Biofuel Market Overview

The use of biofuels, which are fuels made from renewable organic material, in place of fossil fuels has the potential to lessen some of the negative effects of fossil fuel production and use, including exhaustible resource depletion, conventional and glasshouse gas (GHG) pollutant emissions, and reliance on unreliable foreign suppliers. Additionally, the need for biofuels may boost farm revenue. On the other side, research indicates that the production of biofuels may have a number of negative repercussions since many of the feedstocks for biofuels need land, water, and other resources. Changes in land use patterns that might lead to an increase in glasshouse gas emissions, stress on water supplies, pollution of the air and water, and higher food prices are some potential negative effects. Biofuels have the potential to produce even more glasshouse gases than some fossil fuels on an energy-equivalent basis, depending on the feedstock, production method, and time horizon of the analysis.

The global biofuels market size was valued at USD 123.97 billion in 2023 and is expected to grow to USD 257.61 billion by 2034, with a compound annual growth rate (CAGR) of 6.9% from 2024 to 2034.

According to IEA, In the most likely scenario, the demand for biofuels would increase by 41 billion litres, or 28%, between 2021 and 2026. One-fifth of this demand surge is due to a return to pre-Covid-19 consumption levels. Government policies are mostly responsible for the remaining increase, although other elements like as the general demand for transportation fuels, prices, and the design of programmes affect where development happens, and which fuels expand the fastest. During the predicted period, the sum of these forces causes Asian biofuel output to surpass that of Europe. The demand for renewable diesel, also known as hydrogenated vegetable oil (HVO) in Europe, has nearly tripled because of policies in both the United States and Europe. All of the variables affecting the demand for biofuel are unclear. Several governments have loosened or postponed their mandates for the blending of biofuels in response to the present high price of feedstock, which has the impact of decreasing demand. However, in the near term, significant policy discussions in China, the United States, Europe, India, and India offer the possibility of a more than doubling of biofuel demand growth in the accelerated case.

Between 2020 and 2026, the demand for renewable diesel nearly triples, mostly as a result of regulations in the US and EU. However, the rise of ethanol consumption is greater than that of renewable diesel in terms of absolute volume. The United States and Europe account for the lion's share of the rise in renewable diesel. Renewable diesel may be generated with a low GHG intensity utilizing wastes and residues in both areas, making it competitive in a regulatory climate that values GHG reductions and sets restrictions on some biofuel feedstocks. It also has the advantage of being mixed at higher concentrations than biodiesel. Before 2026, nations would need to put current and planned policies into effect and then reinforce them in order to be in line with the Net Zero Scenario. These regulations must also make sure that biofuels are generated sustainably and without endangering freshwater systems, biodiversity, food costs, or availability. In order to maximize the amount of emissions reduction per liter of biofuels used in comparison to fossil fuels, policy must also encourage GHG reductions rather than just biofuel demand.

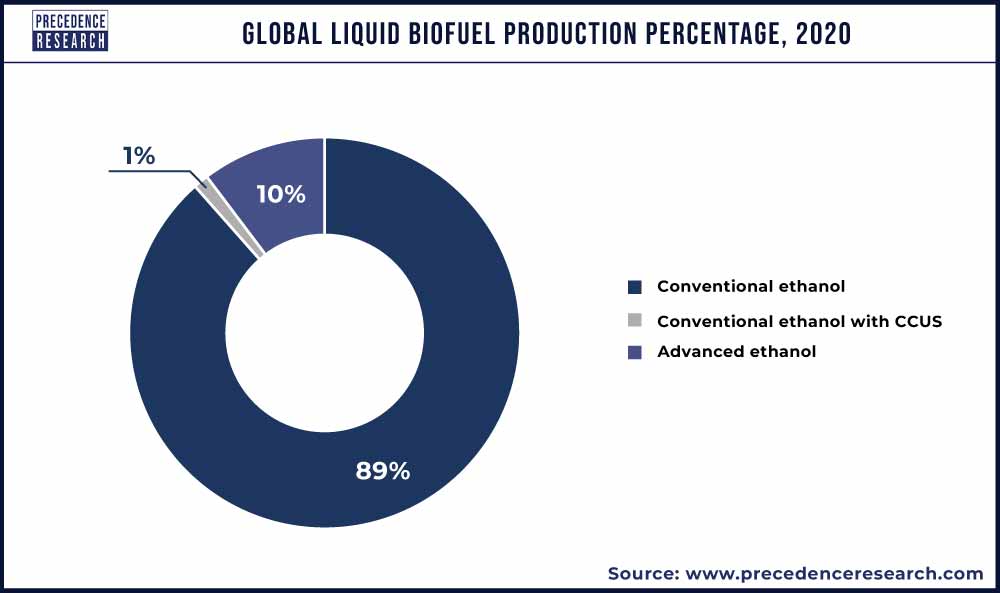

Ethanol has major share in Biofuels

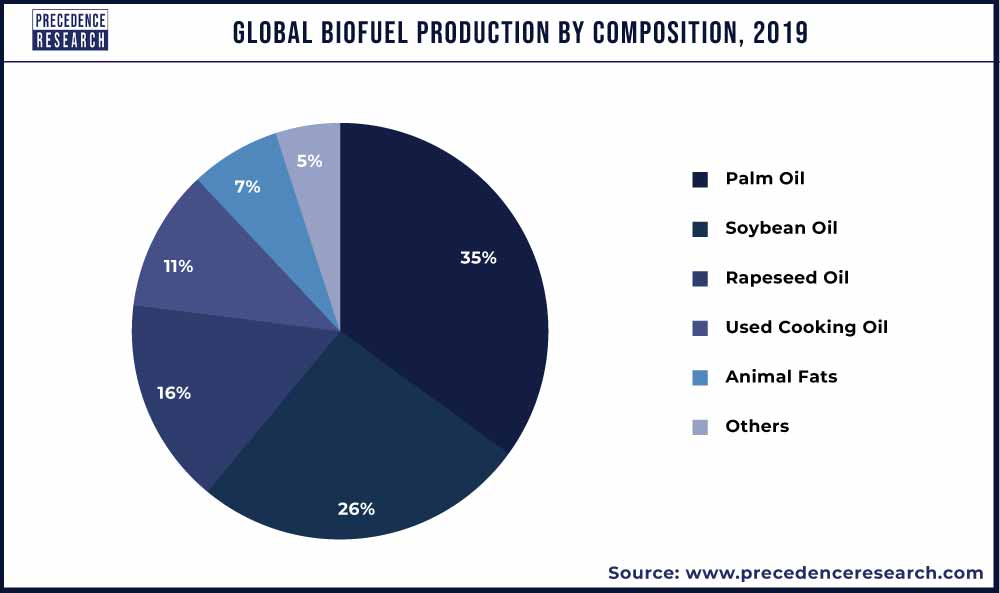

Biodiesel and renewable diesel are two diesel fuel substitutes. Diesel made from petroleum may be combined with biodiesel, which is made from lipids including vegetable oil, animal fat, and used cooking grease. In the United States, certain buses, trucks, and military vehicles utilise fuel mixes containing up to 20% biodiesel, however pure biodiesel can degrade in cold temperatures and may have issues in older cars. A "drop-in" fuel, renewable diesel is chemically distinct from traditional diesel and may be made from fats or plant-based waste. It can replace conventional diesel without blending. Another fuel that has the potential to be utilised not just for transportation but also to produce heat and power is renewable natural gas, or biomethane.

In the United States, approximately 17.5 billion gallons of biofuels were produced in 2021 and around 16.8 billion gallons was used. In 2021, the United States exported 0.8 billion gallons of biofuels on a nett basis, with gasoline ethanol making up the lion's share of both gross and nett exports. The majority of biofuel is used in mixtures with refined petroleum products including gasoline, diesel fuel, heating oil, and jet fuel that is like kerosene. However, certain biofuels known as drop-in biofuels do not need to be blended with their petroleum-based counterparts. The highest proportions of U.S. biofuel production (85%) and consumption (82%) in 2021 were made up of ethanol, an alcohol fuel that is combined with petroleum gasoline for use in automobiles.

As per U.S. Energy Information Administration report the capacity and yearly output of gasoline ethanol in the United States have grown over time. Since 2008, the gains are mostly attributable to the Renewable Fuel Standard program's fuel blending regulations. From 13.6 billion gallons per year in 2011 to 17.5 billion gallons per year in 2021, the total production capacity rose. From 1981 through 2021, the global yearly output of gasoline ethanol rose on average every year. According to the nett production of fuel ethanol at oxygenate plants and renewable fuels, the United States produced around 15 billion gallons of fuel ethanol in 2021. (0.4 billion barrels). Because of the general decline in gasoline consumption in 2020, ethanol mixing into motor gasoline decreased.

Asia will lead in the production of Biofuels

Although the rise of biofuels is being slowed by rising prices, our prediction indicates that consumption will rebound in 2021 from the Covid-19 crisis lows reached in 2020. By temporarily lowering or postponing blending rules, Brazil, Argentina, Colombia, and Indonesia can control rising feedstock and biofuel costs. In comparison to a scenario where requirements stayed the same or were enhanced as planned, we estimate that these steps will lower demand by 3%, or 5 billion litres, in 2021. Depending on the market and fuel, biofuel costs have risen from the average 2019 prices by August 2021 in the United States, Europe, Brazil, and Indonesia by a range of 70% to 150%. In contrast, the cost of crude oil rose by 40% within the same time frame. Even with reduced growth, the total market for biofuels rebounds to 2019 levels this year, although the recovery is uneven. In 2021, ethanol consumption is still 4% below 2019 levels, and it won't completely increase until 2023. Reduced ethanol quantities are expected in 2021 because of both high ethanol costs in Brazil and lower gasoline demand in the United States compared to 2019 levels. After Covid-19's interruption, gasoline consumption in the US and Europe has rebounded by 2023, although it is still significantly below levels in 2019.

Lower demand is a result of rising energy efficiency, booming sales of electric vehicles, and changing consumer behaviour. Under existing rules, lower gasoline demand causes ethanol quantities to decrease. In 2023, however, increases in Asia and Brazil's ethanol consumption will finally outweigh reductions in the United States and Europe.

Due to robust domestic legislation, rising liquid fuel demand, and production that is focused on exports, Asia will produce more biofuel than all of Europe over the predicted period. Over the projection period, roughly one-third of new output will come from Asian nations. The majority of this rise is attributable to ethanol regulations in India and Indonesia as well as blending goals for biodiesel in Indonesia and Malaysia. By 2026, North American biofuel demand will rise the fastest, although 40% of this increase will be due to demand recovering from Covid-19 decreases. The two countries with the highest levels of demand and output for biofuels are still the US and Brazil.

However, due to demand in Latin America and Asia and recovery from Covid-19 decreases, ethanol and biodiesel growth remain strong. In Asia, Indonesia's anticipated 40% ethanol blending mandate for 2022 encourages the increase of biodiesel production, while India's plans to mix 20% ethanol by 2025 boost the rise of the world's ethanol consumption. Consumption for biofuels is increasing in both nations due to requirements, rising transportation fuel demand throughout the predicted period, and other factors. Across a similar vein, the usage of biofuels is increasing in Latin America as a result of Brazil's biofuel policy and rising demand for gasoline and diesel. China's 14th Five-Year Plan blueprint gave little attention to biofuels and bioenergy, but the nation intends to reach its emissions peak by 2030. China intends to strongly push alternatives like advanced liquid biofuels and SAF as part of that strategy (The State Council of the Peoples Republic of China, 2021). According to IEA study, biofuels are crucial to China's efforts to reduce emissions. India's 20% mandate for blending will be difficult to carry out in just five years, but even achieving 11% blending would make India the third-largest ethanol market in the world, behind the United States and Brazil.

Rise in investments towards Biofuels

Although, the impact of COVID-19 was experienced in nearly every industry, the hydrogen sector was proven to be resilient during the global pandemic. Various players in the Biofuels, distribution, and application raised nearly USD 11 billion in equity from January 2019 to mid-2021. This was substantially more than the funding raised in the previous years. In 2020 and 2021, new funding towards hydrogen was raised by companies primarily listed on the stock-exchange. The new shares issued for investors was primarily to collect capital for expansion of manufacturing facilities and meet the expected demand of fuel cells and electrolysers.

The United States-based firm Plug Power engaged in the production of fuel cells, electrolysers and refuelling equipment, sold USD 4.8 billion new shares since 2019. Whereas companies such as ITM Power, Nel, Green Hydrogen Systems, McPhy Energy, and Sunfire raised nearly USD 1.5 billion collectively during the same period. As more electrolyser companies are getting established in the industry, new start-ups are shifting towards non-electrolysis Biofuels routes such as pyrolysis for extraction of hydrogen from methane, and others. For instance, the Monolith Materials based in the United States announced its latest investment round of more than USD 300 million. Monolith is a global leader in carbon black, clean hydrogen, and ammonia production. The investment was mostly led by TPG Rise Climate, with Decarbonization Partners, which is a partnership between Temasek and BlackRock.

Considering the geography, majority of the start-ups are being developed in the European region, which have raised more early-stage funds in 2020 and 2021 than the start-ups based in the United States. Along with Europe and the United States, Canada and China are also expected to rise in terms of start-ups and early-stage fundings. Moreover, the construction of low-carbon Biofuels capacity is expected to account for 25% of global cumulative investments in 2050 as per the Announced Pledges Scenario and 27% of the Net Zero Emissions Strategy. On the basis of the current calculation technique, the European Commission anticipates that its proposals will increase fuels' renewable energy content by two times from the current objective of 14% by 2030. (European Commission, 2021a). The need for biofuels won't necessarily increase as a result, though. According to the ideas, GHG intensity reductions rather than biofuel quantities are rewarded. Biofuels will compete with all other suitable reduction methods, such as electric cars, if member states focus on GHG intensity reductions as Germany does today. Additionally, liquid biofuels, whose demand is declining, are mixed with gasoline and diesel.

Future prospects for the Biofuels industry

Global fuel consumption fell in 2020 as a result of the COVID-19 pandemic's economic impact and lockdown measures. Global oil use for transportation was reduced by COVID-19, but industrial usage of fossil fuels was not as significantly impacted. The biggest drops in ethanol use were seen in the United States and Brazil, which also reduced worldwide demand. Due to greater blend rates, Indonesia and Thailand used more biodiesel while using less diesel. The rising maize and vegetable oil costs, when paired with the falling price of fossil fuels, had an impact on the production margins for biofuels; nevertheless, government support helped to ease some of the market pressure. The usage of ethanol as a sanitizer in reaction to the COVID-19 epidemic has led to an increase in its use in industry, which has supported the manufacture of biofuels.

According to OECD, Global fuel consumption fell in 2020 because of the COVID-19 pandemic's economic impact and lockdown measures. Global oil use for transportation was reduced by COVID-19, but industrial usage of fossil fuels was not as significantly impacted. The biggest drops in ethanol use were seen in the United States and Brazil, which also reduced worldwide demand. Due to greater blend rates, Indonesia and Thailand used more biodiesel while using less diesel. The rising maize and vegetable oil costs, when paired with the falling price of fossil fuels, had an impact on the production margins for biofuels; nevertheless, government support helped to ease some of the market pressure. The usage of ethanol as a sanitizer in reaction to the COVID-19 epidemic has led to an increase in its use in industry, which has supported the manufacture of biofuels. Additionally, biodiesel was more heavily utilised in the generation of power. Other than the transportation industry, minimal impact was felt on the usage of biofuels. Despite government backing and falling demand, worldwide ethanol and biodiesel output fell overall for the first time in the past ten years in 2020 compared to 2019 by 13.2 billion L and 1.9 billion L, respectively.

The policy environment and oil prices are the main risks and uncertainties for the future growth of the biofuels business. Uncertainty in policy involves adjustments to requirement thresholds, enforcement procedures, investments in unconventional biofuel feedstock, tax breaks and subsidies for fossil fuels and biofuels, and strategies to advance the technology of electric vehicles (EVs). Because it is dependent on changes in the agricultural and oil markets, the policy environment will continue to be uncertain. Policies are impacted by changes in the oil market since the cost of fossil fuels determines how competitive the biofuel industry is and how much funding is given to it. A second source of uncertainty is the availability of feedstuffs; historically, nations have tried to use the commodities for which they have a surplus to preserve the supply of food. Countries are wary about accelerating the development of biofuels since they compete with food usage and may have unfavourable consequences on land use. Despite this, blending mandates are anticipated to improve for several emerging economies throughout the projection period.

Current market predictions for biofuels may significantly deviate from reality due to technological developments and anticipated modifications to the regulatory environment governing the transportation industry. Countries are anticipated to establish measures to hasten the adoption of new technology in order to reduce glasshouse gas emissions, including mandates, subsidies, and tax breaks for blending. All of these actions assisted in transferring energy market uncertainties to agriculture markets. Therefore, how the private sector responds to these restrictions will be a key determinant of future biofuel demand. According to the acceptance of this technology and the regulations promoting its adoption, the automotive and other sectors are now investing in EVs, which may contribute to a potential decline in the usage of biofuels over the next decade and beyond.

View Full Insight@ https://www.precedenceresearch.com/biofuels-market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

About the Authors

Aditi Shivarkar

Aditi, Vice President at Precedence Research, brings over 15 years of expertise at the intersection of technology, innovation, and strategic market intelligence. A visionary leader, she excels in transforming complex data into actionable insights that empower businesses to thrive in dynamic markets. Her leadership combines analytical precision with forward-thinking strategy, driving measurable growth, competitive advantage, and lasting impact across industries.

Aman Singh

Aman Singh with over 13 years of progressive expertise at the intersection of technology, innovation, and strategic market intelligence, Aman Singh stands as a leading authority in global research and consulting. Renowned for his ability to decode complex technological transformations, he provides forward-looking insights that drive strategic decision-making. At Precedence Research, Aman leads a global team of analysts, fostering a culture of research excellence, analytical precision, and visionary thinking.

Piyush Pawar

Piyush Pawar brings over a decade of experience as Senior Manager, Sales & Business Growth, acting as the essential liaison between clients and our research authors. He translates sophisticated insights into practical strategies, ensuring client objectives are met with precision. Piyush’s expertise in market dynamics, relationship management, and strategic execution enables organizations to leverage intelligence effectively, achieving operational excellence, innovation, and sustained growth.

Request Consultation

Request Consultation