What is Virtual Private Network (VPN) Market Size?

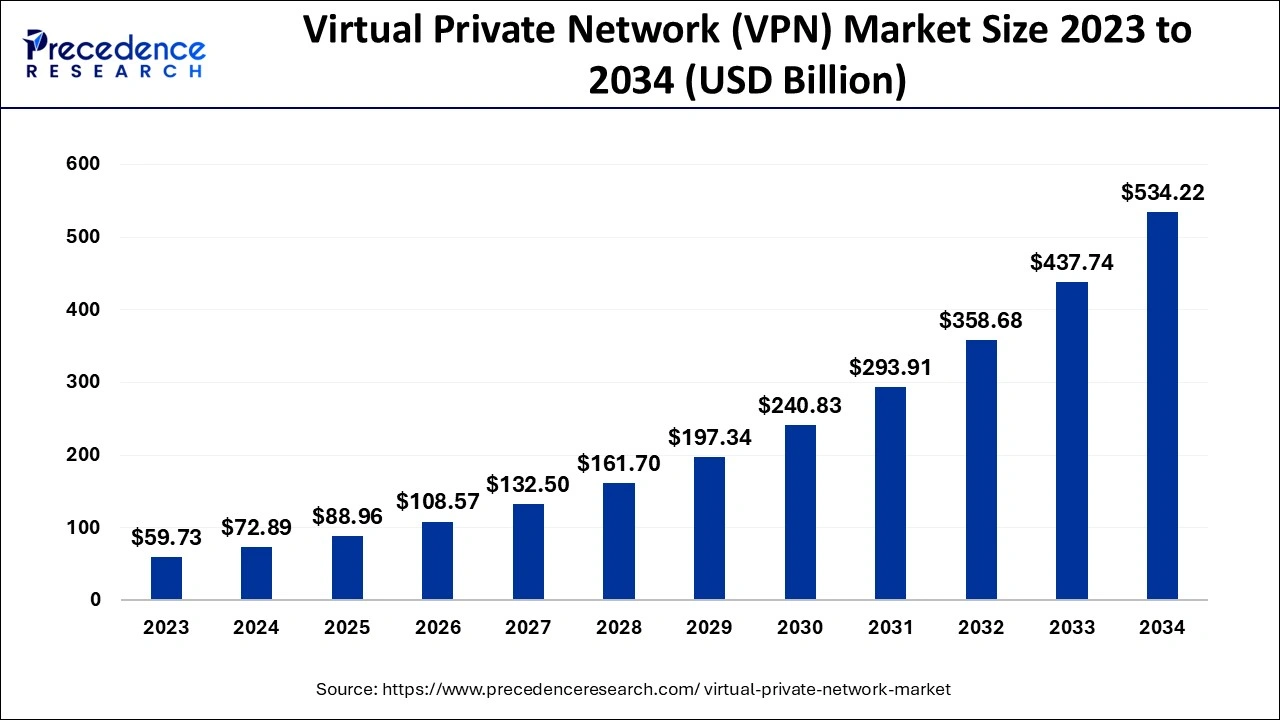

The global virtual private network (VPN) market size accounted for USD 88.96 billion in 2025 and is anticipated to reach around USD 534.22 billion by 2034, expanding at a CAGR of 22.04% between 2025 and 2034.

Market Highlights

- By geography, the North America generates more than 37% of revenue share in 2024.

- By component, the solution segment generates more than 66.0% of revenue share in 2024.

- By type, the remote access segment captured more than 37% of revenue share in 2024.

- By deployment mode, the cloud segment accounted highest revenue share at 75% in 2024.

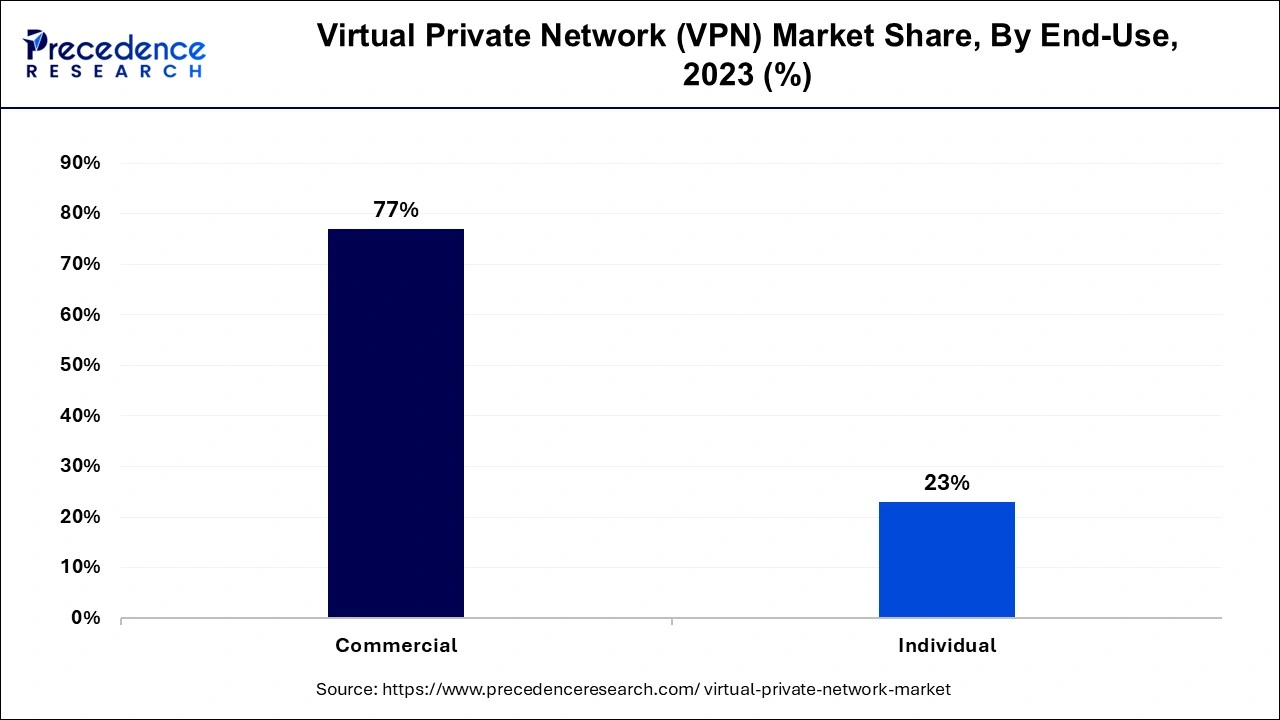

- By end-use, the commercial segment captured more than 77% of total revenue share in 2024.

Market Size and Forecast

- Market Size in 2025: USD 88.96 Billion

- Market Size in 2026: USD 108.57 Billion

- Forecasted Market Size by 2034: USD 534.22 Billion

- CAGR (2025-2034): 22.04%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

A virtual private network (VPN) is a means to provide secure communication between group members using public telecommunications infrastructure while protecting privacy using a tunneling protocol and security measures. VPNs conceal users' internet protocol (IP) addresses, making it nearly impossible to track their online activity. To increase privacy, VPN products and services create safe, encrypted connections.

It has long been possible to provision VPNs utilizing Asynchronous Transfer Mode (ATM) and Frame Relay technology of virtual circuits (VC). However, IP and Multiprotocol Label Switching (MPLS)-based VPNs have grown in popularity during the past few years.

The three main factors driving the market growth for virtual private networks are a rise in data security concerns, an increase in sophisticated cyber threats, and a surge in the use of mobile and wireless devices within enterprises.

The demand for remote accessibility is another factor driving this market's expansion. However, a lack of virtualization skills will likely restrain the growth of the VPN industry. On the other hand, rising private cloud adoption will offer attractive chances to expand the virtual private network market in the following years.

The solution segment led the whole market size of a virtual private network in 2022 based on components. Due to significant investments in network security, North America held the largest market share for virtual private networks in 2022.

The considerable presence of leading market vendors in North America also fuels the market expansion in this area. In addition, one of the main factors propelling the North American market for the virtual private network is the rise in demand from industries like BFSI and telecom, among others.

Businesses of all sizes, operating in a wide range of sectors and industries, are actively seeking safe connectivity between their various business units as well as efficient methods of data management. Businesses also need constant connectivity to sustain cooperation with partners and clients worldwide.

At this point, VPNs can provide exceptional service quality to maintain essential traffic flow for enterprises and prevent packet loss. It is becoming increasingly critical to compete in a cutthroat economic environment, particularly for telecoms and IT organizations, to reduce costs and enhance the quality of business services.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 88.96 Billion |

| Market Size in 2026 | USD 108.57 Billion |

| Market Size by 2034 | USD 534.22 Billion |

| Growth Rate from 2025to 2034 | CAGR of 22.04% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025to 2034 |

| Segments Covered | By Component, By Type, By Deployment Mode and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Component Insights

The solution segment had the highest revenue share in 2024, with almost 66.0%. Over the forecast period, the services segment will likely post a sizable CAGR. Over the past few years, virtual private network solutions have gained significant acceptance, especially among business vendors and independent solution providers. The need for VPN services will continue to be driven by the continuously evolving nature of work and virtual private networks.

Control, reporting, and administration capabilities are typical components of virtual private network solutions. To increase the sales of VPN solutions, suppliers have been working with NAC solution providers and mobile VPN vendors over the past few years. Moreover, VPN services are provided in order to enable the virtual private network to safeguard a remote connection. Vendors also allow real-time price comparison online, which helps budget-conscious customers evaluate the VPN services available before making a purchase decision.

As economies of scale and technological advancements combine, providers should be able to lower their cost structures further and speed up their investments in other areas.

Type Insights

The remote access category generated the most revenue, with a 37% revenue share in 2024. This is explained by the rise in the market's number of franchised dealers. For the projected period, the extranet category will likely grow significantly. The expansion can be linked to increased extranet usage by businesses to publish confidential material on open networks. Additionally, companies are putting more of an emphasis on opening up their internal web applications to their partners and clients.

The demand for site-to-site connectivity and remote access has gradually risen to ensure smooth communication. Optimized bandwidth and data comparison are made possible via site-to-site connections and remote access. Over the past few years, remote virtual private network solutions demand has been driven by mobile VPN device proliferation and the increasing demand for remote accessibility. In particular, remote access can assist firms in adhering to security standards.

Deployment Mode Insights

In 2024, the cloud segment had the highest revenue share at 75%. This is due to a trend toward cloud-based deployment to cut expenses and maintenance. To give private on-premise access and a secure gateway to cloud services, leading market players are now offering virtual private clouds. For instance, IBM Corporation announced the introduction of an on-premises VPN gateway to a cloud VPN built inside a VPC in December 2018.

Vendors now offer virtual private clouds to assist businesses in setting up an environment of private cloud computing on public cloud infrastructure. These services give business customers control that is fine-grained over providing or preventing access to particular resources through exacting applications or IP addresses.

Virtual servers, storage, and networking resources in the cloud can be deployed dynamically to assist VPC customers in adjusting to changes per their business demands. Due to decreased expenses, enterprises can concentrate on achieving core competencies and essential business objectives.

End-Use Insights

In 2024, the commercial category contributed 77% of total revenue on account of growing worries about creating a secure netxwork. Virtual private networks also assist in lowering risks throughout the entire data lifecycle. As an alternative, VPN services assist business users in gaining the trust of their clients. Other alluring qualities like cost effectiveness, fault-tolerant resource availability, and redundant resource availability will likely fuel the virtual private network solution's commercial adoption.

Companies are beginning to permit the usage of remote gadgets at work. As a result, most employees can now access numerous business applications from any location using various connected devices, such as laptops, PCs, netbooks, and tablets. Notably, this is fueling individualized demand for VPN solutions. Additionally, hybrid network applications, such as a combination of Internet VPN and MPLS solutions, are created using virtual private networks. A virtual private network also expands the business's cloud data center.

Regional Insights

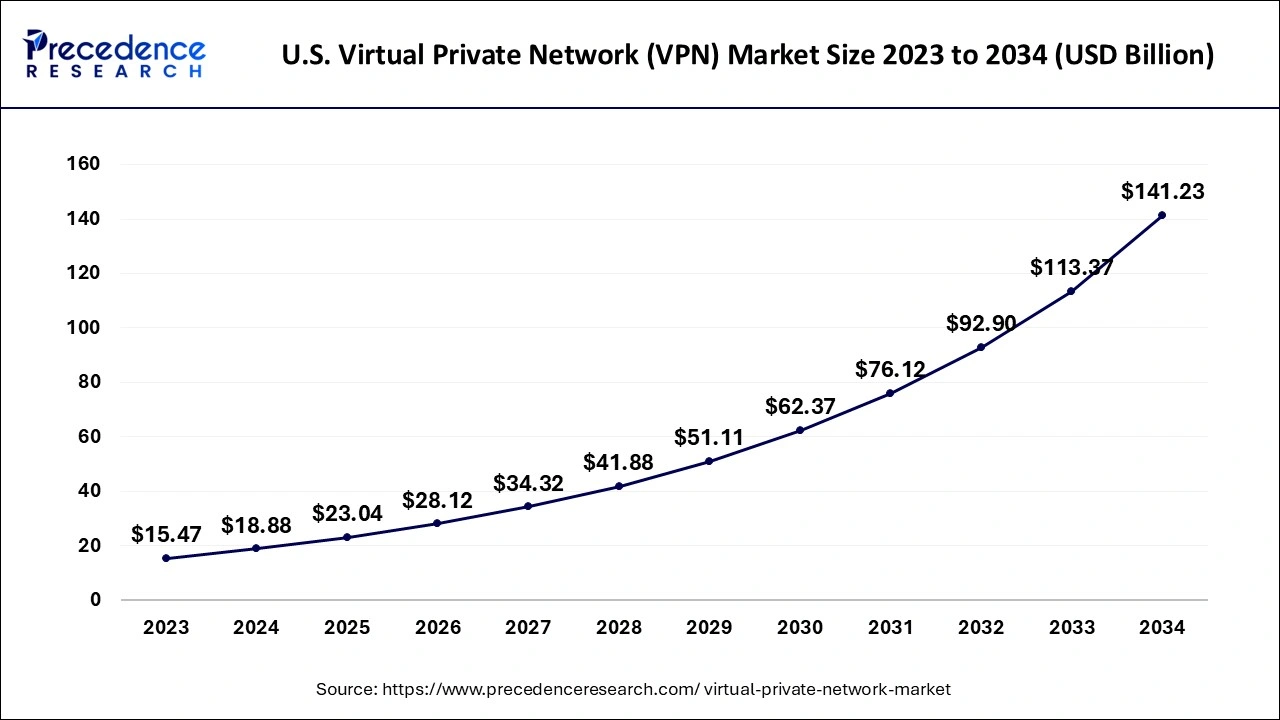

U.S. Virtual Private Network (VPN) Market Size and Growth 2025to 2034

The U.S. virtual private network (VPN) market size is exhibited at USD 23.04 billion in 2025 and is expected to be worth around USD 141.23 billion by 2034, growing at a CAGR of 22.27% from 2025to 2034.

Due to the telecoms and BFSI sectors' and other US industries' and industry verticals' strong development in demand, North America had the most significant revenue share 37% in 2024. The European market also contributed a sizeable market share, which will likely continue expanding. On the other hand, due to the rising use of VPN services and solutions in India, China, and other Asian nations, Asia Pacific is anticipated to experience the highest growth of CAGR over the projection period.

With increasingly organized players using mobile VPN services, China is ruling the Asia Pacific sector. The virtual private network offering as a solution opened up a lot of business prospects for entrepreneurs in Indonesia, China, and other Asian nations due to the numerous government policies and regulations regulating popular websites.

Additionally, effortless networking and streaming in Asian countries are now possible thanks to VPN services. Users who utilize a virtual private network are guaranteed that their data is encrypted and safe from hackers. These aspects have significantly increased the demand for VPN products and services in Asian nations.

The new trend for practically all IT businesses is working remotely. The use of virtual private network (VPN) connections and remote desktops has significantly increased since the COVID-19 pandemic's introduction. The rise in remote workers and various devices drives the demand for better visibility and management. Additionally, because remote users can now connect to several networks, central control is made challenging. Enterprises seek to monitor the wireless activity of mobile workers in addition to managing these devices.

According to a recent analysis by Atlas VPN, VPN usage has climbed 53% in the United States over the past 12 months. And in Italy, a nation that COVID-19 has primarily impacted, it grew by 112%. Additionally, the US Department of Defense Information Systems Agency (DISA) has been trying to increase network and VPN capacity.

Virtual Private Network (VPN) Market Companies

- Cisco Systems, Inc.

- Opera Norway AS

- BM Corporation

- Google LLC

- Citrix Systems, Inc.

- Avast Software s.r.o.

- NetMotion Software

The above mentioned vendors are concentrating on growing their customer base to acquire a competitive advantage in the market. They are exploring several strategic initiatives, including mergers and acquisitions, alliances, and collaborations. One of the most recent advancements in establishing a payment deferrals program by Cisco Systems, Inc. in April 2020 was to encourage businesses to purchase solutions for the virtual private network during the pandemic era.

Segments Covered in the Report

By Component

- Services

- Solution

By Type

- Remote Access

- Extranet

- Site-to-site

- Others

By Deployment Mode

- Cloud

- On-premise

By End-Use

- Individual

- Commercial

ByRegion

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting