What is the Hospital Infection Therapeutics Market Size?

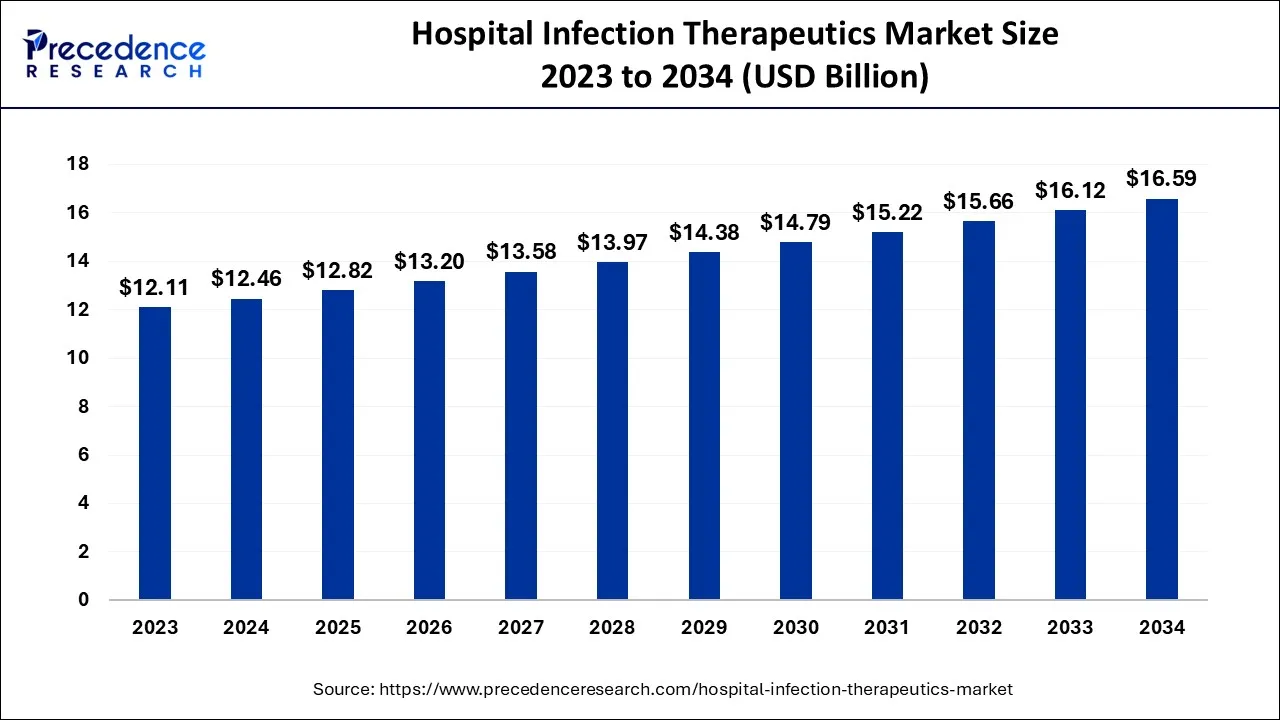

The global hospital infection therapeutics market size is calculated at USD 12.82 billion in 2025 and is predicted to increase from USD 13.20 billion in 2026 to approximately USD 17.05 billion by 2035, expanding at a CAGR of 2.89% from 2026 to 2035.

Hospital Infection Therapeutics Market Key Takeaways

- North America region dominated the global market and generated to the largest market share in 2025.

- By Drug Type, the antibiotics drugs segment captured for a significant market share in 2025.

- By Applications, the bloodstream infections segment recorded for the largest market share in 2025.

Market Overview

Hospital infections, also known as nosocomial infections, occur in a hospital setting and are not present or incubating before the patient's admission. Hospital infections can be caused by various pathogens, including bacteria, viruses, and fungi. These infections can range from mild to severe, leading to prolonged hospital stays, increased healthcare costs, and even death.

The hospital infection therapeutics market is focused on developing and selling drugs and treatments that target these infections. The market is driven by the growing incidence of hospital infections, increasing demand for effective treatment options, and the rising awareness of the need to prevent hospital infections.

Market Outlook

- Industry Growth Overview: The market is experiencing robust growth, driven by rising hospital-acquired infections (HAIs) and the urgent need for effective treatments against antibiotic-resistant pathogens.

- Major investors: Major investors and key players in the market include large pharmaceutical giants like Merck, Pfizer, Johnson & Johnson, GSK, AstraZeneca, and Roche.

- Global Expansion: The global market is driven by the increasing prevalence of respiratory disorders, which leads to hospital visits and stringent government regulations on the production and distribution of therapeutics.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 12.82 Billion |

| Market Size in 2026 | USD 13.20 Billion |

| Market Size by 2035 | USD 17.05Billion |

| Growth Rate from 2026 to 2035 | CAGR of 2.89% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Drug Type and By Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increasing prevalence of hospital-acquired infections (HAIs)

Hospital-acquired infections refer to infections acquired during hospitalization, often due to exposure to pathogens such as bacteria, viruses, or fungi. These infections can be challenging to treat and, in some cases, can lead to severe complications or even death. According to the World Health Organization (WHO), HAIs affect hundreds of millions of patients worldwide every year, causing significant morbidity, mortality, and economic burden.

In the United States alone, the centers for disease control and prevention (CDC) estimates that approximately one in 31 hospital patients has an HAI, resulting in tens of thousands of deaths and billions of dollars in additional healthcare costs each year. As a result, there is a growing demand for effective treatments and preventive measures for HAIs.

This has led to increased investment in the research and development of new therapeutics and technologies to prevent and treat hospital infections. Additionally, regulatory agencies and healthcare organizations worldwide have introduced guidelines and initiatives to reduce the incidence of HAIs, further stimulating the growth of the hospital infection therapeutics Market.

Rising demand for advanced healthcare facilities

As healthcare facilities evolve and improve, the demand for advanced hospital infection therapeutics is also increasing. Hospitals and other healthcare facilities are investing in advanced infection control technologies and solutions, which require advanced therapeutics to be effective. Moreover, the increasing demand for minimally invasive surgeries and procedures drives the demand for hospital infection therapeutics, as these procedures carry a high risk of infection.

Restraints

Antibiotic resistance

Antibiotic resistance is a significant concern for the hospital infection therapeutics market as it limits the effectiveness of antibiotics in treating infections. The overuse and misuse of antibiotics have led to the emergence of antibiotic-resistant strains of bacteria, making it challenging to treat hospital-acquired infections. This is a global issue that affects both developed and developing countries.

The development of new antibiotics is slow, costly, and often not financially attractive for pharmaceutical companies, which creates a gap in the market for effective treatments. Additionally, regulatory agencies have become more stringent in their approval process for new antibiotics due to the emergence of antibiotic-resistant strains of bacteria, which significantly hinder the development and commercialization of new drugs.

Opportunity

Technological advancements

The technological advancements in diagnostics, drug delivery, and treatment monitoring are expected to create ample opportunity for the hospital infection therapeutics market. For instance, the development of rapid diagnostic tests and point-of-care devices helps healthcare professionals to quickly diagnose and treat hospital-acquired infections, which leads to better patient outcomes and reduces the risk of spreading infections.

Additionally, telemedicine and digital health platforms improve patient access to healthcare services and enable remote monitoring of patients with hospital-acquired infections. Moreover, the emergence of new drug delivery systems, such as nanoparticles and liposomes, improves drug efficacy and reduces toxicity, enhancing hospital infection therapeutics' effectiveness.

Therefore, technological advancements create new opportunities for pharmaceutical companies to develop innovative products and services that meet the growing demand for effective hospital infection therapeutics.

Segment Insights

Drug Type Insights

In 2025, the antibiotics drugs segment accounted for a significant market share. Antibiotic drugs are the most commonly used drugs for treating hospital-acquired infections. They work by killing or inhibiting the growth of bacteria and are used to treat a wide range of infections, such as pneumonia, bloodstream infections, and urinary tract infections.

The development of this segment in the hospital infection therapeutics market is attributed to several factors. Bacterial infections are among the most common infections acquired in healthcare settings, and antibiotics are the most effective treatment drugs. The high prevalence of bacterial infections has created a strong demand for antibiotics drugs in the hospital infection therapeutics market.

Moreover, antibiotics have a long history of use and are well-established drugs, making them a go-to option for many healthcare providers. Antibiotic drugs are available in various forms, including oral, intravenous, and topical, making them versatile drugs that can be used in multiple clinical settings.

Furthermore, the emergence of antibiotic-resistant bacteria has increased the demand for new and innovative antibiotic drugs. Developing new antibiotics drugs is costly and time-consuming, but there is a growing need for effective drugs that treat antibiotic-resistant bacteria.

Application Insights

In 2025, the bloodstream infections segment accounted for the highest market share. Bloodstream infections, also known as sepsis or bacteremia, are serious infections that occur when bacteria or other pathogens enter the bloodstream. They are caused by a wide range of microorganisms, including bacteria, viruses, and fungi, and result in severe complications, such as septic shock, organ failure, and death. Bloodstream infections significantly cause morbidity and mortality in hospital settings, particularly in critically ill patients.

The growth of this segment is due to several factors. Bloodstream infections are a common and serious problem in healthcare settings, particularly critically ill patients with invasive medical devices such as central venous catheters. These devices provide a pathway for bacteria to enter the bloodstream, which results in infections.

Moreover, bloodstream infections are challenging to diagnose and treat, leading to a strong demand for effective therapeutics in this area. Diagnosing bloodstream infections requires the collection of blood samples for culture and analysis, which is time-consuming and may delay the initiation of treatment. Additionally, the emergence of antibiotic-resistant bacteria has made the treatment of bloodstream infections more challenging, which has increased the demand for new and innovative therapeutics.

Regional Insights

In 2025, North America dominated the hospital infection therapeutics market holding the highest market share. The region includes countries like the United States and Canada, with well-established healthcare systems and advanced infrastructure. The high prevalence of hospital-acquired infections in North America is a significant factor driving the market growth. Hospital-acquired infections are a significant problem in the region, with millions of patients being affected each year.

The growing incidence of antibiotic-resistant infections in the region has further increased the demand for effective therapeutics, contributing to North America's market growth. The growth of this region is also driven by increasing healthcare expenditure.

The high healthcare expenditure has led to the development of advanced healthcare infrastructure, including hospitals and clinics equipped with modern medical equipment and technology.

Asia Pacific is expected to grow at the fastest rate over the forecast period. The growth of the region can be attributed to the rising healthcare expenditure & infrastructure, along with the supportive government health policies. Furthermore, public health awareness programs and campaigns support better hygiene and treatment solutions, contributing to market expansion soon.

China Hospital Infection Therapeutics Market Trends

In the Asia Pacific, China dominated the market owing to the growing prevalence of healthcare-associated infections (HAIs) and robust government initiatives to enhance R&D capabilities and healthcare infrastructure. Also, the government in the country has successfully implemented supportive reforms and policies to optimise the clinical trial approval process.

Europe is expected to grow at a notable rate over the forecast period. The growth of the region can be credited to the surge in surgical rates, increasing antibiotic resistance, and greater healthcare awareness, which leads to investment in innovative therapies and stringent guidelines. Moreover, well-established healthcare systems boost demand for more advanced solutions.

Germany Hospital Infection Therapeutics Market Trends

The growth of the market in the country can be driven by a rise in the elderly population needing more advanced medical procedures to tackle disease prevalence. In addition, Germany's robust healthcare infrastructure and substantial healthcare expenditure promote the adoption of advanced therapeutics, contributing to market expansion.

Hospital Infection Therapeutics Market Companies

- Pfizer Inc.: A major pharmaceutical leader offering various anti-infective solutions, including the combination therapy Zavicefta (ceftazidime-avibactam), designed to treat multidrug-resistant bacterial infections.

- GlaxoSmithKline (GSK) plc: Offers a range of products, including antibiotics, and is involved in research and development to address antibiotic resistance.

Other Major Key Players

- Merck & Co., Inc.

- Bayer AG

- GlaxoSmithKline Plc.

- Daiichi Sankyo Company, Limited

- AbbVie Inc.

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- Allergan Plc.

- AstraZeneca

Recent Developments

- In April 2022, Pfizer entered a definitive agreement to acquire ReViral, a clinical-stage biopharmaceutical company focused on developing antiviral therapeutics for the respiratory syncytial virus (RSV). The acquisition aims to expand Pfizer's presence in the field of antiviral therapeutics and support its efforts to develop new treatments for RSV and other respiratory infections.

- In Dec 2021, Merck, also known as MSD outside the United States and Canada, along with Ridgeback Biotherapeutics, announced that their antiviral drug molnupiravir has received Emergency Use Authorization (EUA) from the US Food and Drug Administration (FDA) for the treatment of COVID-19. This is a significant milestone in the global effort to combat the COVID-19 pandemic and adds to Merck's history of developing innovative drugs that address major health threats and improve patient outcomes.

- In June 2020, Merck announced that Recarbrio, a drug designed to target hospital-acquired infections at its source, has received approval for a supplemental New Drug Application from the US Food and Drug Administration (FDA). The approval of Recarbrio represents a significant development in hospital infection therapeutics.

Segments Covered in the Report

By Drug Type

- Antibiotics Drugs

- Antifungal Drugs

- Antiviral Drugs

- Others

By Applications

- Bloodstream Infections

- Pneumonia

- Surgical Site Infections

- Urinary Tract Infections

- Gastrointestinal Disorders

- Other Hospital Infections

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting