The global fertilizer market size was valued at USD 212.8 billion in 2023 and is envisioned to hit around USD 285.01 billion by 2032, at a CAGR of 3.30% from 2023 to 2032.

Fertilizer is the artificial or natural material that contains chemical elements and is added to the soil to promote productivity and growth of plants. Along with the natural elements such as hydrogen, carbon, and oxygen, the plants need several crucial nutrients for their health and growth. Commercial fertilizers offers primary nutrients to the plants including phosphorus (P), nitrogen (N), and potassium (K). In addition, some fertilizers offers nutrients such as sulphur (S), calcium (Ca), zinc (Zn), magnesium (Mg), iron (Fe), boron (B), copper (Cu), molybdenum (Mo), manganese (Mn), chlorine (Cl), nickel (Ni), and iodine (I).

The fertilizers are classified into two main categories including organic and inorganic fertilizers. The natural fertilizers are derived from animals or plants are referred as organic fertilizers. These fertilizers can be obtained from agricultural waste, livestock manure, municipal sludge, and industrial waste. On the other hand, chemical fertilizers generated by artificial techniques are known as inorganic fertilizers.

Application of fertilizers to the farmland also helps in enhancing the water holding capacity of soil. In addition, it helps in augmenting the plants’ tolerance towards pests and decreases their dependence on herbicides and insecticides, thus producing healthier crops.

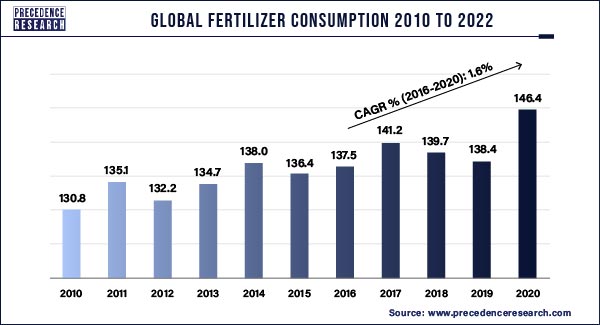

According to the World Bank Group, the demand for fertilizers is expected to boost in the upcoming years. The total fertilizer consumption per hectare of arable land has increased at a CAGR of 1.6% from 2016 to 2020.

Nitrogen Content Fertilizer Sales Dominated the Market in Past Years:

- In 2021, according to the Central Statistics Office, a statistical agency of Ireland, Nitrogen Content Fertilizer was dominant among other nutrients and is expected to maintain its dominance during the upcoming future.

- Phosphorus accounted for significant share of 22%.

- The nitrogen content of fertilizers sold in 2021 was around 5% higher than in 2020 at 399,164 tons.

- Moreover, phosphorus content fertilizers sold in 2021 has observed a year-on-year growth of 4% in 2020 at 46,068 tons.

Fertilizers Market: Value Chain Analysis

The value chain of global fertilizers market comprises of procurement of raw materials, manufacturing, distribution and support.

- Procurement of raw materials: The fertilizer manufacturing comprises of major raw materials including sulfur, potassium salts, hydrocarbon sources (mainly natural gas), micro-nutrients, phosphate rock, water, and air. The raw material suppliers may face challenges such as fluctuating prices for materials and supply chain disruptions.

- Manufacturing: Manufacturing in the fertilizers industry is a process of uniting different raw materials together to create a fertilizer product. The global industry mainly manufactures basic fertilizer chemicals including phosphate, urea, ammonium nitrate, ammonia, and nitric acid. Manufacturing processes are generally automated and involves higher degree of advanced engineering and technology.

- Distribution: After the manufacturing, the fertilizers must be transported to the blender plant, mixed together, packaged and shipped to the consumer or distributor. The transport and distribution of ffertilizers needs a significant investment due to their weight.

- End user: End users such as farmers, small-medium scale flower garden operators, government operated/assisted projects adds value to the global fertilizers market supply chain.

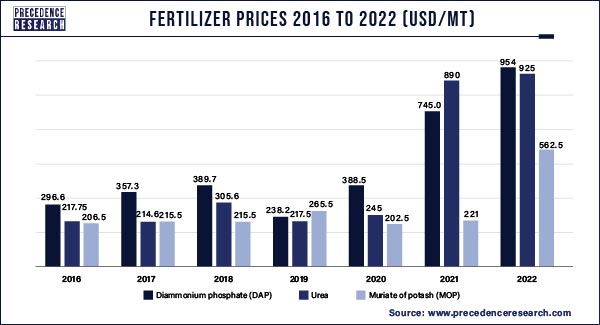

In 2021, the increase in natural gas prices caused a declining production of ammonia, a key component needed for nitrogen fertilizer. In addition, disruptions in supply chains caused the fluctuations in the price of fertilizer.

The following chart shows varying fertilizer prices over the past years:

How Market Potential in Fertilizers Industry Looks Like?

In the developing countries such as India, about 60% population depends on agriculture for their livelihood. In such countries, fertilizers are playing an important role across the agricultural yields. This way, fertilizer industry significantly influence the overall economy of agriculture and the life across rural India. Growing fertilizer prices are impacting the demand for fertilizers and food production across the developing countries.

- For instance, according to the World Bank data, fertilizer prices in September 2022 climbed by 6% compared to September 2021. Further, according to the International Fertilizer Development Center, a nonprofit organization, a fertilizer demand in sub-Saharan Africa was expected to fall 30% in 2022. This reduction in the fertilizer demand has resulted into the declined food production by 30 million metric tons, which is equivalent to food needed for 100 million people.

Fertilizers Market: Investment Opportunities

The global fertilizers industry offers a range of investment opportunities for investors. Some potential investment opportunities in the industry include:

- Fertilizer demand from developing countries: The developing countries including China, India, Mexico, and others are seeing huge demand for food products. For instance, India is the second-largest fertilizer consumer with the consumption of over 55 million tons of fertilizers annually. Also, the country is one of the largest agricultural producers offering crops such as rice, potatoes, groundnut, pulses, and wheat.

- Government support: Governments across the globe are focusing on providing maximum support to farmers by enabling the easier access to newer technologies and subsidized fertilizers. The governments aimed at boosting the agriculture productions and, thereby, contributing to the fertilizer production. For instance, the Department of Fertilizer in India has implemented schemes such as Nutrient Based Subsidy Scheme (NBS), Urea Subsidy Scheme, and Direct Benefit Transfer (DBT) projects for fertilizer subsidy payments to ensure adequate availability of fertilizers to the farmers.

- Shift toward the use of organic fertilizers: There is a burgeoning trend and move towards the use of organic fertilizers due to surge in awareness of the harmful impact of chemical of synthetic fertilizers on both the environment and humans. In addition, people are choosing organic foods and are ready to pay a higher prices for them. This factor is anticipated to ultimately accelerate the global fertilizer market growth over the upcoming years.

- Increasing fertilized area: Fertile soil offers vital nutrients for plant growth to produce healthier food with all the essential nutrients required for human health. As the need for healthier food grows, overall fertilized area is also growing across the globe, creating the lucrative investment opportunities.

- Technology integration: The integration of advances such as Big Data and Internet of Things are projected to increase investment opportunities in the fertilizers market. The Data collection systems have become significantly advanced. The continuous data analyses and collection helps to identify deficiencies in the fertility of the soil to bring right inputs at the right time. Also, the internet platforms and apps are being used for monitoring the crop health and to provide recommendations on mediate deficiencies for the soil.

The fertilizers market is highly competitive and subject to rapid transformations or changes due to supply chain disruptions, which can pose risks to investors. It is important for investors to conduct thorough research and analysis before making any investment decisions. The top fertilizers manufacturing companies across the globe includes CF Industries, Israel Chemicals Ltd., Nutrien Limited, The Mosaic Company, Yara International, Haifa Group, Syngenta AG, EuroChem Group, OCP Group S.A., K+S Aktiengesellschaft, Uralkali and many more. The fertilizers market is highly fragmented due to the presence of huge number of market players. These players are constantly engaged in research & development, acquisitions & mergers, new product launches, and partnerships to gain a competitive edge over others and exploit the prevailing market opportunities.

- For instance, in February 2022, The Mosaic Company, a global manufacturer of agricultural fertilizers and chemicals acquired Plant Response, a provider of biological-based solutions, recovered waste fertilizers and other crop input technologies.

- In January 2022, Norway's Yara, a top global nitrogen fertiliser maker and Sweden's Lantmaennen, a Swedish agricultural cooperative announced to introduce products that are anticipated to become the world's first fossil-free nitrogen fertilizers in order to decarbonize food production.

SWOT Review of the Fertilizers Market

Strengths

- Support from farmers and end users across the developed and developing countries. Farmers prefers to use fertilizers to increase the farming production.

- Various governments across the developing countries subsidizing the use of fertilizers. For instance, recently, Department of Fertilizers (DoF) in India introduced a Direct Beneï¬t Transfer (DBT) project for fertilizer subsidy payment with a vision to enhance fertilizer service delivery to farmers.

- Experts in the farming industry typically recommend high quality fertilizers to increase the farming productivity.

- The number of distributors and dealers of fertilizers is increasing across the globe along with growing farming industry. In addition, the leading market players are focusing on expanding their dealer networks. For instance, National Fertilizers, the Indian fertilizer industry player has built a significantly strong relationship with its dealer network that helps in supplying the products to the end users and promotes the company’s products.

Weaknesses

- The global supply chains of fertilizer can be disrupted due to various factors such as the COVID-19 pandemic, trade wars, natural disasters, and logistics delays and failures. This leads to the increased prices of fertilizer and impacts agriculture and food production globally. During the COVID-19 pandemic, the farmers were unable to get adequate number of laborers needed to work in their fields. Also, the fertilizer production rates fell to over 20% of total capacity causing a huge impact on the supply of fertilizers.

- Shrinking profit margins due to high competitive pricing in the global fertilizer industry is one of the prominent weakness. The fertilizer industry revenue mainly depends on fertilizer prices; however, the competitive pricing by the leading market payers is impact on product prices.

Opportunities

- Fertilizers helps in providing crops with nutrients such as phosphorus, potassium, and nitrogen. These nutrients enables crops to grow faster, bigger, and to produce more food. Farmers need to produce more food to feed the growing population, thus creating demand for fertilizers.

- This trend drives a process of diet convergence among developed and developing countries. It enables the agricultural production to grow at a faster rate.

- The leading market players are focusing on marketing strategies that helps in boosting their growth. The companies are also extending their digital and a social media presence.

Threats

- Global economic uncertainty and volatility, which can impact consumer/farmers’ spending and demand for fertilizers. According to the USDA Foreign Agricultural Service, fertilizer prices accounts for about one-fifth of farming cash costs in the U.S. In addition, the fertilizer accounts for 36% of an operating costs of farmer for corn, and 35% for wheat. These elevated prices of fertilizers were attributed to the economic uncertainty and volatility cause by COVID-19 pandemic and Russian-Ukraine conflict.

- Increasing prices of Hydrocarbon and other raw materials due to supply chain disruptions may impact negatively and creates a significant threat to the global fertilizer industry growth.

- Shortage of raw material in the global market

- Lack of investments into the modern technologies

This SWOT analysis is not exhaustive, and there may be other factors that could impact the global Fertilizers industry in the foreseeable future. Additionally, the impact of the COVID-19 pandemic and Russia-Ukraine conflict on the industry cannot be overlooked, as it has led to significant disruptions and changes in end user behavior.

Vital Factors to Examine Before Making Investments in the Global Fertilizers Market:

- Government Subsidies: The governments of developed and developing countries usually fixes the selling price of fertilizer and provide subsidies to the companies. This may help in creating a steady revenue stream for the fertilizer company.

- Dominating Type of Fertilizer: Nitrogen is the leading type of fertilizer being sold across the globe as nitrogen is one of the vital nutrients essential for the plants’ growth.

- Capital: Fertilizer companies across the globe needs to invest a big amount of money in the business both in the working capital as well as fixed capital. Particularly, the urea manufacturing plants needs higher working capital than other fertilizers.

- Seasonality: The growth of fertilizer business is significantly dependent on monsoon; thus, fertilizer industry has a seasonal nature.

- Regulations: Fertilizer businesses are tied with farming sector and is critical for food security of a country. Due to this reason, fertilizer companies around the globe are subject to a number of heavy regulations.

Major Breakthroughs in the Global Fertilizers Market:

There are several upcoming innovations in fertilizers industry that are being developed by various companies. Here are some examples:

- Slow-release fertilizers: This is a recent development in the global fertilizers industry with the formulations typically consisting of tiny capsules filled with constituents that include phosphorus, nitrogen, and other desired nutrients. This technology make fertilizers more efficient.

- Precision farming: The precision farming technology uses controlled-release fertilizers and minimizes excessive nutrient release and improves crop yield. The technology makes use of technology combination of artificial intelligence (AI), data analytics, and different sensor systems to control how much water and fertilizer plants need. The autonomous vehicles are deployed to deliver nutrients in prescribed locations and amounts.

- Smarter fertilizers: The need to feed growing population has enabled farmers to increase crop yields. This has created the demand for fertilizers; however, standard versions of fertilizer may work inefficiently and often harm the environment. To eliminate this challenge, farmers are using smart controlled-release technologies to fertilizers more efficient.

- Use of Advanced Food Tracking and Packaging: According to the World Health Organization, about 600 million people suffers food poisoning every year and around 420,000 die as a result. The advanced food tracking and packaging technologies helps in reducing both the food poisoning and food waste.

- Move towards digitization in fertilizer industry: In April 2018, Nutrien, a Canadian fertilizer company introduced a digital ag platform to help farmers manage the fertilizer application, timing of planting, and harvesting using soil and weather data.

View Full Report@ https://www.precedenceresearch.com/fertilizer-market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

About the Authors

Aditi Shivarkar

Aditi, Vice President at Precedence Research, brings over 15 years of expertise at the intersection of technology, innovation, and strategic market intelligence. A visionary leader, she excels in transforming complex data into actionable insights that empower businesses to thrive in dynamic markets. Her leadership combines analytical precision with forward-thinking strategy, driving measurable growth, competitive advantage, and lasting impact across industries.

Aman Singh

Aman Singh with over 13 years of progressive expertise at the intersection of technology, innovation, and strategic market intelligence, Aman Singh stands as a leading authority in global research and consulting. Renowned for his ability to decode complex technological transformations, he provides forward-looking insights that drive strategic decision-making. At Precedence Research, Aman leads a global team of analysts, fostering a culture of research excellence, analytical precision, and visionary thinking.

Piyush Pawar

Piyush Pawar brings over a decade of experience as Senior Manager, Sales & Business Growth, acting as the essential liaison between clients and our research authors. He translates sophisticated insights into practical strategies, ensuring client objectives are met with precision. Piyush’s expertise in market dynamics, relationship management, and strategic execution enables organizations to leverage intelligence effectively, achieving operational excellence, innovation, and sustained growth.

Request Consultation

Request Consultation