication infrastructure to their unique requirements. This flexibility enhances operational efficiency and productivity while providing a seamless and personalized communication experience for employees and customers alike, thus driving the growth of the hosted private branch exchange market.

Restraint

Limited customization options for some providers

The limited customization options offered by some providers pose a significant restraint on the market demand for hosted private branch exchange (PBX) solutions. Businesses often have unique communication needs and workflows that require tailored solutions to optimize efficiency and productivity. When providers offer limited customization options, businesses may find it challenging to adapt the hosted PBX system to suit their specific requirements. This limitation can lead to frustration and dissatisfaction among potential customers who seek more flexibility and control over their communication infrastructure.

Furthermore, businesses may perceive limited customization options as a barrier to innovation and growth. They may feel constrained by the rigid features and functionalities offered by providers, hindering their ability to innovate and stay competitive in the hosted private branch exchange market. As a result, businesses may hesitate to invest in hosted PBX solutions, opting instead for alternative communication systems that offer greater customization capabilities. Ultimately, the limited customization options offered by some providers can impede market demand for hosted PBX solutions, limiting the growth potential of the industry.

Opportunity

Offering hybrid solutions combining cloud and on-premises PBX

Offering hybrid solutions that combine cloud-based and on-premises PBX systems presents significant opportunities in the hosted private branch exchange market. Businesses often have varying needs and preferences when it comes to their communication infrastructure. By providing hybrid solutions, service providers can cater to a broader range of customers, accommodating those who prefer the flexibility and scalability of cloud-based PBX as well as those who require the control and security of on-premises systems. This approach allows businesses to leverage the benefits of both deployment models, optimizing their communication capabilities according to their specific requirements.

Moreover, hybrid solutions offer seamless integration between cloud and on-premises PBX systems, providing a unified communication experience for employees and customers. Businesses can enjoy the cost-effectiveness and scalability of cloud-based solutions while maintaining critical control over sensitive data and compliance requirements with on-premises deployments. This flexibility and versatility empower businesses to tailor their communication infrastructure to their unique needs, enhancing productivity and efficiency while maximizing return on investment in the hosted private branch exchange market.

Component Insights

The solution segment held the highest market share of 65% in 2024. In the hosted private branch exchange market, the solution segment refers to the software and services that comprise the hosted PBX system. This includes call management features, voicemail, auto-attendants, and integration capabilities with other business applications. Additionally, solution providers offer implementation, maintenance, and support services to ensure the smooth operation of the hosted PBX system. Trends in the solution segment of the hosted private branch exchange market include the integration of advanced communication technologies such as AI and IoT, enhanced security features, and the development of industry-specific solutions tailored to the unique needs of different sectors.

The service segment is anticipated to witness rapid growth at a significant CAGR of 13.8% during the projected period. In the hosted private branch exchange market, the service segment encompasses the range of offerings provided by service providers to implement, manage, and maintain the hosted PBX systems for businesses. These services include installation, configuration, maintenance, troubleshooting, and support to ensure the smooth operation of the communication infrastructure. Trends in the service segment of the market include an increasing emphasis on customer support and satisfaction, proactive monitoring and maintenance, personalized service packages tailored to specific business needs, and integration with emerging technologies such as AI and analytics for enhanced functionality and performance.

Organization Size Insights

The large enterprises segment held a 62% market share in 2024. The large enterprises segment in the hosted private branch exchange market includes organizations with a substantial workforce and extensive communication needs. These enterprises typically have complex communication requirements spanning multiple locations and departments. In recent trends, large enterprises are increasingly adopting hosted PBX solutions to streamline communication, enhance collaboration, and reduce operational costs. They are leveraging advanced features like scalability, mobility, and integration with other business applications to meet the evolving demands of their expansive operations efficiently.

The SMEs segment is anticipated to witness rapid growth over the projected period. Small and Medium-sized Enterprises (SMEs) typically refer to businesses with a limited number of employees and relatively modest market compared to larger corporations. In the hosted private branch exchange market, SMEs represent a significant segment that seeks cost-effective and scalable communication solutions. Trends indicate a growing adoption of hosted PBX among SMEs due to its affordability, flexibility, and ability to support remote work. SMEs are increasingly leveraging hosted PBX to enhance communication efficiency and streamline operations.

Industry Vertical Insights

The healthcare segment has held a 32% market share in 2024. In the healthcare sector, hosted private branch exchange (PBX) systems facilitate efficient communication among medical staff, patients, and administrators. This segment demands secure and reliable communication solutions to ensure patient confidentiality and streamline operations. Recent trends in the healthcare industry include the adoption of HIPAA-compliant hosted PBX solutions to meet regulatory requirements, integration with electronic medical records (EMRs) for seamless patient information access, and the implementation of telemedicine features to support remote consultations and patient care.

The retail segment is anticipated to witness rapid growth over the projected period. In the retail segment, in the hosted private branch exchange market, it refers to cloud-based communication solutions tailored to meet the needs of retail businesses. These solutions provide features such as call routing, voicemail, and conferencing, facilitating efficient communication between retail locations, headquarters, and customers. A notable trend in this segment is the increasing adoption of omnichannel communication strategies, where businesses integrate various communication channels like voice, email, and messaging to offer seamless customer experiences across online and offline channels, enhancing customer satisfaction and loyalty.

Hosted Private Branch Exchange Market Companies

- Cisco Systems, Inc.

- Avaya Inc.

- Mitel Networks Corporation

- NEC Corporation

- RingCentral, Inc.

- 8x8, Inc.

- Vonage Holdings Corp.

- Microsoft Corporation (Teams)

- Sangoma Technologies Corporation

- Nextiva, Inc.

- Alcatel-Lucent Enterprise

- BroadSoft, Inc. (Now part of Cisco)

- Panasonic Corporation

- ShoreTel (Now part of Mitel)

- Toshiba Corporation

Recent Developments

- In October 2023, Microsoft introduced new AI-driven features for Teams, its cloud-based collaboration platform. These features include real-time transcription and insights into meeting and call data, aiming to enhance efficiency and productivity. They seamlessly integrate with Microsoft Viva, an employee experience platform, to offer additional AI-powered capabilities. These enhancements are now readily available for users.

- In June 2020, RingCentral unveiled a new partner program designed to attract resellers and Managed Service Providers (MSPs). This program equips partners with resources and support to meet customer demands for Unified Communications as a Service (UCaaS) swiftly. The initiative is geared towards helping partners leverage the growing market demand for cloud-based communication solutions.

- In March 2020, Zoom expanded its Zoom Phone service to 11 additional countries, expanding its total supported countries to 17. Additionally, it introduced beta testing in 25 new countries. This expansion offers local phone numbers and Public Switched Telephone Network (PSTN) access in countries like Austria, Belgium, and France, facilitating the transition from legacy phone systems to Zoom's unified communication platform.

Segments Covered in the Report

By Component

- Solution

- Service

- Network Service

- Security Service

- Managed Service

By Organization Size

- Large Enterprises

- SMEs

By Industry Vertical

- BFSI

- Healthcare

- Government

- Retail

- Manufacturing

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting