What is the Laparoscopic Instruments Market Size?

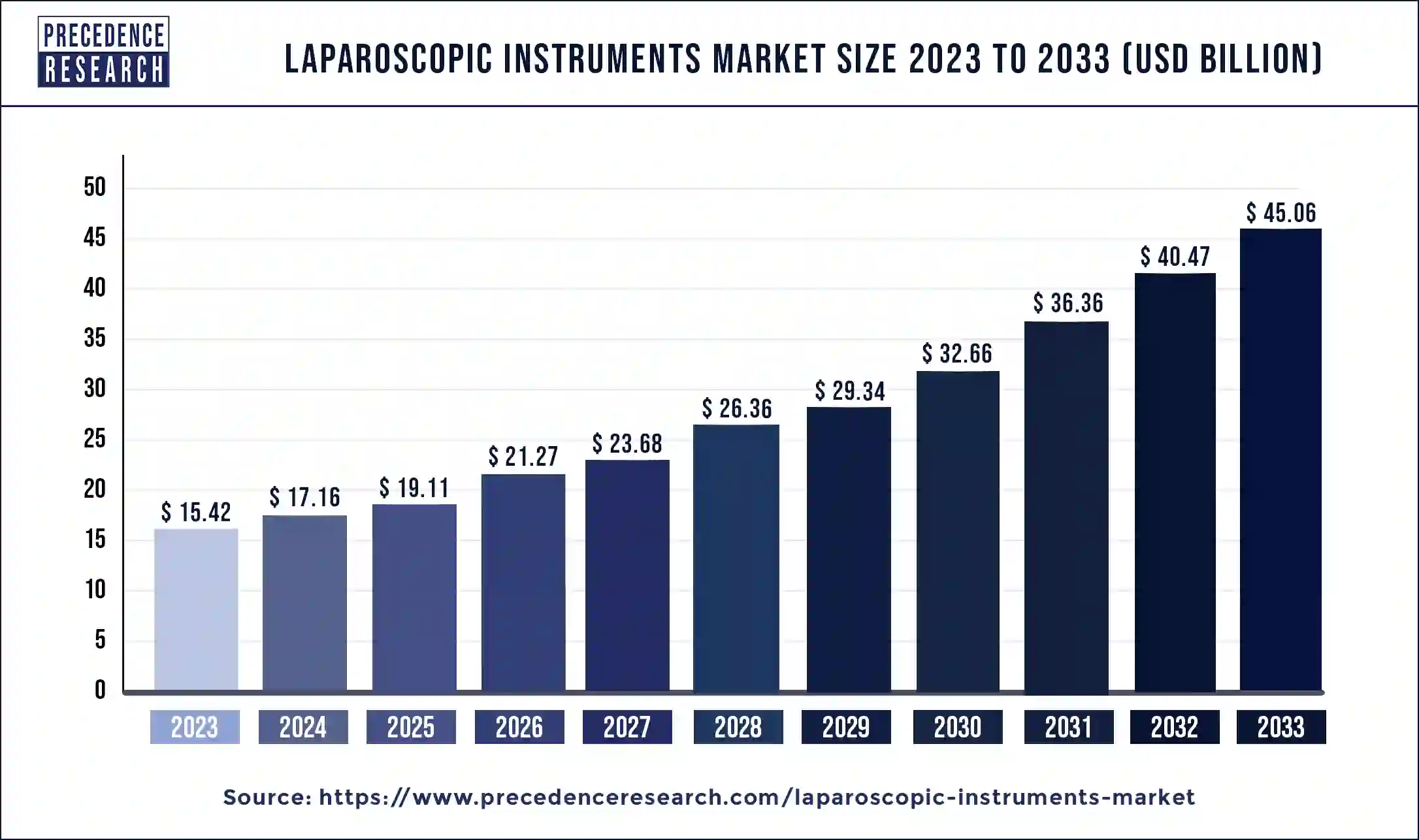

The global laparoscopic instruments market size is accounted at USD 19.11 billion in 2025 and predicted to increase from USD 21.27 billion in 2026 to approximately USD 49.33 billion by 2034, representing a CAGR of 11.14% from 2025 to 2034. The increasing incidence of obesity across all age groups is the key factor that drives the laparoscopic instruments market growth.

Laparoscopic Instruments Market Key Takeaways

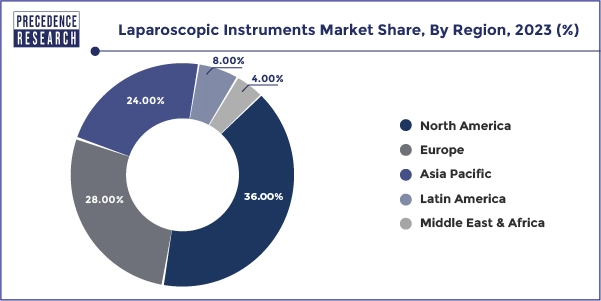

- North America dominated the market with the largest revenue share of 36% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR of 7.83% during the studied period.

- By product, the laparoscopes segment has held a major revenue share of 42% in 2024.

- By product, the insufflators segment is projected to grow at the fastest rate in the market over the forecast period.

- By application, the gynecology segment has contributed more than 33% of revenue share in 2024

- By end-user, the hospital segment dominated the market in 2024.

- By end-user, the ambulatory surgical center segment is expected to show rapid growth during the projected period.

Market Overview

Laparoscopy is a surgical procedure that allows a surgeon to examine the inside of the abdomen and pelvis without making large incisions. This technique, also known as minimally invasive surgery (MIS), uses laparoscopic instruments to manipulate internal organs, while a video camera and rigid telescopes provide internal visualization. The laparoscope is a fiber-optic device consisting of a long, thin tube with high-intensity light and a high-resolution camera inserted through the abdominal wall to inspect abdominal organs or perform minor surgeries.

Laparoscopic instruments vary depending on the surgical field and are commonly used for cutting and dissecting. They are frequently employed in diagnosing and treating diseases like prostatectomy, pancreatic cancer, and gastrointestinal disorders. These devices are invaluable in surgical procedures for minimizing bleeding and maintaining homeostasis. Surgeons and physicians prefer laparoscopy devices due to the high precision they offer during surgeries.

Laparoscopic Instruments Market Growth Factors

- Rising utilization of minimally invasive surgeries globally is expected to drive the growth of the laparoscopic instruments market.

- Technological advancements in laparoscopy can fuel market growth soon.

- The growing geriatric population across the globe will likely help in the laparoscopic instruments market expansion shortly.

- The increasing prevalence of health issues like uterine fibroids and endometriosis can propel the growth of the laparoscopic instruments market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 19.11 Billion |

| Market Size in 2026 | USD 21.27 Billion |

| Market Size by 2034 | USD 49.33 Billion |

| Market Growth Rate from 2025 to 2034 | 11.14% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Government favorable legislation

The laparoscopic instruments market is being propelled by favorable government legislation and regulations. Also, advantageous reimbursement policies in certain countries are expected to increase sales of laparoscopic power morcellators. The demand for laparoscopic devices is growing due to the rising global geriatric population and advancements in energy systems, which have enhanced their availability and affordability.

Laparoscopic devices that integrate energy systems are anticipated to find lucrative applications in various bariatric procedures, such as biliopancreatic diversion with duodenal switch, adjustable gastric band, gastric bypass, and sleeve gastrectomy. Furthermore, the laparoscopic instruments market is strengthening due to the increasing popularity of medical equipment and improved research collaborations along with the partnerships among diverse manufacturers.

- In July 2023, Genesis MedTech, a leading medical device company, announced that its ArtiSential™, a revolutionary series of articulating laparoscopic instruments, has successfully obtained approval from China's National Medical Products Administration (NMPA) for market release.

Restraint

Lack of skilled surgeons

Laparoscopic surgeries demand specialized training and skills, and the shortage of proficient surgeons in this field may impede the growth of the laparoscopic instruments market. Although these procedures are minimally invasive, they are not free of risks. Complications such as bleeding, infection, and organ damage can occur, potentially deterring some patients and surgeons from choosing laparoscopic techniques.

Furthermore, laparoscopic surgeries receive less financial support from public and private payers compared to open surgical treatments. This financial disparity hinders the sales of advanced laparoscopic instruments in the laparoscopic instruments market and complicates funding for further product development by medical device companies.

Opportunity

Growing avenues for healthcare in emerging nations

The healthcare sector is rapidly expanding in emerging economies, particularly in the BRICS nations—Brazil, Russia, India, China, and South Africa—known for their fast-growing economies. This growth is driven by several factors, including increased public and private sector initiatives, a rising patient population and associated costs, expanded distribution networks of market leaders, minimal regulatory trade barriers, ongoing healthcare infrastructure improvements, and the growth of medical tourism. These countries attract numerous medical tourists due to their affordable, high-quality surgical treatments compared to established markets. Several laparoscopic equipment manufacturers are establishing their businesses in Latin America, the Middle East, and Asia. This creates new opportunities in the laparoscopic instruments market.

- In January 2024, Surgical Instruments Group Holdings announced an investment of Rs. 231.5 crore to set up a healthcare device manufacturing facility in Telangana.

Product Insights

The laparoscopes segment dominated the laparoscopic instruments market in 2024. Several factors drive the growth of the laparoscopic devices segment. These include more patients with conditions such as uterine fibroids and endometriosis, a rising number of hysterectomy and myomectomy procedures, and greater awareness of improving healthcare infrastructure in emerging economies. Moreover, the preference for minimally invasive surgeries over traditional methods, a growing prevalence of colorectal cancer, an increase in laparoscopic bariatric procedures, and various surgical-related technological advancements are key contributors to the segment's expansion.

The insufflators segment is projected to grow at the fastest rate in the laparoscopic instruments market over the forecast period. Insufflators are vital for safe and efficient insufflation with humidified carbon dioxide in the abdominal cavity during laparoscopic procedures. The increasing incidence of diseases such as colorectal cancer is a major factor driving the demand for insufflation devices. Colorectal cancer, one of the most common cancers worldwide, often necessitates laparoscopic surgery for treatment. The growing prevalence of this cancer is anticipated to boost the growth of the insufflation device market.

- In July 2023, Palliare's insufflator and smoke evacuation system got a CE Mark. The new system helps meet the specific requirements of robotic, endoscopic, endoluminal, and laparoscopic procedures. The approval has been granted in line with the new EU Medical Devices Regulation (MDR).

Application Insights

The gynecology segment dominated the laparoscopic instruments market in 2024. Laparoscopy is widely used in gynecology for diagnosing and treating conditions such as fibroid tumors, infertility, chronic pelvic pain, endometriosis, and ovarian cysts. Many procedures that once required large abdominal incisions are now performed laparoscopically. Key factors driving the growth of the laparoscopic gynecological procedures market include the increasing adoption of minimally invasive surgeries over traditional methods, the rising prevalence of colorectal cancer, and advancements in surgical technology.

- In April 2024, The Franche-Comté Polyclinic, the leading private hospital group in France, and Moon Surgical, a French American pioneer in collaborative robotics, announced that the Maestro System is now being used clinically in gynecological laparoscopic procedures.

End-user Insights

The hospital segment dominated the laparoscopic instruments market in 2024. The significant growth in the laparoscopic devices market is driven by the increasing number of patients with chronic diseases, leading to a rise in surgical procedures. Hospitals are the preferred settings for bariatric and other laparoscopic surgeries due to their capacity to manage emergencies and provide a broad range of treatments. For example, the American Society for Metabolic and Bariatric Surgery reported that 256,000 people in the U.S. underwent weight-loss surgery in 2019, which can boost the demand for laparoscopic devices in hospitals.

The ambulatory surgical center segment is expected to show rapid growth in the laparoscopic instruments market during the projected period. The ambulatory surgery center sector is expected to experience significant growth. This is attributed to the rising use of minimally invasive surgery, the high demand for outpatient procedures, and the cost-effectiveness of laparoscopic surgeries performed in these centers. These factors are contributing to the lucrative expansion of the laparoscopic equipment market.

Regional Insights

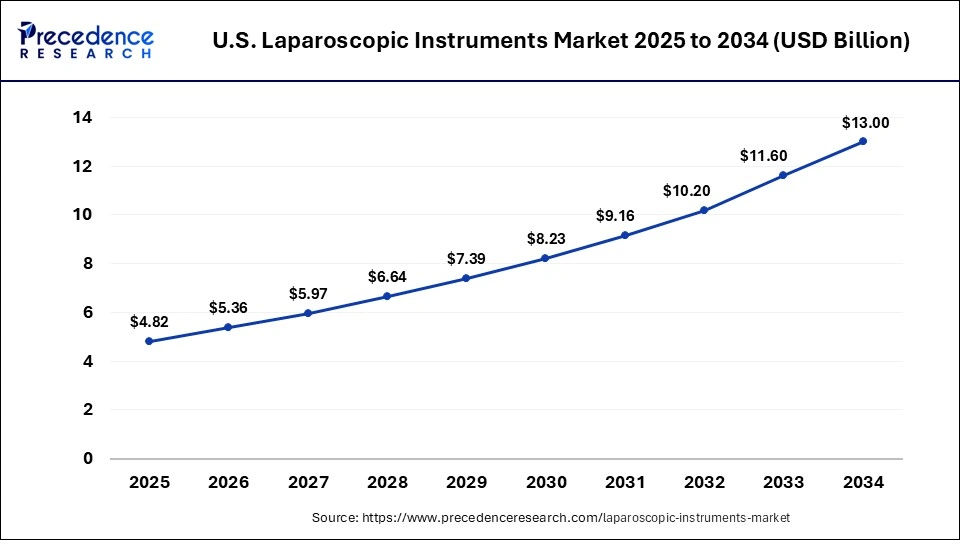

U.S. Laparoscopic Instruments Market Size Growth 2025 to 2034

The U.S. laparoscopic instruments market size is valued at USD 4.82 billion in 2025 and is expected to be worth around USD 13.00 billion by 2034, at a CAGR of 11.65% from 2025 to 2034.

North America dominated the global market for laparoscopic instruments, with the U.S. leading the region in 2024. The market will continue to experience steady growth due to the increasing number of laparoscopic procedures. However, the growth may be partially offset by the rising adoption of robotic-assisted minimally invasive surgeries. This shift is expected to mainly impact high-volume general and laparoscopic procedures, such as colorectal surgeries, cholecystectomy, and hernia repair, as well as urological and gynecological applications, including prostatectomy and hysterectomy.

- In August 2023, the FDA greenlighted Levita's MARS magnetic surgery platform. Magnet and machine combine to give surgeons tissue manipulation control with fewer scars in laparoscopic procedures. The California, U.S.-based company says that the new platform has been designed to give surgeons increased control of surgical instruments and to have more efficient methods of hospital implementation.

Asia Pacific is expected to witness the fastest growth in the laparoscopic instruments market during the studied period. The growth in this region is driven by the increasing number of advanced, well-equipped hospitals and a higher volume of surgical procedures, boosting the demand for laparoscopic devices. Emerging economies like Singapore and South Korea are also contributing due to technological advancements, increased investments, better reimbursement scenarios, and the rise in medical tourism. Additional factors include the availability of affordable devices, an increase in mergers and acquisitions, and government initiatives to enhance healthcare services. Significant government investments in providing basic health insurance coverage to all citizens can support the market's expansion.

Laparoscopic Instruments Market Companies

- Intuitive Surgical, Inc.

- Stryker Corporation

- Olympus Corporation

- Karl Storz GmbH & CO. KG

- Medtronic PLC

- Microline Surgical, Inc.

- B. Braun Melsungen AG

- SCHÖLLY Fiberoptic GmbH

- Optomic

- Victor Medical Instruments Co., Ltd

- Peters Surgical

- EndoMed Systems GmbH

- Becton

- Dickinson and Company

- Mindray Medical International Limited

- CONMED Corporation

- Richard Wolf GmbH

Recent Developments

- In July 2023, Johnson & Johnson released a public statement on the impending launch of one of their groundbreaking products called the Visionary Surgical System. This innovative surgical technology can change the face of minimally invasive surgeries by improving the accuracy and precision of physicians.

- In June 2023, the FDA approved Medtronic's innovative drug-coated balloon catheter. Medtronic—a global leader in medical services, technology, and solutions—introduced this device to control peripheral artery disease. By delivering the medicine to the affected area directly, a surgeon can now lessen the risk of amputation in the patient and improve blood flow, addressing the source of the problem.

- In January 2022, Microline Surgical introduced a new sales team in the Southeast region to strengthen the distribution of its products across the U.S.

Segments Covered in the Report

By Product

- Laparoscopes

- Energy Systems

- Trocars

- Closure Devices

- Suction/irrigation Device

- Insufflation Device

- Robot-assisted Systems

- Hand Access Instruments

By Application

- Colorectal Surgery

- Bariatric Surgery

- Urological Surgery

- Gynecological Surgery

- General Surgery

- Other Surgeries

By End-user

- Hospital

- Clinic

- Ambulatory

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting