What is Integrated Circuit Market Size?

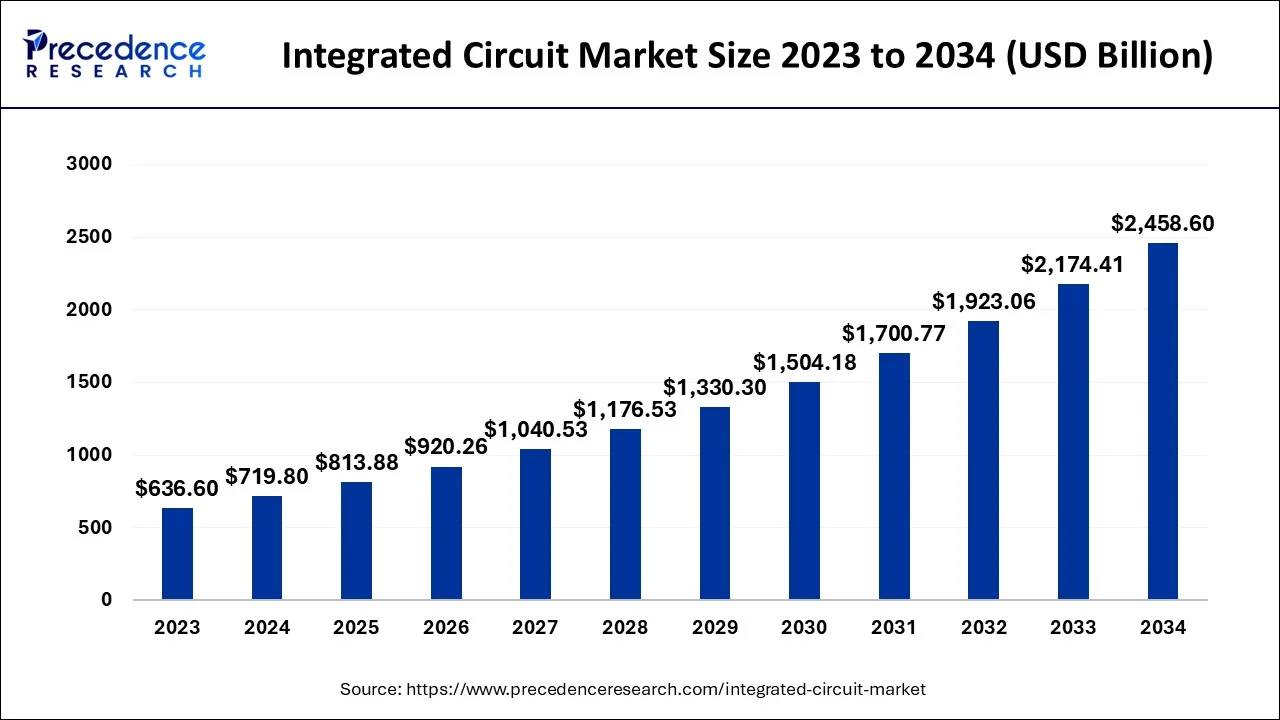

The global integrated circuit market size accounted for USD 813.88 billion in 2025 and is anticipated to reach around USD 2720.90 billion by 2035, expanding at a CAGR of 12.83% between 2026 and 2035.

Market Highlights

- North America region is projected to capture the highest market share between 2026 to 2035

- Asia Pacific is expected to expand at the fastest CAGR from 2026 to 2035

- By Type, The analog IC segment is estimated to dominate the global market from 2026 to 2035

- By Product Type, the application-specific IC segment is predicted to hold the biggest market share from 2026 to 2035

- By Industry Vertical, The consumer electronics segment is anticipated to dominate the global market from 2026 to 2035

Market Overview: Strategic Overview of the Global Integrated Circuit Industry

An integrated circuit (IC) is a miniature silicon semiconductor chip. It is a representation of an assemblage of manufactured small active and passive electronic devices. It was developed to build nanoscale circuits with many different parts and connections between them. A microprocessor, amplifier, counter, oscillator, timer, or computer memory can all be implemented using integrated circuits (ICs). An integrated circuit may be categorized as analog, digital, or hybrid. The use of mechatronics in industrial and automotive applications has caused a significant increase in the demand for electronic parts containing integrated circuits. Moreover, the increasing demand for consumer electronics such as smartphones, tablets, TVs and others drive the market growth over the forecast period.

More than 10 million electric vehicles were sold globally in 2022, according to the latest edition of the IEA's annual Global Electric Vehicle Outlook, and sales are projected to increase by another 35% this year to reach 14 million. According to the most recent IEA predictions, this fast growth has resulted in an increase in the share of electric cars in the entire auto market from 4% in 2020 to 14% in 2022 and is expected to reach 18% this year.

In 2022, the global electronics market was projected to be worth US$ 2.9 trillion. In its National Policy for Electronics (NPE) 2019, the Indian government has extensively acknowledged the strategic relevance and growth potential of this industry. By creating a competitive environment for the industry, NPE aims to transform the nation into a comprehensive hub for Electronics System Design and Manufacturing (ESDM). As one of the top 25 priority sectors under the government's Make in India plan, the ESDM industry also plays a significant role in economic growth. The development of sustainable electronic device production and exports has received significant attention from Indian officials. In general, the electronics manufacturing industry had an exponential expansion, going from US$ 37.1 billion in 2015–16 to US$ 67.3 billion in 2020–21.

Artificial Intelligence: The Next Growth Catalyst in Integrated Circuit

Artificial Intelligenceis having a profound impact on the integrated circuit industry, affecting it as a primary demand driver and a transformative design/manufacturing tool. The compounding demand for AI applications, especiallygenerative AI and autonomous systems, has created a massive need for specialized, high-performance, and energy-efficient chips such as GPUs and ASICs, driving significant market growth and innovation in hardware architecture.

Market Outlook

- Market Growth Overview: The integrated circuit market is expected to grow significantly between 2026 and 2035, driven by the integration of Artificial Intelligence and machine learning, the expansion of 5G connectivity services, and high-performance ICs.

- Sustainability Trends: Sustainability trends involve energy efficiency & renewable energy, circular economy, and water management.

- Major Investors: Major investors in the market include NVIDIA, Samsung Electronics, Taiwan Semiconductor Manufacturing Company, and Broadcom.

- Startup Economy: The startup economy is focused on design and IP, niche specialization in emerging technology, and fabless design.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 813.88 Billion |

| Market Size in 2026 | USD 920.26 Billion |

| Market Size by 2035 | USD 2720.90 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 12.83% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Product Type, and By Industry Vertical, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

An increase in data traffic and the use of IoT-connected devices

The market is expected to rise as more IoT-connected devices are used and data traffic increases. The adoption of digital IC components like magnitude comparators and priority encoders, which offer high-speed data processing, reduced power consumption, enhanced audio and video signal processing, and many other advantages, helps meet customer demands. The overall monthly mobile data traffic in India would increase from 9.4EB to 12EB in 2021, according to Ericsson's mobility research. These components will boost the demand for ICs, strengthening the outlook for the ICs sector.

Restraints

Complexities in designing and programming digital ICs

Complexities in the design and programming of digital IC architectures provide a significant challenge and restrain market expansion. Chip designers struggle to create or program while preserving parameters like cheap costs, low power consumption, great performance, and optimum processing, which restricts the market's expansion. Furthermore, the production costs for semiconductor manufacturers are increased by the large requirement for a professional and trained workforce due to the high accuracy and precision necessary while making these ICs. These variables significantly hinder the expansion of the ICs market.

Opportunities

Growing automotive industry

The growing automotive industry is expected to provide a lucrative opportunity for market growth during the forecast period. The ICs used in various components of the vehicles including ADAS, in-vehicle networking, engine management, transmission control system and infotainment. According to the ACEA, around the world, 79.1 million motor vehicles were produced in 2021, a rise of 1.3% over 2020. Thus, the growing automotive industry is expected to offer a lucrative opportunity for market growth.

Segment Insights

Type Insights

Based on the type, the global integrated circuit market is segmented into Digital IC, Analog IC and Mixed-Signal IC. The Analog IC segment is expected to dominate the market over the forecast period. The growth in the segment is attributed to the various application of analog IC. Operational amplifiers, linear regulators, oscillators, active filters, and phase-locked loops are all designed using analog integrated circuits. Additionally, analog integrated circuits operate with time-varying signals. Analog integrated circuits require external components. They are employed in the creation of electronic circuits like as voltage comparators and amplifiers, among others. Thus, this is expected to drive the segment growth over the forecast period.

Product Type Insights

Based on the product type, the global integrated circuit market is divided into General-Purpose IC and Application-Specific IC. The Application-Specific IC segment is expected to hold the largest market share over the forecast period. ASICs - Application-Specific Integrated Circuits An integrated circuit type known as an "application-specific integrated circuit" (ASIC) is created specifically for a given use or application. An ASIC can run more quickly than a programmable logic device or a conventional logic integrated circuit because it is made expressly to accomplish one thing and does it well. Additionally, it can be reduced in size and electrical usage. In addition, a wide variety of ASICs are used for things like personal digital assistants, emission control, and environmental monitoring. Thereby, driving the segmental growth over the forecast period.

Industry Vertical Insights

Based on the industry vertical, the global integrated circuit market is divided into Consumer Electronics, Automotive, IT & Telecommunications, Manufacturing and Automation, Healthcare, Aerospace & Defense and Others. The consumer electronics segment is expected to dominate the market over the forecast period. The increasing use of ASICs in phones, tablets, and laptops around the world is expected to create considerable growth prospects for all the firms involved in the value chain in the consumer electronics vertical. These ASICs provide several benefits, including as low power consumption, IP security, small size, and better bandwidth, which has led to a growth in the use of the ICs in the consumer electronics sector. Consistent performance and increased energy efficiency are also made possible by the quick development of electronic devices, which is driving the market for application-specific integrated circuits.

Regional Insights

North America is expected to capture the largest market share over the forecast period. The growth in the region is attributed to the robust healthcare infrastructure and the continuous development of healthcare devices and equipment. Medical gadgets including pacemakers, ultrasound machines, and insulin pumps all make use of ICs. By processing signals, keeping track of vital signs, and managing the administration of medications, ICs play a crucial role in these devices. The development of more sophisticated and advanced medical equipment and technologies has been made possible by ICs, which have played a significant role in the healthcare sector. Healthcare improvements and advancements have been made possible by ICs, which have produced more individualized and efficient healthcare solutions. The rising prevalence of cardiovascular disease is predicted to increase pacemaker demand, which will fuel market expansion throughout the forecast period.

According to the CDC, in the United States, heart disease claims the lives of around 697,000 people annually, or 1 in every 5 fatalities. Thus, the increasing usage of medical devices for various diseases is expected to drive market growth in the region over the forecast period.

U.S. Integrated Circuit Market Trends

U.S. expansion in federal investment and domestic, shift in automotive electrification and autonomy, and artificial intelligence and high-performance compounding. The expansion of the 5G/6G wireless network and the proliferation of IoT devices in consumer electronics, industrial automation, and healthcare drive demand for low-power applications, fueling market growth.

The Asia Pacific is expected to grow at the fastest rate over the forecast period. The regional growth is attributed to the increasing consumer electronic industry and the growing automotive sector. The revenue for integrated circuits is mainly coming from the countries like India and China owing to the rapid growth in these industries. The consumer electronics and automotive industries use ICs extensively in products including tablets, smartphones, televisions, laptops, home appliances, infotainment, and ADAS. For instance, according to Statista, 85% of the population in Japan is expected to use a mobile device by 2022, and that percentage is expected to keep rising. According to survey findings, there will be 115.5 million smartphone users worldwide by 2027, or more than 94% of the population. Moreover, China experienced the EV market's fastest growth in 2021, selling almost 3.2 million EVs. This was a 2 million unit gain over 2020, exceeding the total increase of all other regions put together. Thus, the increasing demand for consumer electronics and automobiles is expected to florish the integrated circuit industry over the forecast period.

China Integrated Circuit Market Trend

China's government initiatives, huge demand for high-performance chips for data centers, AI computing, and cloud services. Rapid adoption of electric vehicles boosts demand for automotive-grade chips.

How Did Europe Notably Grow in the Integrated Circuit Market?

Europe's excelling in specialized power electronics and automotive chips for ADAS, regional leaders like Infineon and STMicroelectronics anchor the continent's industrial and defense sectors.

Germany Integrated Circuit Market Trend

Germaine's rising demand in the automotive sector, industrial automation, and IoT sensor systems, and stringent environmental regulations and a national focus on sustainability are driving demand for energy-efficient chips in renewable energy systems and eco-friendly applications.

Value Chain Analysis of the Integrated Circuit Market

- Chip Design & R&D

This initial stage involves creating the architecture and detailed blueprints for the integrated circuits, a highly knowledge-intensive process.

Key Players: Synopsys, Cadence, NVIDIA, Qualcomm, and AMD are prominent examples. - Wafer Fabrication (Foundries)

In this capital-intensive stage, the chip designs are physically manufactured on silicon wafers in high-tech fabrication plants, or "fabs". Foundries require highly specialized equipment and materials supplied by other vendors.

Key Players: TSMC, Samsung Electronics, ASML, Applied Materials, and Lam Research provide critical machinery and materials. - Assembly, Testing, & Packaging (ATP or OSAT)

After fabrication, the wafers are cut into individual chips, which are then assembled, packaged in protective covers, and rigorously tested to ensure functionality and durability.

Key Players: ASE Group and Amkor Technology are key players specializing in these back-end processes. - Integration & End-User Applications

The finished and tested integrated circuits are then sold to Original Equipment Manufacturers (OEMs), who integrate them into a wide array of electronic products, such as smartphones, PCs, and automotive systems.

Key Players: Apple, Samsung, Intel, and Microsoft.

Top Companies in the Integrated Circuit Market & Their Offerings

- Analog Devices Inc (ADI): ADI specializes in high-performance analog, mixed-signal, and digital signal processing (DSP) ICs, bridging the physical and digital worlds to enable intelligent edge applications.

- Texas Instruments Inc (TI): TI is a world leader in the design and manufacture of analog ICs and embedded processors, with a vast portfolio of products used in nearly every electronic device.

- Intel Corporation:Historically a dominant player in PC and data center CPUs, Intel is currently expanding its presence in the market through its foundry services, manufacturing advanced logic wafers for itself and other companies.

- Infineon Technologies AG:Infineon is a leader in power systems and IoT, driving decarbonization and digitalization with its broad portfolio of power semiconductors, microcontrollers, and sensors.

- NXP Semiconductors N.V.: NXP focuses on secure connectivity solutions for embedded applications, with a strong emphasis on the automotive and industrial & IoT markets.

- STMicroelectronics N.V.: As an integrated device manufacturer, STMicroelectronics specializes in products for smarter mobility and power/energy management, including a wide range of microcontrollers, sensors, and power discrete products.

- On Semiconductor Corporation: ON Semiconductor (now branded as onsemi) provides power and signal management, logic, and custom solutions to drive energy-efficient innovations in automotive, industrial, and medical applications.

- Renesas Electronics Corporation: Renesas provides comprehensive embedded semiconductor solutions, including microcontrollers, analog, and power devices for mission-critical automotive and industrial applications.

- Microchip Technology Inc: Microchip is a leading provider of embedded control solutions, offering a diverse portfolio of microcontrollers, analog, and memory products that serve over 100,000 customers worldwide across various industries.

- MediaTek Inc.: MediaTek is a fabless semiconductor company known for its system-on-chip (SoC) solutions, particularly for wireless communications and multimedia products like smartphones, tablets, and smart TVs.

Recent Development

- In December 2025, LG Innotek's next-generation smart IC substrate was launched. This substrate for smart cards reduces carbon emissions by 50% during production and offers triple the durability of previous versions. (https://www.lgcorp.com/media/release/29719)

- In February 2023,Semtech Corporation, a provider of high-performance semiconductors, IoT systems, and Cloud connectivity services, announced its partnership with Shanghai Fudan Microelectronics Group Co., Ltd. to introduce the MCU+SX126x reference design to offer more affordable solutions for customers in the fields of instrumentation, fire prevention and security, environmental monitoring, and other applications.

- In August 2022,with the introduction of "TB67S549FTG," a stepping motor driver IC contained in a tiny package with built-in constant-current regulation that does not require additional circuit components, Toshiba Electronic Devices & Storage Corporation increased its lineup of stepping motor driver ICs. The new driver helps circuit boards use less space and is appropriate for industrial equipment like office automation and banking equipment.

- In May 2023,a developer of electronic design automation systems for the creation of integrated circuits (ICs), Diakopto has been acquired by ANSYS ANSS. Diakopto focuses on solving crucial problems brought on by layout parasitics, which have gotten more complicated in contemporary semiconductor designs using cutting-edge process node technologies. The purchase is anticipated to give design engineers the ability to "shift left," identifying interconnect parasitic issues early in the design cycle and reducing expensive design cycle recurs. Through the acquisition, ANSYS will be able to make use of Diakopto's distinctive methodology and provide designers with practical fixes for the aforementioned problems. In addition, it will aid designers in enhancing IC performance and reliability and speeding up time to market.

- In January 2023,the industry leader in silicon carbide (SiC) and gallium nitride (GaN) power ICs and the only pure-play, next-generation power semiconductor company, Navitas Semiconductor, recently announced an agreement to acquire Halo Microelectronics' remaining minority stake in its silicon control IC joint venture for $20 million in Navita's stock. To design application-specific silicon controllers that are tuned to work with Navitas GaN ICs to set new records for efficiency, density, cost, and integration for a variety of applications, Navitas and Halo established a joint venture in 2021.

Segments Covered in the Report

By Type

- Digital IC

- Analog IC

- Mixed-Signal IC

By Product Type

- General-Purpose IC

- Application-Specific IC

By Industry Vertical

- Consumer Electronics

- Automotive

- IT & Telecommunications

- Manufacturing and Automation

- Healthcare

- Aerospace & Defense

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting