What is the Vending Machine Market Size?

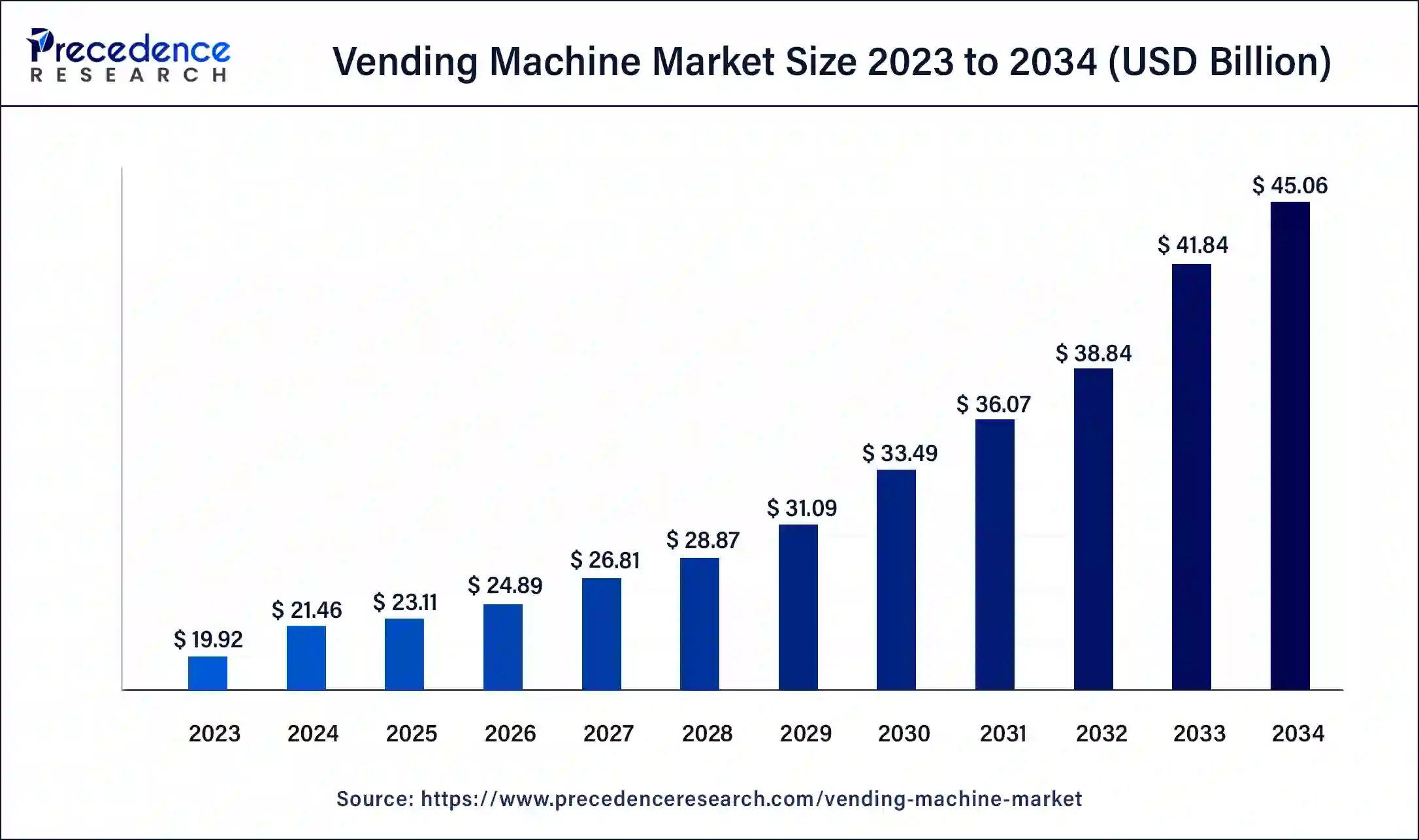

The global vending machine market size was estimated at USD 23.11 billion in 2025 and is predicted to increase from USD 24.89 billion in 2026 to approximately USD 48.13 billion by 2035, expanding at a CAGR of 7.61% from 2026 to 2035.

Vending Machine Market Key Takeaways

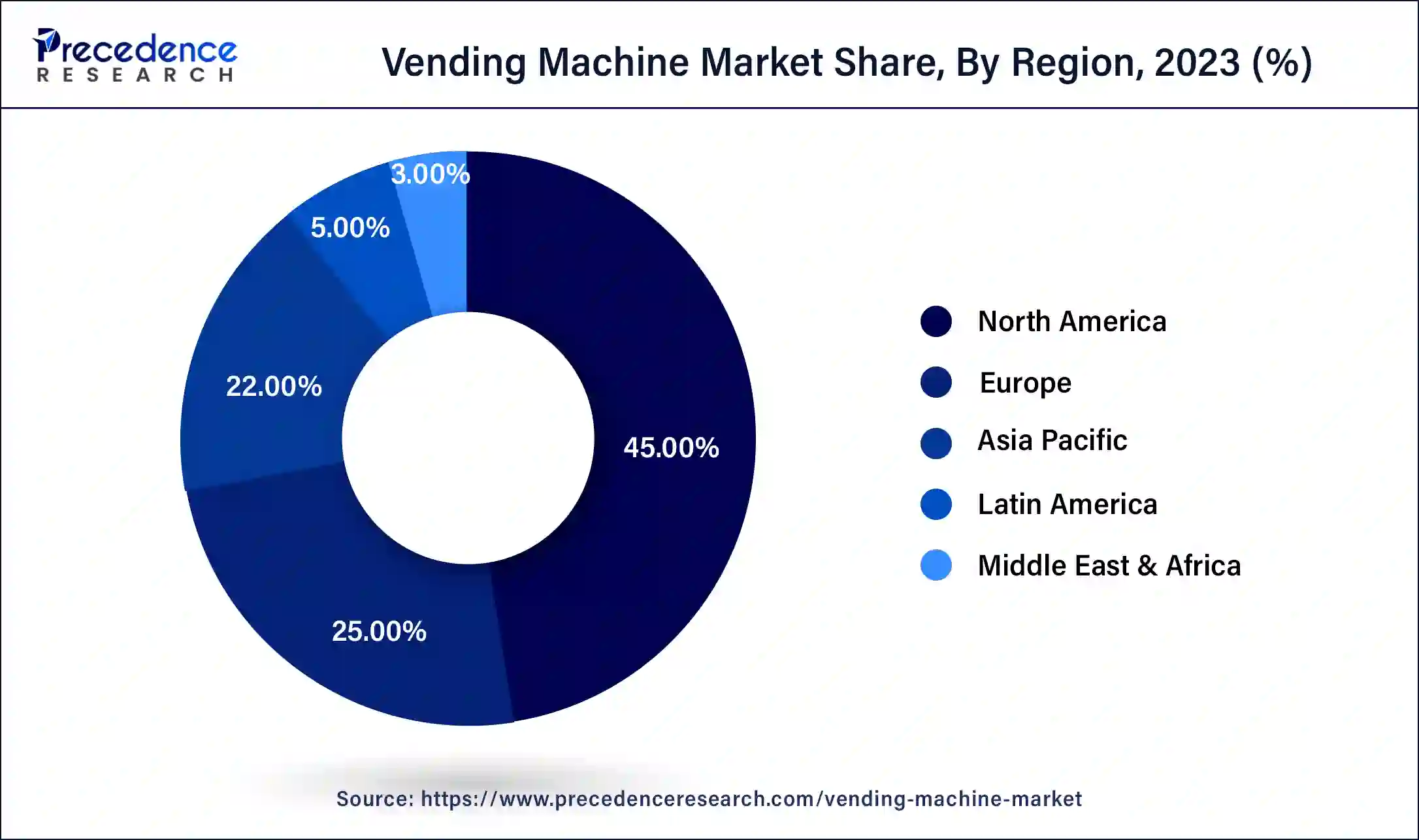

- North America contributed more than 45% of revenue share in 2025.

- Asia Pacific is estimated to expand the fastest CAGR between 2026 to 2035.

- By type, the beverages vending machine segment has held the largest market share of 42% in 2025.

- By type, the food vending machine segment is anticipated to grow at a remarkable CAGR of 7.9% between 2026 to 2035.

- By application, the hotels and restaurants segment generated over 40% of revenue share in 2025.

- By application, the public places segment is expected to expand at the fastest CAGR over the projected period.

- By technology, the automatic machine segment generated over 55% of revenue share in 2025.

- By technology, the smart machine segment is expected to expand at the fastest CAGR over the projected period.

What is the Vending Machine?

A vending machine is an ingenious automated contraption meticulously engineered to offer a hassle-free distribution of a wide assortment of products, spanning from snacks and beverages to compact necessities like toiletries and electronic gadgets. These self-operating mechanisms are frequently sighted in public settings, including office buildings, schools, transit stations, and commercial hubs, presenting patrons with a swift and straightforward avenue to acquire their preferred items, all without necessitating the involvement of human attendants. Vending machines are typically equipped to accept payments in the form of coins or electronic transactions facilitated by card readers, thereby simplifying the entire transaction experience for customers.

The fundamental operation of a vending machine involves a user-friendly interface featuring product selection buttons, a payment mechanism, and an internal storage system to house and distribute the selected items. When a patron inserts the necessary payment, they can press the button corresponding to their desired product. Subsequently, the machine employs mechanical or robotic means to release the chosen item. Vending machines are a cost-efficient and effective method of retailing, affording consumers the convenience of immediate purchases and uninterrupted access to an array of merchandise.

How is AI contributing to the Vending Machine Industry?

AI transforms vending machines into smart shopping points that enhance the efficiency and reliability of engagement. Predictive analytics streamlines inventory and logistics. Robots understand purchasing behavior and scheduling. Customized recommendations boost impulse buying. Grab-and-go experiences are possible courtesy of computer vision. Sensors aid in predictive maintenance that saves time. Online secure payment turns out to be easy. Real-time monitoring enhances security and control of operations in an unattended retail setting.

Vending Machine Market Growth Factors

- Continuous innovation in vending machine technology enhances user experience and operational efficiency.

- Growing consumer preference for healthier snacks and beverages fuels the demand for healthier vending options.

- The rise in digital payments and mobile wallets encourages cashless transactions in vending machines.

- Vending machines offering personalized product choices cater to diverse consumer preferences.

- Eco-friendly vending machines with energy-efficient features align with environmental concerns.

- Touchless selection and payment methods boost hygiene and safety.

- Internet of Things connectivity allows real-time monitoring and maintenance.

- Machines offering a wide range of items from electronics to fresh food appeal to a broader audience.

- Increased urban population density creates more vending machine placement opportunities.

- Machines at airports, train stations, and healthcare facilities serve a captive audience.

- Vending machines in convenience stores expand shopping options for customers.

- Vending machines provide easy access to snacks and beverages for employees.

- Data analytics enable businesses to tailor offerings based on customer preferences.

- Compliance with food safety standards is crucial for vending operators.

- Expansion into developing regions opens up new growth opportunities for vending machine companies.

Market Outlook

- Industry Growth Overview: Smart machines that process cashless AI are driving the vending revolution into automated on-the-go retail.

- Sustainability Trends: Eco packaging and reverse vending of machines, the unattended retail practice can be made greener by supporting the use of energy-efficient machines.

- Major investors: Techstars FoodBytes, Every Major Investor: Artha Venture Fund, Techstars FoodBytes, Providence Equity Partners, Selecta Group, and Canteen Vending are active participants.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 7.61% |

| Market Size in 2025 | USD 23.11Billion |

| Market Size in 2026 | USD 24.89 billion |

| Market Size by 2035 | USD 48.13Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Application, and By Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Cashless payments and health and safety concerns

The vending machine industry is witnessing a significant surge in demand, largely propelled by the widespread embrace of cashless payment systems and the increased emphasis on health and safety. Cashless payments have revolutionized consumer purchasing habits, as digital transactions gain prominence owing to their convenience and security features. Vending machines equipped with features like card readers and mobile wallet compatibility offer a seamless and hygienic buying experience, making transactions quicker and more efficient, and thus appealing to a broader audience.

Additionally, the increased emphasis on health and safety, particularly in light of recent global events, has highlighted the need to minimize physical contact with surfaces. Vending machines have responded by incorporating touchless interfaces, contactless delivery methods, and improved sanitation practices, instilling consumer confidence in the safety and hygiene of these vending solutions. As health and safety concerns persist, vending machines have evolved into a reliable and adaptable retail option, positioning them for sustained growth in a post-pandemic world.

Restraint

Limited product range and vandalism and theft

The vending machine market faces restraints in the form of a limited product range and the persistent threat of vandalism and theft. The primary challenge lies in the restricted space within vending machines, which inherently limits the variety and quantity of products they can offer. This constraint hampers the ability to cater to evolving consumer preferences and adapt to changing trends, potentially leading to missed sales opportunities.

Moreover, vandalism and theft pose significant hurdles for vending machine operators. These machines are often placed in public spaces where they are vulnerable to malicious activities. Vandalism not only results in costly repairs but also disrupts service, causing downtime and revenue loss. Theft of products and cash can further erode profits. As a result, operators must invest in security measures, impacting operational costs and profitability. These dual challenges of limited product range and security concerns necessitate innovative solutions and preventive measures to foster sustained growth in the vending machine industry.

Opportunity

Healthy snacking and micro-markets

Healthy snacking and the emergence of micro markets are creating significant opportunities within the vending machine market. Micro markets, which are essentially small, self-service stores within offices, educational institutions, and other controlled environments, provide an excellent opportunity for vending machine operators to expand their product selection and reach a captive audience. These markets often feature a broader range of items, including fresh food, salads, and even prepared meals. By leveraging micro markets, vending machine operators can tap into a growing niche that values convenience and variety, presenting a promising avenue for market growth and profitability.

Segment Insights

Type Insights

The beverages vending machine segment had the highest market share of 42% in 2025. In the vending machine market, the trend for beverages vending machines is leaning toward healthier choices, including low-sugar beverages, infused waters, and specialty coffees. Additionally, there's a growing focus on letting customers customize their drink selections, allowing them to pick flavors, types of milk, and sugar levels. These trends reflect changing consumer preferences for healthier and more personalized drink options in the vending machine industry.

The food vending machine segment is anticipated to expand at a significant CAGR of 7.9% during the projected period. In recent vending machine market trends, food vending machines have evolved to offer healthier and more diverse food options, catering to the growing demand for nutritious choices. Additionally, advancements in technology, including touchless interfaces and digital payment methods, have enhanced the user experience when purchasing food from these machines, aligning with the broader trend of contactless transactions in the post-pandemic era.

Application Insights

The hotels and restaurants segment has held a 40% revenue share in 2025. In the vending machine market, the hotels and restaurants application category refers to the placement of vending machines within hospitality establishments to offer a range of snacks, beverages, and convenience items to guests. The trends in this sector include an increased emphasis on offering premium and customized vending options to enhance the guest experience. Vending machines in upscale hotels may feature gourmet snacks, artisanal beverages, and high-quality toiletries, while some restaurants are incorporating vending machines to provide contactless payment and order pickup options, streamlining service and ensuring guest safety in a post-pandemic environment.

The public places segment is anticipated to expand fastest over the projected period. In the vending machine market, public places refer to locations accessible to a wide audience, including airports, train stations, shopping malls, and public transit hubs. A notable trend in this segment is the integration of technology to enhance user experience, such as touchless payment methods and interactive displays. There is also a growing demand for healthier vending options, including fresh snacks and beverages. Operators are increasingly focusing on sustainability, offering eco-friendly vending solutions in response to environmental concerns. Overall, vending machines in public places are adapting to evolving consumer needs and preferences.

Technology Insights

The automatic machine segment had the highest market share of 55% in 2025. An automatic vending machine is a self-operated device that delivers products when payment is received. In the vending machine industry, current trends show a movement toward modern technologies likeInternet of Things (IoT) integration, touchless controls, and digital payments. These upgrades improve user convenience and provide operators with real-time data for more efficient inventory management. Automatic machines are embracing these technological enhancements to meet the changing demands of today's consumers.

The smart machine segment is anticipated to expand fastest over the projected period. A smart machine in the vending machine market refers to a technological advancement that enhances operational efficiency and user experience. These machines incorporate features like IoT connectivity, touchless interfaces, and data analytics. Trends in the vending machine market include the integration of machine learning for predictive maintenance, real-time monitoring through IoT, contactless payments for hygiene, and personalized product recommendations. Smart vending machines are evolving to offer a seamless, convenient, and data-driven retail experience, catering to the changing preferences of consumers.

Regional Insights

What is the U.S. Vending Machine Market Size?

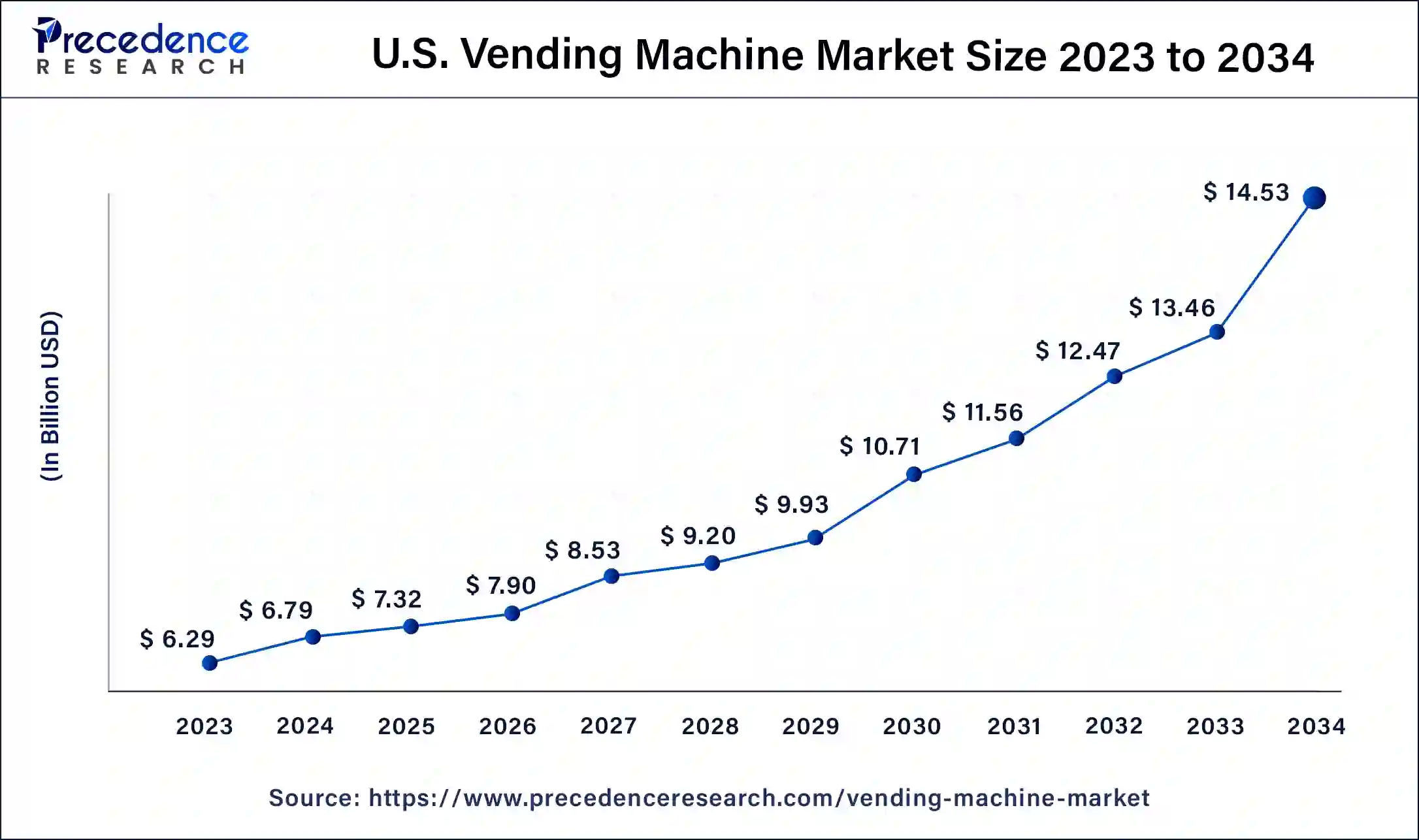

The U.S. vending machine market size was estimated at USD 7.32 billion in 2025 and is predicted to be worth around USD 15.55 billion by 2035, at a CAGR of 7.83% from 2026 to 2035.

North America has held the largest revenue share of 45% in 2025. North America dominates the vending machine market due to a combination of factors. The region benefits from a robust infrastructure, high consumer demand for convenience, and the early adoption of innovative vending technologies. The mature and well-established vending industry in North America has embraced cashless payments, touchless interfaces, and diversified product offerings. Additionally, a culture of on-the-go snacking and a large workforce further drive market growth. These elements collectively position North America as a key player in the vending machine market, holding a major share due to its technological advancements and consumer-oriented approach.

- According to the Observatory of Economic Complexity (OEC) report, the main import for vending machines has been the U.S., importing $257 million in 2023 and $259 million in 2024.

Asia Pacific is estimated to observe the fastest expansion. The region commands substantial growth in the vending machine market due to several factors. First, the region's rapid urbanization has created dense urban populations with a high demand for convenient and accessible retail solutions. Additionally, the prevalence of cashless payment methods and the adoption of advanced technologies have made vending machines more appealing and efficient.

India is a significant player in the Asian vending machine market, driven by rapid urbanization, demand for convenience, and rising adoption of advanced technologies. India is leading the manufacturing and exports of vending machines, driven by government initiatives like “Make in India.” In vending machine exports, India holds the lead position, with 34,262 shipments, followed by China with 21,813 shipments in 2024.

- SYRMA SGS TECHNOLOGY LIMITED, a company, held a large vending machine market share in India with a 4.73% share, valued at $3.32 million.

- The company specializes in vending machines, equipped with advanced technology, offering solutions that cater to both traditional food and beverage vending and more specialized products.

- The company has a strong reputation in the tech-driven vending solutions sector, particularly with automated systems for business environments and public spaces.

What Are the Driving Factors of The Vending Machine Market in Europe?

Europe is expected to grow at a significant rate during the forecast period. Europe is a well-established vending market that is influenced by the culture of strong coffee in the workplaces and urban lifestyles. The focus of demand is on beverages and healthier snacks that have quality convenience. Digital wallets are becoming popular among young people, just as hybrid payment models continue to exist. The operators aim at intelligent connected machines that increase the reliability of the service and user experience.

Germany Vending Machine Market Trends

Germany highlights the workplace vending to accommodate industrial productivity and convenience for the employees. Machines sell fresh meals, high-quality coffee, and healthy snacks. Hybrid systems of payment are still prevalent in terms of balancing between cash and cashless utilization. The large cities resort to the sale of electronics, pharmaceuticals, and goods manufactured on the territory, which enrich the category of products.

Vending Machine Market Companies

- Crane Co.: Offers contactless payments, smart snack beverage vending, and the glass front design with enterprise software to integrate operations.

- SandenVendo America Inc.: Sells high-capacity glass front exterior vending machines, which are designed to withstand durable units and high technology refrigeration and heating effects.

- Fastcorp Vending LLC: Highly specialized in robotic arm vending machines with frozen refrigerated products at low-energy consumption with reliable performance.

Other Major Key Players

- Azkoyen S.A.

- Fuji Electric Co., Ltd.

- N&W Global Vending S.p.A.

- Royal Vendors, Inc.

- Selecta Group AG

- Evoca Group

- FAS International S.p.A.

- Bianchi Industry SpA

- Glory Limited

- Sielaff GmbH & Co. KG

- Groupe SEB

- Vendekin Technologies

Recent Developments

- In April 2025, Coca-Cola Bottlers Japan Inc. and its partner, Fuji Electric, launched the world's first hydrogen-powered vending machine at EXPO 2025 in Osaka, Japan. This technology allows the vending machine to function in any location or weather condition without emitting CO?.

- On April 30, 2025, Aspect Bullion and Refinery launched the 50 gold and silver vending machines. The first machine was already implanted in Mumbai. These machines offer coins and bars with live market pricing. Purchases take under three minutes via UPI or cards.

- In March 2025, Wendor, one of India's leading smart vending solutions providers, launched its innovative state-of-the-art vending machines and smart lockers to revolutionize the food and beverage industry at AAHAR 2025.

- In March 2025, the World's first Chole Kulche Vending Machine was launched in Delhi. Delhi's street food scene just got a futuristic upgrade with a new vending machine that serves chole kulche in just 60 seconds!

- In March 2023, Crane Company successfully completed its separation from Crane Holdings, Co. This strategic move has transformed Crane Company into an independent, publicly traded entity, allowing it to focus more effectively on its business operations. This independence grants the company the flexibility to tailor investment and capital allocation strategies to its two key growth platforms.

- In December 2021,SandenVendo America, Inc. forged a partnership with Vendekin Technologies, a leading provider of diverse vending machine solutions. This collaboration empowers SandenVendo to integrate Vendekin's intelligent vending machine controller, enhancing its product offerings and capabilities.

- In March 2022witnessed Fastcorp Vending LLC announcing a strategic alliance with ABsea Change Inc. This partnership is designed to accelerate the adoption of Fastcorp's innovative smart vending platforms and technologies within the retail sector.

- In November 2020, Azkoyen S.A. introduced the Vitro X1 espresso machine featuring patented distance selection technology. This groundbreaking product not only delivers enhanced safety and hygiene for customers but also significantly contributes to Azkoyen's market presence and expansion within the vending machine industry.

Segments Covered in the Report

By Type

- Beverages Vending Machine

- Tobacco Vending Machine

- Others Vending Machine

- Food Vending Machine

By Application

- Hotels and Restaurants

- Corporate Offices

- Public Places

- Others

By Technology

- Semi-Automatic Machine

- Smart Machine

- Automatic Machine

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting