Infection Control Market Size and Forecast 2025 to 2034

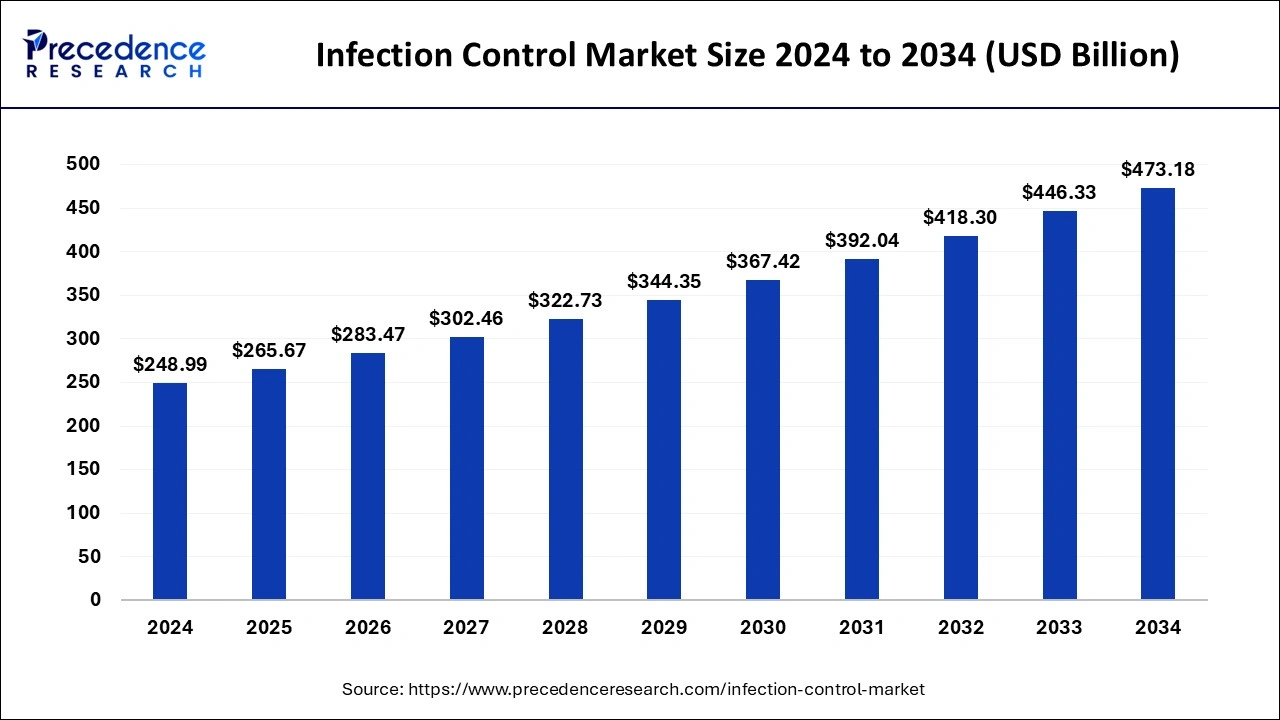

The global infection control market size accounted for USD 248.99 billion in 2024 and is expected to exceed around USD 473.18 billion by 2034, growing at a CAGR of 6.63% from 2025 to 2034.The main cause of infections is microorganisms like fungi, bacteria, viruses, etc. There are various kinds of infections associated with various parts of body like infections related to skin, stomach, lungs, eyes, intestine, ear, and others. The reason behind these infections may be the infection caused due to equipment, due to the surrounding audience, among others. For the treatment of these infections, various products like disinfectants, protective equipment, etc. are available in the market to treat them as well as to get rid of them.

Infection Control Market Key Takeaways

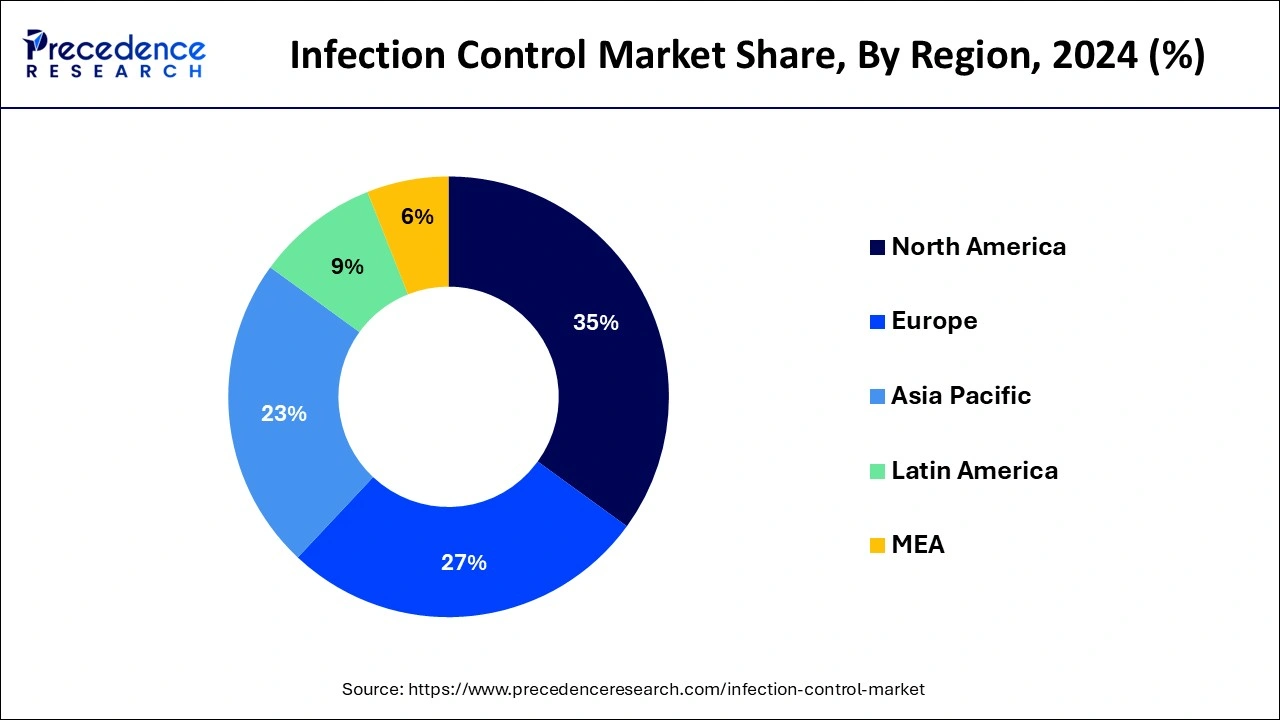

- North America led the global market with the highest market share of 34.14% in 2024.

- Asia Pacific region is estimated to expand the fastest CAGR between 2025 and 2034.

- By Products and Services, the protective barriers segment has held the largest market share in 2024.

- By End-user, the hospitals segment captured the revenue share of 40% in 2024.

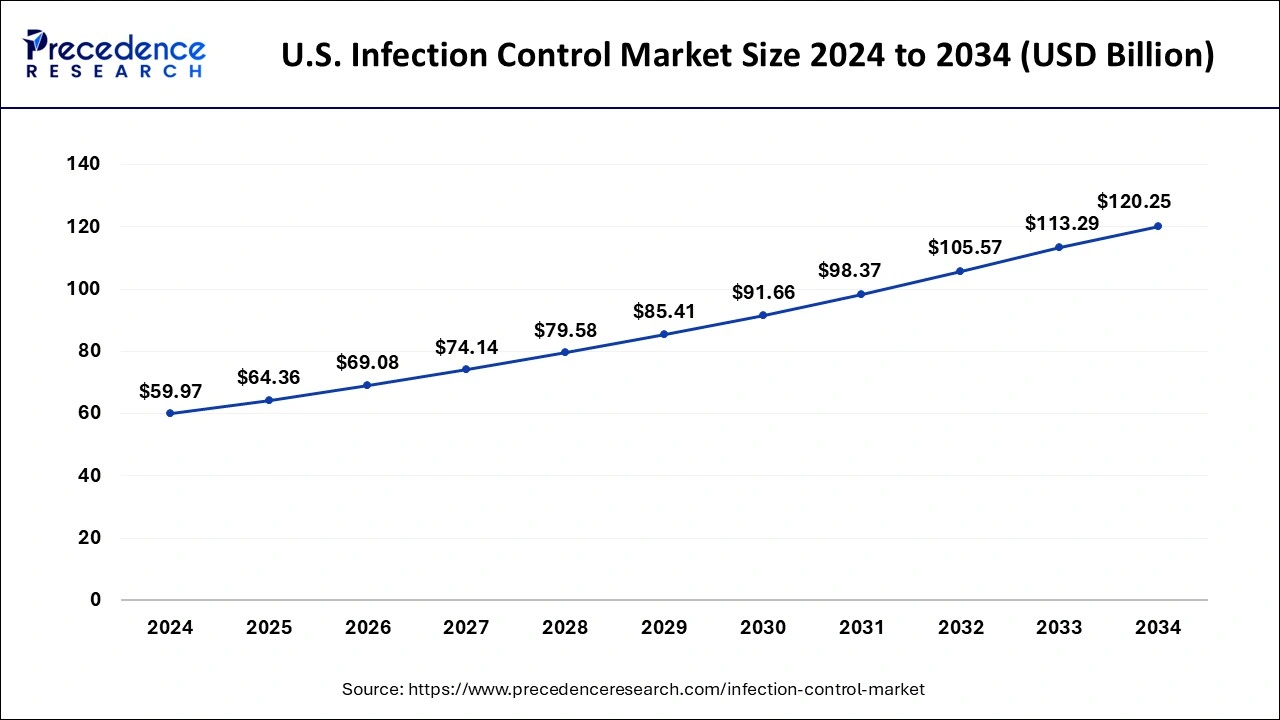

U.S. Infection Control Market Size and Forecast 2025 to 2034

The U.S. infection control market size was exhibited at USD 59.97 billion in 2024 and is projected to be worth around USD 120.25 billion by 2034, growing at a CAGR of 7.21% from 2025 to 2034.

North America accounted for 34.14% of revenue share in 2024. The locale's enormous offer can be credited to the developing interest for and reception of cleansing and sanitization items alongside administrations because of the rising spotlight on solid ways of life and sickness counteraction among customers. The flood in the geriatric populace before long and the ensuing expansion in the predominance of ongoing illnesses, the requirement for infection control to limit the pervasiveness of HAIs, and the execution of positive government drives and rigid guidelines on sanitization and sterilization are likewise pushing the disease control market in the area.

In the Asia Pacific, the market for infection control is supposed to show the quickest CAGR all through the estimated period inferable from the developing presence of rethinking associations, developing medical services consumption, and phenomenal advancement of medical care guidelines and foundation across this district. The presence of different deliberate and government associations zeroed in on further developing disease control norms is additionally one of the huge variables adding to the development of the Asia Pacific area. Expanding pattern of re-appropriating by laid out market players in created economies, to organizations in the Asia Pacific locale, additionally fills in as key development inducing factor for the market. For example, the Asia Pacific Society of Infection Control (APSIC) is a deliberate association working toward laying out cooperative organizations to work with quality improvement and direct infection control examination to advance expense productive practices all through the Asia Pacific locale.

Technological Advancements in the Market

- UV-C light disinfection systems: These are now widely implemented in hospital rooms, operating theatres, and ambulances to kill pathogens without chemicals.

- Contactless monitoring devices: Smart badges and sensors now monitor hand hygiene and sterilization compliance in real-time.

- Next-gen sterilization units: Modern autoclaves and low-temperature sterilization systems allow faster and more energy-efficient processing.

- Nanotech-based coatings: Surfaces infused with silver or copper nanoparticles actively prevent microbial growth over long periods.

Infection Control Market Growth Factors

Hospital-acquired infections (HAIs) are nosocomial contaminations that happen during a patient's visit to medical clinics and related offices and are not seen at the hour of confirmation. They are a significant reason for horribleness and mortality around the world. These contaminations incorporate focal line-related circulatory system diseases, careful site diseases, catheter-related urinary parcel contaminations, medical clinic procured pneumonia, ventilator-related pneumonia, and Clostridium difficile contaminations. The most well-known microscopic organisms related to HAIs incorporate C. difficile, MRSA, Klebsiella, E. coli, Enterococcus, and the Pseudomonas species. Utilizing tainted clinical gadgets during indicative and restorative methods is a significant reason for HAIs. As per the CDC, up to 1.7 million hospitalized patients in the US every year get medical care-related contaminations (HCAIs) while being treated for other medical problems, and more than 98,000 of these patients (one out of 17) pass on because of HCAIs. 32% of all HAIs in the nation are urinary plot contaminations, 22% are careful site diseases, 15% are lung (pneumonia) diseases, and 14% are circulatory system diseases. This is supposed to support the interest in sanitization and sanitizer items.

The occurrence of HAIs is predominantly subject to the patient's resistant status, disease control rehearses, and the commonness of different irresistible specialists in the medical services office. Different elements incorporate longer medical clinic stays, immunosuppression, more seasoned age, and stays in concentrated care units. Around 20% of such diseases happen in ICUs. The significant microorganisms causing HAIs to incorporate C. difficile, Staphylococcus aureus, Klebsiella, and Escherichia coli. The flare-up of COVID-19 and the developing instances of local area transmission diseases recognized in medical care faculty (HCP) has prompted the execution of rules for infection control by different government bodies across the globe. Considering such turns of events, the interest ininfection control practices, for example, the legitimate utilization of cleansing and sanitizer items is supposed to increment in medical care offices across the globe before long.

Recent Government Initiatives Worldwide

- Subsidized Sanitation Infrastructure: Several nations have channeled resources into building advanced decontamination and sterilization units in hospitals.

- Policy Frameworks for Infection Prevention: Health ministries have enforced stricter hygiene protocols and tracking mechanisms post-COVID.

- Pandemic Preparedness Funds: Investments in stockpiling PPE, training healthcare staff, and building rapid response systems have seen notable upticks.

- International Collaboration: Countries are sharing surveillance data and research findings to prevent global outbreaks and healthcare-associated infections.

Infection Control Market Trends

- Integration of Automation and AI: Hospitals and laboratories are rapidly adopting automated sterilization systems and AI-driven monitoring tools to ensure optimal infection prevention protocols.

- Demand for Disposable Medical Supplies: Single-use surgical instruments, gowns, and gloves are seeing increased usage to minimize cross-contamination risks.

- Rise in Healthcare-Associated Infections: Growing awareness and prevalence of HAIs have led to stricter infection control regulations and preventive strategies.

- Emphasis on Antimicrobial Coatings: Surge in demand for surfaces and devices with antimicrobial coatings in both healthcare and public environments.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.63% |

| Market Size in 2025 | USD 265.67 Billion |

| Market Size by 2034 | USD 473.18 Billion |

| Largest Market | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product & Service, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Toxic Properties of Chemical Disinfectants to Lower Its Sales

There are many chemical disinfectants which are readily available in the market possess poisonous properties. For instance, sodium hypochlorite (NaCIO) cures blood rode pathogens effectively. But this compound is extremely acidic in nature and is annoying to the respiratory system. This can turn harmful for cleaning workers and residents of the particular building as well as poisonous when expelled into the locality. An inappropriate usage of these products may trigger environmental risks and be dangerous to individuals coming in contact with it. Disinfectants have got no green certificate till the date. Disinfectants used in the Unites States should have the registered mark of Environmental Protection Agency (EPA), and these disinfectants are administered through the act Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). As the populace is in the demand of greener solutions, the usage of these products is getting restricted. Producers of these products are now being enforced to look upon the greener and advanced options which will not be harmful to the human body.

Increasing Implementation of Single-Use Products

Old age populace across the globe is increasing and the propensity of diabetes and obesity is also rising, which in turn is giving rise to the increasing number of surgical procedures yearly. The increasing number of surgical procedures grew the demand for single-use medical products which are easily able to dispose of immediately after the usage or disposable ones. Healthcare spending per person is augmenting and the significance of hygiene maintenance and cleanliness is rising. These factors are anticipated to upsurge the demand for single-use nonwoven medical products. Various viral diseases like Ebola, Zica virus, dengue, and yellow fever and the pandemic have outspreaded in the past few years. These diseases have also bolstered the demand for these single-use products. Protective apparel market will also witness a considerable growth as the hospitals are focusing more on lowering the rate of Healthcare Associated Infections (HAIs). Thus, all these factors offer lucrative opportunities to the global market to for its growth over the forecast period.

Products and Services Insights

The protective barriers market represented the biggest portion of the infection control market in 2024. The enormous portion of the defensive boundaries market can be credited to the rising reception of clinical nonwovens, for example, facial coverings and careful curtains and outfits, because of the ongoing ascent in COVID-19 cases. The medical clinics and facilities end-client portion is supposed to represent the biggest portion of the disease control market.

End-user Insights

The medical clinics and facilities portion represented the biggest portion of the infection control market in 2024. The general interest ininfection control in clinics is to a great extent driven by the rising pervasiveness of HAIs, the rising number of clinics and facilities around the world, and the rising geriatric populace (as this populace section is more defenseless to different ongoing sicknesses). The developing volume of surgeries performed is additionally a significant supporter of the development of the disease control market for clinics. The rising number of government drives to guarantee serious level disease avoidance is additionally a critical driver of the market fragment. The hospitals segment accounted for 40% revenue share in 2024.

COVID-19 Surged the Demand for Self-Protective Equipment

The demand for advanced facilities of healthcare and infrastructure has surged in a drastic manner as the COVID-19 was outspreading across the world. The demand for infection control goods like self-safeguarding equipment has burgeoned across all the nations to manage the outburst of this pandemic, as these good are one of the important parts of healthcare. Healthcare professionals were dependent on this self-safeguarding equipment to take care of themselves and all the patients coming in their contact. However, the pandemic was outspreading like fire in the jungle, accessibility of these products became insufficient and the healthcare sector has to witness downfall in terms of numbers. According to the World Health Organization (WHO), the number of masks required every month was approximately 89 million. The gloves employed for the examination went nearly to 76 million per month. China is the global leader in manufacturing and exporting masks. In addition, the demand for aerosol disinfectants grew up by almost 32%. As per the estimation of WHO, healthcare professionals needed around 7% to 10% of the whole global supply of surgical masks, and this percentage can even grow more looking towards the outbreak of this pandemic. In addition, according to their estimates the sale for medical masks grew by nearly 319% as well as the sale of maintenance masks uplifted by approximately 262%. COVID-19 became a point of attraction for the individuals to purchase self-protective equipment and the usage of single-use equipment, thus marking a positive impact on the global infection control market.

Infection Control Market Companies

- Getinge AB (Sweden),

- STERIS plc.

- Advanced Sterilization Products (US),

- 3M Company (US),

- Belimed AG (Switzerland),

- Cantel Medical Corporation (US),

- MMM Group

- MATACHANA GROUP (Spain),

- Sotera Health LLC (US)

Recent Developments

- In 2021, STERIS consented to an authoritative arrangement to gain Cantel, a worldwide supplier of contamination anticipation items and administrations, through a US auxiliary, to broaden its immense arrangement of disease control items and administrations.

- In 2020, Getinge sent off its new Getinge Assured Superfast 20 Biological Indicators that permit CSSD staff to acquire brings about 20 minutes.

- In 2020, Cantel cooperated with Censis to consolidate Cantel's driving contamination anticipation endoscope going back over the work process portfolio with the careful resource of the executives and instrument following arrangements from Censis under one brand — CANEXIS Integrated Workflow Solution — to offer an instrument going back over and scope following programming.

- In 2020, Ecolab procured Holchem Group to reinforce its cleanliness and cleaning items and administrations portfolio for the food and drink, food administration, and friendliness enterprises.

- The key market players continually participate in different formative techniques like organization, coordinated efforts, new item dispatches, and acquisitions to reinforce their market position and gain a piece of the pie.

Segments Covered in the Report

By Product & Service

- Sterilization Products and Services

- Sterilization Equipment

- Heat Sterilization Equipment

- Moist Heat Sterilizers

- Dry Heat Sterilizers

- Low-Temperature Sterilization

- Hydrogen Peroxide Sterilization

- Ethylene Oxide Sterilization (ETO)

- Formaldehyde Sterilization

- Other Low-Temperature Sterilization

- Radiation Sterilization

- Filtration Sterilization

- Other Equipment

- Heat Sterilization Equipment

- Contract Sterilization Services Market

- ETO Sterilization Services

- Gamma Sterilization Services

- E-Beam Sterilization Services

- Steam Sterilization Services

- Other Sterilization Services

- Consumables and Accessories

- Sterilization Indicators

- Chemical Indicators

- Biological Indicators

- Packaging Accessories

- Sterilization Indicators

- Sterilization Equipment

- Cleaning and Disinfection Products

- Disinfectants

- Disinfectants, By Product Type

- Hand Disinfectants

- Surface Disinfectants

- Skin Disinfectants

- Instrument Disinfectants

- Disinfectants, By Formulation

- Disinfectant Wipes

- Liquid Disinfectants

- Disinfectant Sprays

- Disinfectants, By EPA Classification

- Low-Level Disinfectants

- Intermediate-Level Disinfectants

- High-Level Disinfectants

- Disinfectants, By Product Type

- Cleaning and Disinfection Equipment

- Washer-Disinfectors

- Flusher Disinfectors

- UV-Ray Disinfectors

- Ultrasonic Cleaners

- Other Cleaning and Disinfection Equipment

- Lubricants and Cleaning Solutions

- Disinfection and Cleaning Accessories

- Disinfectants

- Protective Barriers

- Medical Nonwovens

- Surgical Drapes

- Surgical Gowns

- Face Masks

- Covers and Closures

- Goggles

- Gloves

- Medical Nonwovens

- Endoscope Reprocessing Products

- Endoscope Reprocessing Consumables

- Endoscope Reprocessing Equipment

- Automated Endoscope Re-processors

- Endoscope Tracking Systems

- Other Endoscope Reprocessing Products

- Other Infection Control Products

By End User

- Hospitals & Clinics

- Medical Device Companies

- Pharmaceutical Companies

- Life Science Industry

- Food Industry

- Other

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting