Virtual Networking Market Size and Forecast 2025 to 2034

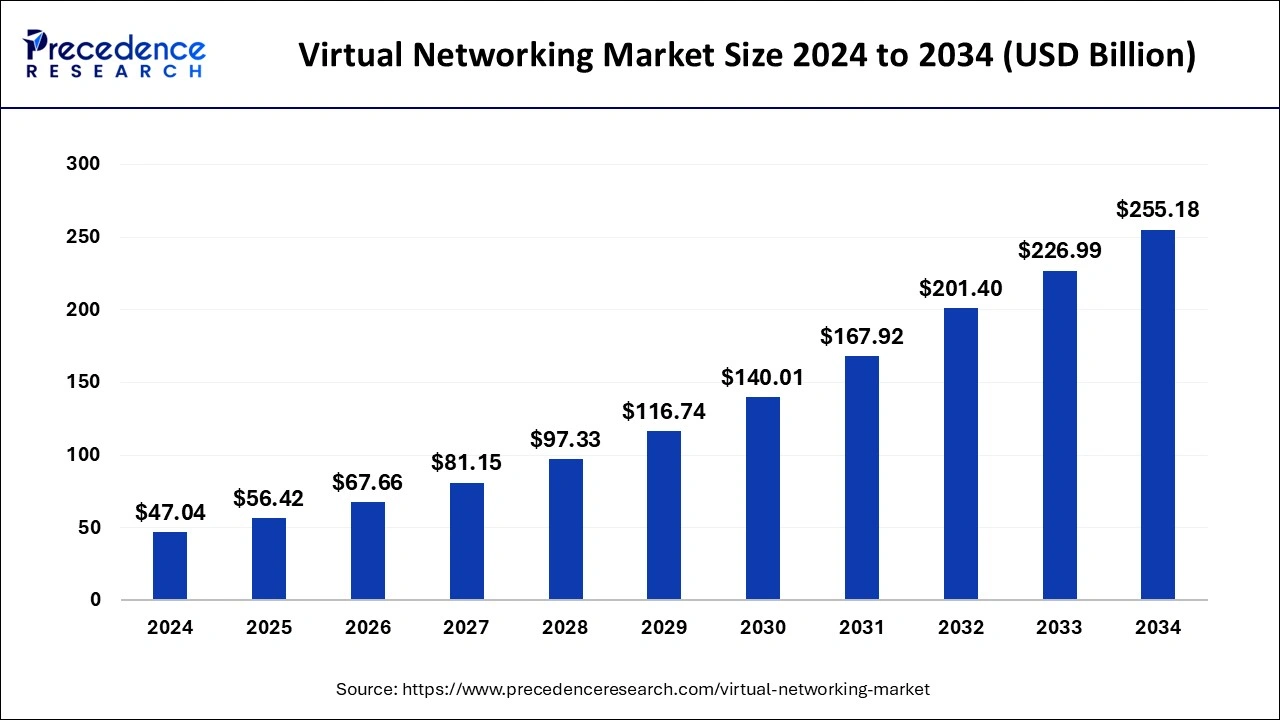

The global virtual networking market size accounted for USD 47.04 billion in 2024 and anticipated to reach around USD 255.18 billion by 2034, growing at a CAGR of 18.42% between 2025 and 2034. The growth of virtual networking market can be attributed to the rising investments and collaborations among various industries to strengthen their global network, widespread adoption of network technologies in many regions as well as rural areas, innovations in enhancing networking capabilities and support from governments promoting the use of this technology.

Virtual Networking MarketKey Takeaways

- In terms of revenue, the market is valued at $56.42 billion in 2025.

- It is projected to reach $255.18 billion by 2034.

- The market is expected to grow at a CAGR of 18.42% from 2025 to 2034.

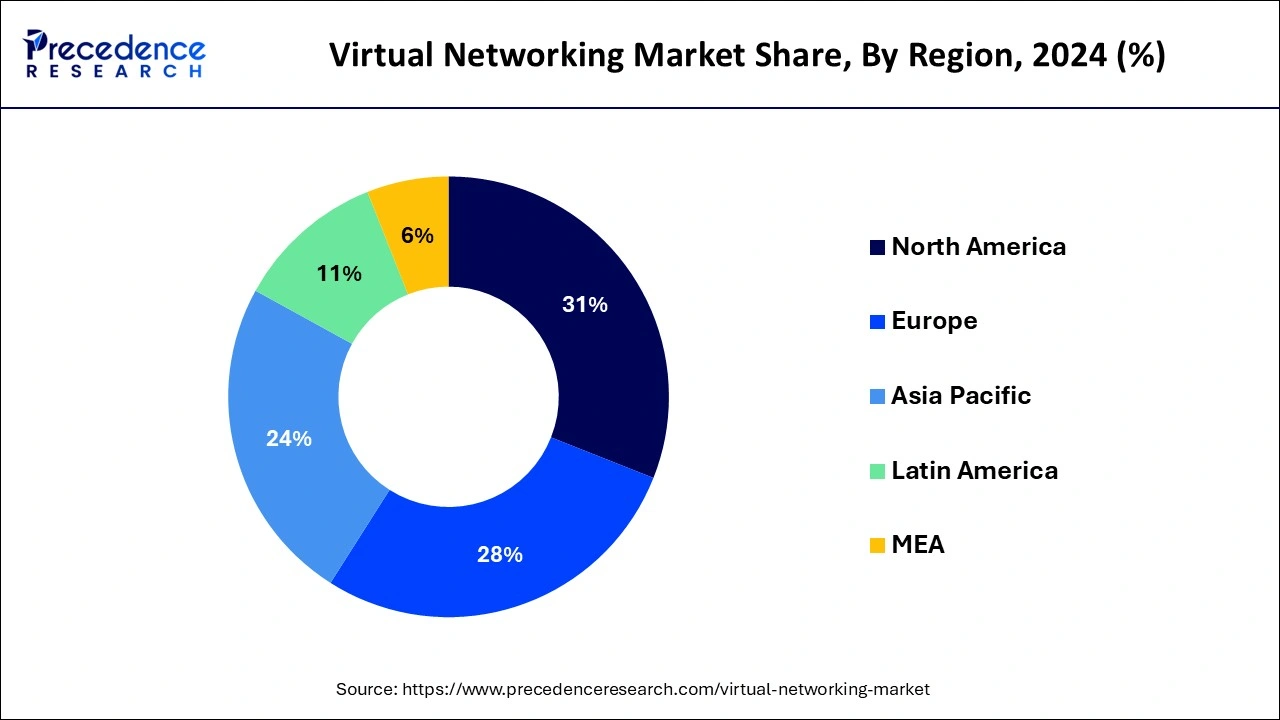

- North America dominated the global market with the largest market share of 31% in 2024.

- By component, the software contributed the highest market share in 2024.

- By deployment, the cloud segment captured the biggest market share in 2024.

- By enterprise size, the large enterprises segment held a revenue share in 2024.

- By application, the IT and Telecommunication generated the major market share in 2024.

Integration of Artificial Intelligence (AI) in Virtual Networking

The integration of artificial intelligence AI in virtual network environments has enhanced the automated management, optimization and security by analysing network data which contributes to improved performance and identification of potential issues by taking charge of actions and minimizing downtime.Machine learning (ML) algorithms and deep learning tools such as complex neural networks (CNNs) are also applied in virtual network traffic allowing advanced pattern recognition capabilities and detection of anomalies enabling predictive analysis and predictive decision-making.

U.S. Virtual Networking Market Size and Growth 2025 to 2034

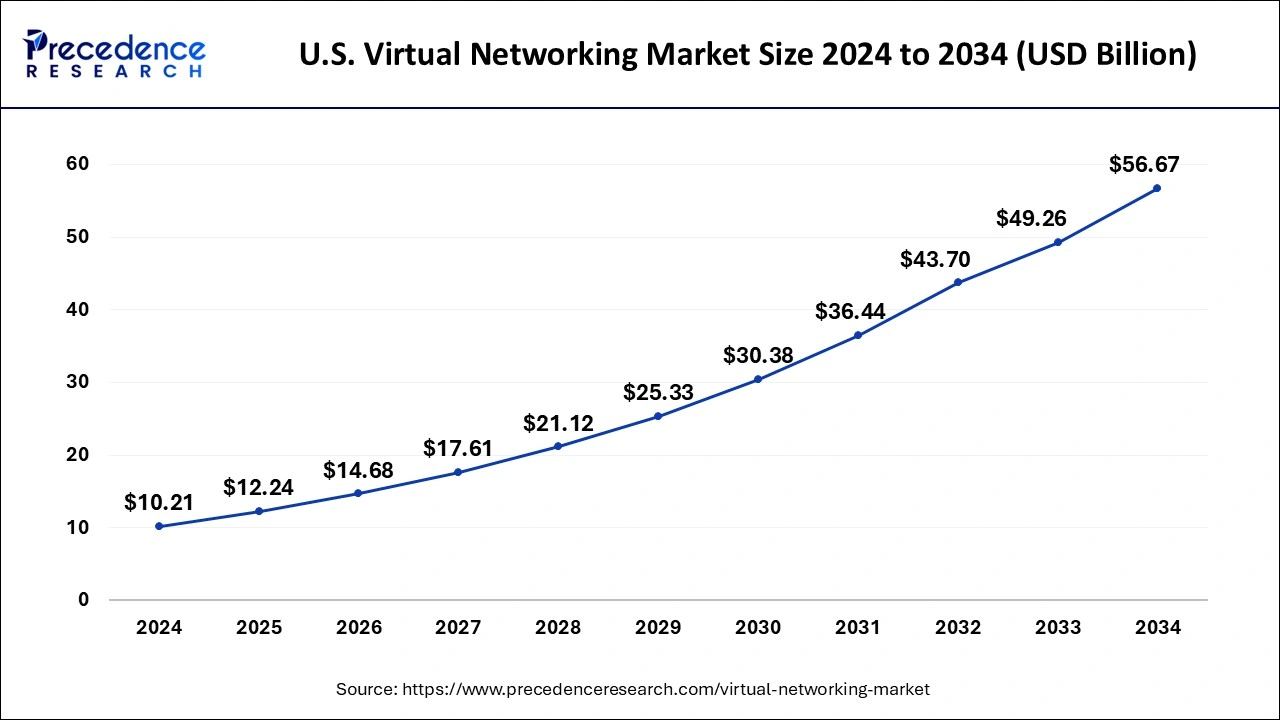

The global virtual networking market size was valued at USD 10.21 billion in 2024 and expected to be worth around USD 56.67 billion by 2034, rising at a CAGR of 18.70% between 2025 and 2034.

In 2024, North America led the local market. It is projected that increasing cloud computing adoption in the region will considerably aid in boosting regional market expansion.

Currently, North America is dominating the virtual networking market. North America holds huge IT hubs, which double the technology and innovation in the Industrial sector. The high-tech companies and captivating internet connectivity accelerate the growth of the market in the region.

Virtual Networking Market Overview

Virtual networking technology utilizes software for connecting devices and virtual machines (VMs) over a network allowing remote and local communication between devices across various locations. Virtual networks offer enhanced productivity and security with flexibility and at cheaper rates which drives the widespread adoption of this technology in various industrial settings. The technology is changing the global perspective for data communication and connection essentially contributing to the market growth.

Furthermore, the increased adoption of cloud computing networks for data reliability and storage, digitalization in various industries, growing IT infrastructure, utilisation of virtual machines, development of highly enhanced communication networks, surge in industrial automation and technological advancements with introduction of innovative solutions is encouraging the growth of the virtual networking market.

Government organizations are significantly contributing to the growth of virtual networks by engaging in contracts with virtual network providers and also by consolidating the setup of network channels for enhanced communication. For instance, in December 2024, Rivada Networks entered into a contract with the United States Navy for developing and delivery of Virtual Network Operator Capabilities over Rivada's Outernet constellation.

Technological Advancement

Technological advancements in the virtual networking market feature multi-cloud networking, 5G, cloud-based virtual networking, and internet-based networking. Multi-cloud networking is mainly used in organizations to manage and secure data. Software-defined networking allows network functionality control through software. Network function virtualization connects network functions from hardware, smoothens operational processes, and develops a habit of operating in a fluctuating demand environment. The cloud-based virtual networking is popularly adopted by organizations due to its convenient offerings. The 5G and edge computing technology are merged with virtual networking to provide bandwidth solutions for applications such as autonomous systems and IoT.

Internet-based networking is designed to achieve business objectives, which acts as an automatic translator into network configuration. This technology strengthens management and reduces errors. These technologies have contributed to organizations and the virtual networking market. The approach to innovation and advancement is a clear motive of this market.

Virtual Networking Market Growth Factors

- Rising adoption of cloud computing networks for enhancing data communication and storage

- Advancements in developing innovative technologies for virtual networks

- Increased influence of governments by developing contracts with leading virtual network companies for national security and other purposes

- Reduced costs with increased productivity, efficiency and security are encouraging the adoption of virtual networks in rural areas

- Driving global reach beyond geographical limitations

- Collaborations among different industries and companies for enhancing global footprint

Virtual Networking Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 255.18 Billion |

| Market Size in 2025 | USD 56.42 Billion |

| Market Size in 2024 | USD 47.04 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 18.42% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Enterprise Size, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Cloud computing & ease of communication and network management

Cloud computing and the ease of communication and network management are key drivers behind the growth of the virtual networking market.

Cloud computing plays a pivotal role in driving the adoption of virtual networking. With the rise of cloud platforms, businesses are increasingly leveraging Infrastructure as a Service (IaaS) and Platform-as-a-Service (PaaS) solutions, which provide virtualized resources and services. These cloud environments enable organizations to deploy and manage virtual networks on demand, without the need for dedicated physical infrastructure. This flexibility allows businesses to quickly adapt to changing demands, scale their network resources up or down as needed, and efficiently allocate computing resources. Furthermore, the ease of communication and network management facilitated by virtual networking solutions contributes to market growth. Virtual networking technologies provide centralized control and management capabilities, allowing administrators to configure, monitor, and troubleshoot networks from a single interface. This streamlines network operations reduces manual configuration efforts, and improves overall network agility.

Moreover, virtual networking supports the concept of software-defined networking (SDN), which separates the network's control plane from the data plane. This decoupling enables dynamic network programmability, where network configurations can be defined and modified using software-based controllers. SDN allows organizations to create virtual networks that are tailored to specific requirements, optimizing performance, security, and resource utilization.

Virtual networking, which also enables network management and monitoring, gives end users full access to the network. Solution providers assist enterprises by warning users and managing network endpoints when danger is discovered. Network management is also made much simpler for businesses by having access to a portal where all network-related processes, such as service management, mobile health monitoring, SLA management, and performance reporting, are documented. Managed network services also help firms utilize all resources to their fullest potential, increasing business efficiency. As a result, it is anticipated that network administration simplicity would be a crucial factor in driving up demand for virtual networking.

Restraint

Cost & lack of infrastructure for support and complicated business models

Finding data gets difficult when everything is moved to a virtual network since virtual PCs and containers can be moved across servers. Due to the large number of virtual machines and containers, the administrator manages several endpoints. Another issue in this scenario is the bandwidth and latency problems that develop if the infrastructure is not built with the required changes in mind. Additionally, the difficulty of integrating software from many suppliers and the complexity it causes make choosing the right vendor for the virtual network installation essential.

Although there are many advantages to virtual networking, such as lower hardware costs and better resource usage, there may be upfront expenses associated with implementing and integrating virtualization technologies. Some firms that are considering using virtual networking may be constrained by these prices. Purchasing physical infrastructure, such as servers with enough processing power, memory, and network connections to support virtualization, is frequently required for virtual networking.

Additionally, enterprises might have to spend money on network switches that enable SDN management software and protocol. In addition to hardware costs, there can be outlays for IT staff training, virtualized management platforms, and software licenses. Organizations must also take into account the costs of continuous operations, such as upkeep, updates, and support.

Opportunity

Internet of things (IoT) connectivity

The network of physically connected objects with connectivity, software, and sensor capabilities is known as the internet of things (IoT). IoT devices are used across many industries, including healthcare, transportation, smart cities, and industrial automation. Virtual networking is essential for effectively connecting and controlling these IoT devices. IoT devices may exchange information and carry out coordinated actions due to virtual networking, which enables seamless communication and data transfer between them. It makes it simpler to manage and control different IoT devices remotely by facilitating the integration of those devices into a single network infrastructure.

There are many advantages to virtual networking for IoT connectivity. It makes it possible for organizations to manage devices effectively, allowing them to remotely monitor, set up, and update Internet of Things (IoT) devices from a single location. Virtual networks may be set up to properly prioritize and route IoT data flow, ensuring top performance and cutting down on latency. Additionally, it permits encrypted and secure connection between IoT devices and data centers, safeguarding private data and preventing illegal access.

Virtual networking also makes it possible for companies to scale their IoT implementations quickly. Virtual networking can dynamically distribute network resources, accommodate new devices, and provide dependable connectivity as the number of IoT devices rises. For large-scale IoT solutions, like smart grids or smart cities, where hundreds or even millions of devices must be connected and controlled effectively, scalability is crucial.

Component Insights

The software segment dominated the market in 2024due to their capacity to improve the scalability, robustness, and portability of applications. Software solutions are focusing on integrating security features throughout the development lifecycle to protect against risks as a result of the rising frequency of cyber-attacks.

Deployment Insights

In 2024, the cloud industry controlled the market. In order to enable clients to build and operate their own virtual networks inside the cloud environment, cloud solution providers are increasingly including virtual networking services as part of their cloud solutions.

Enterprise Size Insights

In 2022, the market was dominated by the big enterprises sector. Large businesses can cut hardware and operating costs by virtualizing network resources because they no longer need to invest in pricey physical network equipment.

Application Insights

In 2024, the IT & Telecommunications sector dominated the market. By supplying connectivity between various cloud environments, IT and telecom businesses are enabling clients to access several clouds while still enjoying a consistent network experience.

Virtual Networking Market Companies

- Huawei Technologies Co., Ltd.

- Hewlett Packard Enterprise Development LP

- VMware, Inc.

- Cisco Systems, Inc

- Microsoft Corporation

- IBM Corporation

- Citrix Systems, Inc.

- Juniper Networks, Inc.

- Oracle

- Verizon Communications Inc.

Latest Announcements

- In December 2024, Rivada Networks Inc., announced the formation of Rivada Secure Services which is a completely owned subsidiary for serving the specialized needs of the U.S. government and defence customers. Declan Ganley, CEO of Rivada Space Networks said that, “The formation of Rivada Secure Services demonstrates our commitment to providing the highest level of secure, resilient communications to our government customers. As a proxy organization, Rivada Secure Services will ensure we can fully support the unique mission requirements of U.S. defence and civilian agencies while maintaining the necessary security protocols”.

- In November 2024, Globe Teleservices, a leading global telecom solutions provider signed an exclusive 3-year contract with XOX Malaysia, a leading mobile virtual network operator (MVNO). “At XOX, our mission is to enhance customer experiences by providing top-tier services. With Globe Teleservices' secure and robust A2P SMS solutions, we are sure to meet the growing demands for seamless communication across borders," said Loh Boon Teong, COO of XOX.

Recent Developments

- In May 2025, Snaile, Canada's leading smart parcel locker provider, and virtual.com, a premier transportation technology, announced their partnership. The engagement will unlock several ideas and innovations in the virtual networking market. (Source - https://www.businesswire.com)

- In April 2025, Hewlett-Packard Enterprise (HPE) expanded its Aruba networking central artificial intelligence (AI)-powered network management offering, with deployment options including a virtual private cloud (VPC) environment. (Source - https://www.computerweekly.com)

- In April 2025, the collaboration between FC Barcelona and the New Era visionary group in the presentation elaborated, Barca Mobiles. A product's new Blaugrana mobile virtual network operator grabbed the attention of many customers. (Source - https://www.fcbarcelona.com)

- In January 2025, Supermicro Inc., a total IT solution provider for AI/ML, HPC, Cloud Storage, and 5G/Edge began the shipments of max-performance servers featuring Intel Xeon 6900 series processors with P-cores.

- In November 2024, SurgePays Inc., a technology and communications company signed an agreement with AT&T which will allow SurgePays to provide mobile wireless, voice data and messaging services.

- In September 2024, Alkira Inc., a leader in Network Infrastructure as a Service, declared its expansion into the Google Cloud Marketplace for providing customers with advanced networking, security and agility.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Deployment

- On-Premise

- Cloud

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Application

- BFSI

- Public sector

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting