What is the Fruits and Vegetables Market Size?

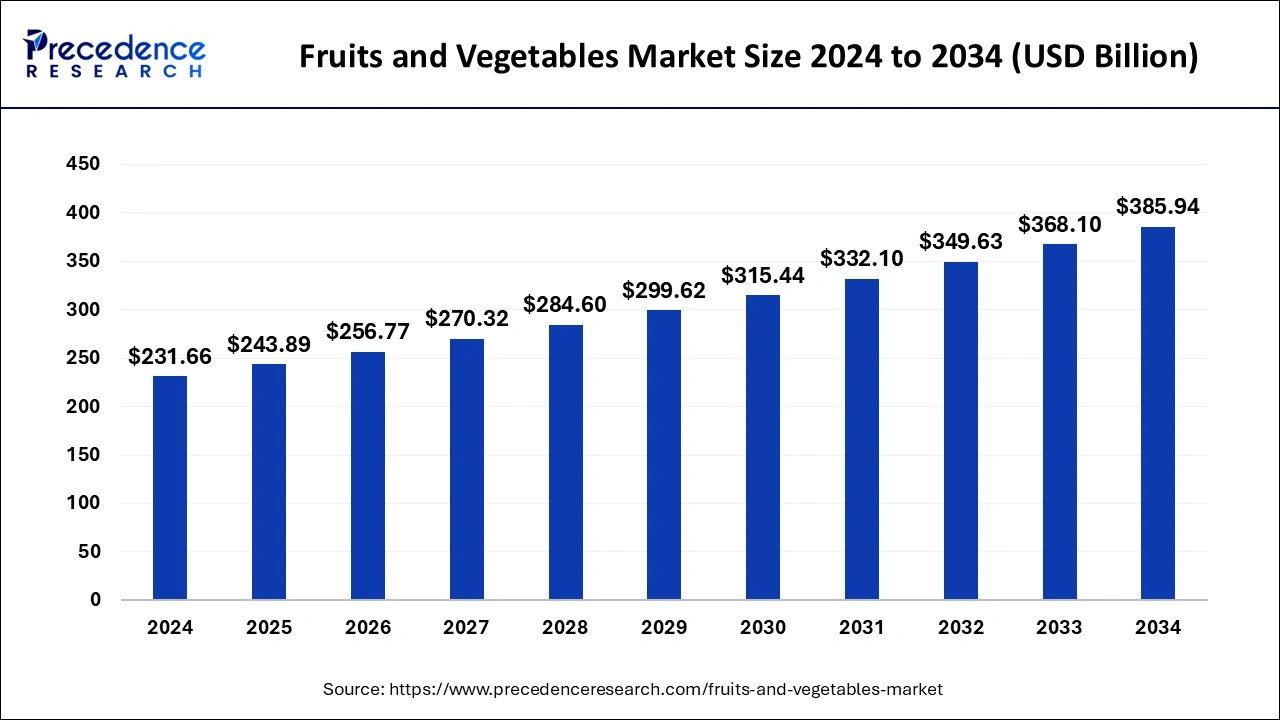

The global fruits and vegetables market size accounted for USD 243.89 billion in 2025, grew to USD 256.77 billion in 2026 and is projected to surpass around USD 404.20 billion by 2035, representing a healthy CAGR of 5.18% between 2026 to 2035.

Market Highlights

- Asia Pacific dominated the market with the largest share in 2025.

- North America is observed to grow at a significant rate during the forecast period.

- By product, the fresh fruits & vegetables segment held the largest share of the market in 2025.

- By distribution channel, the supermarkets/hypermarkets segment dominated the market in 2025. The segment is observed to sustain the position throughout the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 243.89 Billion

- Market Size in 2026: USD 256.77 Billion

- Forecasted Market Size by 2035: USD 404.20 Billion

- CAGR (2026 to 2035): 5.18%

- Largest Market in 2025: Asia Pacific

- Fastest Growing Market: North America

Market Overview

The fruits and vegetables market encompasses the entire supply chain, from farmers and growers to wholesalers, distributors, retailers, and consumers. Fresh produce may be transported locally, regionally, or internationally to meet consumer demand year-round. Fruits and vegetables are essential components of a balanced diet because they are rich in vitamins, minerals, and phytochemicals. They also have a healthy dose of fiber and other micronutrients. They are beneficial by nature and include vitamins and minerals that might support excellent health, such as folic acid, magnesium, zinc, phosphorous, and A (beta-carotene). Eating fruits and vegetables daily can also help prevent several ailments. Because fruits and vegetables contain phytochemicals or plant compounds, they provide several health advantages.

- In addition, eating a diet high in fruits and vegetables helps lower blood pressure, cut the risk of heart disease and stroke, prevent some cancers, reduce the risk of digestive and eye issues, and improve blood sugar regulation, which can help control hunger.

Fruits and Vegetables MarketGrowth Factors

- Increased awareness of health and wellness has led to a growing demand for nutritious and natural foods like fruits and vegetables. Consumers are increasingly seeking fresh, unprocessed, and organic produce, driving the fruits and vegetables market growth.

- As the global population continues to grow, particularly in urban areas, there is a higher demand for convenient and readily available food options. Fruits and vegetables, being essential components of a healthy diet, see increased consumption due to this demographic shift.

- Technological advancements in packaging and processing techniques have extended the shelf life of fruits and vegetables, reduced wastage and made them more accessible to consumers. This has a positive impact on market growth.

- The growth of e-commerce and direct-to-consumer models enables consumers to access fresh produce more conveniently. Online platforms facilitate the direct sale of fruits and vegetables, cutting out intermediaries and potentially reducing costs, which in turn, drive the growth of the fruits and vegetables market during the forecast period.

Market Scope

| Report Coverage | Details |

| Global Market Size in 2025 | USD 243.89 Billion |

| Global Market Size in 2026 | USD 256.77 Billion |

| Global Market Size by 2035 | USD 404.20Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.18% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for organic fruits and vegetable products

The worldwide food and beverage business has seen a rise in demand for organic products. As a result, growth in the global market for fruits and vegetables is projected throughout the forecast period. Organic food is becoming more and more popular all over the world since it is made without the use of artificial ingredients, chemical pesticides, synthetic fertilizers, or genetic engineering. Because it preserves the ecosystem and maintains healthy soil, organic farming is also preferable to chemical farming.

Superior agricultural goods are produced via organic farming, which enhances soil nutrients. For consumers seeking excellent foods manufactured with organic components, organic goods provide the ideal answer. These items are rich in omega-3 fatty acids, vitamins, minerals, and antioxidants. Thus, the rising demand for organic fruits and vegetables is expected to propel the fruits and vegetables market's growth during the forecast period.

Restraint

Contamination of fruits and vegetables

Eating food contaminated with bacteria, viruses, parasites, toxins, or other substances can lead to foodborne disease, often known as food poisoning. Although there are numerous health advantages to fresh vegetables, eating it raw can occasionally result in food poisoning from microorganisms. There is a higher chance of illness or serious disease development in those who eat contaminated food. Food becomes dangerous to eat when these pollutants enter the supply chain through various means. A few other ways that contamination can occur include when livestock, wildlife, or birds are directly contaminated when organic waste and excrement are used as fertilizer on agricultural land, and when post-harvest problems like worker hygiene arise.

Toxins found in toxic mushrooms, mycotoxins, cyanogenic glycosides, and marine biotoxins are a few examples of naturally occurring toxins. Long-term exposure to oxalates, which are present in common fruits like peach palms, can impair immunological function, interfere with proper development, and potentially cause cancer in those who ingest them. Moreover, there is a chance that abrupt climate change will raise the danger of food poisoning. During the projected period, these factors will impede the fruits and vegetables market's expansion.

Opportunity

Growth of the organized retail sector

Continually concentrating on fortifying their distribution network through organized retail, suppliers aim to achieve increased sales volumes and turnover. Many supermarkets, hypermarkets, and specialized shops were established, which led to an increase in organized retailing. The two most significant offline channels for the distribution of fruits and vegetables are supermarkets and hypermarkets. Organized retail is a crucial component of the offline distribution channel that helps customers make purchases and gives them a wide range of options.

Among the supermarkets with a wide selection of goods worldwide are Walmart Inc. and Penny Market. The number of organized retailers providing greater shelf space for both organic and non-organic fruits and vegetables is anticipated to be the primary driver of the worldwide fruits and vegetables market's development during the projected period.

Segments Insights

Product Insights

The fresh fruits & vegetables segment dominated the fruits and vegetables market in 2025. In the United States, the consumption of fresh fruits and vegetables was significantly impacted by the coronavirus outbreak. Fresh fruits and vegetables were in great demand, even if logistical and transportation issues reduced their supply. This occurred as a result of consumers placing a greater emphasis on eating a balanced diet that includes more fresh produce in place of processed or frozen items.

According to a OnePoll study done in 2022 on behalf of Nutrisystem, more than 70% of Americans expressed growing concerns about their health following the epidemic, particularly about weight gain and reduction. Fresh fruit and vegetable consumption has increased dramatically as a result of this. Besides, the dried fruits & vegetables segment is expected to grow at the highest CAGR during the forecast period. Dried fruit and vegetable consumption has been steadily increasing in recent years as people look for healthier snack options. Due to their greater shelf life, portability, and convenience over fresh food, dried fruits and vegetables are becoming more and more popular.

Another factor driving this market is the increasing acceptance of plant-based diets. In January 2022, 10% of Americans over the age of 18 identified as vegans or vegetarians, according to an article published by the Alliance for Science. Nowadays, a lot of customers opt to eat less meat and look for other sources of protein and nourishment. Adding plant-based protein and minerals to meals may be done cheaply and efficiently using dried fruits and vegetables.

Distribution Channel Insights

The supermarkets/hypermarkets segment held the largest share of the fruits and vegetables market in 2025. The segment is observed to sustain the position throughout the forecast period. Supermarkets and hypermarkets offer a diverse range of fruits and vegetables, providing consumers with a one-stop shopping experience. This variety caters to different tastes and preferences, contributing to increased sales and consumption. In addition, supermarkets and hypermarkets are convenient locations for consumers to purchase fresh produce. Their widespread presence and longer operating hours make it easy for customers to access a broad selection of fruits and vegetables whenever they choose.

Besides, the online segment is expected to grow at the highest CAGR during the forecast period. Online platforms offer consumers the convenience of ordering fruits and vegetables from the comfort of their homes. This accessibility is particularly beneficial for individuals with busy lifestyles or those who may face challenges in visiting physical stores regularly.

Reputable online platforms often emphasize quality assurance and transparency in sourcing. Detailed product descriptions, origin information, and customer reviews contribute to building trust among online shoppers regarding the quality and freshness of the fruits and vegetables they purchase. Thus, this is expected to drive the segment expansion during the forecast period.

Regional Insights

What makes Asia Pacific the Leading Region in the Fruits and Vegetables Market?

Asia Pacific held the largest share of the fruits and vegetables market in 2025. due to the region's population's increasing disposable income and increased knowledge of the advantages eating fresh food provides for health. Asia's two biggest markets are China and India. Demand in India would be driven over the projected period by the country's expanding middle class, increased disposable income, and growing awareness of health advantages.

India Fruits and Vegetables Market Trends

Moreover, rapid population growth and urbanization in many Asia Pacific countries contribute to increased demand for convenient and readily available food options, including fresh fruits and vegetables. Urban lifestyles often lead to a shift in dietary habits, with a greater focus on healthy and convenient choices. Furthermore, thegrowth of e-commerce in the Asia Pacific region has transformed the way consumers access and purchase fruits and vegetables. Online platforms provide a convenient and efficient channel for buying fresh produce, particularly in urban areas

What Factors Influence the Significant Position of North America in the Fruits and Vegetables Market?

North America is expected to capture a significant market share during the forecast period. Increasing awareness ofhealth and wellness has led to a higher demand for fresh and nutritious fruits and vegetables. Consumers in North America are often conscious of their dietary choices, driving the popularity of organic and locally sourced produce. Thus, this is expected to drive the market expansion in the region.

U.S. Fruits and Vegetables Market Analysis

In the United States, a growing demand for organic, fresh-cut, and ready-to-eat produce propels the market. Health-conscious consumers are increasingly choosing fruits—including avocados, berries, and citrus—driven by dietary trends and wellness-focused lifestyles. Additionally, retail innovation (e.g., online grocery delivery and subscription-based produce boxes) has increased access to produce. Furthermore, the USDA's promotion of sustainable agriculture and the farm-to-table movement has facilitated local production and created less reliance on imports. India: India is one of the largest producers of fruits and vegetables in the world and has a massive and diverse agricultural landscape. Urbanization and a growing middle class have decreased the demand for cleaner and safer produce and better quality produce. Nevertheless, inefficiencies in the supply chain, post-harvest losses, and lack of illuminated cold storage facilities continue to be factors limiting the factors affecting the industry. Nonetheless, the growth of agri-tech startups, improvement of logistics, and government schemes such as PM-KISAN and eNAM are changing and improving farm-to-market connectivity over time.

What makes Europe the Fastest-Growing Region in the Fruits and Vegetables Market?

Europe is expected to grow at the fastest rate in the market, owing to a strong preference for natural, fresh, and nutrient-dense foods, the increased demand for ready-to-eat food products, and innovations in food processing technologies. Advanced supply chain technologies and digital traceability are improving efficiency and transparency from farm to table. Urban agriculture and controlled environment farming, including vertical and hydroponic systems, are emerging to supplement traditional production.

Germany Fruits and Vegetables Market Analysis

In Germany, the market is closely aligned to sustainability, quality standards, and consumer demands for organic and seasonal products. Germany takes the lead in green farming in the European Union adopting climate-resilient practices at an increasing rate. German consumers are willing to pay an increased price for traceable, non-GMO, and eco-certified fruit and vegetables, which makes it an ideal market for responsible sourcing of high-quality products that are real and cultivated in a sustainable way.

What made Latin America hold a considerable share of the Fruits and Vegetables Market?

Latin America is expected to grow at a notable rate in the market due to the adoption of precision agriculture, massive agricultural production, and consumer demand for high-nutritional-value products. Mexico remains the leading country in agrifood tech investments in Latin America.

What Opportunities Exist in the Fruits and Vegetables Market in the Middle East & Africa?

The Middle East and Africa are expected to grow at a lucrative rate in the market due to the rapidly growing supermarkets and hypermarkets, modernization in retail and e-commerce, and investments in cold chain storage. The agrifood tech innovators of Africa, the Middle East, and North Africa are redefining the global food systems.

Value Chain Analysis

- Raw Material Procurement (Farms, Fisheries, etc.)

This stage involves direct farm engagement, contract farming, AI and IoT in quality assessment, blockchain for traceability and payments, and integration of cold chain and infrastructure.

Key Players: Dole Food Company, Cargill, Inc., Archer Daniels Midland (ADM), Olam International, Greenyard. - Retail Sales and Marketing

This stage is expanding due to quick commerce, dynamic pricing, smart labelling, functionality-led marketing, self-service, and automation.

Key Players: Dole Plc, Zespri International, Fresh Del Monte Produce Inc., Driscoll's, Inc., Instacart, Walmart, Amazon Fresh. - Waste Management and Recycling

This stage is surging in high demand, owing to precision sorting, AI and IoT tracking, shelf-life extension, bioactive extraction, upcycling, and advanced composting.

Key Players: Veolia Environnement S.A., SUEZ Group, Republic Services, Inc., Waste Management, Inc., Remondis SE & Co. KG.

Fruits and Vegetables Market Companies

- General Mills Inc.

- Tanimura & Antle Fresh Foods, Inc.

- Fresh Del Monte Produce, Inc.

- Sunkist Growers, Inc.

- Chiquita Brands International, Inc.

- Nestlé

- Fresh Pro

- Sysco Corporation

- Dole Food Company, Inc.

- C.H. Robinson Worldwide, Inc.

Recent Developments

- On March?7,?2025, biotechnology firm Tropic in Norwich unveiled a gene-edited non-browning banana, designed to stay fresh for up to 12 hours post-peel targeted to reduce waste and meet global demand, with rollouts planned in the US, Canada, and parts of Latin America. (Sources- https://www.theguardian.com)

- On March?26,?2025, Fresh Del Monte Produce announced its strategic acquisition of a majority stake in Ugandan avocado-oil producer Avolio, aiming to scale extraction to 140 metric tons per day and tap into the booming $1.2?billion avocado-oil market. (Sources- https://www.barrons.com)

- In December 2022, the Del Monte Zero pineapple was introduced by Fresh Del Monte Produce, Inc. as their first certified carbon-neutral pineapple. Select European markets as well as North American markets carry the product. The Del Monte Gold, HoneyGlow, and Del Monte pineapple types are the extensions of this product range.

- In October 2023, two new products for the fruit and vegetable market, the ComandanTY Tomato and the TigerGrey Zucchini from its Seminis seed brand were unveiled by Bayer. The firm has expanded its product line to include new items, which are intended to increase farmer productivity and improve the taste and quality of food on the plates of ultimate customers.

Segments Covered in the Report

By Product

- Fresh Fruits & Vegetables

- Frozen Fruits & Vegetables

- Dried Fruits & Vegetables

By Distribution Channel

- Grocery Stores

- Supermarkets/Hypermarkets

- Online

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting