What is the Industrial Cybersecurity Market Size?

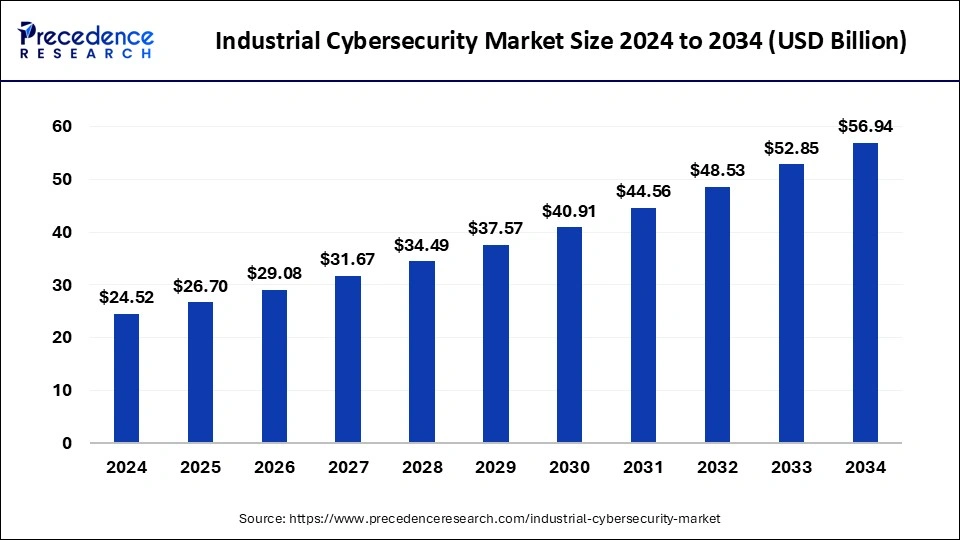

The global industrial cybersecurity market size was estimated at USD 26.70 billion in 2025 and is predicted to increase from USD 29.08 billion in 2026 to approximately USD 61.18 billion by 2035, expanding at a CAGR of 8.65% from 2026 to 2035. The industrial cybersecurity market growth is driven by an increasing number of investments and the ongoing development of a strong cybersecurity network.

Industrial Cybersecurity Market Key Takeaways

- The global industrial cybersecurity market was valued at USD 24.52 billion in 2025.

- It is projected to reach USD 56.94 billion by 2035.

- The industrial cybersecurity market is expected to grow at a CAGR of 8.79% from 2026 to 2035.

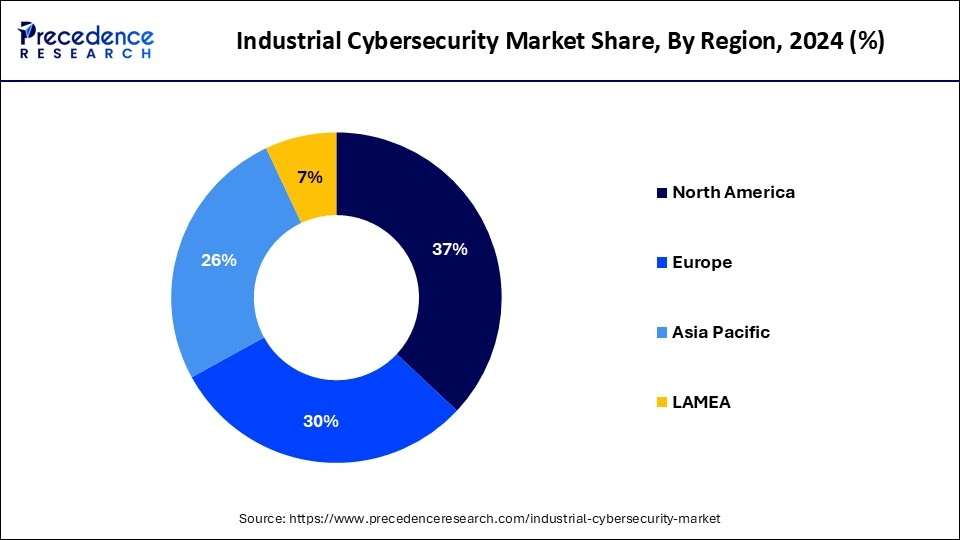

- North America dominated the industrial cybersecurity market with largest revenue share of 37% in 2025.

- Asia Pacific is expected to host the fastest-growing market during the forecast period.

- By component, the software segment dominated the market in 2025.

- By component, the hardware segment is expected to show significant growth over the forecast period.

- By industry, the discrete industry segment dominated the market in 2025.

- By industry, the process industry is expected to grow at the fastest rate during the forecast period.

- By security type, in 2023, the cloud application security segment dominated the market.

- By security type, the network security segment is expected to grow moderately over the projected period.

Market Overview

Industrial cyber security has become increasingly critical due to the growing dependence on cyber technology and the escalating risks of cyber-attacks. Such attacks on industrial systems can result in severe consequences, including the disruption of critical infrastructure, loss of sensitive data, and compromise of equipment and systems.

Cloud-based security solutions enable organizations to scale their security resources quickly, adapt to evolving threats, and streamline the deployment and management of security systems. However, concerns have arisen regarding the security of cloud-based industrial systems due to their vulnerability to cyber-attacks. Therefore, robust encryption and access control mechanisms are essential to protect sensitive data and prevent unauthorized access.

Artificial Intelligence: The Next Growth Catalyst in Industrial Cybersecurity

AI is profoundly impacting the industrial cybersecurity industry by enabling a shift from reactive to proactive defense mechanisms. AI-powered systems use machine learning and behavioural analytics to analyze a vast amount of data from industrial control systems and the Industrial Internet of Things (IIoT), allowing them to establish baselines of normal operations and detect subtle anomalies indicative of zero-day attacks or insider threats in real-time, which often bypass traditional signature-based methods.

Furthermore, AI accelerates incident response by providing human analysts with actionable intelligence and automating routine tasks like vulnerability scanning and alert triage, thereby reducing human error and improving operational efficiency.

Industrial Cybersecurity Market Growth Factors

- The growing number of cyber-attacks on industrial control systems is expected to drive the growth of the industrial cybersecurity market.

- Rising integration of IoT in various industries can fuel market growth in upcoming years.

- Increasing adoption of (ICS)-as-a-service is a key factor that is expected to drive the industrial cybersecurity market revenue growth.

- The growing value of business data and the vulnerability of networked systems can propel the industrial cybersecurity market.

Market Outlook

- Market Growth Overview: The industrial cybersecurity market is expected to grow significantly between 2025 and 2034, driven by the rising digital transformation and Industry 4.0, the rising frequency and complexity of attacks targeting manufacturing, and the merging of information technology and operational technology systems expands vulnerabilities.

- Sustainability Trends: Sustainability trends involve integration with ESG and SDGs, AI and machine learning efficiency, and energy-efficient infrastructure.

- Major Investors: Major investors in the market include Siemens, Microsoft, IBM, Thoma Bravo, ForgePoint Capital, and NightDragon.

- Startup Economy: Startup economy focuses on emerging technologies, targeted innovation, and agility and customization.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 61.18 Billion |

| Market Size by 2026 | USD 29.058 Billion |

| Market Size in 2025 | USD 26.70 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.65% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Security Type, Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Public and private sector funds

The industrial cybersecurity market is expanding due to increased government support and heightened spending by enterprises globally to mitigate cyberattack risks. Digital technology now underpins the essential resources of a country's economy. Cyber threats, including malware, spyware, and phishing, can disrupt plant operations and IT systems. Governments worldwide are increasingly allocating resources to combat security breaches and bolster industrial cybersecurity. Organizations are investing significantly in security software and equipment to protect critical infrastructure, data centers, and industrial control systems, which can further drive the industrial cybersecurity market growth.

- In August 2023, Japan KDDI Corporation, KDDI Research, Inc., Fujitsu Limited, NEC Corporation, and Mitsubishi Research Institute, Inc. (MRI), announced that they will embark on a series of trials exploring the introduction of Software Bill of Materials (SBOM) (1), a list of programs that comprise software, into the communications field including 5G and LTE network equipment with the aim of strengthening cybersecurity.

Restraint

Misunderstanding the nature of threats

The continuous growth of industrial control systems and a diverse array of networked devices has increased their vulnerability to cyberattacks. Developers strive to stay ahead of attackers when designing security systems. These systems are based on historical threats and lack knowledge of emerging operational technologies, thus providing protection only against known synthetic attacks. Therefore, investments in cybersecurity often fall short due to the unknown or unforeseeable sources of future attacks. This limitation is expected to constrain the industrial cybersecurity market growth during the forecast period.

Opportunity

Integrating security solutions with the cloud

Integrating industrial cybersecurity solutions with advanced cloud services is emerging as a significant market trend, driven by the massive volume of data generated daily across various industries. These advanced cloud services are essential for monitoring and analyzing this data. Key market players are focusing on developing and integrating cloud-based cybersecurity solutions for industrial control systems (ICS) and operational technology (OT) applications. The increasing adoption of ICS-as-a-service in the cloud, along with the deployment of AI-powered industrial robots in manufacturing and industrial facilities, is propelling the industrial cybersecurity market.

- In March 2024, Accenture Federal Services announced the partnership with Microsoft to launch a first-of-its-kind, end-to-end, Cloud Modernization and Migration Factory on Microsoft Azure Government to meet the stringent security standards required for those operating across the national security space, including the Special Access Program community. The one-stop service will support federal agencies and ecosystem partners wherever they currently reside.

Segment Insights

Component Insights

The software segment dominated the industrial cybersecurity market in 2024. This growth is mainly driven by the increasing demand for solutions such as DDoS protection, firewalls, virtualization security, SCADA encryption, backup & recovery, and antivirus/malware. Leading companies are focusing on developing and launching advanced industrial security software for sectors including oil & gas, energy, automotive, and others.

- In December 2023, NASA published its first Space Security Best Practices Guide, a 57-page document the agency said would help enhance cybersecurity for future space missions. Concerns about the dangers hackers pose to satellite networks and other space initiatives have been growing for years.

The hardware segment is expected to show significant growth in the industrial cybersecurity market over the forecast period. With the significant rise in cyber threats from various anonymous networks, many end-user businesses and Internet Service Providers (ISPs) are expected to deploy advanced security hardware, such as encrypted USB flash drives, as Intrusion Prevention Systems (IPS). As numerous organizations implement and upgrade their cybersecurity platforms, security vendors develop solutions based on artificial intelligence and machine learning, which require advanced IT infrastructure.

Industry Insights

The discrete industry segment dominated the industrial cybersecurity market in 2024. Discrete manufacturing involves producing individual components and assembling them into a final product. Examples of discrete manufacturing include automobiles, appliances, and consumer electronics.

The process industry is expected to grow at the fastest rate in the industrial cybersecurity market during the forecast period. The process industry is divided into manufacturing, chemical, oil and gas, transportation, power grid, and others. Increased digitalization in the energy and power sector has brought various economic benefits, such as improved energy efficiency and faster processing. However, the rise of malicious software taking control of energy equipment has led to significant data theft, hence increasing the risk of cyber-attacks.

Security Insights

The cloud application security segment dominated the industrial cybersecurity market in 2024. Due to the growing adoption of cloud technology in the manufacturing industry, protecting sensitive manufacturing processes and formulas has become crucial. The spread of these proprietary formulas can negatively impact an organization's growth. Therefore, manufacturers are focusing on securing their sensitive data by developing cloud security solutions. Additionally, tech companies are creating and launching advanced cloud solutions in the market.

The network security segment is expected to grow moderately in the industrial cybersecurity market over the projected period. Network security encompasses products and services designed to detect and prevent cyber threats within computer networks and networked resources. Examples of network security solutions include encryption software, identity and access management (IAM), firewalls, intrusion detection systems (IDS), intrusion prevention systems (IPS), and unified threat management (UTM).

- In October 2023, Siemens debuts a security testing suite for industrial networks. The new all-in-one SINEC Security Inspector offers a single-user interface that combines different cybersecurity tools and includes solutions for asset detection and identification, compliance checks, malware scans, and vulnerability checks.

Regional Insights

What is the U.S. Industrial Cybersecurity Market Size?

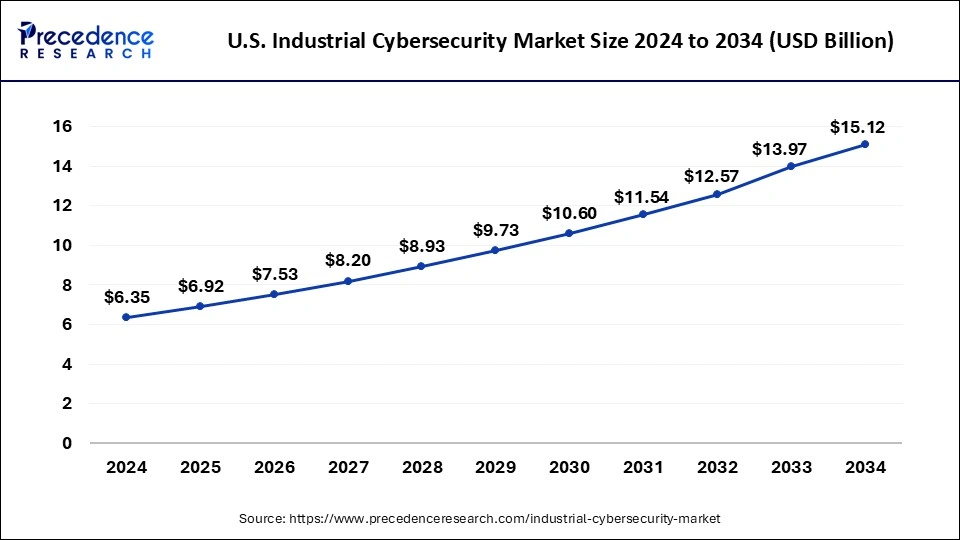

The U.S. industrial cybersecurity market size was exhibited at USD 6.92 billion in 2025 and is projected to be worth around USD 16.44 billion by 2035, poised to grow at a CAGR of 9.04% from 2026 to 2035.

U.S. Industrial Cybersecurity Market Trends

North America dominated the industrial cybersecurity market in 2024. The growth of the North American market in recent years has been driven by the early adoption of new technologies. Moreover, the vast capital and IT markets, along with their diverse businesses, require effective management and security of endpoint devices across untrusted networks. Market expansion is also fueled by increasing cybersecurity concerns in the U.S. and Canada, particularly regarding critical infrastructure such as energy, water, transportation, and manufacturing systems. The U.S. government is addressing industrial cybersecurity by developing policies, regulations, and best practices.

- In January 2024, the U.S. Department of Energy's (DOE) Office of Cybersecurity, Energy Security, and Emergency Response (CESER) announced the launch of Renewable Energy and Storage Cybersecurity Research. A multi-laboratory effort led by the National Renewable Energy Laboratory that will analyze and address cybersecurity concerns for hybrid energy systems that include wind, solar, and energy storage.

Asia Pacific is expected to host the fastest-growing industrial cybersecurity market during the forecast period. The market in the region is driven by the government's increased focus on a proactive cybersecurity approach, including risk and vulnerability assessments, regular security audits, and incident response planning, the region is seeing initiatives to enhance critical infrastructure security. Market vendors are launching innovative cyber capabilities by expanding security data centers and establishing dedicated engineering teams to help organizations strengthen their defenses and accelerate their digital transformation, which can boost the market share over the projected period.

China Industrial Cybersecurity Market Trends

China's expansive attack surfaces of 5G and IoT ecosystems. This shift is driving a critical transition toward AI-powered autonomous threat detection and managed security services, with a specific focus on safeguarding Industrial Control Systems (ICS) against sophisticated ransomware.

How did Europe experience notable growth in the Industrial Cybersecurity Market?

Europe's vulnerabilities were introduced through Industry 4.0, IoT, and 5G adoption across critical sectors. The escalating threat landscape, characterized by sophisticated ransomware and data breaches, has necessitated an urgent move to robust defensive measures.

UK Industrial Cybersecurity Market Trends

The UK's escalating threat landscape includes malware and threats to critical infrastructure. This rise in demand for robust protection is further compounded by increased digitalization across industries and stricter compliance mandates like GDPR and the upcoming Cyber Security and Resilience Bill.

Value Chain Analysis of the Industrial Cybersecurity Market

- Threat Intelligence and Research

This foundational stage involves collecting and analyzing data on potential cyber threats, vulnerabilities, and attack vectors specific to industrial control systems (ICS) and operational technology (OT) environments.

Key Players: FireEye, Kaspersky Lab, Dragos, and Claroty. - Product/Solution Development

In this stage, security solutions such as firewalls, intrusion detection/prevention systems (IDS/IPS), antivirus, and identity and access management (IAM) tools are designed, developed, and tested for industrial applications.

Key Players: Siemens, ABB, Schneider Electric, and Rockwell Automation, Cisco Systems, Palo Alto Networks, and Fortinet. - Solution Implementation

This stage focuses on the integration and deployment of cybersecurity solutions within the industrial environment, which often involves complex IT/OT convergence challenges.

Key Players: IBM, Microsoft, and Honeywell.

Industrial Cybersecurity Market Companies

- ABS Group of Companies, Inc.: ABS Group provides comprehensive consulting, implementation, and managed services to help industrial organizations manage operational technology (OT) cyber risk as an operational safety issue.

- Bechtel Corporation: As a major engineering, procurement, and construction (EPC) firm, Bechtel incorporates cybersecurity at the earliest design and construction phases of large-scale critical infrastructure projects like power and water treatment plants.

- Cisco Systems, Inc.: Cisco contributes to industrial cybersecurity through its robust suite of networking and security products, such as the Cisco Cyber Vision platform, which provides deep visibility into OT environments.

- Fortinet, Inc.: Fortinet offers a unified security platform, the Fortinet Security Fabric, that converges networking and security functions to protect IT and OT resources within a single framework.

- Honeywell International Inc.: Honeywell provides industrial cybersecurity solutions that focus on securing process control networks and ensuring the safe and reliable operation of industrial facilities.

- Microsoft: Microsoft contributes to industrial cybersecurity by extending its extensive enterprise security solutions, such as the AI-powered unified SecOps platform, to cover industrial control systems and Internet of Things (IoT) devices.

Other Major Key Players

- Rockwell Automation

- Schneider Electric

- Siemens

- Thales

- IBM

Recent Developments

- In March 2025, Cisco and NVIDIA are integrating NVIDIA's AI acceleration into their newest industrial security solutions to handle the massive telemetry required for real-time threat hunting. It is accelerating and simplifying enterprise AI adoption. (Source: https://newsroom.cisco.com )

- In July 2023, Honeywell reached an agreement to acquire SCADAfence, a notable provider of cybersecurity solutions for monitoring extensive networks in the operational technology (OT) and Internet of Things (IoT) domains. SCADAfence is known for its expertise in asset discovery, threat detection, and security governance, all of which are vital components of cybersecurity programs in industrial and building management contexts.

- In April 2023, Thales developed a new National Digital Excellence Centre in the Cyber Centre in Canada, which strengthens its cybersecurity skills across the industrial systems and allows SMEs and micro-enterprises to test and develop digital transformation ideas alongside large organizations.

- In September 2022, the Trident 4C Ethernet switch ASIC, a 12.8 terabits/second security switch with the ability to analyze all traffic at line rate, was delivered, according to an announcement from Broadcom Inc. Trident 4C uses flow anomalies to quickly defend against cyber threats by detecting them in real-time.

Segments Covered in the Report

By Component

- Software

- Service

By Security Type

- Network Security

- Application Security

- Endpoint Security

- Wireless Security

- Cloud Security

- Others

By Industry

- Energy and Utilities

- Manufacturing

- Oil and Gas

- Chemicals

- Aerospace & Defense

- Healthcare

- Transportation & Logistics

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting