The global dairy products market size surpassed USD 496.2 billion in 2023 and is estimated to hit around USD 640.8 billion by 2030 growing at a CAGR of 3.2% from 2022 to 2030.

Dairy products are foods derived from the milk of animals such as cows, goats, and sheep. Milk, cheese, yogurt, butter, cream, ice cream, and other products fall under this category. Dairy products are high in nutrients such as calcium, protein, and micronutrients and are consumed by individuals around the globe. These nutrients aid in the rebuilding and repair of muscular tissue, the development and maintenance of healthy teeth and bones, and the overall health of an individual's neurological system. Moreover, protein, zinc, selenium, and vitamins A and D are present in each cup of milk to maintain a healthy immune system.

Trends in Food Sector Reshaping the Landscape of Dairy Products Market

The global food market is changing rapidly, particularly in emerging countries. This shift is based on rising consumer living standards, which are viewed as elements influencing altering lifestyles and global purchase patterns. In the past decade, the growth of the working population has increased at an alarming rate resulting in hectic schedules, an increase in the workload, and tedious commuting. The increased work pressure has forced individuals to compromise their eating habits and shift towards unhealthy packaged foods to fulfil their hunger.

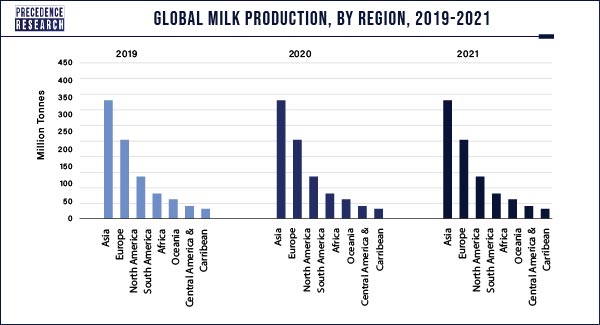

Currently, the rise in awareness of eating healthy foods among individuals has increased the demand for fresh vegetables and dairy products. The rise in demand for dairy products has encouraged cattle owners to increase the production of milk to cater to the market demand. From the year 2019 to 2021 the average growth rate for milk production was 1.36%, and in the upcoming years, the average growth rate for milk production is expected to touch 2%.

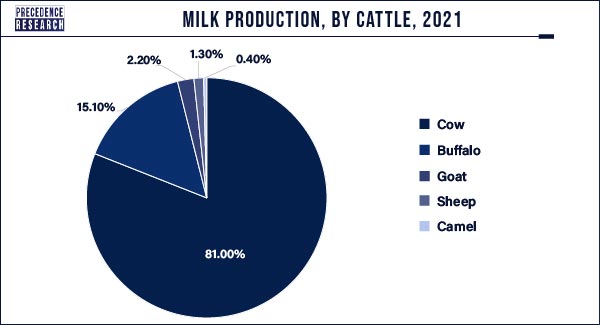

Milk and dairy products are produced and consumed in approximately every nation in the world, and in the majority of them, they rank among the top five agricultural commodities in terms of production quantity and value. Whole fresh cow milk accounts for 81% of worldwide milk output, followed by buffalo milk (15.1%), goat milk (2.2%), sheep milk (1.3%), and camel milk (0.4%).

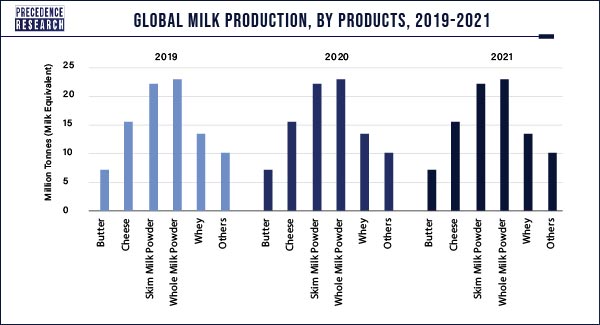

Milk and dairy products make up around 14% of worldwide agricultural commerce. Whole milk powder (WMP) and skimmed milk powder (SMP) represent the most traded agricultural products worldwide as a proportion of output exchanged, whereas fresh dairy goods are the least traded agricultural commodity, accounting for less than 1% of production traded.

Value Chain Analysis of Dairy Products Market

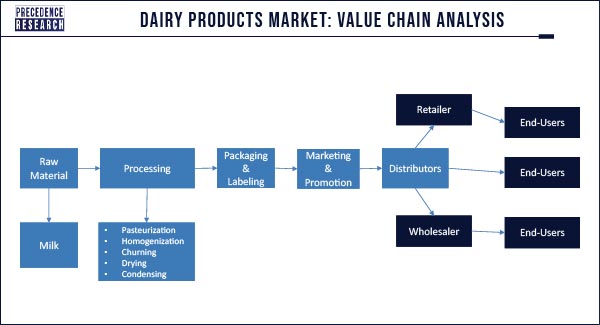

- Raw Material Procurement: Raw material procurement in the dairy products industry typically involves the sourcing and acquisition of raw milk, which is the primary input for most dairy products. Dairy companies source milk from various sources such as local farms, co-operatives, or other suppliers. The choice of the source depends on factors such as proximity to processing facilities, milk quality, price, and availability.

Milk quality is crucial for the production of high-quality dairy products as dairy companies establish their quality standards or adhere to industry-wide standards for measuring the quality of milk for further processing. - Processing: After passing the standard quality test, the raw milk is stored in silos or tanks at low temperatures (usually around 4°C) to prevent bacterial growth and maintain freshness. Further, the raw milk is passed through filters to remove any impurities and foreign matter. In the next step, the milk is transferred to a separation chamber, which separates the milk into cream and skims milk fractions. The process of separation is done using centrifugal separators. Further, the process of standardization is carried out where the cream and skim milk fractions are blended in specific ratios to achieve the desired fat content. The milk is further pasteurized & homogenized, and the final product is churned or fermented into butter, cheese, yoghurt and other dairy product.

- Packaging and Labeling: To protect the dairy product and keep its freshness, the firm selects the proper packaging materials based on the kind of product, shelf life, and storage circumstances. Bottles, cartons, pouches, and cans are common packaging materials in the dairy sector. Following the selection of the packaging material, the dairy product is poured into the package using filling equipment. Depending on the kind of product, the filling process may utilize gravity filling, vacuum filling, or pressure filling. The package is sealed once the food has been packed to avoid contamination and retain freshness. The sealing procedure includes heat sealing, induction sealing, or vacuum sealing.

The product is then labelled with information such as its name, trademark, components, nutritional information, and storage recommendations. Following the completion of the packing and labelling process, the items are visually inspected to ensure that they are free of flaws such as leaks, dents, or mislabeled containers. - Retailers: Retailers face several pain points in the supply chain for consumer electronics, such as managing inventory and logistics, dealing with intense competition and pricing pressures, and ensuring customer satisfaction. They also need to keep up with changing consumer preferences and trends, and may face challenges in managing after-sales support.

- Marketing & Promotion: Dairy firms contact their target market through several advertising and promotional techniques. Television and radio commercials, print advertisements, social media marketing, and in-store promotions such as discounts or product samples are instances of promotional techniques. Dairy firms also form alliances with other businesses or organizations to market their goods. This includes things like sponsoring food festivals and collaborating with health and wellness groups to promote the health advantages of dairy products.

Another kind of advertising is for the dairy firm to interact with consumers to generate customer loyalty and create a favorable brand image. Responding to consumer comments and reviews, arranging events or product demos, and developing online forums where customers can discuss their product experiences are all part of high-level marketing and promotion. - Logistics: Transportation is the initial stage in the logistics process. Depending on the distance and location of the destination, dairy products are carried via road, train, sea, or air. Dairy products may also need to be kept and warehoused at various times during the logistics chain. Refrigerated storage facilities may be included to ensure product freshness and quality. Dairy products are properly managed to ensure that they are available when needed and do not go to waste due to spoiling or expiry. Inventory management, which involves managing product quantities, shelf life, and other criteria to optimize inventory levels, is an important component of logistics.

At the final stage after receiving an order, the dairy product is chosen, packed, and transported to the destination. Coordination of the actions of many parties such as suppliers, manufacturers, distributors, and retailers is required.

The dairy products industry is highly competitive and subject to rapid technological change, which can pose risks to investors. It is important for investors to conduct thorough research and analysis before making any investment decisions. The top dairy products companies across the globe includes Arla Foods amba, Nestlé S.A., Danone S.A., Groupe Lactalis SA, Fonterra Co-operative Group Limited, Dairy Farmers of America Inc., Royal FrieslandCampina N.V., Gujarat Cooperative Milk Marketing Federation Ltd. (Amul), Chobani Inc, Yili Group, Saputo Inc., China Mengniu Dairy Company Limited and many more.

SWOT analysis of the global consumer electronics industry for scenarios in 2021:

Strengths

- The rising population and increasing urbanization are driving the demand for dairy products.

- Advances in technology in dairy farming, such as better genetics, milking technology, and feeding practices increase productivity and efficiency.

- The liberalization of trade policies leads to increased competition and lower prices for dairy products, making dairy products more affordable for consumers.

- Government schemes for the dairy industry through subsidies, research funding, and other contributing to growth and development.

- Strong brand recognition and reputation among consumers help in driving sales and loyalty.

Weaknesses

- Dependence on global supply chains, which can be disrupted due to various factors such as the COVID-19 pandemic, trade wars, and natural disasters

- Intense competition among players in the industry leads to pricing pressures and reduced profit margins

- Increasing concerns over food security can hamper the growth of the market.

- The dairy industry has a significant impact on the environment, particularly in terms of greenhouse gas emissions, water use, and land use, which can impact the sustainability of the industry.

Opportunities

- Growing demand for dairy products from emerging markets as their populations grow and their diets change.

- New product development provides an opportunity to develop new products that cater to changing consumer preferences.

- Growing health and wellness trends as consumers are becoming more health-conscious.

- Advances in technology have led to improvements in the production, processing, and packaging of dairy products.

Threats

- The rise of plant-based alternatives to dairy products has led to increased competition for the industry, particularly among consumers who are looking for alternatives due to health, environmental, or ethical concerns.

- The dairy industry is subject to a range of regulations and policies related to food safety, labeling, and animal welfare, which can impact the profitability and operations of businesses in the industry.

- Commodity prices, such as feed and fuel prices, can be volatile, which can impact the profitability of dairy farmers and processors.

- Economic downturns can lead to a decrease in demand for dairy products, as consumers may reduce their spending on non-essential items.

This SWOT analysis is not exhaustive, and there may be other factors that could impact the global dairy products industry in the foreseeable future. Additionally, the impact of the COVID-19 pandemic on the industry cannot be overlooked, as it has led to significant disruptions and changes in consumer behavior.

Next-generation innovations revolutionizing the global dairy market

There are several upcoming innovations in dairy products that are being developed by various companies. Here are some examples:

- Milk-based Sports Drinks

Sports drinks are beverages designed specifically for athletes to use instead of water to increase energy and hydration levels. Conventional sports drinks are high in sugar and artificial additives. Consumers seek healthier products with reduced sugar content as their health worries grow.

The launch of sports-based milk products is projected to usher in a new healthy dairy product category. The sports drink has everything an athlete requires: carbs, electrolytes, calcium, vitamin D, and others. It also includes two proteins for muscle repair, casein and whey. Milk as a post-exercise rehydration drink is not a novel notion. Yet, with consumers' growing attention to health, this sector has grown up and is witnessing exciting advancements.

GoodSport Nutrition developed a new shelf-stable hydration beverage including a dairy permeate in 2019 and filed a provisional patent for it. They won the 2021 Breakthrough Award for Dairy Ingredient Innovation in the area of "innovative milk-derived or whey-derived dairy ingredient products" a few years later. GoodSport, their product, received the prize. According to their claims, GoodSport "rescues and upcycles" nutrient-rich milk. It also has three times the amount of electrolytes and 33% less sugar than standard sports drinks.

- Cognitive Health Dairy Product

Concerns about the population's diminishing cognitive health have grown since the pandemic's emergence. The workforce's poor work-life balance, students are overwhelmed by study pressure, health professionals, women workforce, and others are eventually turning to functional meals to assist them to unwind and de-stress from their daily routine. In this arena, dairy firms are continually innovating.

Lactalis is already making strides in this approach. It contains Pronativ® protein, which is high in alpha-lactalbumin. Alpha-lactalbumin includes the amino acid tryptophan, which has been shown to improve sleep and, as a result, mental health. Pronativ contains up to 40% more Tryptophan than a classic serum protein. Pronativ has up to 40% more Tryptophan than a traditional serum protein. Pronativ is also higher in Cysteine and an excellent source of protein that may be used in formulations meant to maintain healthy mental health.

Increasing Lactose-intolerant consumers is impacting the dairy products market

Lactose intolerance is characterized by a reduced capacity to digest lactose, a sugar present in milk and other dairy products. According to the National Institute of Health (NIH), lactose intolerance in children is caused by mutations in the LCT gene, which leads to lifelong intolerance, Furthermore, lactose intolerance in adults is caused by a decrease in the function of the LCT gene, which implies that people may have an increasing difficulty digesting lactose as they advance in age.

According to National Center for Biotechnology Information (NCBI), lactose intolerance affects around 65% of the adult human population. Lactose intolerance causes bloating, nausea, vomiting, and diarrhea prompting many to seek other alternatives available in the market. The increased concern about lactose intolerance in newborns and adults is acting as a restraint in the growth of the dairy product market. The growing number of lactose-intolerant individuals throughout the globe is negatively affecting the sales and demand of dairy products which are high on lactose.

Dairy waste comprises milk, milk products, and other dairy processing wastes that do not exceed relevant quality requirements, have been contaminated, or are otherwise inappropriate for human consumption, or livestock feed.

Milk, milk products and all dairy processing wastes must be properly disposed of when they have been discarded, do not meet applicable quality standards, have become contaminated, or otherwise have become unusable for human consumption, animal feed, or any other beneficial use. Milk that cannot be sold to a processor may be recycled by the farmer in the same manner used for manure. Waste from milk processing, including but not limited to raw milk, processed milk, wash water, and disinfectants, is considered industrial process wastewater and may not be discharged to septic systems, or to waters of the state through field tiles, direct dumping or any other method.

| Type of Product | Waste Water Volume (Average Range in Kg) |

| Milk | 100-5400 |

| Condensed Milk | 1000-3000 |

| Butter | 800-6550 |

| Milk Powder | 1500-5900 |

| Cottage Cheese | 800-12400 |

| Milk (Canned) | 320-1870 |

| Natural Cheese | 200-5850 |

Waste management policies of the government can have a significant impact on the global dairy industry in several ways:

- Product innovation: Waste management policies can impact the way manufacturers for introducing innovations in their products. Governments may implement regulations that require manufacturers to innovate products that require less water waste and produces less solid waste, which may help to reduce carbon emission and water waste but may increase the overall cost.

- Recycling and disposal: Waste management policies can also impact dairy products' pricing and quality as manufacturers may try to reduce the overall cost by compromising the quantity of the product offered. Governments may require manufacturers to take responsibility for the disposal of their products, which can lead to increased costs for manufacturers. This may also lead to changes in the way things are made, as packaged goods aim to lessen their environmental effect.

- International trade: Waste management policies can also impact international trade in dairy products. Governments may implement regulations that restrict the import and export of low-quality milk products that do not pass the quality taste of the Food safety department, which can impact the global supply chain and lead to changes in the pricing and availability of dairy products.

The dairy market is constantly evolving and there are several driving forces that will shape its future. Here are some of the key driving forces that are likely to have a significant impact on the dairy products market in the future:

- The dairy products market is driven by technological advancements and innovations. The future of the industry will be shaped by robotic milking machines, cattle monitoring drones, product traceability by block chain, and others. These technologies are likely to be integrated into the global dairy industry.

- Consumer behavior is changing rapidly, driven by factors such as increasing awareness of environmental issues, changing demographics, and evolving lifestyles. Consumers are becoming more aware of healthy eating, and they are also demanding products that are more natural, nutritional, and sustainable.

- The dairy products market is global, and manufacturers are increasingly focused on expanding their presence in emerging markets. Emerging markets such as China, India, and Brazil offer significant growth opportunities for high growth and demand for the products, but they also present unique challenges such as local regulations and competition from local manufacturers.

- Economic factors such as disposable income, high employment rates, and interest for clean label products have a significant impact on the dairy products market. In times of economic uncertainty, consumers may be more cautious about spending money on value-added dairy products, which can lead to lower sales and profits for manufacturers.

In short, technological advancements, changing consumer behavior, globalization, growth of online e-commerce, and economic factors are likely to be the key driving forces shaping the future of the dairy market. Manufacturers that can adapt to these changes and innovate new products that meet evolving consumer needs are likely to succeed in this rapidly changing market.

View Full Report@ https://www.precedenceresearch.com/dairy-products-market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

About the Authors

Aditi Shivarkar

Aditi, Vice President at Precedence Research, brings over 15 years of expertise at the intersection of technology, innovation, and strategic market intelligence. A visionary leader, she excels in transforming complex data into actionable insights that empower businesses to thrive in dynamic markets. Her leadership combines analytical precision with forward-thinking strategy, driving measurable growth, competitive advantage, and lasting impact across industries.

Aman Singh

Aman Singh with over 13 years of progressive expertise at the intersection of technology, innovation, and strategic market intelligence, Aman Singh stands as a leading authority in global research and consulting. Renowned for his ability to decode complex technological transformations, he provides forward-looking insights that drive strategic decision-making. At Precedence Research, Aman leads a global team of analysts, fostering a culture of research excellence, analytical precision, and visionary thinking.

Piyush Pawar

Piyush Pawar brings over a decade of experience as Senior Manager, Sales & Business Growth, acting as the essential liaison between clients and our research authors. He translates sophisticated insights into practical strategies, ensuring client objectives are met with precision. Piyush’s expertise in market dynamics, relationship management, and strategic execution enables organizations to leverage intelligence effectively, achieving operational excellence, innovation, and sustained growth.

Request Consultation

Request Consultation