Intelligent Vending Machines Market Size and Forecast 2025 to 2034

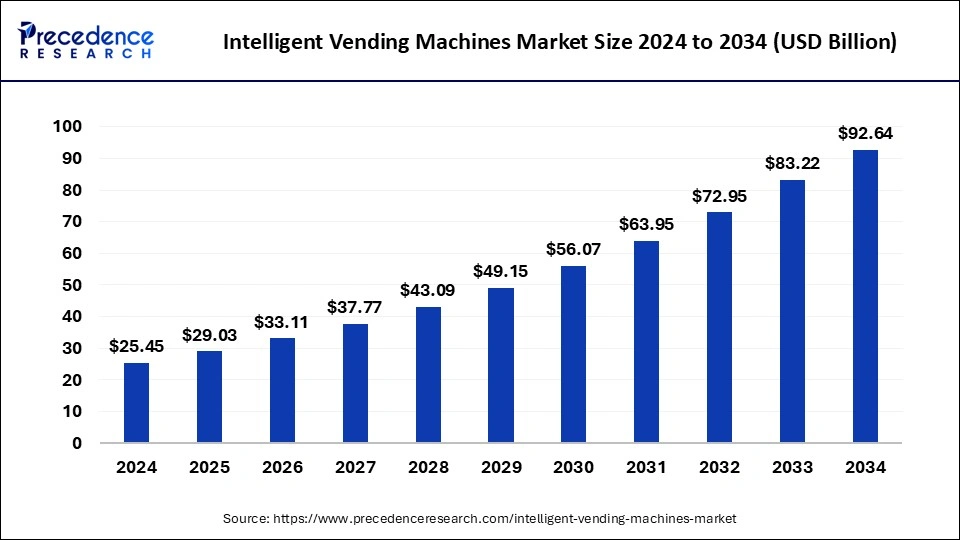

The global intelligent vending machines market size was estimated at USD 25.45 billion in 2024 and is predicted to increase from USD 29.03 billion in 2025 to approximately USD 92.64 billion by 2034, expanding at a CAGR of 13.79% from 2025 to 2034. Increasing development in the commercial properties and offices is expected to drive the intelligent vending machines market.

Intelligent Vending Machines Market Key Takeaways

- In terms of revenue, the global intelligent vending market was valued at USD 25.45 billion in 2024.

- It is projected to reach USD 92.64 billion by 2034.

- The market is expected to grow at a CAGR of 13.79% from 2025 to 2034.

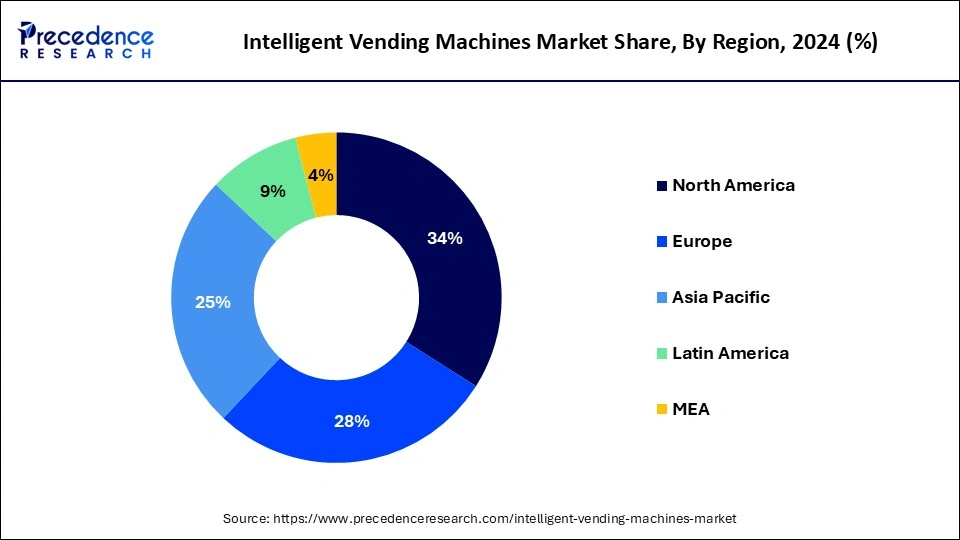

- North America dominated the market with the largest revenue share of 34% in 2024.

- Asia Pacific is expected to grow at a significant CAGR of 15.62% during the forecast period.

- By machine type, the free-standing vending machines segment dominated the market with the biggest share in 2024.

- By product, the food & beverages segment dominated the intelligent vending machines market in 2024.

- By application, the commercial malls & retail stores segmented dominated the market with the largest share in 2024.

U.S. Intelligent Vending Machines Market Size and Growth 2025 to 2034

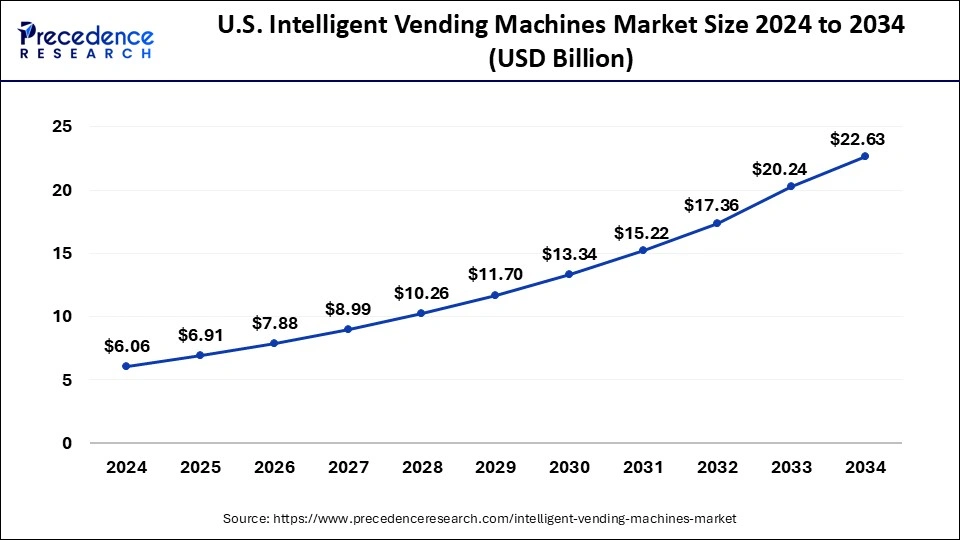

The U.S. intelligent vending machines market size was valued at USD 6.06 billion in 2024 and is expected to be worth around USD 22.63 billion by 2034 with a CAGR of 14.08% from 2025 to 2034.

North America dominated the intelligent vending machines market with the largest share in 2024. Increasing introduction of the intelligent vending machines by the retail market players headquartered in the North America region is estimated to fuel the growth of the market over forecast period. The location of some cities in the U.S. where testing was performed is enlisted here as follows: Woburn, Massachusetts; San Mateo and Garden Grove, California; Nanuet and Hartsdale, New York; Jacksonville, Florida; and Austin, Dallas, Fort Worth and Denton, Texas.

- For instance, in March 2024, Ulta Beauty, Inc., largest beauty retailer in the U.S., announced the launch of the SOS (safe operating stop) smart vending machine. The smart vending machines were mounted to the beauty bars of the Ulta stores, which will help the costumers to claim single free sample every week from a several different type of travel-sized products from brands across skincare, haircare, and cosmetics. Firstly, Ulta Beauty tested the SOS smart vending machines in 5-10 cities across the U.S. to expand its in-store sampling experience.

Asia Pacific is estimated to witness the fastest growth over the forecast period owing to increasing initiatives by the key players operating in the market to expand its geographic market presence. For instance, in October 2023, the Tao Bin, a company that manufactures food and beverage smart vending machine, based in Thailand announced the launch of its newly designed the Smart Robotic Barista in the Southeast Asia country (such as Malaysia) after its introduction in countries Thailand and Bangkok. The Smart Robotic Barista offers a wide range of options to suit different preferences, including protein shakes, sodas, smoothies, and popular staples like coffee and tea. Health-conscious customers may effortlessly customize their drinks by adjusting the sweetness level, which goes from 0% to 100%, to create a personalised experience that exactly fits their tastes.

Market Overview

An automated device designed to offer a wide variety of goods to consumers, including newspapers, tickets, pizzas, cupcakes, snacks, and drinks. Depending on the user's choices and the quantity of money deposited, a vending machine dispenses a product. The vending machine is a stand-alone, 24-hour device that needs a regular power supply connection in order to operate. It is made up of basic electro-mechanical systems that aid in automating the vending machine process as a whole. Its primary purpose is to provide people with a wide variety of products at any time in an impeccable manner.

The vending machine: a coin-operated device that can be used to sell a variety of commodities. Coin-operated amusement games and music machines are not the same as vending machines. Vending machines were first utilized for commerce in early eighteenth-century England, where tobacco and snuff were sold through coin-operated "honour boxes." Later in the century, these gadgets were also utilized in the British-American colonies.

Intelligent Vending Machines Market Trends

- Increasing adoption of the organic growth strategies like marketing by the key players to promote the sale of its product is expected to drive the growth of the intelligent vending machines market.

- Increasing use of mobile payments is rising the demand for the ATM vending machine which is expected to drive the growth of the market over the forecast period.

- Increasing initiatives by key players for technology development is expected to drive the growth of the intelligent vending machines market in the near future.

- Product approval by regulatory bodies is anticipated to drive the intelligent vending machines market growth during the forecast period.

- Government initiative to set up vending machine in public healthcare sectors for physicians is estimated to foster the growth of the market.

- Increasing healthcare expenditure for development of infrastructure of hospitals is expected to create lucrative opportunity for market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 92.64 Billion |

| Market Size in 2025 | USD 29.03 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 13.79% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Machine Type, Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing launch of the new product

The rise in the initiative by the key players in the market to launch the new intelligent vending machines is expected to drive the growth of the market over the forecast period. Launches of new products offer lucrative opportunities for the industry along with the incorporation of advanced technologies in the market. For instance, in May 2024, Luigi Lavazza SPA, Lavazza Professional - Drinks Factory based in U.K., announced the launch of the Lavazza on the Move, a newly innovated self-serve coffee machine. The Lavazza on the Move offers a design for high footfall civic spaces in the U.K.

Restraint

Increase in risk of theft and security concerns and strict government regulation

The increasing security concerns and theft risk for the business owner as well as stringent laws and regulations setup by the government for installation of vending machine has hampered the growth of the intelligent vending machines market. vending machines are vulnerable to theft and vandalism, especially in public places. It might be logistically difficult to keep machines stocked and operating, particularly if they are dispersed. Success depends on securing prime locations, which are in short supply and highly competitive. A vending machine company functions machines that dispense different products, mostly drinks and snacks.

Additionally, the government has put forth certain registration policy for installing vending machine. For instance, in March 2023, according to the data updated by the National Portal of India, a single-window access to information and services published the list of required list of licenses required for vending machine business which are mentioned here as follows: The FSSAI (Food Safety & Standards Authority of India) License, GST Number, Trade License, Weights and Measures Act Compliance, Consumer Protection Act Compliance, and Local Regulations.

Opportunity

Increasing adoption of the inorganic growth strategies like collaboration and partnership

The key players operating in the market are adopting inorganic growth strategies such as collaboration and partnership for developing as well as launching new product in the market. For instance, in January 2024, TOMRA Systems ASA, waste recycling company, collaborated with central system administrator MOL Hulladékgazdálkodási Zrt. (MOHU), a centralized waste management system organizer, for developing new deposit return scheme (DRS) for single-use drink containers and designed the free-standing reverse vending machine (RVM).

Technology Advancement and Launch of product

Increasing launch of the advanced technology products by the key players operating in the market is expected to create opportunity for the growth of market over the forecast period. For instance, in January 2023, Thundercomm, Internet of Things (IoT) product and solution provider revealed the launch of the smart vending machines that offers advanced dynamic vision technology, which can precisely identify the purchased items and quantities after capturing, identifying, and analyzing the entire purchasing process through a video record. For purchases to be completed, customers simply need to open and close the door. Because container space may be fully utilized, operational costs can be decreased. This also helps to increase operational efficiency by lowering limits on container commodity display.

Machine Type Insights

The free-standing vending machines segment held the dominating share of the intelligent vending machines market in 2024 on account of factors such as increasing launch of the new free-standing vending machine. The free-standing reverse vending machine can gather cans and plastic bottles separately in two internal bins, or it can collect one bin for each type of waste.

For instance, in March 2024, TOMRA Systems ASA, waste recycling company, announced the launch of TOMRA B5 Combi which is free-standing reverse vending machine (RVM), innovated to offer easy option for retailers to initiate gathering and collecting empty beverage containers for recycling while saving resources as well as space for stores new to participating in deposit return systems (DRS).

- The TOMRA B5 Combi, the first item in the Basic Line, is reportedly designed for tiny stores or spaces with little room for further retail equipment. Its footprint is 0.8 square meters. Additionally, it boasts a 21.5-inch touch screen in an effort to make deposit returns easier for customers to use.

Product Insights

The food & beverages segment held the largest share of the intelligent vending machines market in 2024. Increasing launch of the new vending machines for serving food & beverages is expected to drive the growth of the segment over the forecast period. For instance, in September 2023, Tao Bin, a company that manufactures food and beverage smart vending machine, announced the launch of the Smart Robotic Barista smart vending machine. This machine utilizes cutting-edge robotis, artificial intelligence (AI), and the Internet of Things (IoT) to produce a variety of drinks, including protein shakes, sodas, smoothies, and traditional tea and coffee. The Smart Robotic Barista offers an extensive menu of over 180 freshly made beverages choices such as mint tea, cold coffee, hot coffee, hot chocolate, and several flavours of soda.

Application Insights

The commercial malls & retail stores segment held the largest share of the intelligent vending machines market owing to rise in introduction of smart vending machine for the retail stores & commercial malls. For instance, in May 2024, Micromart, a company that develops food service operators and food retail technology for vending, announced the introduction of the Micromart Smart Stores vending machine, developed for food and beverages services. Micromart Smart Stores has introduced autonomous technology intended for the food service industry. Modular units from Micromart come with refrigerator, pantry, heating choices, and freezer. With the Micromart Platform and Micromart consumer app, operators can use remote monitoring and performance analysis of their smart store.

Intelligent Vending Machines Market Companies

- FAS International S.p.A.

- Bianchi Vending Group S.p.A

- Jofemar

- Rhea Vendors Group

- Crane Co.

- Sanden Corp.

- Advantech Co. Ltd.

- Azkoyen Group

- N&W Global Vending S.p.A.

- Westomatic Vending Services Ltd.

- Seaga

- Royal Vendors

Recent Developments

- In May 2024, Walker's Shortbread, goods company, launched world's first ever shortbread vending machine at the Scottish airport. The shortbread vending machine provides passengers to take a digital quiz to help match them to the perfect Walker's product for any occasion.

- In April 2024, Dispension Industries Inc., automation company, announced the launch of the contour top SmartServ, a vending machine for beer and ready-made alcoholic drinks.

Segments Covered in the Report

By Machine Type

- Wall-Mounted Vending Machines

- Free-Standing Vending Machines

- Table-top Vending Machine

By Product

- Food & Beverages

- Snacks

- Confections

- Tickets/ Newspapers

- Others

By Application

- Public Transport

- Commercial Malls & Retail Stores

- Offices

- Hospitals

- Educational Institutes

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

References:

Intelligent Vending Machines Market

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting