What is the Nickel Market Size?

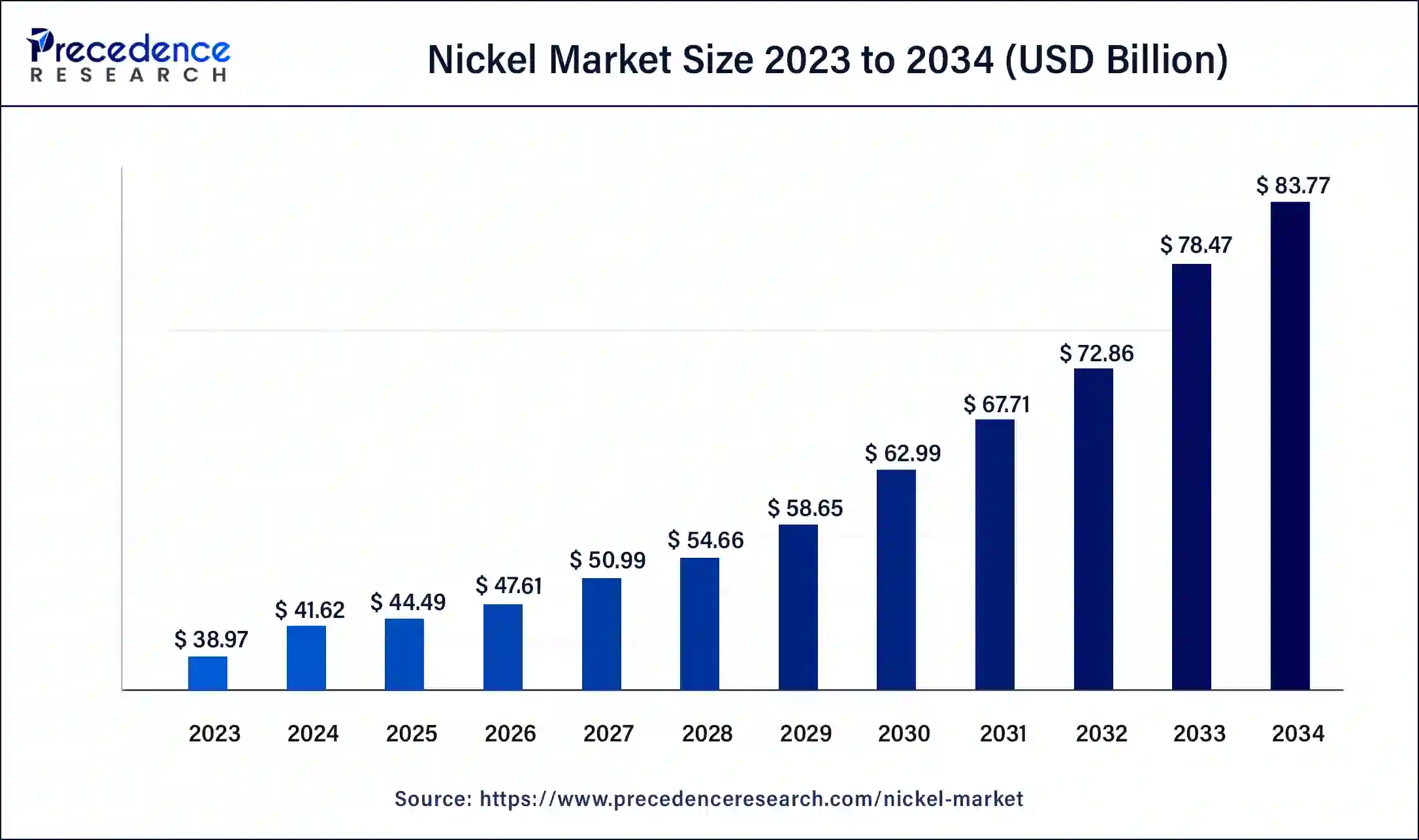

The global nickel market size was calculated at USD 44.49 billion in 2025 and is expected to reach around USD 83.77 billion by 2034, expanding at a CAGR of 7.25% from 2025 to 2034.

Market Highlights

- The global nickel market was valued at USD 41.62 billion in 2024.

- It is projected to reach USD 83.77 billion by 2034.

- The nickel market is expected to grow at a CAGR of 7.25% from 2025 to 2034.

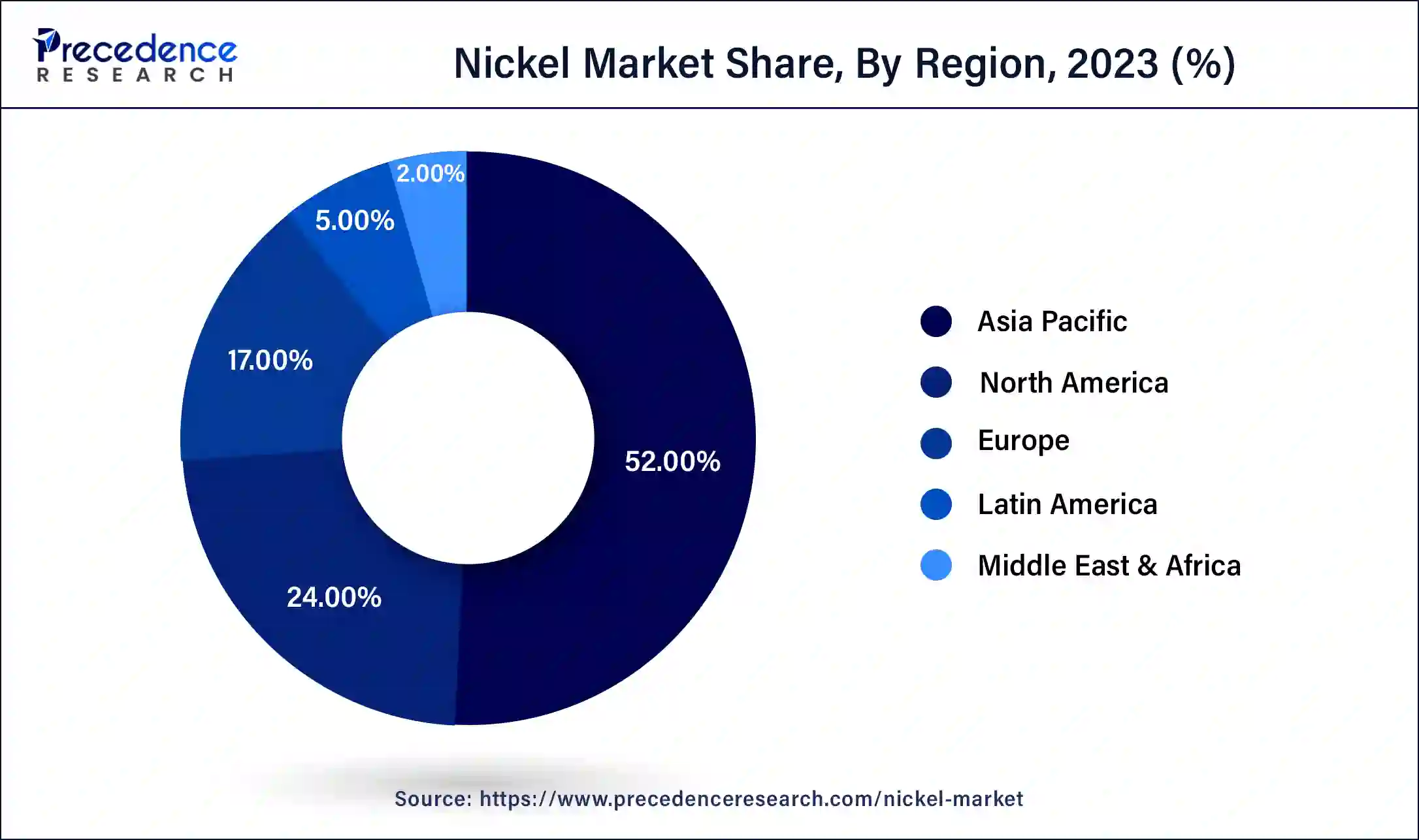

- Asia-Pacific contributed more than 52% of market share in 2024.

- North America is estimated to witness the fastest CAGR between 2025 and 2034.

- By class type, the class 1 (99.8%) segment has held the largest market share of 57% in 2024.

- By class type, the class 2 (<99.8%) segment is anticipated to grow at a remarkable CAGR of 8.12% between 2025 and 2034.

- By application, the stainless-steel segment generated over 32% of market share in 2024.

- By application, the electroplating segment is expected to expand at the fastest CAGR over the projected period.

Market Size and Forecast

- Market Size in 2025: USD 44.49 Billion

- Market Size in 2026: USD 47.61 Billion

- Forecasted Market Size by 2034: USD 83.77 Billion

- CAGR (2025-2034): 7.25%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

Nickel, denoted by the symbol Ni and atomic number 28, is a versatile metallic element valued for its corrosion resistance and silvery-white appearance. This transition metal finds extensive use in industry, particularly in the production of stainless steel, alloys, and currency. Its robust properties, including high-temperature resilience and resistance to oxidation, make nickel a key component in manufacturing processes for industrial equipment, aerospace components, and electrical appliances.

Furthermore, nickel's contribution to rechargeable batteries, such as lithium-ion batteries prevalent in electronics and electric vehicles, underscores its significance in advancing technology and renewable energy. While indispensable in various applications, it's important to note that prolonged exposure to nickel may pose health risks, particularly for individuals prone to allergic reactions.

Nickel Market Data and Statistics

- As per the International Stainless Steel Forum (ISSF), the global production of stainless steel demonstrated a substantial year-on-year increase of 10.6%, reaching 56.3 million metric tons in 2021.

- Chinese stainless steel mills, as key contributors to the industry, consumed more than half of the primary nickel. In 2021, China witnessed a noteworthy year-on-year expansion of 1.6% in stainless steel production, culminating in a total of 30.6 million metric tons. This figure represents a significant 54.4% share of the entire global stainless steel output.

- According to data from the World Bureau of Metal Statistics, India also made strides in stainless steel production, hitting approximately 4 million metric tons in 2021. This marked a noteworthy year-on-year growth of 25% during the period between 2020 and 2021.

Nickel Market Growth Factors

- The global shift towards electric vehicles is a pivotal driver for the nickel market. Nickel, a vital component in the production of lithium-ion batteries for electric vehicles, sees increased demand as the adoption of electric vehicles continues to grow, fostering the expansion of the nickel market.

- The manufacturing of stainless steel significantly propels the demand for nickel. With ongoing growth in the construction and infrastructure sectors, the need for stainless steel in applications such as building materials, pipelines, and automotive components contributes to the overall expansion of the nickel market.

- Nickel's widespread use in diverse industrial applications, including aerospace, electronics, and chemical processing, is a key factor in its demand. The expansion of these industries, spurred by technological advancements and global industrialization, directly impacts the increased need for nickel.

- The continuous development of infrastructure projects on a global scale, particularly in emerging economies, drives the demand for nickel. Materials with high corrosion resistance, such as nickel-containing alloys, are favored in infrastructure projects, thus boosting the overall nickel market.

- Nickel's essential role in the renewable energy sector, particularly in crafting nickel-based batteries for storing renewable power, is noteworthy. With the global shift towards renewable energy, the demand for nickel in energy storage solutions is set to experience substantial growth.

- Trends in urbanization and the increasing production of consumer goods contribute substantially to the demand for nickel. The rise in construction activities associated with urbanization, coupled with the production of consumer goods like appliances, electronics, and packaging materials, underscores the integral role of nickel in supporting overall market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 44.49 Billion |

| Market Size in 2026 | USD 47.61 Billion |

| Market Size by 2034 | USD 83.77 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.25% |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Class Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Infrastructure demand

China's Belt and Road Initiative, a massive infrastructure project, alone is expected to involve investments exceeding $1 trillion, boosting nickel consumption in construction and transportation sectors.

The surge in infrastructure demand is a substantial driver for the increased market demand for nickel. Infrastructure projects, spanning construction, transportation, and utilities, often require materials with high corrosion resistance, making nickel-containing alloys a preferred choice. The robust properties of nickel contribute to the durability and longevity of structures, particularly in challenging environments. As emerging economies embark on extensive infrastructure development initiatives, the demand for nickel rises significantly, fueling its market growth.

Moreover, the use of nickel extends beyond traditional construction to encompass modern infrastructure requirements such as bridges, tunnels, and advanced energy systems. Nickel's role in creating materials with superior strength and resistance to harsh conditions positions it as a critical component in the evolving landscape of global infrastructure. This sustained demand is poised to persist as nations continue to invest in large-scale infrastructure projects, further establishing nickel's integral role in meeting the challenges of contemporary construction and development needs.

Restraint

Supply chain disruptions

Supply chain disruptions serve as significant restraints in the nickel market, impacting market demand in various ways. The nickel market is highly dependent on a complex global supply chain involving mining, processing, transportation, and manufacturing. Any disruption at any stage, whether due to geopolitical tensions, trade restrictions, or unexpected events like natural disasters, can lead to shortages and hinder the market's ability to meet demand. These disruptions not only affect the availability of nickel but also contribute to price volatility, making it challenging for industries relying on nickel to plan and maintain stable operations.

Moreover, the interconnected nature of the global economy means that disruptions in one region can have cascading effects on the entire nickel supply chain. In recent years, events like trade disputes and the COVID-19 pandemic have highlighted the vulnerability of the nickel market to such disruptions. To mitigate these restraints, stakeholders in the nickel industry need to focus on building resilient supply chains, diversifying sources, and implementing contingency plans to navigate unforeseen challenges and ensure a more stable and sustainable market.

Opportunity

Recycling initiatives

Recycling initiatives present promising opportunities in the nickel market by addressing sustainability concerns and fostering a circular economy. As the global focus on environmental responsibility intensifies, there is an increasing emphasis on recycling nickel-containing materials, such as batteries and stainless steel. Developing efficient recycling processes for these materials not only mitigates the environmental impact of nickel extraction but also ensures a more secure and sustainable supply chain.

Furthermore, recycling initiatives contribute to the conservation of valuable resources, reducing the dependence on primary nickel production. Industries are recognizing the economic and environmental benefits of incorporating recycled nickel into manufacturing processes, leading to the emergence of new markets and applications. The growth of recycling in the nickel market aligns with broader environmental goals, creating a win-win scenario where sustainable practices meet the increasing demand for nickel in various industries.

Segments Insights

Class Type Insights

The class 1 (99.8%) segment had the highest market share of 57% in 2024. In the nickel market, Class 1 nickel, characterized by its high purity level of 99.8% or above, represents a premium category of nickel products. This segment is primarily sourced from sulphide ores and is known for its superior quality, making it a preferred choice in critical applications, including aerospace, electronics, and high-performance alloys. The Class 1 nickel market is witnessing a growing demand trend, driven by the increasing requirements for advanced materials in technological and industrial sectors that prioritize the exceptional properties and reliability offered by high-purity nickel.

The class 2 (<99.8%) segment is anticipated to expand at a significant CAGR of 8.12% during the projected period. In the nickel market, Class 2 nickel refers to material with a purity level below 99.8%. This segment includes nickel derived from various sources, such as nickel pig iron and ferronickel. Despite its slightly lower purity, Class 2 nickel is crucial for stainless steel production and the manufacturing of nickel alloys. Recent trends indicate a steady demand for Class 2 nickel, driven by the robust growth in stainless steel applications, infrastructure development, and the expanding electric vehicle market, where nickel is a key component in battery production.

Application Insights

The stainless steel has held a 32% market share in 2024. In the nickel market, the stainless steel segment refers to the utilization of nickel in the production of stainless steel alloys. Stainless steel, renowned for its corrosion resistance and durability, finds extensive applications in construction, automotive, and manufacturing sectors. The trend in this segment involves continuous innovations in stainless steel formulations, production processes, and the rising demand for high-performance materials. As global infrastructure and construction projects expand, the stainless steel segment is poised for growth, driving sustained demand for nickel in the development of corrosion-resistant and robust stainless steel products.

The electroplating segment is anticipated to expand fastest over the projected period. In the nickel market, the electroplating segment involves the application of a thin layer of nickel onto a metal surface through electrochemical processes. This enhances corrosion resistance, durability, and aesthetics, making it pivotal in industries like automotive, electronics, and aerospace. A growing trend in electroplating includes the adoption of advanced techniques to improve efficiency and reduce environmental impact. Innovations in green electroplating methods, such as pulse plating and non-toxic electrolytes, align with sustainability goals and contribute to the evolution of the nickel market in this application.

Stainless steel has a wide range of uses covering almost all sectors of industry, ranging from automotive and construction to healthcare, sanitary, design, and decoration. According to the data released by the Stainless-Steel Council of China Iron and Steel Association (CSSC) on April 25, China's crude stainless-steel output reached 9.62 million tonnes in the first quarter of 2025, rising by 599,300 tonnes or 6.6% from the same period last year.

Regional Insights

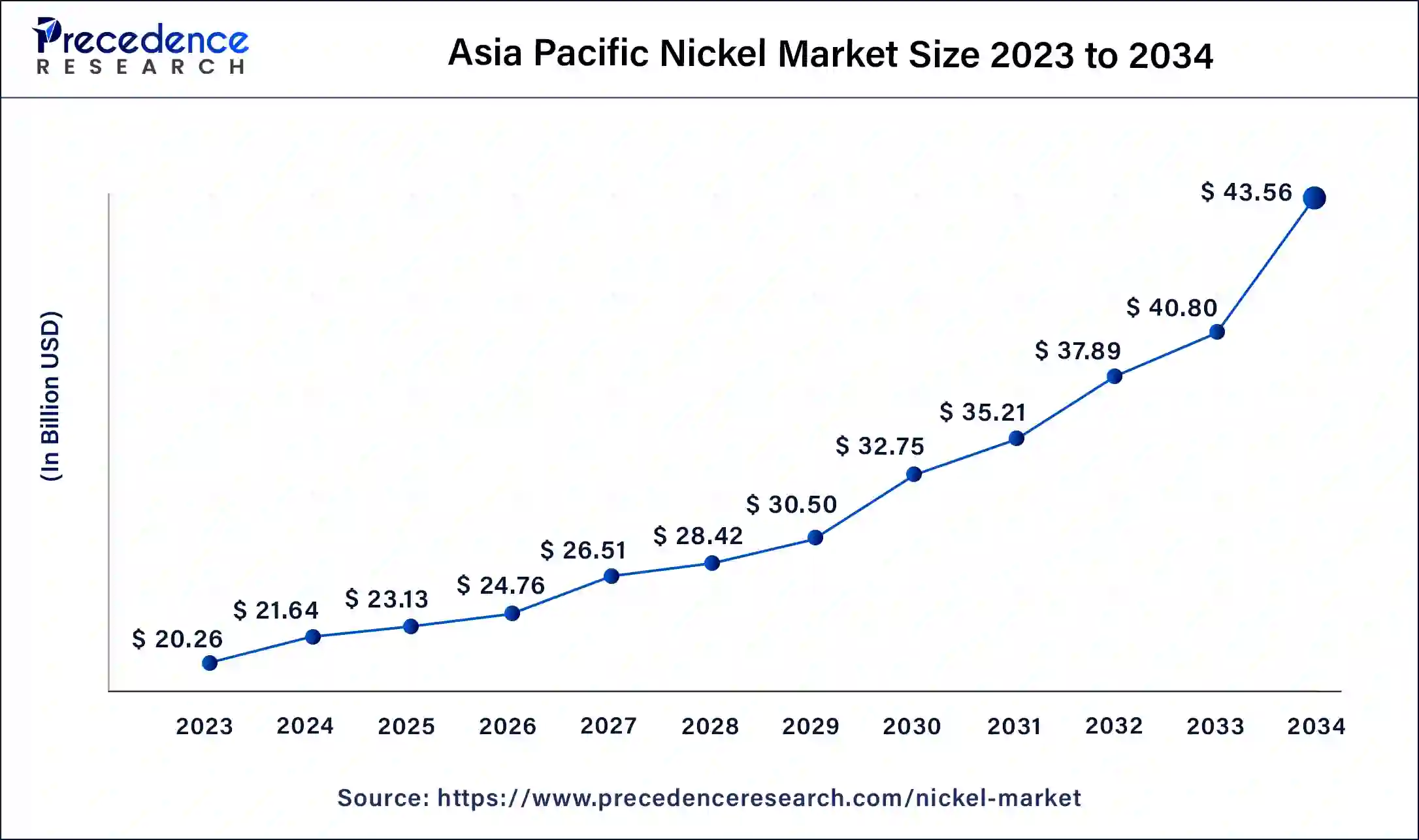

Asia Pacific Nickel Market Size and Growth 2025 to 2034

The Asia Pacific nickel market size was valued at USD 23.13 billion in 2025 and is expected to reach around USD 43.56 billion by 2034, growing at a CAGR of 7.40% from 2025 to 2034.

Asia-Pacific held a dominating share of 52% in the nickel market due to rapid industrialization, robust infrastructure development, and the region's dominance in key industries.

- In November 2024, PT Vale and GEM Co., a Chinese battery metal producer, signed a project investment cooperation framework agreement to establish a high-pressure acid leach (HPAL) facility in Indonesia's central Sulawesi province. The investment worth USD 1.42 billion in the plant will process nickel laterite ore from the Vale unit into 66,000 tonnes of mixed hydroxide precipitate annually.

- China stands as the forefront leader in the electric car market, outpacing the United States with fourfold higher sales of new electric vehicles. In 2021, a noteworthy 3.3 million units of Electric Vehicles (EVs) were purchased in China, reflecting a remarkable 154% surge from the 1.3 million units sold in 2020.

China, a major contributor, leads in stainless steel production and the electric vehicle market, both driving nickel demand. Moreover, the expanding manufacturing and construction sectors in emerging economies within the Asia-Pacific region further contribute to the substantial market share. The continuous growth in these industries, coupled with a rising focus on renewable energy, positions Asia-Pacific as a key player in the global nickel market.

North America is gearing up for accelerated growth in the nickel market, primarily propelled by rising demand in electric vehicles (EVs) and renewable energy applications. The region's commitment to clean energy transitions is fueling substantial investments in EV infrastructure and energy storage projects, where nickel plays a pivotal role. As North America intensifies its green initiatives and modernizes industrial practices, the demand for nickel, essential in batteries and alloys, is set to experience significant expansion.

- In March 2025, First Atlantic Nickel Corp. announced a strategic research partnership with Colorado School of Mines to explore geologic hydrogen as an energy source in Newfoundland Ophiolites. First Atlantic Nickel continues to advance its core operations, focusing on exploring and drilling for awaruite nickel-iron alloy mineralization, which can create a secure, reliable supply of nickel for North America.

Europe is experiencing noteworthy growth in the nickel market due to several factors. The region's increased emphasis on electric vehicle adoption and the growing demand for renewable energy storage systems are key drivers. Additionally, the expanding aerospace and construction sectors contribute to higher nickel consumption. Europe's commitment to sustainability and environmental initiatives further drives the use of nickel in green technologies. As the continent strives for technological advancements and a reduced carbon footprint, the nickel market is positioned for significant growth in meeting the evolving demands of these industries.

Nickel Market Companies

- Vale SA

- Norilsk Nickel

- BHP

- Glencore

- Jinchuan Group International Resources Co. Ltd.

- Sumitomo Metal Mining Co., Ltd.

- Eramet SA

- Western Areas Ltd.

- Sherritt International Corporation

- Independence Group NL

- Nornickel (Norilsk Nickel Mining and Metallurgical Co.)

- Anglo American plc

- Lundin Mining Corporation

- MMC Norilsk Nickel

- First Quantum Minerals Ltd.

Recent Developments

- In June 2024, Draganfly announced its strategic partnership with First Atlantic Nickel to effectively utilize its advanced drone and sensor technology for the exploration of a potentially significant nickel deposit in Atlantic Canada. This partnership aims to identify zones of awaruite, a highly magnetic nickel-iron alloy, within the expansive Atlantic Nickel Project.

- In April 2025, FPX Nickel, a Canada-based nickel mining company, announced its plan to extend its Global Generative Exploration Alliance with the Japan Organization for Metals and Energy Security (JOGMEC), turning it into an open-ended joint venture (JV). After completing two years of collaboration, the partnership continues to focus on identifying and acquiring high-quality awaruite nickel properties globally.

- In August 2024, Lifezone Metals discussed its flagship project in Tanzania as it has gained recognition from the United States government following a meeting with the nation's key officials regarding further investment initiatives in Africa's critical minerals. The company is developing the Kabanga project in Tanzania, believed to be one of the world's largest and highest-grade undeveloped nickel sulfide deposits.

Segments Covered in the Report

By Class Type

- Class 1 (99.8%)

- Class 2 (<99.8%)

By Application

- Stainless Steel

- Special Steels

- Batteries

- Electroplating

- Alloys

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting