What is the Influenza Vaccine Market Size?

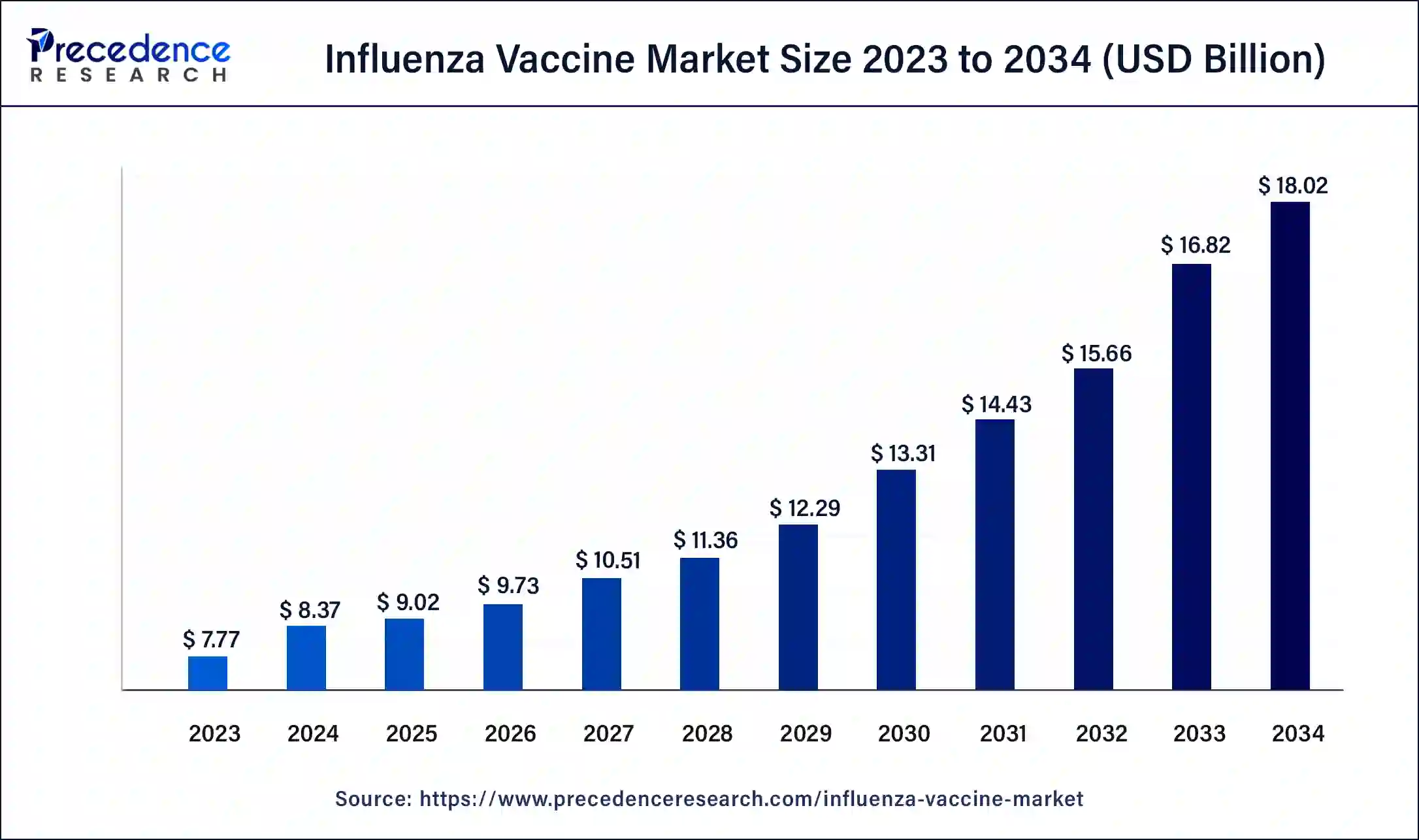

The global influenza vaccine market size is valued at USD 9.02 billion in 2025 and is predicted to increase from USD 9.73 billion in 2026 to approximately USD 19.19 billion by 2035, expanding at a CAGR of 7.84% from 2026 to 2035.

Influenza Vaccine Market Key Takeaways

- The global influenza vaccine market was valued at USD 9.02 billion in 2025.

- It is projected to reach USD 19.19 billion by 2035.

- The influenza vaccine market is expected to grow at a CAGR of 7.84% from 2026 to 2035.

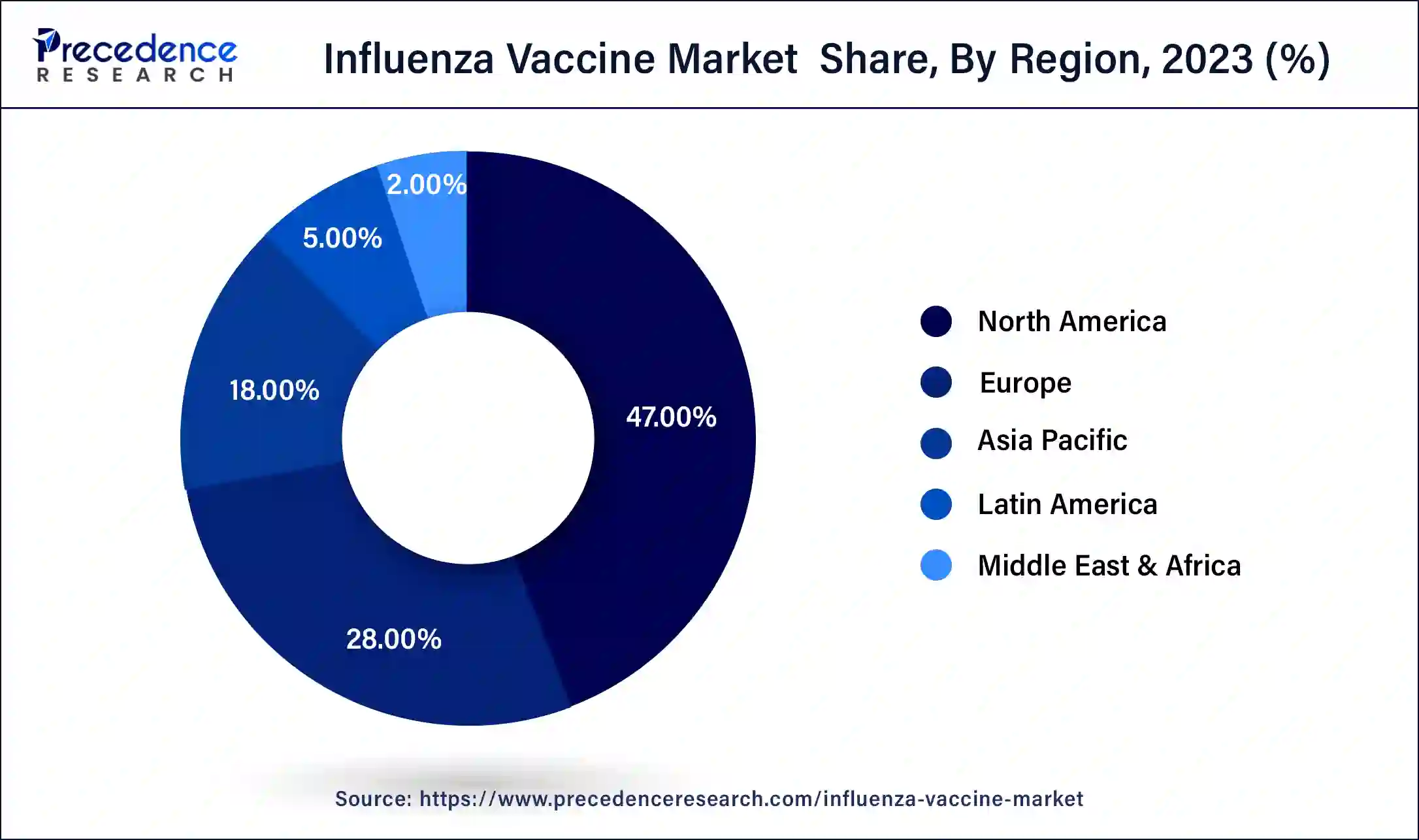

- North America contributed more than 47% of the market share in 2025.

- Asia-Pacific is estimated to witness the fastest CAGR between 2026 and 2035.

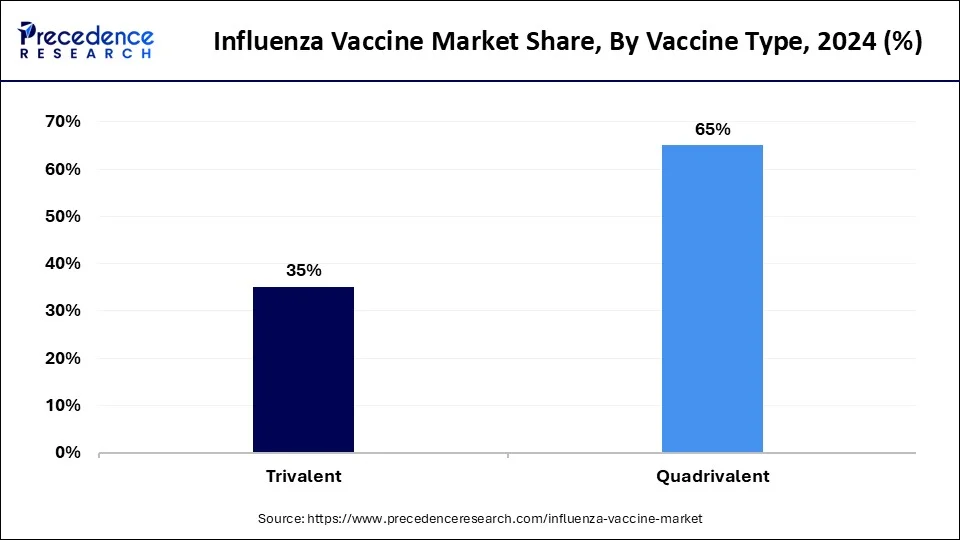

- By vaccine type, the quadrivalent segment has held the largest market share of 65% in 2025.

- By vaccine type, the trivalent segment is anticipated to grow at a remarkable CAGR of 10.1% between 2026 and 2035.

- By technology, the egg-based segment generated over 69% of the market share in 2025.

- By technology, the cell culture segment is expected to expand at the fastest CAGR over the projected period.

- By age group, the pediatric segment held the largest market share of 59% in 2025.

- By age group, the adult segment is expected to expand at the fastest CAGR over the projected period.

- By route of administration, the nasal spray segment generated over 53% of the market share in 2025.

- By route of administration, the injection segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

The influenza vaccine market revolves around the production and distribution of vaccines designed to protect against influenza viruses. Driven by global health initiatives, seasonal outbreaks, and the need for preventive healthcare, the market experiences consistent demand. Key players focus on vaccine development, production innovations, and distribution networks to meet increasing global vaccination needs. The market's growth is influenced by factors such as government immunization programs, rising awareness, and efforts to mitigate the impact of influenza-related illnesses. Ongoing research and development contribute to the market's dynamism, ensuring the availability of effective vaccines against evolving influenza strains.

In addition to seasonal demand, the influenza vaccine market is shaped by advancements in vaccine technologies and international collaboration for pandemic preparedness. Strategic partnerships, public health campaigns, and improved distribution infrastructure further enhance the accessibility and effectiveness of influenza vaccines, contributing to the market's resilience and adaptability.

Reasons for Rapid Global Growth in the Influenza Vaccine Market:

The rapid growth of the influenza vaccine market across the world is attributed to increasing seasonal flu outbreaks, expanding immunisation programs, and increasing knowledge of immunisation among at-risk populations. Demand is also bolstered by government-led procurement efforts, extensive adoption of hospital-based influenza strategies, and ongoing product innovation, including the launch of quadrivalent formulations.

Manufacturers' ongoing commitment to new-generation aborted (or inactivated) vaccines, with shorter lead times and improved efficacy, is also expanding the market as a whole. Moreover, ongoing technological advancements in new cell-based and recombinant platform vaccines continue to alter the competitive landscape.

Influenza Vaccine Market Growth Factors

- The market is fundamentally anchored in addressing global health challenges posed by influenza, emphasizing preventive measures through vaccination.

- Annual outbreaks drive consistent demand for influenza vaccines, aligning with seasonal patterns and necessitating continuous vaccine development.

- Industry growth is fueled by heightened awareness and investments in pandemic preparedness, with a focus on developing vaccines that can effectively combat emerging influenza strains.

- Ongoing research and development lead to technological innovations, such as improved vaccine formulations and production methods, enhancing the efficacy and accessibility of influenza vaccines.

- Collaboration with governments and their immunization programs plays a pivotal role, creating opportunities for vaccine manufacturers to contribute to public health initiatives.

- Collaborative efforts on a global scale enable information exchange, resource-sharing, and coordinated responses, fostering a unified approach to influenza prevention and control.

- Awareness campaigns contribute to increased vaccine acceptance, encouraging public participation and adherence to vaccination schedules.

- Investments in distribution networks and infrastructure improve the accessibility of influenza vaccines, particularly in remote or underserved regions.

- Continuous research into emerging influenza strains ensures the development of vaccines that remain effective against evolving viral variants, providing long-term sustainability for the market.

- Collaborations between pharmaceutical companies, research institutions, and government bodies foster innovation and accelerate the development and distribution of influenza vaccines.

- Customized vaccination strategies for different demographics, such as pediatric or elderly populations, present avenues for market expansion and specialization.

- The economic burden of influenza-related illnesses creates incentives for businesses and governments to invest in preventive measures, driving the market forward.

- Integration of technology, such as digital platforms for vaccine distribution and monitoring, contributes to efficiency and effectiveness in influenza vaccination programs.

- Educational initiatives about the importance of influenza vaccination and the benefits of herd immunity play a crucial role in market growth.

- Ongoing research toward developing universal influenza vaccines with broader protection against multiple strains presents a transformative opportunity for the industry.

Market Outlook

- Industry growth overview: The sector is expected to grow significantly because of year-round demand for flu vaccines, new recombinant technology, and improved global health readiness. More investment is expected in rapid production systems, which will further expand market adoption.

- Sustainability Trends: Manufacturers are moving to more environmentally-friendly production methods, reducing waste, and develop energy-efficient manufacturing facilities. Sustainable packaging and reduced footprint cold-chain logistics are becoming important players across global supply chains.

- Global Expansion: The growth of vaccine distribution in developing markets financed through government funding and global health partnerships, is enhancing long-term growth. Companies are also focused on strengthening regional manufacturing to support continuity of supply.

- Start-up Ecosystem: Biotech start-ups are entering the market with mRNA-flu vaccines, AI strain prediction, and rapid response platforms. Their entry into the market is providing a new level of competition and increased overall agility to the sector.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 19.19 Billion |

| Market Size in 2025 | USD 9.02 Billion |

| Market Size in 2026 | USD 9.73 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.84% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vaccine Type, Technology, Age Group, Route of Administration, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Pandemic preparedness and advancements in vaccine technologies

Pandemic preparedness and advancements in vaccine technologies synergistically surge the market demand for influenza vaccines. The ever-present threat of influenza pandemics, underscored by historical events like H1N1 and H5N1, compels governments, organizations, and pharmaceutical companies to invest significantly in research and development. The collaborative emphasis on preparedness not only guarantees a swift reaction to emerging viral strains but also fortifies the market's adaptability to evolving threats. This collective effort establishes a resilient market, fostering a continuous demand for influenza vaccines.

Moreover, advancements in vaccine technologies play a pivotal role in meeting this demand. Continuous research leads to innovations in vaccine formulations, production processes, and delivery systems, enhancing the efficacy and accessibility of influenza vaccines. Cutting-edge technologies enable the development of vaccines with broader coverage and improved effectiveness against a spectrum of influenza strains, contributing to the market's growth and its critical role in global health initiatives.

Restraint

Vaccine manufacturing complexity and seasonal nature of demand

The influenza vaccine market faces challenges stemming from the intricate manufacturing processes and the seasonal nature of demand. Vaccine manufacturing involves a complex and time-consuming production cycle, requiring precise formulation and testing to ensure efficacy and safety. The intricate nature of this process, coupled with stringent regulatory requirements, contributes to manufacturing complexities, limiting the rapid scaling of production in response to sudden spikes in demand during pandemics.

Moreover, the seasonal nature of influenza, with distinct strains prevalent in different seasons, poses a restraint on year-round demand. Manufacturers must anticipate and produce vaccines tailored to specific strains, leading to periodic fluctuations in market demand. These constraints hinder the market's ability to swiftly adapt to evolving influenza threats, emphasizing the importance of continuous research into streamlining manufacturing processes and developing more adaptable, year-round vaccination strategies.

Opportunity

Global immunization initiatives and universal influenza vaccines

Global immunization initiatives play a pivotal role in surging demand for the influenza vaccine market by fostering widespread awareness and accessibility. Collaborative efforts between governments, international organizations, and pharmaceutical companies ensure that immunization programs are prioritized and implemented globally. As these initiatives aim to reach diverse populations, particularly in developing regions, the demand for influenza vaccines increases, propelling market growth.

The pursuit of universal influenza vaccines further amplifies market demand by addressing the challenges of evolving viral strains. With the potential to provide broad-spectrum protection against multiple influenza variants, universal vaccines appeal to a global audience concerned about the constant threat of seasonal and pandemic outbreaks. As research and development in this direction progress, the promise of more comprehensive and long-lasting immunity fuels heightened interest and investment in influenza vaccination, driving the market's evolution and expansion.

Segment Insights

Vaccine Type Insights

The quadrivalent segment has held a 65% revenue share in 2025. Quadrivalent vaccines protect against four influenza virus strains, including two influenza A strains and two influenza B strains. They have become a standard in influenza vaccination, offering broader coverage against circulating viral variants. Market trends indicate a growing preference for quadrivalent vaccines due to their enhanced protection against both influenza B lineages, aligning with the evolving nature of the virus and providing a more comprehensive defense against seasonal outbreaks.

The trivalent segment is anticipated to expand at a significant CAGR of 10.1% during the projected period. Trivalent vaccines safeguard against three influenza virus strains two influenza A strains and one influenza B strain. Although traditional, trends suggest a gradual shift toward quadrivalent formulations for more extensive coverage. Trivalent vaccines remain relevant, especially in regions where they effectively match prevalent strains. However, the influenza vaccine market increasingly leans towards quadrivalent options, reflecting the industry's commitment to adapting to the dynamic nature of influenza viruses.

Technology Insights

The egg-based segment held the largest market share of 69% in 2025. Egg-based influenza vaccine production involves cultivating virus strains in fertilized chicken eggs. Although a traditional method, it faces challenges such as longer production timelines and limitations in scalability. However, advancements aim to improve efficiency and address concerns related to egg allergies. Trends include ongoing research to enhance yield, reduce production time, and explore alternative platforms, ensuring egg-based technology remains a viable contributor to influenza vaccine manufacturing.

The cell culture segment is projected to grow at the fastest rate over the projected period. Cell culture technology involves using mammalian cells to propagate influenza virus strains, offering a more flexible and scalable alternative to egg-based methods. Trends indicate a shift towards cell culture due to its potential for faster production, reduced risk of egg-related allergens, and adaptability for pandemic response. Continuous efforts in optimizing cell culture systems and increasing capacities underscore the technology's increasing prominence in the influenza vaccine market.

Age Group Insights

The pediatric segment held the highest market share of 59%in 2025 based on the end user. Pediatric influenza vaccine market caters to children, offering preventive measures against influenza viruses. Trends include the development of child-friendly vaccine formulations, such as nasal sprays, to enhance administration. Educational campaigns emphasizing the importance of pediatric influenza vaccination contribute to increased awareness among parents and healthcare providers, driving market growth. Moreover, expanding government immunization programs for children further stimulates demand, ensuring widespread coverage and protection.

The adult segment is anticipated to expand at the fastest rate over the projected period. The adult influenza vaccine market targets the broader population, focusing on individuals beyond childhood. Trends encompass the development of high-dose vaccines for the elderly to address age-related immune decline. Growing awareness campaigns, workplace vaccination programs, and the integration of vaccination into routine healthcare check-ups contribute to increased adult vaccination rates. As governments worldwide emphasize adult immunization, the market experiences sustained demand, with a focus on addressing diverse age groups and healthcare needs.

Age Group Insights

The nasal spray segment held the highest market share of 53%in 2025 based on the end user. Nasal spray influenza vaccines offer an alternative to injections, providing a non-invasive and needle-free administration option. This route introduces the vaccine through the nasal mucosa, stimulating a mucosal immune response. Nasal spray vaccines, while not as prevalent as injections, cater to individuals averse to needles, particularly children. Trends in this segment include ongoing research into improved formulations, broader age group eligibility, and increased adoption as technology continues to refine the nasal spray delivery method.

The injection segment is anticipated to expand at the fastest rate over the projected period. In the influenza vaccine market, injections are a traditional and widely used route of administration. Injectable influenza vaccines, typically administered intramuscularly, have been the primary choice for decades, ensuring reliable and efficient delivery of the vaccine. Recent trends indicate ongoing advancements in injection technologies, including the development of microneedle patches, enhancing ease of administration and potentially increasing patient compliance.

Regional Insights

What is the U.S. Influenza Vaccine Market Size?

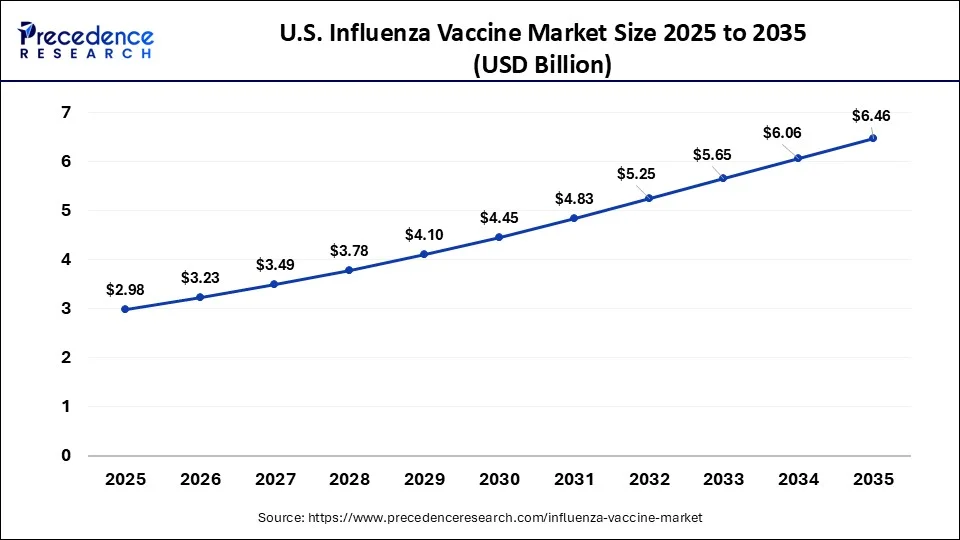

The U.S. influenza vaccine market size is valued at USD 2.98 billion in 2025 and is expected to reach USD 6.46 billion by 2035, growing at a CAGR of 8.04% from 2026 to 2035.

What Factors Drive the Dominating Position of North America in the Influenza Vaccine Market?

North America has held the largest revenue share at 47% in 2025. In North America, a well-established healthcare infrastructure drives advanced trends in the influenza vaccine market. Strong government support and immunization programs, coupled with heightened public awareness, contribute to consistent demand. Technological innovations, such as digital vaccination monitoring, are on the rise. Additionally, strategic partnerships between pharmaceutical companies and research institutions foster the development of next-generation influenzavaccines, aligning with the region's commitment to public health excellence.

North America: U.S. Influenza Vaccine Market Trends

In the U.S., demand is rising due to increasing public awareness of flu risks and more aggressive government vaccination campaigns. There's a clear shift toward quadrivalent vaccines that protect against four flu strains, as manufacturers scale up production to meet broader coverage needs. Breakthroughs in mRNA technology are reshaping the market, with companies pushing forward next-generation, more effective flu shots.

How is the Rapid Growth of Asia Pacific in the Influenza Vaccine Market?

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific influenza vaccine market experiences dynamic trends shaped by increasing healthcare awareness and expanding immunization initiatives. Growing populations in emerging economies drive demand, prompting investments in vaccine production and distribution infrastructure. The region sees a surge in collaborations for technology transfer and localized vaccine manufacturing. Tailored vaccination strategies, public health campaigns, and governmental efforts contribute to a proactive approach to addressing influenza, reflecting the region's evolving healthcare landscape.

Asia Pacific: China Influenza Vaccine Market Trends

In China, the market is experiencing rapid growth as government policies increasingly promote vaccination, and public awareness rises. Despite relatively low coverage compared to developed countries, lot releases of flu vaccines surged from about 30 million in 2019 to over 75 million in 2024, indicating strong production capacity and expanding access. However, intense competition among domestic manufacturers has led to a price war, especially on quadrivalent inactivated vaccines, driving average prices down.

In the European influenza vaccine market, advanced healthcare systems and a commitment to public health underscore trends. The region emphasizes universal access to influenza vaccines through government-led programs and collaborations. Ongoing research into vaccine effectiveness and the development of innovative formulations align with Europe's dedication to healthcare excellence. Stringent regulatory standards guide product development, ensuring safety and efficacy in influenza prevention strategies.

Why Is Europe Becoming a Major Hub for Innovation in Vaccines for Influenza?

Europe is among the most important markets for vaccines for influenza for a number of reasons, including the capacity of its health systems, regulatory frameworks and structures for vaccine procurement for vaccine supply and usage. The high coverage of vaccination among the elderly population, especially, as well as the increasing adoption of advanced recombinant and cell line-based vaccines, are examples of how demand for influenza vaccines remains consistently fostered in Europe.

Many leading manufacturers of seasonal influenza vaccines, including AstraZeneca, Seqirus and Sanofi Pasteur, serve a critical logistical and distribution role when it comes to facilitating scaled vaccinations. Furthermore, continuing investment in R&D, funding of government influenza surveillance programs, and increasing readiness for pandemic intervention will also ensure continued momentum in the influenza vaccine market across Europe.

Germany Influenza Vaccine Market Trends

The German market for healthcare experiences heavy government investments in R&D and public health infrastructure, developments in mRNA-based and recombinant vaccines, and investments in next-generation vaccine research. The market is expanding at a moderate pace, with increasing adoption of both trivalent and quadrivalent formulations to address diverse circulating strains and improve protective efficacy.

What Is Driving the Demand for Influenza Vaccine Among Latin American Countries?

Influenza vaccine demand in Latin America is being driven by the expansion of public immunization campaigns, as well as increased healthcare access in the region's largest economies. Countries like Brazil, Mexico, and Argentina are beginning to prioritize seasonal vaccination campaigns to decrease the burden of hospitalization. The market is also being bolstered by the strong, purposeful relationship between local governments and global vaccine suppliers such as Sanofi and GSK.

Finally, the expansion of the market among rural and urban populations alike is a result of improved supply chain infrastructure, as well as the increasing numbers of awareness campaigns delivered by public health agencies.

What Opportunities Exist in the Influenza Vaccine Market in the Middle East & Africa?

The Middle East and Africa are expected to grow at a lucrative rate in the market, owing to the integration of digital platforms and mobile applications to send reminders, track immunization schedules, and manage vaccine logistics. Rising healthcare investments and government-led initiatives are improving vaccine accessibility and cold chain infrastructure, especially in key markets like Saudi Arabia, the UAE, and South Africa. In September 2024, the Ministry of Health and Prevention (MoHAP) launched the annual national seasonal influenza awareness campaign to enhance prevention methods and boost community awareness.

Main Value Chain Components:

- Research & Development Advanced and Strain Selection: Forecasting of strains through global surveillance, for example, assisted companies like Sanofi and GSK to also develop seasonal vaccines with improved efficacy and safety.

Key Players: Sanofi, GlaxoSmithKline, AstraZeneca, CSL Seqirus, Pfizer, Zydus Lifesciences, Novavax, Osivax. - Production & Quality Control Efficiency: Reliable, high production accuracy, and robust quality testing ensure each vaccine performs consistently, regardless of geography.

Key Players: Moderna, GSK, Sanofi, CSL Seqirus, AstraZeneca, Lonza Group Ltd, Thermo Fisher Scientific Inc. - Distribution & Cold-Chain Networks:Strong relationships with hospitals, clinics, and pharmacies further solidify last miles distribution and broadens immunisation footprint.

Key Players: Abbott Laboratories, GSK, Sanofi, CSL Seqirus, AstraZeneca, UPS Healthcare, FedEx Cold Chain Solutions.

Influenza Vaccine Market Companies

- Sanofi Pasteur

- GlaxoSmithKline plc (GSK)

- Seqirus (a CSL Limited Company)

- Pfizer Inc.

- AstraZeneca

- BiondVax Pharmaceuticals Ltd.

- Novavax, Inc.

- Bharat Biotech

- Johnson & Johnson

- MedImmune, LLC (AstraZeneca)

- FluGen

- Mitsubishi Tanabe Pharma Corporation

- Emergent BioSolutions

- Sinovac Biotech Ltd.

- Bio Farma

Recent Developments

- In October 2025, Sanofi reported a superior protection from its high-dose influenza vaccine for older adults against hospitalization compared to standard-dose. These dose are results in reduced hospital admissions of patients dealing with laboratory-confirmed influenza.

(Source: https://www.sanofi.com) - In July 2025, GlaxoSmithKline plc (GSK) began shipping of influenza vaccine doses, namely FLULAVAL (Influenza Vaccine) and FLUARIX (Influenza Vaccine), for the 2025-26 flu season. Company is continues its support for seasonal flu immunization in the U.S.

(Source: https://us.gsk.com) - In 2022, Pfizer Inc. initiated a crucial Phase 3 clinical trial, administering the first doses to participants. The trial aims to assess the efficacy, safety, tolerability, and immunogenicity of Pfizer's quadrivalent modified RNA influenza vaccine candidate, marking a significant step in advancing innovative approaches to influenza prevention.

- In 2021, Sanofi invested over EUR 600 million in constructing a new vaccine facility in Toronto, aimed at boosting the supply of influenza vaccines in Canada, the United States, and Europe. The facility is set to focus on the development of quadrivalent influenza vaccines, reinforcing Sanofi's commitment to providing effective vaccinations to its customers.

- In 2021, The CDC collaborated in a comprehensive inter-agency partnership led by the Biomedical Advanced Research and Development Authority (BARDA) to advance the development of improved influenza vaccines. This collective effort underscores a commitment to enhancing vaccine technologies and addressing evolving challenges in influenza prevention.

Segments Covered in the Report

By Vaccine Type

- Quadrivalent

- Trivalent

By Technology

- Egg-based

- Cell culture

By Age Group

- Pediatric

- Adult

By Route of Administration

- Injection

- Nasal Spray

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content