What is the Dental Infection Control Products Market Size?

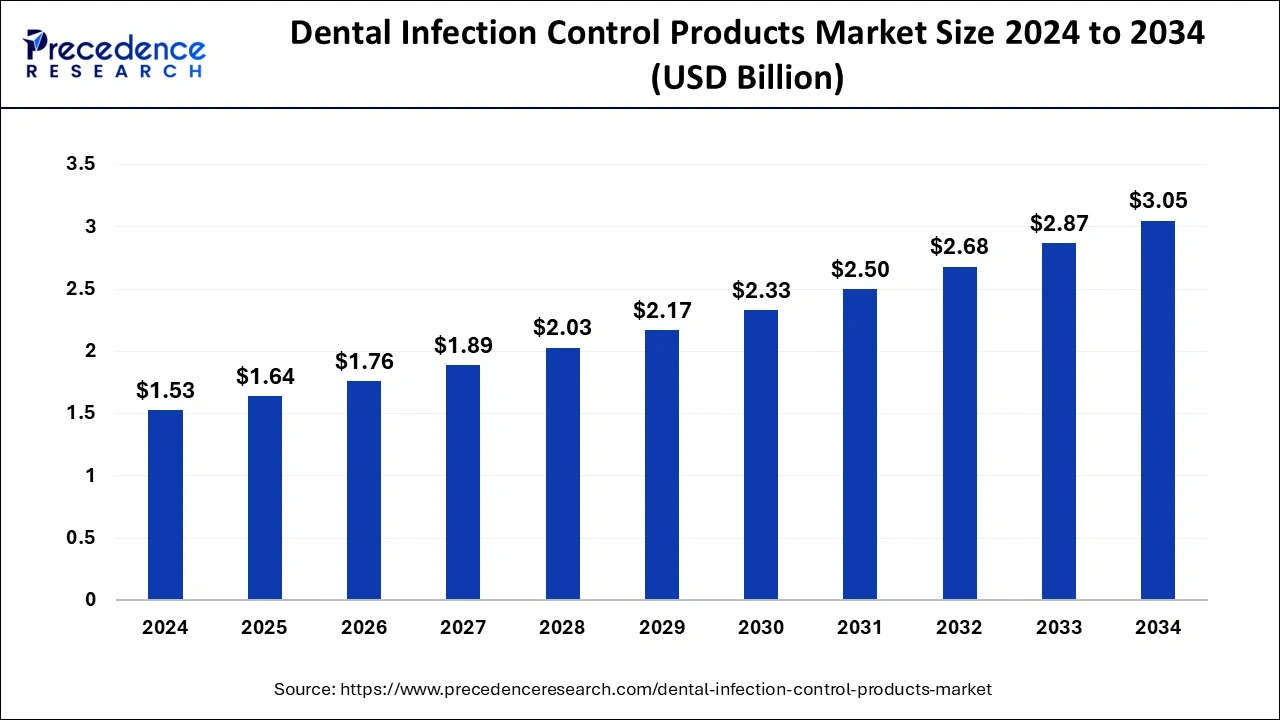

The global dental infection control products market size accounted for USD 1.64 billion in 2025 and is predicted to increase from USD 1.76 billion in 2026 to approximately USD 3.24 billion by 2035, expanding at a CAGR of 7.05% from 2026 to 2035. The dental infection control products market is driven by the rising incidence of dental conditions.

Dental Infection Control Products Market Key Takeaways

- The global dental infection control products market was valued at USD 1.64billion in 2025.

- It is projected to reach USD 3.24billion by 2035.

- The market is expected to grow at a CAGR of 7.05% from 2026 to 2035.

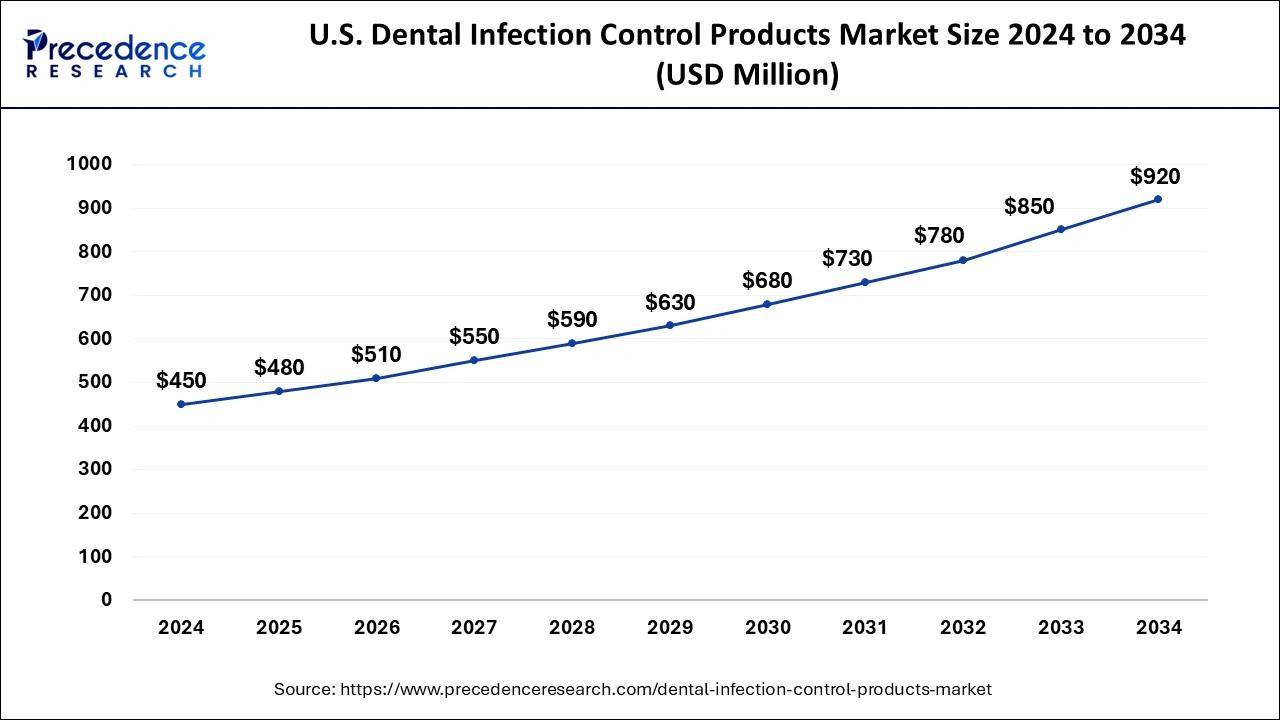

- The North America dental infection control products market size accounted for USD 450 million in 2025 and is expected to attain around USD 990 million by 2035.

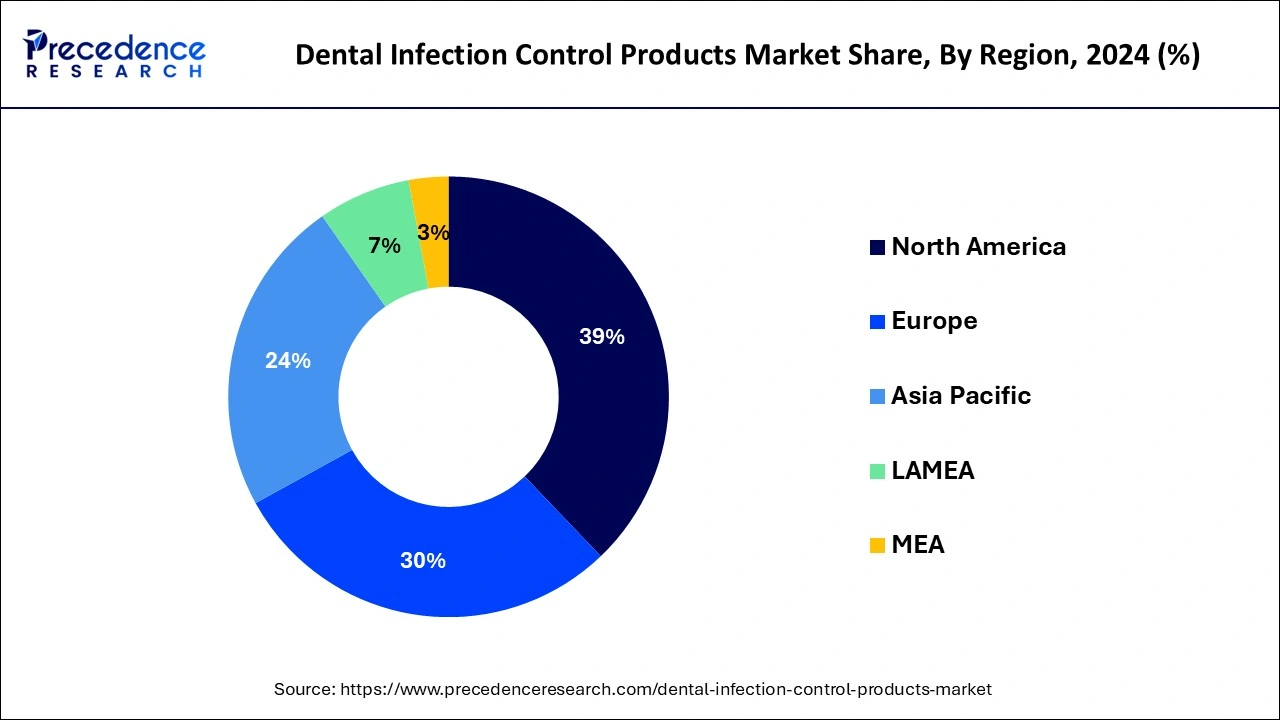

- North America dominated the dental infection control products market in 2025.

- By type, the consumables segment dominated the market in 2025.

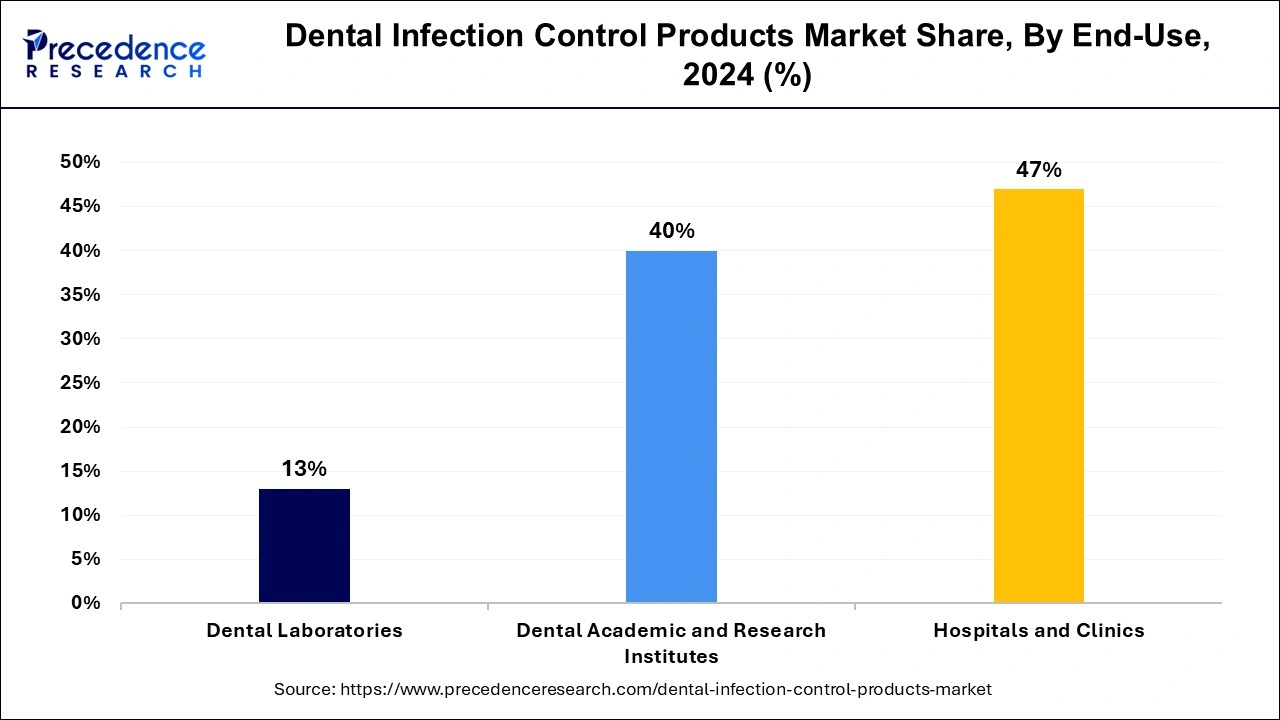

- By end-use, the hospitals and clinics segment dominated the dental infection control products market.

- By end-use, the dental academic and research institutes segment is observed to grow at a rapid pace during the forecast period.

What are the Dental Infection Control Products?

The healthcare business segment that focuses on creating and distributing a range of goods intended to prevent and control infections in dental settings is known as the dental infection control products market. These goods include cleaners, sterilizers, masks, gloves, gowns, other personal protective equipment (PPE), and various other cleaning and sterilizing supplies and instruments.

The market for dental infection control products is essential because it plays a vital role in protecting patients' and dentists' health and safety. During dental operations, one must come into intimate contact with human fluids and surfaces that could be home to hazardous pathogens like viruses and bacteria. Inadequate infection control procedures increase the possibility of infectious disease transmission between dental personnel and patients.

How is AI contributing to the Dental Infection Control Products Industry?

Dental infection control uses artificial intelligence to enable real-time monitoring, automatic sterilization, and risk prediction through its predictive capabilities. The AI system analyzes medical images while monitoring hygiene practices, performing automatic disinfection, and providing staff members with hands-free operational support, and detecting patients who belong to high-risk groups, which enables medical professionals to shift from manual hygiene monitoring to a system that uses artificial intelligence for comprehensive safety administration.

Dental Infection Control Products Market Data and Statistics

- According to studies, there are around 3.5 billion oral health disorders worldwide. Even though they are mostly preventable, oral diseases impact people at all stages of life and can be fatal. They can cause pain, discomfort, deformity, and other health problems in many nations.

- Oral health issues are expensive to treat and typically aren't covered by universal health coverage (UHC).

Dental Infection Control Products Market Growth Factors

- More people are seeking dental care due to expanding disposable incomes and increased awareness of oral health, which raises the demand for infection control supplies in offices and medical facilities.

- The need for dental care, especially preventative measures, is anticipated to increase as the number of elderly people increases. Oral infections are more common in this age range.

- As gum disease, cavities, and other oral infections become more prevalent, infection control strategies must be used to stop the development of these conditions.

- Introducing novel and cutting-edge infection control products, such as automated disinfection systems and disposable tools, creates a broader market.

- The need for dental facilities to maintain high cleanliness standards is fueled by the rise in patients traveling for dental procedures, which encourages the usage of infection control solutions.

- As cosmetic dentistry procedures become more common, there is an increasing demand for sterile and disposable equipment to reduce the risk of infection.

Market Outlook

- Growth Overview: The increasing number of dental procedures and rigid laws hasten the need for sterilization equipment and consumables.

- Trends in Sustainability: Biodegradable materials and energy-efficient sterilizers are on the rise in the dental practices that are environmentally friendly.

- Key Investors: 3M, Dentsply Sirona, Henry Schein, Steris, Envista Holdings, Coltene Group, A-dec are innovative.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 7.05% |

| Market Size in 2025 | USD 1.64 Billion |

| Market Size in 2026 | USD 1.76 Billion |

| Market Size by 2035 | USD 3.24Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing awareness of infection control

Product innovation and technological advancements have accelerated the creation of more efficient infection control solutions suited to dental environment requirements. Dental practitioners can maintain a sanitary environment and stop the spread of infectious agents by using various solutions, from antimicrobial surface disinfectants to sterilization tools and personal protective equipment.

Further, to keep their staff members informed about the most recent infection control recommendations and best practices, dental offices are investing in ongoing education and training and adopting evidence-based methods. This dedication to continuous learning and development highlights the need to prioritize patient safety and demonstrates a proactive approach to infection control. Thereby, such rising awareness of infection control among the practitioners as well as population acts as a driver for the dental infection control products market.

Increasing dental procedures

Globally, there is an increase in the frequency of dental conditions such as oral cancer, periodontal infections, and caries. As a result, more dental procedures are being done to identify, address, and cure these disorders. Effective infection control strategies are essential to prevent nosocomial infections and cross-contamination when more procedures are performed. The necessity of infection control in healthcare settings, particularly dentistry practices, has been highlighted by the rise of infectious disorders like COVID-19.

Because of the pandemic, there is a renewed focus on developing stringent infection control policies and a heightened awareness of disease transmission in healthcare facilities. Dental offices spend money on superior infection control supplies to reduce the chance of spreading illness and guarantee patient security.

Restraint

Limited adoption in developing countries

Dentists may not be aware of the risks associated with insufficient measures and the significance of infection control methods in particular areas. Furthermore, patients might not be aware of infection control procedures and might not ask their dentists to follow them. Adopting infection control products is still low, and no effective education and awareness initiatives exist. Distribution networks might not be able to reach isolated or rural locations where a sizable fraction of the population dwells, even if oral infection management treatments exist on the market. The adoption of these items is further hampered by limited availability, exacerbating the healthcare services gap between urban and rural communities.

Opportunity

Growing emphasis on preventive healthcare measures

Consumers are becoming more conscious of good oral hygiene's role in avoiding dental infections. People are looking for goods and services emphasizing prevention over treatment as they become more aware of the connection between oral health and general well-being. This reduces the possibility of microbial contamination in dental settings and includes routine dental examinations, good oral hygiene habits, and infection control tools.

The focus on prevention offers dental professionals a chance to take the initiative in infection control. Dental experts are now implementing preventive measures into their practices to lessen the chance of infections developing in the first place instead of only treating current illnesses. This entails using premium infection control solutions, adhering to strict sterilization procedures, and educating patients about preventive oral care practices. Thereby, as the emphasis on preventive healthcare rises, the dental infection control products market is observed to witness a sustained growth factor.

Segment Insights

Type Insights

The consumables segment dominated and sustained to be the fastest growing in the dental infection control products market.

The dental sector is always seeing improvements in goods and methods for infection prevention. Manufacturers create innovative consumables with enhanced safety features, usability, and efficacy. Disposable goods, for instance, have improved chemical resistance and barrier qualities. The need for infection control solutions is also fueled by the development of dental tourism, which is the practice of people traveling overseas for dental procedures to save money or receive higher-quality care.

Dental offices that treat patients from other countries need to follow strict infection control guidelines to maintain their good name and attract new patients, which increases the need for consumables.

The equipment segment shows a notable growth in the dental infection control products market during the forecast period.

The global growth in dental operations is attributed to the increased desire for cosmetic dentistry and the rising prevalence of tooth problems. The demand for equipment such as dental unit waterlines, chairside aerosol evacuation systems, and surface disinfectants is driven by the increased requirement for efficient infection control measures resulting from increased treatments.

End-use Insights

The hospitals and clinics segment dominated the dental infection control products market in 2025. Patients want healthcare facilities, including dental clinics, to protect their safety and well-being and to keep their surroundings tidy and sanitary. Using the correct goods and procedures to control infections in hospitals and clinics can increase patient happiness and trust, ultimately fueling market expansion. The dental laboratories segment is the fastest growing in the dental infection control products market during the forecast period.

Innovations in equipment and infection control solutions are only two examples of the dental industry's quick technical improvements. Manufacturers are introducing innovative technologies with enhanced efficacy and user-friendliness, like autoclaves, ultrasonic cleaners, and surface disinfectants. Dental laboratories are eager to implement these cutting-edge approaches to improve infection control procedures and maintain a competitive edge.

The dental academic and research institutes segment is observed to grow at a rapid pace during the forecast period in the dental infection control products market. Dental academic and research institutes must adhere to strict quality assurance standards and accreditation requirements. Dental infection control products are essential for maintaining a safe and hygienic learning environment, ensuring compliance with infection control guidelines, and demonstrating competency in infection prevention and management practices. Dental infection control products are utilized in clinical simulations to recreate real-life scenarios encountered in dental practice. Simulated dental infections allow students to develop clinical skills, practice infection control protocols, and gain confidence in managing various dental emergencies.

Regional Insights

What is the U.S. Dental Infection Control Products Market Size?

The U.S. dental infection control products market size was exhibited at USD 480 million in 2025 and is projected to be worth around USD 990 million by 2035, growing at a CAGR of 7.51% from 2026 to 2035.

North America had the dominating share of the dental infection control products market in 2025. The region is also observed to sustain the position during the forecast period. Dental care is expensive in North America for private patients and those covered by insurance. Therefore, to preserve patient happiness, safety, and trust, dental professionals prioritize infection control.

This emphasis on infection prevention fuels the constant need for high-quality infection control products. Public health education and knowledge of the value of infection control in dental settings are highly prioritized. Patients are becoming more aware of the dangers of untreated infections and the importance of good infection control practices, and dental staff undergo extensive training in infection prevention techniques. This increased awareness fuels the need for infection control products that adhere to strict safety regulations.

- According to the National Library of Medicine, it is estimated that within four years, 13% of people seek dental care for a dental infection or toothache, and 1 in every 2600 Americans are hospitalized for dental infections. Untreated dental caries affects more than 1 in 5 persons, and 3 out of 4 have had at least one dental restoration. Additionally prevalent is periodontitis, estimated to affect 35% of all Americans between the ages of 30 and 90.

U.S. Dental Infection Control Products Market Trends

The U.S. has its way of dominating by enforcing its rules strictly and voluminous procedures. Clinics are changing their old sterilization systems to smart connected equipment. Consumables that are used once are still necessary. The concept of sustainability affects procurement by prioritizing resilient supply chains and green and reusable technological ways to control infections.

Europe is observed to grow at a notable rate in the dental infection control products market during the forecast period. Europe's dentistry market is expanding rapidly due to aging populations, rising disposable income, and dental operations and technology improvements. The need for infection control solutions to uphold hygiene and stop the spread of infections grows along with the number of dental treatments and patient visits. Growth in the European market is driven by the mutually beneficial interaction between the growing dentistry industry and the need for infection control solutions.

Germany Dental Infection Control Products Market Trends

Germany is a leader in terms of quality and compliance. Automated sterilizers and the best hygiene solutions cost the clinic a lot. Patient safety culture is strong, and advanced PPE is adopted. Sustainability leads to the necessity of biodegradable barriers and effective sterilization technology, which deal with the complicated procedures in the aging patient population.

How Is Asia-Pacific Performing in the Dental Infection Control Products Market?

Asia-Pacific demonstrates the most rapid growth because of the increasing dental facilities and disposable incomes. Urban clinics become more prolific in the use of high-end sterilization and consumables. The drivers to growth include private investments in dentistry, laboratory-level digitalization, and visible high-level infection control requirements in contemporary dental practices.

China Dental Infection Control Products Market Trends

China is fast-growing in terms of demand for the growing number of private clinics and hospitals. Procurement is dominated by high-volume consumables. The integration of digital dentistry enhances the requirements of special sterilization. High-end clinics embrace modern technologies in infection control to facilitate the positioning of medical tourism and patient confidence.

Value Chain Analysis of the Dental Infection Control Products Market

- R&D: The creation of highly developed antimicrobial materials and formulations, and the prevention of cross-contamination and dental safety.

Key Players: 3M, Dentsply Sirona, Steris (Cantel/Hu-Friedy), Envista Holdings (Kerr) - Clinical Trials and Regulatory Approvals: Investigation of efficacy and FDA and ISO certification that complies and is clinically safe.

Key Players: 3M, Dentsply Sirona, Steris (Cantel), FDA/EMA - Formulation and Final Dosage Preparation: Transforming active ingredients into sterile disinfectants, wipes, and sterilants to be used in clinical environments.

Key Players: Schulke & Mayr, Coltene, GC Corporation - Packaging and Serialization: Packaging products in identifiable, regulatory-compliant packages that preserve integrity and stop counterfeiting.

Key Players: Dentsply Sirona, Henry Schein, Steris (Crosstex), 3M - Distribution to Hospitals, Pharmacies of Dental Infection Control Products: The management of logistics and delivery so that dental healthcare facilities can be supplied in time.

Key players: Henry Schein, Patterson Companies, Owens & Minor

Dental Infection Control Products Market Companies

- Kerr Corporation: Offers surface disinfectants, disposable barriers, and instrument care solutions that facilitate and help in adhering to hygiene in the operating room and streamline workflow.

- Young Innovations, Inc.: Sells PPE, surface disinfectants, sterilization packets, instrument cleaners, and ergonomic equipment to work towards a detailed dental infection control strategy.

- 3M: Provides dental prevention services such as sealants, eye protection gear, fluoride varnishes, and sterilization tracking equipment.

Other Major Key Players

- Crosstex International, Inc

- COLTENE Group

- Dentisan

- GC America Inc.

- Henry Schein, Inc.

- A-dec Inc.

- Dentsply Sirona

Recent Developments

- In June 2025, ParagonCare launched ParagonCare | Dental, a dental supply division aimed at Australian practices, offering reliable service and trusted products. The launch was showcased at the 2025 Australian Dental Congress, addressing the need for a responsive supply partner amid pressures of patient care and rising operational costs.(Source: https://www.bitemagazine.com.au )

- In November 2023, by introducing a new, cutting-edge Assistina One maintenance device and a new Lexa Plus Class B sterilizer, W&H broadened its hygiene solutions, providing reprocessing and infection control for dental practices with peace of mind.

Segments Covered in the Report

By Type

- Equipment

- Consumables

By End-use

- Hospitals and Clinics

- Dental Academic & Research Institutes

- Dental Laboratories

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting