What is the Insurtech Market Size?

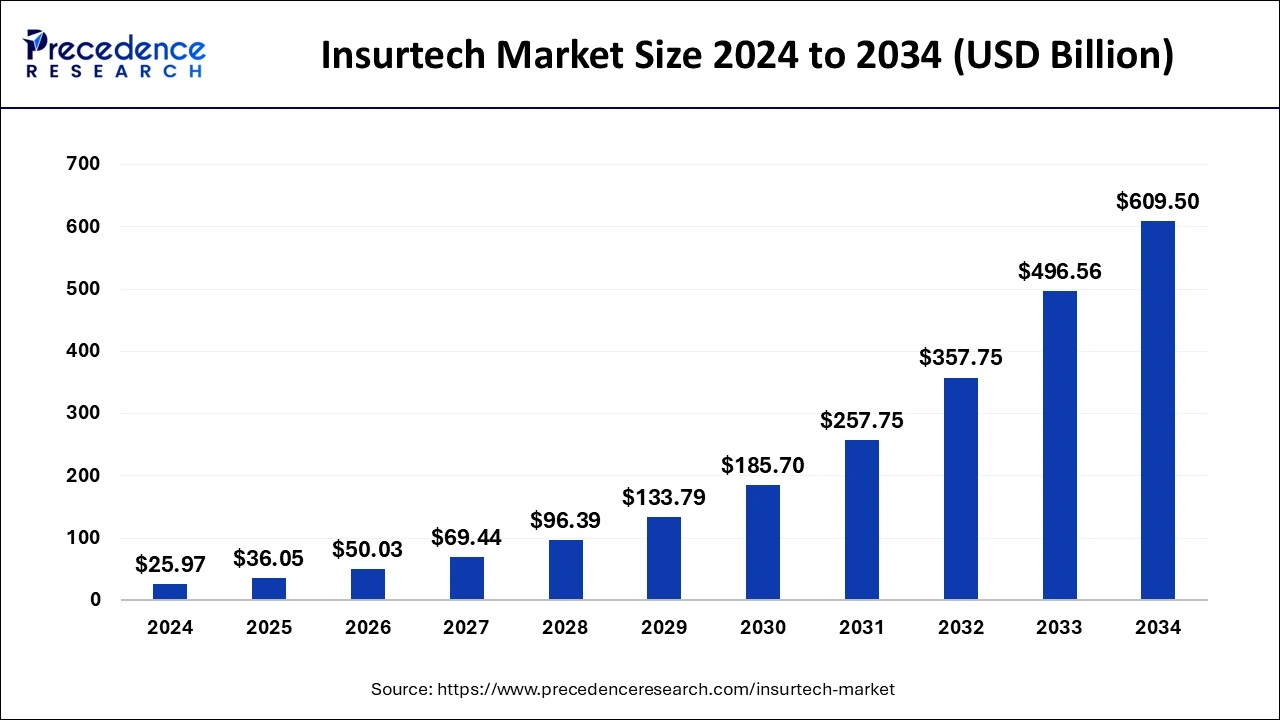

The global insurtech market size is calculated at USD 36.05 billion in 2025 and is predicted to increase from USD 50.03 billion in 2026 to approximately USD 739.69 billion by 2035, expanding at a CAGR of 35.27% from 2026 to 2035.

Insurtech Market Key Takeaways

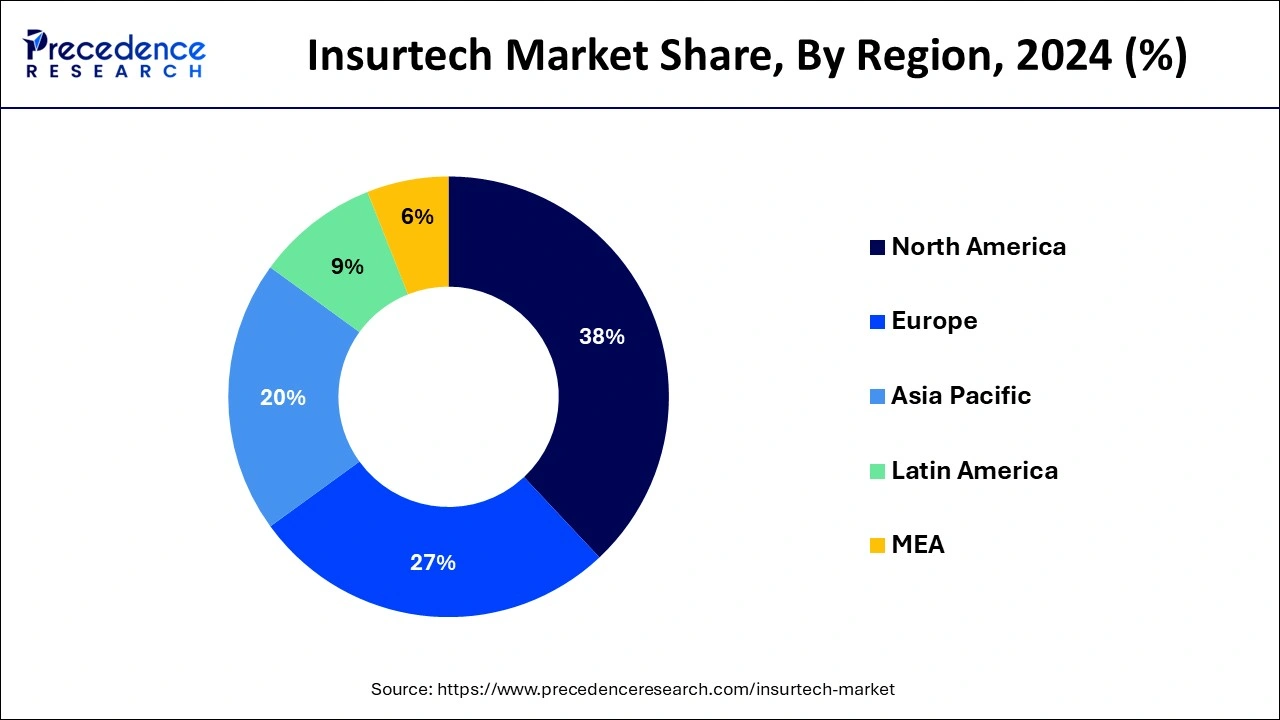

- North America led the global market with the highest market share of 38% in 2025.

- By services, the managed services segment has held the largest market share of 43% in 2025.

- By type, the health fragment segment captured the biggest revenue share of 26% in 2025.

- By technology, the cloud computing segment registered a maximum market share of 28% in 2025.

- By end user, the BFSI segment captured the biggest revenue share of 22% in 2025.

Market Overview

Insurtech refers to technological innovations that are made and executed to work on the productivity of the protection business. Insurtech powers the creation, conveyance, and organization of the protection business. Venture entrepreneurs are keen on Insurtech in light of the fact that the protection business is very much ready to exploit troublesome and imaginative innovation. Insurtech helps huge insurance agency investigate new choices beyond customary human endeavors. This could incorporate powerfully evaluated insurance contracts, independent venture protection, and social protection choices. Insurtech likewise gives insurance agency admittance to information streams from IoT gadgets. This makes a unique evaluating framework in light of economic situations and client conduct.

AI in the Market

AI is bringing a technological revolution in the insurtech market by automating processes for personalizing services and risk management. In claims handling and policy administration, the system simplifies operations, involving cost savings and increased accuracy. As AI analyzes the customer profile, it customizes insurance products and dynamic pricing, with AI-backed chatbots being available to help customers anytime, thereby increasing customer satisfaction. Risk assessment and underwriting constitute predictive modeling, the integration of real-time data from IoT, and proactive risk mitigation strategies; all these help insurers in shifting focus from reactive to proactive. Reduction in ID loss is through fraud detection mechanisms provided by AI-based applications, which identify fraudulent, counterfeit anomalies in claims data while also helping in the faster settlement of claims. Over and above these operational aspects, AI also acts as a transformative enabler, morphing the industry from a reactive to a proactive, data-driven insurance model, human expertise being supplemented by machine intelligence. This merges the two to enhance decision-making while making it faster in delivery, enabling the insurers to deliver what the new customer generation expects from them, hence making the AI one of the prime movers in the future shaping of the insurtech.

Insurtech Market Growth Factors

The rising number of protections claims overall is one of the central points complementing the market development. Auto, life, and home are the most well-known protection claims got by individuals around the world. As per a recent report by the Insurance Barometer, 36% of American respondents wanted to buy extra security in 2021. Insurance agency are progressively putting resources into advanced innovations to lessen functional expenses and to work on functional proficiency and the whole client experience.

Computerized innovations are utilized to comprehend client needs and to upgrade their contributions in view of the changing client needs. As per a study directed by EIS Group, a product organization, 59% of the insurance agency studied expanded their interest in computerized foundation in 2021. Benefits presented by blockchain innovation, like expense investment funds, quicker installments, and misrepresentation alleviation, are driving its interest among insurance agency around the world. Blockchain innovation is utilized in insurance agency for applications like Know Your Customer (KYC), Anti-illegal tax avoidance (AML) methods, guarantee dealing with, and making distributed models.

A few Insurtech organizations are going into associations with insurance agency to offer blockchain innovation-based arrangements. For example, in December 2020, Amodo, an Insurtech organization, reported its organization with Galileo Platforms Limited, an innovation organization. Through this organization, the organizations would utilize blockchain advances to help insurance agency offer new protection arrangements and change their client experience. Insurance agency are progressively tolerating digital money-based installments. For example, in December 2021, Metromile, an accident protection organization, reported its arrangement to permit policyholders to pay expenses and guarantee installments utilizing digital money. This drive is supposed to assist the organization with fortifying its market position.

Moreover, in June 2021, Universal Fire and Casualty Insurance Company zeroed in on offering conventional property and loss insurance to private ventures began tolerating digital currency for payment installments. This pattern is supposed to incline toward the development of the Insurtech market. The interest for on-request protection is developing among shoppers as it empowers them to buy protection inclusion on their cell phones whenever the timing is ideal. Organizations in the on-request protection space are progressively utilizing imaginative advances like the web of things, man-made reasoning, enormous information, and prescient support to reevaluate how on-request protection items are endorsed, made, and appropriated.

- Increasing claims: Increasing claims across all types of auto, life, and home insurance have thrown the spotlight on investments in advanced digital solutions for efficiency.

- Gaining Traction in Blockchain: Insurers are experimenting with blockchain in KYC, AML processes, fraud prevention, and fast payments.

- Compelling Cryptocurrencies: Accepting crypto for premiums and claims is a growing trend that adds flexibility for clients.

- On-the-Spot Insurance: The mobile-first and usage-based insurance front now drives innovation to attract tech-hungry customers.

- Digital Infrastructure Investment: To reduce expenses and enhance customer experience, insurers are ramping up investment in AI, IoT, and cloud platforms.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 36.05 Billion |

| Market Size in 2026 | USD 50.03 Billion |

| Market Size by 2035 | USD 739.69 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 35.27% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Services, Deployment Model, Type, Technology, Application, and End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

Technological advancement, being the main driver of an insurtech market, modifies every step of the insurance value chain. AI and machine learning systems provide enhancements to predictive analytics, fraud detection, and dynamic pricing. Big data analytics help in risk assessment and profiling, along with options strictly customized per requirements. Cloud platforms and mobile integration promote ready access of services by the insurer to the client, who receives on-the-go service and coverage. This set of technological advancements dramatically cuts costs, improves efficiency, and initiates a new customer experience, which leads to even greater adoption of digital-first insurance applications in many markets worldwide.

Restraining factors: Regulatory and compliance hurdles

The insurtech business environment is faced with great challenges due to a rigorous and fragmented regulatory environment. The insurance laws vary greatly from one country to another, making it difficult and incurring more costs for firms that work on an international basis. The uncertainty created by rigid regulations adapting to rapid changes in technology also tends to delay innovation and the entrance of new markets. Intensified scrutiny on AI-based underwriting and claims forces further transparency and explainability of the models. This, therefore, presents an increase in difficulty regarding scalability, slow adoption of newer technologies, and increased cost of compliance on the part of startups trying to go international.

Opportunity – Personalized and On-Demand Cover

Personalized and on-demand cover is one of the major ways to foster growth opportunities for the insurtech segment. Using big data, IoT, and predictive analytics, an insurer can build policies for individual needs and personalities, lifestyles, and behaviors, as well as risk characteristics. Usage-based insurance attracts the digital-first generation that seeks flexibility, e.g., pay-per-mile auto or on-demand travel coverage. Microinsurance makes insuring even more affordable for the youth, particularly. The new breed of customer-centric dynamic offerings provides more engaging experiences, opening access to underserved segments and thus new revenue streams for both emerging and mature markets alike.

Key Market Challenges

- The COVID-19 pandemic is expected to decidedly affect market development in 2021. Various insurance agency are reevaluating their drawn out methodologies and momentary necessities as the COVID-19 and its effects have sped up the execution of online stages and new versatile applications to address shopper issues. A few insurances agency are going into organizations with computerized arrangement suppliers to improve their contributions. For example, in December 2021, Duck Creek Technologies, a center framework supplier for Property and Casualty (P&C) back up plans, declared that SECURA Insurance, a P&C insurance transporter, chose Duck Creek Rating, Claims, Contract, and Insights to smooth out its P&C business.

Market Opportunities

The interest for Insurtech arrangements is ascending as it sets better expectations of purchaser expectations, increments buying amounts, upgrades direction and protection arranging using AI, man-made consciousness, and distributed computing. The deals of Insurtech arrangements are becoming because of the help of different hearty innovations like AI, AI, blockchain, and distributed computing that offer continuous reconnaissance and checking of safeguarded action for some organizations.

Segment Insights

Services Insights

The managed services portion held the main income portion of over 43% in 2025. Overseen administrations suppliers can give guarantors a deliberate door to change by integrating mastery and ability with new innovations. Overseen administrations suppliers additionally offer best cycles, rehearses, and administrative contemplations to guarantors. Simultaneously, oversaw administrations empower back up plans to address difficulties and open doors in protection IT and activities. Back up plans have begun recognizing and embracing the worth of further developed plans of action, accordingly setting out development open doors for the oversaw administrations portion.

The support and maintenance fragment are expected to enroll the most elevated development over the estimate period. The development of the help and upkeep fragment can be ascribed to the rising reception of cutting-edge innovations and dissemination channels by insurance agency. Various insurance agency across the globe is zeroing in on conveying trend setting innovation and tweaking heritage programming items to explicit necessities. This is supposed to drive the interest for help and support administrations across the globe.

Type Insights

The health fragment ruled the market in 2025 and represented over 26% portion of the worldwide income. The rising interest for computerized stages, which associate trades, representatives, suppliers, and transporters in medical coverage, is expected to fuel the interest for the health portion. Life and health safety net providers are zeroing in on utilizing progressed examination to all the more likely serve and grasp their clients. Various health care coverage organizations are embracing Insurtech answers for smooth out claims handling techniques. Back up plans are additionally zeroing in on consolidating their medical coverage administrations with versatility highlights for added comfort.

The home fragment is expected to enlist the most noteworthy development over the estimate period. Various home insurance agency is trying to make inventive items for business and private realtors and their individual occupants and inhabitants. These organizations are taking on Insurtech answers for quicker incline to-rent time. These arrangements use AI innovation to make and convey customized insurance contracts and proficiently handle claims for clients without requiring protection intermediaries. For example, in June 2021, Farmers Insurance coordinated Zesty.ai's out of control fire risk scoring model into its mortgage holder protection guaranteeing processes. Through this association, the previous organization intends to take on an imaginative methodology for dealing with its fierce blaze openness by assessing individual out of control fire dangers to mortgage holders.

Technology Insights

The cloud computing portion drove the market with an income portion of more than 28% in 2025. Distributed computing has changed the protection business with its cleverness, simplicity of sending, and adaptability. Far and wide acknowledgment of Bring Your Own Device (BYOD) arrangements, combined with the developing measure of information insurance agency gather, is supposed to drive the development. Insurance agency are embracing distributed computing arrangements attributable to benefits, like fast sending, cost-viability, and versatility.

Simultaneously, associations between distributed computing arrangement suppliers and insurance agency are assisting organizations with improving their Insurtech items, as most would consider to be normal to drive market development. For example, in November 2021, Amazon Web Services Inc. reported that American International Group, Inc., an insurance agency, has chosen it as a favored public cloud supplier. Through this drive, American International Group intends to convey better administrations to its clients.

The blockchain section is expected to enlist the most elevated development over the gauge period. Blockchain innovation empowers insurance agency to reduce down on functional expenses and drive functional efficiencies. This innovation can be utilized to drive development, incorporate fluctuated Insurtech stages, and empower new administrations to come to advertise, especially for the individuals who couldn't get to protection already. Insurtech organizations are supposed to forcefully pick blockchain innovation attributable to its highlights like shrewd agreements, high level mechanization, and solid online protection.

End User Insights

The BFSI section overwhelmed the market and represented over 22% portion of the worldwide income in 2025. BFSI organizations are broadly embracing Insurtech answers for further developing business proficiency. The expansion in the quantity of associated gadgets in the BFSI area is prompting the age of an enormous measure of information. Additionally, insurance agency has understood that they can utilize such information to convey better administrations, upgrade costs, gain bits of knowledge, and lift incomes. Simultaneously, the developing infiltration of cell phones overall is additionally expected to drive the interest for Insurtech arrangements across the BFSI area.

The medical services section is supposed to enroll the quickest development over the gauge period. The rising digitization in the protection area is supposed to drive the reception of Insurtech arrangements in the medical care industry. The developing number of gadgets has made a requirement for viable checking, the executives, and upkeep of information across medical care associations. The developing digitization among clients has enhanced the interest for simpler and better admittance to protection innovation administrations. Moreover, the ascent in the utilization of blockchain-based innovation among health and life coverage organizations is additionally expected to drive the portion development.

Regional Insights

What is the U.S. Insurtech Market Size?

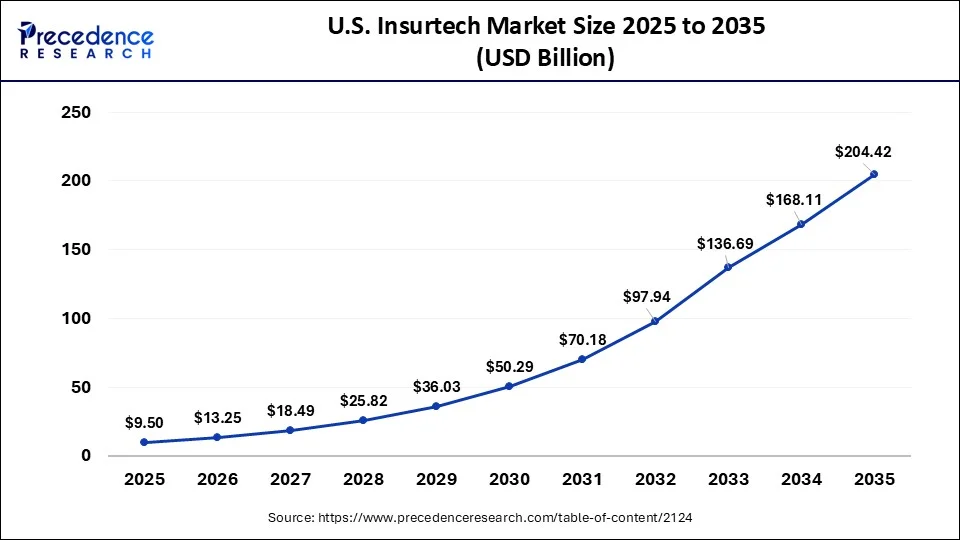

The U.S. insurtech market size was estimated at USD 9.50 billion in 2025 and is predicted to be worth around USD 204.42 billion by 2035, at a CAGR of 35.92% from 2026 to 2035.

Unlike many other jurisdictions that are currently experiencing regulatory challenges with insurtech, the United States has regulations in place that encourage innovation in the insurtech space. The National Association of Insurance Commissioners (NAIC) has put a regulatory framework in place, and U.S. federal government has made significant strides to provide transparency and accountability through platforms such as www.usaspending.gov, that track all expenditure of federal funds, including those for insurtech programs. These provide a fertile ground for insurtech growth and development, especially with digital insurance solutions.

North America overwhelmed the market for Insurtech in 2025 and represented in excess of a 38% portion of the worldwide income. The district is seeing an expanded reception of Insurtech arrangements inferable from the rising expenditure of clients for protection related items. In addition, these arrangements offer adjustable and adaptable designs for property and medical coverage. The developing number of Insurtech new companies across the locale is likewise driving the market development in the district.

U.S. Insurtech Market Trends

This is driven by AI-based personalization, embedded insurance collaborations, and a shift towards niche SME coverage. It is boosted by high smartphone penetration (97%) along with digital need; the field is modernizing, although it faces investment caution.

Asia Pacific is expected to arise as the quickest developing local market over the conjecture period. The locale is supposed to observe huge development because of the presence of various arising economies and monetary centers in Singapore, India, and Hong Kong. Insurance specialist organizations in the locale are planning to offer reasonable protection payment plans.

A Prime Mover of the growth of insurtech in India has been the government through its active policies and regulatory reform. The Insurance Regulatory Development Authority of India (IRDAI) implemented the Bima Sugam digital portal for the insurance ecosystem in order to connect insurers, intermediaries and customers. In addition, the Indian government's flagship schemes Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and “Pradhan Mantri Suraksha Bima Yojana (PMSBY)” - made insurance accessible to millions of people by February 2025 there were 22.97 crore total enrollments under PMJJBY and 49.91 crore total enrollments under PMSBY (Source: http://pib.gov.in) . Growth of insurance penetration while driving the uptake of digital platforms has seen insurance players commit to the insurtech sector.

India Insurtech Market Trends

India is a global contributor in insurance AI adoption, moving from basic AI to generative, along with agentic AI for underwriting, claim processing, and customer service. Companies such as Acko and Digit are rising by providing fully digital, paperless, and even user-friendly interfaces.

The Rise of Insurtech: Technology Disruption in Insurance Services in Europe

Europe's market shows significant growth during the forecast period. This shift is boosted by the need for improved efficiency, lower expenses, personalized products, and seamless, mobile-based user experiences. These startups offer faster claims processing and even better risk assessment, forcing conventional insurers to adapt or partner to stay competitive.

France Insurtech Market Trends

It is driven by the growing healthcare expenses and a 2023 mandate for telemedicine adoption, which has spurred the expansion of digital-first health platforms and even individual insurance products. Artificial intelligence, machine learning, and blockchain are increasingly used to improve operations, improve customer service with chatbots, and also manage risk, with AI adoption anticipated to hit 30% in the industry by 2026.

Digital Insurance Revolution: The Expanding Insurtech Ecosystem in Latin America

Latin America's market shows notable growth during the forecast period. It is driven by a vast portion of the population that lacks life or health insurance, and nearly 70% of cars operate without insurance, offering a huge market for digital, affordable, microinsurance products. Protection is increasingly embedded directly into existing digital journeys, like buying a plane ticket or a phone, usually via WhatsApp or fintech apps, thus in a larger number of markets.

Insurtech Market Analysis in MEA

MEA's market shows fast growth during the forecast period. As traditional insurance penetration is low, mainly in Sub-Saharan Africa. This creates a huge market for digital-native, low-cost insurance (microinsurance), which can cover previously uninsured populations for crop failure, health, and life. Insurance is increasingly integrated into e-commerce, mobility apps, and telco partnerships, enabling for "on-demand" and "pay-as-you-go" models, mainly in retail, health, and auto.

Insurtech Market Companies

- Damco Group

- DXC Technology Company

- Insurance Technology Services

- Majesco

- Oscar Insurance

- Quantemplate

- Shift Technology

- Trav, Inc.

- Wipro Limited

- ZhongAn Insurance

Recent Developments

- In May 2025, Chubb Life Hong Kong introduced a new digital insurance product, Health Up, combining term life and accidental death coverage with a suite of annual health and wellness benefits. To support customer acquisition, Chubb is offering a 30% discount on Health Up through its partner networks such as JP Partners Medical and Vita Green. Their members are eligible for a 30% discount with no time limit. (Source: https://www.insurancebusinessmag.com)

- In May 2025, Toolstation, one of the UK's largest suppliers of tools, accessories and building supplies, has partnered with Superscript, the digital insurance broker, to provide Toolstation customers with access to a new insurance offering. The partnership is designed to safeguard tradespeople across Britain from the unexpected with smart, digital insurance solutions for every type of trade including covers such as public liability insurance, employers liability insurance, contract works cover, tool insurance, accident and illness cover and much more. (Source: https://ffnews.com)

- In January 2025, Lazada, Southeast Asia's eCommerce platform, and Peak3, a global insurance technology company, have announced the launch of a joint venture (JV) to build a digital and embedded insurance ecosystem in Southeast Asia. Bill Song, Group CEO of Peak3 stated, “We're honoured to be recognised as one of the leading InsurTech innovators globally. This acknowledgement underscores our commitment to enabling insurers and insurance intermediaries with future-ready cloud, data, and AI solutions, making insurance more accessible, relevant, and convenient. We're excited to advance innovation to meet the industry's evolving needs”. (Source: https://ibsintelligence.com)

- Metromile, an accident coverage business, expressed in December 2021 that supporters would have the option to pay charges and guarantee payouts utilizing bitcoin. This drive ought to help the association to advance its market position.

- General Fire and Liability Insurance Company, which represents considerable authority in giving conventional property and setback insurance to little ventures, started tolerating digital currencies for installment installments in June 2021.

Segments Covered in the Report

By Services

- Consulting

- Support & Maintenance

- Managed Services

By Deployment Model

- On-premise

- Cloud

By Type

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

By Technology

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

By Application

- Product Development & Underwriting

- Sales & Marketing

- Policy Admin Collection & Disbursement

- Claims Management

By End User

- Automotive

- BFSI

- Government

- Healthcare

- Manufacturing

- Retail

- Transportation

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content