What is the Iron Deficiency Anemia Therapy Market Size?

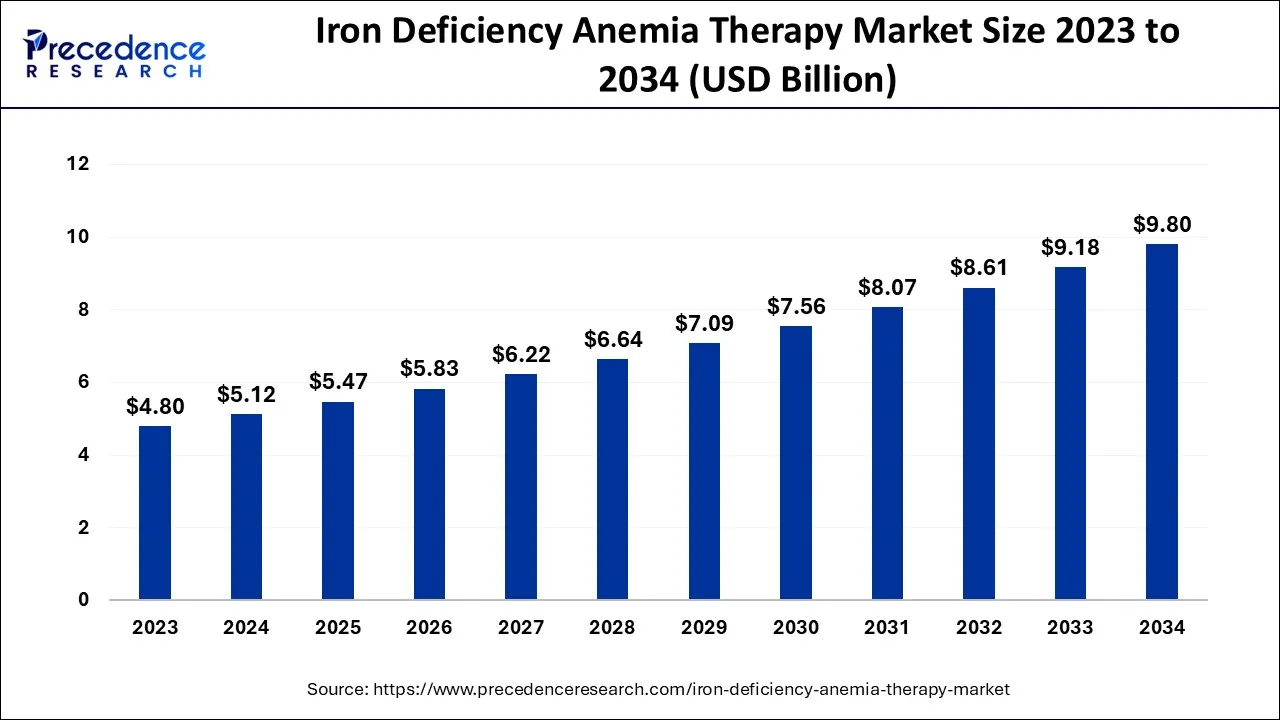

The global iron deficiency anemia therapy market size is valued at USD 5.47 billion in 2025 and is predicted to increase from USD 5.83 billion in 2026 to approximately USD 10.42 billion by 2035, expanding at a CAGR of 6.66% from 2026 to 2035.

Iron Deficiency Anemia Therapy Market Key Takeaways

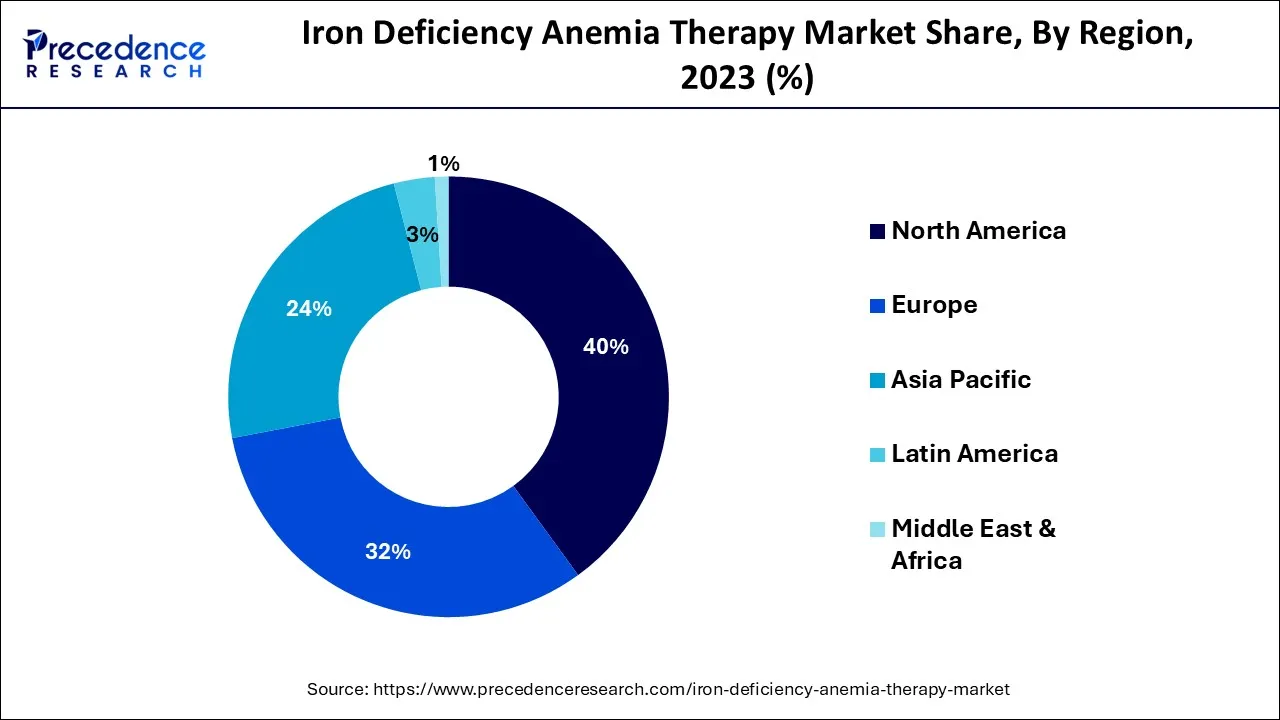

- North America led the global market with the highest market share of 40% in 2025.

- By therapy type, the oral iron therapy segment residential the biggest market share in 2025.

- By end user, the hospitals segment has held the highest market share in 2025.

Strategic Overview of the Global Iron Deficiency Anemia Therapy Industry

Iron deficiency anemia is one of the most typical types of anemia that arises from a lack of iron in the body. Low levels of healthy red blood cells are the cause of anemia, a medical disorder. The body's tissues receive oxygen via red blood cells (RBCs). Hemoglobin, a component of red blood cells, is made in large part by iron. A hemoglobin deficit is a sign that the body is getting less oxygen. Therefore, maintaining iron levels is crucial. The human body needs iron for the transportation of oxygen. Consuming foods high in iron, such as meat, vegetables, fruits, and cereals, can help avoid it. A complete blood count (CBC) test frequently reveals iron deficiency-related anemia. Healthcare experts frequently prescribe iron supplements (oral and parenteral) and advise dietary adjustments to manage this illness. Low levels of red blood cells, which can result in paleness, weariness, and weakness, are the main signs of anemia. The chronicity, size, and origin of the RBCs are used to categorize the subtypes.

Anemia caused by a lack of iron or a rise in hemolysis, or the destruction of red blood cells, can result from blood loss and a decrease in the synthesis of red blood cells. Iron malnutrition is the main cause of anemia. In addition, the main causes of iron deficiency anemia in developing countries are malaria and other worm infections.

- Around 229 million cases of malaria were reported worldwide in 2019, with 94% of those cases occurring in the WHO's Africa Region, according to Medicines for Malaria.

In 2019, malaria claimed the lives of over 409,000 individuals worldwide. Children under the age of five are most adversely impacted by malaria. The prevalence of iron deficiency anemia is raising as a result of the high burden of helminth illnesses, such as malaria.

Artificial Intelligence: The Next Growth Catalyst in Iron Deficiency Anemia Therapy

AI is impacting the iron deficiency anemia (IDA) therapy industry primarily through improved diagnostics, personalized treatment planning, and advanced, non-invasive monitoring tools. Machine learning algorithms aid in the rapid and accurate classification of anemia subtypes, helping clinicians differentiate IDA from other conditions like thalassemia, which ensures the appropriate therapy is selected from the start.

In terms of treatment, AI-driven clinical decision support systems (CDSS) are being used to optimize dosing regimens for iron supplements and erythropoiesis-stimulating agents, leading to better patient outcomes and reduced side effects.

Market Outlook

- Market Growth Overview: The iron deficiency anemia therapy market is expected to grow significantly between 2025 and 2034, driven by increasing awareness and screening, high prevalence, and therapeutic innovations.

- Sustainability Trends: Sustainability trends involve reducing the carbon footprint of medications, focusing on preventative measures, and sustainable sourcing and manufacturing.

- Major Investors: Major investors in the market include CSL Vifor (CSL Limited), Sanofi, Fresenius Kabi, AbbVie, Daiichi Sankyo, and Pfizer.

- Startup Economy: The startup economy is focused on advanced oral formulations, digital health and diagnostics, and novel delivery systems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.47 Billion |

| Market Size by 2035 | USD 10.42 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.66% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Therapy Type and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Market size is anticipated to be large for the oral iron therapy segment

Oral iron therapy is predicted to experience significant growth over the forecast period in the market under study due to factors like a rise in the number of anemia patients and disorders that cause anemia. The growing body of research that supports the use of oral iron therapy as an alternative to intravenous treatments in hospital settings is also expected to increase public acceptance of the therapy, promoting sector growth.

According to a report released by the IRESPUB Journal of Life Sciences in January 2022, oral iron supplementation, for instance, has been identified as the primary treatment for treating iron deficiency anemia in children that affects their growth and development. Similar to the above, it has been noted that oral iron therapy is the first line of treatment for mild iron deficiency anemia and iron deficiency without anemia during pregnancy, per a study published in the Oman Medical Journal in September 2020. The same source also suggests that liposomal iron might be a good oral iron therapy for expecting mothers who have iron deficiency anemia. This substance has a high rate of gastrointestinal absorption and bioavailability and a low frequency of negative effects. The rising demand for oral iron therapy is anticipated to enhance market expansion. Throughout the forecast period, rising business efforts to create oral iron treatment products and supplements, as well as an increase in product releases, are also anticipated to drive market expansion.

- For instance, Shield Therapeutics plc introduced Accrufer in July 2021 for the treatment of Americans with an iron deficit with or without anemia.

Restraints

High cost

The therapy's high cost will slow the market's rate of growth. A dearth of skilled workers and a lack of healthcare infrastructure in developing countries will pose problems for the iron-deficiency anemia therapy industry. The total costs include the price of the medical tests that must be performed to confirm the anemia as well as the costs of medications and, if necessary, surgery. To boost the amount of iron and raise the red blood cell count, though, sometimes a more invasive procedure is required. Furthermore, it is anticipated that throughout the forecast period, a lack of information among people will act as a hindrance and hinder the market's revenue growth.

Opportunities

An increase in iron deficiency anemia prevalence will drive the market

During the projected period, growth in the prevalence of iron deficiency anemia around the world is anticipated to boost the market for treatments for the condition. A frequent type of nutritional anemia is iron deficiency anemia, which is regarded as a major public health issue on a global scale. Iron deficiency anemia is becoming more prevalent, especially in women and children, as a result of low dietary iron intake and excessive red blood cell loss.

- The WHO estimates that anemia affects 1,500 million to 1,740 million individuals worldwide, with iron deficiency being responsible for 50% of all cases.

This can lead to developmental abnormalities in growing children and fetuses in pregnant women, respectively. Observations show that in 2020, anemia was found in about 53% of women.

- 3 million people in North America are thought to have anemia, according to figures from the National Heart, Lung, and Blood Institute.

The yearly incidence rate of iron deficiency anemia ranged from 7.2 to 13.9 per 1,000 person-years, according to a study done for national primary care databases in Germany, Belgium, Spain, and Italy. The increased prevalence of target diseases such as autoimmune diseases, rheumatoid arthritis, renal issues, liver disorders, cancer, thyroid diseases, and inflammatory bowel diseases is one of the major reasons influencing the growth of the iron-deficiency anemia therapy market.

Therapy Type Insights

Red blood cell transfusions, parenteral iron therapy, and oral iron therapy are the three main categories of therapy in the market. The typical first-line treatment for iron-deficiency anemia is considered to be oral iron therapy. However, poor absorption, gastrointestinal disturbances, and treatment non-adherence—estimated to vary from 10% on day 14 of therapy to 32% after two months—all reduce the efficiency of oral iron. However, in some cases, parenteral iron therapy is necessary to treat functional iron deficiency, treat patients who are resistant to or intolerant of oral iron therapy or treat patients who are receiving recombinant erythropoietin therapy. Iron dextran, ferric gluconate, and iron sucrose are the three parenteral iron preparations that are now offered.

Iron dextran, ferric gluconate, and iron sucrose are the three parenteral iron preparations that are now offered. Patients who are unable to tolerate or absorb oral preparations may benefit from parenteral medication. Through a little tube inserted into a vein in your arm, donated blood is given to you during a red blood cell transfusion. Blood loss from surgery or an injury can be replaced with the help of this potentially life-saving technique. The ideal transfusion trigger is still elusive, although research has indicated that a restrictive transfusion trigger of 7 g/dL can decrease RBC transfusions without hurting patient outcomes.

End User Insights

The global market for the treatment of iron deficiency anemia has been segmented into hospitals, clinics, and home healthcare based on end users. Due to advantages such as customized treatment programs, high-quality medication, and growth in hospitals in developing nations, the hospital sector led the market in 2023. Hospitals are facilities for medical treatment that are primarily run by qualified doctors, surgeons, and nurses. They are commonly known as inpatient hospitals where people are admitted due to illnesses or accidents. Hospitals can be general or specialized, and they provide a wide range of services.

On the other side, medical clinics prioritize outpatient care. You can return home after receiving care if you're an outpatient. Public, commercial, or governmental organizations can all run medical clinics. Although certain clinics may also welcome walk-ins, appointments are frequently required to see a medical facility. In general, routine medical care, preventative care, and sick care are the types of health-related services that you can receive at a medical clinic. While some clinics specialize in certain medical conditions, many offer more general healthcare services. In the convenience of your own home, home healthcare is a particular kind of healthcare service. Clinical services are offered at home, including nursing care, physical therapy, and occupational therapy. It differs from home care, which offers non-clinical assistance with daily tasks.

Regional Insights

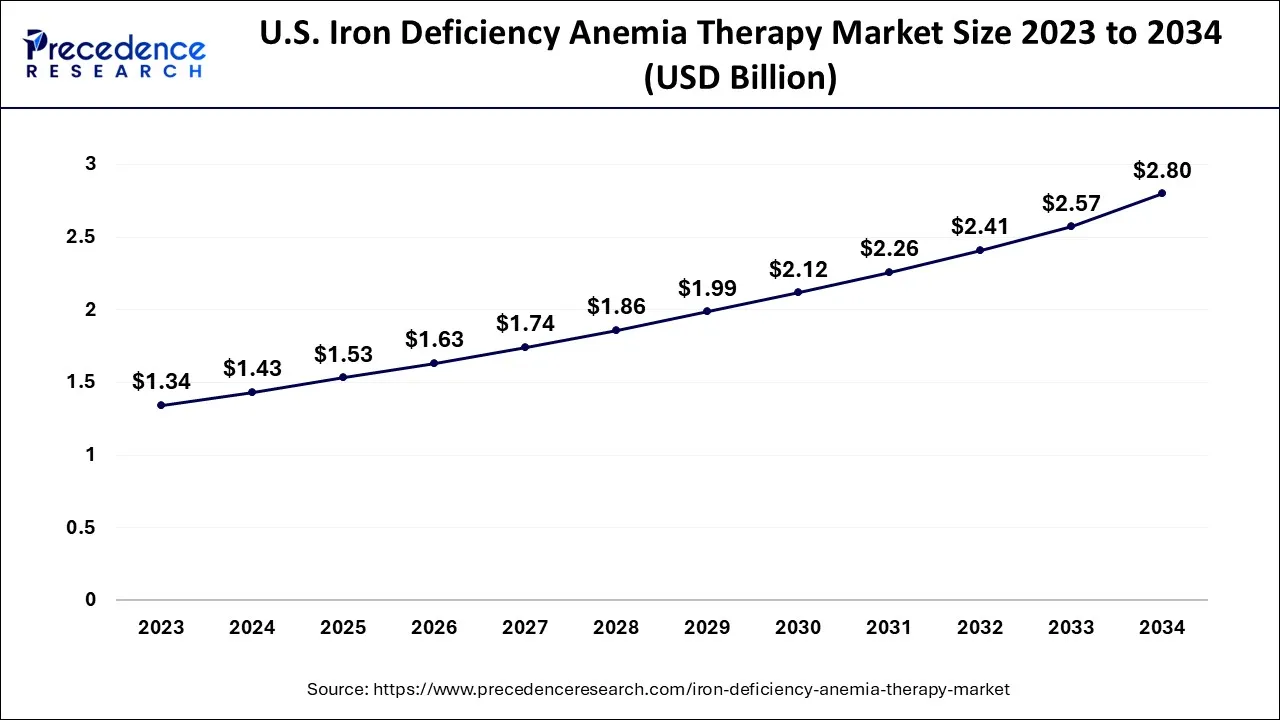

U.S. Iron Deficiency Anemia Therapy Market Size and Growth 2026 to 2035

The U.S. iron deficiency anemia therapy market size is exhibited at USD 1.53 billion in 2025 and is projected to be worth around USD 2.98 billion by 2035, growing at a CAGR of 6.89% from 2026 to 2035.

During the forecast period, it is expected that North America will account for the largest market share for the treatment of iron deficiency anemia globally. Product approvals, women's awareness, technological advancements, and a large number of tests are some of the major influencing factors in this field. One of the most prevalent blood illnesses today is anemia. Some of the most common anemia in North America include plastic anemia, hemolytic anemia, sickle cell anemia, and iron and vitamin deficiencies. Anemia, which affects more than 3 million Americans, is the most common blood ailment, according to the National Heart, Lung, and Blood Institute. The dominance of this region can be attributed to elements like high awareness of women's health, high rates of testing among women, and technological developments in the treatment of iron deficiency anemia.

- For instance, the National Center for Biotechnology Information (NCBI) reports that, with pregnant women omitted from the measurement, the prevalence of anemia in the United States was 5.6% in 2016.

The increased focus of the region's major key players on cutting-edge technology is also expected to boost the market's revenue. According to a 2018 study that was published in Mechanisms of Aging and Development, iron deficiency anemia is more common in children and pregnant women. In the United States, one-third of children (12 months to 36 months) are at risk for iron deficiency anemia, which has a frequency of about 10% among women of reproductive age. Additionally, the presence of major market players helps the region's market share grow throughout the forecast period.

On the other hand, it is anticipated that Asia-Pacific will experience rapid growth soon. Over the projection period, India and China are expected to be attractive markets for the treatment of iron deficiency anemia due to their expanding private health sectors, robust insurance players, and expanding economies. The presence of a sizable senior patient population with iron deficiency as well as an increase in healthcare spending in these nations are expected to contribute to the Asia-Pacific market's anticipated revenue growth throughout the forecast period. The Asia-Pacific region is anticipated to grow at the fastest rate during the forecasted period due to its growing population, rising healthcare costs, government initiatives to support the healthcare sector, and rising demand for IDA treatment. India and China are anticipated to be desirable markets during the projection period for the treatment of iron deficiency anemia. Over the next few years, it is anticipated that the market in the Asia Pacific will grow due to the presence of a sizable senior patient population with iron deficiency and a rise in healthcare spending in these nations.

U.S. Iron Deficiency Anemia Therapy Market Trends

The U.S. region's market growth is driven by high prevalence rates in women and children, driving demand for innovative therapies that offer improved efficacy and fewer side effects. The industry is adapting to a shift towards patient-centric care, with a growing preference for convenient home healthcare options facilitated by digital health platforms and telehealth services.

China Iron Deficiency Anemia Therapy Market Trends

China has a significant prevalence of women and children, a rising incidence of chronic diseases, and a focus on women's health and nutritional deficiencies, which fuel the market growth. Expanding healthcare infrastructure and the presence of domestic pharmaceutical manufacturers are further supporting market expansion across urban and rural regions.

How Did Europe Notably Grow in the Iron Deficiency Anemia Therapy Market?

Europe's rising integration towards chronic disease care pathways, advancement in IV iron formulation, introduction of newer, effective, and safer iron products, and growing awareness and screening programs. Oral iron therapies continue to gain traction as first-line treatment for mild anemia because of their convenience and cost efficiency. Strong government support, established clinical guidelines, and widespread screening programs contribute to consistent therapy adoption across the region.

Germany Iron Deficiency Anemia Therapy Market Trends

Germaine's higher awareness and routine screenings in antenatal care, nephrology, and cardiology boost demand, shift towards early and aggressive treatment, and better IV formulations and child-friendly oral options expand treatment scope. Oral iron treatments are gaining momentum thanks to improved formulations with better tolerability and convenience for outpatient care.

Value Chain Analysis of the Iron Deficiency Anemia Therapy Market

- Research & Development (R&D) and API Manufacturing

This foundational stage involves discovering new iron formulations and producing the active pharmaceutical ingredients (APIs).

Key Players: Pharmacosmos A/S, CSL Vifor, Daiichi Sankyo Company, and Akebia Therapeutics. - Clinical Trials and Regulatory Approval

Following R&D, potential therapies must undergo rigorous clinical trials to prove their safety and efficacy before receiving approval from regulatory bodies like the FDA or EMA.

Key Players: Pfizer Inc., Sanofi, and AbbVie Inc. - Manufacturing and Production

Once a therapy is approved, large-scale manufacturing begins, converting raw APIs into final dosage forms (tablets, capsules, or injectable solutions).

Key Players: Fresenius Kabi AG, Lupin, and Aurobindo Pharma - Distribution and Supply Chain Management

Finished products are then distributed through a complex network to reach various healthcare settings and patients globally.

Top Companies in the Iron Deficiency Anemia Therapy Market & Their Offerings:

- Vifor Pharma Ltd. (CSL Vifor) is a global leader in the field, specializing in the development and commercialization of widely used intravenous iron therapies such as Ferinject/Injectafer and Venofer.

- Teva Pharmaceutical Industries Ltd. primarily contributes to the IDA market as a key player in the generics sector. By offering cost-effective generic versions of essential iron supplements and other medications, Teva helps expand access to treatment, especially in developing regions.

- Sanofi is a major global pharmaceutical company that offers a range of both oral and intravenous iron supplements for IDA treatment, including Maltofer and Ferrlecit/Ferlixit.

- Pfizer Inc. contributes to the IDA therapy market through its involvement in various iron dosage options and a diverse portfolio that includes erythropoiesis-elevating agents.

- Mylan N.V. (now part of Viatris) is a significant player in expanding market access for IDA treatments through its strong presence in the generic drugs market.

Iron Deficiency Anemia Therapy Market Companies

- Vifor Pharma Ltd.

- Teva Pharmaceutical Industries Ltd.

- Sanofi

- Pfizer Inc.

- Novartis AG

- Mylan N.V.

- Lupin

- Zydus Cadila

- GlaxoSmithKline plc

- Fresenius SE & Co. KGaA

- F. Hoffmann-La Roche Ltd.

Recent Developments

- September 2022, Pharmacosmos A/S of Denmark sold Zydus Lifesciences the rights to market the iron deficiency anemia medication MonoFerric (iron isomaltose) injectable in India and Nepal. According to the company's regulatory filing, MonoFerric is indicated for the treatment of iron deficiency in adult patients when oral iron preparations are inefficient or cannot be administered or if there is a clinical need to deliver iron quickly.

- January 2020, The United States Food and Drug Administration (US FDA) recently approved the use of PHARMACOSMOS A/S's ferric isomaltose injectable for the treatment of people with iron deficiency anemia who had an intolerance to, or inadequate response to, oral iron or who had non-hemodialysis-dependent chronic renal disease.

Segments Covered in the Report

By Therapy Type

- Oral Iron Therapy

- Parenteral Iron Therapy

- Red Blood Cell Transfusion

- Others

By End User

- Clinics

- Hospitals

- Home Healthcare

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content