Intranasal Drug Delivery Devices Market Size and Forecast 2025 to 2034

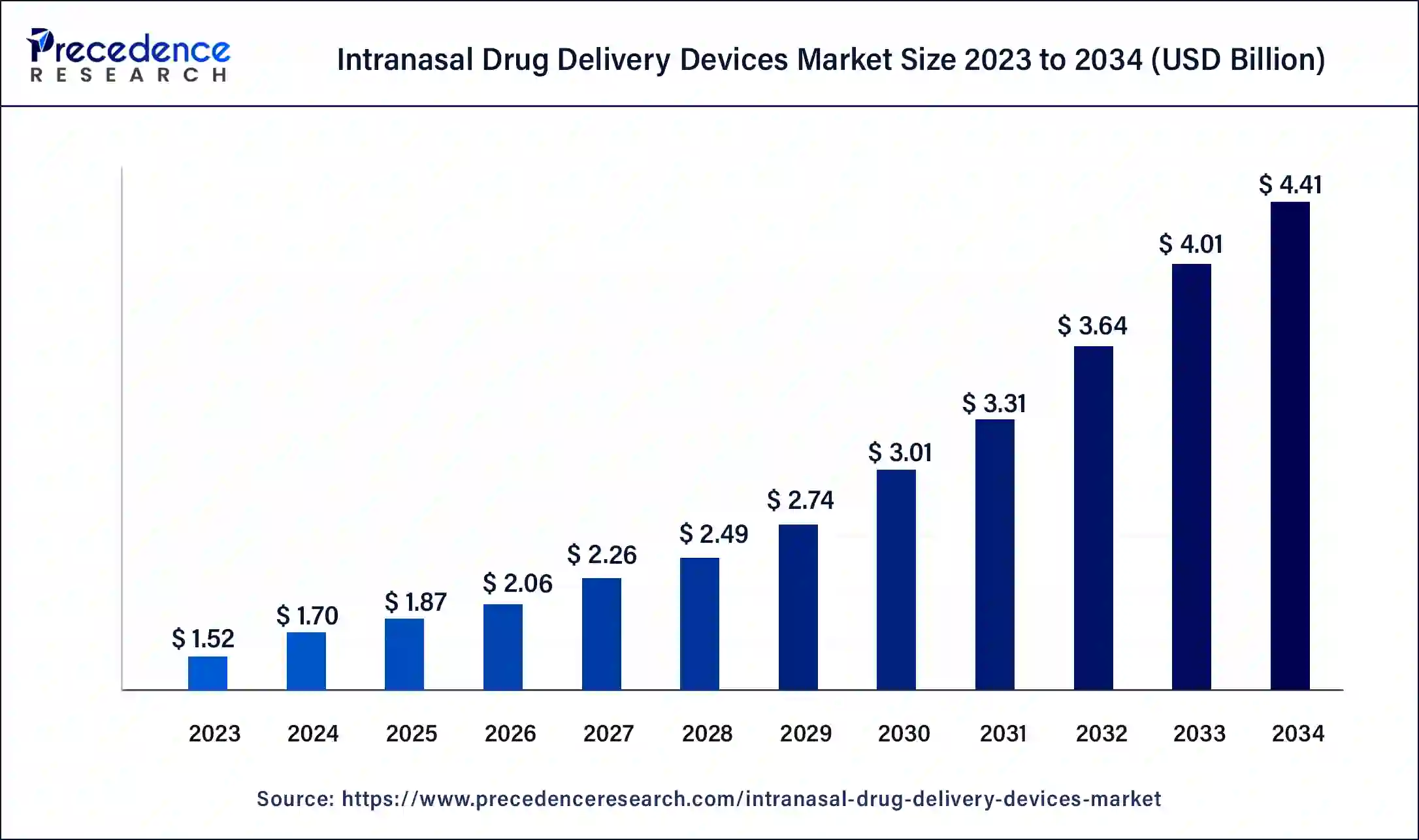

The global intranasal drug delivery devices market size was estimated at USD 1.7 billion in 2024 and is predicted to increase from USD 1.87 billion in 2025 to approximately USD 4.41 billion by 2034, expanding at a CAGR of 10% from 2025 to 2034.

Intranasal Drug Delivery Devices Market Key Takeaways

- In terms of revenue, the intranasal drug delivery devices market is valued at $1.87 billion in 2025.

- It is projected to reach $4.41 billion by 2034.

- The market is expected to grow at a CAGR of 10% from 2025 to 2034.

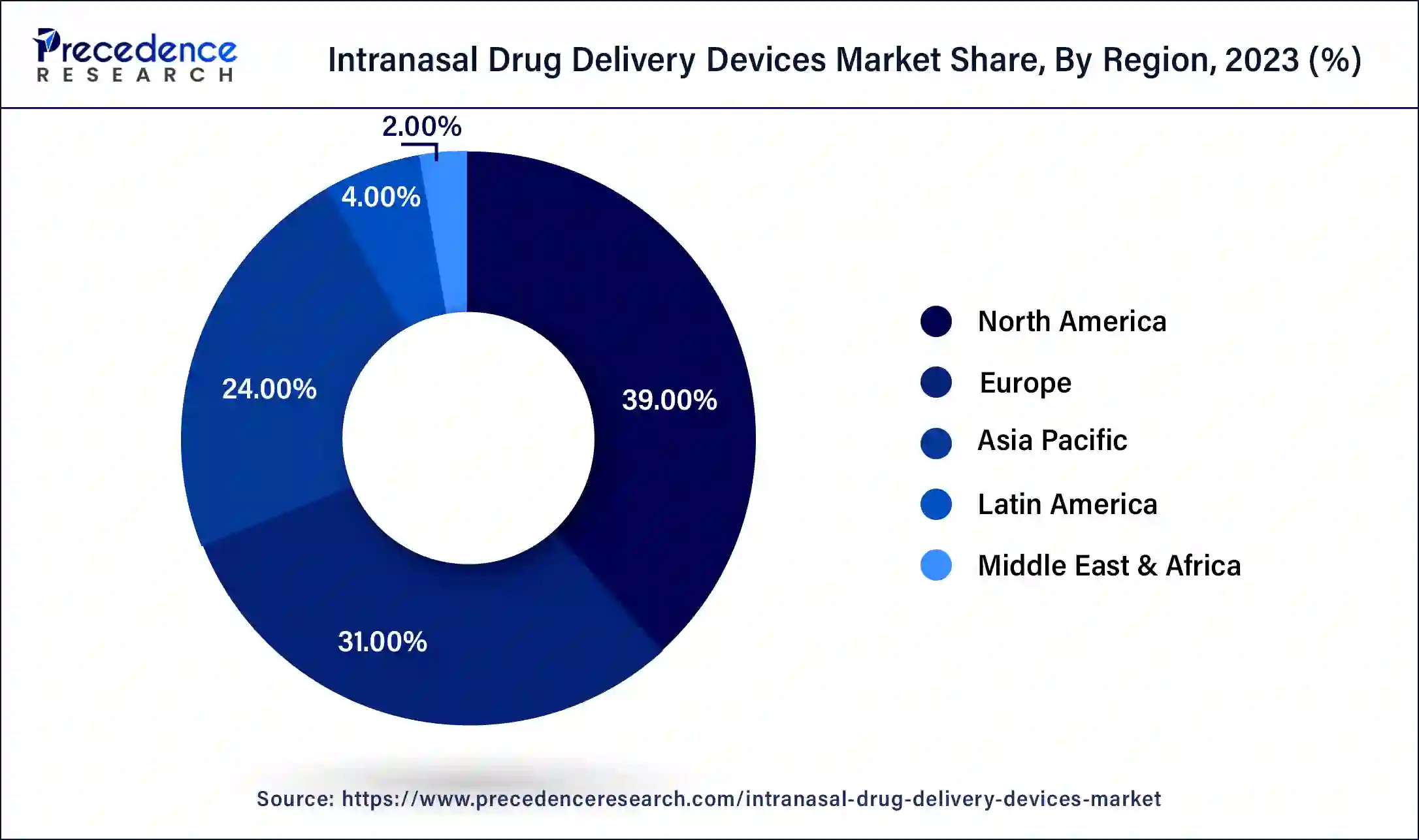

- North America led the global market with the highest market share of 39% in 2024.

- By systems, the multi-dose systems segment has held the largest market share in 2024.

- By application, the asthma segment captured the biggest revenue share in 2024.

- By end user, the hospitals segment registered the maximum market share in 2024.

U.S. Intranasal Drug Delivery Devices Market Size and Growth 2025 to 2034

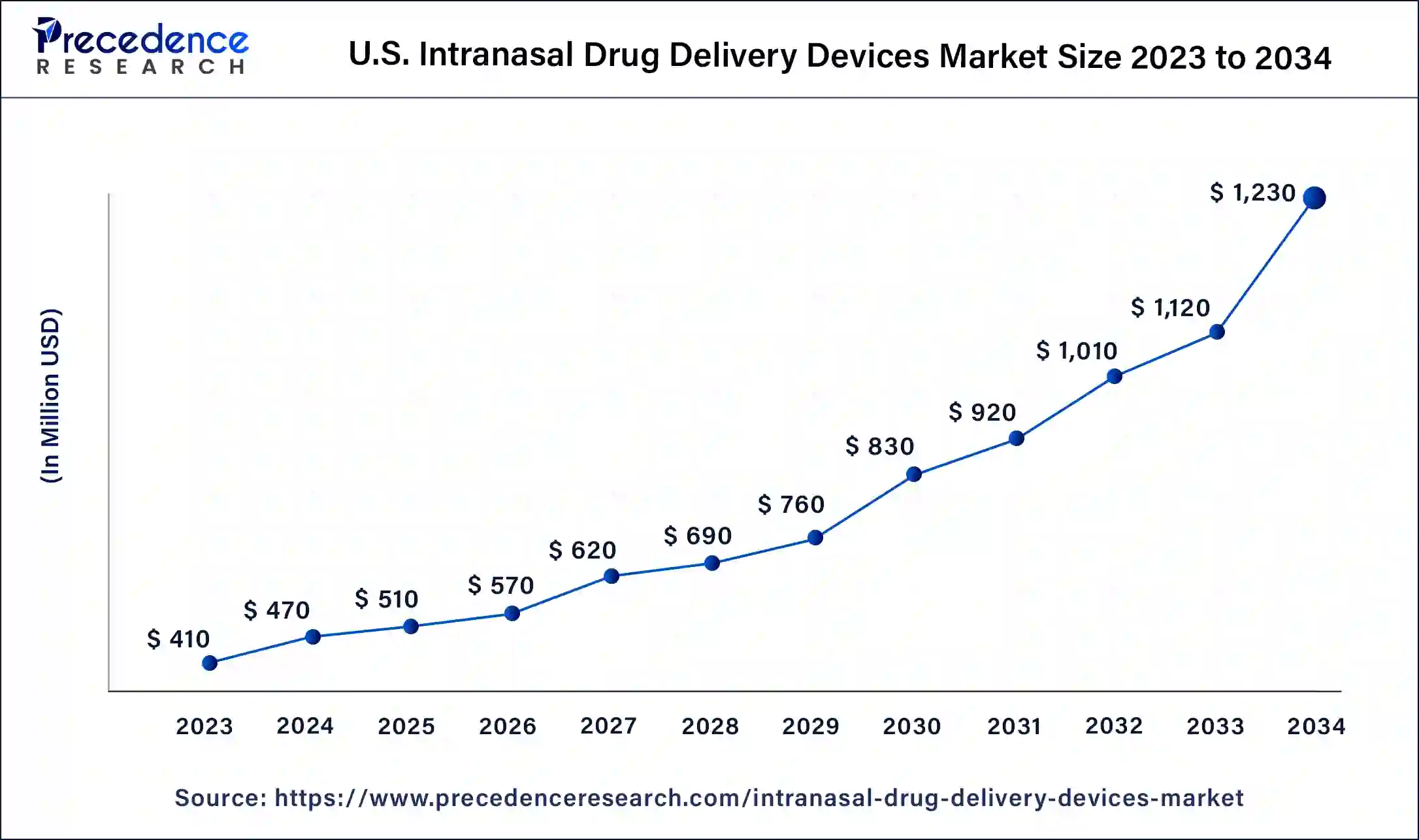

The U.S. intranasal drug delivery devices market size was estimated at USD 510 million in 2024 and is predicted to be worth around USD 1,230 million by 2034, at a CAGR of 10.10% from 2025 to 2034.

The North American region holds the largest market share in the intranasal drug delivery device market due to the increasing prevalence of chronic Respiratory conditions, developed healthcare infrastructure, and the high preference for non-invasive drug delivery devices. Furthermore, strong presence of key partner companies along with increasing R&D in drug formulations supports the growth of intranasal drug delivery device market in the region.

The United States has the largest market size in the North America region owing to increasing patients awareness, reversal of reimbursement policies, and quick regulatory clearance for new innovative devices. The US establishes itself as a strong manufacturing location for drug delivery device and innovative technology commercialization.

- In April 2025, Satsuma Pharmaceuticals, Inc., a announced that the U.S. Food and Drug Administration (FDA) has approved a 505(b)(2) New Drug Application (NDA) for Atzumi™(dihydroergotamine (DHE)) nasal powder for the acute treatment of migraine with or without aura in adults. Atzumi was previously known as STS101.

Europe is the second fastest growing region, following the development of a solid medical infrastructure and increasing desire for non-invasive treatment alternatives. In the perspective of regulations supporting advanced drug delivery systems and pressures on healthcare funding for the treatment of respiratory and neurological conditions, we see a faster rate of growth. Germany is leading the European market based on a strong healthcare system, strong research environment with the presence of major pharmaceutical companies focusing on developing and implementing intranasal drug delivery applications.

Asia Pacific has the fastest regional growth for intranasal drug delivery device, which stems from an increasingly supported healthcare system, increasing disease burden, and growing awareness of alternative non-invasive drug delivery systems. Growth in population and urbanization and subsequently improving access to healthcare are also feeding into the market growth. China is positioned to have the largest market in this region, largely due to its large patient pool, government support for domestic manufacturing, and developing pharmaceutical distribution networks within the region, making it a major contributor to regional growth over the next few years.

Intranasal Drug Delivery Devices Market GrowthFactors

- Increasing patient preference for nasal drug delivery as a result of easy administration and better efficacy

- High prevalence of cardiovascular diseases

- Patent expiration of popular drugs, increased cases of cancer and diabetes

- Growing Adoption of Self-Administration Practices

- Technological advancements

Market Scope

| Report Highlights | Details |

| Market Size by 2034 | USD 4.41 Billion |

| Market Size in 2025 | USD 1.87 Billion |

| Market Size in 2024 | USD 1.70 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segment Covered | System, Container, Application, End User, and Regions |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Major Trends in the Intranasal Drug Delivery Devices Industry:

Considering the wide-ranging awareness in nasal drug delivery and the possible advantages of intranasal administration, it is anticipated that novel nasal drug delivery products will continue to arrive at the market and advance exponentially in the forthcoming years. The prospects in the worldwide market for the intranasal drug delivery devices have drawn huge expenditure by major companies in research and development activities. Moreover, in the emerging countries such as India, China, etc. having low labor and clinical trials costs, will further aidin drawing market players to these nations and will observe an exponential development in the forthcoming years. The novel nasal drug delivery devices are expected to reach the market and grow significantly in the upcoming years due to the prevalent awareness regarding nasal drug delivery and the probable advantages of intranasal administration. The prospects in the global market for the intranasal drug delivery devices have invited huge investments by key companies in the research and development activities. Furthermore, in the emerging economies in the Asia Pacific region, which have lower costs of clinical trials and labor, will further help to draw market players to this region and will observe an exponential development in the near future. Through the development of spontaneous patient-friendly modernizations, intranasal medication delivery devices and apparatuses enable treatments to remain on the cutting edge along with making life better for affected individuals, thereby offering a great prospect for its overall business to flourish in the forthcoming years. To take completebenefit of these openings offered by nasal delivery of medications, innovative methods to overcome the biological blockades to delivery are being established. The technological advancements in many of the nasal drug transfer devices currently, consists of the powder preparation and carrier technology, intended for increased medication absorption through its muco-adhesive features and a transfer device technology intended for simple use, and comprehensive and consistent transfer of intranasal powder preparations. This technology can be employed to a wide range of medications, including peptides, small molecules, and biologics.

System Insights

Multi-dose Systems Segment Reported Foremost Market Stake in 2024

Multi-dose systems segment recorded the prime market share in the global intranasal drug delivery devices market in 2023. The ability of multi-dose systems to deliver drugs by avoiding formulation contamination is the major reason for high market share of multi-dose systems. The factors such as better tolerance and efficient use are expected to increase the usage of the multi-dose intra-nasal drug delivery systems over the estimate period.

The metered dose systems are projected grow at the highest CAGR during the forecast period mainly due to new product launches.

ApplicationInsights

Asthma is Projected to Dominate the Application Segment of Intranasal Drug Delivery Devices Market Revenue

Intranasal drug delivery devices are rapidly being employed for the management of asthma. As per the Centers for Disease Control and Prevention (CDC), 1 in 13 persons have asthma.Thus, high incidence of asthma and ongoing research and development activity in intranasal drug delivery devices for better absorption is the major reason for the high revenue share of asthma.

Rhinitissegment will expand at a significant CAGR during the forecast time-frame.

End UserInsights

Hospitals Projected to Dominate the End-User Segment of Intranasal Drug Delivery Devices Market Revenue

Hospitals have a high flow of patients with respiratory disorders when compared to small clinics. Furthermore, hospitals have capital availability to procure latest equipment's. These factors contribute to the growth of hospital segment.

Intranasal Drug Delivery Devices Market Companies

- Johnson & Johnson, Inc.

- Aptar Pharma Group

- GlaxoSmithKline Plc

- Aegis Therapeutics LLC

- H&T Presspart Manufacturing Ltd.

- AstraZeneca Plc

- Becton, Dickinson and Company

- Novartis AG

- Teleflex Incorporated

- Vectura Group Plc.

Recent Developments

- In 2019, AptarGroup, Inc. acquired Noble International, a frontrunner in drug delivery training equipment's (prefilled syringes, autoinjectors, respiratory and on-body devices) and patient onboarding plans.

- In 2018, Neurelis, Inc. finished the acquisition of Aegis Therapeutics. The product portfolio of Aegis Therapeutics includes Hydrogel, ProTek, and Intravail non-invasive drug transfer and stabilization advances applicable to a wide-array of molecules encompassingpeptides, therapeutic proteins, non-peptide small molecules and macromolecules.

Major Market Segments Covered

By System

- Metered Dose

- Multi-Dose Systems

- Unit-Dose Systems

By Container

- Non-Pressurized Containers

- Pressurized Containers

By Application

- Chronic Obstructive Pulmonary Disease (COPD)

- Rhinitis

- Cystic Fibrosis

- Nasal Congestion

- Asthma

- Others

By End User

- Ambulatory Surgical Centers

- Clinics

- Hospitals

- Others

By Geography

North America

- U.S.

- Canada

Europe

- Germany

- France

- United Kingdom

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Rest of Latin America

Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting