Electrolyzer Market Insights

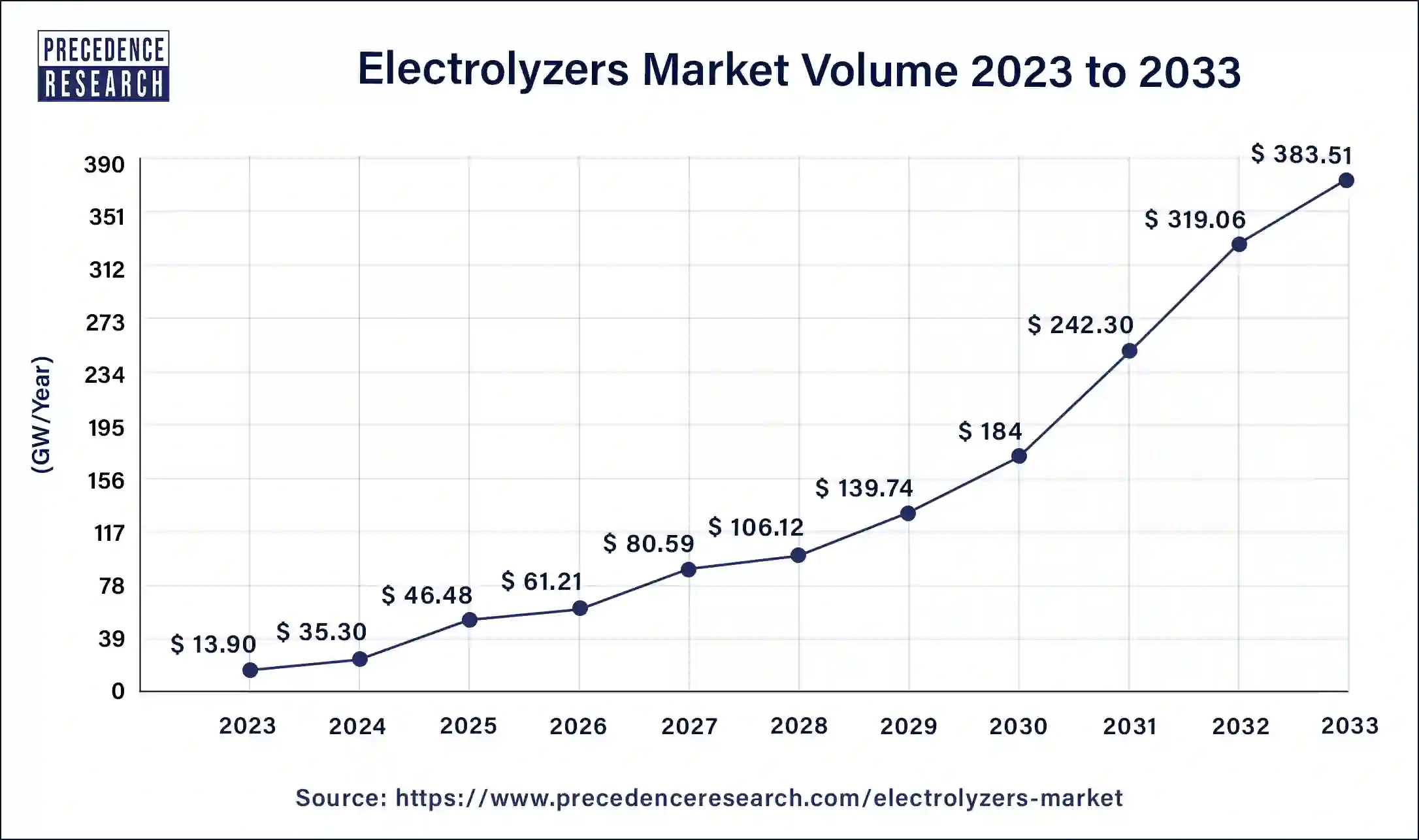

The global electrolyzer market size was accounted for USD 12.81 billion in 2023 and is expanding around USD 278.82 billion by 2033, growing at a compound annual growth rate (CAGR) of 36% from 2024 to 2033.

The electrolyzer, an instrument that utilizes electricity to separate the oxygen and hydrogen molecules through electrolysis, are crucial in producing low-emission hydrogen from nuclear or renewable energy sources. The concurrently generated oxygen is expelled into the environment. In some circumstances, it can be stored for later utilization as a gas for industrial or medical purposes. Hydrogen is either compressed and stored as a gas or liquefied for use in hydrogen fuel cells which can power ships, aircraft, as well as trains. In addition, it is utilized in various industries.

Multiple industries employ electrolysis, and it is also used for metal extraction and purification. One of the commercial techniques to create hydrogen gas utilizes electrolysis procedures. To meet the Hydrogen Energy Earthshot target of reducing the cost of clean hydrogen by 80% to USD 1/kg in a decade, electrolysis is a primary hydrogen production alternative. Hydrogen electrolysis can cause no greenhouse gas emissions depending on the electricity source used.

Electrolyzers Market Statistics

| Electrolyzers Market | 2021 | 2022 | 2023 |

| Electrolyzers Market Volume (GW/year) | 8.80 | 11.00 | 13.90 |

| Electrolyzers Market Revenue ($Billion) | 8.30 | 10.34 | 12.81 |

| Electrolyzers Market Price ($/KW) | 943.48 | 940.45 | 921.80 |

Electrolyzer Variants:

In electrolysis, there are various processes for producing hydrogen. These differ mainly by the following aspects such as:

- Electrolyte used

- Operating temperature

- Structure of the electrolysis cell

Types of Electrolyzers

Alkaline electrolyzer (AEL):

- The diaphragm, a permeable membrane that separates the two electrodes from each other, serves as the electrolyte in alkaline electrolysis or AEL. The electrodes are submerged in a solution that is alkaline in nature. When a voltage is supplied, oxygen and hydrogen are produced at the anode and cathode, respectively.

- The high long-term stability and inexpensive investment costs of this type of electrolysis are its main advantages. Generally, alkaline electrolysis operates for up to 90,000 hours with an effectiveness of about 65%. There are already electrolysis plants in use globally that have a power capacity of up to 130 megawatts.

Proton exchange membrane electrolyzer (PEM)

- A thin thermoplastic membrane is used as the electrolyte in PEM electrolysis (polymer electrolyte membrane electrolysis). Only positive hydrogen ions can flow through this gas-tight membrane that separates the cathode and anode. This electrolysis process is acidic because of ion migration. As a result, the catalysts must be made of precious metals to prevent corrosion.

- The positive load change behavior of this technology is a benefit. It can function at partial load without any issues and respond promptly to changes in the energy supplied. PEM electrolysis has an efficiency of about 63%, barely lower than alkaline electrolysis. Investment expenses are significantly greater than alkaline electrolysis because the technique is still very young. The plants have a power range of as high as 6 megawatts.

Solid oxide electrolyzer (SOE)

- As an electrolyte, SOE uses a solid ceramic substance to divide the two half-cells. Steam is used to inject water into the reaction chambers. The industrial application of this sort of electrolysis is currently transitioning from research.

- Furthermore, solid oxide electrolyzer, a subset of high-temperature electrolysis, operates between 600-900°C and has a very high efficiency of more than 80%, as well as the investment costs, are comparable to those for PEM electrolysis.

Trends in electrolyzer technology for green hydrogen production

Reduction in the cost of electrolyzers for the production of hydrogen at competitive rates

Among the main fuels for the clean energy transition, green hydrogen is created by electrolyzing water with clean electricity from renewable sources, such as wind and solar.

Since electricity and electrolyzers account for the main portion of manufacturing costs, creating more effective electrolyzers has a significant positive impact on the production of green hydrogen. In addition to these expenses, the additional costs included are operating expenses, transmission and distribution costs, power wheeling charges, and local taxes. For instance, according to the NITI Aayog report, the cost of producing hydrogen through electrolysis is currently ranging from USD 4.10 to USD 7 per kilogram, depending on the technology employed and other associated costs.

Moreover, the average amount of electricity used by electrolyzers to produce per kilogram of hydrogen is 50–55 kilowatt hours. electrolyzers can be as small as a few kilowatts or as large as several megawatts.

The two commercial technologies that are most frequently employed are alkaline and polymer electrolyte membrane (PEM) electrolyzers. In the former, sodium or potassium hydroxide is utilized as a liquid alkaline electrolyte. A solid polymer membrane serves as a partition between the cathode and anode compartments in PEM.

However, solid oxide or ceramic is used as the electrolyte in solid oxide electrolyzers in order to create hydrogen and oxygen. Modern technologies, like electrochemistry, use time cycles to split hydrogen and oxygen that are produced.

Electrolyzers Market Government Policies

Rising government aspirations for deploying electrolysis capacity

Governments are setting goals for deploying the production capacity of low-emission hydrogen to communicate with private partners regarding long-term plans for hydrogen technology. Industrial capacity is gaining some pace as a result, and the goals for implementing hydrogen-generating technologies are expanding rapidly. More than double the 74 GW of 2021, the total national targets for deploying electrolysis capacity now stand around 145-190 GW.

Adoption of new mechanisms by the authority to mitigate investment risks and support project developers

Many projects in development are pioneers and are exposed to different hazards, including a lack of infrastructure, unclear legal frameworks, limited operating expertise, and unreliable demand. Governments can assist project developers by enacting regulations that enable them to reduce risk and capitalize on private capital. Several governments are already implementing such regulations through subsidies, loans, tax incentives, and carbon contracts for difference (CCfDs). Over the past year, there has been an incredibly high volume of activity, leading to several noteworthy announcements:

- United States: The US Congress approved the Bipartisan Infrastructure Law in 2021, which provided funding for the construction of hydrogen hubs as well as incentives to support infrastructure and the manufacture of electrolysis equipment. A large-scale hydrogen storage project received a USD 504 million loan guarantee, which was finalized by the US DOE Loan Program Office. Several tax credits and grant funds are available to assist hydrogen technology under the Inflation Reduction Act, which was signed in August 2022.

- European Union: With a focus on hydrogen technology, the European Commission granted financing of USD 5.6 billion in July 2022 to support its first hydrogen-related Important Project of Common European Interest (IPCEI). In late 2022 and early 2023, three additional IPCEIs addressing industrial applications, hydrogen infrastructure, and mobility are anticipated.

- Germany: Germany started the H2Global program in 2021, which employs a method similar to the CCfD strategy and leverages grant financing from the German government to cover the gap between supply prices (manufacturing and transportation) and demand pricing. Also, initiation bidding is anticipated to begin in 2022.

- United Kingdom: A business plan for low-carbon hydrogen based on a methodology comparable to CCfDs was proposed by the United Kingdom for public comment in 2021. The government plans to complete the business plan in 2022 and assign the first support contract to projects in 2023 that have reached a final investment decision.

Electrolyzers Market Investment for Deployment

Investment in the deployment of electrolyzers reached USD 1.5 billion in 2021

In 2021, electrolyzer capacity went online more than ever before. Additionally, in 2022, it was planned to operate electrolyzers with a capacity of almost 900 MW. It is estimated that more than USD 1.5 billion was spent on projects at advanced stages in 2021, that is, those with a final investment decision and under construction, the majority of which projects aim for establishing in 2022 and the upcoming future. The quantity of capital invested in projects increases along with their size and frequency and is only marginally countered by falling prices. Compared to the same spending in 2020, there has been a threefold rise.

Technological Deployment in the Electrolyzers Market

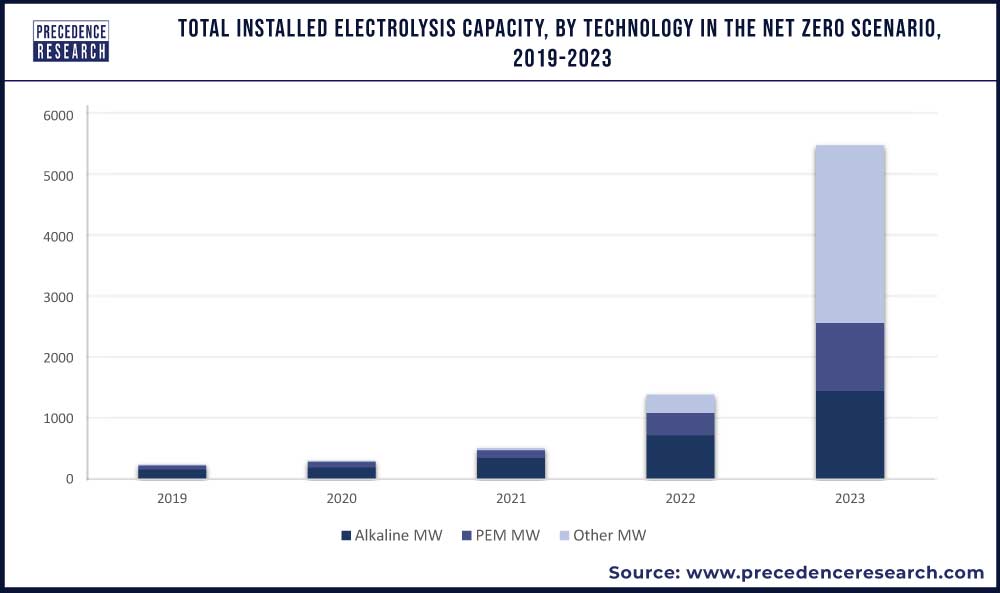

By the end of 2022, the global electrolysis capacity exceeded 1GW

The technique of electrolyzers is widely utilized in the chlorine-alkaline sector for producing sodium hydroxide and chlorine. The capacity of installed electrolysis in this industry has surpassed 20 GW. However, until the last decade, when operations started to increase, the deployment of electrolyzers for the specific production of hydrogen was slow. With more than 200 MW of electrolysis operational capacity, there was a threefold growth over the year 2020, and total installation capacity reaching more than 500 MW, a approximately 70% increase over the previous year's record, 2021 saw substantial growth in the additions of yearly capacity and became the year with the considerable deployment in the recorded series.

Furthermore, according to the pipeline of projects in development, the total capacity of electrolysis worldwide was predicted to nearly triple from 2021 to the end of 2022, or 1.4 GW. If projects are completed on schedule, they might increase by 10 times in 2023. If all pipeline projects are completed by 2030, the worldwide electrolysis capacity might reach between 134 to 240 GW.

Electrolyzer Production Capacity: Future Aspects

How future demand for electrolyzers will expand the production capacity?

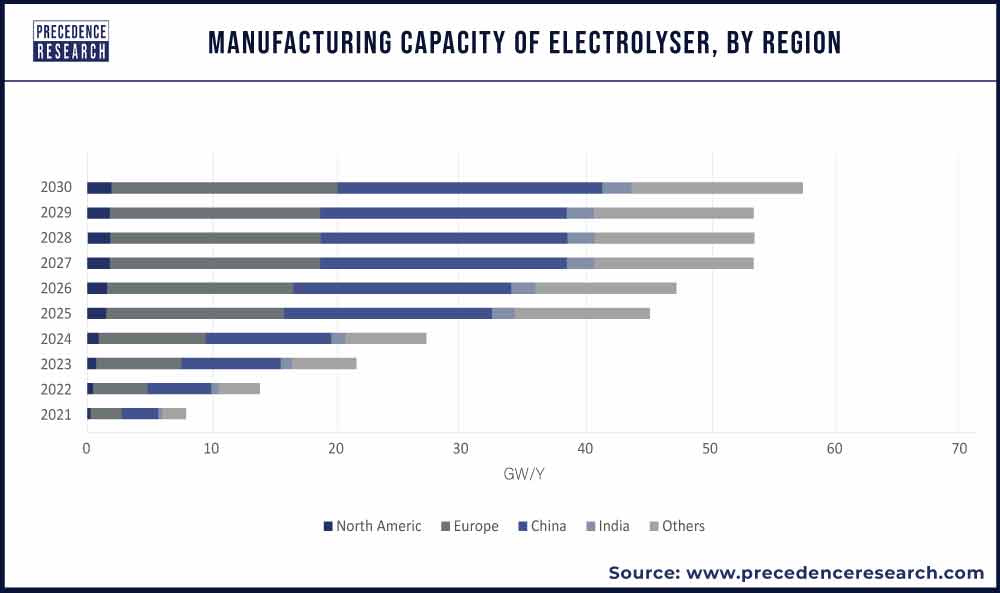

Compared to 2020, the yearly production capacity of electrolyzers increased to about 8 GW in 2021. More than 80% of the world’s manufacturing capacity is in Europe and China. Due to the current market expansion, anticipated future demand growth, and the fact that investing in large manufacturing facilities is a long-term choice, thus manufacturers have begun to increase their production capacity. According to the company’s statement, the capacity for manufacturing electrolyzers globally could exceed 65 GW annually by 2030. Almost two-thirds of the technological capacity is used to produce alkaline electrolyzers, and the remaining 5% is used to produce proton exchange membrane (PEM) electrolyzers.

Impact of the Russia-Ukraine Crisis on the Electrolyzers Market

For European and German authorities, expanding the hydrogen market is becoming more critical than ever because of the gas crisis in Europe and the Russian invasion of Ukraine. But the European Union and its fledgling hydrogen economy face a significant barrier to achieving ambitious goals for green hydrogen. Aside from the need for electricity, the production of electrolyzers is severely lacking. The planned expansion of electrolyzer manufacturing is nearly hard to carry out, interferes with efforts to promote imports, and creates new reliance on suppliers of essential raw materials and vital parts. Although decoupling from Russia's raw material supply is typically feasible, the EU cannot meet its objectives without China.

In addition to relaxed rules and aggressive raw material supply management, Europe may reconsider its unbalanced preference for green hydrogen. Also, Europe must increase its electrolysis capacity while simultaneously securing its market share in the production of electrolyzers.

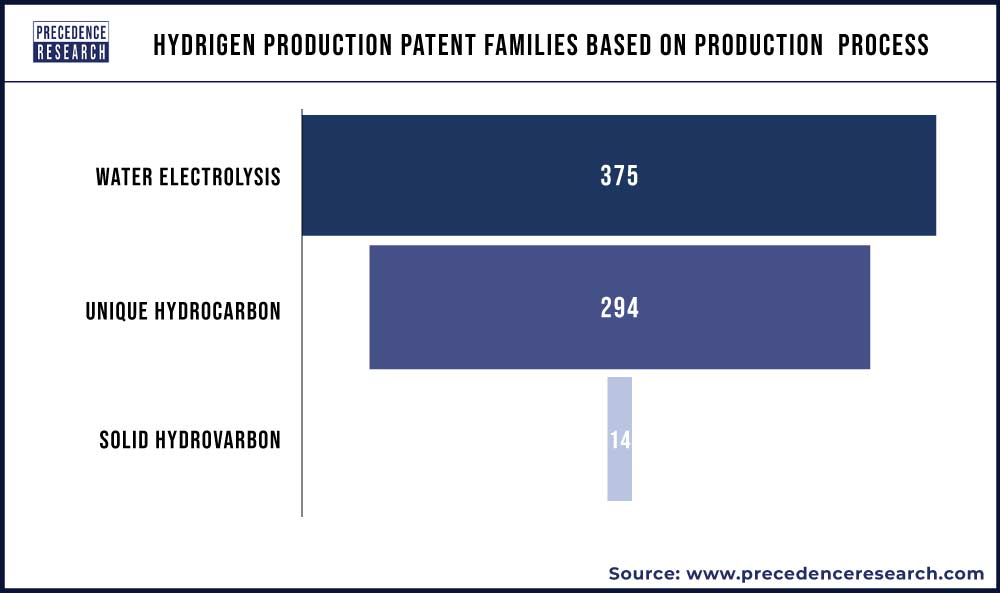

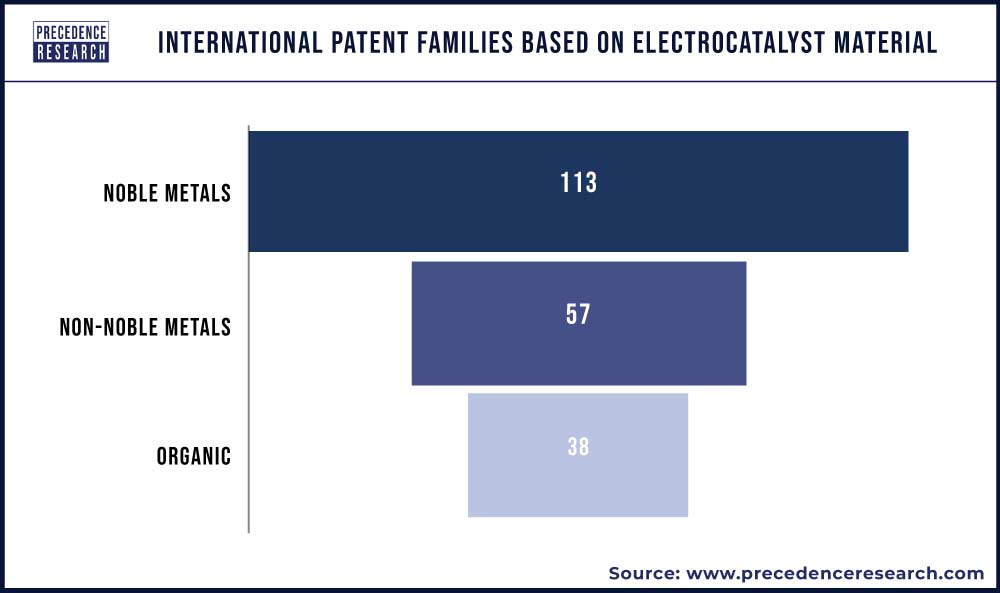

Electrolyzers Market: Patent Insights for Hydrogen Production

According to the analysis by the EPO and the International Renewable Energy Agency, patent applications for methods of producing hydrogen using water electrolysis have increased on average by 18% annually over the last two decades.

These technological advances are essential for addressing climate change. Hydrogen generated through water electrolysis is anticipated to be at the center of the shift to more environmentally friendly energy production because it is a low-carbon process.

Recent and Future Innovations in the Global Electrolyzers Market

There are several upcoming developments and innovations in the electrolyzers industry that are being developed by the key players such as Cummins Inc., Green Hydrogen Systems, Enapter S.r.l., Sunfire GmbH., Siemens Energy, Plug Power Inc., Nel ASA, ITM Power PLC, HydrogenPro ASA, and Ohmium International, Inc. in the market. For instance,

- In April 2023, to deploy the promising technology on an industrial scale and manufacture affordable green hydrogen, industries and energy firms require effective electrolyzers on a large scale; thus, Sunfire and Fraunhofer IFAM and Ionomr Innovations, a Canadian materials partner, are launching the "Integrate" research project.

- In March 2023, With the introduction of the water-cooled version of their AEM electrolyzers EL 4.0, Enapter AG expanded its product line by adding a new standardized gadget. To improve thermal control and effectively utilize waste heat, the AEM Electrolyzer EL 4.0 Liquid-Cooled (LC) allows for the direct connection of an external cooling system.

- In October 2022, Cummins Inc. started manufacturing electrolyzers in the US, demonstrating the company's ongoing commitment to promoting the country's hydrogen economy. Production of electrolyzers begins in Minnesota, with a yearly manufacturing capacity of 500 megawatts, and it is expected to eventually scale up to 1 gigawatt.

View Full Insight@ https://www.precedenceresearch.com/electrolyzer-market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

About the Authors

Aditi Shivarkar

Aditi, Vice President at Precedence Research, brings over 15 years of expertise at the intersection of technology, innovation, and strategic market intelligence. A visionary leader, she excels in transforming complex data into actionable insights that empower businesses to thrive in dynamic markets. Her leadership combines analytical precision with forward-thinking strategy, driving measurable growth, competitive advantage, and lasting impact across industries.

Aman Singh

Aman Singh with over 13 years of progressive expertise at the intersection of technology, innovation, and strategic market intelligence, Aman Singh stands as a leading authority in global research and consulting. Renowned for his ability to decode complex technological transformations, he provides forward-looking insights that drive strategic decision-making. At Precedence Research, Aman leads a global team of analysts, fostering a culture of research excellence, analytical precision, and visionary thinking.

Piyush Pawar

Piyush Pawar brings over a decade of experience as Senior Manager, Sales & Business Growth, acting as the essential liaison between clients and our research authors. He translates sophisticated insights into practical strategies, ensuring client objectives are met with precision. Piyush’s expertise in market dynamics, relationship management, and strategic execution enables organizations to leverage intelligence effectively, achieving operational excellence, innovation, and sustained growth.

Request Consultation

Request Consultation