What is the Fresh Vegetables Market Size?

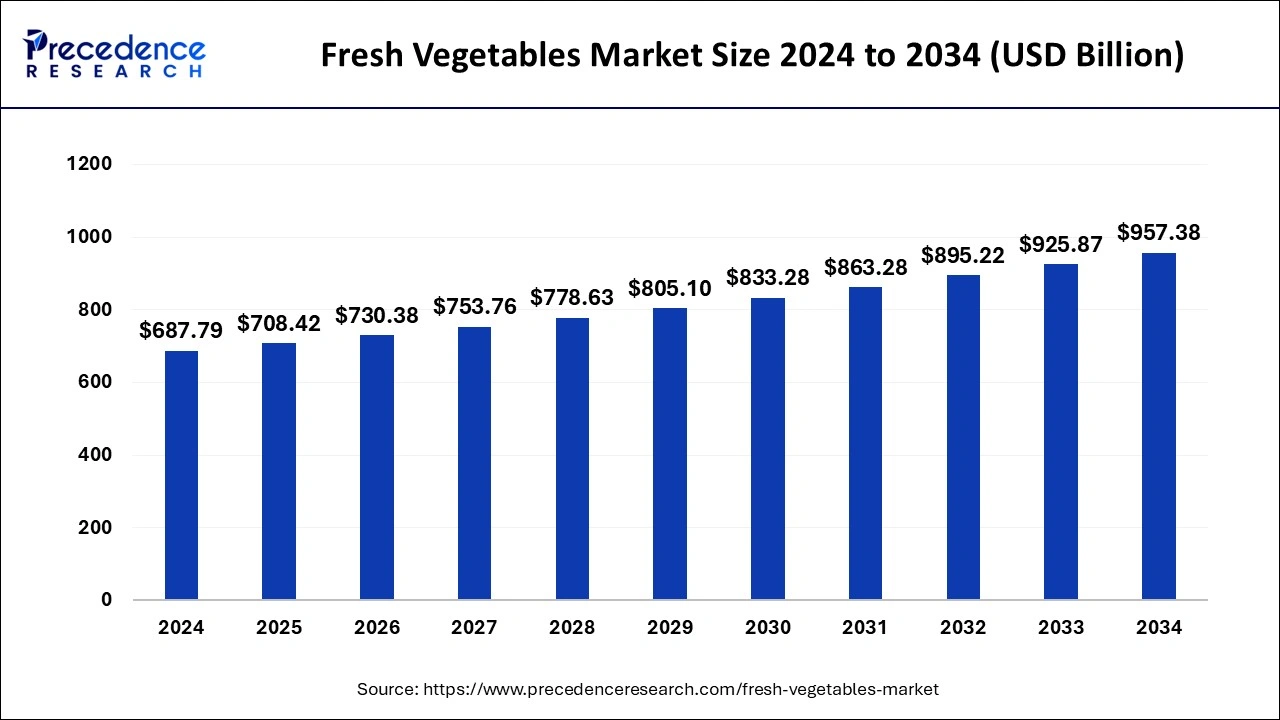

The global fresh vegetables market size is estimated at USD 708.42 billion in 2025 and is predicted to increase from USD 730.38 billion in 2026 to approximately USD 957.38 billion by 2034, expanding at a CAGR of 3.36% from 2025 to 2034

Market Highlights

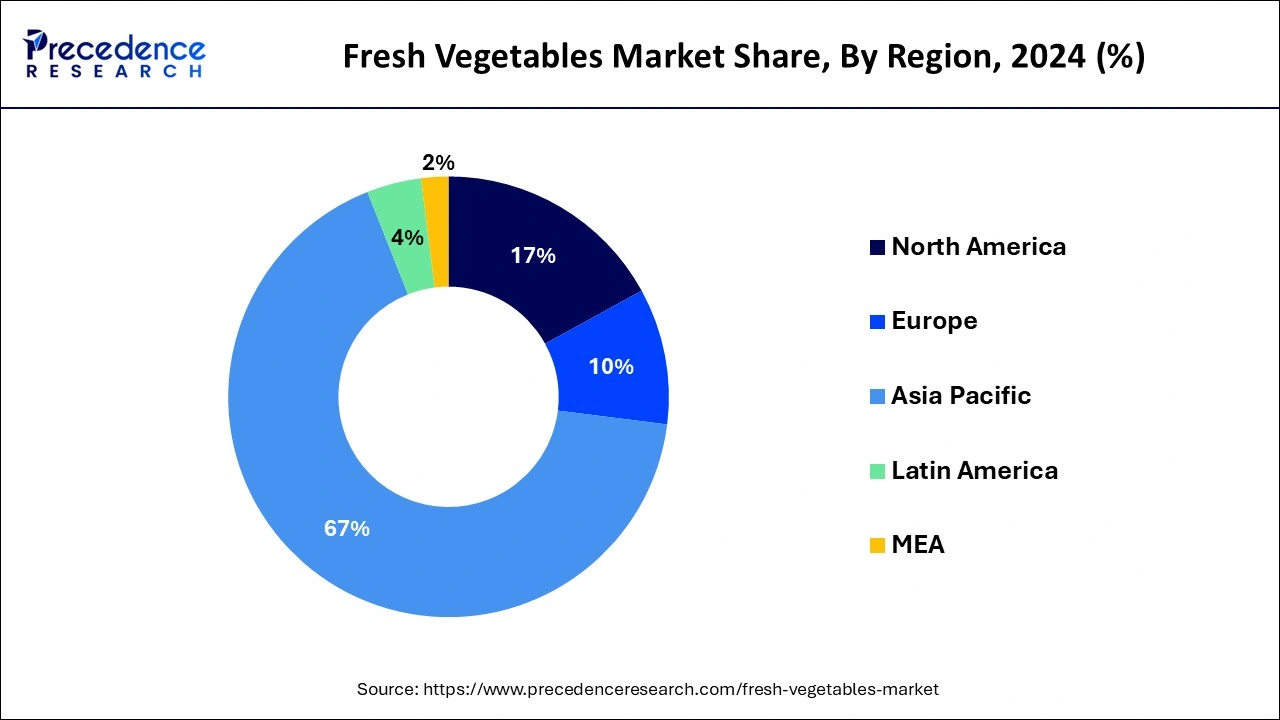

- Asia-Pacific contributed more than 67% of revenue share in 2024.

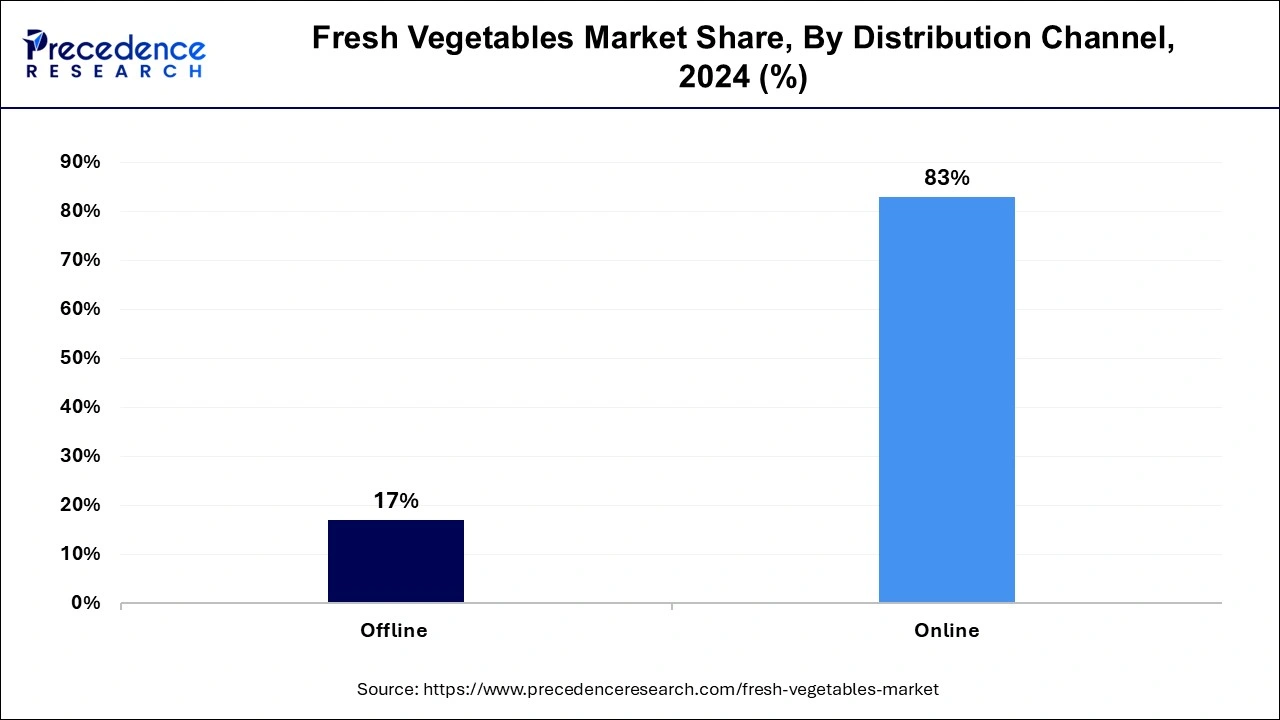

- By Distribution Channel, the offline segment generated more than 83% revenue share in 2024.

- By Distribution Channel, the online segment is expected to expand at a CAGR of 4.7% between 2025 and 2034.

- By Product, the tomato segment captured around 19.8% of revenue share in 2024.

- By Product, the onion segment is anticipated to grow at the fastest CAGR over the projected period.

Market Size and Forecast

- Market Size in 2025: USD 708.42 Billion

- Market Size in 2026: USD 730.38 Billion

- Forecasted Market Size by 2034: USD 957.38 Billion

- CAGR (2025-2034): 3.36%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Market Overview

The fresh vegetables industry represents a vibrant sector within agriculture, dedicated to the distribution and sale of recently harvested, unprocessed produce to consumers.

This market encompasses a diverse array of offerings, including leafy greens, root vegetables, and an array of vibrant peppers, among others. It operates through diverse avenues, such as supermarkets, farmers' markets, and online platforms.

Influential factors impacting this industry encompass seasonal availability, weather patterns, and consumer inclinations toward organic or locally sourced vegetables.

Sustainability and health-conscious trends have significantly influenced this market, resulting in a growing demand for organic and farm-to-table choices. Ultimately, the fresh vegetable market mirrors evolving consumer preferences and ecological considerations.

Fresh Vegetables Market Growth Factors

The fresh vegetables market is a dynamic and constantly evolving segment within agriculture, revolving around the distribution and retail of recently harvested, unprocessed vegetables directly to consumers. This expansive market encompasses a wide array of produce, spanning from leafy greens and root vegetables to vibrant peppers, with distribution channels encompassing traditional brick-and-mortar stores, bustling farmers' markets, and modern online platforms.

One prominent catalyst propelling the industry's growth is the escalating consumer appetite for healthier, more environmentally conscious food choices. This burgeoning trend stems from an increasing awareness of the nutritional advantages fresh vegetables offer and the growing desire for a sustainable, locally-sourced, farm-to-table culinary experience. Consequently, there has been a surge in demand for organically grown and regionally sourced vegetables, opening up substantial business prospects for both growers and retailers capable of satisfying these discerning preferences.

Furthermore, the fresh vegetables market operates under the influence of seasonal variations and the capriciousness of weather conditions, presenting both challenges and lucrative opportunities. Producers must remain adaptable to ever-changing climate patterns, employing strategies such as season extension techniques or investment in advanced greenhouse technologies to meet year-round consumer demand. Simultaneously, the seasonality of produce offers unique avenues for marketing, enabling businesses to capitalize on freshness and flavor during peak growing periods.

Nonetheless, this industry does not come without its share of challenges. Intense market competition and price volatility are persistent factors, necessitating a keen focus on product quality, branding, and efficient supply chain management. Additionally, the ever-present concerns regarding food safety and regulatory compliance demand unwavering commitment to industry standards and practices to maintain consumer trust and safety.

In conclusion, the fresh vegetables market is currently experiencing robust growth propelled by consumer health consciousness and sustainability trends, thereby providing abundant opportunities for businesses capable of aligning with these discerning consumer preferences. Flourishing in this industry demands a skillful navigation of challenges related to changing weather patterns, competitive dynamics, pricing fluctuations, and rigorous food safety standards, all while harnessing the seasonal appeal of fresh produce. Adaptability, innovation, and a commitment to quality will remain pivotal for success in this perpetually evolving sector. As the world continues to prioritize health and sustainability, the future of the fresh vegetables market holds promise, with potential for continued growth and innovation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 708.42 Billion |

| Market Size in 2026 | USD 730.38 Billion |

| Market Size by 2034 | USD 957.38 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.36% |

| Largest Market | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Distribution Channel, Product, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Locally sourced and farm-to-table movements

The surge in popularity of the Locally Sourced and Farm-to-Table movements is propelling notable growth in the market by fundamentally transforming consumer preferences and supply chain dynamics. Consumers are increasingly drawn to locally cultivated vegetables due to their perceived freshness, diminished environmental footprint, and contribution to bolstering regional economies. The farm-to-table ethos accentuates the direct link between consumers and nearby farmers, fostering trust and transparency in the sourcing of fresh vegetables.

This paradigm shift in consumer mindset has galvanized eateries, supermarkets, and foodservice providers to prioritize local procurement and accentuate the origins of their produce. Consequently, there is a burgeoning demand for regional and seasonal vegetables, invigorating local agricultural economies, curbing carbon emissions related to transportation, and generating opportunities for small-scale growers. These movements not only invigorate the fresh vegetables market but also advocate sustainable farming practices while solidifying the connection between producers and consumers, instigating positive transformations within the food industry.

Restraints

Weather-related risks

Weather-related risks present a formidable constraint on the growth trajectory of the fresh vegetables market. This industry is acutely susceptible to the capricious and increasingly irregular climatic patterns associated with climate change. Unpredictable weather phenomena, including prolonged droughts, catastrophic floods, severe hurricanes, and untimely frosts, have the capacity to wreak havoc on vegetable crops, yielding diminished harvests, damage, and even complete crop failures. The repercussions of these meteorological challenges reverberate along the supply chain, causing scarcities and erratic price fluctuations.

Moreover, they necessitate increased investment in protective measures and innovative technologies, amplifying production costs. Producers situated in regions particularly prone to adverse weather conditions encounter elevated levels of uncertainty and financial vulnerabilities. The mounting influence of climate change underscores the urgency for the fresh vegetable industry to embrace resilient agricultural techniques, advanced weather forecasting systems, and sustainable water management practices. In the absence of such adaptations, the market's expansion potential is stifled by the turbulence and uncertainty that accompany extreme meteorological events.

Opportunities

Organic and sustainable agriculture

Organic and sustainable agriculture is generating significant opportunities within the fresh vegetables market. As consumers increasingly prioritize health and environmental concerns, there is a growing demand for vegetables produced using eco-friendly and chemical-free methods. This trend presents an opening for farmers to adopt organic farming practices, eschewing synthetic pesticides and fertilizers while emphasizing natural, sustainable techniques. Organic certification provides a valuable marketing advantage, allowing growers to tap into a premium market segment willing to pay higher prices for organic produce. Sustainable agriculture, with an emphasis on resource conservation and reduced environmental impact, also aligns with these consumer preferences.

Furthermore, environmentally friendly packaging and distribution practices are gaining importance. Reducing food waste through sustainable packaging and supply chain management contributes to a positive brand image and can attract environmentally conscious consumers. Overall, embracing organic and sustainable agriculture not only meets consumer demands but also promotes long-term soil health, biodiversity, and resilience against climate change, positioning growers and the fresh vegetables market for continued growth.

Segments Insights

Distribution Channel Insights

According to the distribution channel, the offline sector has held 83% revenue share in 2024. Firstly, consumer habits have traditionally favored in-store purchases, where shoppers can personally inspect and select their vegetables for freshness and quality. Secondly, physical stores, such as supermarkets and farmers' markets, have well-established distribution networks and a broad presence, providing accessibility to a wide customer base. Lastly, while online sales have grown, the perishable nature of fresh vegetables, coupled with concerns over timely delivery and handling, has maintained the dominance of offline channels in the market.

The online sector is anticipated to expand at a significantly CAGR of 4.7% during the projected period. First, the convenience of online shopping and home delivery appeals to modern consumers, especially during the COVID-19 pandemic, leading to increased adoption. Second, e-commerce platforms offer a wide variety of fresh vegetables, often sourced directly from local or regional producers, providing consumers with choices they may not find in traditional stores. Additionally, online platforms enable greater transparency in sourcing and pricing, fostering trust among consumers. These advantages, coupled with the digital shift in shopping habits, have propelled the online segment's growth and market dominance.

Product Insights

In 2024, the tomato sector had the highest market share of 19.8% on the basis of the Product. The dominance of the tomato segment in the fresh vegetables market can be attributed to its ubiquity, culinary adaptability, and consistent year-round appeal. Tomatoes play a pivotal role in a wide spectrum of cuisines, ingraining themselves as a kitchen essential. Their versatile usage extends from salads and sauces to soups and an array of dishes. The proliferation of fast-food establishments, along with the enduring popularity of pizza and pasta, bolsters the perpetual demand for tomatoes. Notably, their comparatively extended shelf life and suitability for canning and processing further underscore their prominence in the market landscape.

The onion segment is anticipated to expand at the fastest rate over the projected period. Onions hold a major growth in the fresh vegetables market due to their versatility, widespread culinary use, and extended shelf life. They are a staple ingredient in various cuisines, making them a consistent consumer choice. Onions also have a relatively longer storage capability compared to many other fresh vegetables, allowing for year-round availability and reducing the impact of seasonal fluctuations. Their affordability and ability to add flavor and texture to a wide range of dishes contribute to their significant market growth, making onions a cornerstone of the fresh vegetable segment.

Regional Insights

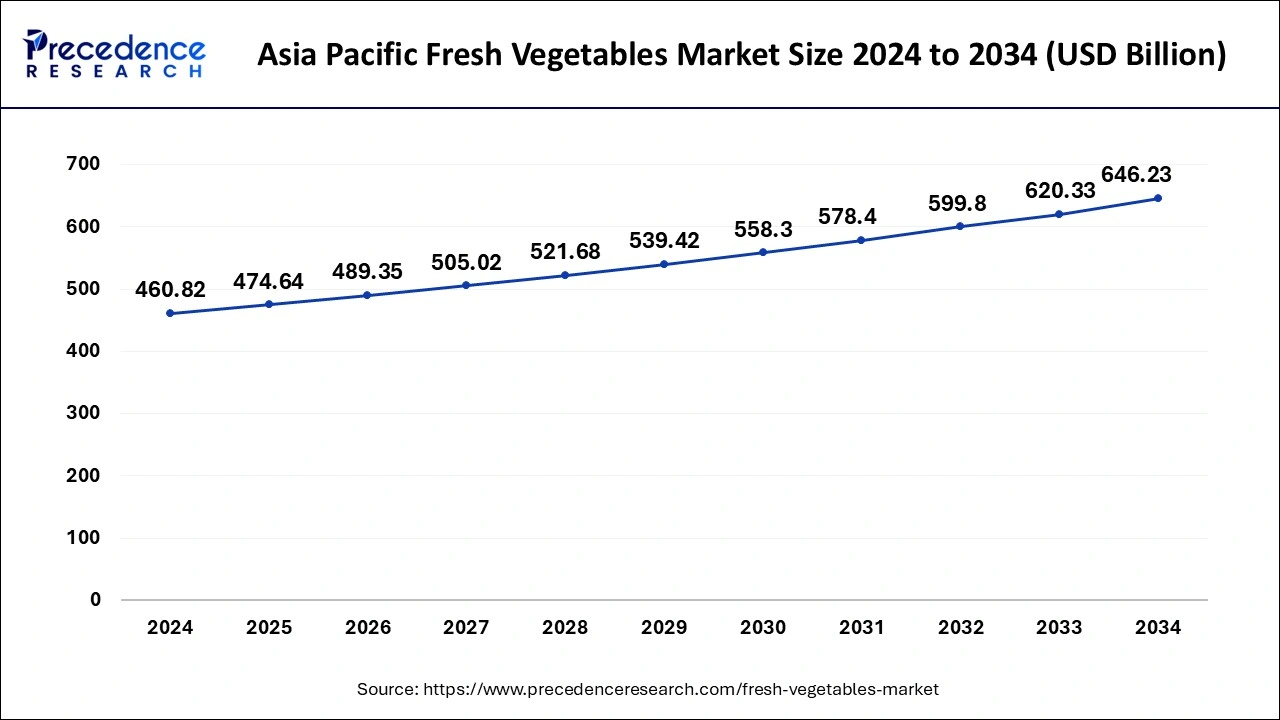

Asia PacificFresh Vegetables Market Size and Growth 2025 to 2034

The Asia Pacific fresh vegetables market size was estimated at USD 474.64 billion in 2025 and is projected to surpass around USD 646.23 billion by 2034 at a CAGR of 3.44% from 2025 to 2034.

Asia-Pacific has held the largest revenue share 67% in 2024.

- Foremost, the sheer magnitude of the population in nations such as China and India fosters a substantial domestic demand for fresh vegetables, serving as a catalyst for heightened production and consumption.

- Moreover, dietary preferences ingrained in Asian cultures prioritize fresh vegetables as a pivotal component of daily nutrition, further elevating market significance. In addition, the region benefits from its diverse array of climates and geographical landscapes, which facilitate year-round cultivation of a wide spectrum of vegetables, ensuring a steady supply and mitigating the effects of seasonal fluctuations.

- The burgeoning urbanization and the expanding middle class in various Asian countries have bolstered consumer purchasing power, fostering a growing inclination towards convenience and driving demand for pre-packaged and processed fresh vegetables.

- Furthermore, the Asia-Pacific region has been a focal point for investments in cutting-edge agricultural technologies, advanced irrigation systems, and robust infrastructure, resulting in amplified yields and enhanced quality of fresh vegetables. Combined with a pronounced focus on tapping into export markets, these factors collectively establish the region as a preeminent force in the global fresh vegetables arena.

Asia Pacific dominates the fresh vegetable market with vast production and growing demand.

Asia Pacific is the largest fresh vegetable market in the world, as it has the largest agricultural base, good climate, and population demand for fresh vegetables. India is the largest player in the region as it grows vegetables on a large scale, and the government currently pushes the agenda for organic and sustainable agriculture. The region enjoys a wide variety of vegetables grown year-round due to the range of climates that are suitable for growing vegetables. The growing awareness of the health benefits of consuming fresh produce and urban migration is driving fresh vegetable consumption in all countries in the region, and this consolidates Asia Pacific's leading position in the global fresh market

North America is estimated to observe the fastest expansion with the highest CAGR of 4.1% during the forecast period.

- Firstly, heightened health-consciousness among North American consumers has driven the demand for fresh vegetables, aligning with the region's growing emphasis on healthier lifestyles.

- Secondly, North America boasts a robust and efficient agricultural infrastructure, allowing for year-round cultivation and distribution of fresh produce. The region's varied climates and advanced farming technologies facilitate consistent and diverse vegetable production, reducing seasonal limitations.

- Furthermore, North America's unwavering commitment to stringent food safety and quality standards enhances consumer confidence in domestically sourced fresh vegetables, further stimulating market expansion.

- Lastly, the convenience aspect plays a pivotal role, with consumers seeking easily accessible, prepared options such as pre-cut vegetables and salad kits. Collectively, these factors propel North America into a position of prominence within the global fresh vegetables market.

North America leads as fastest fastest-growing region, driven by innovation and a health focus.

The fresh vegetable market in North America has been growing quickly, primarily due to changes in consumer preferences for fresh, organic, and convenient produce. In the U.S., the fresh vegetable market is well-developed and expanding because of the supply chain's effectiveness, which is a result of farming demanding approximately 30% to 40% of the fresh produce dollar. Wholesale and retail average about 17% and 20%, respectively, which has proven that the distribution (wholesale) of fresh vegetables works well within the supply chain structure, as does retail demand. All of this is helping the fresh vegetable sector grow, as a result of improved logistics and marketing.

Why is Europe a Notable Region in the Fresh Vegetables Market?

Europe is expected to experience significant growth in the fresh vegetables market in the coming period. This growth is primarily attributed to its large and stable demand, high import volume, and an increasing emphasis on sustainability and quality. Europe is a major importer of fresh fruits and vegetables, driven by a population that prioritizes food safety and quality. Consumers often seek certifications like HACCP (Hazard Analysis and Critical Control Points) to ensure that products meet high standards. Additionally, there is a growing emphasis on local and seasonal produce, influenced by climate change concerns and consumer preferences for eco-friendly practices with a stronger focus on food safety and certifications.

How will Latin America Surge in the Fresh Vegetables Market?

Latin America is also experiencing substantial growth in the fresh vegetables market, thanks to a rising middle class, increasing demand for nutrient-dense foods, and government initiatives aimed at promoting agricultural development. This growth is propelled by both domestic consumption and exports, particularly to major markets such as the United States, the EU, and China. Numerous Latin American governments are investing in modern agricultural practices, including improved seed technology and the development of supporting infrastructure, which further stimulates market growth. The region's diverse climate and abundant natural resources, including arable land and water, position it well for agricultural production.

How Will the Middle East and Africa Occupy the Fresh Vegetables Market?

The Middle East and Africa occupy a unique role in the fresh vegetables market, driven by rising health consciousness, urbanization, and government initiatives that promote agriculture. Governments in the region are actively supporting domestic agriculture through policies, subsidies, and infrastructure investments, aimed at enhancing food security and reducing reliance on imports. Investments in smart agriculture and vertical farming, particularly in countries like the UAE and Qatar, are essential to minimize import dependence and ensure a consistent supply of fresh produce. Hydroponics is also enhancing production efficiency, allowing for year-round availability of fresh vegetables even in challenging environments.

Fresh Vegetables Market Companies

- Dole Food Company, Inc.

- Fresh Del Monte

- Keelings

- Tanimura & Antle

- BelOrta

- FreshPoint Inc.

- Mirak Group

- C.H. Robinson Worldwide, Inc.

- Goknur Gida

- Fruitable Fresh Sdn Bhd.

- Global Fresh Trading FZE

Recent Developments

- In February 2025, Coupang launched its Premium Fresh service for superior quality fresh foods in Korea. “Premium Fresh” offers over 500 products across 12 categories, including fruits, seafood, vegetables, meat, eggs, and dairy products. Fruits, seafood, and vegetables that meet Coupang's premium quality standards in terms of quality and size will bear the "Premium Fresh" label, ensuring the highest quality for customers through a stringent inspection process. (Source: https://biz.chosun.com)

- In April 2025, AI-powered tech enabler GrubMarket completed the acquisition of Nogales-based Delta Fresh Produce, a leading distributor specialising in tomatoes, cucumbers, peppers, grapes, watermelons, and various other fresh produce commodities sourced from Mexico. Delta Fresh manages an extensive farming and distribution network across Mexico, including over 900 acres of open-field production, 1,400 acres of indoor production, and state-of-the-art packing facilities across Baja, Sonora, Sinaloa, and Central Mexico. (Source: https://www.fruitnet.com)

- In February 2024, Wholesale Produce Supply LLC (WPS Fresh), a fresh produce logistics and inventory management solutions provider to grocery wholesalers, foodservice distributors, and other customers, acquired the assets of G.O. Corporation, a processor of fresh-cut produce. The company performs value-added services such as ripening, grading, fresh-cutting, washing, sorting, and packaging. (Source: https://www.supermarketnews.com)

- In June of 2023, FreshPoint Inc. made a strategic move by acquiring BIX Produce, aiming to broaden its customer base, introduce freshly cut selections, and promote its specialty product range in previously untapped markets.

- In January 2023, Dole plc underwent a significant transaction, selling its Fresh Vegetables Division to Fresh Express Incorporated. This decision was driven by a pursuit of innovation, operational efficiency, and enhanced food safety standards, all with the aim of elevating their future offerings and service quality.

- In December 2022, Keelings entered into a meaningful partnership with the charitable organization FareShare. This collaboration is dedicated to addressing food wastage and alleviating hunger. The core mission of this partnership is to provide nutritious and fresh food to underprivileged families and children, contributing to their well-being and health.

Segments Covered in the Report

By Distribution Channel

- Offline

- Online

By Product

- Tomato

- Onion

- Cabbage

- Cucumber

- Eggplant

- Beans

- Carrot

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting