What is the Mining Equipment Market Size?

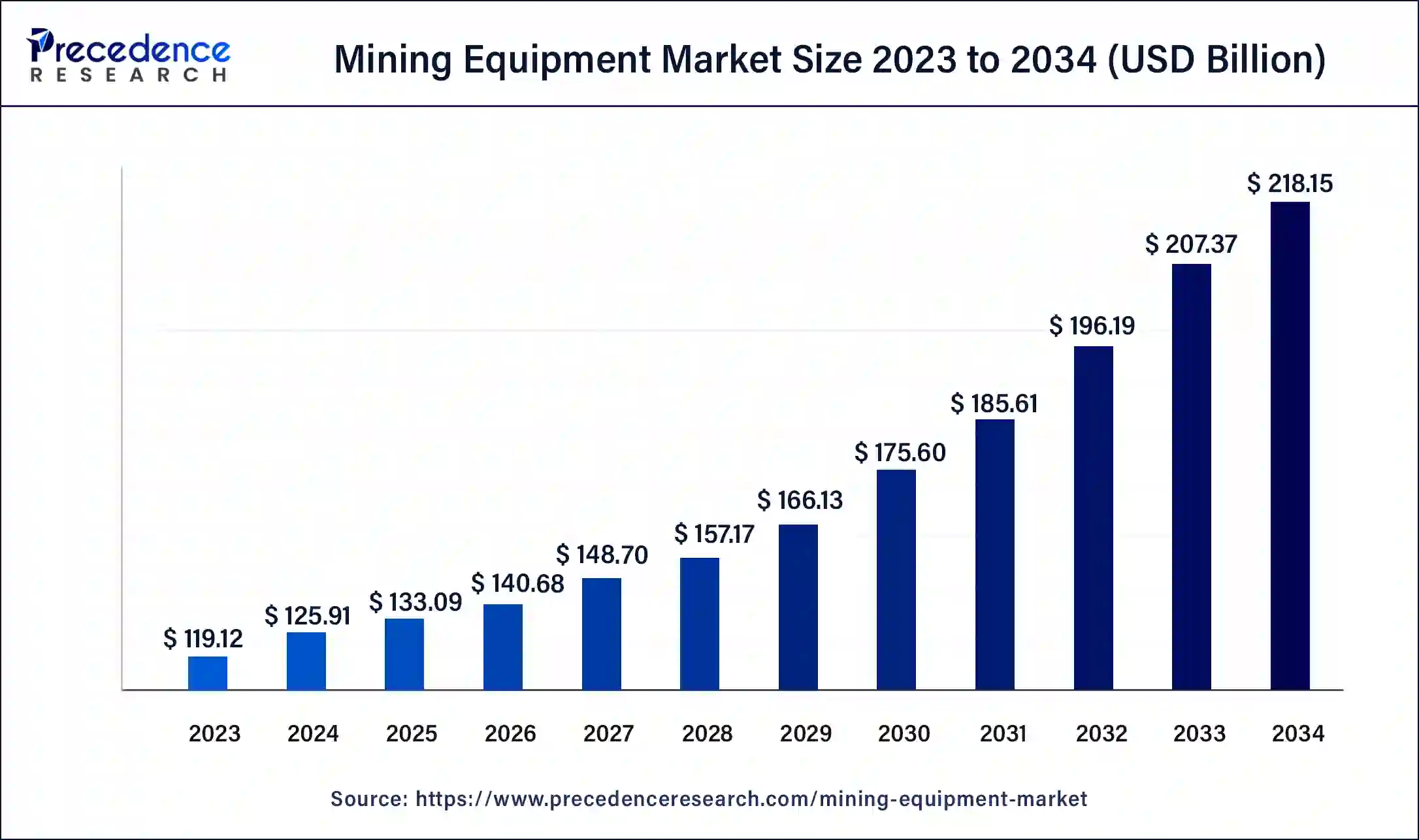

The global mining equipment market size accounted for USD 133.09 billion in 2025 and is expected to reach around USD 229.20 billion by 2035, expanding at a CAGR of 5.59% from 2026 to 2035.

Market Highlights

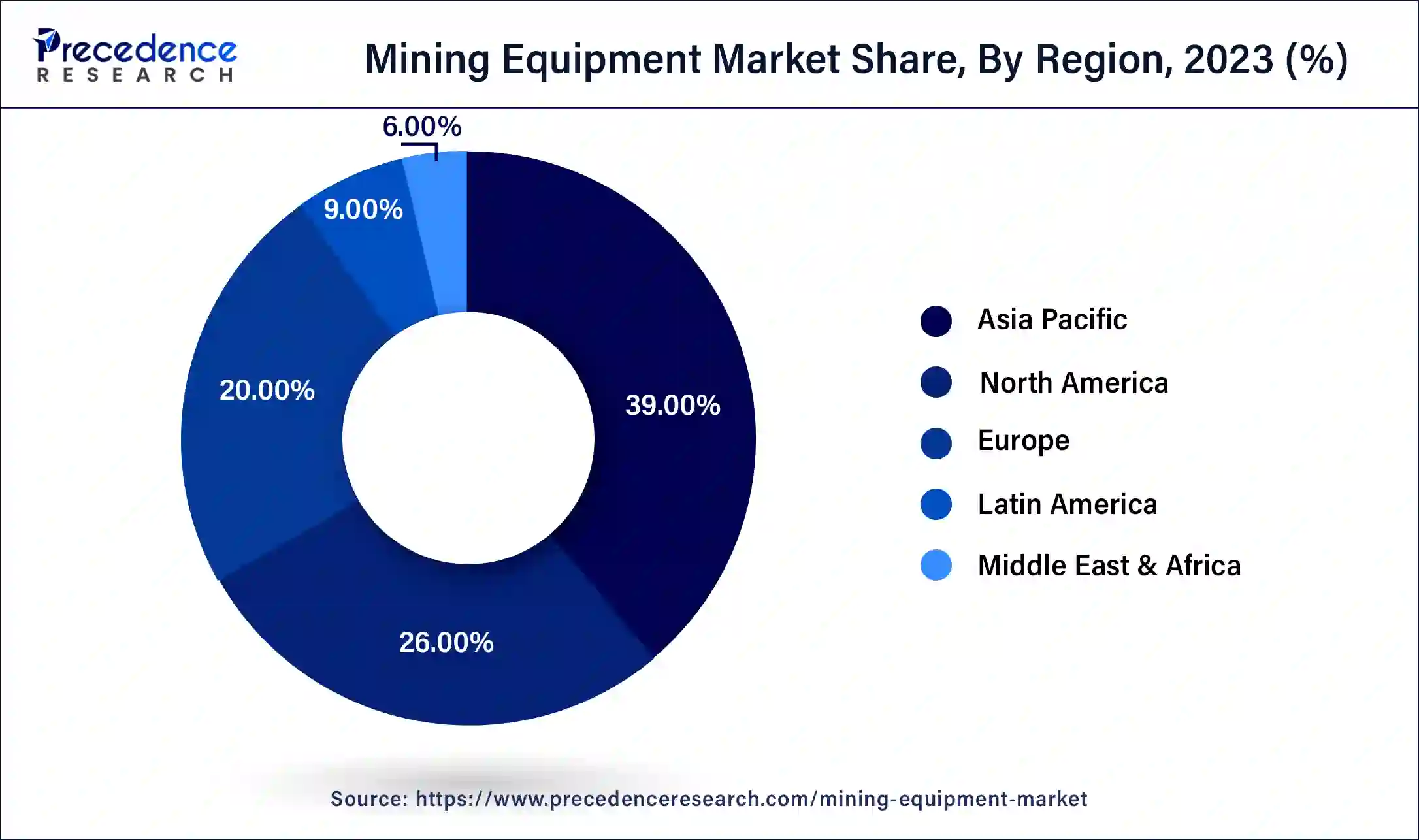

- Asia Pacific led the global market with the highest market share of 39% in 2025.

- The underground mining equipment segment is expected to grow at a CAGR of 15.3% from 2026 to 2035.

- By application, the coal segment accounted for 39% of revenue share in 2025.

- The surface mining equipment market has reached USD 35 billion in 2025.

- The metal mining application is expected to grow at a CAGR of 6% from 2026 to 2035

Market Overview

Mining is the process of extracting natural products from earth including coals, metals, and more. And the equipments used in extraction are known as mining equipment. The material is excavated underground using specialized mining equipment like trucks, loaders, diggers, etc., and is often transported to the surface for further processing using skips or lifts.

One of the top priorities in the mining sector is worker safety. To assist ensure worker protection, many industry players are tackling safety issues by automating tasks that were previously completed by people labor. In mines all throughout the world, automation, the use of machines and other control systems to complete jobs that would otherwise be carried out by people, is becoming more and more prevalent. Mines can create final goods of a higher quality because automation provides them more control over their production processes. Most notably, automation has improved worker safety in mining in a variety of ways. Hence, with the use of technology safer environment for workers can be created.

Artificial Intelligence: The Next Growth Catalyst in Mining Equipment

AI is fundamentally transforming the mining equipment industry by shifting it from traditional, labor-intensive machinery to intelligent, autonomous, and connected systems. The integration of AI-powered predictive maintenance allows machines to monitor their own health, significantly reducing unexpected downtime and maintenance costs by anticipating failures before they occur.

Furthermore, the deployment of AI-driven autonomous trucks, drills, and loaders enhances productivity and safety by operating 24/7 in hazardous environments with minimal human intervention.

Mining Equipment Market Growth Factors

An increase in urban population drives up demand for oil and natural resources, which is predicted to drive up demand for mining equipment and propel the expansion of the mining equipment market. The interconnectedness of population expansion and natural resources affects the disruption of the climate capacity to adapt to it, particularly in developing nations with quick-changing demographics and economies that depend heavily on natural resources.

The utilization of natural resources, environmental pollution, and changes in land use like urbanization will all increase with a growing population. The changes in global demographic patterns will directly affect local habitats through resource usage and climate change.

In addition, for the next 20 years, emerging economies like Asia and Africa are expected to account for more than 50% of global urban expansion. One of the major factors driving the market's growth is the increase in industrialization and urbanization around the world. The steady economic progress is also giving customers in the Asia-Pacific region more money to spend, which has eventually increased demand for natural resources.

Moreover, the population has increased significantly during the past few years, which has increased mineral consumption. Rise in population drives the need of such products as these products are used by almost every individual and hence, it is expected that rising population can lead to drive the market. A further factor supporting the boom in mineral demand is an increase in household earnings, which is beneficial for the market's expansion.

Major Trends of the Mining Equipment Market:

- Automation and Autonomous Haulage Systems (AHS)

Mining companies are rapidly adopting self-driving trucks, loaders, and drills to improve productivity and safety, particularly in surface mines. - Electrification of Fleets (BEVs): The industry is undergoing a significant transition to battery-electric vehicles (BEVs) and hybrid machinery, particularly in subterranean operations, to achieve corporate net-zero objectives. This shift reduces operational overhead, specifically ventilation costs, by eliminating diesel emissions, simultaneously enhancing workplace safety and environmental compliance.

- AI-Enabled Predictive Maintenance: Integration of Internet of Things (IoT) sensors and artificial intelligence (AI) is facilitating real-time performance analytics and advanced predictive maintenance protocols across capital assets. This strategy minimizes unscheduled downtime, optimizes asset utilization, and drives down total cost of ownership (TCO) by preempting critical equipment failures.

- Remote Operations and Advanced Connectivity: The deployment of Remote Operating Centers (ROCs), leveraging 5G and LEO satellite communications, is centralizing control and monitoring functions away from high-risk environments. This connectivity ensures operational continuity and enhances safety by enabling real-time, low-latency control of autonomous and semi-autonomous machinery.

Market Outlook

- Industry Growth Outlook: The mining equipment market is expected to grow at a rapid pace from 2026 to 2035 due to increasing demand for minerals, metals, and energy resources driven by industrialization and urbanization. Advanced technologies and automation are further fueling efficiency and productivity in mining operations worldwide.

- Sustainability Trends: Sustainability trends are reshaping the market by driving demand for energy-efficient, low-emission, and eco-friendly machinery. Manufacturers are focusing on developing equipment that are energy-efficient, recyclable, and quieter to meet environmental regulations.

- Global Expansion: The market is expanding worldwide due to the rising demand for minerals, coal, and metals, coupled with growing investments in infrastructure and construction. Equipment suppliers continue to expand their distribution networks as well as service hubs across emerging economies to establish a greater market presence while enhancing customer proximity.

- Major Investors: Major investors include multinational mining equipment manufacturers, private equity firms, and government-backed mining corporations. They contribute through capital investments, technology development, mergers and acquisitions, and expansion of manufacturing and service networks.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 133.09 Billion |

| Market Size in 2026 | USD 140.68 Billion |

| Market Size by 2035 | USD 229.20 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.59% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Solution, Propulsion, Application, Powertrain Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segments Insights

Propulsion Insights

During the projected period, the diesel segment is anticipated to be the largest. The growth of surface mines around the world has fueled the demand for diesel mining equipment. The diesel category is anticipated to rule the market in terms of value during the projection period due to the strong torque at low speed that diesel engines deliver. CNG/LNG burns cleanly hence, natural gas is a fantastic option for different kinds of heavy and medium-duty vehicles. Businesses with fleets of mining can significantly cut their carbon footprint by switching to renewable natural gas.

Application Insights

On the basis of application, the mineral segment is expected to be the largest market to show a tremendous growth during the forecast period. The demand for minerals and metals is being driven by global industrialization, urbanization, and population expansion. In the coming decades, demand for renewable, clean energy, and even some conventional energy is predicted to rise dramatically, putting even more attention on supply, security, and environmental effect issues.

Competition for minerals will increase as sustainable energy and electric vehicle technologies receive more attention. Due to demand from developing nations, the coal mining industry is expected to have a substantial market. Improvements in roof control, conveying systems, and other technical developments in coal extraction methods and technology satisfy these objectives.Due to demand from rising economies, the metal ore mining industries are anticipated to rise steadily. The sector is also impacted by demand in various nations around Asia Pacific due to the region's development.

Category Insights

Depending upon the category, the underground mining machinery segment is the dominant player and is anticipated to have the biggest impact on mining equipment market. Underground mining operations have seen a boost globally as a result of the growth in energy generation. Additionally, because explosions are made underground and no hazardous chemicals are released into the environment, underground mining is less harmful to the environment than surface mining. Moreover, energy consumption has significantly increased in recent years as a result of rapid urbanization and growing industrialization.

Due of technical advancements, contemporary automated excavators and mining trucks are more effective than earlier ones. In the event of a malfunction or operational issue, they promptly convey information to service centers, reducing information flow time and costs. Surface mining machinery is projected to increase at a significant rate. The supply in contracts with mining enterprises has increased due to the use of automated equipment like dump trucks and the arrival of new technologies in mining.

Regional Insights

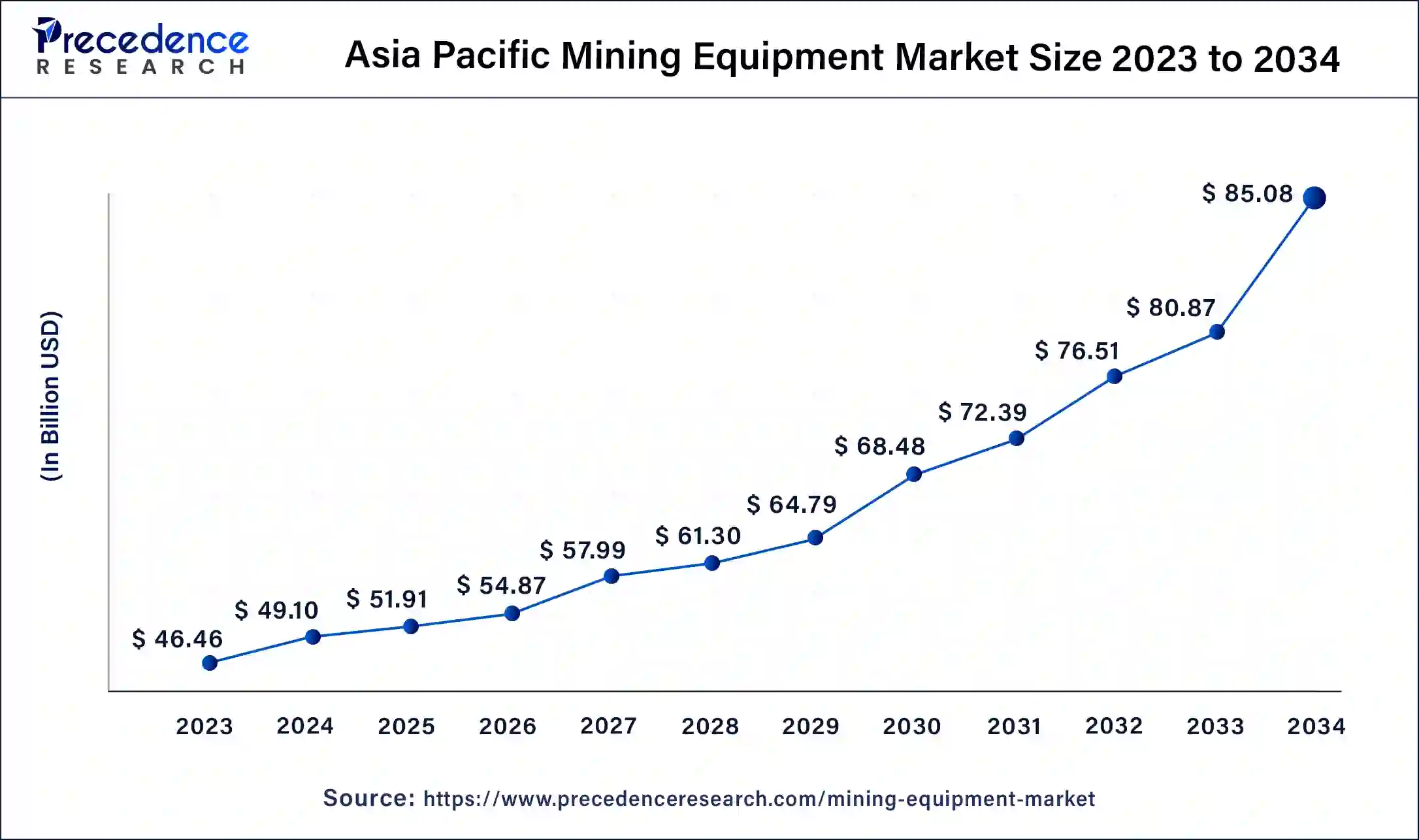

What is the Asia Pacific Mining Equipment Market Size?

The Asia Pacific mining equipment market size is estimated at USD 51.91 billion in 2025 and is predicted to be worth around USD 89.39 billion by 2035, at a CAGR of 5.59% from 2026 to 2035.

What Made Asia Pacific the Dominant Region in the Mining Equipment Market?

The highest market share and dominant position in the mining equipment market belongs to Asia-Pacific. During the projection period, Asia Pacific is expected to surpass other regions in terms of market share for mining equipment. Additionally, in order to increase electricity production and to gather minerals and ore for export, governments in these areas are boosting their support for mining. Additionally, growing investments in cutting-edge excavation tools and equipment in nations like Australia and India as well as other developing nations are anticipated to fuel market expansion. Additionally, due to the investment in infrastructure development and the booming power and cement industries, India is predicted to have tremendous growth.

India Mining Equipment Market Analysis

India is considered a major player in the market due to its abundant mineral resources, growing mining activities, and government initiatives promoting domestic mining and infrastructure development. In January 2025, the Ministry of Mines approved the national critical mineral mission to establish a resilient value chain for vital mineral resources for green technologies, with an allocation of Rs. 34,300 Crore over seven years. India also updated policies to support the mining industry in the country.

Due to the early adoption of these machines, North America is anticipated to increase significantly. Also, it is projected that the mining industry would expand significantly and sustain stable mining equipment demand. In terms of mining, Europe is also established and industrialized. It is expected to continue to develop as a result. During the anticipated period, the market is anticipated to see an increase in governmental and private sector spending in the field of sustainable development.

How is the Opportunistic Rise of North America in the Mining Equipment Market?

North America is experiencing an opportunistic rise in the market. The market in the region is driven by increasing investments in mining exploration, modernization of existing operations, and the adoption of advanced technologies such as automation and IoT-enabled equipment. Strong demand for critical minerals, including those used in batteries and renewable energy, is accelerating equipment sales, while government support for sustainable and efficient mining practices further boosts market growth. Additionally, the presence of major mining equipment manufacturers and robust infrastructure enables North America to capitalize on both domestic and export opportunities.

U.S. Mining Equipment Market Analysis

The U.S. is a major contributor to the market through government initiatives that support resource exploration, modernization, and sustainable mining practices. In September 2025, the U.S. Department of Energy launched Mine of the Future initiatives to advance the U.S. mining industry. In November 2025, the U.S. Department of Energy (DOE) announced $355 million in funding to boost U.S. production of critical minerals and to advance next-generation mining technology.

What Factors Drive Europe's Lead in the Mining Equipment Market?

Europe is expected to experience significant growth in the market in the upcoming period due to several initiatives to support the mining industry. In March 2025, the European Union selected 47 strategic projects to ensure access to critical minerals. The EU introduced a plan to secure supplies of 17 strategic raw materials used in mining. In November 2025, the European Investment Bank (EIB) signed an agreement with Sandvik, investing €500 million in advanced mining and machining innovation. In October 2025, the UN Environment Program reported on plans for responsible financing and investment in energy transition minerals.

Many factors influence Europe's increasing demand for mining equipment, but two are the modernization of mines, and increasing regulatory compliance. Some mining companies are purchasing new equipment that complies with strict environmental regulations (i.e. low emission, low noise and digitally monitored) and protects their employees. There is also a trend towards refurbishing existing mining operations using improved technology instead of developing new mining operations.

Germany Mining Equipment Market Analysis

Sales of mining equipment made in Germany are expected to reach record levels in predicted years. This might be the outcome of the country's expanding mineral mining industry. Aluminum,kaolin, salt, feldspar, and other commodities are all produced in large quantities throughout the nation. Due to the need to mine raw materials, specialized underground mining equipment including loaders, diggers, and trucks is becoming more and more popular.

What are the Major Factors Contributing to the Mining Equipment Market Within Latin America?

Latin America is expected to see steady growth during the forecast period. The Latin American mining trade shows in Chile and Peru are accessible to over 35 countries, including decision-makers, industry leaders, mining organizations, equipment providers, and technology companies. Mining companies in Chile have adopted machinery, auxiliary services, and technology, spending more than USD 15 billion in 2024 to support sustainable, efficient operations. Countries in Latin America, including Chile, plan to invest $83 billion in mining through 2033.

Brazil Mining Equipment Market Analysis

Brazil leads the market due to several government initiatives. In October 2025, the Brazilian government introduced the tax incentives framework and strategic mineral financial guarantees. The National Mining Policy Council shapes the national policies for rare earths and critical minerals. The Minerals for Clean Energy Program focuses on expanding mineral research, geological knowledge, and processing capabilities for critical minerals needed for the energy transition. In September 2025, the Brazilian miner Vale reported investing $12 billion in its mining operations in Minas Gerais state by 2030.

Why is the Middle East & Africa Considered a Significant Region in the Mining Equipment Market?

The Middle East & Africa (MEA) is a significant region for the market due to its rich mineral reserves, growing mining activities, and increasing investments in modern and efficient mining technologies. The market is also supported by the UAE's investments in African mining, Saudi Arabia's growth in mining, and the UAE-US critical minerals initiative. The rising demand for critical minerals and regional efforts to diversify the economy drive increased investment and funding in the mining sector. There have been significant advances in mining equipment and related infrastructure. Additionally, rising demand for metals and minerals for industrial and energy applications drives the adoption of advanced mining equipment across the region.

Saudi Arabia Mining Equipment Market Analysis

Saudi Arabia is expected to maintain its stronghold in the MEA market. In January 2024, Saudi Arabia allocated $182 million for minerals exploration in the mining sector. Many government initiatives and programs in the country focus on advancing the mining industry and developing local equipment manufacturing capacity as part of Saudi Vision 2030. The national minerals program aims to leverage Saudi Arabia's mineral resources to ensure reliable supply chains.

Is Latin America Becoming a Major Growth Market for Mining Equipment?

Increasing demand for high capacity and highly durable mining equipment relates to increased mining activity in Latin America, specifically copper, lithium and precious metals. The use of heavy-duty machinery in remote and/or difficult to access locations is a primary consideration; operators in remote locations require durable machinery, mobile equipment and reliable after-market support in order to keep their miners working.

Value Chain Analysis

- Raw Material Sourcing

This stage involves the sourcing of metals, alloys, and components essential for manufacturing mining equipment.

key players: ArcelorMittal, POSCO, and BHP Billiton. - Equipment Manufacturers

Companies design, engineer, and produce mining machinery such as excavators, drills, and loaders.

Key players: Caterpillar, Komatsu, Sandvik, and Hitachi Construction Machinery. - Distribution & Logistics

This stage focuses on the storage, transportation, and delivery of equipment to mining sites.

Key players: Ritchie Bros. Auctioneers, Wirtgen Group, and regional distributors. - Equipment manufacturers are continually strengthening their relationships with mining operators by offering their customers bundled services, which include training, software and maintenance for their equipment, which are becoming increasingly important to mining.

- Some of the major companies in the area of mining equipment, including Caterpillar, Komatsu and Sandvik, are emphasizing their product offerings, in addition to their traditional mining equipment, to give their customers value added services that differentiate their products from other manufacturers.

- Components of Value Chain

- Design and Engineering optimization: In terms of design and engineering optimization through modular design, companies are able to custom build mining equipment and manufacture it more quickly than ever before.

- Exemplary Endeavours in Manufacturing & Assembly: Regional assembly plants, and lean manufacturing within plants all serve to mitigate logistical costs and increase resilience within the supply chain.

- Aftermarket Services & Digital Support: Digital predictive maintenance tools, and service contracts help maintain continual uptime/a "plugged-in" relationship with customers.

Mining Equipment Market Companies

- Akzo Nobel N.V.: Through its International and Interpon brands, the company provides high-performance anticorrosive and powder coatings that protect critical mining infrastructure like crushing and filtration equipment from harsh environments.

- Arkema Inc.: The company provides tailor-made mining reagents and specialty surfactants, such as the Opale™ range, which optimize mineral recovery and improve the handling of suspensions and slurries.

- Linde Plc: As a major industrial gas supplier, Linde provides oxygen and nitrogen for pyro-metallurgical and hydro-metallurgical processes, significantly enhancing the efficiency of mining smelters and leaching operations.

- The Chemours Company: Chemours contributes through advanced performance materials like Teflon and Viton, which are used in high-purity fluid-handling systems and gaskets within chemical processing and mining equipment.

- Shell plc: Shell provides specialized high-performance lubricants and greases designed to withstand the extreme pressures and temperatures encountered by heavy-duty mining machinery.

- Henkel AG & Co.: Henkel offers a broad portfolio of Loctite adhesives and sealants that are essential for the assembly, maintenance, and repair of large-scale mining equipment.

Other Major Key Players

- CPMC Holdings Ltd.

- Ball Corporation

- Toyo Seikan Co. Ltd.

- Guangdong Sihai Iron-Printing and Tin-Making Co., Ltd.

Recent Developments

- In April 2025, Hitachi Construction Machinery Co., Ltd. Launched its LANDCROS Connect Insight solution, which analyzes near-real-time mining equipment data to boost operational efficiency. The solution is set to be deployed via dealers to mining sites in Australia, Zambia, Chile, and the U.S. starting FY2025.(Source: https://www.hitachicm.com)

- In October 2025, state-owned BEML partnered with Italy's Tesmec, S.p.A to introduce surface mining equipment in India. The equipment, including surface miners, enables open-cast mining by cutting and crushing rock and soil without drilling or blasting. (Source:https://www.business-standard.com)

- In reflecting the company's unified focus on growth in such sectors, Komatsu announced intentions to rebrand its underground hard rock equipment, surface wheel loaders, and new range of blasthole drills. During its renaming, a few goods were added. The Komatsu ZT44 track drill was the first product to be rebranded.

Segments Covered in the Report

By Solution

- Products

- Services

By Propulsion

- Diesel

- CNG/LNG/RNG

By Application

- Mineral

- Metal

- Coal

By Powertrain Type

- IC Engine Vehicle

- Electric Vehicle

By Category

- Crushing, Pulverizing, Screening Machinery

- Mineral processing Backhoe Loader

- Surface Mining Machinery

- Underground Mining Machinery

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting