What is the Nickel Mining Market Size?

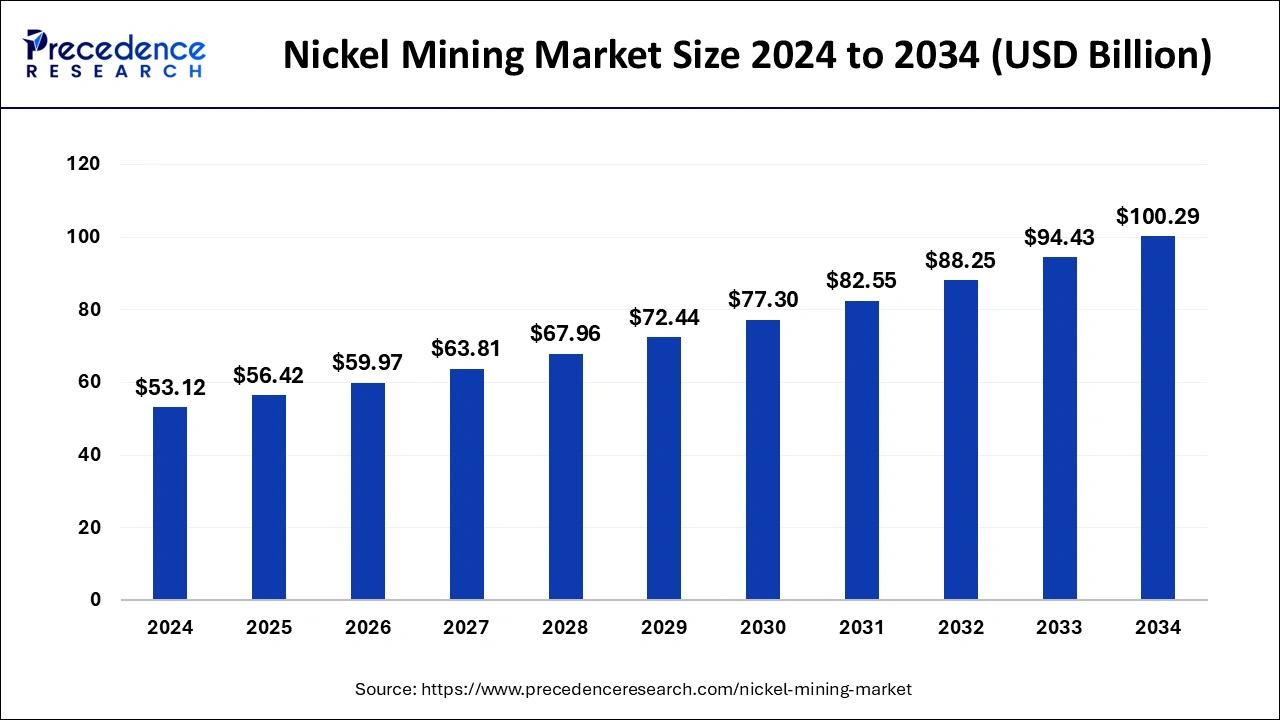

The global nickel mining market size is calculated at USD 56.42 billion in 2025 and is predicted to increase from USD 59.97 billion in 2026 to approximately USD 100.29 billion by 2034, expanding at a CAGR of 6.56% from 2025 to 2034.

Nickel Mining Market Key Takeaways

- The global nickel mining market was valued at USD 53.12 billion in 2024.

- It is projected to reach USD 100.29 billion by 2034.

- The nickel mining market is expected to grow at a CAGR of 6.56% from 2025 to 2034.

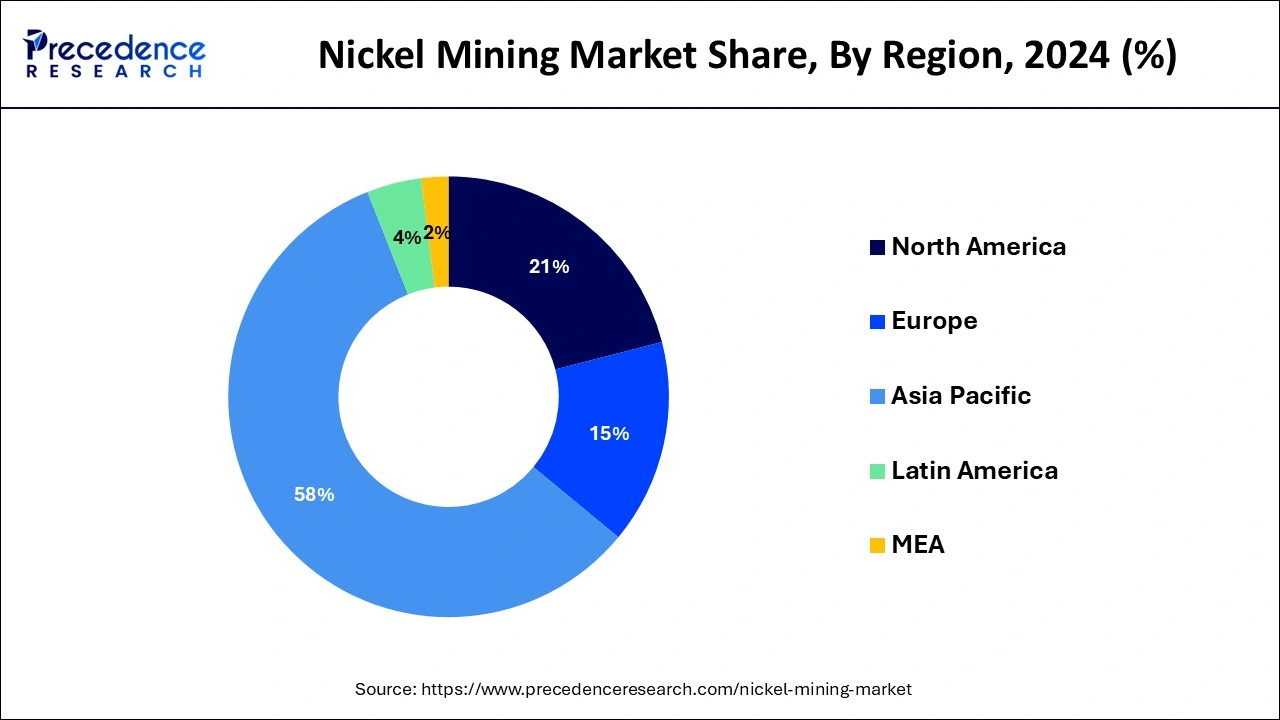

- Asia-Pacific contributed more than 58% of market share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By end-use, the non-ferrous alloys segment has held the largest market share of 46% in 2024.

- By end-use, the batteries segment is anticipated to grow at a remarkable CAGR of 7.8% between 2025 and 2034.

- By mining technique, the open cast mining segment generated over 56% of market share in 2024.

- By mining technique, the underground mining segment is expected to expand at the fastest CAGR over the projected period.

What is nickel mining?

Nickel mining involves the extraction of nickel-containing ores from the Earth's crust. The primary sources of nickel include laterite and sulfide deposits. Laterite deposits are commonly found in tropical regions and are extracted through open-pit mining. The process typically involves the removal of overlying soils and bedrock to access the nickel-rich layer beneath. Sulfide deposits, on the other hand, are often situated in deeper underground formations and require more complex mining methods, including underground mining and flotation processes. Post-extraction, nickel ores undergo processes like crushing, grinding, and concentration to isolate the valuable nickel.

Subsequently, smelting or hydrometallurgical methods are used to obtain pure nickel. This end product is crucial for stainless steel manufacturing, as well as for batteries, alloys, and various industrial applications. The environmental impact of nickel mining, including habitat disruption and potential contamination, has led to a push for sustainable mining practices.

Nickel Mining Market Growth Factors

- The rapid expansion of the electric vehicle (EV) market stands as a pivotal catalyst, driving a surge in nickel demand. Nickel's indispensable role in electric vehicle batteries positions it as a cornerstone element in this burgeoning market. Projections from the International Energy Agency (IEA) indicate a noteworthy 41% increase in global electric car sales, surpassing 3 million units in 2020, underscoring the heightened nickel consumption associated with the EV boom.

- Ongoing advancements in mining technologies have improved efficiency and extraction rates in nickel mining. These technologies contribute to increased productivity and cost-effectiveness. For instance, the utilization of automation and advanced drilling techniques has enhanced extraction processes, positively impacting production volumes.

- Large-scale infrastructure projects worldwide drive demand for nickel in applications such as bridges, railways, and buildings. The Global Infrastructure Hub estimates that the global infrastructure investment need will reach $94 trillion by 2040, creating a sustained demand for nickel in construction materials.

- Supportive government policies and investments in mining infrastructure further stimulate growth. Governments recognizing the strategic importance of nickel in industrial development may implement favorable policies. For instance, in 2021, the Australian government announced a $1.5 billion investment to support critical minerals projects, including nickel.

- The mining industry's increasing focus on sustainability and responsible practices is influencing nickel mining. Companies are adopting environmentally friendly processes to meet regulatory standards and consumer expectations. For example, initiatives like the International Council on Mining and Metals (ICMM) Sustainable Development Framework emphasize responsible mining practices, aligning with the global shift toward sustainable resource extraction.

Nickel Mining Market Outlook:

- Industry Growth Overview: Strong growth is expected in the nickel mining sector between 2025 and 2030, fueled by the rapid growth of electric vehicle (EV) batteries and stainless-steel product demand. Continued growth in energy storage and renewable infrastructure reinforces long-term demand for nickel, especially in the Asia-Pacific and North America.

- Sustainability Trends: Sustainability is disrupting the way nickel is mined via low-emission extraction, recycling, and introducing circular economy models. Companies such as Vale and BHP are re-investing across different areas to support carbon-neutral nickel mining and production of battery-grade nickel refining to enable investors to achieve ESG goals and meet the demand of global green energy initiatives.

- Global Expansion: Top miners are scouting for expansion of operations on the ground across Indonesia, the Philippines, and Australia to ensure they can source high-grade nickel reserves. As a strategy, there are increased partnerships and joint ventures to create localized refineries and build capacity to manufacture EV batteries in the Asia-Pacific region.

- Key Investors: Several institutional and private equity investors are investing in nickel projects, as they relate to the growth of EVs and clean energy. Tesla, Trafigura, and Glencore have also financed sustainable mining projects to bolster long-term supply security.

- Startup Environment: The startup environment related to nickel mining is being developed by focusing on areas related to the recovery of minerals, waste, and hydrometallurgical refining processes. Companies such as Lifezone Metals and DeepGreen are developing techniques that are ecologically efficient to develop extraction methods that reduce the environmental footprint and energy required.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.56% |

| Market Size in 2025 | USD 56.42 Billion |

| Market Size in 2026 | USD 59.97 Billion |

| Market Size by 2034 | USD 100.29 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | End-use and Mining Technique |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Stainless steel production surge

The surge in stainless steel production significantly propels the demand for nickel in the mining market. Stainless steel, a corrosion-resistant alloy, is a major consumer of nickel, utilizing it to enhance durability and resistance to corrosion and rust. As infrastructure development, urbanization, and construction projects intensify globally, the demand for stainless steel rises commensurately.

- In 2020, global stainless steel production surpassed 52 million metric tons, as reported by the World Stainless Steel Association.

This growth is driven by robust construction activities and the increasing preference for stainless steel in diverse industries. Moreover, stainless steel's ubiquity in various applications, from architecture to automotive components, amplifies the need for nickel. The construction boom in emerging economies and ongoing infrastructure projects further fuels this demand. As a result, the nickel mining market experiences heightened activity, driven by the integral role of nickel in the production of stainless steel for diverse industrial applications.

Restraint

Social and community opposition

Social and community opposition poses a significant restraint to the market demand for nickel mining. Local communities near mining sites often express concerns about the potential negative impacts of mining operations on their livelihoods, health, and overall well-being. Community resistance can lead to delays in project approvals, heightened regulatory scrutiny, and increased operational costs as companies navigate efforts to address and mitigate community concerns. In some cases, opposition may result in legal challenges, causing protracted delays and uncertainties in project development.

The adverse social and community sentiments surrounding nickel mining can also affect a company's social license to operate, influencing its reputation and relationships with stakeholders. Public resistance and negative perceptions can lead to heightened scrutiny from environmental and human rights organizations, impacting investor confidence and raising challenges in attracting funding for mining projects. As a result, effective community engagement and proactive measures to address social concerns are imperative for the sustainable development of the nickel mining industry.

Opportunity

Recycling and circular economy initiatives

Recycling and circular economy initiatives are creating notable opportunities for the nickel mining market by emphasizing sustainable practices and resource efficiency. As industries worldwide prioritize environmental responsibility, the demand for recycled materials, including nickel, has surged. Nickel, a key component in various alloys and products, can be recovered and reintegrated into the supply chain through advanced recycling technologies. This not only reduces the reliance on virgin ore but also aligns with the principles of a circular economy.

The growing emphasis on recycling nickel aligns with global goals to minimize environmental impact and foster a more sustainable supply chain. Moreover, as regulations and consumer preferences increasingly favor eco-friendly practices, nickel mining companies engaging in responsible recycling initiatives can enhance their market positioning, meet evolving sustainability standards, and contribute to a circular economy that promotes resource conservation and waste reduction.

End-Use Insights

The non-ferrous alloys segment had the highest market share of 46% in 2024. This substantial investment is set to boost the demand for non-ferrous alloys. These alloys, containing metals like nickel, are crucial in aerospace applications due to their resilience against corrosion and high strength. Collins Aerospace's strategic move aligns with the broader industry trend of heightened reliance on non-ferrous alloys, especially in cutting-edge technologies. The investment underscores the significance of these alloys in the realm of engineering and manufacturing, signalling a notable development in the sector.

- In December 2022, Collins Aerospace unveiled plans to invest USD 200.0 million in India over the next five years, focusing on engineering and manufacturing activities.

The batteries segment is anticipated to expand at a significant CAGR of 7.8% during the projected period. The batteries segment in the nickel mining market pertains to the utilization of nickel in battery technologies, particularly in electric vehicles (EV) and energy storage applications. Nickel, a crucial component in lithium-ion batteries, enhances their energy density and performance. The increasing demand for electric vehicles and grid-level energy storage systems is driving substantial growth in this segment. As the global transition toward cleaner energy accelerates, the batteries segment in nickel mining is witnessing a surge, with ongoing trends emphasizing advancements in battery technologies and sustainable resource extraction practices.

Mining Technique Insights

The open cast mining segment held a 56% market share in 2024. Open-cast mining, also known as open-pit mining, is a mining technique employed in the nickel mining sector, involving the extraction of ore deposits from the surface. In this method, large quantities of overlying soil and rock are removed to access the nickel-rich ore beneath. Open-cast mining is preferred for its cost-efficiency and suitability for shallow nickel deposits. Recent trends in the nickel mining market indicate a continued reliance on open-cast mining techniques due to their economic viability, ease of access to ore bodies, and adaptability to varying geological conditions.

The underground mining segment is anticipated to expand fastest over the projected period. Underground mining in the nickel mining market involves extracting ore deposits beneath the Earth's surface. This technique minimizes environmental impact and allows access to deeper, higher-grade nickel deposits. A trend in the nickel mining industry involves continuous improvements in underground mining technologies, enhancing safety, efficiency, and extraction rates. Innovations such as advanced drilling techniques and automated systems contribute to the sustainable development of underground nickel mining, meeting the rising demand for nickel in applications like electric vehicles and renewable energy.

Regional Insights

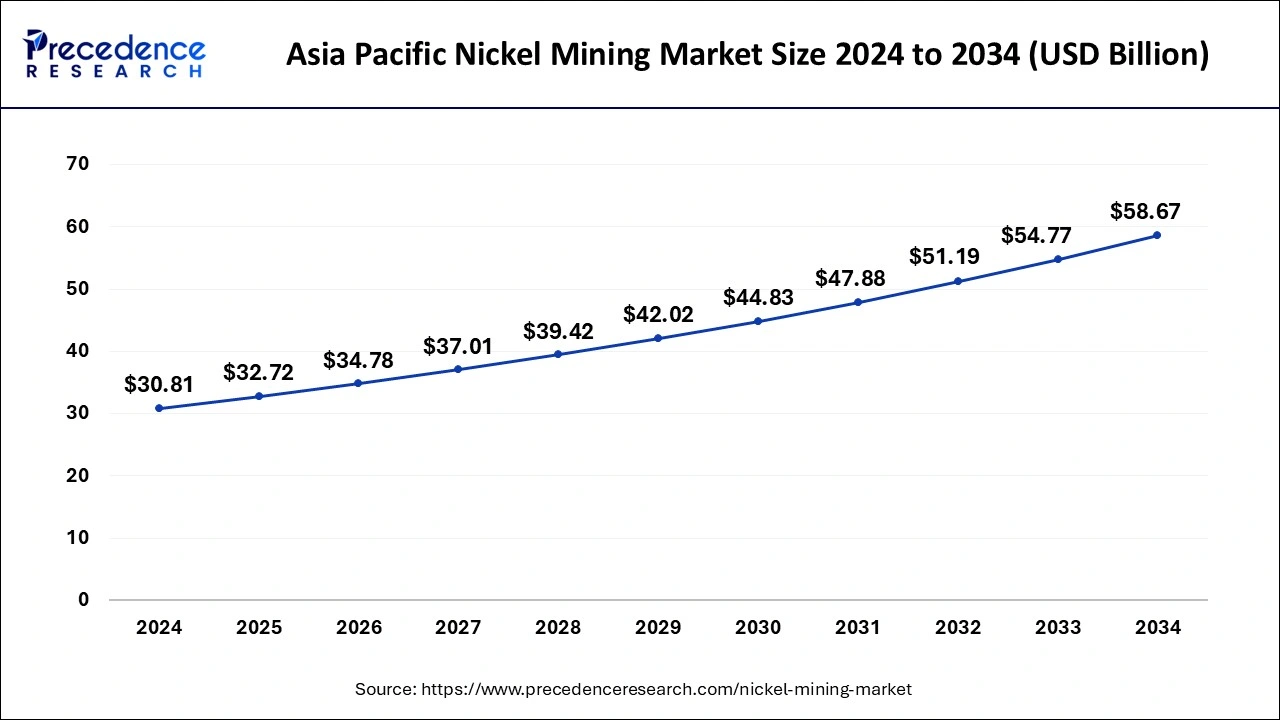

Asia PacificNickel Mining Market Size and Growth 2025 to 2034

The Asia Pacific nickel mining market size is exhibited at USD 32.72 billion in 2025 and is projected to be worth around USD 58.67 billion by 2034, growing at a CAGR of 6.65% from 2025 to 2034.

Asia-Pacific held a dominating share of 58% in the nickel mining market due to a combination of factors. Asia-Pacific commands a significant share in the nickel mining market due to robust industrialization, infrastructure development, and the region's pivotal role in the global stainless steel sector.

- In April 2023, Nickel Asia Corp, a Philippines-based company, revealed its intentions for expansion by announcing plans to add two more mines to its operations in the country.

The surge in electric vehicle (EV) production and renewable energy projects further propels the demand for nickel, a crucial component in batteries and clean energy technologies. With expanding economies, strategic investments in mining infrastructure, and a burgeoning urbanization trend, Asia-Pacific remains a key player, driving substantial growth and influencing the dynamics of the global nickel mining market.

North America is set for swift expansion in the nickel mining market owing to a heightened need for nickel in electric vehicle (EV) manufacturing and renewable energy applications. The region's commitment to clean energy initiatives and carbon reduction fuels the demand for nickel, essential in EV battery production. Supported by favorable government policies, investments in sustainable mining methods, and advancements in mining technologies, North America stands as a pivotal player in the growing nickel mining sector on the global stage.

Europe is witnessing substantial growth in the nickel mining market, propelled by a heightened demand for nickel, particularly in electric vehicle (EV) manufacturing and renewable energy projects. The region's strong commitment to reducing carbon emissions and embracing sustainable energy sources has fueled investments in nickel, essential for EV batteries and green technologies. Supported by progressive government policies, technological advancements, and a dedication to environmentally conscious practices, Europe emerges as a key player in the expanding nickel mining market.

Why did Indonesia dominate the Asia-Pacific nickel mining market?

Indonesia was the top producer of nickel in the world, benefiting from vast reserves of laterite ore and loads of government support. The country banned raw ore exports to promote local processing and smelting projects to get more value domestically. Internationally recognized companies partnered with Indonesian firms to promote nickel production to battery-grade specifications, and Indonesia positioned itself strategically to excel in the EV battery market, signaling Indonesia's potential as the world's top supplier during the energy transition.

Why did Canada dominate the North American nickel mining market?

Canada dominated the regional market, having large reserves, stable mining regulations, and advanced technology and mining professionals. Mining companies such as Vale Canada and Glencore increased production to meet the growing demand for EV batteries. The Canadian government supported low-carbon mining practices and incentives for clean tech projects. With strong research capacity and a commitment to sustainability, Canada also positioned itself as a reliable source of high-quality nickel sourced from responsible mines.

Why did Russia dominate Europe's nickel mining market?

Russia continued to be a major player in Europe's nickel mining market due to the significant production from Norilsk Nickel and other major producers. Russia has rich deposits of sulfide ores and excellent refining infrastructures to support production. Russia ramped up export capacity and trade with Asian partners despite the economic challenges faced during the uprising in Ukraine.

What made Latin America grow in the nickel mining market?

It was anticipated that the nickel mining market in Latin America would grow because of substantial reserves, continuing industrialization, and rising global demand for electric vehicles (EVs). The region became appealing to foreign investors focused on securing commodities for battery production. Initiatives for sustainable mining and investments in exploration activities in Brazil and Cuba helped promote growth in the region.

Brazil Nickel Mining Market Trends

Brazil was the leader in the Latin American market due to its large reserves and plans for multi-million-dollar mining projects. National mining modernization incentives and foreign partnership arrangements underpinned a strengthening of the output of nickel in Brazil. The country's emphasis on sustainable operations and energy-efficient extraction of nickel enhanced its potential to export. Moreover, the Brazilian nickel industry represented an important part of the global stainless-steel market and supported the battery industry.

What made the nickel mining market in the Middle East & Africa grow rapidly?

The nickel mining market in the Middle East & Africa was expected to grow due to rich deposits of resources and increased foreign investment. African countries continued to ramp up exploration efforts to meet the growing demand for battery materials globally. Additionally, the focus on infrastructure development and local processing of minerals opened up space for opportunities in the regions. Countries like South Africa and Madagascar have emerged as major suppliers of nickel, spurred by a favorable policy environment and the need for mineral diversification away from other commodities.

South Africa Nickel Mining Market Trends

South Africa led this regional market due to its large mineral reserves and mature mining infrastructure. The South African government provided investment-friendly policies and promoted sustainable practices. Jonas and other major mining companies have modernized these operations to meet export requirements while growing profitability. The region's integration of nickel with other mineral projects has positioned South Africa as a vital supplier to global exchange economies, particularly in electric vehicle manufacturing and clean energy.

Recent Developments

- In December 2020, BASF and Eramet entered into a collaborative agreement to explore the development of an advanced nickel and cobalt hydrometallurgical refining complex. This potential venture includes the establishment of a High-Pressure Acid Leaching (HPAL) plant alongside a Base Metal Refinery (BMR).

- In November 2020, Nickel Mines inked a deal with its partner Shanghai Decent Investment to secure a 70% ownership stake in the Angel nickel project in Indonesia. The acquisition, valued at US$490 million, encompasses four Rotary Kiln Electric Furnace (RKEF) lines and a 380MW power station, currently in construction within the Indonesia Weda Bay Industrial Park (IWIP) on Halmahera Island in North Maluku province.

Nickel Mining Market Companies

- Vale S.A.

- Norilsk Nickel

- BHP

- Glencore

- Jinchuan Group International Resources Co. Ltd.

- Anglo American

- Sumitomo Metal Mining Co., Ltd.

- MMC Norilsk Nickel

- Sherritt International Corporation

- Eramet

- Western Areas Ltd.

- Independence Group NL

- Lundin Mining Corporation

- First Quantum Minerals Ltd.

- Giga Metals Corporation

Segments Covered in the Report

By End-use

- Stainless Steel

- Non-Ferrous Alloys

- Batteries

- Others

By Mining Technique

- Underground Mining

- Open Cast Mining

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content